兹维博迪金融学第二版试题库08TB

兹维博迪金融学第二版试题库08TB

《兹维博迪金融学第二版试题库08TB》由会员分享,可在线阅读,更多相关《兹维博迪金融学第二版试题库08TB(22页珍藏版)》请在装配图网上搜索。

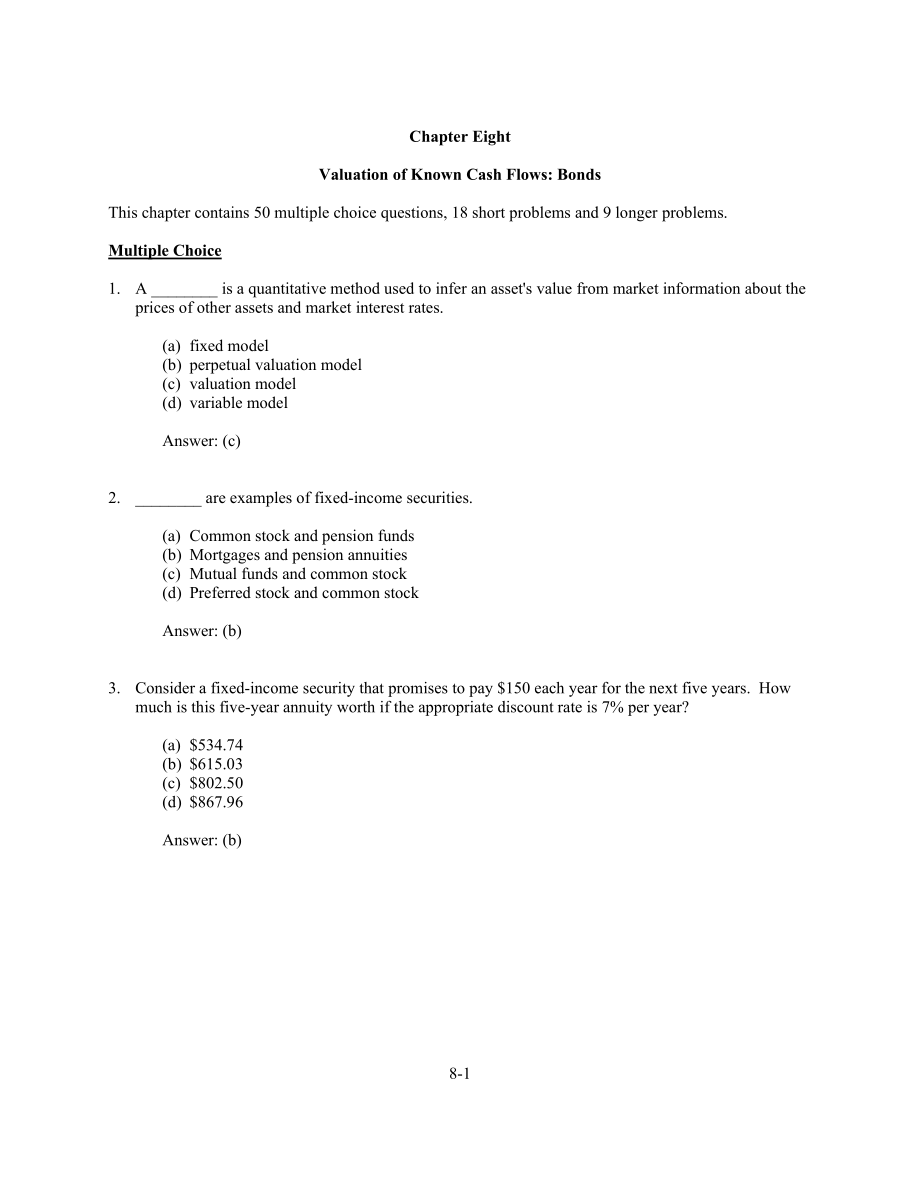

1、Chapter EightValuation of Known Cash Flows: BondsThis chapter contains 50 multiple choice questions, 18 short problems and 9 longer problems.Multiple Choice1. A _ is a quantitative method used to infer an assets value from market information about the prices of other assets and market interest rates

2、.(a) fixed model(b) perpetual valuation model(c) valuation model(d) variable modelAnswer: (c)2. _ are examples of fixed-income securities.(a) Common stock and pension funds(b) Mortgages and pension annuities(c) Mutual funds and common stock(d) Preferred stock and common stockAnswer: (b)3. Consider a

