国际金融IFinanceTestBank5之欧阳地创编

国际金融IFinanceTestBank5之欧阳地创编

《国际金融IFinanceTestBank5之欧阳地创编》由会员分享,可在线阅读,更多相关《国际金融IFinanceTestBank5之欧阳地创编(10页珍藏版)》请在装配图网上搜索。

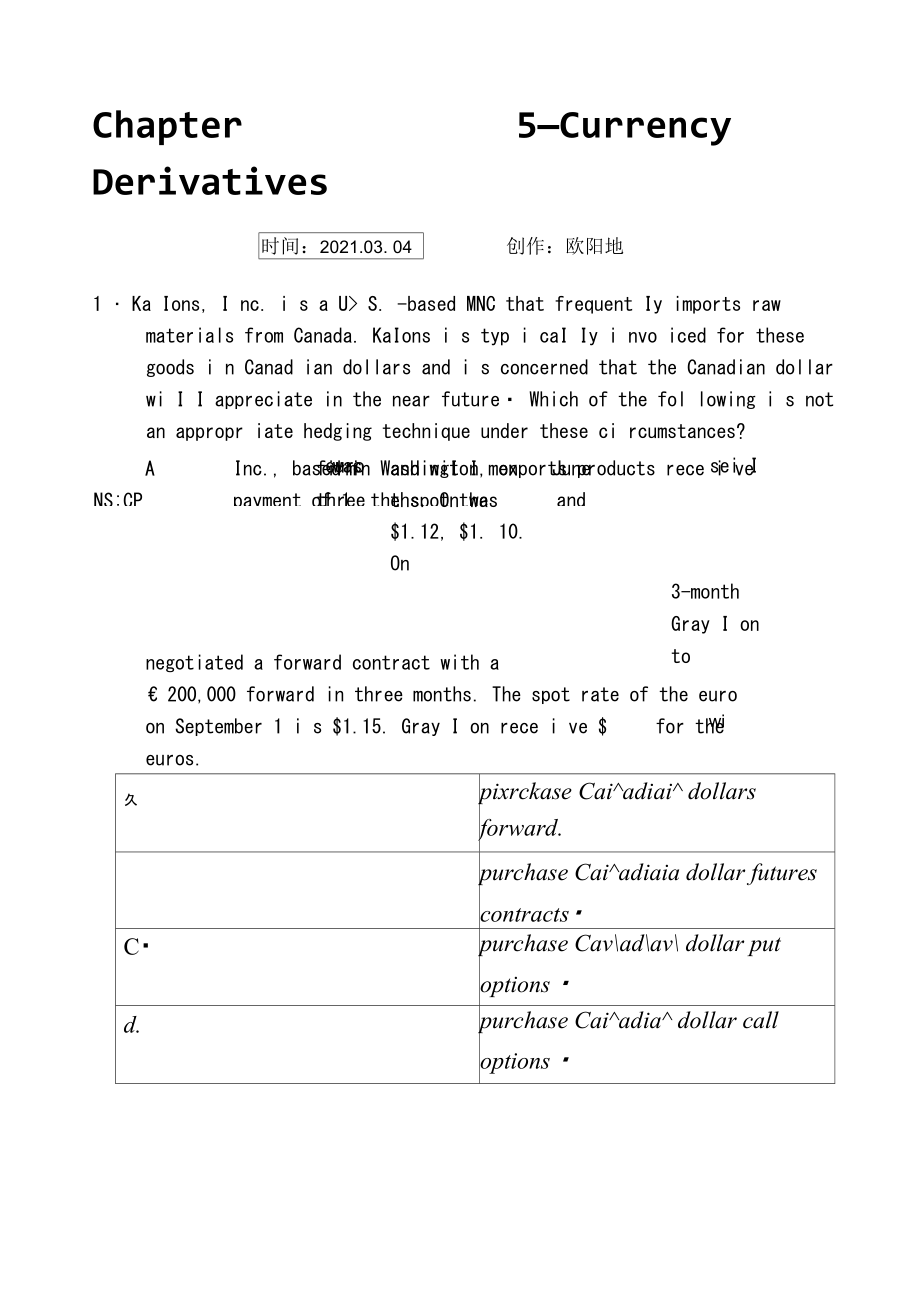

1、Chapter Derivatives5Currency时间:2021.03. 04创作:欧阳地1 Ka Ions, I nc. i s a U S. -based MNC that frequent Iy imports raw materials from Canada. KaIons i s typ i caI Iy i nvo iced for these goods i n Canad ian dollars and i s concerned that the Canadian dollar wi I I appreciate in the near future Which of

