4LeasingNew opportunities JZQE

4LeasingNew opportunities JZQE

《4LeasingNew opportunities JZQE》由会员分享,可在线阅读,更多相关《4LeasingNew opportunities JZQE(3页珍藏版)》请在装配图网上搜索。

1、Sino-foreign leasing companies facenew opportunitiesBy Jiang Zhongqin “Sino-foreign leasing companies face new opportunities” says the Secretary General of the Leasing Business Committee of the China Association of Enterprises with Foreign Investment (LBC), Mr. Qu Yankai. Mr. Qu plays a critical rol

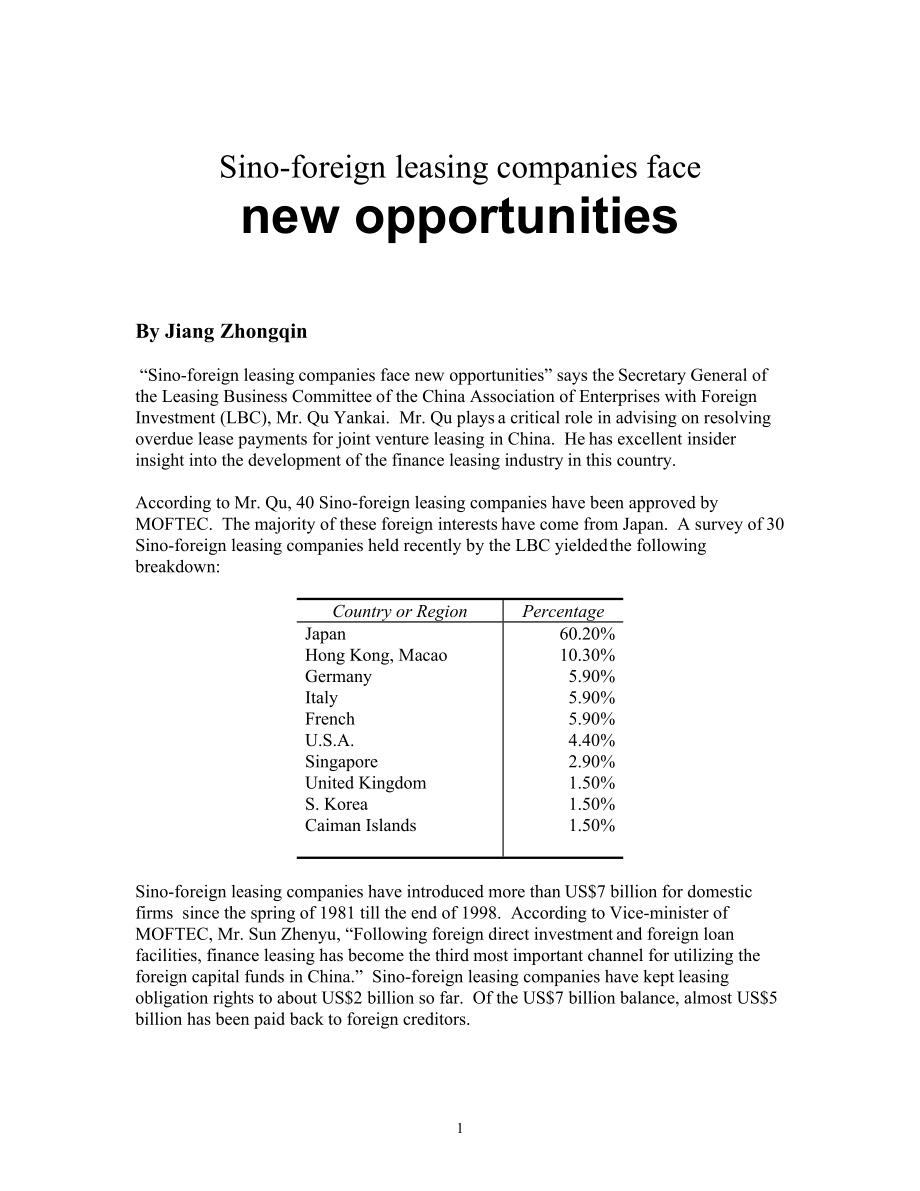

2、e in advising on resolving overdue lease payments for joint venture leasing in China. He has excellent insider insight into the development of the finance leasing industry in this country. According to Mr. Qu, 40 Sino-foreign leasing companies have been approved by MOFTEC. The majority of these fore

3、ign interests have come from Japan. A survey of 30 Sino-foreign leasing companies held recently by the LBC yielded the following breakdown:Country or RegionPercentageJapanHong Kong, MacaoGermanyItalyFrenchU.S.A.SingaporeUnited KingdomS. KoreaCaiman Islands60.20%10.30%5.90%5.90%5.90%4.40%2.90%1.50%1.

