国际结算英文选择题附答案(共8页)

国际结算英文选择题附答案(共8页)

《国际结算英文选择题附答案(共8页)》由会员分享,可在线阅读,更多相关《国际结算英文选择题附答案(共8页)(8页珍藏版)》请在装配图网上搜索。

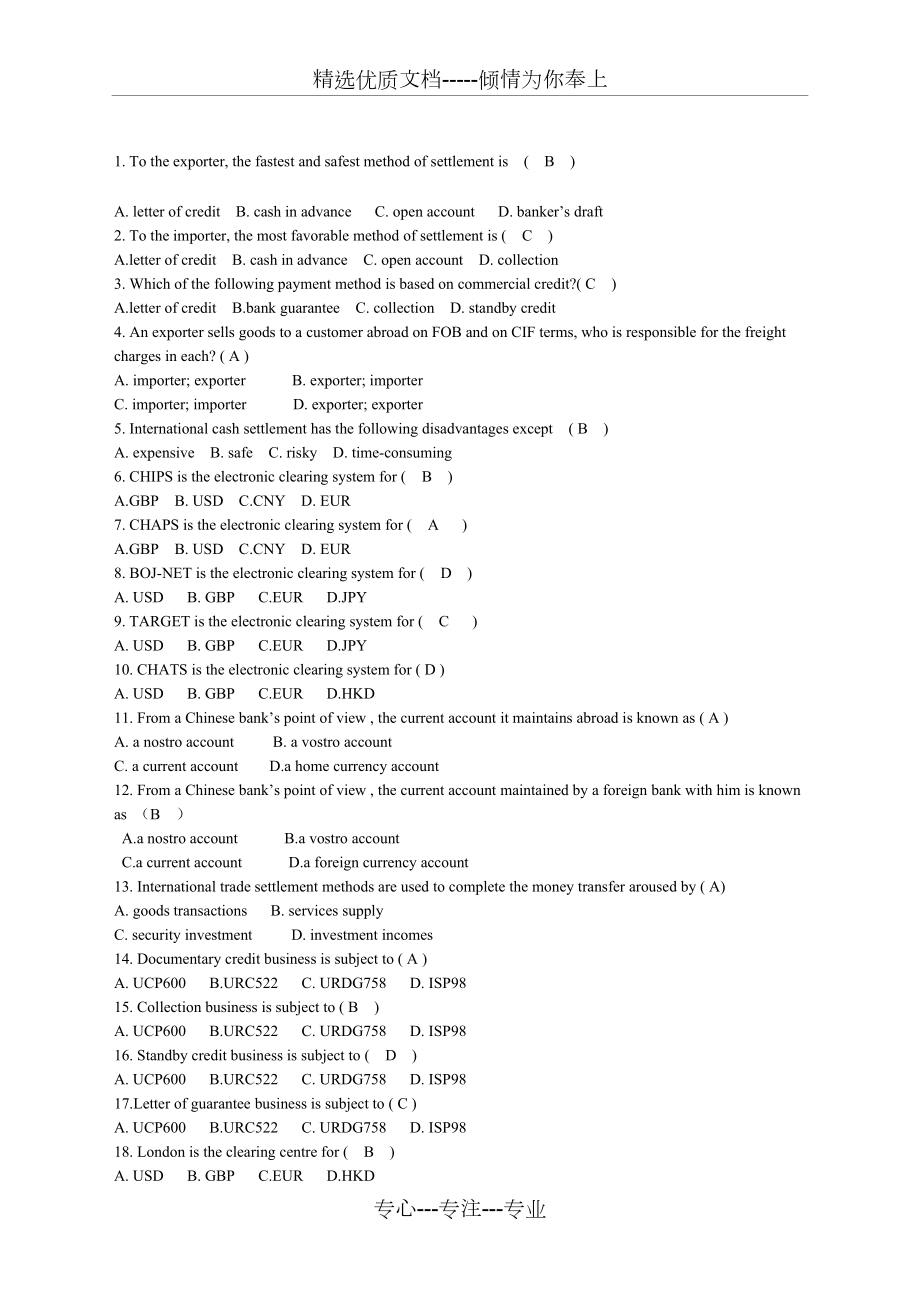

1、精选优质文档-倾情为你奉上1. To the exporter, the fastest and safest method of settlement is ( B )A. letter of credit B. cash in advance C. open account D. bankers draft2. To the importer, the most favorable method of settlement is ( C )A.letter of credit B. cash in advance C. open account D. collection3. Which

