《证券投资分析》英文试卷及评分答案

《证券投资分析》英文试卷及评分答案

《《证券投资分析》英文试卷及评分答案》由会员分享,可在线阅读,更多相关《《证券投资分析》英文试卷及评分答案(17页珍藏版)》请在装配图网上搜索。

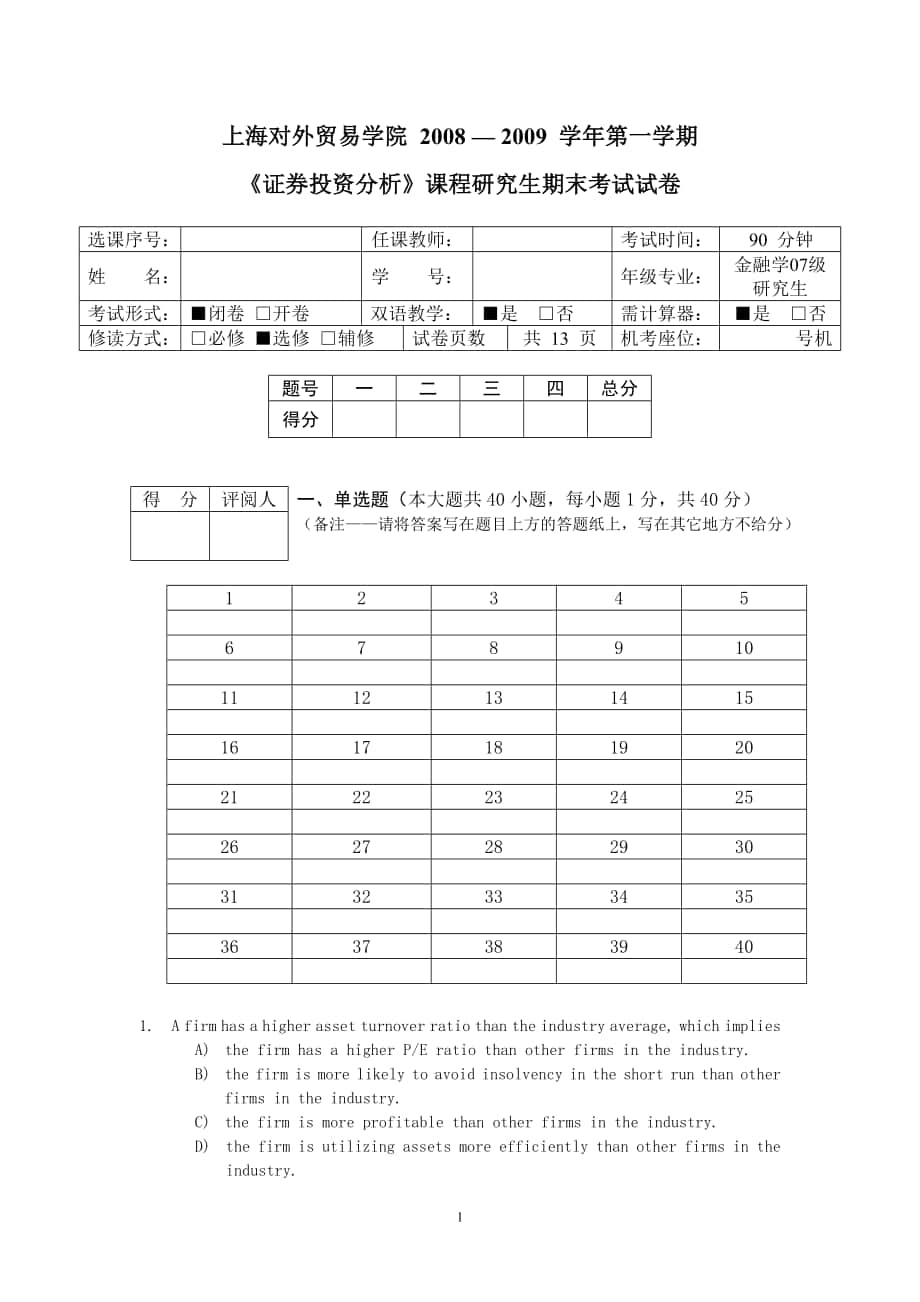

1、上海对外贸易学院 2008 2009 学年第一学期证券投资分析课程研究生期末考试试卷选课序号:任课教师:考试时间:90 分钟姓 名:学 号:年级专业:金融学07级研究生考试形式:闭卷 开卷双语教学:是 否需计算器:是 否修读方式:必修 选修 辅修试卷页数共 13 页机考座位:号机题号一二三四总分得分得 分评阅人一、单选题(本大题共40小题,每小题1分,共40分)(备注请将答案写在题目上方的答题纸上,写在其它地方不给分)123456789101112131415161718192021222324252627282930313233343536373839401. A firm has a hi

