国际财务管理课程介绍与教学大纲

国际财务管理课程介绍与教学大纲

《国际财务管理课程介绍与教学大纲》由会员分享,可在线阅读,更多相关《国际财务管理课程介绍与教学大纲(14页珍藏版)》请在装配图网上搜索。

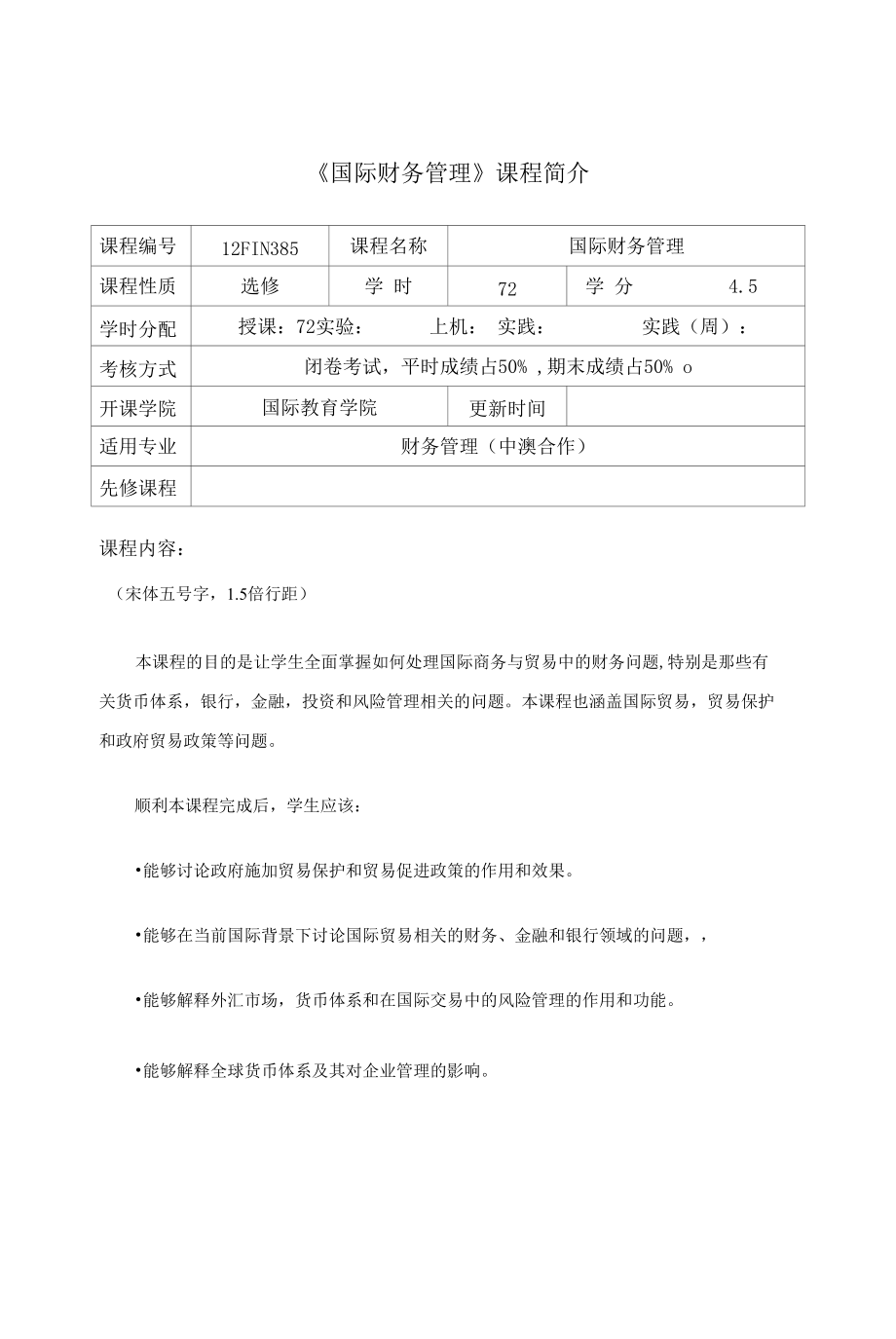

1、国际财务管理课程简介课程编号12FIN385课程名称国际财务管理课程性质选修学 时72学 分4.5学时分配授课:72实验:上机: 实践:实践(周):考核方式闭卷考试,平时成绩占50% ,期末成绩占50% o开课学院国际教育学院更新时间适用专业财务管理(中澳合作)先修课程课程内容:(宋体五号字,1.5倍行距)本课程的目的是让学生全面掌握如何处理国际商务与贸易中的财务问题,特别是那些有关货币体系,银行,金融,投资和风险管理相关的问题。本课程也涵盖国际贸易,贸易保护和政府贸易政策等问题。顺利本课程完成后,学生应该:能够讨论政府施加贸易保护和贸易促进政策的作用和效果。能够在当前国际背景下讨论国际贸易相

