2022最全江西财经大学高级财务会计国际学院题库

2022最全江西财经大学高级财务会计国际学院题库

《2022最全江西财经大学高级财务会计国际学院题库》由会员分享,可在线阅读,更多相关《2022最全江西财经大学高级财务会计国际学院题库(58页珍藏版)》请在装配图网上搜索。

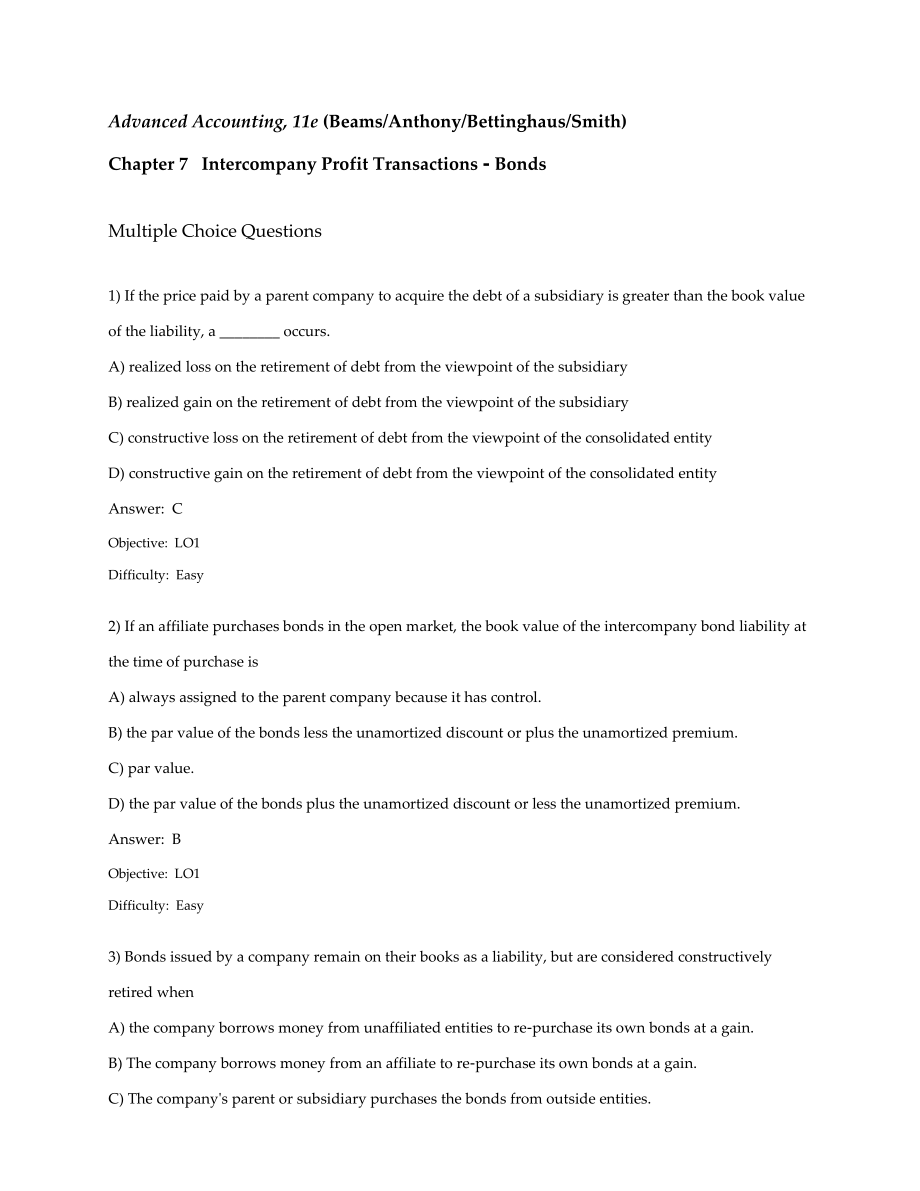

1、Advanced Accounting, 11e (Beams/Anthony/Bettinghaus/Smith)Chapter 7 Intercompany Profit Transactions - BondsMultiple Choice Questions1) If the price paid by a parent company to acquire the debt of a subsidiary is greater than the book value of the liability, a _ occurs.A) realized loss on the retire

2、ment of debt from the viewpoint of the subsidiaryB) realized gain on the retirement of debt from the viewpoint of the subsidiaryC) constructive loss on the retirement of debt from the viewpoint of the consolidated entityD) constructive gain on the retirement of debt from the viewpoint of the consoli

