投资学模拟题80道

投资学模拟题80道

《投资学模拟题80道》由会员分享,可在线阅读,更多相关《投资学模拟题80道(12页珍藏版)》请在装配图网上搜索。

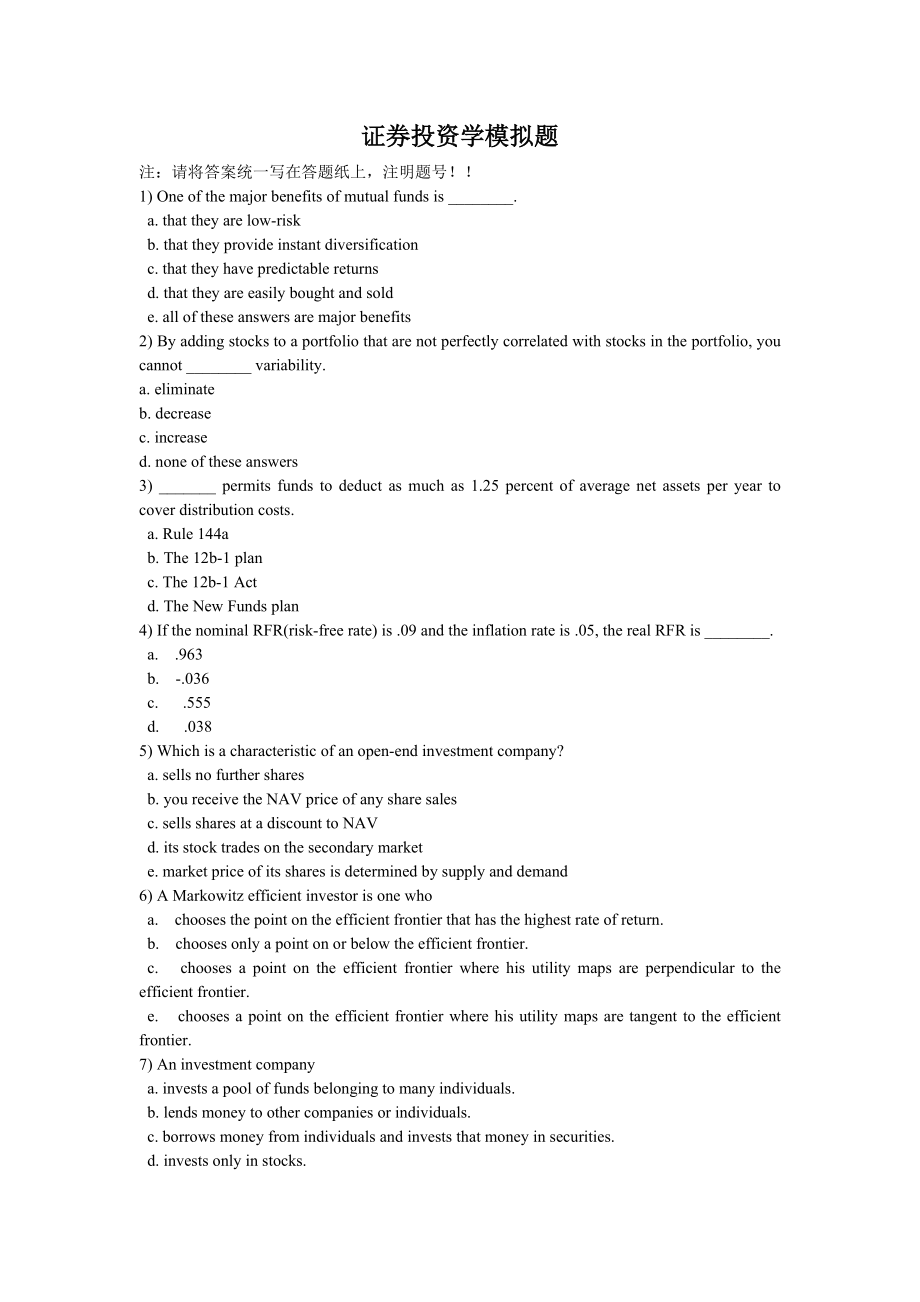

1、证券投资学模拟题注:请将答案统一写在答题纸上,注明题号!1) One of the major benefits of mutual funds is _. a. that they are low-risk b. that they provide instant diversification c. that they have predictable returns d. that they are easily bought and sold e. all of these answers are major benefits2) By adding stocks to a portf

