投资学第7版TestBank答案.doc

投资学第7版TestBank答案.doc

《投资学第7版TestBank答案.doc》由会员分享,可在线阅读,更多相关《投资学第7版TestBank答案.doc(21页珍藏版)》请在装配图网上搜索。

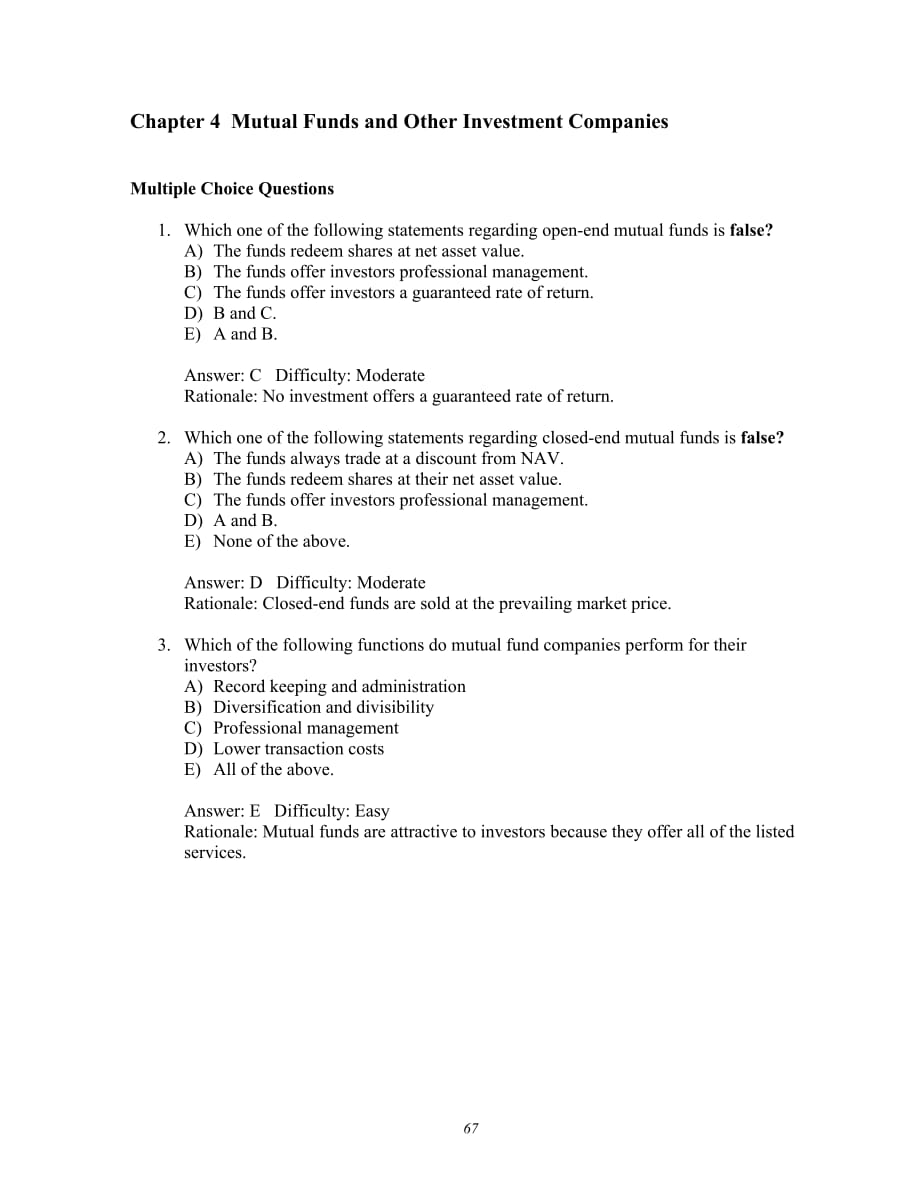

1、Chapter 4 Mutual Funds and Other Investment Companies Multiple Choice Questions1.Which one of the following statements regarding open-end mutual funds is false? A)The funds redeem shares at net asset value. B)The funds offer investors professional management. C)The funds offer investors a guaranteed

