国际结算练习答案

国际结算练习答案

《国际结算练习答案》由会员分享,可在线阅读,更多相关《国际结算练习答案(16页珍藏版)》请在装配图网上搜索。

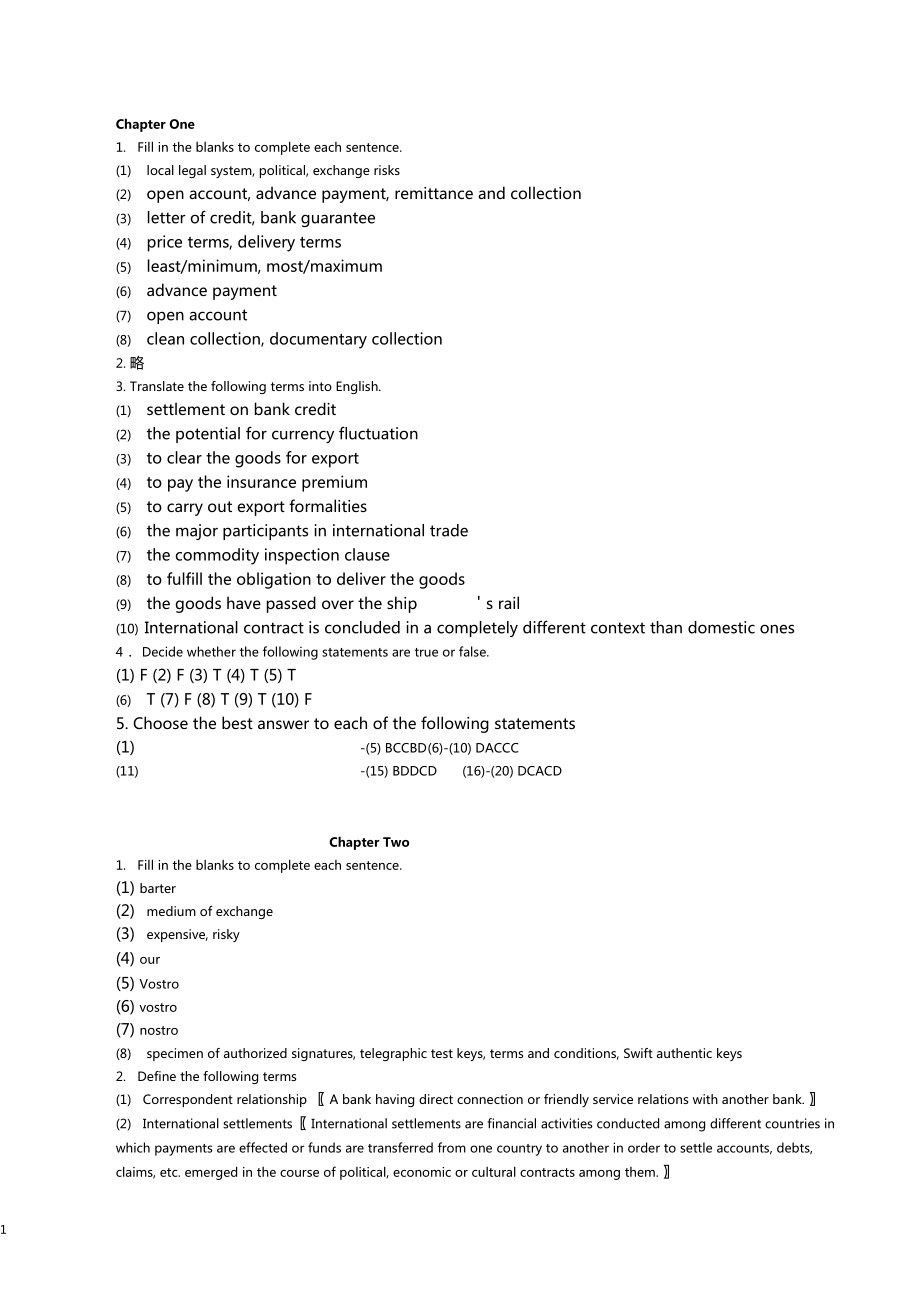

1、Chapter One1. Fill in the blanks to complete each sentence.(1) local legal system, political, exchange risks(2) open account, advance payment, remittance and collection(3) letter of credit, bank guarantee(4) price terms, delivery terms(5) least/minimum, most/maximum(6) advance payment(7) open accoun

2、t(8) clean collection, documentary collection2. 略3. Translate the following terms into English.(1) settlement on bank credit(2) the potential for currency fluctuation(3) to clear the goods for export(4) to pay the insurance premium(5) to carry out export formalities(6) the major participants in inte

3、rnational trade(7) the commodity inspection clause(8) to fulfill the obligation to deliver the goods(9) the goods have passed over the ship s rail(10) International contract is concluded in a completely different context than domestic ones4 Decide whether the following statements are true or false.(

4、1) F (2) F (3) T (4) T (5) T(6) T (7) F (8) T (9) T (10) F5. Choose the best answer to each of the following statements(1) -(5) BCCBD(6)-(10) DACCC(11) -(15) BDDCD(16)-(20) DCACDChapter Two1. Fill in the blanks to complete each sentence.(1) barter(2) medium of exchange(3) expensive, risky(4) our(5)

5、Vostro(6) vostro(7) nostro(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys2. Define the following terms(1) Correspondent relationship A bank having direct connection or friendly service relations with another bank. (2) International settlements

6、 International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them.

