Anoldsurvey1984(风险投资创新与金融的结合,刘曼红)

Anoldsurvey1984(风险投资创新与金融的结合,刘曼红)

《Anoldsurvey1984(风险投资创新与金融的结合,刘曼红)》由会员分享,可在线阅读,更多相关《Anoldsurvey1984(风险投资创新与金融的结合,刘曼红)(38页珍藏版)》请在装配图网上搜索。

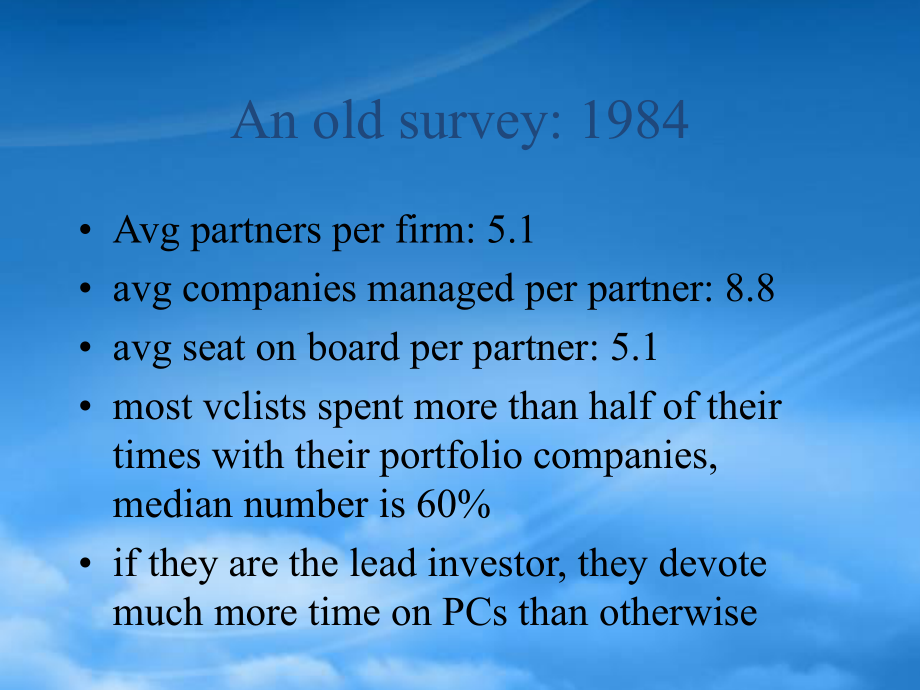

1、An old survey:1984 Avg partners per firm:5.1 avg companies managed per partner:8.8 avg seat on board per partner:5.1 most vclists spent more than half of their times with their portfolio companies,median number is 60%if they are the lead investor,they devote much more time on PCs than otherwiseVentu

2、re capitalists pay the 80s,venture capitalists base salary”$150,000 to$200,000,calculated on a 2 to 2.5 percent management fee,less expenses.As the size of the funds have mushroomed while most expenses have remained generally flat,many venture capitalists now pull in two to three times that.Base sal

3、aries of$1 million are no longer unusual of course,that doesnt account for winning investments really big payoffs-performance-based fees and personal equity stakes.Louis John Doerr,III Doerr is to his business what Gates is to software.”Doerr can boast of helping to midwife such enterprises as Netsc

4、ape Communications Corp.,Compaq Computer Corp.,Intuit,Lotus Development Corp.and Sun Microsystems.Since joining Kleiner Perkins in 1980,Doerr has ridden three tsunamilike waves of technology:personal computing,PC software and,now,the InternetDoerrs firm VC-backed companies grew jobs 20%on average fr

5、om 1990 to 1994.KPCB calculates that the companies it has backed have generated 131,000 new jobs,along with combined annual revenues of$44 billion.Their total market capitalization:$84 billion.The firm has reportedly racked up average annualized returns of more than 30 percent since its founding in

6、1972,putting it in the top 1 percent of all venture firms.The industry as a whole has averaged 13.1 percent annual returns over the past two decadesA new concept:Keiretsu value-added investing is access to a network of shared information and knowledge referred to as the Keiretsu.Companies that becom

7、e part of this interlocking KPCB network share experiences,insights,knowledge,and information.the flip side of Keiretsu is that Doerr also sits on the boards of directors of companies that hold competing,not cooperative,interests.One secret for Vclist to success:Recruiting The famous VC firm:Kleiner

8、,Perkins Caufield&Byers.John Doerrs power and influence on the VBC:recruiting efforts.He is a great recruiter.Why so critical?CEO-in-residence program,william Campbell,the former Go chief,later in Intuit.Road shows and conferencesDare to pay high price John Doerr,paid a 5 million to Netscape in june

