伊利财务报表分析案例资料学生用

伊利财务报表分析案例资料学生用

《伊利财务报表分析案例资料学生用》由会员分享,可在线阅读,更多相关《伊利财务报表分析案例资料学生用(8页珍藏版)》请在装配图网上搜索。

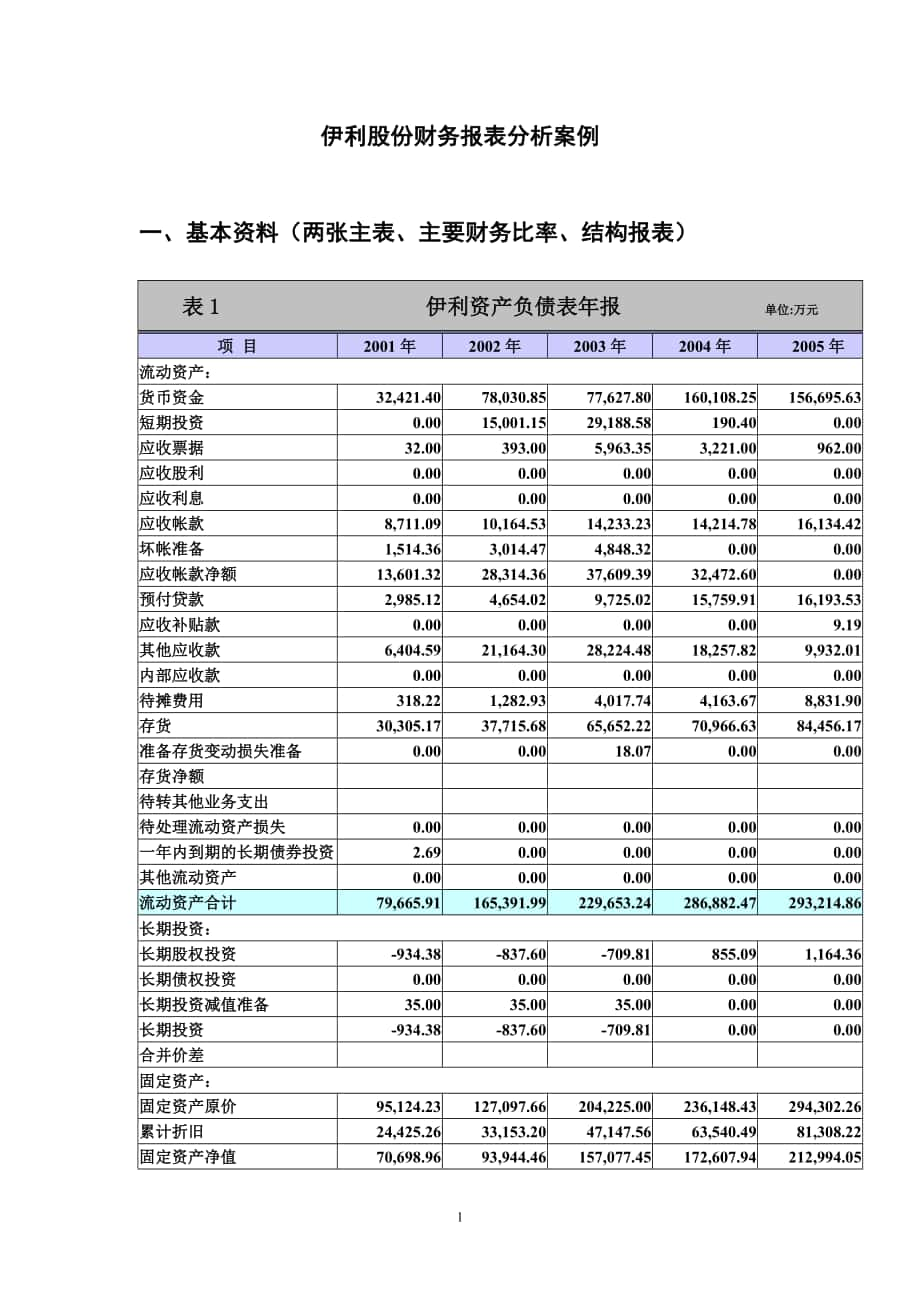

1、伊利股份财务报表分析案例一、基本资料(两张主表、主要财务比率、结构报表)表1 伊利资产负债表年报 单位:万元项 目2001年2002年2003年2004年2005年流动资产:货币资金32,421.4078,030.8577,627.80160,108.25156,695.63短期投资0.0015,001.1529,188.58190.400.00应收票据32.00393.005,963.353,221.00962.00应收股利0.000.000.000.000.00应收利息0.000.000.000.000.00应收帐款8,711.0910,164.5314,233.2314,214.7816