2、olio that are not perfectly correlated with stocks in the portfolio, you cannot _ variability.a. eliminateb. decreasec. increased. none of these answers3) _ permits funds to deduct as much as 1.25 percent of average net assets per year to cover distribution costs. a. Rule 144a b. The 12b-1 plan c. T

3、he 12b-1 Act d. The New Funds plan4) If the nominal RFR(risk-free rate) is .09 and the inflation rate is .05, the real RFR is _. a. .963 b. -.036 c. .555 d. .0385) Which is a characteristic of an open-end investment company? a. sells no further shares b. you receive the NAV price of any share sales

4、c. sells shares at a discount to NAV d. its stock trades on the secondary market e. market price of its shares is determined by supply and demand6) A Markowitz efficient investor is one who a. chooses the point on the efficient frontier that has the highest rate of return. b. chooses only a point on

5、 or below the efficient frontier. c. chooses a point on the efficient frontier where his utility maps are perpendicular to the efficient frontier. e. chooses a point on the efficient frontier where his utility maps are tangent to the efficient frontier.7) An investment company a. invests a pool of f

6、unds belonging to many individuals. b. lends money to other companies or individuals. c. borrows money from individuals and invests that money in securities. d. invests only in stocks.8) Money market funds attempt to _.I. provide current income and safety of principalII. provide liquidityIII. hedge

7、the investors riskIV. provide long-term capital gain a. II only b. I & IV c. I & II d. I & III9) You have estimated that the expected rate of return on your investment is 10.6%. However, the CAPM required rate of return is 11.3%. In the context of CAPM, your portfolio is _. a. under-priced b. under-

8、 or overpriced c. fairly priced d. overpriced10) The average discount from NAV for a closed-end investment company shares _ over time. a. rises and falls b. rises c. remains constant d. falls11) Two risky assets, A and B, have the following scenarios of returns:ProbabilityAB35% 10%7%35% -4%4%30% 9%

9、-6%The covariance between the returns of A and B is _. a. 0.0036 b. 0.0600 c. 0.1052 d. 0.015412) Open-end investment companies a. have shares that tend to be priced at a discount to their NAVs. b. will repurchase shares at their NAVs. c. do not typically repurchase shares. d. do not typically sell

10、shares after their initial public offerings.13) Which of the following situation(s) represent(s) an arbitrage opportunity under CAPM?I. A security lies above the SML.II. A security lies below the SML.III. A security lies above the CML.IV. A security lies below the CML. a. I only b. II only c. III on

11、ly d. I & II e. IV only f. I & III14) International funds a. typically have one-half of their portfolios invested in the U.S. b. typically have one-third of their portfolios invested in the U.S. c. typically have one-fifth of their portfolios invested in the U.S. d. do not invest any portion of thei

12、r portfolios in the U.S. e. typically have two-thirds of their portfolios invested in the U.S.15) _ attempt to match the composition of the market. a. Composite funds b. Growth funds c. Balanced funds d. Market index funds16) Which is true when combining a risk-free asset with a risky portfolio? a.

13、Both return and risk increase in a non-linear fashion along the capital market line. b. The standard deviation is the non-linear proportion of the standard deviation of the risky asset portfolio. c. A graph of portfolio returns and risks looks like a straight line between the two assets. d. The expe

14、cted rate of return is an average weighted relatively more to the risky assets. e. All of these answers are correct.17) What would the offering price be if the NAV of a fund with a 7.5% load is $10.25? a. 10.25 b. 11.31 c. 10.90 d. 10.45 e. 11.0818) The share price of a closed-end investment company

15、 is a. generally higher than its NAV. b. always equal to its NAV. c. typically equal to its NAV. d. generally lower than its NAV.19) Annual management fees compensating the professional managers typically vary from _ of the average net assets of the fund. a. one half to one percent b. one quarter to

16、 one percent c. one to two percent d. two to five percent20) The characteristic line is _. a. the typical Markowitz efficient frontier b. used to derive the total risk of an asset c. used to derive the systematic risk of an asset d. the SML21) If the correlation coefficient between two assets with e