9、.1994,and in may,it worth about 600 millionthe partners in KPCB took 30 minutes to vote investing in Netscape.Monday morning,all 10 partners gather at headquarter-sitting around a table:the world largest surfboard.Formal presentation at 11 am and 2 pm hold board seats on 80%of the VBC.Doerr believes

10、 1980s is for hardware and software,but 90s is for internet.KPCB-why famous strategies are easy,its execution is everything.The firm reviews some 2,000 business plans a year,of which 200 get serious consideration and 20 to 25 actually get money.1994,Silicon Graphics founder Jim Clark called Doerr to

11、 tell him about a little piece of software called a browser,written by this 23-yearold kid from the University of Illinois named Marc Andreessen.Four years later the call still ranks as the most significant thing to happen to KPCB in a decade.And perhaps the luckiest.Louis John Doerr,III-2 Born in 1

12、951 in a middle-class section of South St.Louis,the eldest of five.His role model was his father-Lou,quit job to buy a small St.Louis specialty pump maker,Charles Lewis Pump Co.,which he built into the worlds largest supplier of sulfuric acid pumps.Doerr was studying EE at Rice U.in Houston,Tx.With

13、2 friends started their own company,wrote graphics software for Burroughs computers.graduated from Rice in 1973 BS,MS in EE MBA at HBS,which has probably produced more venture capitalists than any other institutionLouis John Doerr,III-3 5 years at Intel.made the unusual request to be transferred fro

14、m the Santa Clara headquarters to the Chicago sales office.He needed to be a field salesman,to live that experience In 1980 he contacted Byers,who offered a job as a Kleiner Perkins associate,he accepted,but with the stipulation that Kleiner Perkins would back him if he decided to pursue his own sta

15、rt-up.1980-82 he spent half time for Silicon Compilers,in which he had a small equity stake,in 1982,KP raised venture capitals first megafund,a then-unheard-of$150 million,asked him back as a general partner.Louis John Doerr,III-4 Brands matter in consumer marketing.Reputation and values matter in s

16、ervice businesses,notes Doerr At the core of Kleiner Perkinss relationship network are the more than 250 its PCs.Doerr calls them our most important off-balance-sheet weapon.”KP have taken venture capital to the next level by building extensive bridges to other companies through alliances and joint

17、ventures.the Kleiner keiretsu,after the Japanese system of extensive cross-ownership within a family of companies,encourages its companies to work with one another whenever possibleLouis John Doerr,III-5 cannot build a great company nor make a great investment by cutting a tough deal with an entrepr

18、eneur,need to be ruthlessly honest about the risks and focus on removing those risks.”Doerr hardwires his network by placing Kleiner CEOs on the boards of other com of the keiretsu.Netscape Jim Clark personally putting up$3MM&pricing his concept at another$3 MM,with a multiple of three times,value t

19、he start-up at$18 MM.Mayfield not respond,and NEA only offer a multiple of two.But Doerr in Jan.1994,was intrigued by Andreessen,invested$5mm,later became$600mmLouis John Doerr,III-6 Tom Perkins wanted a no-bullshit atmosphere,where people rolled up their sleeves&got something done In the 1980s PC h

20、ardware and software grew into a$100 billion industry,says Doerr.The Internet could be three times bigger.Kleiner Perkins now has stakes in more than a dozen pure-play Internet companies,including:Com21,Concentric Network Corp.,Diamond Lane Communications,Excite,Home,Healthscape,Individual,OnLive!Te

21、chnologies,Netscape,Precept Software,SportsLine USA,Total Entertainment Network and VeriSign.Louis John Doerr,III-7 10/2/1969,UC gave birth to a beautiful,bouncing baby network-the first electronic communication passed from the universitys Berkeley campus to its LA campus,marking the beginning of an

22、 E-mail system,the foundation for the modern Internet.joined Intel in 1975 as an engineer-UCLA decided to make hiim a member of its birthday party advisory committee.”From then on,Doerrs influence has spanned almost two decades of technology investments.Why is he successful?“his energy jolts people

23、out of ordinary thinking.Louis John Doerr,III-8 Lotus early seed money,and IBM Corp.later bought Lotus in 1995 for$3.5 billion.on Palo Alto-based Suns board throughout its most bruising fights with rival Microsoft Corp.Intuit.The maker of Quicken and QuickBooks is very strong growth in its market ca

24、pitalization Home.on the board of the high-speed cable-based Internet services company,cap of$14 billion plus.“Venture capitalists should help entrepreneurs assemble great teams,But VCs dont manage,inspire or lead.Were off stage,behind the curtains,Venture capital is a supporting role”Venture Capita

25、list:Arthur Rock Worth$660 mm.Age 71(1998)Originally a Wall Street stock picker,showed rocksolid instincts during 1950s boom.Sensing 1962 crash,quit,headed West.Founded venture capital partnership.Again great instincts.Early backer Apple,Intel.Likes to keep an eye on his basket:invests only in compa