3、 fixed-income security that promises to pay $150 each year for the next five years. How much is this five-year annuity worth if the appropriate discount rate is 7% per year?(a) $534.74(b) $615.03(c) $802.50(d) $867.96Answer: (b)4. Consider a fixed-income security that promises to pay $120 each year

4、for the next four years. Calculate the value of this four-year annuity if the appropriate discount rate is 6% per year.(a) $415.81(b) $508.80(c) $531.85(d) $629.06Answer: (a)5. The price of any existing fixed-income security _ when market interest rates rise because investors will only be willing to

5、 _ them if they offer a competitive yield.(a) rises; buy(b) rises; sell(c) falls; buy(d) falls; sellAnswer: (c)6. A fall in interest rates causes a _ in the market value of a fixed-income security.(a) a rise(b) a fall(c) no change(d) it cannot be determined from the information givenAnswer: (a)7. A

6、change in market interest rates causes _ in the market values of all existing contracts promising fixed payments in the future.(a) a change in the same direction(b) a change in the opposite direction(c) no change(d) an unpredictable variationAnswer: (b)8. What happens to the value of a four-year fix

7、ed-income security promising $100 per year if the market interest rate rises from 5% to 6% per year?(a) A rise of 1% causes a drop of $4.87 in market value.(b) A rise of 1% causes a rise of $4.87 in market value.(c) A rise of 1% causes a drop of $8.09 in market value.(d) A rise of 1% causes a rise o

8、f $8.09 in market value.Answer: (c)9. What happens to the value of a four-year fixed-income security promising $100 per year if the market interest rate falls from 6% to 5% per year?(a) A fall of 1% causes a drop of $4.87 in market value.(b) A fall of 1% causes a rise of $4.87 in market value.(c) A

9、fall of 1% causes a drop of $8.09 in market value.(d) A fall of 1% causes a rise of $8.09 in market value.Answer: (d)10. A zero-coupon bond is also known as _.(a) a perpetual bond(b) a pure discount bond(c) a market rebate(d) an infinite bondAnswer: (b)11. The promised cash payment on a pure discoun

10、t bond is called its _.(a) face value(b) par value(c) fixed interest(d) both a and bAnswer: (d)12. What is the yield of a 1-year pure discount bond with a price of $850 and a face value of $1,000?(a) 8.50%(b) 9.09%(c) 15.00%(d) 17.65%Answer: (d)13. What is the yield of a 1-year pure discount bond wi

11、th a price of $900 and a face value of $1,000? (a) 5.26%(b) 10.00%(c) 11.11%(d) 15.79%Answer: (c)14. Consider a four-year pure discount bond with a face value of $1,000. If its current price is $850, compute its annualized yield.(a) 1.17%(b) 4.15%(c) 5.57%(d) 17.60%Answer: (b)15. Consider a three-ye

12、ar pure discount bond with a face value of $1,000. If its current price is $900, compute its annualized yield.(a) 1.036%(b) 1.111%(c) 3.57%(d) 5.41%Answer: (c)16. Consider a five-year pure discount bond with a face value of $1,000. If its current price is $780, what is its annualized yield?(a) 5.09%

13、(b) 2.82%(c) 1.28%(d) 1.05%Answer: (a)17. A _ obligates the issuer to make periodic payments of interest to the bondholder for the life of the bond and then to pay the face value of the bond when the bond matures.(a) pure discount(b) zero-coupon(c) perpetual bond(d) coupon bondAnswer: (d)18. The _ o

14、f the bond is interest rate applied to the _ of the bond to compute the periodic payment.(a) coupon rate; face value(b) maturity rate; face value(c) coupon rate; price(d) maturity rate; priceAnswer: (a)19. For a bond with a face value of $1,000 and coupon rate of 11%, what is the annual coupon payme

15、nt?(a) $100(b) $110(c) $1,000(d) $1,100Answer: (b)20. For a bond with a face value of $1,000 and a coupon rate of 9%, what is the annual coupon payment?(a) $90(b) $99(c) $1,000(d) $1,190Answer: (a)21. If the market price of a coupon bond equals its face value, it is also termed a _.(a) par bond(b) p

16、remium bond(c) discount bond(d) zero-discount bondAnswer: (a)22. If the bonds market price is higher than its face value, it is termed a _.(a) par bond(b) premium bond(c) discount bond(d) zero-discount bondAnswer: (b)23. If the bonds market price is lower than its face value, it is termed a _.(a) pa