2、,134.42坏帐准备1,514.363,014.474,848.320.000.00应收帐款净额13,601.3228,314.3637,609.3932,472.600.00预付贷款2,985.124,654.029,725.0215,759.9116,193.53应收补贴款0.000.000.000.009.19其他应收款6,404.5921,164.3028,224.4818,257.829,932.01内部应收款0.000.000.000.000.00待摊费用318.221,282.934,017.744,163.678,831.90存货30,305.1737,715.6865,65

3、2.2270,966.6384,456.17准备存货变动损失准备0.000.0018.070.000.00存货净额待转其他业务支出待处理流动资产损失0.000.000.000.000.00一年内到期的长期债券投资2.690.000.000.000.00其他流动资产0.000.000.000.000.00流动资产合计79,665.91165,391.99229,653.24286,882.47293,214.86长期投资:长期股权投资-934.38-837.60-709.81855.091,164.36长期债权投资0.000.000.000.000.00长期投资减值准备35.0035.0035.

4、000.000.00长期投资-934.38-837.60-709.810.000.00合并价差固定资产:固定资产原价95,124.23127,097.66204,225.00236,148.43294,302.26累计折旧24,425.2633,153.2047,147.5663,540.4981,308.22固定资产净值70,698.9693,944.46157,077.45172,607.94212,994.05工程物资3.525,990.243,631.872,115.72830.74在建工程7,103.6917,337.175,504.6716,072.9127,821.19固定资产清

5、理0.000.000.000.000.00待处理固定资产净损失0.000.000.000.000.00其他固定资产合计77,635.43117,029.48163,737.37187,928.37239,332.23无形资产及其他资产:无形资产6,486.307,116.038,642.260.000.00递延资产0.000.000.000.000.00开办费0.000.000.000.00长期待摊费用1,056.341,154.471,303.53805.70869.32无形资产及递延资产合计0.000.000.000.000.00其他长期资产7,542.658,270.519,945.79

6、9,373.1511,334.96递延税款借项0.000.000.000.000.00资产总计163,909.61289,854.37402,626.58485,039.07545,046.41流动负债短期借款10,830.005,230.0023,835.5322,520.0025,160.00应付帐款21,002.5342,968.0566,595.5380,003.31130,660.10应付票据7,290.789,527.848,035.6561,582.755,013.31应付工资4,443.118,165.6011,052.9414,137.0617,612.44应付福利费2,70

7、4.854,352.765,221.636,520.126,560.62预收帐款2,950.575,409.519,649.7412,915.3230,975.24其他应付款11,481.7616,004.6430,854.6737,810.9647,791.57内部应付款未交税金-1,226.16466.512,774.99721.36-299.85未付股利7,126.814,971.881,030.051,025.381,197.50其他未交款185.2849.77168.61212.93221.34预提费用296.42282.1935.8612.702.35待扣税金住房周转金0.000.

8、000.000.000.00一年内到期的长期负债452.00422.001,300.005,944.793,722.36其他流动负债0.000.000.000.000.00流动负债合计67,537.9497,850.74160,555.21243,406.67268,616.98长期负债:长期负债5,582.905,945.0816,897.951,862.903,462.90应付债券0.000.000.000.000.00长期应付款0.000.000.001,446.583,303.27其他长期负债0.000.000.000.000.00待转销汇税收益长期负债合计5,582.906,109.