2、 rate of return. D)B and C. E)A and B. Answer: C Difficulty: Moderate Rationale: No investment offers a guaranteed rate of return.2.Which one of the following statements regarding closed-end mutual funds is false? A)The funds always trade at a discount from NAV. B)The funds redeem shares at their ne

3、t asset value. C)The funds offer investors professional management. D)A and B. E)None of the above. Answer: D Difficulty: Moderate Rationale: Closed-end funds are sold at the prevailing market price.3.Which of the following functions do mutual fund companies perform for their investors? A)Record kee

4、ping and administration B)Diversification and divisibility C)Professional management D)Lower transaction costs E)All of the above. Answer: E Difficulty: Easy Rationale: Mutual funds are attractive to investors because they offer all of the listed services.4.Multiple Mutual Funds had year-end assets

5、of $457,000,000 and liabilities of $17,000,000. There were 24,300,000 shares in the fund at year-end. What was Multiple Mutuals Net Asset Value? A)$18.11 B)$18.81 C)$69.96 D)$7.00 E)$181.07 Answer: A Difficulty: Moderate Rationale: (457,000,000 - 17,000,000) / 24,300,000 = $18.115.Growth Fund had ye

6、ar-end assets of $862,000,000 and liabilities of $12,000,000. There were 32,675,254 shares in the fund at year-end. What was Growth Funds Net Asset Value? A)$28.17 B)$25.24 C)$19.62 D)$26.01 E)$21.56 Answer: D Difficulty: Moderate Rationale: (862,000,000 - 12,000,000) / 32,675,254 = $26.016.Diversif

7、ied Portfolios had year-end assets of $279,000,000 and liabilities of $43,000,000. If Diversifieds NAV was $42.13, how many shares must have been held in the fund? A)43,000,000 B)6,488,372 C)5,601,709 D)1,182,203 E)None of the above. Answer: C Difficulty: Moderate Rationale: ($279,000,000 - 43,000,0

8、00) / $42.13 = 5,601,708.996.7.Pinnacle Fund had year-end assets of $825,000,000 and liabilities of $25,000,000. If Pinnacles NAV was $32.18, how many shares must have been held in the fund? A)21,619,346,92 B)22,930,546.28 C)24,860,161.59 D)25,693,645.25 E)None of the above. Answer: C Difficulty: Mo

9、derate Rationale: ($825,000,000 - 25,000,000) / $32.18 = 24,860,161.59.8.Most actively managed mutual funds, when compared to a market index such as the Wilshire 5000, A)beat the market return in all years. B)beat the market return in most years. C)exceed the return on index funds. D)do not outperfo

10、rm the market E)None of the above is a correct statement. Answer: D Difficulty: Easy Rationale: Most actively managed mutual funds fail to equal the return earned by index funds, possibly due to higher transactions costs.9.Pools of money invested in a portfolio that is fixed for the life of the fund

11、 are called A)closed-end funds. B)open-end funds. C)unit investment trusts. D)REITS. E)redeemable trust certificates. Answer: C Difficulty: Easy Rationale: Unit investment trusts are funds that invest in a portfolio, often fixed-income securities, and hold it to maturity.10.Investors in closed-end f

12、unds who wish to liquidate their positions must A)sell their shares through a broker. B)sell their shares to the issuer at a discount to Net Asset Value. C)sell their shares to the issuer at a premium to Net Asset Value. D)sell their shares to the issuer for Net Asset Value. E)hold their shares to m

13、aturity. Answer: A Difficulty: Moderate Rationale: Closed-end fund shares are sold on organized exchanges through a broker.11.Closed end funds are frequently issued at a _ to NAV and subsequently trade at a _ to NAV. A)discount, discount B)discount, premium C)premium, premium D)premium, discount E)N