2、of the following payment method is based on commercial credit?( C )A.letter of credit B.bank guarantee C. collection D. standby credit4. An exporter sells goods to a customer abroad on FOB and on CIF terms, who is responsible for the freight charges in each? ( A )A. importer; exporter B. exporter; i

3、mporter C. importer; importer D. exporter; exporter5. International cash settlement has the following disadvantages except ( B ) A. expensive B. safe C. risky D. time-consuming 6. CHIPS is the electronic clearing system for ( B )A.GBP B. USD C.CNY D. EUR 7. CHAPS is the electronic clearing system fo

4、r ( A )A.GBP B. USD C.CNY D. EUR 8. BOJ-NET is the electronic clearing system for ( D )A. USD B. GBP C.EUR D.JPY9. TARGET is the electronic clearing system for ( C )A. USD B. GBP C.EUR D.JPY10. CHATS is the electronic clearing system for ( D )A. USD B. GBP C.EUR D.HKD11. From a Chinese banks point o

5、f view , the current account it maintains abroad is known as ( A )A. a nostro account B. a vostro account C. a current account D.a home currency account 12. From a Chinese banks point of view , the current account maintained by a foreign bank with him is known as (B ) A.a nostro account B.a vostro a

6、ccount C.a current account D.a foreign currency account13. International trade settlement methods are used to complete the money transfer aroused by ( A)A. goods transactions B. services supply C. security investment D. investment incomes14. Documentary credit business is subject to ( A )A. UCP600 B

7、.URC522 C. URDG758 D. ISP9815. Collection business is subject to ( B )A. UCP600 B.URC522 C. URDG758 D. ISP9816. Standby credit business is subject to ( D )A. UCP600 B.URC522 C. URDG758 D. ISP9817.Letter of guarantee business is subject to ( C )A. UCP600 B.URC522 C. URDG758 D. ISP9818. London is the

8、clearing centre for ( B )A. USD B. GBP C.EUR D.HKD19. New York is the clearing centre for ( A )A. USD B. GBP C.EUR D.HKD20. Tokyo is the clearing centre for ( D )A. USD B. GBP C.EUR D.JPY21. Frankfurt is the clearing centre for ( C )A. USD B. GBP C.EUR D.HKD22.Among the following documents, the one

9、which is not regarded as control documents is ( D )A. authorized signatures B. test keys C. schedule of terms and conditions D. correspondent arrangement23. The seller should arrange for the insurance of the goods transportation under ( C )A.FOB B.CFR C.CIFD.EXW24.( A ) cheque can be cashed over the

10、 counter of paying bank.A. An open B. A crossed C. A general crossing D. A special crossing25. The effect of a blank endorsement is to make a negotiable instrument payable to the ( C ) A. specified person B, order of a specified person C. bearer D. named person26. If the bill is payable “60 days aft

11、er date”, the date of payment is decided according to ( C )A. the date of acceptance B. the date of presentation C. the date of issuance D. the date of maturity27. The party to whom the bill is addressed is called the( B )A. drawer B. drawee C. holder D. payee28. When financing is without recourse,

12、this means that the bank has no recourse to the ( D )if such drafts are dishonored. A. payer B. drawee C. acceptor D. drawer29. The( C ) of a promissory note assumes the prime liability to make payment of the note.A. holder B. drawee C. maker D. acceptor 30. The bill which must be presented for acce

