兹维博迪金融学第二版试题库1

兹维博迪金融学第二版试题库1

《兹维博迪金融学第二版试题库1》由会员分享,可在线阅读,更多相关《兹维博迪金融学第二版试题库1(29页珍藏版)》请在装配图网上搜索。

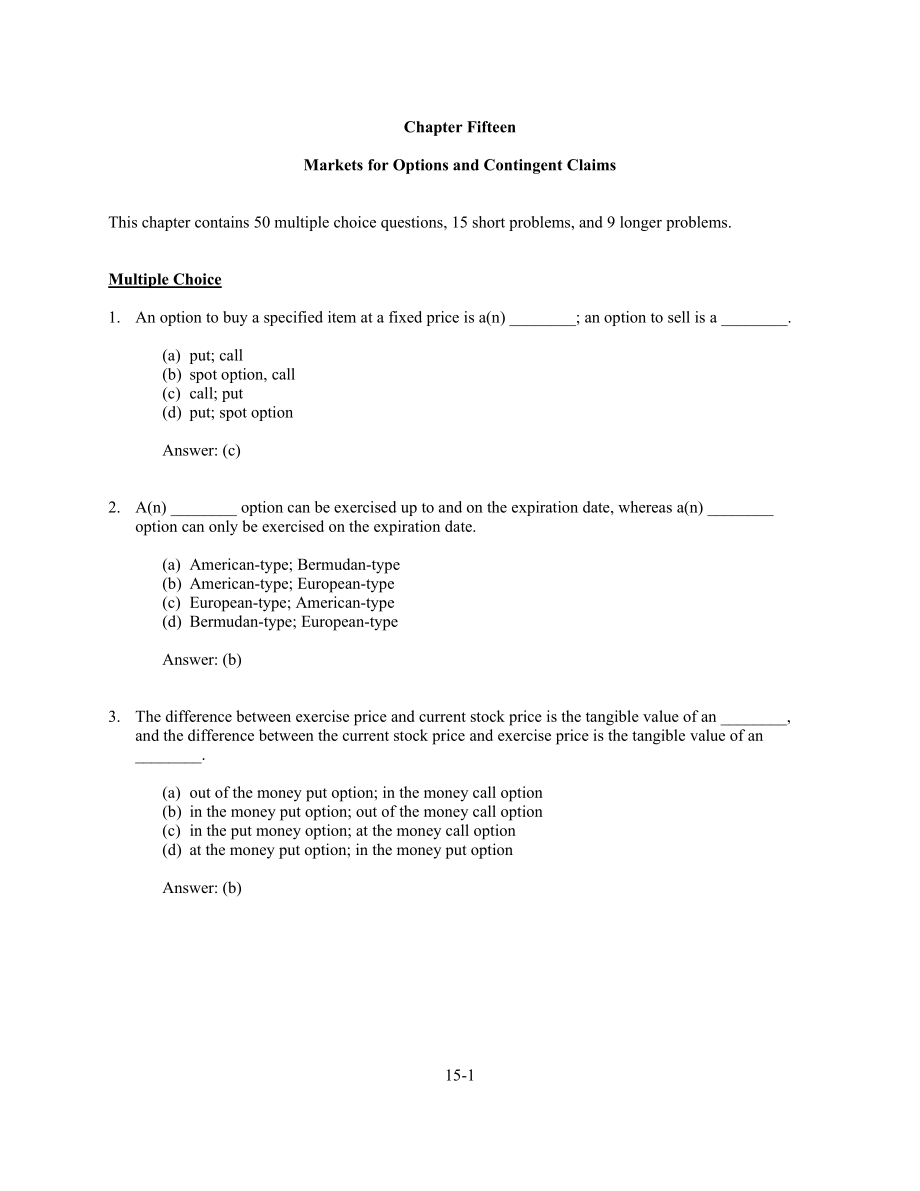

1、Chapter FifteenMarkets for Options and Contingent ClaimsThis chapter contains 50 multiple choice questions, 15 short problems, and 9 longer problems.Multiple Choice1. An option to buy a specified item at a fixed price is a(n) _; an option to sell is a _.(a) put; call(b) spot option, call(c) call; pu

2、t(d) put; spot optionAnswer: (c)2. A(n) _ option can be exercised up to and on the expiration date, whereas a(n) _ option can only be exercised on the expiration date.(a) American-type; Bermudan-type(b) American-type; European-type(c) European-type; American-type(d) Bermudan-type; European-typeAnswe