2、关的财务、金融和银行领域的问题,能够解释外汇市场,货币体系和在国际交易中的风险管理的作用和功能。能够解释全球货币体系及其对企业管理的影响。执笔:审核:批准:Brief IntroductionCode12FIN385TitleTrade and Business FinanceCourse natureOptionalSemester Hours72 Credits 4.5Semester HourStructureLecture: 72 Experiment:Computer Lab:Practice:Practice (Week):AssessmentClosed book examina

3、tion, usually results accounted for 50%, the final gradeaccounted for 50%.Offered byInternational Education CollegeDateforFinancial Management (Sino-Australian cooperation)PrerequisiteCourse Description:This subject is intended to provide the student with a sound but generalized oversight ofinternat

4、ional trade issues, particularly those related to monetary systems, banking, finance,investment and risk management. The subject embraces these issues in the context of trade,restrictions of trade and the impact of government trade policies.Upon successful completion of this subject, students should

5、: Be able to discuss the role and effect of government imposed trade restriction and tradepromotion policies. Be able to discuss international trade finance and banking issues in a current context Be able to explain the role and function of foreign exchange markets, currency systems andrisk manageme

6、nt in international transactions Be able to explain the global monetary system and its implications for business management.国际财务管理课程教学大纲课程编号12FIN385课程名称国际财务管理课程性质选修学 时72学 分4.5学时分配授课:72实验:上机: 实践:实践(周):考核方式闭卷考试,平时成绩占50% ,期末成绩占50%O开课学院国际教育学院更新时间适用专业财务管理(中澳合作)先修课程一、教学内容CHAPTER 1 GLOBALIZATION AND THE MU

7、LTINATIONAL ENTERPRISEWhen you have finished studying this topic, you should be able to explain and describe:1. Theories that explain why nations engage in international trade.2. Theories that explain patterns in international trade.3. Arguments for free trade.4. Government trade policies: instrumen

8、ts used and arguments for trade policy.Key points: Theories that explain patterns in international tradeDifficulties: Arguments for free tradeCHAPTER 2 FINANCIAL GOALS AND CORPORATE GOVERNANCEWhen you have finished studying this topic, you should be able to explain and describe:1. Models of corporat

9、e governance2. Implications of the different models of governance3. Agency theory4. Different philosophies for the goals of the firm such as the shareholder wealthmaximisation and stakeholder capitalism modelsKey points: Agency theoryDifficulties: Implications of the different models of governanceCH

10、APTER 3 INTERNATIONAL MONETARY SYSTEMWhen you have finished studying this topic, you should be able to explain and describe:1. The international monetary system2. The role of the IMF3. Exchange rate regimes4. Major arguments for and against fixed or floating exchange rate regimes5. The concept of a

11、countrys balance of payments and its structureKey points: Exchange rate regimes; the international monetary systemDifficulties: A countrys balance of payments and its structureCHAPTER 4 THE BALANCE OF PAYMENTSWhen you have finished studying this topic, you should be able to explain and describe:1. B

12、alance of Payments2. The concept of a countrys balance of payments and its structure3. Fundamentals of BOP Accounting4. The Current Account5. The Capital/Financial AccountKey points: Current Account; Capital/Financial AccountDifficulties: A countrys balance of payments and its structureCHAPTER 5 CUR

13、RENT MULTINATIONAL FINANCIAL CHALLENGES: THECREDIT CRISIS OF 2007-2009When you have finished studying this topic, you should be able to explain and describe:1. The Seeds of Crisis: Sub-Prime Debt2. The Transmission Mechanism: Securitization3. The Remedy: Prescriptions for an Infected Global Financia

14、l OrganismKey points: Sub-Prime Debt; SecuritizationDifficulties: A countrys balance of payments and its structureCHAPTER 6 FOREIGN EXCHANGE MARKETSWhen you have finished studying this topic, you should be able to explain and describe the:1. Foreign exchange market including its geographical spread,

15、 its functions and itsparticipants;2. Types of foreign exchange transactions, including spot, forward, and swaps;3. Methods used for exchange rate quotationsKey points: Foreign exchange market, including spot, forward, and swapsDifficulties: Methods used for exchange rate quotationsCHAPTER 7 FOREIGN