17、qual risk and expected returns is 0.5, then the expected return of the portfolio will be a. higher than that of the individual assets. b. lower than that of the individual assets. c. 78.2% of that of the individual assets. d. 50% of that of the individual assets. e. the same as that of the individua

18、l assets.22) If the average annual after tax cash flow was $5,101, the after tax net proceeds from sales was $89,514, the initial equity was $60,000 and n was 5, then what is the approximate yield? a. 15.7% b. 14.7% c. 15.2% d. 16.9%23) Systematic risk is defined as a. risk that can be diversified a

19、way. b. risk that is diversified away in the market portfolio. c. the variability of all risky assets caused by macroeconomic variables. d. the variability of all risky assets caused by conditions unique to individual assets.24) The major duties of an investment management company are:I. handling of

20、 redemptions and dividendsII. investment research and portfolio managementIII. recommending stocks and bonds to investorsIV. arranging bank loans for fund investors a. I, II & III b. II only c. I & II d. I, II, III & IV25) Individuals with near-term, high-priority goals should select: a. high risk,

21、short term investments. b. high risk, long term investments. c. low risk, short term investments. d. low risk, long term investments.26) A portfolio that has a negative beta: a. has an expected return less than the risk-free rate. b. cannot exist. c. none of these answers. d. has an expected return

22、more than the markets expected rate.27) Two countries, Gaziabad and Jhumritalayya, have well-developed stock markets. The covariance between their national market indices is 0.04. Gaziabads index has a 20% standard deviation while Jhumritalayya displays a standard deviation of 27%. Gaziabads index h

23、as an expected return of 31% while that of Jhumritalayya has an expected return of 42%. An international investor who invests 35% of his wealth in Gaziabad and the rest in Jhumritalayya can expect an expected return of _ and a standard deviation of _. a. 38%; 23% b. 39%; 25% c. 33%; 26% d. 35%; 26.5

24、%28) Which of the following is NOT one of the four decisions to be made in an individuals investment strategy? a. Determine the regulatory constraints governing the investment process. b. Assign policy weights to each eligible asset class. c. Decide on which specific securities will be purchased. d.

25、 Identify the asset classes to be used for investments.29) The _ interest rate represents the pure time value of money. a. long-term borrowing b. risk-free c. nominal d. compounded30) The _ of an investment company depends on the companys portfolio of stocks. a. none of these answers b. liquidity of

26、 the shares c. value of the shares d. bond-rating31) The basic interest rate assuming no inflation and no uncertainty about cash flow is called the _ risk-free rate. a. subjective b. nominal c. real d. objective32) If investors become more risk averse, and expected real growth increases, the slope o

27、f the security market line (SML) will _ and will shift _. a. increase; upwards b. increase; downwards c. decrease; upwards d. decrease; downwards33) Stock As variance is 25% and its covariance with stock B is 20%. If the correlation coefficient between the stocks is 0.3, the variance of stock B is _

28、. * 1,778% * 177.8% * 1.778% * 17.78%34) Given that the risk premium on the market is 14%, and the beta on an asset is 0, what would be the risk premium on the asset? a. 4.4% b. Not enough information c. 0% d. 2%35) The Capital Market Line reflects risk in terms of a. Sharpe ratio. b. coefficient of

29、 variation. c. beta. d. standard deviation.36) The excess return on stock Z with beta of 0.88 is 6.3%. If the markets expected return is 13.2%, the risk-free rate equals _. a. 6.19% b. 6.04% c. 5.76% d. 5.91%37) As a portfolio manager of an Asia Pacific Equity Fund, which of the following affect you

30、r decision on investments in portfolio which replicates the returns of the Nikkei index. (Assume redemptions = new investment).I. business riskII. liquidity riskIII. exchange rate riskIV. country risk a. I & II b. I, II, III, & IV c. I, II, & IV d. III & IV e. II, III, & IV38) The correlation coeffi

31、cient between a risk-less asset and the market portfolio over the investment horizon equals _. a. one b. none of these answers c. zero d. indeterminate39) Portfolio theory assumes that a. investors are risk averse. Given a choice between investing in two assets with the same returns, they will inves

