CFA一级模考试题及答案

CFA一级模考试题及答案

《CFA一级模考试题及答案》由会员分享,可在线阅读,更多相关《CFA一级模考试题及答案(24页珍藏版)》请在装配图网上搜索。

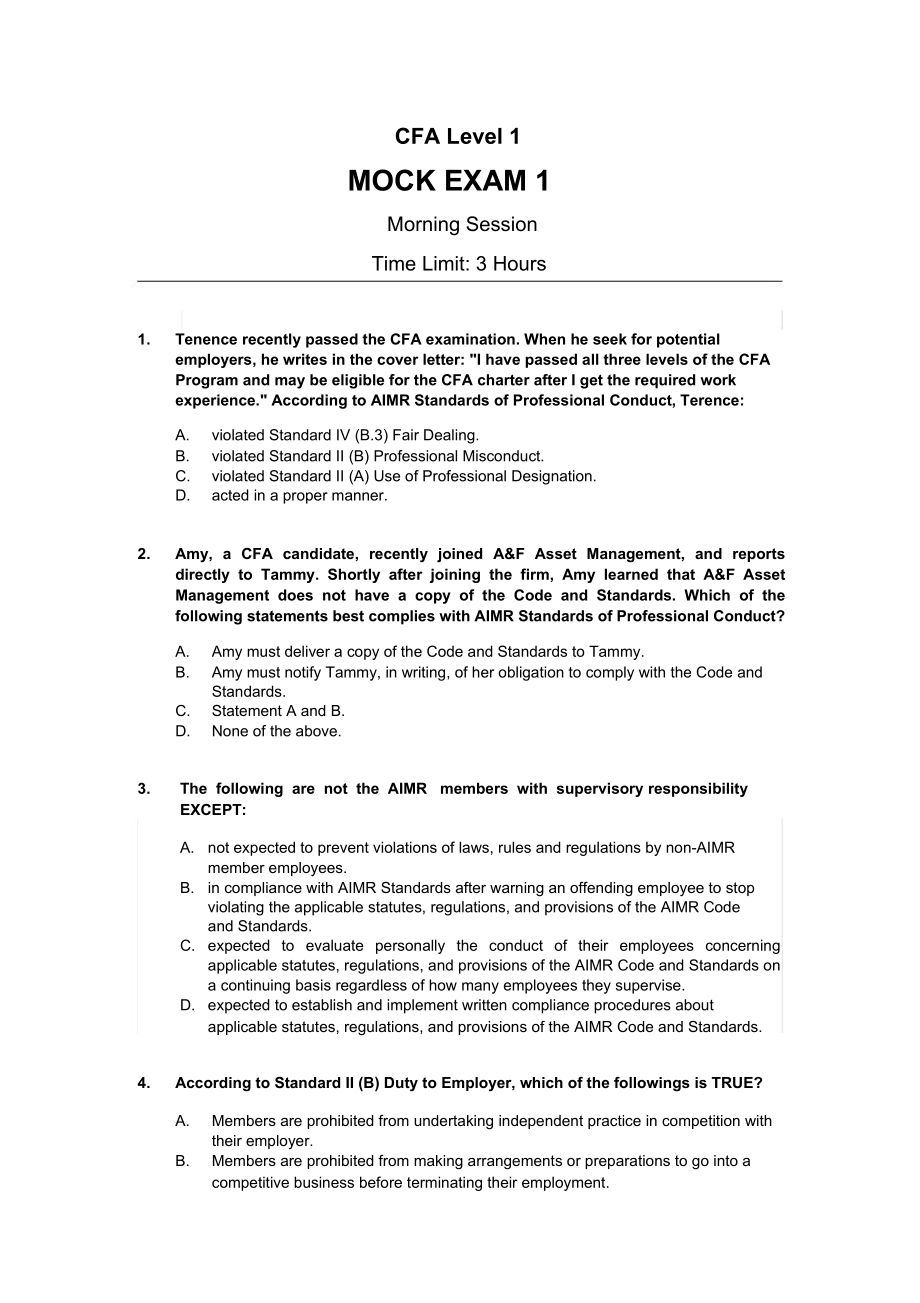

1、CFA Level 1MOCK EXAM 1Morning SessionTime Limit: 3 Hours1. Tenence recently passed the CFA examination. When he seek for potential employers, he writes in the cover letter: I have passed all three levels of the CFA Program and may be eligible for the CFA charter after I get the required work experie

