国际金融托马斯普格尔复习资料整理

国际金融托马斯普格尔复习资料整理

《国际金融托马斯普格尔复习资料整理》由会员分享,可在线阅读,更多相关《国际金融托马斯普格尔复习资料整理(18页珍藏版)》请在装配图网上搜索。

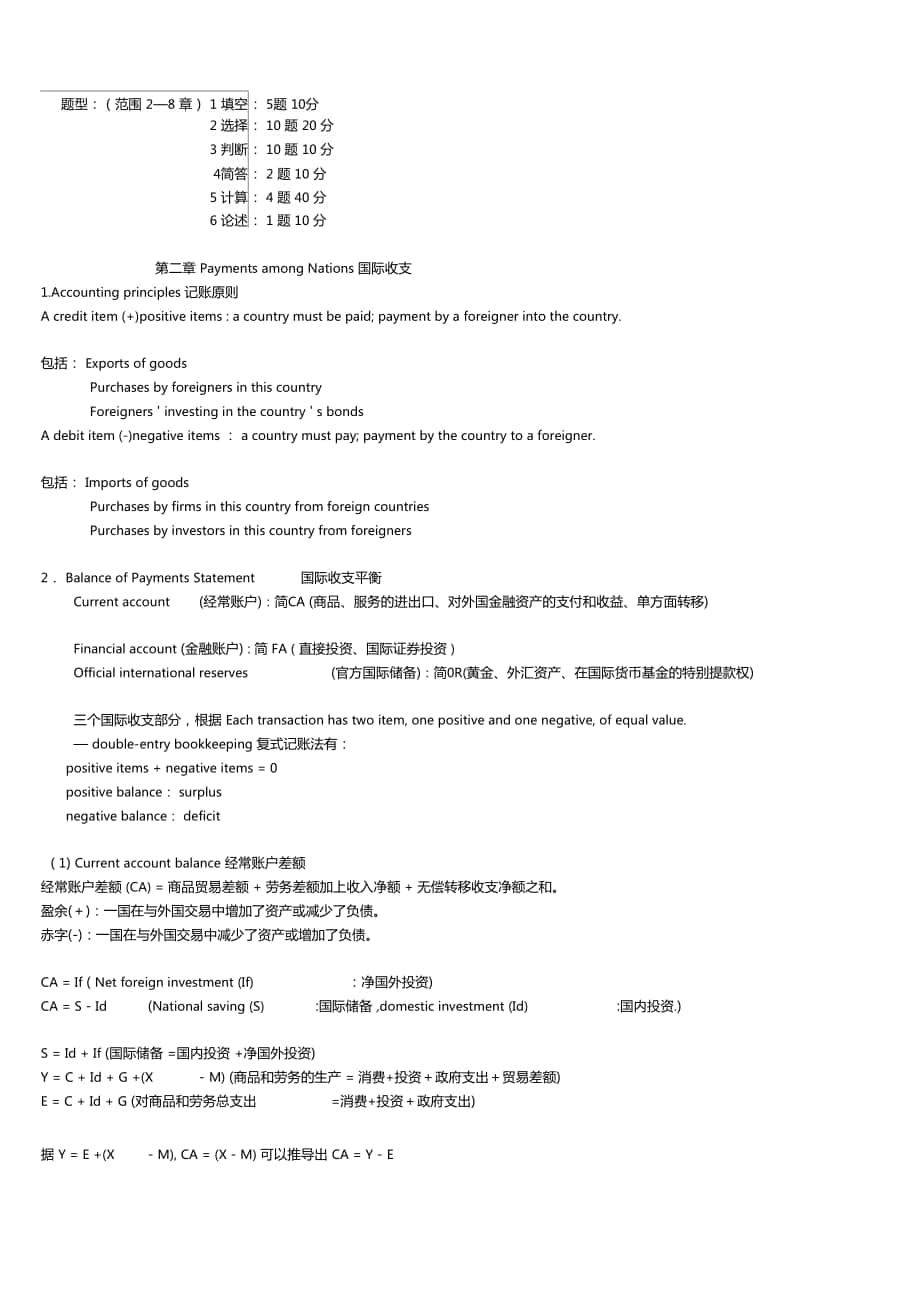

1、题型:(范围 28 章) 1 填空: 5题 10分2 选择: 10 题 20 分3 判断: 10 题 10 分4简答: 2 题 10 分5 计算: 4 题 40 分6 论述: 1 题 10 分第二章 Payments among Nations 国际收支1.Accounting principles 记账原则A credit item (+)positive items : a country must be paid; payment by a foreigner into the country.包括: Exports of goodsPurchases by foreigners in

2、this countryForeigners investing in the country s bondsA debit item (-)negative items : a country must pay; payment by the country to a foreigner.包括: Imports of goodsPurchases by firms in this country from foreign countriesPurchases by investors in this country from foreigners2 Balance of Payments S

3、tatement国际收支平衡Current account(经常账户):简CA (商品、服务的进出口、对外国金融资产的支付和收益、单方面转移)Financial account (金融账户) : 简 FA ( 直接投资、国际证券投资 )Official international reserves(官方国际储备):简0R(黄金、外汇资产、在国际货币基金的特别提款权)三个国际收支部分,根据 Each transaction has two item, one positive and one negative, of equal value. double-entry bookkeeping 复

4、式记账法有:positive items + negative items = 0positive balance: surplusnegative balance: deficit( 1) Current account balance 经常账户差额经常账户差额 (CA) = 商品贸易差额 + 劳务差额加上收入净额 + 无偿转移收支净额之和。 盈余():一国在与外国交易中增加了资产或减少了负债。赤字(-):一国在与外国交易中减少了资产或增加了负债。CA = If ( Net foreign investment (If):净国外投资)CA = S - Id(National saving (