17、r bond(b) premium bond(c) discount bond(d) zero-par bondAnswer: (c)24. If a bond selling for $850 has an annual coupon payment of $80 and a face value of $1,000, what is its current yield?(a) 8.00%(b) 9.41%(c) 17.65%(d) 27.05%Answer: (b)25. If a bond selling for $1,120 has an annual coupon payment o

18、f $110 and a face value of $1,000, what is its current yield?(a) 8.90%(b) 9.82%(c) 10.71%(d) 11.00%Answer: (b)26. If a bond selling for $900 has an annual coupon payment of $80 and a face value of $1,000, what is its current yield?(a) 8.00%(b) 8.89%(c) 11.00%(d) 20.00%Answer: (b)27. The _ is the dis

19、count rate that makes the present value of the bonds stream of promised cash payments equal to its price.(a) compound rate(b) yield to maturity(c) coupon rate(d) current yieldAnswer: (b)28. Suppose you are considering buying a one-year 11% coupon bond with a face value of $1,000 and a current price

20、of $1,020. What is its yield to maturity?(a) 8.82%(b) 9.00%(c) 10.78%(d) 11.00%Answer: (a)29. Suppose you are considering buying a one-year 11% coupon bond with a face value of $1,000 and a current price of $1,050. What is its yield to maturity?(a) 4.76%(b) 5.71%(c) 6.00%(d) 10.48%Answer: (b)30. Sup

21、pose you are considering buying a five-year 11% coupon bond with a face value of $1,000 and a current price of $950. What is its yield to maturity?(a) 5.62%(b) 9.63%(c) 11.58%(d) 12.40%Answer: (d)31. Suppose you are considering buying a five-year 11% coupon bond with a face value of $1,000 and a cur

22、rent price of $1,100. What is its yield to maturity?(a) 3.87%(b) 8.47%(c) 10.00%(d) 13.62%Answer: (b)32. Suppose you are considering buying a six-year 10% coupon bond with a face value of $1,000 and a current price of $1,100. What are the current yield and yield to maturity of this bond?(a) CY = 11.

23、00%; YTM = 12.23%(b) CY = 12.23%; YTM = 11.00%(c) CY = 7.85%; YTM = 9.09%(d) CY = 9.09%; YTM = 7.85%Answer (d)33. Suppose you are considering buying a seven-year 11% coupon bond with a face value of $1,000 and a current price of $950. What are the current yield and yield to maturity of this coupon b

24、ond?(a) CY = 12.10%; YTM = 11.58%(b) CY = 11.58%; YTM = 12.10%(c) CY = 9.92%; YTM = 10.45%(d) CY = 10.45%; YTM = 9.92%Answer: (b)34. Over time bond prices _ their face value. Before maturity, bond prices can _ a great deal as a result of changes in market interest rates.(a) diverge from; fluctuate(b

25、) converge toward; flatten out(c) converge toward; fluctuate(d) diverge from; flatten outAnswer: (c)35. When the yield curve is not flat, bonds of the same _ with different coupon rates have _ yields to maturity.(a) maturity, different(b) maturity, identical(c) callability, different(d) callability,

26、 identicalAnswer: (a)36. Bonds offering the same future stream of promised payments can differ in a number of ways, but the two most important are _ and _.(a) taxability, issue origin(b) type of issuer, default risk(c) type of issuer, taxability(d) taxability, default risk Answer: (d)37. A _ is one

27、that gives the holder of a bond issued by a corporation the right to convert the bond into a pre-specified number of shares of common stock.(a) callable bond(b) convertible bond(c) stock bond(d) preferred bondAnswer: (b)38. A _ is one that gives the issuer of the bond the right to redeem it before t

28、he final maturity date.(a) callable bond(b) convertible bond(c) stock bond(d) preferred bondAnswer: (a)39. Five years ago, English and Co. issued 25-year coupon bonds with par value $1,000. At the time of issuance, the yield to maturity was 6 percent and the bonds sold at par. The bonds are currentl

29、y selling at 110 percent of their par value. Assuming that the coupon is paid annually, what is the current yield to maturity?(a) 3.77%(b) 5.18%(c) 5.27%(d) 5.46%Answer: (b)40. Potemkin Corporation plans to raise $10,000,000 in funds by issuing zero coupon $1,000 par value bonds with a 25 year matur

30、ity. Potemkin Corporation is able to issue these bonds at an after tax cost of debt of 12%. To the nearest whole number, how many bonds must Potemkin Corporation issue? (a) 10,000 bonds(b) 42,919 bonds(c) 125,837 bonds(d) 170,000 bondsAnswer: (d)41. Calculate the years to maturity for a bond based o