2、gher asset turnover ratio than the industry average, which implies A)the firm has a higher P/E ratio than other firms in the industry. B)the firm is more likely to avoid insolvency in the short run than other firms in the industry. C)the firm is more profitable than other firms in the industry. D)th

3、e firm is utilizing assets more efficiently than other firms in the industry. 2. The holding period yield (HPY) is equal to the holding period return (HPR) minus A) 0.B) 1.C) 2.D) 3. 3. Commercial paper is a short-term security issued by _ to raise funds. A)the Federal Reserve Bank B)commercial bank

4、s C)large, well-known companies D)the New York Stock Exchange 4. You sold short 200 shares of common stock at $60 per share. The initial margin is 60%. Your initial investment was A)$4,800. B)$12,000. C)$5,600. D)$7,200. 5. Multiple Mutual Funds had year-end assets of $457,000,000 and liabilities of

5、 $17,000,000. There were 24,300,000 shares in the fund at year-enD) What was Multiple Mutuals Net Asset Value? A)$18.11 B)$18.81 C)$69.96 D)$7.00 6. Which of the following would increase the net asset value of a mutual fund share, assuming all other things remain unchanged? A)an increase in the numb

6、er of fund shares outstanding B)an increase in the funds accounts payable C)a change in the funds management D)an increase in the value of one of the funds stocks 7. Over the past year you earned a nominal rate of interest of 10 percent on your money. The inflation rate was 5 percent over the same p

7、erioD) The exact actual growth rate of your purchasing power was A)15.5%. B)10.0%. C)5.0%. D)4.8%. 8. You purchased a share of stock for $20. One year later you received $1 as dividend and sold the share for $29. What was your holding period return? A)45% B)50% C)5% D)40% 9. Other things equal, an i

8、ncrease in the government budget deficit A)drives the interest rate down. B)drives the interest rate up. C)might not have any effect on interest rates. D)increases business prospects. 10. In the mean-standard deviation graph an indifference curve has a _ slope. A)negative B)zero C)positive D)northea

9、st 11. Which of the following describes the term risk averse?A) Being willing to take a fair gamble. B)Not willing to take on any risk.C)Choosing the less risky of two equal payoffs.D)Always choosing low risk low return investments.12. Which of the following is NOT a step in the portfolio management

10、 process?A) Sell all assets and reinvest the proceeds at least twice a year .B) Construct the portfolio.C) Study current financial and economic conditions.D) Monitor investors needs and market conditions.13. The rate of exchange between future consumption (future dollars) and current consumption (cu

11、rrent dollars) is A) the real rate of interest.B) the pure rate of interest.C) the risk-free rate of interest.D) the nominal rate of interest.14. You have $1000 to invest in a bank, which has offered you 6% interest compounded monthly. How much would you have at the end of the year if you placed $10

12、00 in the bank?A) 1060.B) 1060.90.C) 1061.68.D) 1061.83.15. Firms that specialize in helping companies raise capital by selling securities are called _. A)commercial banks B)investment banks C)savings banks D) credit unions16. Which of the following is not a risk in international operations?A) Gover

13、nment regulations.B) Manufacturing locations.C) Capital structure decision.D) Dividend decision.17. The security market line (SML)A) tells us the price of a security in the market.B) indicates the amount of unsystematic risk for a given return .C) describes the relationship between risk and return a

14、s being positive.D) indicates the correlation between the risk free asset and the market.18. The Important strategic decisions that should be addressed in an investment policy statement include?A) The asset classes that are to be deemed appropriate for investment in the target portfolio.B) The allow

15、able range of asset mixes.C) The allowable risk level for individual securities within asset classes.D) All of above are true statements.19. Which of the following statements regarding risk-averse investor is TRUE?A) They only care about the rate of return.B) They accept investments that are fair ga

16、me.C) They only accept risk investments that offer risk premiums over the risk-free rate.D) Both “A)” and “B)” are true statements.20 Liquidity isA)The ease with which an asset can be sold.B) The ability to sell an asset at or very near its fair market value.C) The degree of inflation protection an

