2022-2023年ACCA英国注册会计师考试模拟试题含答案(300题)套卷89

2022-2023年ACCA英国注册会计师考试模拟试题含答案(300题)套卷89

《2022-2023年ACCA英国注册会计师考试模拟试题含答案(300题)套卷89》由会员分享,可在线阅读,更多相关《2022-2023年ACCA英国注册会计师考试模拟试题含答案(300题)套卷89(154页珍藏版)》请在装配图网上搜索。

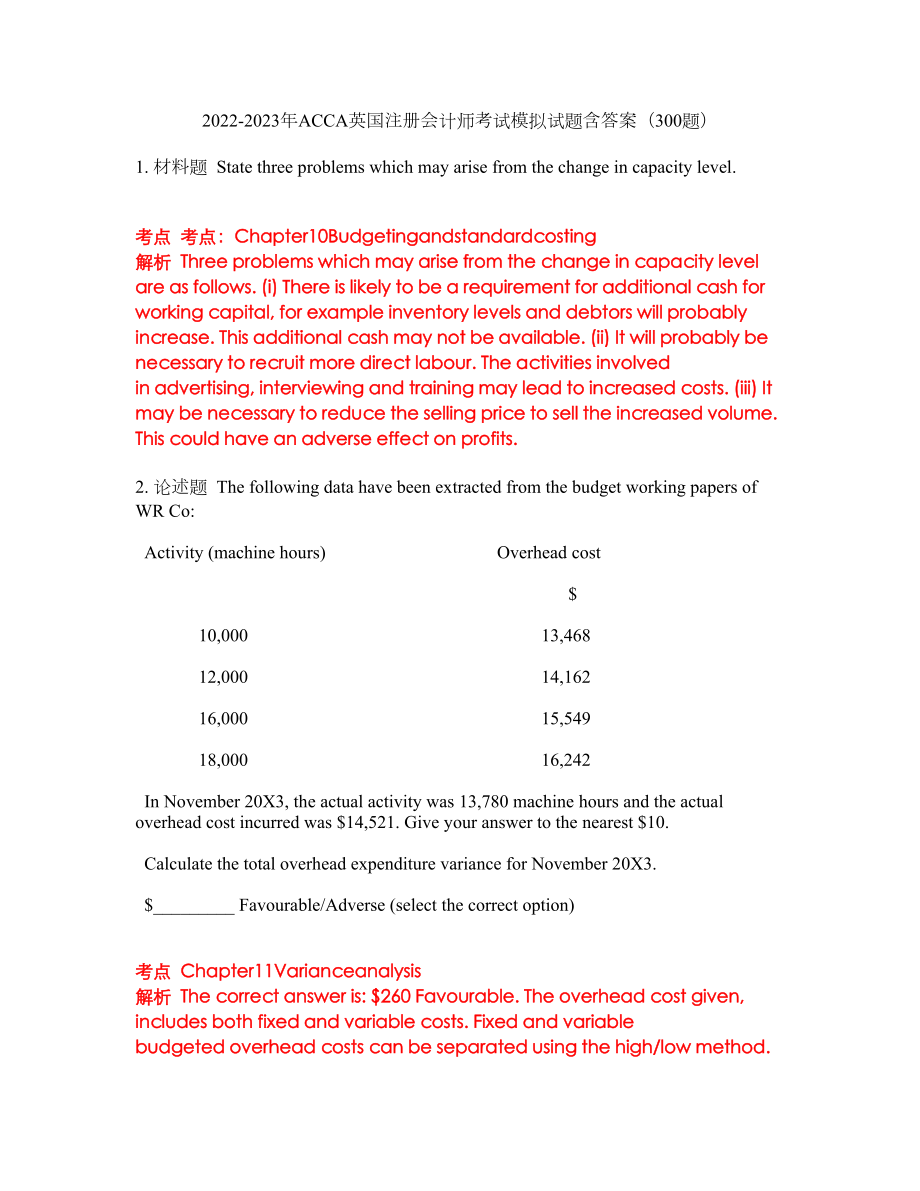

1、2022-2023年ACCA英国注册会计师考试模拟试题含答案(300题)1. 材料题 State three problems which may arise from the change in capacity level.考点 考点:Chapter10Budgetingandstandardcosting解析 Three problems which may arise from the change in capacity level are as follows.(i) There is likely to be a requirement for additional cash f

2、or working capital, for exampleinventory levels and debtors will probably increase. This additional cash may not beavailable.(ii) It will probably be necessary to recruit more direct labour. The activities involved inadvertising, interviewing and training may lead to increased costs.(iii) It may be