14、o consistent relationship has been observed. Answer: D Difficulty: Moderate Rationale: Closed-end funds are typically issued at a premium to Net Asset Value and subsequently trade at a discount.12.At issue, offering prices of open-end funds will often be A) less than NAV due to loads and commissions

15、. B)greater than NAV due to loads and commissions. C)less than NAV due to limited demand. D)greater than NAV due to excess demand. E)less than or greater than NAV with no apparent pattern. Answer: B Difficulty: Difficult Rationale: Open-end funds are redeemable on demand at NAV so they should never

16、sell for less than NAV. However, loads and commissions can increase the price above NAV.13.Which of the following statements about Real Estate Investment Trusts is true? A)REITS invest in real estate or loans secured by real estate. B)REITS raise capital by borrowing from banks and issuing mortgages

17、. C)REITS are similar to open-end funds, with shares redeemable at NAV. D)All of the above are true. E)Both A and B are true. Answer: E Difficulty: Moderate Rationale: Real Estate Investment Trusts invest in real estate or real-estate-secured loans. They may raise capital from banks and by issuing m

18、ortgages. They are similar to closed-end funds and shares are typically exchange traded.14.In 2004 the proportion of mutual funds specializing in common stocks was A)21.7% B)28.0% C)54.1% D)73.4% E)63.5% Answer: C Difficulty: Moderate Rationale: See Table 4.1.15.In 2004 the proportion of mutual fund

19、s specializing in bonds was A)15.9% B)28.0% C)54.1% D)73.4% E)63.5% Answer: A Difficulty: Moderate Rationale: See Table 4.1.16.In 2004 the proportion of mutual funds specializing in money market securities was A)21.7% B)28.0% C)54.1% D)73.4% E)23.6% Answer: C Difficulty: Moderate Rationale: See Tabl

20、e 4.1.17.Management fees and other expenses of mutual funds may include A)front-end loads. B)back-end loads. C)12b-1 charges. D)A and B only. E)A, B and C. Answer: E Difficulty: Easy Rationale: All of the listed expenses may be included in the cost of owning a mutual fund.18.The Profitability Fund h

21、ad NAV per share of $17.50 on January 1, 2005. On December 31 of the same year the funds NAV was $19.47. Income distributions were $0.75 and the fund had capital gain distributions of $1.00. Without considering taxes and transactions costs, what rate of return did an investor receive on the Profitab

22、ility fund last year? A)11.26% B)15.54% C)16.97% D)21.26% E)9.83% Answer: D Difficulty: Moderate Rationale: R = ($19.47 - 17.50 + .75 + 1.00) / $17.50 = 21.26%19.The Yachtsman Fund had NAV per share of $36.12 on January 1, 2005. On December 31 of the same year the funds NAV was $39.71. Income distri

23、butions were $0.64 and the fund had capital gain distributions of $1.13. Without considering taxes and transactions costs, what rate of return did an investor receive on the Yachtsman Fund last year? A)22.92% B)17.68% C)14.39% D)18.52% E)14.84% Answer: E Difficulty: Moderate Rationale: R = ($39.71 -

24、 36.12 + .64 + 1.13) / $36.12 = 14.84%20.Investors Choice Fund had NAV per share of $37.25 on January 1, 2005. On December 31 of the same year the funds rate of return for the year was 17.3%. Income distributions were $1.14 and the fund had capital gain distributions of $1.35. Without considering ta

25、xes and transactions costs, what ending NAV would you calculate for Investors Choice? A)$41.20 B)$33.88 C)$43.69 D)$42.03 E)$46.62 Answer: A Difficulty: Moderate Rationale: .173 = (P - $37.25 + 1.14 + 1.35) / $37.25; P = $41.2021.Which of the following is not an advantage of mutual funds? A)They off