7、(3) Visible trade The exchange of goods and commodities between the buyer and the seller across borders.(4) Financial transaction International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.(5)

8、 . V ostro account Vostro account is an account held by a bank on behalf of a correspondent bank.3. Translate the following terms into English.(1) commercial credit(2) control documents(3) account relationship(4) cash settlement(5) financial intermediary(6) credit advice(7) agency arrangement(8) cre

9、dit balance(9) reimbursement method(10) test key/code4 Decide whether the following statements are true or false.(1) T (2) F (3) F (4) T (5) F5. Choose the best answer to each of the following statements(1) -(5) BCDAD (6)-(10) BBDABChapter Three1. Define the following Terms:(1) Negotiable instrument

10、 “A negotiable instrument is a chose in action, the full and legal title to which is tr ansferable by delivery of the instrument (possibly with the transferor s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the

11、transferee, providing the latter takes the instrument in good faith and for value. ”(2) Bill of exchange A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a

12、 fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer. (3) Check A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or

13、to the order of a named person or to bearer. (4) Documentary bill It is a bill with shipping documents attached thereto. (5) Crossing A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to a bank only. 2. Translate the following terms into English.(1)

14、一般划线支票 generally crossed check(2) 特殊划线支票 specially crossed check (3) 过期支票 a check that is out of date (4) 未到期支票 post dated check(5) 大小写金额 amount in words (6) 白背书 blank endorsement(7) 特别背书 special endorsement(8) 限制性背书(9) 跟单汇票documentary bill restrictive endorsement (10) 即期汇票 sight draft (11) 远期汇票 usa

15、nce/term bill (12) 承兑汇票 acceptance bill (13) 可确定的未来某一天 determinable future date (14) 光票 clean bill (15) 流通票据 negotiable instrument (16) 贴现行 discounting house (17) 商人银行 merchant bank (18) 无条件的付款承诺 unconditional promise of payment (19) 负连带责任 jointly and severally responsible (20) 出票后 90 天付款 payable 90

16、 days after date3. Decide whether the following statements are true or false.(1) T(2) F(3) T(4) T(5) T(6) F(7) T(8) T(9) T(10) T(11) F(12) T(13) T(14) F(15) T(16) T(17) T(18) F(19) F(20) F4. Choose the best answer to each of the following statements(1)-(5)CACBC(6)-(10)BACBB(11)-(15)BDCCC(16)-(20)BBA

17、AC5-7 略Chapter Four1. Fill in the blanks to complete each sentence.(1) beneficiary(2) payment order / mail advice / debit advice(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key(4) sell it to his own bank for crediting his account(5) debits / credits(6)

18、 demand draft(7) act of dishonor(8) swiftness / reliability / safety / inexpensiveness(9) debiting remitting bank s nostro account(10) delivery of the goods2. Define the following Terms.(1) International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad b

19、y one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the remitting bank s overseas branch or its correspondentwith a nostro account.(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or i

20、ts branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.(4) Demand draft tra

21、nsfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.(5) Cancellation of the reimbursement under mail transfer or te

22、legraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.3. Translate the following terms into English.(2) 汇出汇款 outward remittance(4) 往来账户 current account(6) 作为偿付 in cover(8) 信汇通知书 mail advice(1) 汇款通知单 remittance adv

23、ice(3) 国际汇款单 international money order(5) 自动支付系统 automated payment system (7) 赔偿保证书 letter of indemnity(9) 汇票的不可流通副本 non-negotiable copy of draft (10) 首期付款 down payment4. Choose the best answer to each of the following statements(1) -(5) BCABD (6)-(10) BBBAAChapter Five1. Fill in the blanks to compl

24、ete each sentence.(1) presenting bank(2) title documents / pays the draft / accepts the obligation to do so(3) legal / the exchange control authorities(4) the payment is made(5) open account / advance payment(6) Inward collection(7) . the remitting bank(8) trust receipt(9) D/P at sight(10) documents

25、, draft, and collection order2. Define the following termss bank(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping d ocuments are forwarded to the seller with clear instructions for collection through on

26、e of its correspondent banks located in the domicile of the buyer.(2) The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.(3) Documentary collectio

