厦门钨业(600549)重大事项点评:收购钨矿股权,保障资源供应130207

厦门钨业(600549)重大事项点评:收购钨矿股权,保障资源供应130207

《厦门钨业(600549)重大事项点评:收购钨矿股权,保障资源供应130207》由会员分享,可在线阅读,更多相关《厦门钨业(600549)重大事项点评:收购钨矿股权,保障资源供应130207(7页珍藏版)》请在装配图网上搜索。

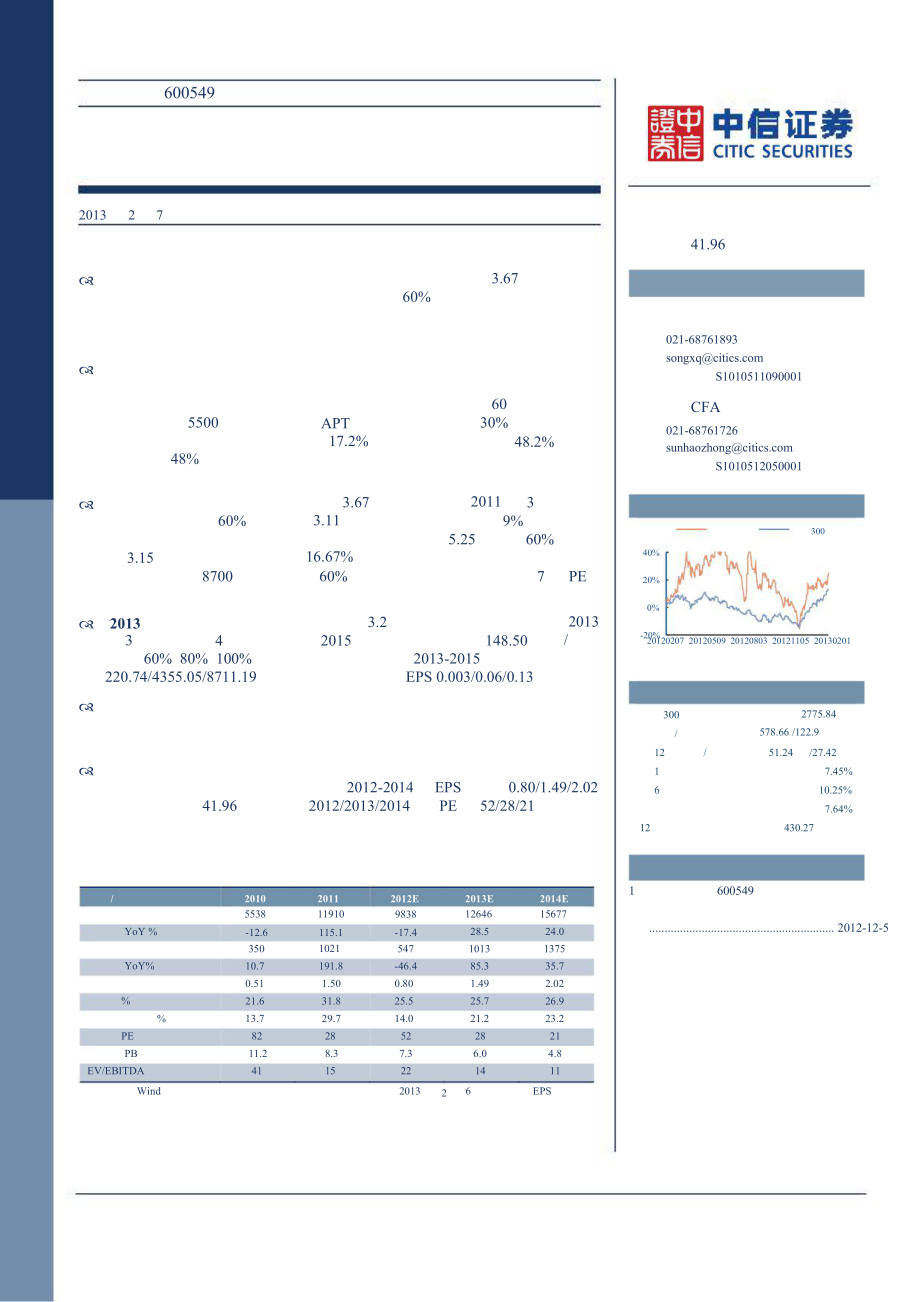

1、-20%/6/60054920132760%3.676041.96021-S1010511090001CFA550048%APT17.2%3.6730%201148.2%3021-S10105120500013.1560%3.1116.67%5.259%60%40%300870060%7PE20% 20133420153.2148.502013/0%20120207 20120509 20120803 20121105 2013020160% 80% 100%220.74/4355.05/8711.192013-2015EPS 0.003/0.06/0.133002775.84578.66 /