26、er a variety of investment styles. B)They offer small investors the benefits of diversification. C)They treat income as passed through to the investor for tax purposes. D)A, B and C are all advantages of mutual funds. E)Neither A nor B nor C are advantages of mutual funds. Answer: C Difficulty: Easy

27、 Rationale: A disadvantage of mutual funds is that investment income is passed through for tax purposes and investors may therefore lose the ability to engage in tax management.22.Which of the following would increase the net asset value of a mutual fund share, assuming all other things remain uncha

28、nged? A)an increase in the number of fund shares outstanding B)an increase in the funds accounts payable C)a change in the funds management D)an increase in the value of one of the funds stocks E)a decrease in the funds 12b-1 fee Answer: D Difficulty: Easy 23.Which of the following characteristics a

29、pply to unit investment trusts?I) Most are invested in fixed-income portfolios.II) They are actively managed portfolios.III) The sponsor pools securities, then sells public shares in the trust.IV) The portfolio is fixed for the life of the fund. A)I and IV B)I and II C)I, III, and IV D)I, II, and II

30、I E)I, II, III, and IV Answer: C Difficulty: Moderate 24.Jargon Rapid Growth is a mutual fund that has traditionally accepted funds from new investors and issued new shares at net asset value. Jeremy Jargon manages the fund himself and has become concerned that its level of assets has become too hig

31、h for his management abilities. He issues a statement that Jargon will no longer accept funds from new investors, but will continue to accept additional investments from current shareholders. Which of the following is true about Jargon Rapid Growth fund? A)Jargon used to be an open-end fund but has

32、now become a closed-end fund. B)Jargon has always been an open-end fund and will remain an open-end fund. C)Jargon has always been a closed-end fund and will remain a closed-end fund. D)Jargon is an open-end fund but would change to a closed-end fund if it wouldnt accept additional funds from curren

33、t investors. E)Jargon is violating SEC policy by refusing to accept new investors. Answer: B Difficulty: Moderate 25.As of December 31, 2004, which class of mutual funds had the largest amount of assets invested? A)stock funds B)bond funds C)mixed asset classes such as asset allocation funds D)money

34、 market funds E)global funds Answer: A Difficulty: Easy Rationale: See Table 4.1.26.Commingled funds are A)amounts invested in equity and fixed-income mutual funds. B)funds that may be purchased at intervals of 3, 6, or 12 month intervals at the discretion of management. C)amounts invested in domest

35、ic and global equities. D)closed-end funds that may be repurchased only once every two years at the discretion of mutual fund management. E)partnerships of investors that pool their funds, which are then managed for a fee. Answer: E Difficulty: Easy 27.Which of the following is true regarding equity

36、 mutual funds?I) They invest primarily in stock.II) They may hold fixed-income securities as well as stock.III) Most hold money market securities as well as stock.IV) Two types of equity funds are income funds and growth funds. A)I and IV B)I, III, and IV C)I, II, and IV D)I, II, and III E)I, II, II

37、I, and IV Answer: E Difficulty: Moderate 28.The fee that mutual funds use to help pay for advertising and promotional literature is called a A)front-end load fee. B)back-end load fee. C)operating expense fee. D)12b-1 fee. E)structured fee. Answer: D Difficulty: Easy 29.Patty OFurniture purchased 100

38、 shares of Green Isle mutual fund at a net asset value of $42 per share. During the year Patty received dividend income distributions of $2.00 per share and capital gains distributions of $4.30 per share. At the end of the year the shares had a net asset value of $40 per share. What was Pattys rate

39、of return on this investment? A)5.43% B)10.24% C)7.19% D)12.44% E)9.18% Answer: B Difficulty: Moderate Rationale: R = ($40-42+2+4.3)/$42 = 10.238%30.Assume that you purchased 200 shares of Super Performing mutual fund at a net asset value of $21 per share. During the year you received dividend incom

40、e distributions of $1.50 per share and capital gains distributions of $2.85 per share. At the end of the year the shares had a net asset value of $23 per share. What was your rate of return on this investment? A)30.24% B)25.37% C)27.19% D)22.44% E)29.18% Answer: A Difficulty: Moderate Rationale: R =