3、r: (b)3. The difference between exercise price and current stock price is the tangible value of an _, and the difference between the current stock price and exercise price is the tangible value of an _.(a) out of the money put option; in the money call option(b) in the money put option; out of the m

4、oney call option(c) in the put money option; at the money call option(d) at the money put option; in the money put optionAnswer: (b)4. A call option is said to be out of the money if its _.(a) exercise price is equal to the price of the underlying stock(b) current stock price is greater than its str

5、ike price(c) strike price is greater than the current stock price(d) strike price is less than its current stock priceAnswer: (c)5. The time value of an option is _.(a) the difference between an options stock price and its tangible value(b) the difference between the current stock price and exercise

6、 price(c) the difference between the exercise price and the stock price(d) the difference between an options market price and its tangible valueAnswer: (d)6. The prices of puts are _ the higher the exercise price, and the prices of calls are _ the higher is the exercise price.(a) lower; higher(b) hi

7、gher; lower(c) lower; lower(d) higher; higherAnswer: (b) Questions 7 through 10 refer to the following hypothetical information:Listing of LePlastrier Options (symbol: LLB)(Prices listed are closing prices.)February 27, 2009CALLSStock Price on NYSEExercise PriceJanuaryFebruaryApril109.75109.75109.75

8、1071101133.3750.6250.1255.6252.18750.8757.1254.8752.375PUTSStock Price on NYSEExercise PriceJanuaryFebruaryApril109.75109.75109.751071101131.753.62593.3755.875105.8757.37511.757. What is the tangible value of the April LLB 110 put?(a) 0(b) 0.25(c) 3.25(d) 7.375Answer: (b)8. What is the tangible valu

9、e of the February LLB 107 call?(a) 0(b) 5.625(c) 0.75(d) 2.75Answer: (d)9. In what state is the January LLB 107 call?(a) in-the-money(b) out-of-the-money(c) at-the-money(d) zero stateAnswer: (a)10. In what state is the February LLB 113 put?(a) in-the-money(b) out-of-the-money(c) at-the-money(d) zero

10、 stateAnswer: (a)11. Which is the correct formula describing the put-call parity relation?(a) S + C = (b) S + P = (c) S + P = (d) S + C = Answer: (c)12. A protective-put strategy is where one _.(a) buys a share of stock and a call option(b) buys a put option and a call option(c) buys a put option an

11、d a share of stock(d) sells a put option and buys a call optionAnswer: (c)13. SPX options are effectively calls or puts on a hypothetical index fund that invests in a portfolio composed of the stocks that make up the S&P 500 index, each of the 500 companies _.(a) equally represented with respect to

12、the others(b) in proportion to the total value of its shares outstanding(c) in proportion to the trading volume of its shares(d) rotating on a proportional basis dependent on earningsAnswer: (b)14. The SPX contract specifies that if the call option is exercised, the owner of the options _.(a) pays a

13、 cash settlement of $100 times the difference between the index value and the strike price(b) receives a cash payment of $100 times the difference between the index and tangible values (c) receives a cash payment of $100 times the difference between the index value and the strike price(d) receives a

14、 payment of index shares $100 times the difference between the index value and strike priceAnswer: (c)15. The stock of Deneuvre Ltd, currently lists for $370 a share, while one-year European call options on this stock with an exercise price of $150 sell for $290 and European put options with the sam

15、e expiration date and exercise price sell for $58.89. Infer the yield on a one-year zero-coupon U.S. government bond sold today.(a) 2.49%(b) 8.00%(c) 11.11%(d) 24.90%Answer: (b)16. The stock of Fellini Ltd, currently lists for $550 a share, while one-year European call options on this stock with an

16、exercise price of $250 sell for $380 and European put options with the same expiration date and exercise price sell for $56.24. Infer the yield on a one-year zero-coupon U.S. government bond sold today.(a) 6.67%(b) 10.5%(c) 19.76%(d) 23.76%Answer: (b)17. Consider a stock that can take only one of tw

17、o values a year from now, either $250 or $90. Also consider a call option on the stock with an exercise price of $160 expiring in one year. At expiration, the call will pay either $90 if the stock price is $250 or it will pay nothing if the stock price is $90. Calculate the call options hedge ratio.