2、nce. According to AIMR Standards of Professional Conduct, Terence:A. violated Standard IV (B.3) Fair Dealing.B. violated Standard II (B) Professional Misconduct.C. violated Standard II (A) Use of Professional Designation.D. acted in a proper manner.2. Amy, a CFA candidate, recently joined A&F Asset

3、Management, and reports directly to Tammy. Shortly after joining the firm, Amy learned that A&F Asset Management does not have a copy of the Code and Standards. Which of the following statements best complies with AIMR Standards of Professional Conduct?A. Amy must deliver a copy of the Code and Stan

4、dards to Tammy.B. Amy must notify Tammy, in writing, of her obligation to comply with the Code and Standards.C. Statement A and B.D. None of the above.3. The following are not the AIMR members with supervisory responsibilityEXCEPT:A. not expected to prevent violations of laws, rules and regulations

5、by non-AIMR member employees.B. in compliance with AIMR Standards after warning an offending employee to stop violating the applicable statutes, regulations, and provisions of the AIMR Code and Standards.C. expected to evaluate personally the conduct of their employees concerning applicable statutes

6、, regulations, and provisions of the AIMR Code and Standards on a continuing basis regardless of how many employees they supervise.D. expected to establish and implement written compliance procedures about applicable statutes, regulations, and provisions of the AIMR Code and Standards.4. According t

7、o Standard II (B) Duty to Employer, which of the followings is TRUE?A. Members are prohibited from undertaking independent practice in competition with their employer.B. Members are prohibited from making arrangements or preparations to go into a competitive business before terminating their employm

8、ent.C. Members must obtain their employers written consent to engage in an independent competitive consulting work.D. Members are not obligated to obtain their clients written recognition that they are engaging in an independent competitive consulting arrangement not related to members firm.5. Keith

9、, CFA, has been invited to join a group of analysts in touring the riverboats ofA & K Limited. Since commercial flight schedules are inconvenient and not practical for the groups time schedule, A & K Limited has arranged chartered flights from casino to casino. A & K Limited has also arranged to pay

10、 the hotel bill for the three nights of the tour. The trip is purely business. According to AIMR Standards of Professional Conduct, Keith should:A. As the arrangements are inappropriate, decline to accept the trip.B. offer to pay for his share of the airfare and his own hotel bill.C. accept the flig

11、ht, but pay his own hotel bill.D. accept the arrangements as they are.6. Karen, CFA, is the investment manager of a corporate pension plan. Under ERISA, she owes her fiduciary duty to:A. the plan sponsor.B. the firms shareholders.C. the plan participants and beneficiaries.D. none of the above.7. Dan

12、iel, CFA, is a portfolio manager with the trust department of Citi Nation Bank.One of his accounts is his childrens trust fund. Daniel allocated IPO shares to his childrens trust fund before he has completely satisfied all the needs of his other accounts. According to AIMR Standards of Professional

13、Conduct, which of the following standards did Daniel violate?A. Standard (A.3) Independence and Objective.B. Standard IV (B.4) Priority of Transactions.C. Standard IV (B.7) Disclosure of Conflicts to Clients and Prospects.D. Standard IV (A.1) Reasonable Basis and Representations.8. Which of the foll

14、owing about the breach of Standard IV (B.4) Priority of Transactions is correct:A. Members wait to trade until after their firms clients have been informed, but before they have had time to act.B. Members for their clients account before the release of material nonpublic information.C. Members trade

15、 on their family accounts after the members clients and employer have had an adequate opportunity to act.D. Members buy stock for a clients account after the stock is put on the firms recommenced buy list but before this information is made public.9. As part of an AIMR investigation into the conduct

16、 of Helen, CFA, AIMR requestsrecords from Helen about her investment accounts. Helen writes AIMR a letter stating that under Standard IV (B.5), Preservation of Confidentiality, that she is unable to comply with their request. Which of the following statement is TRUE?A. is correct in her interpretati

