证券和组合课后习题:tb15

证券和组合课后习题:tb15

《证券和组合课后习题:tb15》由会员分享,可在线阅读,更多相关《证券和组合课后习题:tb15(20页珍藏版)》请在装配图网上搜索。

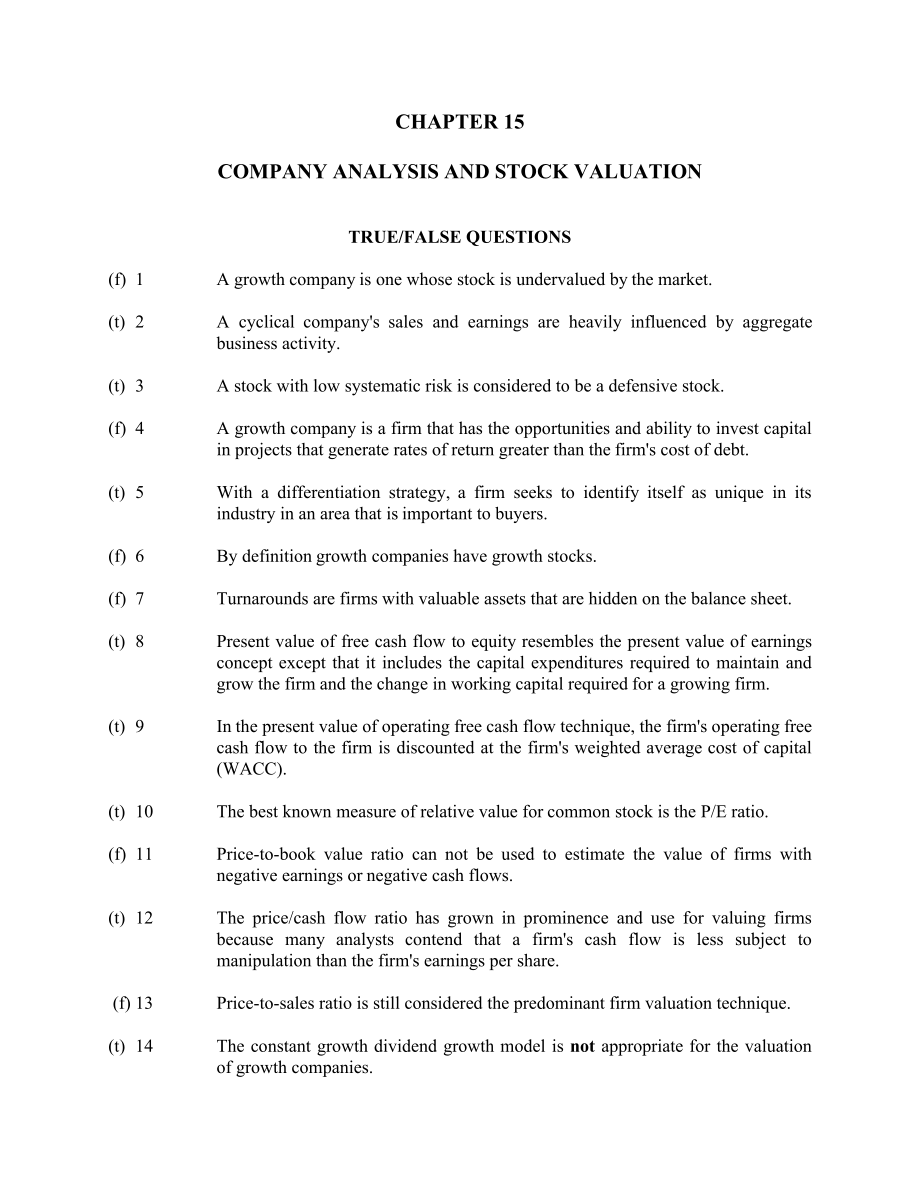

1、CHAPTER 15COMPANY ANALYSIS AND STOCK VALUATIONTRUE/FALSE QUESTIONS(f)1A growth company is one whose stock is undervalued by the market.(t)2A cyclical companys sales and earnings are heavily influenced by aggregate business activity.(t)3A stock with low systematic risk is considered to be a defensive

2、 stock.(f)4A growth company is a firm that has the opportunities and ability to invest capital in projects that generate rates of return greater than the firms cost of debt.(t)5With a differentiation strategy, a firm seeks to identify itself as unique in its industry in an area that is important to

