英文版国际金融试题和答案

英文版国际金融试题和答案

《英文版国际金融试题和答案》由会员分享,可在线阅读,更多相关《英文版国际金融试题和答案(3页珍藏版)》请在装配图网上搜索。

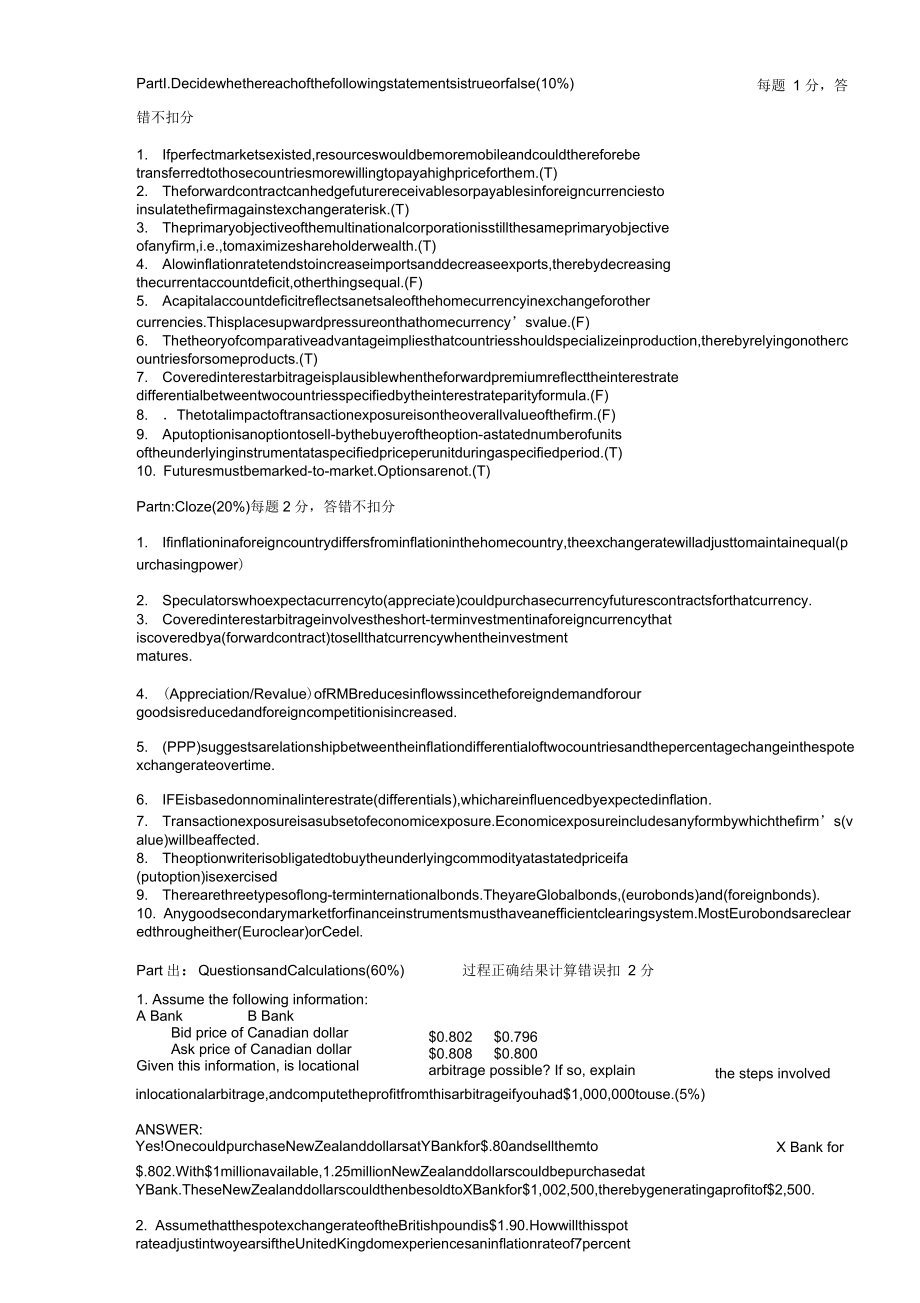

1、每题 1 分,答PartI.Decidewhethereachofthefollowingstatementsistrueorfalse(10%)错不扣分1. Ifperfectmarketsexisted,resourceswouldbemoremobileandcouldthereforebetransferredtothosecountriesmorewillingtopayahighpriceforthem.(T)2. Theforwardcontractcanhedgefuturereceivablesorpayablesinforeigncurrenciestoinsulateth