9、0820,251.295,997.7316,500.60递延税项:递延税款贷项207.28194.39192.62192.62192.62负债合计73,328.13104,154.21180,999.12249,597.02285,310.20股东权益:少数股东权益7,234.7911,437.0626,521.2428,697.0432,675.03股本14,667.1119,563.2539,126.5039,126.5039,126.50资本公积42,822.30118,579.1099,920.11101,319.51102,131.98盈余公积17,233.1022,194.7428

10、,175.4036,544.9245,304.73其中:公益金5,281.686,699.299,396.2211,787.5114,707.45未分配利润8,624.1913,926.0227,884.2230,515.8741,173.80外币报表折算差额0.000.000.000.000.00股东权益合计83,346.70174,263.11195,106.23206,745.01227,061.18负债与股东权益合计163,909.61289,854.37402,626.58485,039.07545,046.41表2 伊利利润分配表年报 单位:万元项 目2001年2002年2003年

11、2004年2005年一、主营业务收入270,198.30401,009.24629,933.35873,499.101,217,526.41减:折扣与折让0.000.000.000.000.00主营业务收入净额270,198.30401,009.24629,933.35873,499.101,217,526.41减:主营业务成本191,728.38267,538.40427,389.32613,925.28864,107.96主营业务税金及附加827.111,609.892,823.433,856.985,469.48二、主营业务利润77,642.82131,860.95199,720.612

12、55,716.83347,948.97加:其他业务利润450.73972.99927.85573.36885.66营业费用51,777.5090,303.14139,061.65186,770.31259,651.44管理费用12,071.8220,208.5429,621.9530,365.6641,735.13财务费用153.90260.441,133.32890.67-230.27三、营业利润14,090.3322,061.8130,831.5338,263.5547,678.33加:投资收益334.96-49.0926.51-1,904.03412.07补贴收入23.96459.191

13、,089.801,694.552,336.26营业外收入218.54838.921,148.561,431.541,266.83减:营业外支出562.251,976.981,207.251,597.742,532.36四、利润总额14,105.5421,333.8431,889.1537,887.8649,161.14减:所得税1,808.885,202.827,053.5412,185.8115,214.59减:少数股东损益329.001,936.184,876.612,550.924,521.98五、净利润11,967.6714,194.8419,958.9923,912.9029,338

14、.61加:年初未分配利润6,267.438,624.1917,838.6727,884.2230,515.87盈余公积转入0.000.000.000.000.00六、可分配利润18,235.1022,819.0337,797.6651,797.1359,854.48减:提取法定盈余公积金1,278.611,417.613,197.092,391.292,919.94提取法定公益金1,254.061,417.612,696.932,391.292,919.94七、可供股东分配的利润15,702.4219,965.0931,883.5147,014.5553,875.36减:应付优先股股利0.00

15、0.000.000.000.00提取任意公积1,798.072,126.4286.643,586.942,919.94应付普通股股利5,280.163,912.653,912.6512,911.749,781.62转做股本的普通股股利0.000.000.000.000.00八、未分配利润8,624.1913,926.0227,884.2230,515.8741,173.808目2002年2003年2004年2005年伊利行业平均伊利行业平均伊利行业平均伊利行业平均权益净利率11.022.5610.812.8711.90-0.8813.530.02资产净利率6.261.385.761.506.3

16、9-0.445.700.01销售净利率3.543.783.173.672.740.522.411.03销售毛利率33.2823.5932.1517.7229.7218.4629.0315.99流动比率1.691.251.431.221.181.141.091.05速动比率1.301.031.020.940.890.890.780.94资产负债率(%)35.9346.8844.9548.4651.4651.5752.3551.87负债权益比0.600.940.931.031.211.171.261.22应收账款周转率42.493.5451.644.1861.415.1780.237.13存货周转

17、率7.874.178.273.858.993.7511.123.95固定资产周转率4.871.695.021.785.302.116.312.33总资产周转率1.770.571.820.611.970.732.360.85每股收益0.730.060.510.080.61-0.030.570.00每股净资产8.912.454.992.555.282.354.402.29表5 伊利2001-2005年资产负债表构成分析 单位:万元项 目20012001结构比20022002结构比20032003结构比20042004结构比20052005结构比2002/2001变动比2003/2002变动比200

18、4/2003变动比2005/2004变动比应收帐款8,711.095.3110,164.533.5114,233.233.5414,214.782.9316,134.422.9616.6840.03-0.1313.50应收票据32.000.02393.000.145,963.351.483,221.000.66962.000.181128.131417.39-45.99-70.13存货30,305.1718.4937,715.6813.0165,652.2216.3170,966.6314.6384,456.1715.5024.4574.078.0919.01流动资产合计79,665.9148

19、.60165,391.9957.06229,653.2457.04286,882.4759.15293,214.8653.80107.6138.8524.922.21固定资产合计77,635.4347.36117,029.4840.38163,737.3740.67187,928.3738.74239,332.2343.9150.7439.9114.7727.35无形资产6,486.303.967,116.032.468,642.262.150.000.000.000.009.7121.45-100.00资产总计163,909.61100.00289,854.37100.00402,626.5