3、buyers.(f)6By definition growth companies have growth stocks.(f)7Turnarounds are firms with valuable assets that are hidden on the balance sheet.(t)8Present value of free cash flow to equity resembles the present value of earnings concept except that it includes the capital expenditures required to

4、maintain and grow the firm and the change in working capital required for a growing firm.(t)9In the present value of operating free cash flow technique, the firms operating free cash flow to the firm is discounted at the firms weighted average cost of capital (WACC).(t)10The best known measure of re

5、lative value for common stock is the P/E ratio.(f)11Price-to-book value ratio can not be used to estimate the value of firms with negative earnings or negative cash flows.(t)12The price/cash flow ratio has grown in prominence and use for valuing firms because many analysts contend that a firms cash

6、flow is less subject to manipulation than the firms earnings per share. (f)13Price-to-sales ratio is still considered the predominant firm valuation technique.(t)14The constant growth dividend growth model is not appropriate for the valuation of growth companies.(t)15A negative EVA (Economic Value A

7、dded) for the year implies that the firm has not earned enough during the year to cover its capital of capital and the value of the firm has declined.(t)16While EVA is considered an internal performance measure, MVA is considered to be an external performance measure.MULTIPLE CHOICE QUESTIONS(b)1A s

8、peculative stock possesses a _ probability of _ return and is currently _.a)High, negative, underpriced.b)High, negative, overpriced.c)High, positive, overpriced.d)Low, negative, overpriced.e)Low, positive, underpriced.(d)2A _ stock possesses a high probability of low or negative rates of return and

9、 a low probability of normal or high rates of return.a)Growthb)Defensivec)Cyclicald)Speculativee)Value(c)3A growth company is one that has the ability toa.Acquire capital at a low cost and is able to invest in projects that yield an average return.b.Acquire capital at a low cost and is able to inves

10、t in projects that yield a below average return.c.Acquire capital at an average cost and is able to invest in projects that yield an above average return.d.Acquire capital at an average cost and is able to invest in projects that yield an average return.e.Acquire capital at an above average cost and

11、 is able to invest in projects that yield an average return.(c)4Porter contends that and are two important competitive strategies.a)Low cost leadership, barrier to entryb)New entrant deterrent, differentiationc)Low cost leadership, differentiationd)Differentiation, monopolistice)Monopolistic simulat

12、ion, differentiation(d)5In a _ strategy, a firm seeks to identify itself as unique within its industry.a) Defensiveb) Offensivec) Low-cost d) Differentiatione) None of the above(e)6In SWOT analysis, one examines all of the following factors, excepta) Strengths.b) Weaknesses.c) Opportunities.d) Threa

13、ts.e) Turnarounds.(b)7Which of the following statements concerning SWOT analysis is false?a)Strengths are the factors that give the firm a comparative advantage in the marketplace. b)Weaknesses result when the company has potentially exploitable advantages over other firms. c)Opportunities are envir

14、onmental factors that favor the firm. d)Threats are environmental factors that can hinder the firm in achieving its goals. e)None of the above (that is, all statements are true)(d)8Peter Lynch identified a number of attributes of firms that may result in favorable stock market performances, includin

15、g a)Products that are faddish, people like change.b)Firms that have competitive advantages over their rivals.c)Firms that can benefit from cost reductions.d)Choices b and c onlye)All of the above(d)9Peter Lynch categorizes companies into six categories. Which of the following is not such a category?

16、a)Slow growersb)Fast growersc)Cyclicalsd)Turnoverse)Stalwarts(b)10_ are expected to have faster earnings growth, but because of their consistent growth, large stock price changes are unlikely.a)Fast growthb)Stalwartsc)Cyclicalsd)Asset playse)Turnarounds(e)11Which of the following is not a technique

17、for valuing a firms common stock?a)Present value of free cash flow to equityb)Present value of dividendsc)Price-earnings ratiod)Price-book value ratiose)Price-cost of goods sold ratio(d)12Which of the following is not considered when looking at free cash flow to equity technique?a)Depreciation expen

18、seb)Change in working capitalc)Principal debt repaymentsd)Change in competitive environmente)Net income(a)13Under the present value of operating free cash flow technique, the firms operating free cash flow to the firm is discounted at the firmsa)Weighted average cost of capital.b)Cost of debt.c)Inte