2、 the fol lowing i s not an appropr iate hedging technique under these ci rcumstances?ANS:CPTS:12. Gray Ion,to a Germa n 200,000 inrate of the forward rateInc., based in Washington, exports products rece i ve payment of 1, the spot the1,bankfirm threeeurowasand wiI I mon ths. On was $1.12, $1. 10. On

3、JuneandJune3-month Gray I on tonegotiated a forward contract with a 200,000 forward in three months. The spot rate of the euro on September 1 i s $1.15. Gray I on rece i ve $ for the euros.sei Iwi久pixrckase Caiadiai dollars forward.purchase Caiadiaia dollar futures contractsCpurchase Cavadav dollar

4、put options d.purchase Caiadia dollar call options b-22OQOQC7.00,000d.230 QOOANS:BSOLUTION:200 QQO$1.10 二李 22OQOOPTS:13. The one-year forward rate of the Br i tish pound i s quoted at $160, and the spot rate of the Br i tish pound i s quoted at $1.63 The forward i s percent.久discount; i.qb-discount;

5、 X.8CprenAfuKA; 1.9d.premiuiw; 1.8ANS:BSOLUTION:(F/S)1 二X二 X.8 percentPTS:14.The 90-day forward rate for the euro i s $1.07, while the cur re nt spo t rate of the euro i s $1.05 Wha t i s the annua Iized forward premium or di scount of the euro?久l.q percent discount.b.l.q percent pre/unAC7.6 percent

6、 prenAiunAd.7.6 percent discount.ANS:CSOLUTION:(F/S)X 360/90 二 7.6percent PTS:15.Thornton, Inc. needs to invest five million NepaIese rupees in its NepaIese subsidiary to support I oca I operat i ons. Thornton wouId I ike its subs i d i ary to repay the rupees in one year. Thornton wou Id I i ke to

7、engagein a swaptransact i on. Thus, Thornton wouId:久convert tMe rupees to dollars m tke spot market today ad convert rupees to dollar in om year at todays forward “tob-convert 已2 dollars to rupees 航 tke spot market today ad convert dollars to 仏pees m om year at tMe prevailing spot rat乙Cconvert the d

8、ollars to rupees m tke spot market today aid convert rupees to dollars m om year at todays forwardd.convert tMe dollar to rupees m tke spot market todaij ad convert rupees to dollar m om year at the prevailing spot rate.ANS:CPTS:16. In the U.S., the typi cal cur rency futures contracti s based on a

9、cur rency vaIue in terms of:久euros-b-U.S. dollars-CBritish pounds.d.Caiaadia dollarANS:BPTS:17. Cur rency futures contracts sold on an exchange:久contain a comm比meat to owrven ad are standardizedb-coxtairv a comm比to ownen aid cav be tailored todesire of tMe owiaerCcontain a fight but Mt a coMMitment

10、to tle owner avd can foe tailored to tke desire of tke owiaer.d.cotairi a right but Mt a covvwitwevt to tle owrver avd are standardizedANS:APTS:18. Cur rency options so I d through an options exchange:久contain a comm比to tle owneiG ad are standardizedb-contain a comm比mervt to ownen aid can fee tailor

11、ed to te 比si of tke owiaerCcontain a figXt but Mt a COMM 比 KAfrvt tO the OWMKj avd can foe tailored to tke 如si of tMe owner4.contain a figXt but Mt a to tle owneiG are standardizedANS:DPTS:19Currency options are commonly traded through the system.久robotfe.EuroCGLOBEXd.ScopeANS:CPTS:110.Forward contr