5、S):国际储备 ,domestic investment (Id):国内投资.)S = Id + If (国际储备 =国内投资 +净国外投资)Y = C + Id + G +(X- M) (商品和劳务的生产 = 消费+投资政府支出贸易差额)E = C + Id + G (对商品和劳务总支出=消费+投资政府支出)据 Y = E +(X- M), CA = (X - M) 可以推导出 CA = Y - ESurplus 盈余Deficit 赤字Positive net foreig n in vestme nt len der)贷款者Net foreig n borrower借款者Saving m

6、ore tha n in vesti ng domestically 储蓄超过国内投资Domestic savingsless than domestic investment储蓄低于国内投资Producing more than spending on goods and services生产超过支出Spending more tha n produc ing生产少于支出If CA is in deficit, then what could we do?(若 CA是赤字,我们应该怎么做?)In crease Y, or decrease E.(增加商品和劳务的生产,或减少对商品和劳务的总支

7、出)(2) Official settlements balanee官方结算差额OFR= Current account balanee + Private capital balanee即 B = CA + KA因为所有项目最终差额必须为0,所以官方结算差额的不平衡必须用官方储备资产( OR来弥补,因此,B + OR = 0意义: 如B0,则外汇贮备增加。如B0, investing in BritainCD0, investing in America (home country)Forward premiumF = (f-e)/eForward disco unt远期升水一远期汇率高于即

8、期汇率升水幅度 (if F is positive)远期贴水一远期汇率低于即期汇率If F is n egative,CD = F + (iuk -ius )3. Covered In terest Parity抛补利息平价CD=0Sell forward (f)Euy forward 1/f) *CD= F + (iuk ius ) =0Thatis,F=ius - iuk 远期升(贴)水等于两国货币利差。Or F+ iuk =ius国内收益等于抛补性国外投资的总收益。当A国利率低于B国利率时,A国货币远期升水。反之,则贴水。当前远期汇率简f , 当前即期汇率简e,四个rates的计算: c

9、urre nt forward excha nge rate curre nt spot excha nge rate两国当前利率简iuk、ius.curre nt in treast rates in the two coun tries.4. Uncovered Interest Parity非抛补利息平价EUD=Expected appreciati on + (iuk - ius ) =0即 EUD=eex-e/e + (iuk - ius)=0 ,其中 Expected appreciation= eex-e/e四个 rates 的计算,其中 eex 表示投资者预期的未来的即期汇率