3、dated entityAnswer: CObjective: LO1Difficulty: Easy2) If an affiliate purchases bonds in the open market, the book value of the intercompany bond liability at the time of purchase isA) always assigned to the parent company because it has control.B) the par value of the bonds less the unamortized dis

4、count or plus the unamortized premium.C) par value.D) the par value of the bonds plus the unamortized discount or less the unamortized premium.Answer: BObjective: LO1Difficulty: Easy3) Bonds issued by a company remain on their books as a liability, but are considered constructively retired whenA) th

5、e company borrows money from unaffiliated entities to re-purchase its own bonds at a gain.B) The company borrows money from an affiliate to re-purchase its own bonds at a gain.C) The companys parent or subsidiary purchases the bonds from outside entities.D) The company borrows money from an affiliat

6、e to repurchase its own bonds at a gain or at a loss.Answer: CObjective: LO1Difficulty: EasyUse the following information to answer the question(s) below.Pascalian Company owns a 90% interest in Sapp Company. On January 1, , Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of

7、 $9,000. The bonds mature on December 31, . Sapp acquired one-third of Pascalians bonds in the open market for $97,000 on January 1, . Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, , the books of the two affiliates held the

8、 following balances:Pascalians books6% bonds payable$300,000Premium on bonds7,200Interest expense16,200Sapps booksInvestment in Pascalian bonds$ 97,600Interest income6,6004) The gain from the bond purchase that appeared on the December 31, consolidated income statement wasA) $4,320.B) $4,800.C) $5,4

9、00.D) $6,000.Answer: DExplanation: D) Book value of Pascalians bonds acquired by Sapp equals 1/3times ($300,000 + $9,000)$103,000Less: Cost of acquiring Pascalian bonds( 97,000)Constructive gain on bonds$ 6,000Objective: LO2Difficulty: Moderate5) Consolidated Interest Expense and consolidated Intere

10、st Income, respectively, that appeared on the consolidated income statement for the year ended December 31, wasA) $10,800 and $0.B) $10,800 and $6,600.C) $0 and $0.D) $16,200 and $6,600.Answer: AExplanation: A) Consolidated interest expense =$16,200 2/3$10,800Objective: LO2Difficulty: Moderate6) Pru

11、ssia Corporation owns 80% the voting stock of Stad Corporation. On January 1, , Prussia paid $391,000 cash for $400,000 par of Stads 10% $1,000,000 par value outstanding bonds, due on April 1, . Stads bonds had a book value of $1,045,000 on January 1, . Straight-line amortization is used. The gain o

12、r loss on the constructive retirement of $400,000 of Stad bonds on January 1, was reported in the consolidated income statement in the amount ofA) $14,000.B) $21,600.C) $23,000.D) $27,000.Answer: DObjective: LO2Difficulty: ModerateUse the following information to answer the question(s) below.Pfadt I

13、nc. had $600,000 par of 8% bonds payable outstanding on January 1, due January 1, with an unamortized discount of $12,000. Senat is a 90%-owned subsidiary of Pfadt. On January 2, , Senat Corporation purchased $150,000 par value of Pfadts outstanding bonds for $152,000. The bonds have interest paymen

14、t dates of January 1 and July 1. Straight-line amortization is used.7) With respect to the bond purchase, the consolidated income statement of Pfadt Corporation and Subsidiary for showed a gain or loss ofA) $ 4,500.B) $ 5,000.C) $10,800.D) $12,000.Answer: BExplanation: B) ($588,000 0.25) -$152,000Ob

15、jective: LO2Difficulty: Moderate8) Bond Interest Receivable for of Pfadts bonds on Senats books wasA) $5,400.B) $6,000.C) $10,800.D) $12,000.Answer: BExplanation: B) $150,000 8% 1/2Objective: LO2Difficulty: Moderate9) Bonds Payable appeared in the December 31, consolidated balance sheet of Pfadt Cor

16、poration and Subsidiary in the amount ofA) $398,925.B) $441,000.C) $443,250.D) $450,000.Answer: CExplanation: C) $591,000 75%Objective: LO2Difficulty: ModerateUse the following information to answer the question(s) below.Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, , at

17、 par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, . On January 2, , Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plentys separate net income for included the annual interest expense for all

18、3,000 bonds. Scrawns separate net income for was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.10) What was the amount of gain or (loss) fro