17、on of Standard IV (B.5).B. should not turn over the information because it will violate federal material nonpublic information statutes and AIMRs Standard V (A) Prohibit against Use of Material Nonpublic information.C. will no be in violation of Standard IV (B.5) by turning over the requested inform

18、ation because under the Professional Conduct Program, the Disciplinary Review Subcommittee is considered an extension of Helen.D. All of the above.10. Vivian, CFA, a research analyst assigned to Double Limited, has been recommending the stocks purchase in her quarterly report. Vivian has recently ma

19、rried and just discovered her husbands trust account owns several million dollars worth of Double Limited. The stock makes up more than 50 percent of the trusts value but less than 5 percent of Double Limiteds outstanding shares. According to AIMR Standards of Professional Conduct, Vivian should:A.

20、take no action because the stock is not in her name.B. disclose her interest in the stock at the time of her next report.C. cease including Double Limited stock in her report.D. take no action because the holding is less than 5 percent of the outstanding shares.11.Which of the following statements c

21、oncerning the AIMR Performance Presentation Standardsabout the calculation of composite returns is True?A. Asset weighting within composites is not required using beginning of period weights.B. Portfolios no longer under management should be included in historical composites.C. Model results may be

22、presented if they conform to the portfolios investment strategy and objectives.D. All of the above.12.According to AIMR Performance Presentation Standards, which of the following statements about composite return calculations is FALSE?A. Returns must be total returns.B. Cost accounting is required.C

23、. Returns must be time-weighted rates of return calculated using geometric linking.D. Returns from cash and cash equivalents held in portfolios must be included in return calculations.13. Kenneth, CFA, is a portfolio manager at A&B limited, if he suspects a colleague at his company of engaging in on

24、going illegal activities, as according to the AIMR Standards of Professional Conduct,he is required to take all of the following actionsEXCEPT:A. determine whether the conduct is, in fact, illegal.B. disassociate himself from any illegal activity.C. report the illegal violations to the appropriate g

25、overnmental or regulatory organizations.D. none of the above.14. Gloria, CFA, has been assigned by her employer to analyze Well Limited. Which of the following actions would most likelyviolate AIMRs Standard III(C), Disclosure of Conflicts to Employer? Gloria does NOT report to her employer that:A.

26、she owns three shares of Well LimitedB. her mother owns 10 shares of Well Limited.C. she is trustee of the Well Limited Foundation for Heart Research.D. her brother in-law works on the assembly line at Well Limited.15. Paul, CFA, heads the research department of a large brokerage firm. Paul has supe

27、rvisory responsibility over 25 analysts. If Paul delegates some supervisory duties, which statement bestdescribes his responsibilities based on the AIMR Standards of Professional Conduct?A. Paul is not responsible for those duties he has delegated to his subordinates.B. Pauls supervisory responsibil

28、ities only apply to analysts with the CFA designation.C. Paul retains supervisory responsibility for all subordinates despite his delegation of some duties.D. The AIMR standards prevent Paul from delegating supervisory duties to subordinates.16. Before disseminating changes in his firms buy/sell lis

29、t. Johnson, a CFA candidate, calls his best clients to apprise them of the pending change. Based on the AIMR Standards of Professional Conduct,what standard, if any, did Johnson violate?A. Standard IV(B.3), Fair Dealing.B. Standard IV(B.4), Priority of Transactions.C. Standard V(A), Prohibition Agai

30、nst Use of Material Nonpublic Information.D. None of the above.17. According to the AIMR Standards of Professional Conduct,which of the following about Standard IV (B.5), Preservation of Confidentiality, is TRUE?A. If a member receives information due to his or her special relationship with the clie

31、nt indicating illegal behavior on the part of the client, the member may not have an obligation to inform the appropriate authorities.B. Confidentiality clauses in settlement agreements protect members from divulging information during investigations.C. Members having a special relationship with a c

32、lient may withhold that information from an AIMR Professional Conduct Program investigation of that client.D. A member may disclose information received from a client, even to authorized fellow employees who are also working for the client.18.Based on the AIMR Standards of Professional Conduct, whic

33、h of the following statements is least likely to be a violation of Standard IV (B.6), Prohibition against Misrepresentation?A. An analyst tells a prospective client that investment grade bonds involve less default risk than junk bonds.B. A bond trader tells a client that he can assist the client in