26、nies within driving distance of Bay Area.Backs people,not things His initial$300,000 investment in Intel is now worth around$600 million.A venture capitalist&artist Nicholas B.Binkley,50,mix finance and art for 20 yrs.worked as an executive at Chase Manhattan Bank,Security Pacific Bank and Bank of A

27、merica,he was moonlighting at night,playing in local bands and developing his craft.Binkley recently released a CD,Pin Stripe Brain,offering 15 songs he wrote Binkley insists that theres a connection between venture capital and music-that creativity and empathy are skills that transfer to both world

28、s.Norman Brodsky:invest for fun Brodsky,a venture capitalist,no longer invests just for the money but for fun,being part of a new business and the satisfaction he gets from helping entrepreneurs succeed.4 rules of angel investing:1.Invest in people who want your help,not your money.2.When possible,g

29、o it alone.3.Take a majority stake until your investment has been repaid.4.Retain the right to force a payout.its not my business but it is,I own 100%of the stock.davie is the entrepreneur.if he pays back my initial investment,hell be the majority shareholder Korea Vclist:Chai Hyun-Sukat KDIFC 40 ye

30、ar old,10 year experience 29 hits in 32 at-bats in vc investment,successful rate is 90.6%invest in Dooin,1 million,4.4 million 2 years later.Has to be adventurous:when the firm is more stable,youve lost a chance to invest.Venture capitalist Chai Hyun-Suk 40 yr old,on the board of Korea Development I

31、nvestment Finance Corp.(KDIFC)in 1997.He has scored 29 hits in 32 at-bats in capital investment plays.A recent example of Chais success in investments is the Dooin Electronics,which is standing out in the multimedia card sector.From a single investment of 900 million won,Chai earned about 4 billion

32、won within just 2 years on behalf of the KDIFC.Vclist Chai Hyun-Suk-2 When a venture firm has grown and enters a more stable stage,you already lose the chance to invest Chai could not always hit home runs.In a few cases,he lost 100%of the money he invested.But he said he could learn more from a fail

33、ure than a success.he believes that nothing can be realized without good teamwork is going to invest in a space-shuttle related project,which no Korean venture capital firm has ever tried.It is high risk,but could put the nations venture capital on a higher,more sophisticated plane.Denzil Doyle esti

34、mates Canada is running a$15 billion trade deficit in high-tech products and services,primarily with the U.S.The capital gains tax rate is 40.The highest marginal income tax rate is 50,and three quarters of capital gains are lumped in with income.The Canadian government would like to create jobs but

35、 unwilling to provide tax incentives to attract investment angels.prior to 1996,Canadians could contribute up to$5,000 to venture capital funds and receive a 40 tax credit.now only$3,500 and the tax credit is 30.Young Vclist:Brad Feld A sophomore undergraduate at MIT,Feld started to consult for the

36、dentist(the stepfather of his friends)and others,flying to California on weekends,at his junior year,he was earning$80,000 consulting between classes Feld Technologies was soon acquired by GE Capital.In 1994,Feld himself became a venture capitalist;he says he has helped launch 15 new software compan

37、ies.Overall,he says,hes become involved in more than 30 companies I think of myself as a seed entrepreneur,Prof.Fred Terman In 1938,he persuaded 2 of his students,Bill Hewlett and David Packard,to set up a company making electronic measuring equipment in a garage In the 1950s,Hewlett-Packard,and oth

38、ers moved into Stanford Universitys new industrial park.Over the next 2 decades,the number of young firms multiplied steadily The name Silicon Valley-an allusion to its main industry,silicon chips-was invented in 1971 by a local technology journalist.the valley is an existential creation:nobody said

39、 lets build an entrepreneurial technological centre.The Silicon Valley Real start from HP moved to Standford in 1950s.1957,vclist arthur Rock tried to back a company:Fairchild Semiconductor 1971,silicon valley name appeared 1976,apple computer was born the mid-198os,Silicon Valleys chip industry fou

40、nd itself outclassed by Japanese competitors.The valley responded by revamping manufacturing operations,outsourcing and diversifying into other areas,particularly computer softwareThe silicon valley-2 Since 1992 the valley has been on a roll,adding more than 125,000 jobs and doubling its annual expo

41、rts to about$40 billion,a fifth of its total output The chief driving force has been software(market$120 BM)But Silicon Valley does not live just on chips and software.It includes at least 7 different industries,including biotechnology and environmental science,especially internet.The average wage i

42、n these cluster industries is over$60,000 a year,but add value of$114,000 in 1992 It took HP nearly 40 years to reach revenues of$1 billion.But Netscape can be there in less than 5yearsA venture capitalists confession Making a little bit of money means youre not a very good venture capitalist.Please

