PE投资协议条款样本NVCA中英文对照版

PE投资协议条款样本NVCA中英文对照版

《PE投资协议条款样本NVCA中英文对照版》由会员分享,可在线阅读,更多相关《PE投资协议条款样本NVCA中英文对照版(30页珍藏版)》请在装配图网上搜索。

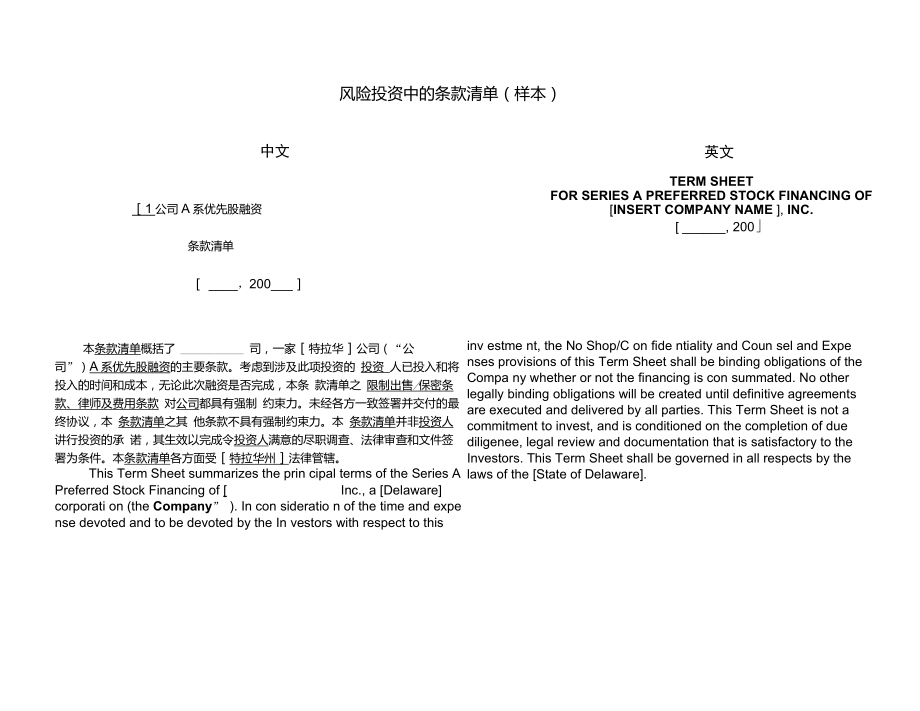

1、风险投资中的条款清单(样本)出资条款:Offering Terms出资条款:Offering Terms英文TERM SHEETFOR SERIES A PREFERRED STOCK FINANCING OFINSERT COMPANY NAME , INC., 200中文1公司A系优先股融资条款清单,200_出资条款:Offering Terms出资条款:Offering Terms本条款清单概括了 司,一家特拉华公司(“公司”)A系优先股融资的主要条款。考虑到涉及此项投资的 投资 人已投入和将投入的时间和成本,无论此次融资是否完成,本条 款清单之 限制出售/保密条款、律师及费用条款 对公

2、司都具有强制 约束力。未经各方一致签署并交付的最终协议,本 条款清单之其 他条款不具有强制约束力。本 条款清单并非投资人讲行投资的承 诺,其生效以完成令投资人满意的尽职调查、法律审查和文件签 署为条件。本条款清单各方面受特拉华州法律管辖。This Term Sheet summarizes the prin cipal terms of the Series A Preferred Stock Financing of Inc., a Delawarecorporati on (the Company” ). In con sideratio n of the time and expe ns

3、e devoted and to be devoted by the In vestors with respect to this inv estme nt, the No Shop/C on fide ntiality and Coun sel and Expe nses provisions of this Term Sheet shall be binding obligations of the Compa ny whether or not the financing is con summated. No other legally binding obligations wil

4、l be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligenee, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all res