20、8100.00485,039.07100.00545,046.41100.0076.8438.9120.4712.37短期借款10,830.006.615,230.001.8023,835.535.9222,520.004.6425,160.004.62-51.71355.75-5.5211.72应付帐款21,002.5312.8142,968.0514.8266,595.5316.5480,003.3116.49130,660.1023.97104.5954.9920.1363.32应付票据7,290.784.459,527.843.298,035.652.0061,582.7512.705

21、,013.310.9230.68-15.66666.37-91.86预收帐款2,950.571.805,409.511.879,649.742.4012,915.322.6630,975.245.6883.3478.3833.84139.83流动负债合计67,537.9441.2097,850.7433.76160,555.2139.88243,406.6750.18268,616.9849.2844.8864.0851.6010.36负债合计73,328.1344.74104,154.2135.93180,999.1244.95249,597.0251.46285,310.2052.3542

22、.0473.7837.9014.31股本14,667.118.9519,563.256.7539,126.509.7239,126.508.0739,126.507.1833.38100.000.000.00未分配利润8,624.195.2613,926.024.8027,884.226.9330,515.876.2941,173.807.5561.48100.239.4434.93股东权益合计83,346.7050.85174,263.1160.12195,106.2348.46206,745.0142.62227,061.1841.66109.0811.965.979.83负债与股东权益合

23、计163,909.61100.00289,854.37100.00402,626.58100.00485,039.07100.00545,046.41100.0076.8438.9120.4712.37表6 伊利2001-2005年利润分配表构成分析 单位:万元项 目20012001结构比20022002结构比20032003结构比20042004结构比20052005结构比2002/2001变动比2003/2002变动比2004/2003变动比2005/2004变动比主营业务收入270,198.30100.00401,009.24100.00629,933.35100.00873,499.1

24、0100.001,217,526.41100.000.480.570.390.39主营业务成本191,728.3870.96267,538.4066.72427,389.3267.85613,925.2870.28864,107.9670.970.400.600.440.41主营业务税金及附加827.110.311,609.890.402,823.430.453,856.980.445,469.480.450.950.750.370.42主营业务利润77,642.8228.74131,860.9532.88199,720.6131.71255,716.8329.27347,948.9728.5

25、80.700.510.280.36其他业务利润450.730.17972.990.24927.850.15573.360.07885.660.071.16-0.05-0.380.54营业费用51,777.5019.1690,303.1422.52139,061.6522.08186,770.3121.38259,651.4421.330.740.540.340.39管理费用12,071.824.4720,208.545.0429,621.954.7030,365.663.4841,735.133.430.670.470.030.37财务费用153.90.06260.440.061,133.32

26、0.18890.670.10-230.27-0.020.693.35-0.21-1.26营业利润14,090.335.2122,061.815.5030,831.534.8938,263.554.3847,678.333.920.570.400.240.25补贴收入23.960.01459.190.111,089.800.171,694.550.192,336.260.1918.161.370.550.38营业外收支净额-343.71-0.13-1,138.06-0.28-58.69-0.01-166.20-0.02-1,265.53-0.102.31-0.951.836.61利润总额14,1

27、05.545.2221,333.845.3231,889.155.0637,887.864.3449,161.144.040.510.490.190.30所得税1,808.880.675,202.821.307,053.541.1212,185.811.4015,214.591.251.880.360.730.25净利润11,967.674.4314,194.843.5419,958.993.1723,912.902.7429,338.612.410.190.410.200.23 二、要求 (一)通过纵向比较和横向比较,简要评价伊利股份公司2002-2005年间的偿债能力、资产管理效率和盈利能力。 (二)分析伊利股份公司2002-2005年间存在的主要问题:1.ROE为何逐年提高?2.在资产周转率提高的同时,为何偿债能力下降? 三、资料的收集基本方法 进入 或后,直接输入公司的股票代码(若不知道股票代码,可以先搜索)搜索,点击“主页-个股档案-金融界”就可以收集你所需要的各年度的年度财务报告、分红方案、财务指标,公司简介等内容。也可以直接点击“中国上市公司资询网”或“中国证监会网”、“上海证券交易所网”、“深圳证券交易所网”、“巨潮资讯网”等。

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。