17、asset provides.D) Both “A)” and “B)” are true statements.21 The presence of risk means that:A) Investors will lose money.B) More than one outcome is possible.C) The standard deviation of the payoffs is larger than the expected return.D) Terminal wealth will be less than initial wealth.22 The _ assum

18、es that current security prices fully reflect all public information.A) the weak-form EMHB) the semistrong-form EMHa. the strong-form EMHb. the full-form EMH23 Portfolio theory as described by Markowitz is most concerned with:A) The identification of unsystematic risk.B) The elimination of systemati

19、c risk.C) The effect of diversification on portfolio risk.D) None of the above is correct.24 A portfolio holding 90% of its assets in an S&P 500 index fund and 10% in Treasury bills is most sensitive to:A) Systematic risk.B) Unsystematic risk.C) Interest-rate risk.D) Reinvestment risk.25 The efficie

20、nt frontier of risky assets is?A) The set of portfolios that have zero standard deviation.B) The portion of the investment opportunity set that has the highest Sharpe ratio.C) The portion of the investment opportunity set that represents the highest reward-to-volatility ratio.D) Both “B)” and “C)” a

21、re true statements.26 Which of the following would best explain the change from a straight to a kinked capital market line?A) Reward-to-volatility increasing .B) Investors risk tolerance decreasing.C) Borrowing rate exceeding lending rate.D) None of the above is correct.27 Which of the following is

22、TRUE about risk and return?A) The higher the nominal return, the lower the risk.B) The reward to bearing risk is measured by the standard deviation.C) An increase in the risk of an investment should, result in an increase in the return.D) Real returns often exceed nominal returns when risk is involv

23、ed.28 Beta can be viewed as a standardized measure of A) Systematic risk.B) Unsystematic risk.C) Interest-rate risk.D) Reinvestment risk.29 The arbitrage pricing theory developed by A) Ross.B) Markowitz.C) Sharpe.D) Black.30 The three-step approach think the valuation process should be A) bottom-up.

24、B) top-down.C) bottom-middle-up.D) None of the above is correct.31 The income earned on reinvestment of the interim interest payments is referred to as A) interest-on-reinvestment.B) interest-on-investment.C) interest-on-interest.D) investment -on-interest.32 The process intended to eliminate intere

25、st rate risk is referred to asA) hedger. B) diversification.c. immunization.d. portfolio.33 Switching from one industry group to another over the course of a busi ness cycle is known as A) rotation strategy.B) active strategy.C) positive strategy.D) buy and hold strategy.34 A portfolio holding 10% o

26、f its assets in an S&P 500 index fund and 90% in Treasury bills is most sensitive to:A) Systematic risk.B) Unsystematic risk.C) Interest-rate risk.D) Reinvestment risk.35 Which of the following fund has least risk?A) stock index.B) bond.C) growth.D) industry.36. The first major step in asset allocat

27、ion is: A)assessing risk tolerance. B)analyzing financial statements. C)estimating security betas. D)identifying market anomalies. 37. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.08? A)85%

28、and 15% B)75% and 25% C)62.5% and 37.5% D)57% and 43% 38. In a factor model, the return on a stock in a particular period will be related to _. A)firm-specific events B)macroeconomic events C)the error term D)both A and B 39. An example of a highly cyclical industry is _. A)the automobile industry B

29、)the tobacco industry C)the food industry D)A and B 40. _ are financial assets. A)Bonds B)Machines C)Stocks D)A and C 得 分评阅人二、分析计算题(本大题共2小题,每小题10分,共20分)1 .You have calculated the following annual rate of return for both X and Y, calculate the correlation coefficient (show your calculating process).Y

30、earXY1999382000610200181420025122003913200411152Noren is considering undertaking a project. Noren is financed by 80% equity and 20%. Noren estimates that the project risk is the same as its own and plans to finance it in the same proportions as it is financed itself. The projects cash flows are expe

31、cted to be $200,000 for the next four years. At the end of the fourth year the government will purchase the ongoing project from the company for $4m.Norens equity beta is 1.4 and the beta of its debt is 0.2. The risk free rate of interest is 4.5%and the stock market risk premium is 6%. The project w

32、ill require an initial investment of $3m.Ignore taxes.1. Calculate the cost of debt.2. Calculate the cost of equity.3. Calculate the WACC.4. Calculate the NPV of the project. Should the company undertake the project?5. What will be the effect on Norens share price if the company undertakes the proje