18、(a) 0.3600(b) 0.4444(c) 0.5625(d) 0.6400Answer: (c)18. Consider a stock that can take only one of two values a year from now, either $320 or $130. Also, consider a call option on the stock with an exercise price of $200 expiring in one year. At expiration, the call will pay either $120 if the stock

19、price is $320 or it will pay nothing if the stock price if $130. The risk-free rate is 5% per year. Calculate the hedge ratio.(a) hedge ratio = 0.3750(b) hedge ratio = 0.4063(c) hedge ratio = 0.6000(d) hedge ratio = 0.6316Answer: (d)19. As one attempts to improve the two state model, we can further

20、subdivide time intervals into shorter increments and build the _.(a) Binomial option pricing model(b) Black-Scholes model(c) Discrete model(d) a and bAnswer: (d)20. When the _ price of the underlying stock equals the _, this reasoning leads to the simplified Black-Scholes formula.(a) future; price o

21、f the call(b) current; future value of the strike price(c) current; present value of the strike price(d) future; price of the putAnswer: (c)21. Which is the correct formula using Black-Scholes method for a European call option on a non-dividend paying stock?(a) C = N(d1)S + N(d2)Ee-rT(b) C = N(d2)S

22、+ N(d1)Ee-rT(c) C = N(d1)S N(d2)Ee-rT(d) C = N(d1)E N(d2)Se-rTAnswer: (c)22. Use the Black-Scholes formula to find the value of a European call option on the following stock:Time to maturity6 monthsStandard deviation50 percent per yearExercise price60Stock price60Interest rate10 percent per yearAssu

23、me it is a non-dividend paying stock. The value of a call is _.(a) $6.83(b) $9.76(c) $9.96(d) $14.36Answer: (b)23. Use the Black-Scholes formula to find the value of a European call option on the following non-dividend paying stock:Time to maturity4 monthsStandard deviation45 percent per yearExercis

24、e price65Stock price60Interest rate11 percent per year(a) $5.09(b) $7.75(c) $9.66(d) $11.43Answer: (a)24. The Black-Scholes formula has four parameters that are directly observable and one that is not. Which of the following parameter is not directly observable?(a) exercise price(b) stock price(c) v

25、olatility of the stock return(d) risk-free interest rateAnswer: (c)25. As a financial analyst at Dodgie Brothers investment house, you are asked by a client if she should purchase European call options on Angel Heart Ltd shares that are currently selling in U.S. dollars for $45.00. The options on An

26、gel Heart Ltd have an exercise price of $65.00. The current stock price for Angel Heart is $70 and the estimated rate of return variance of the stock is 0.09. If these options expire in 35 days and the riskless interest rate over the period is 6%, what should your client do?(a) The call is valued at

27、 $19.63; this is less than $70 and not worth buying.(b) The call is valued at $5.37; this is less than $45 and not worth buying.(c) The call is valued at $70; this is greater than $45 and worth buying.(d) The call is valued at $15; this is greater than $6 and worth buying.Answer: (b)26. Use the line

28、ar approximation of the Black-Scholes model to find the value of a European call option on the following stock:Time to maturity6 monthsStandard deviation0.3Exercise price50Stock price50Interest rate10 percent per yearWhat is the discrepancy between the value obtained from the linear approximation an

29、d traditional Black-Scholes formula?(a) Linear approx = $3.01; Discrepancy = $1.0154(b) Linear approx = $4.24; Discrepancy = $1.2016(c) Linear approx = $3.01; Discrepancy = $1.2016(d) Linear approx = $4.76; Discrepancy = $1.2153Answer: (b)27. Use the Black-Scholes formula to find the value of a Euro

30、pean call option and a European put option on the following stock:Time to maturity0.5Standard deviation30% per yearExercise price100Stock price100Risk-free interest rate10 percent per yearThe values are closest to:(a) Value of call = $16.73; Value of put = $7.22(b) Value of call = $12.27; Value of p

31、ut = $9.32(c) Value of call = $10.90; Value of put = $6.02(d) Value of call = $8.28; Value of put = $3.40Answer: (c)28. Use the Black-Scholes formula to find the value of a European call option and a European put option on the following stock:Time to maturity0.5Standard deviation42% per yearExercise

