财务管理最佳实践之固定资产管理最新实用教案

财务管理最佳实践之固定资产管理最新实用教案

《财务管理最佳实践之固定资产管理最新实用教案》由会员分享,可在线阅读,更多相关《财务管理最佳实践之固定资产管理最新实用教案(21页珍藏版)》请在装配图网上搜索。

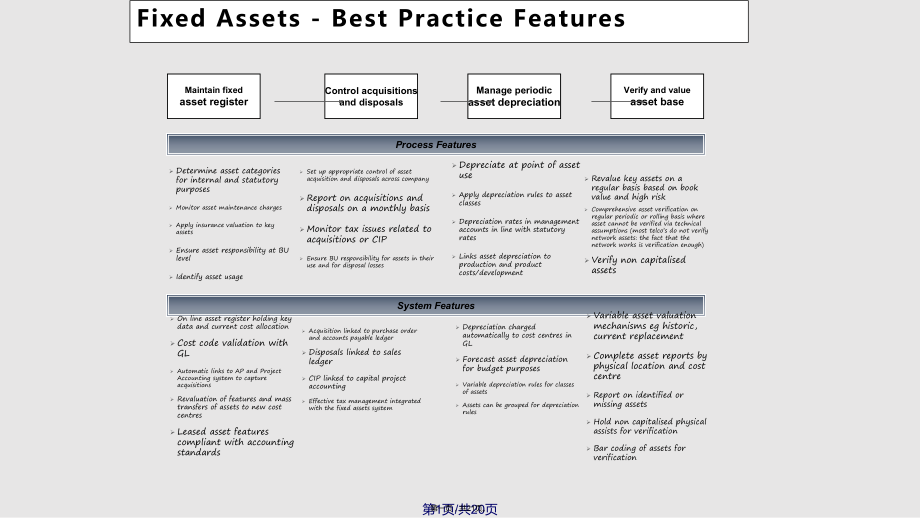

1、Maintain fixedasset registerControl acquisitionsand disposalsManage periodicasset depreciationVerify and valueasset baseProcess FeaturesDetermine asset categories for internal and statutory purposesMonitor asset maintenance chargesApply insurance valuation to key assetsEnsure asset responsibility at

2、 BU levelIdentify asset usage Set up appropriate control of asset acquisition and disposals across companyReport on acquisitions and disposals on a monthly basisMonitor tax issues related to acquisitions or CIPEnsure BU responsibility for assets in their use and for disposal lossesDepreciate at poin

3、t of asset useApply depreciation rules to asset classesDepreciation rates in management accounts in line with statutory ratesLinks asset depreciation to production and product costs/developmentRevalue key assets on a regular basis based on book value and high riskComprehensive asset verification on

4、regular periodic or rolling basis where asset cannot be verified via technical assumptions (most telcos do not verify network assets: the fact that the network works is verification enough)Verify non capitalised assetsSystem FeaturesOn line asset register holding key data and current cost allocation

5、Cost code validation with GLAutomatic links to AP and Project Accounting system to capture acquisitionsRevaluation of features and mass transfers of assets to new cost centresLeased asset features compliant with accounting standardsAcquisition linked to purchase order and accounts payable ledgerDisp

6、osals linked to sales ledgerCIP linked to capital project accountingEffective tax management integrated with the fixed assets systemDepreciation charged automatically to cost centres in GLForecast asset depreciation for budget purposesVariable depreciation rules for classes of assetsAssets can be gr

7、ouped for depreciation rulesVariable asset valuation mechanisms eg historic, current replacementComplete asset reports by physical location and cost centreReport on identified or missing assetsHold non capitalised physical assists for verificationBar coding of assets for verificationFixed Assets - B

8、est Practice Features第1页/共20页第一页,共21页。Fixed Assets - Measures/Cost DriversNo of Business Unit FTEs per Fixed Assets FTE90 percentileMedian10 percentile5,2001,40035010 percentileMedian90 percentile731151Cost driversFixed Assets cost per Business Unit FTE (in s)Median14 days90 percentile40 days10 perc

9、entile1 dayFixed Assets processing timeComplexity of assetsNumber of assets on registerNumber of asset movementsComplexity of depreciation policiesComplexity of authorisation proceduresRange of data heldNumber of users of data rangeSource: Statistics taken from Benchmarking database: 21 February 199