10、)That is, expected appreciation of the pound =ius- iuk预期英镑升 ( 贬)值等于两国货币利差Or expected appreciation + iuk =ius 国内收益等于非抛补性国外投资的总收益。EUD=Expected depreciation + (iuk -ius ) 0The U.K. investor should invest dollar-denominated bonds课后练习4 The current spot exchange rate当前即期汇率 is $0.010/yen.The current 60-day

11、 forward exchange rate当前远期汇率 is $0.009/yen.How would the U.S firms and people described in question 3 each use a forward foreign exchange contract 远期外汇合同 to hedge 规避 their risk exposure 风险 ?what are the amounts in each forward contract ?a. The U.S. firm has an asset position in yen it has a long pos

12、ition in yen. To hedge its exposureto exchange rate risk, the firm should enter into a forward exchange contract now in which the firm commits to sell yen and receive dollars at the current forward rate. The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.b. The studen

13、t has an asset position in yen a long position in yen. To hedge the exposure to exchange rate risk, the student should enter into a forward exchange contract now in which the student commits tosell yen and receive dollars at the current forward rate. The contract amounts are to sell 10 million yen a

14、nd receive $90,000, both in 60 days.c. The U.S. firm has an liability position in yen a short position in yen. To hedge its exposure toexchange rate risk, the firm should enter into a forward exchange contract now in which the firm commitsto sell dollars and receive yen at the current forward rate.

15、The contract amounts are to sell $900,000 and receive 100 million yen, both in 60 days.5. The current exchange rate 即期汇率 is $1.20/euro.The current 90-day forward exchange rate当前远期汇率 is $1.18/euro.You expect the spot rate to be $1.22/euro in 90 days .How would you speculate投机 usinga forward contract?

16、If many speculate in this way ,what a pressure is placed on the value of the current forward exchange rate?Relative to your expected spot value of the euro in 90 days ($1.22/euro), the current forward rateof the euro ($1.18/euro) is lowthe forward value of the euro is relatively low. Using the princ

17、iple ofbuy low, sell high, you can speculate by entering into a forward contract now to buy euros at $1.18/euro. If you are correct in your expectation, then in 90 days you will be able to immediately resell those euros for $1.22/euro, pocketing a profit of $0.04 for each euro that you bought forwar

18、d.If many people speculate in this way, then massive purchases now of euros forward (increasing the demand for euros forward) will tend to drive up the forward value of the euro, toward a current forward rate of$1.22/euro.8.The following rates are available in the markets:Current spot exchange rate

19、即期汇率 : $0.500/FrCurrent 30-day forward exchange rate当前 30 天远期汇率:$0.505/SFrAnn ualized in terestrate on 30-day dollar-de nomi natedbo nds 30 天美元计价券的年利率:12%(1.0%for 30 days)Ann ualized in terest rate on 30-day swiss franc -den omi nated bonds 30天瑞郎计价券的年利率:6%(0.5%for30 days)A. Is the swiss franc at a f

20、orward premium or discount远期溢价或折价 ?The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) is greater than its current spot value ($0.500/SFr).B. Should a U.S-based in vestor make a covered in vestme nt in swiss fran c-de nomin ated 30-day bonds ,rathertha n in vest ing in 30

21、-day dollar-de nomin ated bon ds?expla in.CD=F+ iuk -ius =( 0.505-0.5)/0.5+(0.005-0.01)=0.005, there is a covered in terest differe ntial of 0.5%for 30 days (6 percent at an annual rate). The U.S. investorcan makea higher return, covered against exchangerate risk, by in vesti ng in SFr-de nomin ated

22、 bon ds.第五章 What Determines Exchange Rates?汇率是由什么决定的?focuses on short-r un moveme nts in excha nge rates.短期内汇率变动focuses on Ion g-term tren ds.长期内汇率变动shows one way in which the short term flows into the medium term and the n into the long term.短期汇率变动对中长期的影响。Asset market approach to exchange rates资产市场