41、 ($23-21+1.5+2.85)/$21 = 30.238%31.Assume that you purchased shares of High Flying mutual fund at a net asset value of $12.50 per share. During the year you received dividend income distributions of $0.78 per share and capital gains distributions of $1.67 per share. At the end of the year the shares

42、 had a net asset value of $13.87 per share. What was your rate of return on this investment? A)29.43% B)30.56% C)31.19% D)32.44% E)29.18% Answer: B Difficulty: Moderate Rationale: R = ($13.87-12.50+0.78+1.67)/$12.50 = 30.56%32.Assume that you purchased shares of a mutual fund at a net asset value of

43、 $14.50 per share. During the year you received dividend income distributions of $0.27 per share and capital gains distributions of $0.65 per share. At the end of the year the shares had a net asset value of $13.74 per share. What was your rate of return on this investment? A)2.91% B)3.07% C)1.10% D

44、)1.78% E)-1.18% Answer: C Difficulty: Moderate Rationale: R = ($13.74-14.50+0.27+0.65)/$14.50 = 1.103%33.Assume that you purchased shares of a mutual fund at a net asset value of $10.00 per share. During the year you received dividend income distributions of $0.05 per share and capital gains distrib

45、utions of $0.06 per share. At the end of the year the shares had a net asset value of $8.16 per share. What was your rate of return on this investment? A)-18.24% B)-16.1% C)16.10% D)-17.3% E)17.3% Answer: D Difficulty: Moderate Rationale: R = ($8.16-10.00+0.05+0.06)/$10.00 = -17.3%34.A mutual fund h

46、ad year-end assets of $560,000,000 and liabilities of $26,000,000. There were 23,850,000 shares in the fund at year end. What was the mutual funds Net Asset Value? A)$22.87 B)$22.39 C)$22.24 D)$17.61 E)$19.25 Answer: B Difficulty: Moderate Rationale: (560,000,000 - 26,000,000) / 23,850,000 = $22.389

47、35.A mutual fund had year-end assets of $250,000,000 and liabilities of $4,000,000. There were 3,750,000 shares in the fund at year-end. What was the mutual funds Net Asset Value? A)$92.53 B)$67.39 C)$63.24 D)$65.60 E)$17.46 Answer: D Difficulty: Moderate Rationale: (250,000,000 - 4,000,000) / 3,750

48、,000 = $65.6036.A mutual fund had year-end assets of $700,000,000 and liabilities of $7,000,000. There were 40,150,000 shares in the fund at year-end. What was the mutual funds Net Asset Value? A)$9.63 B)$57.71 C)$16.42 D)$17.87 E)$17.26 Answer: E Difficulty: Moderate Rationale: (700,000,000 - 7,000

49、,000) / 40,150,000 = $17.2637.A mutual fund had year-end assets of $465,000,000 and liabilities of $37,000,000. If the fund NAV was $56.12, how many shares must have been held in the fund? A)4,300,000 B)6,488,372 C)8,601,709 D)7,626,515 E)None of the above. Answer: D Difficulty: Moderate Rationale:

50、($465,000,000 - 37,000,000) / $56.12 = 7,626,515.38.A mutual fund had year-end assets of $521,000,000 and liabilities of $63,000,000. If the fund NAV was $26.12, how many shares must have been held in the fund? A)17,534,456 B)16,488,372 C)18,601,742 D)17,542,515 E)None of the above. Answer: A Diffic

51、ulty: Moderate Rationale: ($521,000,000 - 63,000,000) / $26.12 = 17,534,456.39.A mutual fund had year-end assets of $327,000,000 and liabilities of $46,000,000. If the fund NAV was $30.48, how many shares must have been held in the fund? A)11,354,751 B)8,412,642 C)10,165,476 D)9,165,414 E)9,219,160

52、Answer: E Difficulty: Moderate Rationale: ($327,000,000 - 46,000,000) / $30.48 = 9,219,160.40.A mutual fund had NAV per share of $19.00 on January 1, 2005. On December 31 of the same year the funds NAV was $19.14. Income distributions were $0.57 and the fund had capital gain distributions of $1.12.