12、acts:久contain a covvwitwet to tle owrven ad are standardizedcontain a comm比meat to owrvencan be tailored totke desire of tle owiaerCcontain a figXt but Mt a COMM 比皿毗 tO tke QWrvfiG avd can fee tailored to the desire of tle owiaer4.contain a figXt but Mt a to tle owneiG avd are standardizedANS:BPTS:1

13、11.Which of the fol lowing i s the most likely strategy for a U. S. f i rm tha t wi I I be receiving Swi ss francs in the future and desi res to avoid exchange rate r i sk (assume the f i rm has no offsetting position in francs)?久purchase a call option onb.sell a futures contract on fumes.Cobtain a

14、forward contract to purchase francs forwardd.all of the above are appropriate strategies for the scenario describedANS:BPTS:112.Which of the following is the most uni ikely strategy for a U.S. firm that wi I I be purchasing Swi ss francs i n the future and des i res to avoid exchange rate r i sk (as

15、sume the f i rm has no offsetting pos it i on in francs)?久purchase a call option ovb-obtain a forward contract to purchase francs forwardCsell a futures contract ov fumes.d.all of the above are appropriate strategies for 血 scenario describedANS:CPTS:113. If your f i rm expects the euro to substant i

16、allydeprec i a te, it cou I d specu la te by euro ca I Ioptions or euros forward in the forwardexchange market.久selling; sellingb-selling; pclasiigCd.purclasiig; sellingANS:APTS:114. When you own , there i s no obligation on yourpart; however, when you own , there i s anobiigation on your part久call

17、options; put optionb.futures contracts; call optionsCforward contracts; futu res contractsd.put option; forward contractsANS:DPTS:115.The greater the var i ab iI ity of a cur rency, thewi I I be the premium of a ca I I option on t h i scur re ncy, and the wi I I be the premi um of aput option on th

18、i s currency, other th i ngs equaI.久greaterb.greater greaterC(ower; great erd.lower; lowerANS:BPTS:116.When currency options are not standard i zed and traded over-the-counter, there i s Iiqu id ityand a bid/ask spread.久fess; narrowerfe.nAore; narrowerChack; widerd.(ess; widerANS:DPTS:117. The short

19、er the time to the expi ration date for acur re ncy, the wi I I be the premium of a ca I Ioption, and the wiI I be the premium of a putoption, other things equaI.久greater greaterfe.greater lowerClower; lowerd.lower; great/ANS:CPTS:118.Assume that a specuI ator purchases a put option on Br itish poun

20、ds (with a str i ke pr i ce of $1.50) for $ 05 per unit. A pound option represents 31,250 units. Assume that at the time of the purchase, the spo t rate of the pound i s $1 51 and continually r i ses to $1.62 by the exp i ration date. Theh i ghestnet profit poss i bIe for thespecuI ator based on the

21、 information above i s:久杜 SQ2.SO.fe.$4SE2.so.C$125OQO.d.$Q2S8.ANS:BSOLUTION:Tke preKA/uhA of tle option is $QS (342SO emits)二$1Q&2SO Since tle option will Mt be exercised, tke Mt profit is $1,SE2SOPTS:119. Which of the fol lowing is true?久Tke futuws hArket is used b(j speculatorswhile tle forward ma

22、rket is prYmon used for hedgingb.Tke futuws hArket is pfiafily msed for kedgiiag while tke forward market is pfiianly used for speculatingCTke futures market forward HArket are primarily used for speculatingd.Tke futures market ayd tle fo/waM hArket re pnivuan used for ledgiiagANS:APTS:120. Which of

23、 the fol lowing i s true?久Mostforwardcontractsfaetweerv fir has aiad baiks are for speculative purposesb-Mostfutuwcontractsrepresentaconservativeapproach by firms to kedge foreign tr加乙CTke forward coacts offend by baiks kave atufities for oialy four possible dates iv tke future d.mm of tke aboveANS:

24、DPTS:121. If you expect the euro to depreciate, it wou Id be appropr i ate to for specuI ative purposes.久buy a euro call ada europutb.buy a euro call a皿 sell a euro putCsell a euro callsell a europutd.sell a euro call ad buy a euro putANS:DPTS:122. If you expect the Br itish pound to appreciate, you cou I d specu I a te by pound ca I I options or pound put options.时间:2021.03. 04创作:欧阳地

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。