13、ptance is ( B )A. the bill payable at xx days after date B. the bill payable xx days after sight C. the bill payable on a fixed date D. the bill payable at sight31. In order to retain the liabilities of the other parties, a bill that has been dishonored must be ( A )A. protested B. given to the acce

14、ptor C. retained in the files D. presented to a bank32.( C )is not a holder of a billA. Payee B. Endorsee C. Drawer D. Bearer33. Which of the following is a relative essential item of a bill ?( B )A. amount B. tenor C. payee D. drawee34. An endorsement ,which prohibits the further negotiation of the

15、 instrument ,is called ( D )endorsement . A. qualified B. general C. specific D. restrictive35. A check is a ( D )draft drawn on a bank A. time B.usance C. direct D. demand36. The act which is never involved in promissory note business is ( C ) A.endorsement B.dishonor C.acceptance D.presentation37.

16、 The act which is never involved in check business is ( C ) A.endorsement B.dishonor C.acceptance D.presentation38. The acceptor of a bill is the person who originally named as ( B ) of the bill.A. drawer B. drawee C.payee D.endorser39. The first holder of a bill is the ( C ) of the billA. drawer B.

17、 drawee C.payee D.acceptor40. Among the following crossed cheques, the one which contains the words ( D ) is a special crossed cheque.A. banker B. not negotiable C. A/C payee D. Bank of China 41. The means of authenticating payment order in mail transfer is the ( D )A. SWIFT authentic key B. schedul

18、e of terms and conditions C. test key D. authorized signatures42. The means of authenticating payment order in telegraphic transfer is the( C )A. correspondent arrangement B. schedule of terms and conditions C. test key D. authorized signatures43. Which of the following is not a method of remittance

19、? ( C )A. M/T B. T/T C. T/R D. D/D44. Open account as a payment method is usually used when ( D )A.goods are sold under the sellers market conditionB.goods are badly needed by the buyerC.goods are of special standards or special specificationsD.goods are sold under the buyers market condition45. If

20、the reimbursement instruction written on the payment order is expressed as in cover , we have credited your A/C with us, the A/C relationship between the remitting bank and the paying bank must be( A )A. the paying bank maintains an A/C with remitting bank B. the remitting bank maintains an A/C with

21、 paying bankC. both remitting bank and paying bank maintain their A/Cs with a third bankD. remitting bank and paying bank have their A/Cs with two different banks46. If the reimbursement instruction written on the payment order is expressed as in cover, please debit our A/C with you, the A/C relatio

22、nship between the remitting bank and the paying bank must be( B )A. the paying bank maintains an A/C with remitting bank B. the remitting bank maintains an A/C with paying bankC. both remitting bank and paying bank maintain their A/Cs with a third bankD. remitting bank and paying bank have their A/C

23、s with two different banks47. If the reimbursement instruction written on the payment order is expressed as in cover, we have authorized Bank A to debit our A/C and credit your A/C with them, the A/C relationship between the remitting bank and the paying bank must be( C )A. the paying bank maintains

24、 an A/C with remitting bank B. the remitting bank maintains an A/C with paying bankC. both remitting bank and paying bank maintain their A/Cs with a third bankD. remitting bank and paying bank have their A/Cs with two different banks48. If the reimbursement instruction written on the payment order i

25、s expressed as in cover, we have instructed Bank X to transfer the proceeds to your A/C with bank Y, the A/C relationship between the remitting bank and the paying bank must be ( D )A. the paying bank maintains an A/C with remitting bank B. the remitting bank maintains an A/C with paying bankC. both

26、 remitting bank and paying bank maintain their A/Cs with a third bankD. remitting bank and paying bank have their A/Cs with two different banks49. It will be more convenient if the collecting bank appointed by the seller ( B ) A. is a large bank B. is the remitting banks correspondent in the place o

27、f the importer C. is in the exporters country D. acts on the importers instructions50. Under D/P, the documents will not be delivered to the buyer until ( D ) A. the goods have arrived B. the documents have arrived C. the documents are presented to the buyer D. the bill is paid by the buyer51. Under