32、 price100Stock price110Risk-free interest rate12 percent per yearThe values are closest to:(a) Value of call = $29.26; Value of put = $7.95(b) Value of call = $21.53; Value of put = $5.73 (c) Value of call = $10.30; Value of put = $13.90(d) Value of call = $8.28; Value of put = $3.40Answer: (b)29. C

33、all options become more valuable as the exercise price _, as the stock price _, as the interest rate _, and as the stocks volatility _.(a) increases; increases; increases; increases(b) increases; decreases; decreases; increases(c) decreases; increases; decreases; increases(d) decreases; increases; i

34、ncreases; increasesAnswer: (d)30. Implied volatility is the value of s that makes _ of the option equal to the value computed using the option-pricing formula.(a) the exercise price(b) the observed market price(c) the historical market price(d) the call valueAnswer: (b)31. Calculate the implied vola

35、tility of a stock which has a time to maturity of 3 months, a risk-free rate of 8%, exercise price of $70, current stock price of $65, and does not pay dividends. Use the linear function of the option price. The value of the call is $6.50(a) 15%(b) 35%(c) 46%(d) 50%Answer: (d)32. Calculate the impli

36、ed volatility of a stock using the linear function of the option price for the following data: time to maturity = 4 months, call value = $5.80, stock price = $50 and risk-free rate = 10%. The value is closest to:(a) 14.54%(b) 36.78(c) 45%(d) 50.50%Answer: (d)33. The same methodology used to price op

37、tions can be used to value many other contingent claims, including:(a) corporate stocks and bonds(b) loan guarantees(c) real options embedded in research and development(d) all of the aboveAnswer: (d)34. The replication strategy used in contingent claims analysis is known as:(a) claims financing(b)

38、self-financing(c) replicating financing(d) risk adjusted financingAnswer: (b)Questions 35-37 refer to the following information:Crabby Tabby Corporation is in the cat food business and has a total market value of $140 million. The corporation issues two types of securities: common stock (850,000 sha

39、res) and zero-coupon bonds (95,000 bonds each with a face value of $1,000). The bonds are considered to be default-free and mature in one year. The risk-free interest rate is 4.5% per year.35. What is the market value of Crabby Tabbys bonds?(a) $99,275,000(b) $95,000,000(c) $92,476,091(d) $90,909,09

40、1Answer: (d)36. What is the market value of Crabby Tabbys stocks?(a) $45,000,000(b) $43,062,201(c) $46,976,946(d) $49,090,909Answer: (d)37. What is Crabby Tabbys share price?(a) $52.94(b) $55.26(c) $57.75(d) $58.26Answer: (b)Questions 38-40 refer to the following information:The Callas Corporation i

41、s in the music publishing business, and has a total market value of $115 million. The corporation issues two types of securities: common stock (800,000 shares) and zero-coupon bonds (90,000 bonds each with a face value of $1,000). The bonds are considered to be default-free and mature in one year. T

42、he risk-free interest rate is 6% per year.38. What is the market value of Callas bonds?(a) $95,400,000(b) $90,000,000(c) $84,905,650(d) $83,333,333Answer: (c)39. What is the market value of Callas stock?(a) $30,094,340(b) $27,042,314(c) $25,000,000(d) $19,600,000Answer: (a)40. What is Callas share p

43、rice?(a) $24.50(b) $31.25(c) $37.62(d) $41.66Answer: (c)41. The Gobbi Corporation has a total market value of $120 million. The corporation issues two types of securities: common stock (950,000 shares) and zero-coupon bonds (95,000 bonds, each with a face value of $1,000). There is risk associated w

44、ith the bonds, however, because the bonds mature in one year. What do the stockholders receive a year from now, if the value (denoted V1) of the firms assets falls short of $95 million?(a) The company will default on the debt and the stockholders will get nothing.(b) The company will default on the

45、debt and the stockholders will receive all of the firms assets.(c) The stockholders receive V1 $95 million.(d) None of the above.Answer: (a)42. Lenski Corporation has issued two types of securities: common stock (2 million shares) and zero-coupon bonds with an aggregate face value of $95 million (95

46、,000 bonds each with a face value of $1,000). Lenskis bonds mature one year from now. If we know that the total market value of Lenski Corporation is $200 million, the risk-free interest rate is 7% per year and the volatility of the firms asset value is 0.35, then what are the separate market values