2、122.91251.24/27.4217.45%2012-2014EPS0.80/1.49/2.0210.25%41.962012/2013/2014PE52/28/217.64%12430.27201055382011119102012E98382013E126462014E156771600549YoY %YoY%PEPBEV/EBITDAWind-12.635010.70.5121.613.78211.241115.11021191.81.5031.829.7288.315-17.4547-46.40.8025.514.0527.3222013228.5101385.31.4925.72

3、1.2286.014624.0137535.72.0226.923.2214.811EPS. 2012-12-5600459APT1615500APT1.775005000200030001.225000.52011119.152%47%2201116%32011, 15.6%,32%wind52%,37.3%wind47.1%160045920288114659.309.6471733223.12.71.9965760.21%10.31WO3MoMoWO32,5822,0784,65949,01247,41496,4260.21%4500/7,1737,1730.02%1,4251,7993

4、,2248,22111,64519,8660.06%2010116,5766,5760.02%201341313.2148.50/2015201332650148.5*0.21%*85%=265020133/4 *60% 20141193 2120 265080% 2015100%220.742013-20154,355.058,711.1998.95%60%60550017.2%APT1.748.2%30%48%26010.317.2%5500815048.2%30%48%18%2012112327600459201212314.3884541.270.8454-1.27+5.67=5.25

5、5.673.685379.89%9.66/2011316.473.67/60%9%3.1146.125.2516.67%870060%PE 3.67/8700*60%=7200reo8.410070%71360/43/201310001001000606001004530201251%51%51%*60%51%*60%770%3212012430102 0304050607080910111201/6004592012PMI4 20121400001350001300001250001200001150001100001050001000005 201255000050000045000040

6、0000350000300000060708091011120102wind2013-2015wind0.003/0.06/0.132012/2013/2014EPS0.80/1.49/2.0220111.5041.962012/2013/2014PE52/28/21460045920105,5384,34121.63%821091.96%3085.57%771.40%762811.33%31765213720.98%1663506.32%0.51201111,9108,12231.81%7491461.22%5214.37%1581.33%192,15518.09%54622,1476543

7、0.46%4721,0218.57%1.502012E9,8387,32925.50%4921181.20%4434.50%920.94%01,27612.97%35201,29138730.00%3575475.56%0.802013E12,6469,40325.65%1901521.20%5694.50%1851.46%02,13616.89%35202,15164530.00%4921,0138.01%1.492014E15,67711,46026.90%2351881.20%7054.50%1791.14%02,90118.51%35202,91687530.00%6661,3758.

8、77%2.0220107365,8399811,1218,6772,3221012296433,29511,9721,3399535,3997,691421361787,8706827604,10320115075,4951,2511,1398,3932,6701782481,1674,26312,6561,4711,2074,0386,7166901988877,6036827565,0522012E3944,7559051,0917,1442,9211782481,2324,57911,7238901,0992,9704,9596901988875,8476827565,8762013E5

9、066,0991,1761,4019,1823,1951782481,1834,80413,9861,0981,4103,3605,8696901988876,7566827567,2302014E6277,4341,4741,72211,2563,3081782481,1424,87616,1326931,7193,7676,1806901988877,0676827569,0651,54611,9721,61212,6561,96811,7232,46113,9863,12716,132201020112012E2013E2014E3501,0215471,0131,37520102011

10、2012E2013E2014E166472357492666202-12276243-2,474248212-129183254-1,237197286-1,245187-12.6-8.410.7115.1243.4191.8-17.4-40.8-46.428.567.585.324.035.835.7671-4901,1697201,269%-51726121-1,09312-90-528000-479000-357000%EBIT Margin %EBITDAMargin %21.612.616.36.331.819.922.08.625.514.817.05.625.718.520.58

11、.026.919.721.58.8-388-1,181-528-479-357%04901,7770-58102080-405%13.73.429.79.514.05.321.29.523.211.2-258-374-82-152-206%-482-692-409381,442-229-92-755-113-185-129112-179-790121%65.721.026.560.130.59.149.930.09.148.330.010.143.830.010.15-“”Analyst CertificationiiiThe analysts primarily responsible fo

12、r the preparation of all or part of the research report contained herein hereby certify that: (i)the views expressed in this research report accurately reflect the personal views of each such analyst about the subject securities and issuers; and (ii)no part of the analysts compensation was, is, or w

13、ill be directly or indirectly, related to the specific recommendations or views expressed in thisresearch report.“”/()(1)(2)/2013130020%63005%20%263006300300300300300300-10% 5%10%10%-10% 10%10%481568811001252220012251804826Foreign Broker-Dealer Disclosures for Distributing to the U.S.This report has

14、 been produced in its entirety by CITIC Securities Limited Company (“CITIC Securities”, regulated by the China Securities RegulatoryCommission. Securities Business License Number: Z20374000). This report is being distributed in the United States by CITIC Securities pursuant to Rule15a-6(a) (2) under the U.S. Securities Exchange Act of 1934 exclusively to “major U.S. institutional investors” as defined in Rule 15a-6 and the SEC no-actionletters thereunder.Z203740001934“”15a-6(a) (2)15a-6

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。