33、ct?得 分评阅人四、问答题(本大题共4小题,每小题10分,共40分)1.Discuss the relationships between the required rate of return on a stock, the firms return on equity, the plowback rate(留存比率), the growth rate, and the value of the firm. 2.Discuss the various forms of market efficiency. Include in your discussion the information

34、 sets involved in each form and the relationships across information sets and across forms of market efficiency. Also discuss the implications for the various forms of market efficiency for the various types of securities analysts. (一)有效市场假说概述20世纪60年代,美国芝加哥大学财务学家尤金法默提出了著名的有效市场假说理论。有效市场假说理论认为,在一个充满信息

35、交流和信息竞争的社会里,一个特定的信息能够在股票市场上迅即被投资者知晓。随后,股票市场的竞争将会驱使股票价格充分且及时地反映该组信息,从而使得投资者根据该组信息所进行的交易不存在非正常报酬,而只能赚取风、险调整的平均市场报酬率。只要证券的市场价格充分及时地反映了全部有价值的信息、市场价格代表着证券的真实价值,这样的市场就称为“有效市场”。有效市场假说表明,在有效率的市场中,投资者所获得的收益只能是与其承担的风险相匹配的那部分正常收益,而不会有高出风险补偿的超额收益。因而,在有效率的市场中,“公平原则”得以充分体现,同时资源配置更为合理和有效。由此可见,不断提高市场效率无疑有利于证券市场持续健康

36、的发展。但是,市场达到有效的重要前提有两个:其一,投资者必须具有对信息进行加工、分析,并据此正确判断证券价格变动的能力;其二,所有影响证券价格的信息都是自由流动的。因而,若要不断提高证券市场效率,促进证券市场持续健康地发展,一方面,应不断加强对投资者的教育,提高他们的分析决策能力;另一方面,还应不断完善信息披露制度,疏导信息的流动。(二)有效市场分类及其对证券分析的意义与证券价格有关的“可知”的资料是一个最广泛的概念,它包括有关国内及世界经济、行业、公司的所有公开可用的资料,也包括个人、群体所能得到的所有私人的、内部的资料。这类资料被定义为第类资料。第类资料则是第类资料中已公开的部分。第类资料

37、是第类资料中对证券市场历史数据进行分析得到的资料。这三类资料是一种包含关系,如图1-1所示。依据有效市场假说,结合实证研究的需要,学术界一般依证券市场价格对三类不同资料的反映程度,将证券市场区分为三种类型,即弱势有效市场、半强势有效市场及强势有效市场。这三类市场对于以信息为分析基础的证券投资分析而言,具有不同的意义。1.弱势有效市场。在弱势有效市场中,证券价格充分反映了历史上一系列交易价格和交易量中所隐含的信息,从而投资者不可能通过分析以往价格获得超额利润。也就是说,使用当前及历史价格对未来做出预测将是徒劳的。要想取得超额回报,必须寻求历史价格信息以外的信息。在该市场中,信息从产生到被公开的效

38、率受到损害,即存在“内幕信息”。投资者对信息进行价值判断的效率也受到损害。并不是每位投资者对所披露的信息都能做出全面、正确、及时和理性的解读和判断,只有那些掌握专门分析工具和具有较高分析能力的专业人员才能对所披露的信息做出恰当的理解和判断。2.半强势有效市场。在半强势有效市场中,证券当前价格完全反映所有公开信息,不仅包括证券价格序列信息,还包括有关公司价值、宏观经济形势和政策方面的信息。如果市场是半强势有效的,那么仅仅以公开资料为基础的分析将不能提供任何帮助,因为针对当前已公开的资料信息,目前的价格是合适的,未来的价格变化依赖于新的公开信息。在这样的市场中,只有那些利用内幕信息者才能获得非正常

39、的超额回报。因此,在半强势有效市场中,已公布的基本面信息无助于分析师挑选价格被高估或低估的证券,基于公开资料的基础分析毫无用处。3.强势有效市场。在强势有效市场中,证券价格总是能及时充分地反映所有相关信息,包括所有公开的信息和内幕信息。任何人都不可能再通过对公开或内幕信息的分析来获取超额收益。在该市场中,有关证券产品信息的产生、公开、处理和反馈几乎是同时的,而且有关信息的公开是真实的,信息的处理是正确的,反馈也是准确的。结果,在强势有效市场上,每位投资者都掌握了有关证券产品的所有信息,而且每位投资者所占有的信息都是一样的,每位投资者对该证券产品的价值判断都是一致的。证券的价格反映了所有即时信息