10、7第2页/共20页第二页,共21页。Separate fixed assets moduleLack of asset ownershipCost of asset usage not attributed to productPerformed by Finance DepartmentIntegrated systems for:Asset tracking via Geographical Information System (GIS)Asset usage Network Capacity PlanningAsset Maintenance Capital project plann

11、ing and control Product/service costingBU responsibility for ownershipFromToFixed Assets - Trends第3页/共20页第三页,共21页。Fixed Assets - Critical Success Factors These are a summary of the key business requirements, which must be met to achieve the objectives.Asset accounting policies clearly documentedAppr

12、opriate coding by asset category establishedAuthority levels clearly definedProcedures surrounding Fixed Asset process are documented and communicated to staffBudgets in place for capital expenditureAll existing assets identified and classifiedStaff trained in FA process and have clear roles and res

13、ponsibilitiesStatutory and tax requirements understoodFA calendar in place and communicated to staffStanding data set up on the system reflecting asset accounting policiesAbility to model depreciation scenario第4页/共20页第四页,共21页。InventoryAccounts PayableAuditProject accountingPurchasingGeneral LedgerFi

14、xed AssetsFixed Assets - Level 0 Context DiagramAsset data (depreciation etc)Goods issuedAsset details& asset paymentsMgt ReportsStatutory reportsAsset disposalsCapitalised assetsCommitmentsUnique asset identifierManagement AccountingAccounts receivableMaintenanceMaintenace CycleCircuit Provisioning

15、Usage data第5页/共20页第五页,共21页。Fixed Assets - Level 1 OverviewFA 1.1 Maintain Standing DataFA 1.2 Add AssetsFA 1.3 Dispose of AssetsFA 1.4 Maintain Asset RegisterFA 1.5 Perform Period End RoutinesFA 1.6 Verify Physical AssetsActivitiesFA 1.7 Answer Adhoc queriesRaise request e.g. new asset classPrepare

16、formal requestReview and approve Set up new codes / dataNotify affected users and departmentsInput automatic dataInput manual dataAdd additional informationPost asset detailsReceive requestTransfer assetsAdjust assetsRevalue assetsCapitalise WIP assetsReport on amendmentsWrite - off / down assetsCap

17、italised labour calculationDepreciation calculated Depreciation posted to GL Reconcile accountsSend monthly reports to ownersCompile accurate data for asset verificationConduct inventory checkHighlight exceptionsTrack asset history & reconcileUpdate FA register & prepare GL journalsReceive requests

18、for adhoc reportsProduce reports Select assets to disposeObtain quote if applicableSell / dispose of assetsNotify relevant accountantsRecord transactions in accountsReconcile GL accountsCalculate profit/loss on disposalChanges in FAPolicies and ProceduresFA registerstructuremaintainedUpdated FA Regi

19、sterUpdated FAregister &reportsReconciledGL A/ csRequest for adhoc reportsReportsVerified FARegisterAuthorised GLadjustmentsAssets from AP or project accountingAsset AdditionnotificationGL a/ cs maintainedfor disposalUpdated FARegisterGL a/cs maintainedfor additions Asset addition notificationAmend/

20、update asset types or categoriesMaintain Standing DataFA 1.1Add AssetsFA 1.2Dispose of AssetsFA 1.3Maintain Asset RegisterFA 1.4Verify Physical AssetsFA 1.6Answer Adhoc QueriesFA 1.7AdjustmentsReportsNotification proceduresSystem validation controlsChange request proceduresAuthorisation rulesRequest

21、erFA accountantFinance managerSystem controlsAccounting policiesDisposal procedures, validation procedures, authorisation, reconciliation proceduresCost centre manager, FA accounting staff,FA requester, financial managerReportsAP systemFA accounting staffCost centre managersAuthorisation proceduresM

22、aintenance policySystem controlsFA accounting staffCost centre managerManagement accountantDepreciation policiesMaintenance policiesSystems controlsMonth end reconciliationPeriod end timetableCost centre analysisFA accounting staffFA systemVerification timetableInventory control systemAudit trialAut

23、horisation for write offsFA accounting staffInventory staffReporting guidelinesSystem controlsFA accounting staffFA systemsCost centre managersPerform Period End RoutinesFA 1.5第6页/共20页第六页,共21页。Fixed Assets - Level 2 FA1.1 Maintain Standing DataFA 1.11 Raise requestFA 1.12 Prepare formal requestFA 1.