43、 get the executive summary of your business plan to me as soon as possible,so that I can either throw money at you or tell you what a schmuck you are for daring to darken our doorway.Looking for a potential RBC,really big company The key to starting a RBC is riding a fundamental change in technology

44、,just as Cisco successfully rode the arrival of the Internet,rather than taking on an established company on its home turf.Active Angle investors these active angles invest tens of thousands,along with tech-industry experience and usually settle for a 5 percent stake in the company.Typically,Madhava

45、n Rangaswami seeks out companies with assets of less than$5 million,works to double the firms value,then sends management out for venture capital funding.Invested$30,0000 in MarketFirst,which develops software to automate basic marketing events and processes.Also helped raise about$500,000 from frie

46、nds and business contactsA venture capitalist:mark levin Mark Levin of Millennium Pharmaceuticals is an engineer.That makes him ideally qualified to be a successful biotechnology entrepreneur signed the biggest biotech alliance in history-a$465m agreement with Bayer,a German drug firm.he founded MP

47、in Cambridge MA,in 1993,from 30 researchers to 600+of the best,brightest scientists,managers and technicians.also a vclist for 7 years.One observer has called him the Mao Zedong of biotech,a believer in continuous revolution in both technology and organizationA vclist Regis McKenna He looks like a z

48、en monk with stiffness he had Clinton to dinner,along with eight of Silicon Valleys major names.He was the first on his block to try digital thermostats,a home theater with a digital projector he uses to view the Internet the future,which belongs,he believes,to intranets because its a fairly inexpen

49、sive and rapid way to deploy applications across an enterprise Bad news for Microsoft.A venture capitalist Pappajohn John Pappajohns initial$125,000 stake will be work$15 million-a 120-fold return in 18 months.he set up shop as a venture capitalist in 1969,he had$100,000.By investing in health care

50、startups he has now more than$200 million.Pappajohns venture fund consist solely of his own money.In the past 27 years he has founded more than 2 dozen public companies.to be there first or very early,says Pappajohn.Wall Street will pay more for a successful new idea.A venture capitalist pappajohn-2

51、 Pappajohn was born in Greece and grew up in Mason City,Iowa,his father ran a corner grocery store,no telephone and shared a car.His father died when he was 16,leaving him to support his mother,who spoke no English,and his younger brothers.He doesnt use a computer.He keeps a list of his companies on

52、 a tatty piece of paper in his coat pocket.Yet he quickly grasped the market potential of NetGenics software,which might speed up the colossally expensive drug discovery process.modest life,to be the biggest philanthropist in iowaA vclist:Tom Perkins As one of the founders of the pioneering Silicon

53、Valley venture capital firm of KPCB in the early 1970s,Perkins invested$8 million and cofounded two legendary successes,Genentech and Tandem.1953,he graduated from MIT with an EE degree;4 years later,an M.B.A.from Harvard,an educational path is now considered a winning combination.Packard put him in

54、 the HPs machine shop.For several months,he was probably the best educated lathe and mill operator in America.A vclist:Tom Perkins-2 he took$12,000 to manufacture and market lightbulb-simple lasers based on his own optical inventions.lasers were complex,fragile and,at$2,000 to$5,000 each,expensive.H

55、is product high quality and lower price:$300 When Perkins left HP to go into business with Eugene Kleiner,he was in the right place at the right time,with the right instincts.Since 1972,the firm has raised nine funds,returning an average of 35%to investors and littering the landscape with successful

56、,imaginative businesses.Young Venture Capitalists To make the really big bucks,young venture capitalists once had to wait years to make general partner.No more.That 20%is diwied up at the discretion of the top partners,based on seniority and performance.Today a junior partner may get as much as 1.5%

57、,an associate lo-still less than senior partners,who make 4%to 7%,but more than they got three years ago Carried interest is even being used as a recruiting lure to find the best and the brightest at the associate level,an incentive almost unheard-of five years agoYoung Venture Capitalists-2 venture

58、 capitalists are desperate for new blood.A record of-$16 bil.in 1998-more hands are needed Senior partners are doing less work and the younger guys are picking up the slack,William M.Mercers 1998 Compensation Survey,analyzed pay for 60 vc&pe firms through 1998,total compensation jumped 128%for junio

59、r partners and 35%for associates.Most from carried interest.Summit Partners(Boston),$3 billion under mgt.last 3 years,doubled the combined value of salary,bonus and carried interest for its junior-level vclists.谢谢观看/欢迎下载BY FAITH I MEAN A VISION OF GOOD ONE CHERISHES AND THE ENTHUSIASM THAT PUSHES ONE TO SEEK ITS FULFILLMENT REGARDLESS OF OBSTACLES.BY FAITH I BY FAITH

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。