19、m the intercompany purchase of Plentys bonds on January 2, ?A) $(56,250)B) $(75,000)C) $ 75,000D) $ 56,250Answer: BExplanation: B) Total book value acquired =$6,000,000 50% $3,000,000Purchase price 3,000 $1,025 3,075,000Loss on constructive retirement$ 75,000Objective: LO2Difficulty: Moderate11) If

20、the bonds were originally issued at 106, and 80% of them were purchased by Scrawn on January 2, at 98, the gain or (loss) from the intercompany purchase wasA) $(384,000).B) $(211,200).C) $ 211,200.D) $ 384,000.Answer: CExplanation: C) Book value at January 2, equals $6,360,000 minus $216,000= $6,144

21、,000Percentage of bonds acquired 80%Equals book value acquired4,915,200Purchase price 4,800 bonds $980= 4,704,000Gain on constructive retirement=$ 211,200Objective: LO2Difficulty: Moderate12) If the bonds were originally issued at 103, and 70% of them were purchased on January 2, at 104, the constru

22、ctive gain or (loss) on the purchase wasA) $(142,800).B) $( 42,000).C) $ 42,000.D) $ 142,800.Answer: AExplanation: A) Book value at January 2, equals $6,180,000 minus $144,000 $6,036,000Percentage of bonds acquired 70%Equals book value acquired 4,225,200Purchase price 4,200 bonds $1,040 4,368,000Los

23、s on constructive retirement $ 142,800Objective: LO2Difficulty: Moderate13) Using the original information, the amount of consolidated Interest Expense for wasA) $ 135,000.B) $ 180,000.C) $ 270,000.D) $ 360,000.Answer: BExplanation: B) ($6,000,000 - $3,000,000) 6%Objective: LO2Difficulty: Moderate14

24、) Using the original information, the balances for the Bonds Payable and Bond Interest Payable accounts, respectively, on the consolidated balance sheet for December 31, wereA) $3,000,000 and $ 90,000.B) $3,000,000 and $180,000.C) $6,000,000 and $ 90,000.D) $6,000,000 and $180,000.Answer: AExplanati

25、on: A) Bonds payable $6,000,000 minus bonds held by Scrawn of $3,000,000. Interest accrued on December 31, will be the interest on bonds held by non-affiliates or $3,000,000 6% 1/2 yearObjective: LO2, 3Difficulty: Moderate15) Using the original information, the elimination entries on the consolidati

26、on working papers prepared on December 31, included at leastA) debit to Bond Interest Expense for $360,000.B) credit to Bond Interest Expense for $180,000 and a debit to Bond Interest Payable for $90,000.C) credit to Bond Interest Receivable for $180,000.D) debit to Bond Interest Revenue for $360,00

27、0.Answer: BObjective: LO2Difficulty: Moderate16) No constructive gain or loss arises from the purchase of an affiliates bonds if theA) affiliate is a 100%-owned subsidiary.B) bonds are purchased at book value.C) bonds are purchased with arms-length bargaining from outside entities.D) gain or loss ca

28、nnot be reasonably estimated.Answer: BObjective: LO1Difficulty: Easy17) There are several theories for allocating constructive gains or losses between purchasing and issuing affiliates. The Agency TheoryA) does so based on the par value of the bonds purchased.B) assigns the entire constructive gain

29、or loss to the parent based on their control of the decision to purchase the bonds.C) assigns the entire constructive gain or loss to the subsidiary based on the need to have the noncontrolling interest share in the retirement of the debt.D) assigns the entire constructive gain or loss to whichever

30、company issued the bonds.Answer: DObjective: LO1Difficulty: Easy18) Pickle Incorporated acquired a $10,000 bond originally issued by its 80%-owned subsidiary on January 2, . The bond was issued in a prior year for $11,250, matures January 1, , and pays 9% interest at December 31. The bonds book valu

31、e at January 2, is $10,625, and Pickle paid $9,500 to purchase it. Straight-line amortization is used by both companies. How much interest income should be eliminated in ?A) $720B) $800C) $900D) $1,000Answer: DExplanation: D) $9,500 - $10,000 = discount to amortize as interest expense over 5 years,

32、or $100 per year + $900 paid by issuer.Objective: LO2, 3Difficulty: ModerateUse the following information to answer the question(s) below.Poe Corporation owns an 80% interest in Seri Company acquired at book value several years ago. On January 2, , Seri purchased $100,000 par of Poes outstanding 10%