47、 of Lenski Corporation stocks and bonds?(a) E = $105 million; D = $95 million(b) E = $111.58 million; D = $82.64 million(c) E = $88.42 million; D = $111.58 million(d) E = $111.58 million; D = $88.42 millionAnswer: (d)43. Lenski Corporation has issued two types of securities: common stock (2 million

48、shares) and zero-coupon bonds with an aggregate face value of $95 million (95,000 bonds each with a face value of $1,000). Lenskis bonds mature one year from now. If we know that the total market value of Lenski Corporation is $200 million, the risk-free rate interest rate is 7% per year and the vol

49、atility of the firms asset value is 0.35, then what is the continuously compounded promised rate of interest on the debt?(a) 7.00% per year(b) 7.18% per year(c) 7.44% per year(d) 10.00% per yearAnswer: (b)Questions 44-40 refer to the following information:The Dolce Company is in the confectionary bu

50、siness, and has a total market value of $80 million. The corporation issues two types of securities: common stock (700,000 shares) and zero-coupon bonds (60,000 bonds each with a face value of $1,000). The bonds are considered to be default-free and mature in one year. The risk-free interest rate is

51、 5% per year and the volatility of the firms asset value is 0.3. 44. What is the market value of the firms equity?(a) $1.31 million(b) $22.93 million(c) $24.24 per year(d) $35.55 per yearAnswer: (c)45. What is the market value of the firms debt?(a) $44.45 million(b) $55.76 million(c) $57.07 million(

52、d) $60 millionAnswer: (b)46. What is the continuously compounded promised rate of interest on the debt?(a) 5.03% per year(b) 7.33% per year(c) 8.33% per year(d) 28.77% per yearAnswer: (b)47. Suppose that a bank undertakes to guarantee the debt of Dolce against default. What is the fair market value

53、of this guarantee?(a) $1.11 million(b) $1.21 million(c) $1.31 million(d) $3.50 millionAnswer: (c)48. In the United States, the largest provider of financial guarantees is _.(a) insurance companies(b) banks(c) government and government agencies(d) real estate investment trustsAnswer: (c)49. An implic

54、it guarantee is involved any time a loan is made and the fundamental identity is:(a) Risky Loan = Default-Free Loan + Loan Guarantee(b) Risky Loan = Default-Free Loan Loan Guarantee(c) Risky Loan = Default-Free Loan x Loan Guarantee(d) Risky Loan = Default-Free Loan / Loan guaranteeAnswer: (b)50. A

55、high-grade bond has a _ guarantee component, compared with a junk bond that typically has a _ component.(a) very small; large(b) large; very small(c) large; large(d) small; smallAnswer: (a)Shorter Problems1. Refer to the following table to answer this question.Listing of LePlastrier Options (symbol:

56、 LLB)(Prices listed are closing prices.)February 27, 2009CALLSStock Price on NYSEExercise PriceJanuaryFebruaryApril109.875109.875109.8751071101133.3750.6250.1255.6252.18750.8757.1254.8752.375PUTSStock Price on NYSEExercise PriceJanuaryFebruaryApril109.875109.875109.8751071101131.753.62593.3755.87510

57、5.8757.37511.75Answer the following questions:(a)For the call options, what happens to the option prices as the exercise price increases? The puts?(b)What is the price of a February LLB 110 put?(c)What is the option price of a January LLB 107 call?(d)What is the tangible value of an April LLB 113 pu

58、t?(e)What is the tangible value of a February LLB 110 call?(f)In what state is the January LLB 113 call?(g)In what state is the April LLB 110 put?Answer:(a)For call options, we notice that as the exercise price increases, the price of the call decreases. For the put options, we notice that as the ex

59、ercise price increases, the price of the put increases.(b)February LLB 110 put: = $5.875(c)January LLB 107 call:= $3.375(d)The April LLB 113 put is in the money.Tangible value= $113.00 $109.875 = $3.125(e)The February LLB 110 call is out of the money, so its tangible value is zero.(f)January LLB 113

60、 call:Strike price Stock price, so this option is out of the money.(g)April LLB 110 put:Strike price Stock price, so this option is in the money.2. Is it possible to insure against downside price risk? If so, describe how you would achieve this.Answer:Yes it is. Buy a share of stock and a put option. Such an approach is called a protective put strategy.3. The stock of LaDolce Vita Ltd, currently lists for $350.00 a share, while one-ye

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。