2、efirmagainstexchangeraterisk.(T)3. Theprimaryobjectiveofthemultinationalcorporationisstillthesameprimaryobjectiveofanyfirm,i.e.,tomaximizeshareholderwealth.(T)4. Alowinflationratetendstoincreaseimportsanddecreaseexports,therebydecreasingthecurrentaccountdeficit,otherthingsequal.(F)5. Acapitalaccount

3、deficitreflectsanetsaleofthehomecurrencyinexchangeforothercurrencies.Thisplacesupwardpressureonthathomecurrencysvalue.(F)6. Thetheoryofcomparativeadvantageimpliesthatcountriesshouldspecializeinproduction,therebyrelyingonothercountriesforsomeproducts.(T)7. Coveredinterestarbitrageisplausiblewhenthefo

4、rwardpremiumreflecttheinterestratedifferentialbetweentwocountriesspecifiedbytheinterestrateparityformula.(F)8. Thetotalimpactoftransactionexposureisontheoverallvalueofthefirm.(F)9. Aputoptionisanoptiontosell-bythebuyeroftheoption-astatednumberofunitsoftheunderlyinginstrumentataspecifiedpriceperunitd

5、uringaspecifiedperiod.(T)10. Futuresmustbemarked-to-market.Optionsarenot.(T)Partn:Cloze(20%)每题2分,答错不扣分1. Ifinflationinaforeigncountrydiffersfrominflationinthehomecountry,theexchangeratewilladjusttomaintainequal(purchasingpower)2. Speculatorswhoexpectacurrencyto(appreciate)couldpurchasecurrencyfuture

6、scontractsforthatcurrency.3. Coveredinterestarbitrageinvolvestheshort-terminvestmentinaforeigncurrencythatiscoveredbya(forwardcontract)tosellthatcurrencywhentheinvestmentmatures.4. (Appreciation/Revalue)ofRMBreducesinflowssincetheforeigndemandforourgoodsisreducedandforeigncompetitionisincreased.5. (

7、PPP)suggestsarelationshipbetweentheinflationdifferentialoftwocountriesandthepercentagechangeinthespotexchangerateovertime.6. IFEisbasedonnominalinterestrate(differentials),whichareinfluencedbyexpectedinflation.7. Transactionexposureisasubsetofeconomicexposure.Economicexposureincludesanyformbywhichth

8、efirms(value)willbeaffected.8. Theoptionwriterisobligatedtobuytheunderlyingcommodityatastatedpriceifa(putoption)isexercised9. Therearethreetypesoflong-terminternationalbonds.TheyareGlobalbonds,(eurobonds)and(foreignbonds).10. Anygoodsecondarymarketforfinanceinstrumentsmusthaveanefficientclearingsyst

9、em.MostEurobondsareclearedthrougheither(Euroclear)orCedel.过程正确结果计算错误扣 2 分Part出:QuestionsandCalculations(60%)1. Assume the following information:A BankB BankBid price of Canadian dollarAsk price of Canadian dollarGiven this information, is locational$0.802$0.796$0.808$0.800arbitrage possible? If so,

10、explainthe steps involvedinlocationalarbitrage,andcomputetheprofitfromthisarbitrageifyouhad$1,000,000touse.(5%)ANSWER:X Bank forYes!OnecouldpurchaseNewZealanddollarsatYBankfor$.80andsellthemto$.802.With$1millionavailable,1.25millionNewZealanddollarscouldbepurchasedatYBank.TheseNewZealanddollarscould

11、thenbesoldtoXBankfor$1,002,500,therebygeneratingaprofitof$2,500.2. AssumethatthespotexchangerateoftheBritishpoundis$1.90.HowwillthisspotrateadjustintwoyearsiftheUnitedKingdomexperiencesaninflationrateof7percentperyearwhiletheUnitedStatesexperiencesaninflationrateof2percentperyear?(10%)ANSWER:Accordi