33、 bonds for $103,000. The bonds were issued at par and mature on January 1, . Straight-line amortization is used. Separate incomes of Poe and Seri for are $350,000 and $120,000, respectively. Poe uses the equity method to account for the investment in Seri.19) Controlling interest share of consolidat

34、ed net income for wasA) $443,600.B) $444,000.C) $444,400.D) $448,000.Answer: BExplanation: B) Poes separate income$ 350,000 Income from Seri ($120,000 80%) 96,000 Less: Loss on constructive retirement of Poe bonds(3,000)Plus: Piecemeal recognition of the constructive loss ($3,000/3 years) 1,000 Cont

35、rolling interest share$ 444,000 Objective: LO4Difficulty: Moderate20) Noncontrolling interest share for wasA) $23,000.B) $23,600.C) $24,000.D) $24,400.Answer: CExplanation: C) Since Poe is the issuing entity, the gain or loss is not allocated to the noncontrolling interest. The noncontrolling intere

36、st share is ($120,000 20%) = $24,000.Objective: LO4Difficulty: ModerateExercises1) Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31, are summarized as follows: Pitta Soujourn Consolidated Sales Revenue$ 500,000$ 100,000$ 600,000Inc

37、ome from Sojourn19,900Bond interest income6,000Gain on bond retirement3,000Total revenues519,900106,000603,000Cost of sales$ 280,000$ 50,000$ 330,000Bond interest expense9,0003,600Other expenses 120,900 31,000 151,900Total expenses 409,900 81,000 485,500Consolidated net income 117,500Noncontrolling

38、interest share 7,500 Separate net income andControl. interest share in consolidated net income$ 110,000 $ 25,000$ 110,000The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, . On January 2, , a portion of the bonds wa

39、s purchased and constructively retired.Required: Answer the following questions.1.Which company is the issuing affiliate of the bonds payable?2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for ?3.What portion of

40、the bonds payable is held by nonaffiliates at December 31, ?4.Is Sojourn a wholly-owned subsidiary? If not, what percentage does Pitta own?5.Does the purchasing affiliate use straight-line or effective interest amortization?6.Explain the calculation of Pittas $19,900 income from Sojourn.Answer: 1.Pi

41、tta is the issuing affiliate.2.Effect on consolidated net income:Gain on constructive retirement of bonds$ 3,0003.Percent of bonds held by nonaffiliates at December 31, is 40%, computed as $3,600 consolidated interest expense divided by $9,000 interest expense of Pitta.4.Sojourn is partially owned a

42、s evidenced by the noncontrolling interest share. The ownership percentage is 70% ($7,500 noncontrolling interest share divided by $25,000 income of Sojourn = 30% noncontrolling interest.)5.Straight-line amortization$100,000 par 60% purchased$60,000Purchase price 5 years before maturity 57,000Gain 3

43、,000Nominal interest ($60,000 9%)$ 5,400Discount amortization ($3,000/5 years) 600Bond interest income $ 6,0006.Pittas income from SojournShare of Sojourns reported income($25,000 70%) =$17,500Add: Constructive gain3,000Less: Piecemeal recognition of constructive gain (600) Income from Sojourn$19,90

44、0Objective: LO1, 2, 4Difficulty: Moderate2) Platts Incorporated purchased 80% of Scarab Company several years ago when the fair value equaled the book value. On January 1, , Scarab has $100,000 of 8% bonds that were issued at face value and have five years to maturity. Interest is paid annually on D

45、ecember 31. Both Platts and Scarab would use the straight-line method to amortize any premium or discount incurred in the issuance or purchase of bonds. On January 1, , Platts purchased all of Scarabs bonds for $96,000.Required:1.Prepare the journal entries in that would be recorded by Platts and Sc

46、arab on their separate financial records.2.Prepare the consolidating working paper entries required for the year ending December 31, .Answer: Requirement 1:Platts entries:1/1/11Investment in bonds$96,000Cash$96,00012/31/11Cash8,000Interest income 8,000Investment in bonds1,000Interest income 1,000Sca

47、rab entries:12/31/11Interest expense 8,000Cash 8,000Requirement 2:Consolidating entries:12/31/11Bonds payable100,000Investment in bonds97,000Gain on retirement of debt3,000Interest income9,000Interest expense8,000Gain on retirement of debt1,000Objective: LO2, 3Difficulty: Moderate3) Paka Corporation

48、 owns an 80% interest in Sandra Company. Paka acquired Sandras bonds on January 2, . The following information is from the adjusted trial balances at December 31, , at which time the bonds have three years to maturity. The bonds have interest payment dates of January 1 and July 1. Straight-line amor

