企业所得税纳税申报表英译模板

企业所得税纳税申报表英译模板

《企业所得税纳税申报表英译模板》由会员分享,可在线阅读,更多相关《企业所得税纳税申报表英译模板(8页珍藏版)》请在装配图网上搜索。

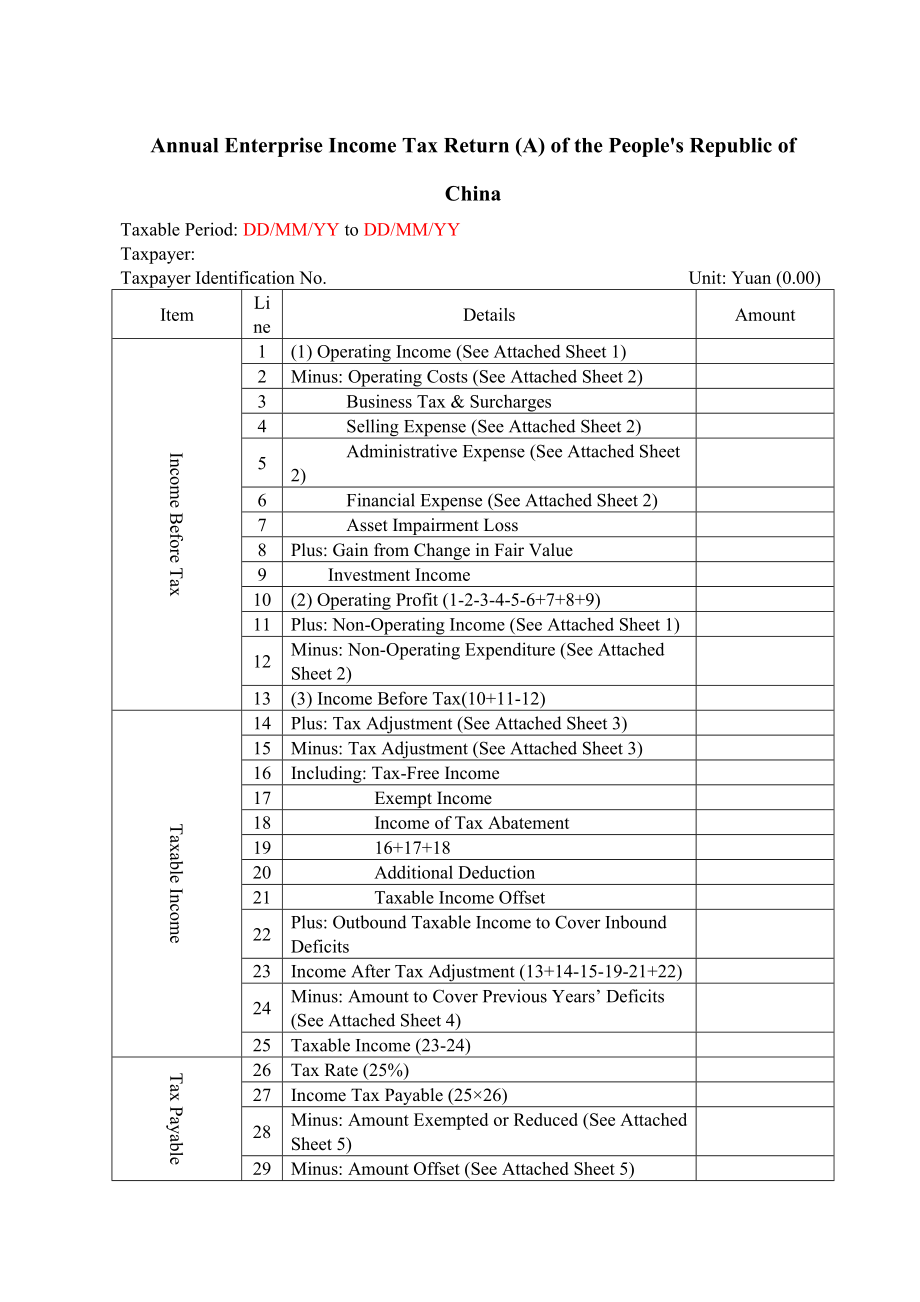

1、Annual Enterprise Income Tax Return (A) of the Peoples Republic of ChinaTaxable Period: DD/MM/YY to DD/MM/YYTaxpayer: Taxpayer Identification No. Unit: Yuan (0.00) ItemLineDetailsAmountIncome Before Tax1(1) Operating Income (See Attached Sheet 1)2Minus: Operating Costs (See Attached Sheet 2)3 Busine