53、Without considering taxes and transactions costs, what rate of return did an investor receive on the fund last year? A)11.26% B)10.54% C)7.97% D)8.26% E)9.63% Answer: E Difficulty: Moderate Rationale: R = ($19.14 - 19.00 + .57 + 1.12) / $19.00 = 9.63%41.A mutual fund had NAV per share of $26.25 on J

54、anuary 1, 2005. On December 31 of the same year the funds rate of return for the year was 16.4%. Income distributions were $1.27 and the fund had capital gain distributions of $1.85. Without considering taxes and transactions costs, what ending NAV would you calculate? A)$27.44 B)$33.88 C)$24.69 D)$

55、42.03 E)$16.62 Answer: A Difficulty: Moderate Rationale: .164 = (P - $26.25 + 1.27 + 1.85) / $26.25; P = $27.43542.A mutual fund had NAV per share of $16.75 on January 1, 2005. On December 31 of the same year the funds rate of return for the year was 26.6%. Income distributions were $1.79 and the fu

56、nd had capital gain distributions of $2.80. Without considering taxes and transactions costs, what ending NAV would you calculate? A)$17.44 B)$13.28 C)$14.96 D)$17.25 E)$16.62 Answer: E Difficulty: Moderate Rationale: .266 = (P - $16.75 + 1.79 + 2.80) / $16.75; P = $16.61543.A mutual fund had NAV pe

57、r share of $36.15 on January 1, 2005. On December 31 of the same year the funds rate of return for the year was 14.0%. Income distributions were $1.16 and the fund had capital gain distributions of $2.12. Without considering taxes and transactions costs, what ending NAV would you calculate? A)$37.93

58、 B)$34.52 C)$44.69 D)$47.25 E)$36.28 Answer: A Difficulty: Moderate Rationale: .14 = (P - $36.15 + 1.16 + 2.12) / $36.15; P = $37.93144.Differences between hedge funds and mutual funds are that A)hedge funds are only subject to minimal SEC regulation. B)hedge funds are typically open only to wealthy

59、 or institutional investors. C)hedge funds managers can pursue strategies not available to mutual funds such as short selling, heavy use of derivatives, and leverage. D)hedge funds attempt to exploit temporary misalignments in security valuations. E)all of the above Answer: E Difficulty: Moderate 45

60、.Of the following types of mutual funds, an investor that wishes to invest in a diversified portfolio of stocks worldwide (including the U.S.) should choose A)international funds. B)global funds. C)regional funds. D)emerging market funds. E)none of the above. Answer: B Difficulty: Moderate 46.Of the following types of mutual funds, an investor that wishes to invest in a diversified portfolio of foreign stocks (excluding the U.S.) should choose A)Internationa

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 三基培训ppt课件--抗生素的分类及临床应用

- 三年级科学上册3.2《果实累累的季节》-ppt课件大象版

- 《离子键》ppt教学讲解课件

- 三年级科学上册4.2《动物怎样过冬》-ppt课件大象版

- 中考“转换”专题徽标类资料课件

- 人力资源管理师(二级第三章师级培训开发)课件

- 《利用相似三角形测高》教学ppt课件

- 两条直线的交点坐标及两点间的距离公式课件

- 人力资源管理师(四级)第三版-第六章-劳动关系管理课件

- 严格按照定额计价即施工图预算法课件

- 《良性前列腺增生》PPT课件

- 《廉颇蔺相如列传》复习ppt课件上课

- 人教版九年级物理上册ppt课件第十五章电流和电路

- 严谨务实准确高效课件

- 《廉颇蔺相如列传》公开课优质课ppt课件