5、pects by the laws of the State of Delaware.出资条款:Offering Terms交割日:投资人:融资金额:每股价格:融资前估价:资本结构表:当公司接受此条款清单且交割条件完备 时即尽快交割(“交割”)。(若需要 多次交割,请与此写明。)投资人 1:股(%),$投资人 2: 股(%),$以及投资人和公司一致同意的其他 投 资人$,含由过渡贷款转换的本金及利息$ 1$每股 (以下文所列公司资本结构表为依据)(“原始购买价”)原始购买价以充分稀释融资前估价$和融资后估价$_为基础计算(含充分稀释的融资后资本中员工 股预留%)交割前后公司资本结构表请见附件一

6、Clos ing Date:Inv estors:As soon as practicable follow ing the Compa ny accepta nee of this Term Sheet and satisfact ion of the Conditions to Closing (theClosing).provide for multiple closings if applicableInvestor No. 1: shares (_%),$ Investor No. 2: shares (_%),$ as well other inv estors mutually

7、agreed upon by In vestors and the Compa nyAmount Raised: $_, in clud ing $_ from the conv ersi on of prin cipal a nd in terest on bridge no tes.1Price Per Share: $_ per share (based on the capitalizatio n of the Compa ny set forth below) (the Original Purchase Price).Pre-Mo ney Valuatio n:Capitaliza

8、ti on:The Original Purchase Price is based upon a fully-diluted pre-money valuation of $_ and a fully-diluted post-money valuation of $_ (in clud ing an employee pool representing _% of the fully-diluted postmoney capitalizati on).The Compa ny s capital stcture before and afterModify this provisi on

9、 to accou nt for staged in vestme nts or in vestme nts depe ndent on the achieveme nt of milesto nes by the Compa ny.the Closing is set forth as Exhibit A.股息分配:公司章程可选方案1:当普通股分配股息 时,A系优先股按视为转 换成普通股参与分配可选方案2:经董事会宣布,A系 优先股以每股$ 分配Divide nds:CHARTER 2Alter native 1: Divide nds will be paid on the Series

10、A Preferred on an as-c on verted basis when, as, and if paid on the Common StockAlter native 2: Non-cumulative divide nds will be paid on the Series A Preferred in an amount equal to $_ per share of Series A Preferred非累积性股息可选方案3: A系优先股按年利率 %分配累积性股息按年度计算复 利,于公司清算或赎回股份时可分 配。其他股息或分红,按视为转换成 普通股参与普通股分配。3

11、when and if declared by the Board.Alternative 3: The Series A Preferred will carry an annual _% cumulative divide ndcompo un ded annu ally, payable upon a liquidation or redemption. For any other divide nds or distributi ons, participati on with Common Stock on an as-c onv erted basis3In some cases,

12、 accrued and un paid divide nds are payable on con versi on as well as upon a liquidati on eve nt. Most typically, however, divide nds are not paid if the preferred is con verted. Ano ther alter native is to give the Compa ny the opti on to pay accrued and un paid divide nds in cash or in com monsha

13、res valued at fair market value. The latter are referred to as-in-kind) divfdendl”. (payment清算优先受偿权:公司如因任何原因清算、解散或停业Liquidation清理过程,公司收益将作如下分配:Preferenee:可选方案1 (优先股不参与分配): 首先,每股A系优先股按一倍原始购 买价加累计股息加已宣布但未付股 息分配。其余分配给普通股股东可选方案2 (优先股充分参与分 配):首先,每股A系优先股按一倍 原始购买价加累计股息加已宣布未 付股息分配。然后优先股按视为转 换成普通股参与普通股分配可选方案

14、3 (优先股限制参与分 配):首先,每股A系优先股按一倍 原始购买价加累计股息加已宣布未 付股息分配。然后优先股按视为转 换成普通股参与普通股分配,直至A 系优先股股东获得总计倍于原始 购买价的分配In the eve nt of any liquidatio n, dissoluti on or winding up of the Compa ny, the proceeds shall be paid as follows:Alter native1(non-participat ingPreferredStock):First pay one times the OriginalPurc

15、hase Price plus accrued divide nds plus declared and un paid divide nds on each share of Series A Preferred. The bala nee of any proceeds shall be distributed to holders of Common Stock.Alter native 2 (full participati ng Preferred Stock):First pay one times the OriginalPurchase Price plus accrued d