28、 D/A, the documents will not be delivered to the buyer until ( D ) A. the goods have arrived B. the documents have arrived C. the documents are presented to the buyer D. the bill is accepted by the buyer52. In collection business, banks are obligated to check the documents received to see that ( C )

29、 A. they are authentic B. they are regular C. they are the same as those listed in the collection instruction D. they are in the right form53. A bill of exchange which is accompanied by shipping documents is known as ( B ) A. a clean bill B. a documentary bill C. a clean collection D. a documentary

30、collection54. In documentary collection, after the goods have been shipped, the exporter presents the documents to ( C )for collectionA. the collecting bank B. the reimbursing bank C. the remitting bank D. the opening bank55. Which of the following is not the obligation of remitting bank in collecti

31、on ?( D )A. to complete a collection order strictly according to the principals instructions.B. to perform following all the instructions given by the principal.C. to keep the documents wellD. to examine the contents of documents in detail56. Which of the following is not the obligation of the colle

32、cting bank?( B )A.to verify the authenticity of the collection orderB. to take care of goodsC.to release documents strictly on the delivery terms of documents.D.to perform following all the instructions given by the remitting bank.57.In collection business, the drawer of the draft for collection is

33、( A )A. seller B. buyer C. remitting bank D. collecting bank58. In collection business, the drawee of the draft for collection is ( B )A. seller B. buyer C. remitting bank D. collecting bank59. If the collection instruction given by the principal specifies that collection charges are to be borne by

34、the drawee but with no express statement that they may not be waived, charges will be for the account of ( A ) providing the drawee refuses to pay them.A. principal B. remitting bank C. collecting bank D. presenting bank60.The price term which is more favorable to the seller under collection is ( D

35、)A. EXW B. FOB C. CFR D. CIF61. In L/C business , the exporter can receive the payment only when ( C )A. he has shipped the goods B.he has presented the documents C.the documents presented constitute a complying presentation D.the importer has taken delivery of the goods.62. In L/C business, the iss

36、uing bank can refuse to pay the credit amount when ( C ) A.the applicant prevents him from making payment B.the goods are not the same as those stipulated in the sales contract C.one kind of document required by L/C isnt presented. D.balance of the applicants account is not enough for payment .63. O

37、f the following kinds of L/C, ( B )is the L/C which requires no drafts at all. A.sight payment credit B.deferred payment credit C.acceptance credit D.negotiation credit64. Of the following kinds of L/C, ( C ) is the L/C in which drafts are always required. A.sight payment credit B.deferred payment c

38、redit C.acceptance credit D.negotiation credit65. Of the following kinds of L/C, ( D ) is the L/C which is especially suitable for use to settle the payment of trade conducted through a middleman. A.non-transferable credit B.reciprocal credit C.revolving credit D.back to back credit 66. Of the follo

39、wing kinds of L/C, ( A )is the L/C which is especially suitable for use to settle the payment of trade conducted through a middleman. A. transferable credit B. reciprocal credit C. revolving credit D.confirmed credit 67 Of the following kinds of L/C, ( C ) is the L/C which is especially suitable for

40、 use to settle the payment under a long term contract covering goods to be transported by regular partial shipments. A.non-transferable credit B.reciprocal credit C.revolving credit D.back to back credit68.Of the following kinds of L/C, ( B ) is the L/C which is especially suitable for use to settle

41、 the payment under counter trade. A.non-transferable credit B.reciprocal credit C.revolving credit D.back to back credit69. Confirmation of a credit may be given by ( B )A. the beneficiary at the request of the importerB. the advising bank at the request of the issuing bankC. the advising bank after

42、 the receipt of correct documentationD. the issuing bank after the receipt of correct documentation70. The credit may only be confirmed if it is so authorized or allowed by ( A )A. the issuing bank B. the supplierC. the advising bankD. the beneficiary71. The second beneficiary of a transferable lett