3、necessary to reduce the selling price to sell the increased volume. This couldhave an adverse effect on profits.2. 论述题 The following data have been extracted from the budget working papers of WR Co: Activity (machine hours) Overhead cost $ 10,000 13,468 12,000 14,162 16,000 15,549 18,000 16,242 In N

4、ovember 20X3, the actual activity was 13,780 machine hours and the actual overhead cost incurred was $14,521. Give your answer to the nearest $10. Calculate the total overhead expenditure variance for November 20X3. $_ Favourable/Adverse (select the correct option) 考点 Chapter11Varianceanalysis解析 The

5、 correct answer is: $260 Favourable.The overhead cost given, includes both fixed and variable costs. Fixed and variable budgetedoverhead costs can be separated using the high/low method. Hours $High 18,000 16,242Low 10,000 13,468 8,000 2,774The variable cost per machine hour can be estimated as $2,7

6、74 / 8,000= $0.34675The fixed cost is $10,000, being the difference between variable overheads of 10,000 0.34675and total cost of $13,468.The total overhead variance for November is: Fixed overhead + Variable overhead for qualityachieved - Total actual overhead cost incurred.Budgeted cost ($10,000 +

7、 13,780 $0.34675)Total actual overhead cost incurred $ 14,778 14,521 257 (F)3. 单选题 Which of the following differences between share capital and debentures is correct?A Dividend payments on shares is tax-deductible, interest payments on debentures is not tax-deductibleB Interest payments on debenture

8、s is mandatory, dividend payments on shares is discretionaryC In the event of liquidation, shareholders are paid their investment back before the debentureholders考点 Chapter16Loancapital解析 Interest on debentures must be paid and is tax-deductible. Dividends are only paid if the directorsdeclare them

9、and payment is not tax-deductible. In the event of liquidation, debentureholders havetheir investment repaid before anything is returned to the shareholders.4. 单选题 An accountant has to check a sample of invoices. The invoices are divided into three groups, by value as follows:under 100、100 - 500 and

10、 over 500. Samples are then selected randomly from each group.Which ONE of the following sampling methods is involved?A ClusterB Multi-stageC QuotaD Stratified考点 Chapter2Sourcesofdata解析 Accountant first stratifies the invoices according to value and then selects randomly. Sampling method is stratifi

11、ed.5. 单选题 The closing inventory of X amounted to $116,400 excluding the following two inventory lines: 1 400 items which had cost $4 each. All were sold after the reporting period for $3 each, with selling expenses of $200 for the batch. 2 200 different items which had cost $30 each. These items wer

12、e found to be defective at the end of the reporting period. Rectification work after the statement of financial position amounted to $1,200, after which they were sold for $35 each, with selling expenses totalling $300. Which of the following total figures should appear in the statement of financial

13、 position of X for inventory? A $122,300B $121,900C $122,900D $123,300考点 Chapter7Inventory解析 Line 1: (400 x $3) - $200 $116,400 Line 2: (200 x $35) - $300 - $1,200 $1,000 $5,5000 $122,9006. 单选题 Which of the following statements about the valuation of inventory are correct, according to IAS 2 Invento

14、ries? 1 Inventory items are normally to be valued at the higher of cost and net realisable value. 2 The cost of goods manufactured by an entity will include materials and labour only. Overhead costs cannot be included. 3 LIFO (last in, first out) cannot be used to value inventory. 4 Selling price le

15、ss estimated profit margin may be used to arrive at cost if this gives a reasonable approximation to actual cost. A 1, 3 and 4 onlyB 1 and 2 onlyC 3 and 4 onlyD None of the statements are correct考点 Chapter7Inventory解析 Statement 1) inventory should be valued at the lower of cost and NRV not the highe

16、rStatement 2) production overheads based on a normal level of production should be included 7. 单选题 The following statements refer to qualities of good information: (i) It should be communicated to the right person. (ii) It should always be completely accurate before it is used. (iii) It should be un

17、derstandable by the recipient. Which of the above statements are correct? A (i) and (ii) onlyB (i) and (iii) onlyC (ii) and (iii) onlyD (i), (ii) and (iii)考点 Chapter2Sourcesofdata解析 The information should be sufficiently accurate given time and cost constraints. Managers should be made aware of the

18、degree of accuracy of the information.8. 单选题 Which of the following statements regarding payment for shares is correct?A Public company shares must always be paid for in cashB At the time of allotment, a public company must receive payment of at least 50% of the nominal valueof the sharesC A private

19、 company may allot shares for inadequate consideration by accepting goods or services atan over-valueD A private company must have non-cash consideration independently valued before accepting it aspayment for shares考点 Chapter15Sharecapital解析 A private company may accept goods or services for payment