19、rnal rate of return.d)External cost of new equity.e)Net present value.(d)14Which of the following is not considered a relative valuation technique?a)Price-earnings ratiob)Price/cash flow ratioc)Price/book value ratiod)Price/cost of goods sold ratioe)Price/sales ratio(d)15Which of the following is no

20、t considered in the price-earnings ratio technique?a)Firms required rate of return on equity (k)b)Firms dividend payout ratio (D/E)c)Firms expected growth rate of dividends (g)d)All of the above are components of P/E ratioe)None of the above are components of P/E ratio(c)16Evidence that a firm has h

21、igh business risk would be provided by its volatile _.a)Fixed costs.b)Profit after taxes.c)Operating profit.d)Sales.e)Employee turnover.(b)17Which of the following factors does not indicate market liquidity?a)Number of shareholdersb)High price volatilityc)Number of shares outstandingd)Number of shar

22、es tradede)Institutional interest(d)18A growth company can invest in projects that generate a return greater than the firmsa)Return on equity.b)Cost of debt.c)Cost of equity.d)Cost of capital.e)Return on assets.USE THE FOLLOWING INFORMATION FOR THE NEXT TWO QUESTIONS(1)The firms expected rate of gro

23、wth of earning per share(2)The amount of capital invested in growth investments(3)The rate of return earned on the funds relative to the required rate of return(4)The required rate of return on the security based on its systematic risk(5)The firms dividend payout ratio(6)The time horizon when these

24、growth investments will be available(c)19In the listing above, which three factors influence the capital gain component of a growth company?a)1, 3, and 5b)2, 3, and 4c)2, 3, and 6d)3, 4, and 5e)3, 4, and 6(a)20In the listing above, which three factors influence the earnings multiple for a stock?a)1,

25、 4, and 5b)1, 4, and 6c)2, 4, and 6d)2, 5, and 6e)4, 5, and 6(e)21An inconsistency between a stocks P/E ratio and growth rate can be attributed to all of the following, excepta)A major difference in the risk involved.b)Inaccurate growth estimates.c)An undervaluation of the stock.d)An overvaluation o

26、f the stock.e)Competition.(d)22A set of performance measures called are directly related to the capital budgeting techniques used in corporate finance.a)Dividend discount modelb)Aggressive growth indexesc)Growth indexesd)Value addede)Profit sensitization(e)23“Economic profit” is analogous to in capi

27、tal budgeting.a)Weighted average cost of capitalb)Internal rate of returnc)Composite discount ratesd)Discounted cashflowse)Net present value(d)24Which of the following is not a value added performance measure?a) Economic Value Added (EVA)b) Market Value Added (MVA)c) Franchise Factord) Company Value

28、 Added (CVA)e) None of the above (that is, all are value added performance measures)(a)25Market value-added is a measure of performance.a)Externalb)Internalc)Competitived)Economice)None of the above(e)26Which of the following statements concerning global company analysis is false?a)Analysis of compa

29、nies within industries should be extended to include foreign companies. b)There is a problem in obtaining data that is required for a thorough company analysis of foreign companies.c)Foreign companies financial risk should be evaluated over time.d)Differences in relative measures can be explained by

30、 the variations in accounting procedures among countries and investors attitudes within each country.e).None of the above (that is, all statements are true)(d) 27The following are tenets of Warren Buffetta) Business tenets.b) Financial tenets.c) Management tenets.d) All of the above.e) None of the a

31、bove.(a) 28Which of the following is a business tenet of Warren Buffetta) Long term prospects.b) Resistance to institutional imperative.c) Creation of one dollar of market value for every dollar retained.d) Purchase at discount to intrinsic value.e) Product is not faddish(b) 29Which of the following

32、 is a management tenet of Warren Buffetta) Long term prospects.b) Resistance to institutional imperative.c) Creation of one dollar of market value for every dollar retained.d) Purchase at discount to intrinsic value.e) Product is not faddish(c) 30Which of the following is a financial tenet of Warren

33、 Buffetta) Long term prospects.b) Resistance to institutional imperative.c) Creation of one dollar of market value for every dollar retained.d) Purchase at discount to intrinsic value.e) Product is not faddish.(d) 31Which of the following is a market tenet of Warren Buffetta) Long term prospects.b)