12、ngtoPPP,forwardrate/spot=indexdom/indexfortheexchangerateofthepoundwilldepreciateby4.7percent.Therefore,thespotratewouldadjustto$1.90x1+(-.047)=$1.81073. AssumethatthespotexchangerateoftheSingaporedollaris$0.70.Theone-yearinterestrateis11percentintheUnitedStatesand7percentinSingapore.Whatwillthespot

13、ratebeinoneyearaccordingtotheIFE?(5%)ANSWER:accordingtotheIFE,St+1/St=(1+Rh)/(1+Rf)$.70X(1+.04)=$0.7284. AssumethatXYZCo.hasnetreceivablesof100,000Singaporedollarsin90days.ThespotrateoftheS$is$0.50,andtheSingaporeinterestrateis2%over90days.SuggesthowtheU.S.firmcouldimplementamoneymarkethedge.Bepreci

14、se.(10%)ANSWER:ThefirmcouldborrowtheamountofSingaporedollarssothatthe100,000Singaporedollarstobereceivedcouldbeusedtopayofftheloan.Thisamountsto(100,000/1.02)=aboutS$98,039,whichcouldbeconvertedtoabout$49,020andinvested.TheborrowingofSingaporedollarshasoffsetthetransactionexposureduetothefuturerecei

15、vablesinSingaporedollars.5. AU.S.companyorderedaJaguarsedan.In6months,itwillpay场0,000forthecar.Itworriedthatpoundster1ingmightrisesharplyfromthecurrentrate($1.90).So,thecompanyboughta6monthpoundcall(supposedcontractsize=场5,000)withastrikepriceof$1.90forapremiumof2.3cents/(1)Ishedgingintheoptionsmark

16、etbetteriftheroseto$1.92in6months?(2)whatdidtheexchangeratehavetobeforthecompanytobreakeven?(15%)Solution:(1)Iftheroseto$1.92in6months,theU.S.companywouldexercisethepoundcalloption.Thesumofthestrikepriceandpremiumis$1.90+$0.023=$1.9230/Thisisbiggerthan$1.92.Sohedgingintheoptionsmarketisnotbetter.(2)

17、whenwesaythecompanycanbreakeven,wemeanthathedgingornothedgingdoesntmatter.Andonlywhen(strikeprice+premium)=theexchangerate,hedgingornotdoesntmatter.So,theexchangerate=$1.923/.6.Discusstheadvantagesanddisadvantagesoffixedexchangeratesystem.(15%)textbookpage50答案以教材第50页为准PARTW:Diagram(10%)Thestrikepric

18、eforacallis$1.67/ThepremiumquotedattheExchangeis$0.0222perBritishpound.Diagramtheprofitandlosspotential,andthebreak-evenpriceforthiscalloptionSolution:Followingdiagramshowstheprofitandlosspotential,andthebreak-evenpriceofthisputoption:SupposethatyouareexpectingrevenuesofY100,000fromJapaninonemonth.C

19、urrently,1monthforwardcontractsaretradingat$1=$105Yen.YouhavethefollowingestimateoftheYen/$exchangerateinonemonth.PriceProbability90Yen/$4%95Yen/$25%100Y/$45%105Yen/$20%110Yen/$6%a) b) c)hedge your exchange risk?WhatpositioninforwardcontractswouldyoutaketoCalculatetheexpectedvalueofthehedge.Howcould

20、youreplicatethishedgeinthemoneymarket?YouareexpectingrevenuesofY100,000inonemonththatyouwillneedtocoverttodollars.YoucouldhedgethisinforwardmarketsbytakinglongpositionsinUSdollars(shortpositionsinJapaneseYen).Bylockinginyourpriceat$1=Y105,yourdollarrevenuesareguaranteedtobeY100,000/105=$952Ontheothe

21、rhand,youcanwaitandusethespotmarkets.ExchangeRateProbabilityRevenuew/HedgeRevenuew/outHedgeValueofHedge90Y/$4%$1,111$952-$15995Y/$25%$1,052$952-$100100Y/$45%$1,000$952-$48105Y/$20%$952$952$0110Y/$6%$909$952$43ExpectedValue=(.02)(-159)+(.25)(-100)+(.45)(-48)+(.20)(0)+(.08)(43)=-$24Youcouldreplicatethishedgebyusingthefollowing:a) BorrowinJapanb) ConverttheYentodollarsc) InvestthedollarsintheUSd) PaybacktheloanwhenyoureceivetheY100,000

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。