31、n the following information. The bond trades at $950, it has a par value of $1,000, a coupon rate of 11%, and a required rate of return of 12%.(a) 8 years(b) 12 years(c) 15 years(d) 16 yearsAnswer: (a)42. Compute the current price of Walsingham bonds based on the following information. Walsingham bo

32、nds have a $1,000 par value, have 20 years remaining until maturity, a 12 percent coupon rate, and a yield to maturity of 10.5 percent.(a) $858.42(b) $982.47(c) $1,119.52(d) $1,124.41Answer: (d)43. Compute the yield to maturity of Arundel bonds based on the following information. Arundel bonds have

33、a $1,000 par value, 25 years remaining until maturity, an 11% coupon rate, and a current market price of $1,187.(a) 4.55% (b) 9.08%(c) 9.27%(d) 13.17%Answer: (b)44. When prices of U.S Treasury strips are listed, principal from a Treasury bond is denoted by the letters _.(a) ci(b) tb(c) bp(d) npAnswe

34、r: (c)45. The _ is the price at which dealers in Treasury bonds are willing to sell.(a) bid price(b) asked yield(c) ask price(d) maturity priceAnswer: (c)46. The _ is the price at which dealers are willing to buy.(a) bid price(b) ask price(c) asked yield(d) maturity priceAnswer: (a)47. The bid price

35、 of a bond is always _ the ask price.(a) greater than(b) less than(c) identical to(d) it varies from case to caseAnswer: (b)48. The _ of a bond price measures the sensitivity of the bond price to a change in the yield to maturity.(a) callability(b) convertibility(c) immutability(d) elasticityAnswer:

36、 (d)49. Suppose you buy a 25-year pure discount bond with a face value of $1,000 and a yield of 6% per year. A day later market interest rates drop to 5% and so does the yield on your bond. What is the proportional change in the price of your bond?(a) a decrease of 26.74%(b) a decrease of 21.10%(c)

37、an increase of 26.74(d) an increase of 21.20Answer: (c)50. Suppose you buy a 25-year pure discount bond with a face value of $1,000 and a yield of 6% per year. A day later market interest rates rise to 5% and so does the yield on your bond. What is the elasticity of the bond price to the change in t

38、he yield?(a) 0.62%(b) 1.27%(c) 1.60%(d) 2.67%Answer: (c)Short Problems1. Consider a five-year fixed-income security which promises $120 per year. Calculate the value of the security if the market interest rate rises from 5% to 6% per year.Answer:niPVPMTResult55?$120PV = $519.54niPVPMTResult56?$120PV

39、 = $505.48The price drops by $14.06.2. Consider a four-year fixed-income security which promises $120 per year. Calculate the value of the security if the market interest rate falls from 7% to 6% per year.Answer:niPVPMTResult47?$120PV = $406.47niPVPMTResult46?$120PV = $415.81The price increases by $

40、9.34.3. Discuss the general principles about the relation between prices and yields of coupon bonds.Answer:Principle #1: Par Bonds.If a bonds price equals its face value, then its yield equals its coupon rate.Principle #2: Premium Bonds.If a coupon bond has a price higher than its face value, its yi

41、eld to maturity is less than its current yield, which is in turn less than its coupon rate.Principle #3: Discount Bonds.If a coupon bond has a price lower than its face value, its yield to maturity is greater than its current yield, which is in turn greater than its coupon rate.4. List some reasons

42、why differences in the prices of fixed-income securities of a given maturity may arise.Answer:Differences in the prices of fixed-income securities of a given maturity may arise due to differences in coupon rates, default risk, tax treatment, callability and convertibility.5. Explain why it is import

43、ant to have a method for valuation of fixed-income contracts.Answer:(1) The parties to the contracts need to have an agreed-upon valuation procedure in setting the terms of the contracts at the outset.(2) Since market factors determining the value of fixed-income contracts change over time, both buy

44、ers and sellers have to reevaluate them each time they are traded.6. Consider a five-year pure discount bond with a face value of $1,000. If its current price is $775, compute its annualized yield.Answer:niPVFVResult5?$775$1,000i = 5.23%7. A four-year bond has a coupon rate of 6% per year, a price o

45、f $950, and a face value of $1,000. Calculate its current yield and yield to maturity.Answer:Current yield = coupon/price= 60/950= 6.32%To calculate yield to maturity:ni = YTMPVFVPMTResult4?$950$1,000$60YTM = 7.49%8. What is the current price of a bond that has a coupon rate of 7%, a return rate of