20、 at an over-value. No independent valuation is required. A public company may issue shares for non-cash consideration and at least 25% of the nominal value of the shares must be paid up on allotment.9. 材料题 材料全屏 Earl has been employed by Flash Ltd for the past 20 years. During that time, he has also

21、invested in thecompany in the form of shares and debentures. Earl owns 5,000 ordinary shares in Flash Ltd. The shares areof 1 nominal value and are fully paid-up. The debentures, to the value of 5,000, are secured by a fixedcharge against the land on which Flash Ltds factory is built. In April it wa

22、s announced that Flash Ltd was going into immediate insolvent liquidation, owing considerableamounts of money to trade creditors. As a result of the suddenness of the decision to liquidate the company,none of the employees received their last months wages. In Earls case this amounted to 2,000. 35 【论

23、述题】 State whether Earl has any right to his unpaid wages 考点 考点:Chapter21Insolvencyandadministration解析 Earl will become a preferential creditor in respect of his unpaid wages and as such he will only have a claimto have the debt paid to him after the secured creditors have been repaid in full.10. 单选题

24、 The following, with one exception, are potential problems for time management. Which is the exception?A An open door policy of managementB A sociable work groupC An assertive style of communication考点 Chapter18Personaleffectivenessandcommunication解析 Rationale: An assertive style of communication wil

25、l help in time management, because it enablesyou to say no (appropriately) to interruptions and unscheduled demands. The other options are problems: options A and B are invitations to waste time in non-essential communication. 11. 材料题 材料全屏 A company produces and sells one product only, the Thing, th

26、e standard cost for one unit being asfollows. $ Direct material A 10 kilograms at $20 per kg 200 Direct material B 5 litres at $6 per litre 30 Direct wages 5 hours at $6 per hour 30 Fixed production overhead 50 Total standard cost 310 The fixed overhead included in the standard cost is based on an e

27、xpected monthly output of 900 units.Fixed production overhead is absorbed on the basis of direct labour hours. During April the actual results were as follows. Production 800 units Material A 7,800 kg used, costing $159,900 Material B 4,300 litres used, costing $23,650 Direct wages 4,200 hours worke

28、d for $24,150 Fixed production overhead $47,000 29 【论述题】 Calculate price and usage variances for each material. 考点 考点:Chapter11Varianceanalysis解析 Price variance Material ATake the actual quantity of materials purchased/used and compare the actual prices paid for thematerials with their standard pric

29、e. $7,800 kg should have cost ( $20) 156,000 but did cost 159,900Price variance (actual cost exceeds standard cost) 3,900 (A)Usage variance Material ATake the actual quantity of units produced and compare the actual quantity of materials used intheir production with the standard quantity that should

30、 have been used. The variance is convertedinto a monetary value at the standard price per unit of material.800 units should have used ( 10 kg) 8,000 kg but did use 7,800 kgUsage variance in kg (actual usage less than standard) 200 (F) standard cost per kilogram $20Usage variance in $ $4,000 (F)Price

31、 variance Material B $4,300 litres should have cost ( $6) 25,800 but did cost 23,650Price variance 2,150 (F)Usage variance Material B $800 units should have used ( 5 l) 4,000 l but did use 4,300 lUsage variance in litres 300 (A) standard cost per litre $6Usage variance in $ $1,800 (A)12. 材料题 Explain

32、 the liability of the partners for the contract to buy the bicycles考点 考点:Chapter11Partnerships解析 Tam entered into a contract to buy bicycles in the name of the partnership. The partnership agreementspecifies that the partnership should only sell petrol, so Tam does not have authority to undertake th

33、iscontract. However, the third party is not privy to the partnership agreement so is not aware that the contractis beyond the scope of the partnership. Tam has apparent authority to undertake the contract on behalf ofthe other partners who are liable on the contract.13. 单选题 A machine has an investme

34、nt cost of $60,000 at time 0. The present values (at time 0) of the expected net cash inflows from the machine over its useful life are: Discount rate Present value of cash inflows 10% $64,600 15%$58,200 20% $52,100 What is the internal rate of return (IRR) of the machine investment? A Below 10%B Be

35、tween 10% and 15%C Between 15% and 20%D Over 20%考点 Chapter19Methodsofprojectappraisal解析 $Investment (60,000)PV of cash inflow 64,600NPV 10%4,600$Investment (60,000)PV of cash inflow 58,200NPV 15% (1,800)The IRR of the machine investment is therefore between 10% and 15% because the NPV falls from $4,

