IAS 38 INTANGIBLE ASSETS

IAS 38 INTANGIBLE ASSETS

《IAS 38 INTANGIBLE ASSETS》由会员分享,可在线阅读,更多相关《IAS 38 INTANGIBLE ASSETS(6页珍藏版)》请在装配图网上搜索。

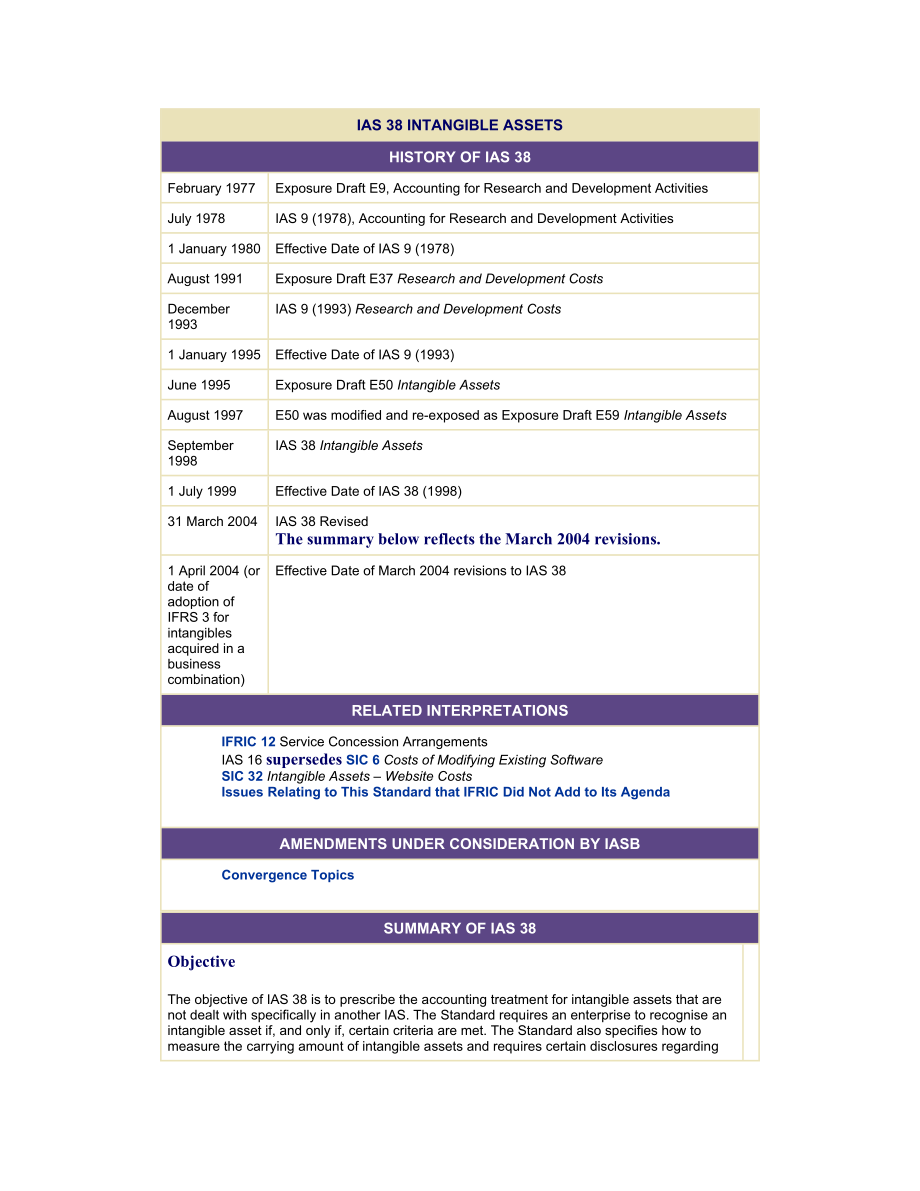

1、IAS 38 INTANGIBLE ASSETSHISTORY OF IAS 38February 1977Exposure Draft E9, Accounting for Research and Development ActivitiesJuly 1978IAS 9 (1978), Accounting for Research and Development Activities1 January 1980Effective Date of IAS 9 (1978)August 1991Exposure Draft E37 Research and Development Costs

2、December 1993IAS 9 (1993) Research and Development Costs1 January 1995Effective Date of IAS 9 (1993)June 1995Exposure Draft E50 Intangible AssetsAugust 1997E50 was modified and re-exposed as Exposure Draft E59 Intangible AssetsSeptember 1998IAS 38 Intangible Assets1 July 1999Effective Date of IAS 38