16、ivide nds plus declared and un paid divide nds on each share of Series A Preferred. Thereafter, the Series A Preferred participates with the Com mon Stock on an as-c onv erted basis.Alter native3 (cap on Preferred Stockparticipation rights): First pay one times the Original Purchase Price plus accru

17、ed divide nds plus declared and un paid divide nds on each share of Series A Preferred. Thereafter, Series A Preferred participates with Com mon Stock on an as-converted basis until the holders of Series A Preferred receive an aggregate of timesthe Original Purchase Price.A merger or consolidation (

18、other than one in which stockholders of the Company own a majority by voting power of the outstanding shares of the surv iving or acquiri ng corporati on) and a sale, lease, tran sfer or other dispositi on of表决权:公司的兼并或合并(公司原股东拥有 存续公司或收购公司的发行在外股票 过半数表决权的情形除外),以及公司出售、租赁、转让或以其他方式处 置公司全部或大部分资产的行为,应 当视为公

19、司清算事项(视为清算事 项),并导致上述清算优先权得以产生 除非%的A系优先股股东投票反 对这种处理。除下列情形外,A系优先股股东在视 为转换成普通股的基础上与普通股股 东一起表决,而不能作为独立表决团 体:(i ) A系优先股股东作为一个团体有 权选举名董事会成员(A系董 事);(ii)出现如下文所示“保护性条款” 之情况;(iii )法律另有的其他规定。公司章程应当规定,经 优先股和普通 股股东多数同意,并作为一个表决团 体集体表决(不经普通股股东单独表 决),公司可以增加或减少授权发行 的股票数量4。For California corporations, one cannotshare

20、s of Com mon Stock.Vot ing Rights:all or substantially all of the assets of the Compa ny will be treated as a liquidatio n eve nt (a Deemed LiquidationEvent” ), therebytriggeri ng payme nt of the liquidati on prefere nces described above uni ess the holders of _% of the Series A Preferred elect othe

21、rwise.The Series A Preferred Stock shall vote together with the Common Stock on an as- converted basis, and not as a separate class, except (i) the Series A Preferred as a class shall be entitled to elect (_)members of the Board (the -Series A Directors II ), (ii) as provided under ProtectiveProvisi

22、ons II below or (iii) as required by law.The Compan s Certificate of Incorporation will provide that the number of authorized shares of Common Stock may be increased or decreased with the approval of a majority of the Preferred and Common Stock, voting together as a single class, and without a separ

23、ate class vote by the Common Stock.optout ” of the statutory requirement of a separate class vote by Common Stockholder s to authorize保护性条款:只要有写明固定数量、百分比或任何A系优先股仍发行在外,未经 至少% A系优先股股东书面同意, 公司不得直接或变相进行兼并、合并 或下列其他业务:(i )清算、解散或停业清理,或进行 任何视为清算事项;(ii)以不利于A系优先股股东的方 式修改、变更或撤销 公司章程或细则 中的任何条款Note that as a mat

24、ter of background law, Section 242(b)(2) of the Delaware General Corporation Law provides that if any proposed charter amendment would adversely alter the rights, preferences and powers of one series of Preferred Stock, but not similarly adversely alter the entire class of all Preferred Stock, then

25、the holders of that series are entitled to a separate series vote on the amendment.(iii )创设、授权创设或发行可转换 或可行使拥有优于或同等于 A系优先 股之权利、优待或特权的 公司证券, 或增加发行A系优先股授权数量;(iv) 优于A系优先股,对任何股份予 以收购、赎回或分配股息。由于前员 工的雇佣(或顾问的服务)关系的终 止,以低于公平市场价回购其股份的 除外由董事会(含位A系董 事)同意的除外;(v) 发行或授权发行任何 公司债券若 公司总计负债因此超过$ _设备ProtectiveSo long a

26、s insert fixed number, or %, orProvisions:“ anyf shares of Series A Preferred areoutstanding, the Company will not, without the written consent of the holders of at least _% of the Company sSeries A Preferred, either directly or by amendment, merger, consolidation, or otherwise:(i) liquidate, dissol