36、600 at 10% to -$1,800 at 15%. Therefore at some point between 10% and 15% the NPV = 0. When the NPV = 0, the internal rate of return is reached.14. 材料题 材料全屏 Mr Grob started trading in 20X3, selling one product, wheelbarrows, on credit to small retail outlets. The following budgeted information for 2

37、0X4 has been gathered: January 20X4 February 20X4 March 20X4 Credit sales $12,000$15,000 $21,000 Receivables have recently been settling their debts 50% in the month following sale; and 50% two months after sale. A prompt payment discount of 3% is offered to those receivables paying within one month

38、. The gross profit margin is expected to be 25%. Due to an anticipated continued increase in sales, Mr Grob intends to increase inventory levels in March 20X4 by $2,000, and it is intended that the payables balance is increased by $3,000 to ease cash flow in the same month. 72 【简答题】 Calculate the bu

39、dgeted cash that will received in March 20X4. 考点 考点:Chapter15Budgeting解析 Cash received in March = $15,000 x 0.5 x 0.97 + $12,000 x 0.5 = $13,27515. 单选题 The absence of certain job features will reduce employee satisfaction. However, their presence will not result in positive motivation What term rela

40、ting to motivation does this refer to? A Maslows primary needsB Herzberg hygiene factorsC McGregor Theory XD Herzberg theory of job design考点 Chapter15Motivatingindividualsandgroups解析 This is the definition of hygiene factors.16. 材料题 Explain any criminal offences Sid may have committed考点 考点:Chapter22

41、Fraudulentandcriminalbehaviour解析 Under the Criminal Justice Act 1993, Sid is an insider by virtue of his position as director in Trend plc andUmber plc. The information he holds is price-sensitive as it concerns large profits and large losses.Therefore, it would appear that he is liable under for de

42、aling in price-affected securities. None of thedefences would apply to him as he clearly expected to make a profit in one transaction and to avoid a loss inthe other.17. 单选题 VV Company has been asked to quote for a special contract. The contract requires100 hours of labour. However, the labourers, w

43、ho are each paid $15 per hour, are workingat full capacity. There is a shortage of labour in the market. The labour required to undertake this specialcontract would have to be taken from another contract, Z, which currently utilises500 hours of labour and generates $5,000 worth of contribution. If t

44、he labour was taken from contract Z, then the whole of contract Z would have to bedelayed, and such delay would invoke a penalty fee of $1,000. What is the relevant cost of the labour for the special contract? A $1,000B $1,500C $2,500D $7,500考点 Chapter6Short-termdecisions解析 Labour is in short supply

45、 so there is an opportunity cost. The contribution from Contract Zwill still be earned but will be delayed. The relevant cost is therefore the wages earnedplus the penalty fee.($15 100) + ($1,000) = $2,50018. 单选题 Last year, Bryan Air carried excess baggage of 250,000 kg over a distance of 7,500 km a

46、t a cost of $3,750,000 for the extra fuel.What is the cost per kg-km?A $0.002 per kg-kmB $2.00 per kg-kmC $33.33 per kg-kmD $500.00 per kg-km考点 Chapter10Job,batchandservicecosting解析 First we calculate the total number of kg-kmKg x km takencost per kg-km250,000 kg x 7,500 km =1,875,000,000 kg-kmcost

47、per kg-km=$3,750,000/1,875,000,000 = $0.002 per kg-km19. 材料题 Explain how the companys debts will be paid out of its liquidated assets考点 考点:Chapter21Insolvencyandadministration解析 Company assets:Land valued at 20,000Other assets 10,000 (7,750 plus 2,250 raised from the shareholders)Companys liabilitie

48、s:Secured loan 20,000Business creditors 10,000Bank overdraft 10,000The sale of the land will be used to repay the secured loan and this will leave assets of 10,000 to paycreditors of 20,000. The business creditors and the bank will therefore receive half their money back. Thiswould leave the busines

49、s creditors and the bank owed 5,000 each.20. 单选题 What would the budgeted profit be if a marginal costing system were used?A $22,500 lowerB $10,000 lowerC $10,000 higherD $22,500 higher考点 Chapter9AbsorptionandmarginalCosting解析 Production volume exceeded sales volume, so the profit with absorption cos

50、ting is higher than the profit with marginal costing.Fixed overheads in inventory = $30,000/750 = $40 per unit, therefore total fixed overhead in closing inventory (absorption costing) = 250 units x $40 = $10,000. Profit with marginal costing is therefore lower by $10,000.21. 单选题 The following statements have been made about feed-forward control budgetary systems: (1) Feedforward control systems have an advantage over other types of control in that itestablishes how effective planning was. (2) Feedforward control occurs while an activity is in progress. Which of the above s

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。