3、 (1998)31 March 2004IAS 38 RevisedThe summary below reflects the March 2004 revisions.1 April 2004 (or date of adoption of IFRS 3 for intangibles acquired in a business combination)Effective Date of March 2004 revisions to IAS 38RELATED INTERPRETATIONS IFRIC 12 Service Concession Arrangements IAS 16

4、 supersedes SIC 6 Costs of Modifying Existing Software SIC 32 Intangible Assets Website Costs Issues Relating to This Standard that IFRIC Did Not Add to Its Agenda AMENDMENTS UNDER CONSIDERATION BY IASB Convergence TopicsSUMMARY OF IAS 38Objective The objective of IAS 38 is to prescribe the accounti

5、ng treatment for intangible assets that are not dealt with specifically in another IAS. The Standard requires an enterprise to recognise an intangible asset if, and only if, certain criteria are met. The Standard also specifies how to measure the carrying amount of intangible assets and requires cer

6、tain disclosures regarding intangible assets. Scope IAS 38 applies to all intangible assets other than: IAS 38.2-3 financial assets mineral rights and exploration and development costs incurred by mining and oil and gas companies intangible assets arising from insurance contracts issued by insurance

7、 companies intangible assets covered by another IAS, such as intangibles held for sale, deferred tax assets, lease assets, assets arising from employee benefits, and goodwill. Goodwill is covered by IFRS 3. Key Definitions Intangible asset: An identifiable nonmonetary asset without physical substanc

8、e. An asset is a resource that is controlled by the enterprise as a result of past events (for example, purchase or self-creation) and from which future economic benefits (inflows of cash or other assets) are expected. Thus, the three critical attributes of an intangible asset are: IAS 38.8 identifi

9、ability control (power to obtain benefits from the asset) future economic benefits (such as revenues or reduced future costs) Identifiability: An intangible asset is identifiable when it: IAS 38.12 is separable (capable of being separated and sold, transferred, licensed, rented, or exchanged, either

10、 individually or as part of a package) or arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations. Examples of possible intangible assets include: computer software patents copyrights motion

11、picture films customer lists mortgage servicing rights licenses import quotas franchises customer and supplier relationships marketing rights Intangibles can be acquired: by separate purchase as part of a business combination by a government grant by exchange of assets by self-creation (internal gen

12、eration) Recognition Recognition criteria. IAS 38 requires an enterprise to recognise an intangible asset, whether purchased or self-created (at cost) if, and only if: IAS 38.21 it is probable that the future economic benefits that are attributable to the asset will flow to the enterprise; and the c

13、ost of the asset can be measured reliably. This requirement applies whether an intangible asset is acquired externally or generated internally. IAS 38 includes additional recognition criteria for internally generated intangible assets (see below). The probability of future economic benefits must be

14、based on reasonable and supportable assumptions about conditions that will exist over the life of the asset. IAS 38.22 The probability recognition criterion is always considered to be satisfied for intangible assets that are acquired separately or in a business combination. IAS 38.33 If recognition

15、criteria not met. If an intangible item does not meet both the definition of and the criteria for recognition as an intangible asset, IAS 38 requires the expenditure on this item to be recognised as an expense when it is incurred. IAS 38.68 Business combinations. There is a rebuttable presumption th

16、at the fair value (and therefore the cost) of an intangible asset acquired in a business combination can be measured reliably. IAS 38.35 An expenditure (included in the cost of acquisition) on an intangible item that does not meet both the definition of and recognition criteria for an intangible ass

17、et should form part of the amount attributed to the goodwill recognised at the acquisition date. IAS 38 notes, however, that non-recognition due to measurement reliability should be rare: IAS 38.38 The only circumstances in which it might not be possible to measure reliably the fair value of an inta

18、ngible asset acquired in a business combination are when the intangible asset arises from legal or other contractual rights and either: (a) is not separable; or (b) is separable, but there is no history or evidence of exchange transactions for the same or similar assets, and otherwise estimating fai

19、r value would be dependent on immeasurable variables. Reinstatement. The Standard also prohibits an enterprise from subsequently reinstating as an intangible asset, at a later date, an expenditure that was originally charged to expense. IAS 38.71 Initial Recognition: Research and Development Costs C

20、harge all research cost to expense. IAS 38.54 Development costs are capitalised only after technical and commercial feasibility of the asset for sale or use have been established. This means that the enterprise must intend and be able to complete the intangible asset and either use it or sell it and

21、 be able to demonstrate how the asset will generate future economic benefits. IAS 38.57 If an enterprise cannot distinguish the research phase of an internal project to create an intangible asset from the development phase, the enterprise treats the expenditure for that project as if it were incurre