43、er of credit is the ( D )A. middleman B. transferring bank C. the applicant of the transferred credit D. real supplier of the goods72. The first beneficiary of a transferable letter of credit is the ( A )A. middleman B. transferring bank C. the applicant of the transferred credit D. real supplier of

44、 the goods73. The red clause credit is often used as a method of ( B )A. providing the buyer with funds prior to shipmentB. providing the seller with funds prior to shipmentC. providing the buyer with funds after shipmentD. providing the seller with funds after shipment74. An applicant must reimburs

45、e an issuing bank unless he finds that ( D )A. goods are defectiveB. goods are not as ordered in the sales contractC. documents received do not allow him to clear the goods through customsD. documents do not conform on the face to the terms and conditions of the credit75. Application for any amendme

46、nt to a letter of credit should be given to the issuing bank by ( A ) A. the applicantB. the beneficiaryC. the advising bankD. the nominated bank76. The message type which is used to send a amendment notice of a documentary credit through SWIFT is numbered ( C )A. 700 B. 705 C. 707 D. 71077.Among al

47、l the financial methods mentioned bellow , which method provides funds without recourse ? ( C )A. packing loansB. bill discounting C. forfaitingD. borrowing docs against T/R78.Under letter of credit, the primary debtor is the( C )A. applicant B. importer C. issuing bank D. nominated bank79. The appl

48、icant of letter of credit is ( B )A. the exporter B. the importer C. the exporters bank D. the importers bank80. The beneficiary of letter of credit is ( A )A. the exporter B. the importer C. the exporters bank D. the importers bank81.A letter of credit which is expired on Oct. 1, 2008 specifies tha

49、t “documents must be presented within 15days after the on board date of bill of lading”. If the on board date of bill of lading is Sep. 10,2008, the latest date of presentation must be ( B )A. Sep. 24 ,2008 B. Sep. 25 ,2008 C. Sep. 26 ,2008 D. Oct. 1, 200882. If there is no indication in the credit

50、of the insurance coverage required, the amount of insurance coverage must be at least ( C ) of the CIF or CIP value of the goods.A. 100% B.105% C. 110% D.120%83. Which of the following actions performed by the nominated bank is not regard as the action of honor( D )A. to pay at sight under sight pay

51、ment creditB. to incur a deferred payment undertaking and pay at maturity under deferred payment creditC. to accept the draft and pay at maturity under acceptance creditD. to negotiate under negotiation credit84. Complying presentation under letter of credit means a presentation that is in accordanc

52、e with the terms and conditions of credit, the applicable rules of UCP and provisions of ( B )A. ISP98 B. ISBP681 C. ICC Publication No.522 D.ICC Publication No. 75885. Among the following banks, the one who has no obligation to examine documents under letter of credit is ( C )A. the issuing bank B.

53、 the confirming bank C. the reimbursing bank D. the nominated bank86.The following are the financing methods which can be used by the seller in L/C business except ( D )A. negotiating the documentary draft to his bankA. applying for packing loans from his bankB. discounting the time draft already ac

54、cepted by the drawee bankD. Borrowing docs from issuing bank against T/R87.The following are the financing methods which can be used by the buyer in L/C business except ( D )A.applying for issuing L/C with no margin requirement.B.borrowing docs from issuing bank against T/RC.taking the goods from sh

55、ipping company against indemnity guarantee signed by the issuing bank.D.applying for packing loans from his bank88. A bill of lading doesnt function as ( D )A. a contract of transportation B. a receipt of goods C a certificate of title to the goods D. an accounting document89. The drawee of a draft

56、drawn under letter of credit may be ( C )A. the beneficiary B. the applicant C. the issuing bank D. the negotiating bank90. If the bill of lading is made out to order , it must be endorsed by ( B )so as to complete the transfer of the title to the goods .A. the carrier B. the shipper C. the notify party D. the nominated bank 专心-专注-专业

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。