27、ve or wind-up the affairs of the Company, or effect any Deemed Liquidation Event; (ii) amend, alter, or repeal any provision of the Certificate of Incorporation or Bylaws in a manner adverse to the Series A Preferred (iii) create or authorize the creation of or issue any other security convertible i

28、nto or exercisable for any equity security, having rights, preferences or privileges senior to or on parity with the Series A Preferred, or increase the authorized number of shares of Series A Preferred; (iv) purchase or redeem or pay any dividend on any capital stock prior to the Series A Preferred

29、, other than stock repurchased from former employees or consultants in connection with the cessation of their employment/services, at the lower of fair market value or cost; other than as approved by the Board, including the approval of Series A Director(s); orcreate or authorize the creation of any

30、 debt security if the Company s aggregateindebtedness would exceed $ other than equipment leases or bank lines of creditother than debt with no equity featureunless such debt security has received the prior approval of the Board of Directors, including the approval of Series A Director(s); (vi) incr

31、easeor decrease the size of the Board of Directors.Each share of the Series A Preferred shall be con vertible, at the opti on of the holder thereof, at any time, into such number of shares of Com mon Stock as is determ ined by dividi ng the Series A Original Purchase Price by Series A Preferred Con

32、versi on Price (as defi ned below) in effect at the time of conversion. T he “ Series A Preferred Conversion Price ”shall initially be equal to $(the Series A Origi nal PurchasePrice). Such initial Series A Conversion price is subject to adjustme nts for stock divide nds, splits, comb in ati ons and

33、 similar eve nts and as described below un der “ An tidiluti on Provisi ons.”In the eve nt that the Compa ny issues additi onal securities at a purchase price less than the current Series A Preferred Conversion Price, such conversion price shall be adjusted in accorda nee with the followi ng formula

34、:Alternative 1:“ Typical ” weighted average:CP2 = CPi * (A+B) / (A+C)租赁或银行信用额度除外无股权特 征的负债除外此类债券获得董事会 (含位A系董事)事先同意的除外 ;(vi )增加或减少董事会成员人数。可选择转换:A系优先股股东有权将其拥有每一 AOptional系优先股随时转换为普通股,每一 AConversion:系优先股可转换为普通股的数量为原 始购买价除以转换时的A系优先股转换价(定义如下)。最初的 A系优先 股转换价应当原始购买价。A系优先 股转换价应当根据普通股的配股、股 票分割、股票合并等类似事项,以及 如下“

35、反稀释条款”所述内容进行调 整。反稀释条款:若公司以低于现行 A系优先股转换价Anti-dilution的价格发行新的股票,该转换价格应Provisi ons:按下列公式调整:可选方案1 “典型”加权平均数:CP=CP*(A+B)/(A+C)CP2=新A系优先股转换价CP2New Series A Conv ersi on PriceCP=新股发行前实际A系优 先股转换价A噺股发行前视为已发行的 普通股数量(含所有已发 行的普通股,所有视为已 转换的已发行优先股,以 及所有已发行的可行使期 权;不含转入此轮融资的 任何可转换证券)B=公司此次发行预计融资总 额除以CPC=本次交易中股票发行数量

36、可选方案2:完全棘轮方案一转换价降到与新发行价一致可选方案3:无基于价格调整的反稀释措施CPi =Series A Conversion Price in effect immediately prior to new issueA =Number of shares of Com mon Stock deemed to be outstanding immediately prior to new issue (includes all shares of outstanding com mon stock, all shares of outsta nding preferred stoc

37、k on an as-c onv erted basis, and all outsta nding opti ons on an as-exercised basis; and does not include any convertible securities con vert ing in to this round of financing)B =Aggregate consideration received by the Corporation with respect to the new issue divided by CP1C =Number of shares of s

38、tock issued in the subject tran sacti onAlternative 2: Full-ratchet - the Series A Preferred Conversion Price will be reduced to the price at which the new shares are issued.Alternative 3: protectionNo price-basedanti-dilutionF列发行不导致反稀释调整6:(i )可发行证券是基于任何A系优先 股转换后产生,或作为A系优先股的 股息或分红;(ii)可发行证券是基于任何信用债券