2、ss Tax & Surcharges4 Selling Expense (See Attached Sheet 2)5 Administrative Expense (See Attached Sheet 2)6 Financial Expense (See Attached Sheet 2)7 Asset Impairment Loss8Plus: Gain from Change in Fair Value9 Investment Income10(2) Operating Profit (1-2-3-4-5-6+7+8+9)11Plus: Non-Operating Income (S

3、ee Attached Sheet 1)12Minus: Non-Operating Expenditure (See Attached Sheet 2)13(3) Income Before Tax(10+11-12)Taxable Income14Plus: Tax Adjustment (See Attached Sheet 3)15Minus: Tax Adjustment (See Attached Sheet 3)16Including: Tax-Free Income17 Exempt Income18 Income of Tax Abatement19 16+17+1820 A

4、dditional Deduction21 Taxable Income Offset22Plus: Outbound Taxable Income to Cover Inbound Deficits23Income After Tax Adjustment (13+14-15-19-21+22)24Minus: Amount to Cover Previous Years Deficits (See Attached Sheet 4)25Taxable Income (23-24)Tax Payable26Tax Rate (25%)27Income Tax Payable (2526)28

5、Minus: Amount Exempted or Reduced (See Attached Sheet 5)29Minus: Amount Offset (See Attached Sheet 5)30Income Tax Payable (27-28-29)31Plus: Taxable Foreign-Sourced Income (See Attached Sheet 6)32Minus: Taxable Foreign-Sourced Income Exempted (See Attached Sheet 6)33Actual Tax Payable (30+31-32)34Min

6、us: Accumulated Income Tax Prepaid in This Year35Including: Amount Amortized and Prepaid by the Tax Payment Consolidator36 Amount Prepaid by the Tax Payment Consolidator with Treasury37 Prepaid Amount Amortized by the Tax Payment Consolidators Branches38 Prepayment Proportion of the Tax Consolidatio

7、n Members (subsidiary relationship)39 Amount Prepaid by the Tax Consolidation Member at the Locality40Income Tax to be Reimbursed This Year (3334)Supplementary Information41Amount Offset by the Extra Income Tax Paid in Previous Years42Overdue Income Tax Paid This YearI hereby state that this form is

8、 true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the Peoples Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the Peoples Republic of China and the States related taxation provisions. Legal Representative: Date: Taxpaye

9、r: Agency:Tax Authority: (seal)Undertaker: Undertaker & License No.:Undertaker: (signed)Date: Date:Date: Monthly(Quarterly)Enterprise Income Tax Return (A) of the Peoples Republic of ChinaTaxation Period: DD/MM/YY to DD/MM/YYTaxpayer ID: Taxpayer Name: Unit: Yuan (0.00) LineItemCurrent AmountAccumul

10、ated Amount1I. Prepayment Based on Actual Profit2Operating Income3Operating Costs4Total Profit5plus: Taxable Special Business Income6less: Tax-free Income7 Tax-exempt Income8 Prior Year Deficiency9Actual Profit (Line 4+Line 5-Line 6- Line 7-Line 8)10Tax Rate (25%)11Income Tax Payable12less: Income T

11、ax Reduced/Exempted13less: Income Tax Prepaid14less: Special Business Income Tax Prepaid(Collected)15Refund for Overpayment or Supplemental Payment for Deficiency (Line 11-Line 12- Line 13-Line 14)16less: Overpayment of Previous Years17Actual Refund for Overpayment or Supplemental Payment for Defici

12、ency(Line 15-Line 16)18II.Prepayment Based on the Average Amount of Taxable Income of the Last Tax Year19Taxable Income of the Last Tax Year20Taxable Income of This Month (Quarter) (Line 19*1/12 or 1/4)21Tax Rate (25%)22Income Tax Payable in This Month (Quarter) (Line 20 * Line 21)23III. Prepayment

13、as Otherwise Specified by Tax Authority24Specified Amount of This Months (Quarters)Income Tax Prepayment25Apportionment of Income Tax26Head OfficeIncome Tax Born by Head Office (Line 15/22/24* Proportion)27Income Tax distributed by Central Finance28Income Tax Born by Branch(es) (Line 15/22/24* Propo

14、rtion)29including: Income Tax Born by Head Offices Independent Production/Management Department(s)30Income Tax Born by Head Offices Revoked Branch(es)31Branch(es)Proportion32Income Tax Born by Branch(es) I hereby state that this form is true, reliable and complete, filled in accordance with the Law