16、 EXCHANGE THEORIESWhen you have finished studying this topic, you should be able to explain and describe the:4. International Parity Conditions;5. Prices and Exchange Rates;6. The purchasing power parity theory of exchange rate determinationKey points: Prices and Exchange RatesDifficulties: The purc

17、hasing power parity theoryCHAPTER 8 FOREIGN CURRENCY DERIVATIVESWhen you have finished studying this topic, you should be able to explain and describe:1. Foreign currency derivatives, including, foreign currency futures and options2. The means by which these derivatives are priced and traded;3. The

18、uses of these derivations for purposes of hedging risk and speculation;4. Currency futures and forwards;5. Call and put currency options and the roles of purchasers and writers;6. The pricing of currency options and the measures of price volatilityKey points: The foreign currency futures and options

19、Difficulties: Call and put currency options and the roles of purchasers and writersCHAPTER 9 INTEREST RATE AND CURRENCY SWAPSWhen you have finished studying this topic, you should be able to explain and describe:1. Interest rate and currency swaps2. The nature of interest and currency rate risk3. Th

20、e use of swaps to manage interest and currency risk4. The distinction between forward rate agreements, interest rate futures, interest rateswaps, currency swaps and foreign exchange swaps5. Methods of pricing interest rate and currency swapsKey points: Interest rate and currency swapsDifficulties: M

21、ethods of pricing interest rate and currency swapsCHAPTER 10 FOREIGN EXCHANGE RATE DETERMINATION ANDFORECASTINGWhen you have finished studying this topic, you should be able to explain and describe:1. Exchange rate determination approaches, purchasing power parity, balance of payments,monetary and a

22、sset market approaches.2. Disequilibrium: exchange rates in emerging markets.3. Forecasting in practiceKey points: Exchange rate determination approachesDifficulties: Forecasting in practiceCHAPTER 11 TRANSACTION EXPOSURESWhen you have finished studying this topic, you should be able to explain and

23、describe:1. Types of Foreign Exchange Exposure2. Transactional risk exposure3. The possible techniques that management might adopt to manage translation exposure4. The issues management has to weigh in deciding which of the various approaches itshould adopt in managing translation exposure.Key point

24、s: Measurement of translation exposureDifficulties: The possible techniques to manage translation exposureCHAPTER 12 OPERATING EXPOSURESWhen you have finished studying this topic, you should be able to explain and describe:1. Operations risk exposure2. The possible techniques that management might a

25、dopt to manage operating exposure3. The issues management has to weigh in deciding which of the various approaches itshould adopt in managing operating exposure.Key points: Measurement of operating exposureDifficulties: The possible techniques to manage operating exposureCHAPTER 13 TRANSLATION EXPOS

26、URESWhen you have finished studying this topic, you should be able to explain and describe:1. Translation risk exposure2. The possible techniques that management might adopt to manage translation exposure3. The issues management has to weigh in deciding which of the various approaches itshould adopt

27、 in managing translation exposure.Key points: Measurement of translation exposureDifficulties: The possible techniques to manage translation exposure二、教学基本要求CHAPTER 1 GLOBALIZATION AND THE MULTINATIONAL ENTERPRISEThis topic provides a background to the growth in international trade and finance. It l

28、inkswith, and extends, material covered in the subject, BUS 383. Very few businesses are now able toescape some involvement in international trade, be that as an importer, exporter or as the passiveconsumer of goods and services produced in another country. Even if a business is not directlyinvolved

29、 in international trade, the consequences for trade in goods, commodities and services willhave an inevitable affect on all aspects of modern society. This is true regardless of the countrythat a business is functioning in.CHAPTER 2 FINANCIAL GOALS AND CORPORATE GOVERNANCECritical concepts include t

30、he ownership structure of the firm. Typically we assume a MNE isa publicly listed company where the concept of ownership-management separation is integral andhas implications as captured by Agency Theory. This theory points to a potential for conflict basedon differing goals and philosophies as to w

31、hat those goals should be. Anglo-American firmstypically operate under a shareholder wealth maximisation (SWM) philosophy. Butnon-Anglo-American firms are more likely to operate under a stakeholder capitalism model(SCM). The former argues the goal of the firm is to maximise the financial return to i

32、tsshareholders. The latter has a wider and often longer term focus for return and benefit.Stakeholders extend beyond shareholders to include other groups such as workers, community andgovernment.CHAPTER 3 INTERNATIONAL MONETARY SYSTEMThe international monetary system refers to the institutional arra

33、ngements that countriesadopt to govern exchange rates, regulate financial institutions and the settlement of trade financingimbalances between each others citizens and institutions. An excellent way to understand theinternational monetary system and its operation is via historical review. Chapter 3