39、,认股权证,期权或其它可转换证 券转换后产生;(iii )可发行普通股是基于股票分 割,配股,或任何普通股的细分而产 生;(iv)普通股(或认购该类普通股的 期权)发行或可发行给 公司的员工、 董事、顾问,是基于公司董事会董事(含至少_名A系董事)同意的任何 股权计划而产生的;(v)普通股发行或可发行给银行,设 备出租人,是基于公司董事会董事(含至少_名A系董事)同意的债务 融资,设备租赁或不动产租赁交易而 产生的。The following issuances shall not trigger antidilution adjustment:(i) securities issuable

40、upon conv ersi on of any of the Series A Preferred, or as a divide nd or distributen on the Series A Preferred;(ii) securities issued upon the con versi on of anydebe nture, warra nt, opti on, or other conv ertible security; (iii) Common Stock issuable upon a stock split, stock divide nd, or any sub

41、divisi on of shares of Common Stock; and (iv) shares of Common Stock (or options to purchase such shares of Common Stock) issued or issuable to employees or directors of, or con sulta nts to, the Compa ny pursua nt to any pla n approved by the Company s Board of Directors including at least 1 Series

42、 A Director(s) (v) sharesof Com mon Stock issued or issuable to ban ks, equipme nt lessors pursua nt to a debt financing, equipment leasing or real property leasing tran sact ion approved by the Board of Directors of the Corporati on , i nclud ing at least Series A Director(s).强制性转换:若(i)公开发行价格高于_1倍原

43、始购买价承销所有股票,且 公司所取得 的净/总收入不低于$ (“合格公开发行QPO”),或(ii )经%A系优先股股东书面同MandatoryEach share of Series A Preferred willConv ersi on:automatically be conv erted into Com mon Stockat the then applicable Series A Preferred Conv ersi on Price in the eve nt of the clos ing of a firm commitment underwritten public o

44、ffering with a price of times the Original Purchase 意,在具有包销承诺的有保荐人的 公开发行交割时,每股A系优先股将 自动以当时适当的转换率转换为 普通 股。(适用普通股股息,分割,合并 及类似调整业务)出资人参与交易:除非董事会决定含多数A系董事投票决定允许主要投资人放弃参与 权,在之后的公司再融资交易中,所 有主要投资人都必须充分行使其参与 权(如下文 投资人权利协议一按比例 参与未来交易”所述)除非% A系优先 股股东投票同意不按此方案处理,否 则任何未行使上述参与权A系优先股 8的主要投资人所持有的全部A系优 先股都将丧失反稀释权利丧

45、失未来 交易参与权如果可适用,转换为普通 股并丧失董事席位The per share test en sures that the in vestor achieves a sig nifica nt retur n on in vestme nt before the Compa ny can go public. Also con sider allow ing a non-QPO to become a QPO if an adjustme nt is made to the Con vers ion Price for the ben efit of the in vestor, so

46、 that the in vestor does not have the power to block a public offeri ng. If the punishment for failure to participate is losing some but notcom mon), the Charter will n eed to have so- called “ bla nk check preferred class of preferred with dimi nished rights in the eve nt an in vestor fails to part

47、icipate. Note that as a draft ing matter it is far easier to simply have (some or all of) the preferred con vert to com mon.。Price (subject to adjustme nts for stock divide nds, splits, comb in ati ons and similar eve nts) and n et/gross proceeds to the Compa ny of not less than $_ (a QPO” ),or (ii)

48、 upon thewritten consent of the holders of % of the Series A Preferred.Pay-to-Play:Unless the holders of % of the Series Aelect otherwise, on any subseque nt dow n round all Major Investors are required to participate to the full exte nt of their participati on rights (as described below under“Inves

49、tor RightsAgreement Right to Participate Pro Rata in Future Roun ds” ), uni ess the participati on requirement is waived for all Major Investors by the Board (i nclud ing vote of a majority of the Series A Directors). All shares of Series A Preferred8 of any Major Investor failing to do so will auto