40、。在这种市场中,任何企图寻找内部资料信息来打击市场的做法都是不明智的。强势有效市场假设下,任何专业投资者的边际市场价值为零,因为没有任何资料来源和加工方式能够稳定地增加收益。对于证券组合的管理者来说,如果市场是强势有效的,管理者会选择消极保守的态度,只求获得市场平均的收益水平。管理者一般模拟某一种主要的市场指数进行投资。而在弱势有效市场和半强势有效市场中,证券组合的管理者往往是积极进取的,在选择证券和买卖时机上下大功夫,努力寻找价格偏离价值的证券。3. Discuss the two major components of active portfolio management, securi

41、ty selection and market timing. How may the investor potentially benefit from such activities?积极型管理的目标:超越市场。如果股票市场并不是有效的市场,股票的价格不能完全反映影响价格的信息,那么市场中存在错误定价的股票。在无效的市场条件下,基金管理人有可能通过对股票的分析和良好的判断力,以及信息方面的优势,识别出错误定价的股票,通过买人“价值低估”的股票、卖出“价值高估”的股票,获取超出市场平均水平的收益率,或者在获得同等收益的情况下承担较低的风险水平。因此基金管理人应当采取积极式管理策略,通过挑选价

42、值低估股票超越大盘。积极的股票风格管理及应用所谓积极的股票风格管理则是通过对不同类型股票的收益状况做出的预测和判断主动改变投资组合中增长类、周期类、稳定类和能源类股票的权重的股票风格管理方式。例如,预测某一类股票前景良好,那么就增加它在投资组合中的权重,且一般高于它在标准普尔500种股票指数中的权重。另一方面,如果某类股票前景不妙,那么就降低它在投资组合中的权重。这种战略可以称之为类别轮换战略。相对于前面提到的消极战略来说,这是一种积极的股票风格管理方法。4. In recent years there has been a growth in the number of specialize

43、d mutual funds, such as energy funds, small-company funds, and so on. How might the APT be useful to you in predicting the performance of these funds? 答 (1)套利定价理论试图以多个变量去解释资产的预期报酬率,认为资产的收益率是由多种因素共同决定的一种资产定价方法。其认为经济体系中,有些风险都是无法经由多元化投资加以分散,例如通货膨胀或国民所得的变动等系统性风险。其与资本资产定价模型差异主要体现在后者认为市场风险是资产收益率唯一的解释变量。公式

44、为ri=E(ri)+i1F1+i2F2+inFn+i(随机误差项)(1)E(ri)为无风险收益 ,in为证券i对第n个影响因素的灵敏度系数,Fn为对因素Fn具有单位敏感性的因素风险溢价。套利是利用一种实物资产或证券的不同价格来赚取无风险利润的行为,是现代有效市场的一个决定性要素。套利定价模型是一个均衡的多因素模型,与单因素资本资产定价理论(CAPM)不同,它假定证券收益率只受K个共同因素(系统风险)和一个特殊因素(可分散的非系统风险)的影响。由于不同证券对K个共同影响因素的敏感程度不同,所以不同证券应对应不同的收益率;反之,对共同因素敏感程度相同的证券或证券组合在均衡时(即对非系统风险进行剔除

45、后)将以相同的方式运动,即具有相同的预期收益率。不然,“准套利”机会便会出现,投资者就会不失时机地充分利用这些机会,直至机会消失。这就是套利定价理论最本质的逻辑,也是根据套利关系进行资产定价的理论基础。 (2)所谓共同基金是指专门的投资机构通过发行受益凭证的方式将社会上闲散资金集中起来交由专家管理分散投资于各种有价证券或其他行业投资者按投资比例分享基金的投资收益。而专业化共同基金是指专门投资于在某个特定的行业或按被投资公司规模来分类的共同基金,比如现在刚出台的在浦东新区和滨海新区试点的房地产投资信托基金(REITS)。(3)如何用APT理论来预测专业化共同基金的收益率,以REITS为例,首先宏