46、8%, and a face value of $1,000? Assume that this bond will mature in five years. Compare the current price of the bond against its face value.Answer:ni = YTMPVFVPMTResult58?$1,000$70PV = $960.07Because the price of the bond is below its face value, it is a discount bond.9. A five-year coupon bond ha

47、s a coupon rate of 5%, a return rate of 6%, and a face value of $1,000. What is its current price and how does it compare to its face value?Answer:ni = YTMPVFVPMTResult56?$1,000$50PV = $957.88Because the price of the bond is below its face value, it is a discount bond.10. What is the yield to maturi

48、ty of a five-year coupon bond with a current price of $850, a face value of $1,000, and coupon rate of 7%?Answer:ni = YTMPVFVPMTResult5?$850$1,000$70YTM = 11.07%11. Five years ago, English and Co. issued 30 year coupon bonds with a par value of $1,000. At the time of issuance, the yield to maturity

49、was 6 percent per year and the bonds sold at par. The bonds are currently selling at 85 percent of their par value. Assuming that the coupon is paid annually, what is the current yield to maturity?Answer:Five years ago, the bonds were issued at par, which means at the time yield to maturity equaled

50、coupon rate. So the annual coupon is 0.06 x $1,000 = $60.For the current yield to maturity:ni = YTMPVFVPMTResult25?8501,00060YTM = 7.33%12. Eisenstein Corporation plans to raise $100,000,000 in funds by issuing zero-coupon $1,000 par value bonds with a 30-year maturity. Assuming that Eisenstein Corp

51、oration is able to issue these bonds at an after-tax cost of debt of 11%, how many bonds must Eisenstein Corporation issue?Answer:First, calculate the price of an Eisenstein bond:ni = YTMPVFVPMTResult3011?1,0000PV = $43.68The corporation wants to raise $100,000,000, so it must issue the following nu

52、mber of bonds: $100,000,000/$43.68 = 2,289,377 bonds13. Currently, an Eisenstein bond trades at $1,050 per bond and has a coupon rate of 10%. Assuming the bond matures at a $1,000 value, and the required rate of return is 9.5%, in how many years does an Eisenstein bond mature?Answer:ni = YTMPVFVPMTR

53、esult?9.51,0501,0000n = 3314. Compute the current price of Walsingham bonds based on the following information. Walsingham bonds have a $1,000 par value, 26 years remaining until maturity, a 13 percent coupon rate, and a current yield to maturity of 11 percent per year.Answer:ni = YTMPVFVPMTResult26

54、11?1,0000PV = $1,169.6915. Health & US Corporation is a major pharmaceutical firm that has recently experienced a market reevaluation. Currently, the firm has a bond issue outstanding with 18 years to maturity and a coupon rate of 9 percent, with interest paid annually. The required rate of return o

55、f this debt issue has risen to 15 percent. Calculate the current price of this bond.Answer:ni = YTMPVFVPMTResult1815?1,00090PV = $632.3216. Calculate the coupon rate, current yield, and the yield to maturity for a bond that has $1,000 par value, pays a coupon of $85 annually, matures in 20 years, an

56、d has a current price of $985.25.Answer:Coupon rate = 85/1,000 = 8.5% per yearCurrent yield = coupon/price = 85/985.25 = 8.63%For yield to maturity:ni = YTMPVFVPMTResult20?985.251,00085YTM = 8.66%17. Suppose you buy a 20-year pure discount bond with a face value of $1,000 and a yield of 7% per year.

57、 A day later, market interest rates rise to 8% and so does the yield of your bond. What is the proportional change in the price of your bond? What is the elasticity of the bond price to the change in the yield?Answer: ni = YTMPVFVPMTResult207?1,0000PV = $258.42ni = YTMPVFVPMTResult208?1,0000PV = $21

58、4.55The price of the bond decreased by $43.87, so the proportional decline in price is $43.87/$258.42 = 16.98%.Elasticity is % change in price over % change in YTM, or 16.98%/14.29% = 1.19.18. As of today, January 1, 2009, Flanders Corporation is holding $10,000,000 in long-term debt at par bonds. T

59、he bonds have a par value of $1,000, mature on January 1, 2019, and pay a 5 percent coupon. Calculate the current market value of Flanders debt, if the yield to maturity is 7 percent.Answer:Total number of bonds = $10,000,000/$1,000 = 10,000 bondsniPVFVPMTResult107?1,00050PV = $859.50The current market value = $859.50 x 10,000= $8,578,800Longer Problems1. Consider the purchase of a 30-year pure discount bond with a face value of $1,000 and a yield of 7% per year. A w

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。