34、Resistance to institutional imperative.c) Creation of one dollar of market value for every dollar retained.d) Purchase at discount to intrinsic value.e) Product is not faddish(c) 32Studies that have examined the relationship between EVA and MVA have found a) An inverse relationship.b) A positive rel

35、ationship.c) A poor relationship.d) EVA always exceeded MVA.e) MVA always exceeded EVA.(d) 33The franchise P/E is a function ofa) Relative rate of return on new business opportunitiesb) Size of superior return opportunities.c) Duration of earnings growth.d) a) and b)e) a), b) and c)MULTIPLE CHOICE P

36、ROBLEMS(d)1What is the implied growth duration of Bowe Industries given the following:S&P 400 Bowe IndustriesP/E Ratios10 25Average Growth (%)5.0 15.0Dividend Yield.06 .02a) 3.2 yearsb) 6.6 yearsc) 9.6 yearsd)17.2 yearse)18.6 years(b)2What is the implied growth duration of Casey Industries given the

37、 following:S&P 400Casey IndustriesP/E Ratios1520Average Growth (%)10.015.0Dividend Yield.04.06a) 3.2 yearsb) 4.8 yearsc) 9.6 yearsd)13.2 yearse)18.6 years(c)3What is the implied growth duration of Jones Industries given the following:S&P 400Jones IndustriesP/E Ratios1215Average Growth (%)6.016.0Divi

38、dend Yield.05.03a) 1.2 yearsb) 4.9 yearsc) 3.2 yearsd)12.9 yearse)15.2 years(a)4What is the implied growth duration of Freed Industries given the following:S&P 400Freed IndustriesP/E Ratios1922Average Growth (%)11.016.0Dividend Yield.06.08a)2.5 yearsb)1.3 yearsc)5.0 yearsd)4.5 yearse)3.5 years(e)5Wh

39、at is the implied growth duration of Howard Industries given the following:S&P 400Howard IndustriesP/E Ratios1419Average Growth (%)6.012.0Dividend Yield.07.04a) 1.5 yearsb) 6.8 yearsc) 2.6 yearsd) 9.4 yearse)11.6 yearsUSE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMSModular Industries currentl

40、y has a 16% annual growth rate while the market average is 6 percent. The market multiple is 10.(e)6Determine the justified P/E ratio for Modular Industries assuming Modular can maintain its superior growth rate for the next 5 years.a) 6.4b)13.1c)16.5d)23.8e)15.7(b)7Determine the P/E ratio for Modul

41、ar Industries assuming Modular can maintain its superior growth rate for the next 8 years.a) 6.4b)20.5c)16.5d)23.8e)29.5USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMSHarcourt Industries currently has an 18% annual growth rate while the market average is 8 percent. The market multiple is 12.

42、(e)8Determine the justified P/E ratio for Harcourt Industries assuming Harcourt can maintain its superior growth rate for the next 9 years.a) 5.98b)13.13c)21.20d)58.68e)26.65(c)9Determine the P/E ratio for Harcourt Industries assuming Harcourt can maintain its superior growth rate for the next 3 yea

43、rs.a) 4.25b)12.50c)15.67d)30.10e)42.80USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMSThe Valentine Company currently has a 14% annual growth rate while the market average is 4 percent. The market multiple is 15.(e)10Determine the justified P/E ratio for the Valentine Company assuming Valenti

44、ne can maintain its superior growth rate for the next 10 years.a) 3.0b) 9.2c)16.6d)28.6e)37.6(a)11Determine the P/E ratio for the Valentine Company assuming Valentine can maintain its superior growth rate for the next 5 years.a)23.7b)16.4c)15.3d) 8.3e) 3.8(c)12Given Gitechs beta of 1.55 and a risk f

45、ree rate of 8 percent, what is the expected rate of return assuming a 14 percent market return?a)12.4%b)14.3%c)17.3% d)20.4%e)29.7%(b)13The expected rate of return on Research Industries is twice the 12 percent expected rate of return from the market. What is Researchs beta if the risk free rate is

46、6 percent?a)2b)3c)4d)5e)6(b)14Given Birdchips beta of 1.25 and a risk free rate of 6 percent, what is the expected rate of return assuming a 12 percent market return?d) 1%a)10%b)11%c)12%e)31%(c)15The expected rate of return on Rewind Industries is 2.5 times the 12 percent expected rate of return fro