24、13 Review and approveSub Processes / NotesFA 1.14 Set up new codes / dataSend request to FA accountant by e-mail with full explanation / reason for requestEvaluate request against current FA Register to identify actual need for new standing dataRaise request and attach originalEvaluate requestCommun

25、icate acceptance or rejection to originatorSet up standing data by FA AccountantReview set-up data and codes periodicallyFA 1.15 Notify affected users and groupsChanges inFA PoliciesandProceduresRequestFormal requestAcceptedrequestRejected requestActionedrequestFA RegisterstructuremaintainedAmend/up

26、dateasset typesor categories Raise requestFA 1.11Prepare formal requestFA 1.12Set up new codes / dataFA 1.14Notify affected users & groupsFA 1.15Send formal notification of set-upNotify that request rejected and whyChangerequestproceduresChangerequestproceduresAuthorisationrulesSystemvalidationcontr

27、olsNotificationproceduresRequesterFA AccountantFinance ManagersFA AccountantFA AccountantReview and approveFA 1.13第7页/共20页第七页,共21页。Fixed Assets - Notes on Maintain Standing Data Best Practice Features Asset accounting polices clearly documented; Master Data set up on the system to reflect these poli

28、cies Appropriate coding by asset category established Procedures surrounding the Fixed Asset process are documented and communicated to staff including requirements for issuing new codes Asset Register Rules incorporated into Master File, which control issues of new numbers within structured coding

29、scheme Staff trained in Fixed Asset Accounting processes and have clear roles and responsibilities. They should have a good understanding of network and engineering areas Supervisory staff understand statutory and tax requirements Internal Control Requirements Once entered, updates should be verifie

30、d against the original requests Codes will be received from the Master File and updates will be confirmed against the Master File The system will check that all required data fields are complete There must be supervisory review for Master Data updates Key Performance Indicators Speed of update: time

31、 from receipt of request to modification and verification of records: this should not exceed one day Number of input errors when asset details are validated: this should be zero Cost Drivers Complexity of assets New types of assets Number of changes to physical location coding第8页/共20页第八页,共21页。Fixed

32、Assets - Level 2 FA1.2 Add AssetsFA 1.21 Input automatic dataFA 1.22 Input manual dataFA 1.23 Add additional informationFA 1.24 Post asset detailsSub Processes / NotesReceive asset addition notifications from AP into FA RegisterRun interfaces with AP to transfer invoice linesTag/label asset with uni

33、que identifierManually enter assets which do not have invoice informationIdentify assets as ; WIP;Expenses; andCapitalised assets.Add additional asset datail to lines e.g.assign asset categories;split or merge assets; andadd to existing as cost adjustment.Assign asset lifeAssign asset to departmenta

34、l manager, location Post prepared lines to fixed asset registerAssets from AP orProject AccountingAsset additionnotificationAP lines withSkeleton detailsAP lines with additional informationAdded AssetsUpdated FA RegisterFA register structuremaintainedFA register structuremaintainedGL a/c maintained

35、for additionsInput automatic dataFA 1.21Add additional informationFA 1.23Post asset detailsFA 1.24Input manual dataFA 1.22System controlsAccounting policiesAccountingPoliciesSystemControlsAP SystemFA accounting staffSystem controls & accounting policiesFA accounting staffFA accounting staffFA accoun

36、ting staffCost centre managers第9页/共20页第九页,共21页。Fixed Assets - Notes Add Assets Best Practice FeaturesLinked databases used in recording asset details, to increase accuracy of the asset register and to eliminate duplicate paper trailsAppropriate asset “numbering” methods driven by users of asset info

37、rmation; bar coding used on relevant assetsDirect links to Project AccountingClear policy established for treatment of assets and guidance on how to classify different types of assets, to reduce the number of reclassifications neededSystem interconnection to MIS (Management Information Systems) for

38、tax and insurance planningAssets identified by “custodian”, i.e. person who controls the asset, rather than a department or the company as a wholeUnified transfer pricing in all Business Units for asset transfersUse of asset transfer strategy to optimise the usage of assets Internal Control Requirem