22、d in the research phase only. Initial Recognition: In-process Research and Development Acquired in a Business Combination A research and development project acquired in a business combination is recognised as an asset at cost, even if a component is research. Subsequent expenditure on that project i

23、s accounted for as any other research and development cost (expensed except to the extent that the expenditure satisfies the criteria in IAS 38 for recognising such expenditure as an intangible asset). IAS 38.34 Initial Recognition: Internally Generated Brands, Mastheads, Titles, Lists Brands, masth

24、eads, publishing titles, customer lists and items similar in substance that are internally generated should not be recognised as assets. IAS 38.63 Initial Recognition: Computer Software Purchased: capitalise Operating system for hardware: include in hardware cost Internally developed (whether for us

25、e or sale): charge to expense until technological feasibility, probable future benefits, intent and ability to use or sell the software, resources to complete the software, and ability to measure cost. Amortisation: over useful life, based on pattern of benefits (straight-line is the default). Initi

26、al Recognition: Certain Other Defined Types of Costs The following items must be charged to expense when incurred: internally generated goodwill IAS 38.48 start-up, pre-opening, and pre-operating costs IAS 38.69 training cost IAS 38.69 advertising cost IAS 38.69 relocation costs IAS 38.69 Initial Me

27、asurement Intangible assets are initially measured at cost. IAS 38.24 Measurement Subsequent to Acquisition: Cost Model and Revaluation Models Allowed An entity must choose either the cost model or the revaluation model for each class of intangible asset. IAS 38.72 Cost model. After initial recognit

28、ion the benchmark treatment is that intangible assets should be carried at cost less any amortisation and impairment losses. IAS 38.74 Revaluation model. Intangible assets may be carried at a revalued amount (based on fair value) less any subsequent amortisation and impairment losses only if fair va

29、lue can be determined by reference to an active market. IAS 38.75 Such active markets are expected to be uncommon for intangible assets. IAS 38.78 Examples where they might exist: Milk quotas. Stock exchange seats. Taxi medallions. Under the revaluation model, revaluation increases are credited dire

30、ctly to revaluation surplus within equity except to the extent that it reverses a revaluation decrease previously recognised in profit and loss. If the revalued intangible has a finite life and is, therefore, being amortised (see below) the revalued amount is amortised. IAS 38.85 Classification of I

31、ntangible Assets Based on Useful Life Intangible assets are classified as: IAS 38.88 Indefinite life: No foreseeable limit to the period over which the asset is expected to generate net cash inflows for the entity. Finite life: A limited period of benefit to the entity. Measurement Subsequent to Acq

32、uisition: Intangible Assets with Finite Lives The cost less residual value of an intangible asset with a finite useful life should be amortised over that life: IAS 38.97 The amortisation method should reflect the pattern of benefits. If the pattern cannot be determined reliably, amortise by the stra

33、ight line method. The amortisation charge is recognised in profit or loss unless another IFRS requires that it be included in the cost of another asset. The amortisation period should be reviewed at least annually. IAS 38.104 The asset should also be assessed for impairment in accordance with IAS 36

34、. IAS 38.111 Measurement Subsequent to Acquisition: Intangible Assets with Indefinite Lives An intangible asset with an indefinite useful life should not be amortised. IAS 38.107 Its useful life should be reviewed each reporting period to determine whether events and circumstances continue to suppor

35、t an indefinite useful life assessment for that asset. If they do not, the change in the useful life assessment from indefinite to finite should be accounted for as a change in an accounting estimate. IAS 38.109 The asset should also be assessed for impairment in accordance with IAS 36. IAS 38.111 S

36、ubsequent Expenditure Subsequent expenditure on an intangible asset after its purchase or completion should be recognised as an expense when it is incurred, unless it is probable that this expenditure will enable the asset to generate future economic benefits in excess of its originally assessed sta

37、ndard of performance and the expenditure can be measured and attributed to the asset reliably. IAS 38.60 Disclosure For each class of intangible asset, disclose: IAS 38.118 and 38.122 useful life or amortisation rate amortisation method gross carrying amount accumulated amortisation and impairment l

38、osses line items in the income statement in which amortisation is included reconciliation of the carrying amount at the beginning and the end of the period showing: o additions (business combinations separately) o assets held for sale o retirements and other disposals o revaluations o impairments o

39、reversals of impairments o amortisation o foreign exchange differences basis for determining that an intangible has an indefinite life description and carrying amount of individually material intangible assets certain special disclosures about intangible assets acquired by way of government grants i

40、nformation about intangible assets whose title is restricted commitments to acquire intangible assets Additional disclosures are required about: intangible assets carried at revalued amounts IAS 38.124 the amount of research and development expenditure recognised as an expense in the current period IAS 38.126

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。