47、m the market. What is Rewinds beta if the risk free rate is 6 percent?a)2b)3c)4d)5e)6(b)16Given Gilberts beta of 1.10 and a risk free rate of 5 percent, what is the expected rate of return assuming a 10 percent market return?a)21.5%b)10.5%c) 5.5%d)15.5%e)16.5%(a)17The expected rate of return on Root

48、er Industries is 1.5 times the 16 percent expected rate of return from the market. What is Researchs beta if the risk free rate is 8 percent?a)2b)3c)4d)5e)6(d)18ABC Co. has paid annual dividends in the past five years of $.20, $.25, $.28, $.33, and $.36. Calculate the average growth rate of its divi

49、dends.a)1.16%b)1.80%c)12.47%d)15.83%e)None of the aboveUSE THE FOLLOWING INFORMATION FOR THE NEXT TWO QUESTIONS Wal-Blue IndustryDPS1.001.50Total Asset Turnover3.202.50Net Profit Margin3.50%3.00%EPS 4.003.00Total Assets/Equity3.004.00(d)19What are the ROEs for Wal-Blue and its industry?a)24.3% and 2

50、7.0%b)29.7% and 27.0%c)29.7% and 30.0%d)33.6% and 30.0%e)34.5% and 31.5%(a)20What are the expected sustainable growth rates for Wal-Blue and its industry?a)25.2% and 15.0%b)30.0% and 17.5%c)25.2% and 17.5%d)27.5% and 12.5%e)30.0% and 15.0%(d)21A firm has a current price of $40 a share, an expected g

51、rowth rate of 11 percent and expected dividend per share (D1) of $2. Given its risk you have a required rate of return for it of 12 percent. Your expected rate of return and investment decision is as follows:a)10% - do not buyb)12% - do not buyc)14% - buyd)16% - buye)18% - buy(a)22Assuming that you

52、expected the stock price in the prior question to increase to $42 during the investment period, your expected rate of return and decision would be:a)10% - do not buyb)12% - do not buyc)14% - buyd)16% - buye)18% - buy(a) 23Based on the information provided, calculate the intrinsic value in 1999 of a

53、share of INV Corp. using the FCFF (free cash flow to the firm ) model. For 1999 the FCFF was $15,000, total debt was $20,000, and there 12000 shares outstanding. The required rate of return is 9% and the estimated growth rate in FCFF is 6.5%.a) $51.58b) $53.25c) $12.50d) $54.92e) $50.45(a) 24Based o

54、n the information provided, calculate the intrinsic value in 1999 of a share of INV Corp. using the Present Value of Earnings Model (infinite holding period). For 1999 Net Income was $250,000, total debt was $50,000, and there 11,000 shares outstanding. The required rate of return is 12% and the est

55、imated growth rate in earnings is 5.5%.a) $19.43b) $23.98c) $28.52d) $22.73e) $15.50(d) 25You are provided with the following information about Javier Corporation. Sales for the year 2000 were $500,000, the Net Profit Margin (NPM) was 15%. Analysts project sales to grow by 12% next year, that is 200

56、1. However, because of more competition, the NPM is expected to decline by 10% for the year 2000. The expected P/E multiple for the year 2001 is 22. The total number of shares outstanding is 20,000. Use the earnings multiplier model to calculate the expected price for Javier Corporation in the year

57、2001.a) $74.25b) $61.6c) $82.5d) $83.16e) $101.64USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT FIVE QUESTIONSYou are provided with the following information on Kayray Corporation. Your ultimate objective is to calculate the EVA for the firm. LIFO reserve60 Net plant, property, and equipment1325 O

58、ther assets30 Goodwill325 Accumulated Goodwill amortized65 PV of Operating leases140 Tax benefit from interest on expenses10 Tax benefit from interest on leases5 Taxes on non-operating income2 Implied interest on op. lease9.5 Increase in LIFO reserve12 Goodwill amortization15Operating profit550Income tax expense215Net working capital440WACC0.12(a) 26Calculate the adjusted operating profits before taxes.a) $586.5b) $225.64c) $825.23d) $831.56e) $692.5(b) 27Calculate the cash operating expenses for the firma) 225b) 228c) 232d) 242e) 252(d) 28Calculate the capit

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。