32、t in the asset with the lower risk. The purchase of insurance is an indication of risk aversion. b. investors are risk averse. Given a choice between investing in two assets with the same returns, they will invest in the asset with the lower risk. The few investors who are not risk averse are the ca

33、use of the curved shape of the efficient frontier. c. investors are risk averse. Given a choice between two assets, they will choose the asset with the lower risk. The fact that they are risk averse causes the parabolic shapes of the efficient frontier and their utility curve. d. some investors are

34、risk averse. Given a choice between investing in two assets, they will invest in the asset with the lower risk. The purchase of insurance is an indication of risk aversion.40) The expected return on security A is twice that on security B. Then, under CAPM, A has a beta that is _ that of B. a. half b

35、. insufficient information c. twice d. none of these answers41) Which is not a major assumption in the Arbitrage Pricing Theory (APT)? a. Investors always prefer more wealth to less wealth with certainty. b. A market portfolio that contains all risky assets and is mean-variance efficient. c. The sto

36、chastic process generating asset returns can be represented as a K factor model. d. Capital markets are perfectly competitive.42) The _ can only take values between -1 and 1. a. variance b. none of these answers c. correlation coefficient d. standard deviation43) As more stocks are added to a portfo

37、lio, the risk keeps _ at _ rate. a. rising; a decreasing b. falling; an increasing c. falling; a decreasing d. rising; an increasing44) There is a _ relationship between the real growth rate of the economy and the risk-free rate. a. positive b. causal c. dialectic d. negative45) The risk-free rate p

38、revailing in Nirvania is about 6.5%. Nirvanias market risk premium has been estimated at 8.9%. If the markets excess return per unit of risk is 0.77, the risk-to-reward ratio of an efficient portfolio, P, which consists of 35% invested in the risk-less asset equals _. a. 0.44 b. 1.33 c. 0.75 d. 0.61

39、46) A portfolio that dominates another portfolio a. has a higher rate of return than the other portfolio. b. has either a higher rate of return for equal risk or lower risk for an equal rate of return. c. has lower risk and a higher rate of return than the other portfolio. d. has lower risk than the

40、 other portfolio.47) The _ should equal the long-run growth rate of the economy with an adjustment for short-term liquidity. a. GNP deflator b. beta coefficient c. inflation rate d. interest rate e. none of these answers f. risk-free rate48) Which of the following is/are true about the taxes an indi

41、vidual investor must pay on bond investments?I. Government securities are exempt from state taxes.II. Interest income on municipal bonds is exempt from all federal taxes.III. Municipal bonds are exempt from all state and local taxes. a. I & III b. I only c. III only d. II only e. I & II49) A and B a

42、re efficient portfolios. Then, a. if A has a higher expected return, it must have a lower risk. b. A and B must have the same risk. c. A and B have the same risk-to-reward ratio. d. A combination of investments in A and B is necessarily an efficient investment.50) As you add more stocks to a portfol

43、io, the systematic risk of the portfolio _. a. may rise or fall b. remains unaffected c. rises d. falls51) The major barrier to international diversification can generally be thought of as a. lack of adequate financial information. b. currency controls. c. exchange risk. d. lack of liquidity. e. tax

44、 regulations.52) Stocks A and B are perfectly positively correlated and have the same variance. Then, doubling the amount invested in A will a. halve the variance. b. not affect the variance. c. double the variance. d. quadruple the variance.53) Variance is a. a measure of volume. b. a measure of ex

45、pected return. c. a measure of change. d. a measure of risk.54) The line of best fit for a scatter diagram showing the rates of return of an individual risky asset and the market portfolio of risky assets over time is called the a. characteristic line. b. capital asset pricing model. c. line of leas

46、t resistance. d. market line. e. security market line.55) An investor chooses a. any point on or below the efficient frontier. b. the lowest point on the efficient frontier. c. the highest point on the efficient frontier. d. a point along the efficient frontier based on his utility function.56) A cl

47、osed-end investment company a. typically repurchases shares on demand. b. has stock that trades on a secondary market. c. will typically offer more share issues after the initial share offering. d. is a type of mutual fund.57) _ is the capacity to buy or sell an investment rapidly without a substant