23、说一 portfolio repositioning (投资组合重置)The long run: the mon etary approach长期:货币理论The qua ntity theory (货币数量理论)货币数量公式:Ms=kx PX Y(1)Mfs=kf X Pf X Yf (2)Ms: Money supply货币供给k: proporti onal relatio nships betwee n money hold ings and the nominal value of GDP货币持有量禾口 GDP的名义价值之比(代表消费者的行为)P: price level价格水平Y:

24、 real domestic products实际国内产出1. Three types of variability for excha nge rates(三种变异类型的汇率)Lon g-term tren ds.Medium-term (over periods of several years) tren ds.Short- term (month to month )variability.2. 短期汇率的决定因素变量的变化国际金融资产重组方向对当前现汇汇率的影响 (e =本币/外币)国内利率(i)增加转向本币资产e减少(本币升值)减少转向外币资产e增加(本币贬值)国外利率(if)增加

25、转向外币资产e增加(本币贬值)减少转向本币资产e减少(本币升值)预期远期现汇汇率(eex)增加转向外币资产e增加(本币贬值)减少转向本币资产e减少(本币升值)分析基于三个变量中一个发生变化时,其他两个不变,对现汇汇率的影响。If domestic i in creases, while if and eex投资者预期的未来的即期汇率remained con sta nt,the returncomparis on shifts in favor of in vestme nts in domestic bon ds.Why?This in crease dema nd for domestic

26、 curre ncy in creases the curre nt spot excha nge rate value of domestic currency ,soe 当前即期汇率 decreases.If foreig n i in creases, whilei and eex rema ined con sta nt, the retur n comparis on shifts in favor ofin vestme nts in foreig n bon ds.This in crease dema nd for foreig n curre ncy in creases t

27、he curre nt spot excha nge rate e (the domestic curre ncy depreciates)3. The Long Run: Purchasing Power Parity长期:购买力平价说(PPP)Three versionsThe law of one price一价定律:商品的国内价格等于国外价格乘以现汇汇率。P = e - Pf该定律对交易大宗商品来说是正确的。女口,黄金,其他金属,原油和农产品。“一价定律”在现实中已失去意义。Absolute purchasi ng power parity绝对购买力平价说:汇率取决于以不同货币衡量的多

28、种可贸易商品价格水平之比。P = Pf e -or- e = P/Pf绝对购买力平价不成立。Relative purchas ing power parity相对购买力平价说:Rate of appreciation of the foreign currency=口一口 f国外货币的升贬值率=国内通胀率一国外通胀率若 0,本币贬值 0,本币升值4. The effect of money supplies on an excha nge rate货币供给对汇率的影响Example:(英国为外国,美国为本国)英国减少10%的货币供给一一英镑减少,变得更值钱一一从紧货币政策,银行缩减信贷一一造成

29、借贷困难,减少了总 需求,产出,就业。价格水平下降10%一一根据相对购买力平价说,英镑汇率上升10%The effect of real in comes on an excha nge rate实际收入对汇率的影响Example:(英国为外国,美国为本国)英国生产力上升,实际收入增加了10%一一增加了人们对英镑的需求一但假定英国货币存量没有增加,则物价会下降10%一一根据相对购买力平价说,英镑汇率上升 10%课后作业2. The following rates currently exist:Spot exchange rate即期汇率:$1.000/euroAnnual interest

30、rate on 180-day euro- denominated bonds 180 欧元计价券的年利率 :3%Annual interest rate on 180-day U.S dollar-denominated bonds 180 天美元计价券的年利率 :4%In vestors curre ntly expect the spot excha nge rate to be about $1.005/euro in 180 daysA. Show that un covered in terest parity抛补利率平价 holds(appromixmately)at these