50、matically lose anti-dilution rights lose right to participate in future rounds con vert to Com mon Stock and lose the right to a Board seat if applicable.Alter natively, this provisi on could apply on a proporti on ate basis(e.g., if Investor plays for ? of pro rata share, receives ? of anti-dilutio

51、nadjustme nt).9all rights of the Preferred (e.g., anything other tha n a forced con vers ion to ” provisions at least to the extent necessary to enable the Board to issue a赎回权Redempti on rights allow In vestors to force the Compa ny to redeem their shares at cost plus a small guara nteed rate of ret

52、ur n (e.g., divide nds). In practice, redemption rights are not often used; however, they do provide a form of exit and some possible leverage over the Company. While it is possible that the right to recei ve divide nds on redempti on could give rise to a Code Secti on 305“ deemed divide nd ” proble

53、m, many tax peactitairietseake the vliquidati on prefere nee provisi ons in the Charter are drafted to provide that, on con vers ion, the holder receives the greater of its liquidati on prefere nee or its as-converted amount (as provided in the NVCA model Certificate of Incorporation), then there is

54、 no Section 305 issue. Due to statutory restricti on s, it is unl ikely that the Compa ny will be legally permitted to redeem in the very circumsta nces where in vestors most want it (the so- called “ sideways situation” ), investors will sometimes request that certain penalty provisions take effect

55、 where redempticbElan requested butthe Company savailable cash flow does not permit such redemption - - e.g., the redemption amount shall be paid in the form of a one-year note to each unredeemed holder of Series A Preferred, and the holders of a majority of the Series A Preferred shall be entitled

56、to elect a majority of th e Company s Board of Directors un til such amou nts are paid in full.:交割后第五年开始,经至少%的A系优先股股东选择, A 系优先股股东 可 以要求公司以可合法分配资金以原始 购买价加所有累积未付股息赎回其 所持有的A系优先股o赎回将在三年 内分阶段等额完成。如符合规定比例 的A系优先股股东提出赎回请求,其 他所有A系优先股都将被可赎回除明 确选择放弃上述权利的A系优先股股 东外ioRedemption Rights:The Series A Preferred shall

57、 be redeemablefrom funds legally available for distribution at the option of holders of at least _% of the Series A Preferred commencingany time after the fifth anniversary of the Closing at a price equal to the Original Purchase Price plus all accrued but unpaid dividends. Redemption shall occur in

58、 three equal annual portions. Upon a redemption request from the holders of the required percentage of the Series A Preferred, all Series A Preferred shares shall be redeemed (except for any Series A holders who affirmatively opt-out).股份买卖协议书Stock Purchase Agreement1212陈述与保证:完成交割的条件:公司提供标准的陈述与保证.由公司

59、 创始人对技术所有权等提供陈述与 保证.12完成交割的标准条件,包括:完成相 应的财务和法律的尽职调查,股票的发行符合 州证券法(Blue Sky laws) 的 规定,赋予了 A系优先股权利和优待 的公司章程的进行了登记备案,以及公 司律师出具了法院意见函等事项。Represe ntati on s andWarra nties:Con diti ons toClosi ng:Standard representations and warranties by the Company. Representations and warranties by Founders regarding

60、technology ownership, etCj.Standard conditions to Closing, which shall include, among other things, satisfactory completion of financial and legal due diligence, qualification of the shares under applicable Blue Sky laws, the filing of a Certificate of Incorporation establishing the rights and prefe

61、rences of the Series A Preferred, and an opinion of counsel to the Company.12Coun sel andExpe nses:律师及费用:投资人/公司的律师起草交割文件。公司在交割时,应当支付因融资产生 的所有法律和行政花费,包括合理专 业服务费用(投资人律师费由公司承 担部分不得超过$ )和其他费用由 于投资人无故撤销其承诺而使得交易 未完成的除外The bracketed text should be deleted if this section is not designated in the introductory paragraph as one of the sections that is binding upon theCompa ny regardless of whether the financing is con summated.。Investor/Company counsel to draft closing documents. Company to pay all legal and administrative costsof the financing at Closing, including reasonable

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。