15、of the Peoples Republic of China on Enterprise Income Tax, the Implementation Ordinance of the Law on Enterprise Income Tax of the Peoples Republic of China and Chinas related taxation provisions. Legal Representative (signature): Date:Taxpayers Official Seal: Agencys Official SealTax Authoritys Sea

16、l:Accounting Supervisor: Undertaker:Undertakers License No.:Undertaker:Date:Date:Date:Under the supervision of the State Administration of TaxationThe Peoples Republic of China Monthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YY Taxpayer Identification No.: Taxpay

17、er: Unit: RMB Yuan (0.00)ItemLineAccumulated AmountTaxable IncomeAmount Based on IncomeTotal Income1Tax Rate (%)2Taxable Amount (Line 1Line 2)3Amount Based on CostsTotal Costs4Tax Rate (%)5Taxable Amount Line 4/(Line 1- Line 5)Line 56Amount Based on ExpensesTotal Expenses7Tax Rate (%)8Income Convert

18、ed Line 7/(Line 1-Line 8)9Taxable Amount(Line 8Line 9)10Income Tax PayableTax Rate (25%)11Income Tax Payable (Line 3Line 11 or Line 6Line 11 or Line 10Line 11)12Income Tax Exempted13Tax Rebate or Supplementary PaymentIncome Tax Prepaid14Overdue Tax15Tax Rebate or Supplementary Payment (Line 12-Line

19、13-Line 14-Line 15)16E-Signature StringI hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the Peoples Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the Peoples Republic of China and the

20、States related taxation provisions. Legal Representative (signature): Date:Taxpayers Official Seal: Agencys Official Seal:Tax Authoritys Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker:License No.:Date:Date:Date:Under the supervision of the State Administration of TaxationThe Peoples Re

21、public of China Monthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.: Taxpayer: Unit: RMB Yuan (0.00)ItemLineAccumulated AmountTaxable IncomeAmount Based on IncomeTotal Income1Tax Rate Decided by the Tax Authority (%)2Taxable Amount (Line

22、 1Line 2)3Amount Based on CostsTotal Costs4Tax Rate Decided by the Tax Authority (%)5Taxable Amount Line 4/(Line 1- Line 5)Line 56Amount Based on ExpensesTotal Expenses7Tax Rate Decided by the Tax Authority (%)8Income Converted Line 7/(Line 1-Line 8)9Taxable Amount(Line 8Line 9)10Income Tax PayableT

23、ax Rate (%)11Income Tax Payable (Line 3Line 11 or Line 6Line 11 or Line 10Line 11)12Income Tax Exempted13Tax Rebate or Supplementary PaymentIncome Tax Prepaid14Tax Rebate or Supplementary Payment (Line 12-Line 13-Line 14)15I hereby state that this form is true, reliable and complete, filled in accor

24、dance with the Law on Enterprise Income Tax of the Peoples Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the Peoples Republic of China and the States related taxation provisions. Legal Representative (seal): Date:Taxpayers Official Seal: Agencys Official Seal

25、:Tax Authoritys Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker:License No.:Date:Date:Date:Under the supervision of the State Administration of TaxationThe Peoples Republic of China Monthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YY Taxpayer Identifi

26、cation No.: Taxpayer: Unit: RMB Yuan (0.00)ItemLineAccumulated Amount1. Enterprises whose taxable income is calculated based on taxable income rate should fill in the following blanks.Taxable IncomeAmount Based on IncomeTotal Income1Less: Tax-free Income2 Tax-exempt income3Taxable Income (1-2-3)4Tax

27、able Income Rate Specified by Tax Authority (%)5Taxable Income (4*5)6Amount Based on CostsTotal Costs7Taxable Income Rate Specified by Tax Authority (%)8Taxable Income 7/(1-8)*89Income Tax PayableTax Rate (25%)10Income Tax Payable (6*10 or 9*10)11Amount of Tax Refundable and Supplementary PaymentInc

28、ome Tax Prepaid12Amount of Tax Refundable and Supplementary Payment (11-12)132. Enterprises whose income tax payable is determined by tax authority should fill in the following blank.Income Tax Payable Determined by Tax Authority14E-Signature StringI hereby state that this form is true, reliable and

29、 complete, filled in accordance with the Law on Enterprise Income Tax of the Peoples Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the Peoples Republic of China and the States related taxation provisions. Legal Representative (signature): Date:Taxpayers Official Seal: Agencys Official Seal:Tax Authoritys Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker:License No.:Date:Date:Date:Under the supervision of the State Administration of Taxation

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。