31、 rates.The euro is expected to appreciate at an annual rate of approximately(1.005 - 1.000)/1.000)(360/180) = 1%. The expected un covered in terest differe ntial is approximately 1%+ 3% - 4% = 0, so un covered in terest parity holds (approximately)即期汇率 if the interest rate on 180-dayB. What is likel

32、y to be the effect on the spot exchange ratedollar-denominated bonds 180 天美元计价券的禾U率declinesto 3 percent?lfthe euro interest rate and theexpected future spot rate are unchanged ,and if uncovered interest parity抛补利息平价 is reestablished重建 ,what will the new curre nt spot excha nge rate be ? Has the doll

33、ar appreciated or depreciated升值或贬值?If the interest rate on 180-day dollar-denominated bonds declines to 3%, the expected uncovered interest differe ntial shifts in favor of in vesti ngin euro-de nomin ated bon ds. The in creased dema nd for euros in thespot excha nge market tends to appreciate the e

34、uro.Since ieu=3%, eex =$1.005/euro, EUD=0, e?(1.005-e)/e + (3% - 3%)= 0e=$1.005/euroWith e in creas ing, U.S. dollar depreciates4.You observe the followi ng curre nt rates:Spot excha nge rate:$0.01/ye nAnnual in terest rate on 90-day U.S -dollar denomin ated bonds :5%Annual in terest rate on 90-day

35、yen denomin ated bonds :4%A. If un covered in terest parity holds, what spot excha nge rate do in vestors expect to exist in 90 days?For un covered in terest parity holds,(eex-0.01)/0.01 + 4% - 4%=0eex= $0.01/ye n.B. A close U.S preside ntial elect ion美国总统选举 has just bee n decided.the can didate who

36、m intern ati onalin vestors view as the stron ger and more probus in ess pers on won .Because if this ,in vestors expect theexcha nge rate to be $0.0095/ye n in 90 days.what will happe n in the foreig n excha nge market?If in vestors expect that the excha nge rate will be $0.0095/ye n, the n they ex

37、pect the yen to depreciatefrom its initial spot value during the next 90 days. Given the other rates, investors tend to shift theirinvestments toward dollar-denominated investments. The extra supply of yen (and demand for dollars) in the spot exchange market results in a decrease in the current spot

38、 value of the yen (the dollar appreciates).Thus, the yen will depreciate (the dollar to appreciate) immediately in the current spot market10.To aid its efforts to get reelected,the current government of a contry decides to increase the growthrate of the demostic money supply by two percentage points

39、.The increased growth rate becomes “ permanent ” 永久 because once started it is difficult to reverse相反 .A. according to the monetary approach 货币理论 ,how will this affected the long-run trend for the exchange rate value of the contry s currency?Because the growth rate of the domestic money supply (Ms)

40、is two percentage points higher than it was previously, the monetary approach indicates that the exchange rate value (e) of the foreign currency will be higher than it otherwise would be that is, the exchange rate value of the countrys currency will belower. Specifically, the foreigncurrency will ap

41、preciate by two percentage points more per year. That is,the domestic currency will depreciate by two percentage points more per year.第六章 Government Policies toward the Foreign Exchange Market政府的外汇市场政策Possible government policies toward the foreign exchange market.政府对外汇市场的政策Official intervention on

42、this market and restrictions. Lessons of history of exchange rate system. exchange controls 外汇控制对市场的官方干预和限制汇率体制的1.Types of floating exchange rate Clean float 清洁浮动 Managed float (dirty float)2.Types of fixed exchange rate浮动汇率的种类管理浮动(肮脏浮动)固定汇率的种类 :Adjustable peg :可调整的钉住汇率Crawling peg 爬行钉住汇率3.How to de

43、fend the fixed rate?(如何保护固定汇率 )Official intervention by the government buying or selling currencies 由政府干预买进或卖出货币Exchange control (tariffs, quotas etc.)外汇管制(关税、配额等)Altering domestic interest rates改变国内利率Macroeconomic adjustment fiscal or monetary policy宏观经济调整财政或货币政策To surrender rather than defend (若妥协而不是保护) :Altering its fixed rate or switch to a floating exchange rate

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。