4、50%1.50%Sino-foreign leasing companies have introduced more than US$7 billion for domestic firms since the spring of 1981 till the end of 1998. According to Vice-minister of MOFTEC, Mr. Sun Zhenyu, “Following foreign direct investment and foreign loan facilities, finance leasing has become the third

5、 most important channel for utilizing the foreign capital funds in China.” Sino-foreign leasing companies have kept leasing obligation rights to about US$2 billion so far. Of the US$7 billion balance, almost US$5 billion has been paid back to foreign creditors. Of the US$2 billion in lease rent paya

6、bles, based on LBCs statistics, the total principal of overdue lease payments is about $300 million. Mr. Qu said that two points should be emphasized:· First, as far as the timing, most of overdue lease payments are from projects signed 10 years ago. The reason that overdue lease payments occur

7、red is that along with the variation of economic systems, investor titles have changed. This has resulted in lack of clarity in gauging the responsibilities of investors. Overdue lease payments are an anticipated risk in finance leasing. · Second, there has been a change in legal structures. 10

8、 years ago Chinas economic system was under reform and based on a weak legal system. Many legal areas were in transition or improving step by step. Some foreign interests believed that the “guarantee from the government” waived the need for any due diligence on leasing projects. Some foreign interes

9、ts were well aware how risky these projects were as the interest rates on loans for finance leases were relatively high. There is a price of reform in any country. The price the Chinese government has paid for reform has been very heavy. Some foreign investors have also had to make concessions to a

10、certain degree, to solve overdue lease payments. This was a one-time situation, due to legal change, and will not be repeated.Beginning in the 1990s, overdue lease payments began to influence the operations of Sino-foreign leasing companies. With a sustained effort from the LBC, and assistance from

11、the government organs concerned, Premier Zhu Rongji took up the matter personally and the State Council decided to change foreign loans into domestic loans, arranging a special RMB loan equivalent of US$200 million to solve overdue lease payments. “Of course we have a long way in solving overdue lea

12、se payments;” Mr. Qu said. “In order to more efficiently solve overdue lease payments, the State Council has recently approved arranging alternative special RMB loans equivalent to US$20 million for projects which have not been declared. At the mean time, government organs concerned circulated a not

13、ice of criticism towards some cities or provinces that did not do their best to solve overdue lease payments.”Mr. Qu emphasized that few overdue lease payments exist for projects begun after 1990, and Sino-foreign leasing companies that were established after 1989 have largely enjoyed successful ope

14、rations. PEC International Finance Leasing Co., Ltd. with foreign investment from Japan (IBJ, Marubeni, and Yasuda Trust Banking Co., Ltd.) is one such example. Since its establishment in 1990, PEC has introduced more than US$500 million in foreign capital funds without any bad debts. All loan facil

15、ities, whether from Japanese banks or from other foreign banks, have been paid to PEC on schedule. This success story was reported by Japan Industrial News in 1995. Another success story is Xin De Telecom, invested in by Germanys Siemens and Deutsche Telecom. In order to support the nations communic

16、ations infrastructure, Xin De Telecom recently developed a new form of finance leasing, the Structured Participating Lease (SPL). The rent payment in SPL is based on the cash flow of the project. This makes it better suited to financing new operators and start-up new projects. Both experts in leasin

17、g business circles and officials with regulatory authority value the spirit of innovation expressed in the SPL. “Actually finance leasing has not developed into a real industry in China,” said Mr. Qu. “Going back to 1981, Sino-foreign leasing companies were seen only as a window for introducing fore

18、ign capital funds. This window will only open wider in future.” In order to promote effective demand in the domestic market and to accelerate firms technological revamping, the Peoples Bank of China recently decided that firms with foreign investment can obtain RMB loans from domestic commercial ban

19、ks, so long as foreign currency is provided as a mortgage, or a Letter of Guarantee from a foreign capital bank is provided. It has finally been resolved that Sino-foreign leasing companies will have a larger and growing role in providing leasing arrangements for domestic and international equipment.(the end) 3

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。