46、观上的因素和分析其他共同基金没什么区别,对GDP、CPI等因素的影响分析,以及无风险收益的确定,但具体到房地产行业,我们可以将房价,建筑成本,运营成本等作为几个很重要的影响因素,再分别将各自的计算出来,总的资产收益率大概就出来了。相比与一般的共同基金,专业化的共同基金更着重于某个行业或某类公司,用APT理论来分析其资产收益率也更具有针对性。步骤:(1)运用统计分析模型对证券的历史数据进行分析,以分离出那些统计上显著影响证券收益的主要因素。 (2)明确确定某些因素与证券收益有关,对证券的历史数据进行回归以获得相应的灵敏度系数,再运用公式(1)预测证券的收益。上海对外贸易学院 2008 2009

47、学年第一学期证券投资分析课程研究生期末考试试卷标准(参考)答案及评分标准选课序号:任课教师:修读方式:必修 选修 辅修考试形式:闭卷 开卷一、单项选择题(本大题共40小题,每小题1分,共40分)12345DBCDA678910DDBBC1112131415BCCCB1617181920DCDCD2122232425CBCAD2627282930CCAAB3132333435CCACB3637383940ACDAD二、简单计算题(本大题共5小题,每小题8分,共40分)1. 答:38-416-41616610-11-24281411242512-24000913241121115416391242

48、343475.677122.652.385.67R I j =5.67/(2.65)(2.38)=0.8982.答:1)=4.5%+1.4(6%)=4.5%+8.4%=12.9%(2分)2)=4.5%+0.2(6%)=4.5%+1.2%=5.7%(2分)3)WACC=0.812.9%+0.25.7%=10.32%+1.14%=11.46%(2分)4)NPV=200,000/(1+11.46%)+200,000/(1+11.46%)2+200,000/(1+11.46%)3+4,200,000/(1+11.46%)4-3,000,000=200,000/1.1146+200,000/1.2423

49、+200,000/1.3847+4,200,000/1.5434-3,000,000=179436.57+160987.41+144435.62+2721264.74-3,000,000 =206124.34(3分)5) Norens share price will increase if the company undertakes the project(1分)三、问答题(本大题共2小题,共20分)1. Answer: If the firm earns more on retained earnings (equity) than the firms cost of equity ca

50、pital (required rate of return), the value of the firms stock increases; therefore, the firm should retain more earnings, which will increase the growth rate and increase the value of the firm (share price). (3分)If the firm earns less on retained equity than the required rate of return, and the firm

51、 increases the retention rate and the growth rate, the firm decreases firm value, as reflected by share price. In this scenario, the shareholders would prefer that the firm pay out more of earnings in dividends, which the shareholders could invest at a greater rate of return than that earned by the

52、firm (ROE). (4分)If the required rate of return equals the ROE, investors are indifferent between the firms retaining earnings and paying out dividends. As a result, the retention rate and the growth rate in this scenario have no effect on firm value (stock price). (3分)This question is designed to as

53、certain the students understanding of these relationships, which are important both from the investment and corporate finance perspectives. 2Answer: The weak form of the efficient markets hypothesis (EMH) states that stock prices immediately reflect market data. Market data refers to stock prices an

54、d trading volume. Technicians attempt to predict future stock prices based on historic stock price movements. Thus, if the weak form of the EMH holds, the work of the technician is of no value. (2分)The semistrong form of the EMH states that stock prices include all public information. This public in

55、formation includes market data and all other publicly available information, such as financial statements, and all information reported in the press relevant to the firm. Thus, market information is a subset(子集) of all public information. As a result, if the semistrong form of the EMH holds, the wea

56、k form must hold also. If the semistrong form holds, then the fundamentalist, who attempts to identify undervalued securities by analyzing public information, is unlikely to do so consistently over time. In fact, the work of the fundamentalist may make the markets even more efficient! (3分)The strong

57、 form of the EMH states that all information (public and private) is immediately reflected in stock prices. Public information is a subset of all information, thus if the strong form of the EMH holds, the semistrong form must hold also. The strong form of EMH states that even with inside (legal or i

58、llegal) information, one cannot expect to outperform the market consistently over time. (3分)Studies have shown the weak form to hold, when transactions costs are considered. Studies have shown the semistrong form to hold in general, although some anomalies have been observed. Studies have shown that

59、 some insiders (specialists, major shareholders, major corporate officers) do outperform the market. (2分)The purpose of this question is to assure that the student understands the interrelationships across different forms of the EMH, across the information sets, and the implications of each form for

60、 different types of analysts.3. Answer: Security selection is the process of identifying underpriced securities. The analyst that can consistently identify such securities can outperform the market, risk-adjusted. (4分)Market timing consists of being able to predict correctly whether the stock market will be up or down and whether the bond market will be attractive or not. The in

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。