39、entsAsset number controlsAll asset register updates reviewed after entry, to limit period end differencesUpdate details sent periodically to source and asset custodian (or other initiator of the update) for information and coroboration purposes Key Performance IndicatorsNumber of reconciliation at p

40、eriod end: if a reconciliation is needed between Fixed Assets and other accounts, this indicates that one or other of the accounts is not up to dateNumber of changes processedNumber of verification adjustments Cost DriversNumber of assetsAverage useful life of assets (i.e. rate of asset turnover)Num

41、ber of changes in Master Data leading to manual adjustments.(e.g. change in organisation codes)Number of revaluations / disposals第10页/共20页第十页,共21页。Fixed Assets - Level 2 FA1.3 Dispose of AssetsSales priceand buyerconfirmedSale/DisposalcompletedAsset sale ordisposalregistered withAccounts deptFARegis

42、terupdatedAssetsidentifiedfor disposalAsset disposalnotificationInterfaceto GLFA 1.31 Select assets to disposeFA 1.32 Obtain quote (if applicable)FA 1.33 Sell / Dispose of AssetFA 1.34 Notify Accountants FA 1.36 Reconcile GL accountsSub Processes / NotesCost Centre managers identify items for dispos

43、al Cost Centre manager to obtain quote for asset, place item in auction, or advertise as appropriate Asset sold and monies received by Cost Centre managersCost Centre managers to ensure monies received for assets as agreed or expected from auctionInvoices raised by AR for sale of assets on creditCos

44、t Centre managers to notify FA staff /accounts of disposals Cost Centre manager to ensure asset payment received and registered.Ensure FA register reconciles with asset values in GLGL maintained for DisposalsEnsure that all details of profit / loss have been recorded accurately to the correct cost c

45、entres in GL FA accountant to update register with disposalsFA 1.35 Record Transactions in accountsSelect assets to disposeFA 1.31Obtain quote (if applicable)FA 1.32Sell/dispose of assetsFA 1.33Notify financeFA 1.34Reconcile GL accountsFA 1.36GL a/csmaintainedfor disposalsUpdate FAregisterDisposal p

46、roceduresValuation proceduresAuthorisation proceduresDisposal proceduresDisposal proceduresReconciliation proceduresCost centre managersCost centre managersCost centre managersCost centre managerFA accounting staffFA registerFA accounting staffFinancial managerRecord transactions in accountsFA 1.35第

47、11页/共20页第十一页,共21页。Fixed Assets - Level 2 FA1.4 Maintain Asset RegisterFA 1.41 Receive RequestFA 1.42 Transfer AssetsFA 1.43 Adjust AssetsFA 1.44 Write-off / down assetsSub Processes / NotesFA 1.45 Revalue AssetsFA 1.46 Capitalise WIP AssetsFA 1.47 Report on adjustmentsReceive request to alter fixed

48、assets registerTransfer single asset between GL depreciation expense accounts or departmentsTransfer a group of assets between GL depreciation expense accounts or departmentsReserve adjustments i.e. adjust for accumulated depreciation for single or groups of assetsFully or partly write off assetsCal

49、culate gains and losses before running depreciationRecognise go live statusCommence depreciationRevalue assetsRun depreciationRun reports detailing changes to FA registerSystems controlsUpdated FARegisterFA accounting staffCost centre managersManagement accountantAuthorisation proceduresMaintenance

50、policyAsset register updatedReportsAuthorisation proceduresMaintenance policyFA Accounting staffCost centre managersReceive requestFA 1.4Transfer AssetsFA 1.42Adjust AssetsFA 1.43Write-off / down AssetsFA 1.44Revalued AssetsFA 1.45Capitalise WIP AssetsFA 1.46Report on adjustmentsFA 1.47FA accounting

51、 staffApproved request第12页/共20页第十二页,共21页。Fixed Assets - Level 2 FA1.5 Perform Period End RoutineSub Processes / Notes FA 1.52 Calculate depreciationFA 1.53 Post depreciation to GLFA 1.54 Reconcile accountsFA 1.55 Send monthly reports to asset ownersCalculate cumulative depreciation to date in the ye

52、ar based on current asset register with reference to relevant asset rulesPrepare all postings for GL e.g. additions, disposals, depreciation, adjustmentsPost to GL automatically Reconcile Asset register to Balance SheetReport on adjustments / corrections required Generate standard month end asset /