49、tization is used by both companies. Paka Sandra Investment in Sandra Bonds, $100,000 par98,5007% Bonds payable, $200,000200,000Bond premium6,000Interest expense12,000Interest receivable7,000Interest income7,500Interest payable7,000Required:Prepare the necessary consolidation working paper entries on

50、 December 31, with respect to the intercompany bonds.Answer: Debit Credit 12/31Bond Interest Payable7,000Bond Interest Receivable7,00012/31Bonds Payable100,000Interest Income7,500Bond premium3,000Interest Expense (50% owned)6,000Investment in Sandras Bonds 98,500Gain on retirement of bonds6,000Suppo

51、rting Computations:Cost of bonds to Paka ($98,500 - $500)$98,000Book value acquired 1/1/ where $2,000 per year is amortized($200,000 + $8,000) 50% =104,000Gain on constructive bond retirement$6,000Objective: LO2, 3Difficulty: Moderate4) Pheasant Corporation owns 80% of Sal Corporations outstanding c

52、ommon stock that was purchased at book value equal to fair value on January 1, .Additional information:1.Pheasant sold inventory items that cost $3,000 to Sal during for $6,000. One-half of this merchandise was inventoried by Sal at year-end. At December 31, , Sal owed Pheasant $2,000 on account fro

53、m the inventory sales. No other intercompany sales of inventory have occurred since Pheasant acquired its interest in Sal.2.Pheasant sold equipment with a book value of $5,000 and a 5-year useful life to Sal for $10,000 on December 31, . The equipment remains in use by Sal and is depreciated by the

54、straight-line method. The equipment has no salvage value.3.On January 2, , Sal paid $10,800 for $10,000 par value of Pheasants 10-year, 10% bonds. These bonds were originally sold at par value, and have interest payment dates of January 1 and July 1, and mature on January 1, . Straight-line amortiza

55、tion has been applied by Sal to the Pheasant bond investment.4.Pheasant uses the equity method in accounting for its investment in Sal.Required:Complete the working papers to consolidate the financial statements of Pheasant Corporation and Sal for the year ended December 31, .Answer: Objective: LO2,

56、 3Difficulty: Difficult5) Phauna paid $120,000 for its 80% interest in Schrub on January 1, when Schrub had $150,000 of total stockholders equity.On January 1, , Phauna purchased $50,000 of Schrub Corporations 8% bonds for $48,000. At that time, $100,000 of bonds had been issued by Schrub, and unamo

57、rtized premium was $2,000. The bonds pay interest on June 30 and December 31 and mature on December 31, . Both Phauna and Schrub use straight-line amortization. Phauna uses the equity method of accounting for its investment in Schrub.Required:Prepare eliminating/adjusting entries for the bonds on th

58、e consolidating work papers for the year ended December 31, .Answer: 12/31/Interest income (8% $50,000) + ($2,000/5) 4,400Interest expense(8% $50,000) - ($1,000/5) 3,800Gain on retirement of bonds600Bonds payable50,000Premium on bonds payable800Bond investment48,400Gain on retirement of bonds2,400Pr

59、emium on bonds payable:$1,000 - $1,000/5 =$800Bond investment:$48,000 + $2,000/5 = $48,400Supporting computations:Book value of bonds($102,000 50%)$51,000 Cost of acquiring $50,000 par (48,000)Constructive gain3,000 Piecemeal recognition of gain (600)Unrecognized at December 31, $ 2,400 Objective: L

60、O2, 3Difficulty: Difficult6) Pelami Corporation owns a 90% interest in Sunbird Corporation. At December 31, , Sunbird had $3,000,000 of par value 6% bonds outstanding with an unamortized premium of $30,000. The bonds have interest payment dates of January 1 and July 1 and mature on January 1, .On Ja

61、nuary 2, , Pelami purchased $1,200,000 par value of Sunbirds outstanding bonds for $1,210,000. Assume straight-line amortization.Required:Prepare the necessary consolidation working paper entries with respect to the intercompany bonds for the year ending December 31, .Answer: Debit Credit 12/31Bond Interest Payable36,000Bond Interest Receivable36,00012/31Premium on Bonds Payable9,000Bonds Payable1,200,000Interest Revenue69,500Interest Expense69,000Investment in Sunbird Bonds1,207,500Gain on Retirement of Bonds2,000Suppor

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。