34、all the clients investment needs: equity, fixed income, and derivatives.C. An investment manager recommends to a prospective client an investment in mortgage IO strips because they are guaranteed by an agency of the federal government.D. A broker guarantees that a specific common stock will double i

35、n value over the next six months.19. John receive $1,000 at the beginning of each for the next 10 years. Assume that the interest rate is 12%, calculate the value of this annuity at the end of the ten-year period.A. $13,578.24B. $17,548.74.C. $19,654.58.D. None of the above.20. There is a perpetuity

36、 of $500 and the interest rate is 10%. Calculate the present value of this perpetuity.A. $500.B. $5,000.C. $5,500.D. None of the above.21. John buy the computer through creating a loan of $40,000. It is to be paid off using 6 percent over ten years. Calculate the monthly payment.A. $421.72.B. $444.0

37、8.C. $478.59.D. None of the above.22. Which of the following statements about probability concepts is TRUE?A. The multiplication rule for independent events is P(AB) = P(A)(B).B. A conditional probability is the probability of a particular event occurring given that another event has not occurred.C.

38、 The addition rule of probabilities is P(A or B) = P(A)+P(B).D. All of the above.23. For a binomial random variable B(n=12,p=0.5), Find out the mean and variance.MeanVarianceA.63B.73.5C.84D. None of the above.24. Which of the following statements best describes the binomial distribution?A. has a var

39、iance equal to -1.B. is skewed to right.C. is defined in terms of the mean and variance of its associated normal distribution.D. is a discrete probability distribution that is used to make probability statements about quantities with binary outcomes.25. Peter buys a stock for $25 per share. At the e

40、nd of the one-year holding period the price of the stock is $40 per share. Assume that it pays no dividends, calculate the continuously compounded return.A. 35%.B. 47%.C. 56%.D. None of the above.26. Which of the following statements about time-series data is TRUE?A. Consists of a range of values th

41、at bracket the parameter with a specified level of probability 1- is a confidence internal estimate.B. Cross-sectional data are a set of values of a particular variable in sequential time periods.C. A point estimate is a single estimate of an unknown population.D. None of the above.27. Which of the

42、following statements about correlation and linear regression is TRUE?A. A limitation of regression analysis is that regression relations can change over time.B. Outlines are small numbers of observations at either extreme (small or large) of a sample.C. Spurious correlation arises in data solely bec

43、ause each of two variables is related to some third variable.D. The dependent variable Y, is equal to the intercept b0 , plus a slope coefficient, b1 , times the independent X, plus an error term, .28. Based on the following table, if the discount rate is 10%, calculate the present value of the cash

44、 flow.Year-End Cash Flows1234$100$150$200$250If the discount rate is 12 percent, the present value of this stream of cash flows is closest to:A. $636.36B. $579.87C. $535.89D. None of the above.29. There is 5-year annuity of $3,000 per year. However, the first payment will not pay until year 3. Assum

45、ing the interest rate is 10%, calculate the present value of this annuity.A. $8397.B. $9,399.C. $10,258.D. None of the above.30. Which of the following is the weakestand strongestmeasurement scale?WeakestStrongestAordinalintervalBordinalratioCnominalintervalDnominalratio31. Which of the following st

46、atements about statistical concepts is FALSE?A. A frequency is a tabular display of data summarized into a relatively small number of intervals.B. An interval is a set of return values within which an observation not falls.C. A parameter is any descriptive measure of a population characteristic.D. N

47、one of the above.32. The following shows the yearly returns of aggressive equity funds for four years:1999 = +5%2000 = +2%2001 = +1%2002 = -4%Assume that this distribution can represent either the population or a sample of aggressive equity funds. Calculate the population and sample standard deviati

48、on.PopulationSampleStandard DeviationStandard DeviationA.2.73%3.99%B.3.09%4.55%C.3.24%3.74%D. None of the above.33. The minimum proportion of observations falling within 2 standard deviations of the mean is closest to:A. 95%.B. 75%.C. 68%.D. None of the above.Use the following data to answer Questio

49、ns 34 and 35.The following table summarizes the results of a poll taken of CEOs and analysts about the economic impact of a pending piece of legislation:GroupThink the legislation willThink the legislation willTotalhave a positive impact.have a negative impact.Others403070Analysts10030130Total140602

50、0034. What is the probability of selecting an analyst who thinks that the legislation will have a negative impact on the economy?A. 0.15.B. 0.3.C. 0.5.D. None of the above.35. What is the probability that a randomly selected individual from this group will be either an analyst or someone who thinks

51、this legislation will have a positive impact on the economy?A. 0.35.B. 0.58.C. 0.64.D. None of the above.36. Accounting to a new classical view, what is the effect of increasing government expenditures financed by a budget deficit.A. stimulate output if the marginal propensity to save is negative.B.