48、ial price concession. a. Composite b. Liquidity c. Risk d. Exchange e. Country-risk58) The _ portfolio is the efficient portfolio with the highest utility for an investor. a. positive covariance b. independent c. optimal d. correlated e. neutral f. more diversified59) An assets risk premium is deter

49、mined by a. rate of return. b. its beta. c. standard deviation. d. its beta and the prevailing market risk premium. e. the prevailing market risk premium.60) Which of the following statements is true? a. Three-quarters of all mutual funds are 95% or more diversified, providing one of their most impo

50、rtant benefits. Studies also have found that most mutual funds have maintained the stability of their correlation with the market, but not of their risk class. b. Three-quarters of all mutual funds are 90% or more diversified, providing one of their most important benefits. Studies also have found t

51、hat most mutual funds have maintained the stability of their correlation with the market, and of their risk class. c. Three-quarters of all mutual funds are 80% or more diversified, providing one of their most important benefits. But studies also have found that most mutual funds have not maintained

52、 the stability of their correlation with the market, or of their risk class. d. One-half of all mutual funds are 95% or more diversified, providing one of their most important benefits. Studies have also found that most mutual funds have maintained the stability of their correlation with the market,

53、 and of their risk-adjusted returns.61) The _ investment strategy is appropriate when investors want the portfolio to grow in real terms over time to meet some future need. a. capital preservation b. total return c. capital appreciation d. current income62) _ is a measure of an assets systematic ris

54、k. a. Eta b. Alpha c. Gamma d. Beta e. Delta63) Both portfolio theory and capital market theory indicate that investors should use a(n) _ measure of risk. a. heterogeneous b. external market c. self-determined d. internal market63) Markowitz believes that any asset or portfolio of assets can be desc

55、ribed by _ parameter(s). a. three b. four c. two e. one64) Zeta-Jones, Inc.s stock has a beta of 1.3. The risk-free rate equals 7% and the market premium is 6%. If Zeta-Joness stock had a return of 16%, it _ the market on a risk-adjusted basis. a. under-performed b. outperformed c. performed the sam

56、e as d. insufficient information to answer the question.65) Securities that plot _ the SML are considered overpriced. a. above b. to the left of c. on d. below66) The Security Market Line experiences a(n) _ shift in response to a change in the real risk-free rate or the expected rate of inflation. a

57、. upward b. downward c. leftward d. parallel e. rightward67) Which of the following is NOT a measure of risk? a. variance b. skewness c. range of returns d. Sharpe ratio68) The _ is an absolute measure of how two assets move together over time. a. standard deviation b. covariance c. utility function

58、 d. efficient frontier69) An investors investment objectives must be framed in relation to: a. the aversion to risk and desire for income. b. the possibility of losses and the short-term needs. c. expected returns commensurate with appetite for risk. d. the desired expected returns and the investmen

59、t horizon.70) An investor has invested 55% of his asset in the market portfolio and the rest in risk-free T-bills. The market has an expected return of 13% and a standard deviation of 23%. The covariance between the investors portfolio and the market portfolio equals _. a. 0.17 b. 0.004 c. 0.036 d.

60、0.02971) An investor borrows $1,000 at 5% interest rate. She invests this amount and an additional $300 of her own savings in an S&P 500 fund, which returns 13% over one year. The rate of return that the investor obtains over the year equals _. a. 24.00% b. 39.67% c. 42.27% d. 56.33%72) _ is acknowl

61、edged to have the smallest country risk in the world. a. Russia b. Japan c. Germany d. The United States e. Canada f. England h. China73) Given that the expected market rate of return is 18%, a securitys risk premium is 14%, and the securitys beta is 1.2, what is the risk-free rate of return? a. 4.3

62、3% b. 5.82% c. 8.45% d. 6.33%74) The _ of the Security Market Line changes because of a change in an investors attitude toward risk. a. intercept b. position c. slope d. none of these answers75) Stock A has a higher expected return than stock B. Then, the variance of stock B a. can be higher or lower than that of A. b. must be higher than that of A. c. must be lower than that of A. d. none of these answers.76) Which assumption is similar between the CAPM model and the APT? a. T

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。