27、n is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism th

28、at allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents

29、 attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.(5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill

30、 drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.3. Translate the following terms into English.(2) 商业承兑汇票 trade acceptance(4) 出口押汇 export bill purchased(6) 以寄售方式 on consignment(8) 货运单据 shipping documents(1) 承兑交单 acceptance against docum

31、ents(3) 需要时的代理人 case of need(5) 物权单据 title document(7) 直接托收 direct collection(9) 付款交单 documents against payment(10) 远期汇票 time/ tenor/term/ usance draft4. Choose the best answer to each of the following statements(1) -(5) ABCAB (6)-(10) ACAADChapter Six1. Define the following terms:(1) Letter of cred

32、it The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions ofthe documentary credit are complied with. (2)

33、Confirmed letter of credit A credit that carries the commitment to pay by both the issuing bank and the advising bank. (3) Revolving credit A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being requi

34、red. (4) Confirming bank A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit. (5) Applicant of the credit The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to

35、issue a credit in favor of an exporter or a seller abroad.2. Translate the following terms or sentences into English.(1) 未授权保兑 silent confirmation (2) 有效地点为开证行所在地的柜台 to expire at the counters of the issuing bank (3) 凭代表物权的单据付款 to pay against documents representing the goods(4) 信用证以银行信用代替了商业信用。 A cre

36、dit places a bank s credit instead of commercialcredit.(5) 信用证独立于它所代表的商业合同。 A credit stands independent of the sales contract. 3. Decide whether the following statements are true or false.(1) F(2) F(3) T(4) F(5) T(6) F(7) F(8) T(9) F(10) F(11) T(12) T(13) F(14) F(15) T4. Choose the best answer to ea

37、ch of the following statements(1) -(5)BCDBA(6)-(10) DDCCC(11) -(15) DDADB(16)-(20) DDDABChapter Seven1. Fill in the blanks to complete each sentence.(1) completeness, correctness, consistency(2) underlying transaction(3) authorized signatures, test key(4) comply with(5) ISO currency code2. Translate

38、 the following terms or sentences into English.(1) 信用证表面的真实性 the apparent authenticity of the credit (2) 标准国际银行惯例 international standard banking practice (3) 信息交换系统 data communication network (4) 有足够的资金来支付信用证 to have sufficient funds to cover the credit (5) 买方考虑自己的要求也同样的重要 It is equally important th

39、at the buyer oswnrequirements be taken into account. 3. Decide whether the following statements are true or false.(1) F (2) F (3) F (4) T (5) T(6) T (7) F (8) T (9) F (10) T4. Choose the best answer to each of the following statements(1) -(5) CDCBC (6)-(10) CAADD(11) -(15) ADDABChapter Eight1. Defin

40、e the following terms:(1) Commercial invoice The commercial invoice is the key accounting document describing the commercial transaction between the buyer and the seller. It is a document giving details of goods, service, price, quantity, settlement terms and shipment. (2) Export license An export l

41、icense is a document prepared by a government authority of a nation granting the right to export a specific quantity of a commodity to a specified country. (3) Bill of lading A bill of lading is a document issued by a carrier to a shipper, signed by the captain, agent, or owner of a vessel, providin

42、g written evidence regarding receipt of the goods, the conditions on which transportation is made, and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading.(4) Inspection certificate A document issued by an authority indicating that goods h

43、ave been inspected prior to shipment and the results of the inspection. (5) Consular invoice A consular invoice is an invoice covering a shipment of goods certified in the country of export by a local consul of the country for which the merchandise is destined. II. Translate the following into Engli

44、sh:(1) 战略产品 strategic commodity (2) 普惠制 General System of Preference(3) 有预订的泊位 with reserved berth (4) 多式联运提单 multi-modal transport bill of lading (5) 抽样方式 sampling methodology 3. Decide whether the following statements are true or false.(1) F (2) F (3) T (4) T (5) F(6) F (7) F (8) T (9) T (10) F4.

45、Choose the best answer to each of the following statements(1) -(5) ABDAC(6)-(10) CCCDA(11) -(15) DDAAA(16)-(20) ABACDChapter Nine1. Fill in the blanks to complete each sentence.(1) acceptable accounts receivable / non-recourse and notification(2) collection as well as the risk of credit losses(3) th

46、e level of sales(4) changes in the world economic structure(5) growing demands(6) purchasing the client s accounts receivables(7) financial and administration(8) the invoice date / the customer makes his payment(9) market conditions and his assessment of the risks involved in a particular transactio

47、n(10) fluctuations in the exchange rate / in the status of the debtor2. Define the following terms(1) Factoring is a form of trade financing that allows sellers to sell their products to overseas buyers essentially on an open account basis. In simple terms, factoring is the purchase of claims, arisi