52、 exert little impact on aggregate demand.C. Increase aggregate demand and employment.D. None of the above.37. Which of the following statement is FALSE?A. The crowding-out model implies that deficits will have a upward pressure on thereal rate of interest.B. The new classical model contends that def

53、icits exert little impact on interest rates.C. Empirical studies consistently show a statistically significant relationship between budget deficits and interest rates.D. All of the above.38. Based on the following information, if the Federal Reserve buys $150 million of Treasury Bills from public, w

54、hat is the effect on money supply? Reserve requirement: 25%? Bank keeps no excess reserveA. increase by $112.5 million.B. increase by $150 million.C. increase by $600 million.D. decrease by $800 million.39. If there is an unanticipated increase in the money supply, what will be the effect?A. Decreas

55、e in price level.B. Increase in interest rate.C. Decrease in GDP.D. increase output as demand increases as people try to reduce their holdings of money.40. Which of the following about a purely competitive market is FALSE?A. All firms in the market produce homogeneous products.B. Each seller is smal

56、l relative to the total market.C. There are a large number of dependent firms.D. There are no barriers to entry or exit.41. Which of the following statements about supply curves is TRUE?A. For decreasing cost industries, the supply cuve slopes downward to the right.B. For increasing cost industries,

57、 the supply curve sweeps upward to the right.C. For constant cost industries, the supply curve is horizontal.D. All of the above.42. Which of the following statements about a monopolist is TRUE?A. There is no restriction for entrance.B. Many competitors are found in the market.C. is the sole produce

58、r of a product for which there are several substitutes.D. sells a product for which consumers believe no adequate substitutes exist.43. Which of the following is the reason for the Oligopolists to collude and to cheat on collusive agreements?A. restrict output.B. restrain trade.C. increase its share

59、 of the joint profit.D. all of the above.44. Under a system of flexible exchange rates, if there is a decrease in demand for the U.S. dollar in the foreign exchange market will cause:A. the U.S. trade surplus to increase.B. the U.S. unemployment rate decrease.C. the U.S. dollar to depreciate in valu

60、e.D. the U.S. dollar to appreciate in value.45. Which of the following are the two specific conditions that must be met for revenue recognition to take place under the accrual concept of income?A. Cash is received.B. Delivery of goods and services and the absence of significant contingent obligation

61、 on the part of the seller.C. passage of risk of ownership from seller to buyers.D. Completion of the earnings process and assurance of payment.46. In a flexible or floating change rate system, which of the following types of changes is least likely to affect the exchange-rate?A. Changes in supply of currency.B. Changes in demand of currency.C. Changes in. interest rates.D. Changes in unemployment.47. If the real interest rates in the U.S. are lower than its trading

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 高考生物一轮复习-1-3-2物质出入细胞的方式ppt课件-教科版

- 高考历史必修一第七单元复习课件

- 串联电路的特点1课件

- 平抛运动教学ppt课件

- 串联电路电压的特点课件

- 高考数学(文)一轮复习名师公开课省级获奖ppt课件正弦定理和余弦定理(湘教版)

- 高考生物一轮复习-1-3-1细胞与能量、酶ppt课件-教科版

- 高考生物一轮复习-1-4-3减数分裂和受精作用ppt课件-教科版

- 串联质谱气相色谱质谱结果解读培训课件

- 平行四边形的判定优秀ppt课件

- 高考数学-6.3二元一次不等式(组)与简单的线性规划问题配套ppt课件-理-新人教A版

- 高二英语下学期单词讲解课件

- 高考数学-4-3三角函数的图像与性质ppt课件-理

- 串联型晶体管稳压电源课件

- 平行四边形的面积公开课一等奖课件