53、depreciation report for relevant managersReportsUpdated FAregister & reportsReconciled GLaccountsDepreciationamountsFA interface with GLAdjustmentsCalculate depreciationFA 1.52Postdepreciationto GLFA 1.53ReconcileaccountsFA 1.54Spend monthly reports to asset ownersFA 1.55Depreciation policiesMainten

54、ance policiesSystems controlsMonth end reconciliationPeriod end timetableCost centre analysisPeriod end timetableFA accounting staffFA accounting staffFA systemFA accounting staffFA accounting staffFA systemAdjustments第13页/共20页第十三页,共21页。Fixed Assets - Notes Depreciation calculation Best Practice fea

55、turesIntegrated fixed asset systems to calculate depreciation charges for tax and accounting purposesDepreciation rates by asset category are based on useful life of the asset, rather than designed to meet accounting requirements onlyConsistency of depreciation methods and rates across the business

56、Internal Control requirementsResults of depreciation run compared to expected amounts (from budget or forecast) to identify potential errors and over-runsUpdates to assets depreciation information must only be accepted if properly authorised and consistent with management/tax policy Key Performance

57、Indicators Time taken to update depreciation data in fixed asset register at period close Reconciling items on depreciation accounts: should be zero Cost DriversNumber of depreciation ratesNumber of assets第14页/共20页第十四页,共21页。Fixed Assets - Notes Perform Period End Routine Best Practice FeaturesAutoma

58、tic data flows between ledgers, e.g., between Fixed Asset Register and General Ledger, Project Accounting, etc., to remove manual reconciliation effortSystem allows assets to be grouped or desegregated for reporting purposes Internal Control RequirementsSystem internal controls (e.g. user profiles)T

59、imely and accurate clearance of system reject reportsReconciliation of budget Vs. actual period end totalsReconciliation of movement in fixed asset accounts for the month (e.g. new NBV = old NBV + additions - disposals - depreciation) Key Performance IndicatorsTime taken to close Fixed Asset Registe

60、r at period endTime taken to complete the GL/FA reconciliation Differences during reconciliationTime to print out the period end reports Cost DriversNumber of asset recordsCPU time for generation of reportsReconciliation required to clear General Ledger mis-matchesNumber of necessary changes during

61、reconciliation with General Ledger第15页/共20页第十五页,共21页。Fixed Assets - Level 2 FA1.6 Verify Physical AssetsFA 1.61 Compile accurate data for asset verificationFA 1.62 Conduct inventory checkSub Processes / NotesFA 1.63 Highlight exceptionsFA 1.64 Track asset history & reconcileFA 1.65 Update FA registe

62、r & prepare GL journalsValidation checks on FA registerCompile FA reports to required specificationsConduct inventory check / FA verificationComplete formal check reportsIdentify book value and physically check variancesReport differences Track asset histories / audit trialReconcile differencesEnter

63、 write-off on FA register via adjustment or disposal journals Updated FAregister &reportsComplete listfor InventorycontrolFeedbackon itemsheldItems to be furtherinvestigatedIdentifiedcorrectionsVerified FAregisterAuthorisedGL adjustmentsCompile accurate data for asset verificationFA 1.61Conduct inve

64、ntory checkFA 1.62Highlight exceptionsFA 1.63Track asset history and reconcileFA 1.64Update FA register & prepare GL journalsFA 1.65Verification timetableInventory control systemInventory control systemAudit trialAuthorisation for write offsFA accounting staffInventory staffFA accounting staffFA acc

65、ounting staffFA accounting staffFA accounting staff第16页/共20页第十六页,共21页。Fixed Assets -Notes Verify Physical Assets Best Practice featuresAll existing capitalised assets identified and classifiedRegular physical verification, focused on high-value and high-risk areasUse alternative verification methods

66、 where appropriate eg review maintenance log, establish that asset is operating effectively Internal Control requirementsRegular physical verification exercises and reconciliation to the Fixed Asset RegisterFixed Assets must ensure that transferred assets retain their original project number identification in the asset record, to ensure appropriate access to archived records Cost DriversNumber of verifications required第17页/共20页第十七页,共21页。Fixed Assets - Level 2 - FA 1.7 Answer Adhoc QueriesReceive

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。