48、ng from sales of goods, by a specialized company known as factoring company or factor. Factoring is in fact a three-party transaction between the factor and a business entity, i.e. the exporter selling goods or providing services to foreign the importer.(2) Forfaiting is the term generally used to d

49、enote the purchase of obligations falling due at some future date, arising from deliveries of goods and services-mostly export transactions-without recourse to any previous holder of the obligation. Simply speaking, forfaiting is the business of discounting medium-term promissory notes or drafts rel

50、ated to an international trade transaction.3. Translate the following terms into English.(1) 或有负债 contingent liability(3) 卖方信贷 supplier credit(5) 信用审定 credit approval(7) 买方信贷担保 buyer credit guarantee(9) 贸易壁垒 trade barrier(2) 信用额度 credit limit(4) 无追索权的 without recourse(6) 资本货物 capital goods(8) 福费廷融资便

51、利 forfaiting facility(10)大宗采购折扣 bulk purchase discount4. Choose the best answer to each of the following statements(1) B(2)A (3) D (4) C(5) DChapter 101. Fill in the blanks to complete each sentence.(1) secure mechanism for payment / default instrument(2) party tendering / the contract has been awar

52、ded(3) presentation of the beneficiary s demand and stipulated documentation(4) issue a guarantee directly to the beneficiary(5) Unconditional bonds(6) withdraw its bid / accept the award of contract in its favor / between 2% and 5%(7) UCP for documentary credits / Uniform Rules for Demand Guarantee

53、.(8) An advance payment(9) borrower (the principal) / the lender (the beneficiary)(10) counter indemnity2. Define the following terms(1) A bank guarantee is an instrument for securing performance or payment especially in international business. It is a written promise issued by a bank at the request

54、 of its customer, undertaking to make payment to the beneficiary within the limits of a stated sum of money in the event of default by the principal. It may also be defined as an independent obligation where the guarantor has to make a special agreement with its customer, ensuring that it will be re

55、funded by him for any payment to be effected under the contract of guarantee.(2) A beneficiary is the party in whose favor the guarantee is issued. He is secured against the risk of the principal s not fulfilling hisaotibolnigs towards the beneficiary in respect of the underlyingtransaction for whic

56、h the demand guarantee is given. He will not obtain a sum of money if the obligations are not fulfilled.(3) An indirect guarantee is a guarantee where a second bank, usually a foreign bank located in the beneficiary s country of domicile, will be requested by the initiating bank to issue a guarantee

57、 in return for the latter-gusacroaunnteter.(4) A performance bond is an undertaking given by the guarantor at the request of a supplier of goods or services or a contractor to a buyer or beneficiary, whereby the guarantor undertakes to make payment to the beneficiary within the limit of a stated sum

58、 of money in the event of default by the supplier or the contractor in due performance of the terms of a contract between the principal and the beneficiary.(5) A standby letter of credit is a clean letter of credit that generally guarantees the payment to be made for an unfulfilled obligation on the

59、 part of the applicant. It is payable on presentation of a draft together with a signed statement or certificate by the beneficiary that the applicant has failed to fulfill his obligation.3. Translate the following terms into English.(1) 履约保函 performance bond(3) 反赔偿 counter indemnity(5) 备用信用证 stand-

60、by letter of credit(7) 基础交易 underlying transaction(9) 延期付款保函 deferred payment bond(2) 担保书,保函 letter of guarantee(4) 附属保函 accessory guarantee(6) 工程承包 engineering contracting(8) 见索即付保函 demand guarantee(10) 反担保 counter guarantee4. Choose the best answer to each of the following statements(1)-(5) BAADC

61、(6)-(10) BCDBAChapter 111. Fill in the blanks to complete each sentence.(1) collection operations for drafts and for documentary collections(2) all collections / collection instruction all Documentary Credits / Credit(4) all Ban k-to-Ba nk Reimburseme nts / Reimburseme nt Authorizatio n.(5) any dema

62、 nd guara ntee and ame ndme nt thereto / Guara ntee or any ame ndme nt thereto.(6) docume nts / goods / terms and con diti ons(7) codificati on of rules / banking practice regard ing docume ntary credits(8) intern ati onal finance, trade, tran sportati on and computer tech no logy(9) quite differe n

63、t from the practice of guara ntee / banking and commercial(10) ban k-to-ba nk reimburseme nts2. Tran slate the followi ng terms into En glish.(1) 索偿 reimbursement claim仲裁书 arbitral award(3) 银行委员会 banking commissi on(4) 多式联运 multi-model transport(5) 偿付保证 reimbursement undertaking(6) 银行惯例 banking practices(7) 集装箱运输 containerized traffic(8) 非转让运输单据 non-n egotiable waybill(9) 远期托收提示 tenor collecti on prese ntati on(10) 国际商会 International Chamber of Commerce3. Fill in the following table of the improvement of UCPTime of adopti on/ operati o

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。