34、provided such areview.CHAPTER 4 THE BALANCE OF PAYMENTSInternational business transactions occur in many different forms over the course of a year.The measurement of all international economic transactions between the residents of a countryand foreign residents is called the balance of payments (BOP

35、)CHAPTER 5 CURRENT MULTINATIONAL FINANCIAL CHALLENGES: THECREDIT CRISIS OF 2007-2009The origins of the current crisis lie within the ashes of the equity bubble and subsequentcollapse of the equity markets at the end of the 1990s. With the collapse of the bubble,capital began to flow increasingly tow

36、ard the real estate sectors in the United States. The U.S.banking sector found mortgage lending highly profitable and saw it as a rapidly expanding marketCHAPTER 6 FOREIGN EXCHANGE MARKETSForeign exchange means the money of a foreign country; that is, foreign currency bankbalances banknotes, checks

37、and drafts. A foreign exchange transaction is an agreement between abuyer and a seller that a fixed amount of one currency will be delivered for some other cunency ata specified date.CHAPTER 7 FOREIGN EXCHANGE THEORIESSome fundamental questions managers of MNEs, international portfolio investors, im

38、porters,exporters and government officials must deal with every day are: What are the determinants ofexchange rates? Are changes in exchange rates predictable? The economic theories that linkexchange rates, price levels, and interest rates together are called international parity conditions.These in

39、ternational parity conditions form the core of the financial theory that is unique tointernational finance.CHAPTER 8 FOREIGN CURRENCY DERIVATIVESThis topic requires you to work closely though the text. We study foreign currencyderivatives. The two key currency derivative products to be studied are f

40、oreign currency futuresand foreign currency options. The basic concepts are the same as those that apply to conventionalfutures and option products. The difference here is that the commodity being traded is a foreigncurrency.CHAPTER 9 INTEREST RATE AND CURRENCY SWAPSWe study interest rate derivative

41、s of which swaps are the dominant derivative traded in todaysmarkets. In addition to your prescribed reading from the Text, Reading 5.1 is provided as anupdate on cuiTent developments in the OTC financial markets. It particular this article deals withthe regulatory reform initiatives being pursued i

42、n the US and Europe in the aftermath of the GFC.The growth in OTC markets is considered a contributor to the GFC and a serious regulatory riskfor another crisis in the future. It is recommended you read this article at the end of your study ofthis section.CHAPTER 10 FOREIGN EXCHANGE RATE DETERMINATI

43、ON ANDFORECASTINGIn this topic we examine the broad subject of exchange rates and their forecasting. Thereare several models for the assessing of future exchange rates. Superficially, these appear as ifthey are conflicting but in practice they should be view as complementary. The alternativeapproach

44、es to explaining exchange rate determination are discussed in turn.CHAPTER 11 TRANSACTION EXPOSURESForeign exchange exposure is a measure of the potential fbr a firms profitability, net cashflow, and market value to change because of a change in exchange rates. An important task of thefinancial mana

45、ger is to measure foreign exchange exposure and to manage it so as to maximize theprofitability, net cash flow, and market value of the firm. The effect on a firm when foreignexchange rates change can be measured in several ways.CHAPTER 12 OPERATING EXPOSURESMeasuring the operating exposure of a fir

46、m requires forecasting and analyzing all the firmsfuture individual transaction exposures together with the future exposures of all the firmscompetitors and potential competitors worldwide. The analysis of longer term 一 where exchangerate changes are unpredictable and therefore unexpected 一 is the g

47、oal of operating exposureanalysis.CHAPTER 13 TRANSLATION EXPOSURESTranslation exposure, also called accounting exposure, arises because financial statements offoreign subsidiaries 一 which are stated in foreign currency 一 must be restated in the parenfsreporting currency for the firm to prepare conso

48、lidated financial statements. The accountingprocess of translation, involves converting these foreign subsidiaries financial statements into USdollar-denominated statements.三、章节学时分配章次总课时课堂讲授实验上机实践备注1662663444445446667668669661066116612661366总计7272四、教材与主要参考资料教材1 Eiteman, D. K., Stonehill, A. I, and M

49、offett, M. H. (2010). Multinational Busines Finance(12th Global Edition). Pearson.参考资料1 Sawyer, W. C., & Sawyer, R. L. (2009). International economics (3rd ed., Chapter 2).Prentice-HalL2 Bernanke, B. (2007). Embracing the challenge of free trade: Competing and prospering in aglobal economy. Speech to the Montana Development Summit 2007 (pp. 1-10).

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。