DBTODAYGLOBALMACROTHURSDAY24THJANUARY0125

DBTODAYGLOBALMACROTHURSDAY24THJANUARY0125

《DBTODAYGLOBALMACROTHURSDAY24THJANUARY0125》由会员分享,可在线阅读,更多相关《DBTODAYGLOBALMACROTHURSDAY24THJANUARY0125(24页珍藏版)》请在装配图网上搜索。

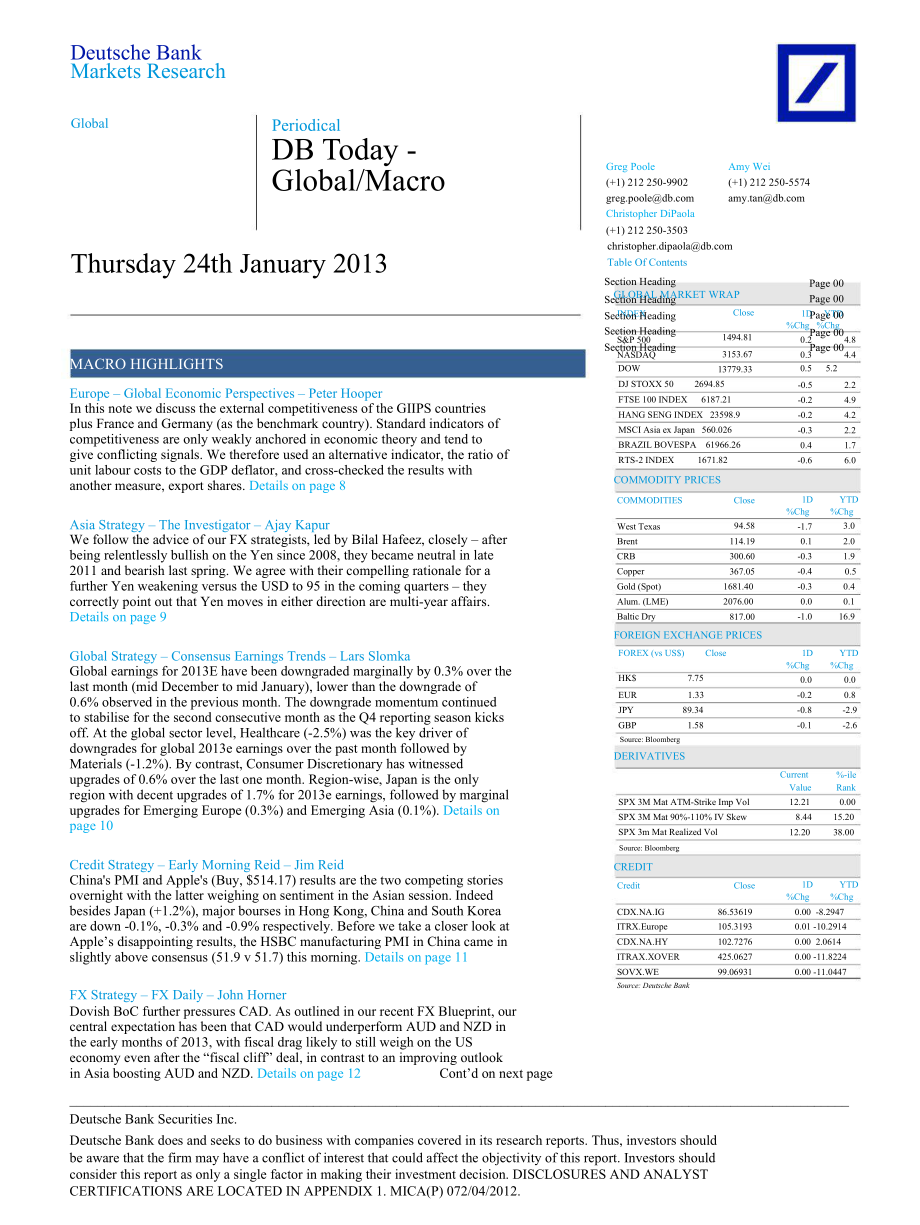

1、Section HeadingINDEXS&P 500NASDAQ1D YTD0.24.80.34.4-0.6-0.5-0.2-0.2-0.30.41.72.26.04.94.22.2Deutsche BankMarkets ResearchGlobalPeriodicalDB Today -Global/MacroGreg Poole(+1) 212 250-Christopher DiPaola(+1) 212 250-3503Amy Wei(+1) 212 250-Thursday 24th January Table Of ContentsSection HeadingGLOBAL M

2、ARKET WRAPPage 00Page 00MACRO HIGHLIGHTSSection HeadingSection HeadingSection HeadingDOWClose1494.813153.6713779.33Page 00%Chg %ChgPage 00Page 000.5 5.2Europe Global Economic Perspectives Peter HooperIn this note we discuss the external competitiveness of the GIIPS countriesplus France and Germany (

3、as the benchmark country). Standard indicators ofcompetitiveness are only weakly anchored in economic theory and tend togive conflicting signals. We therefore used an alternative indicator, the ratio ofunit labour costs to the GDP deflator, and cross-checked the results withanother measure, export s

4、hares. Details on page 8DJ STOXX 50 2694.85FTSE 100 INDEX 6187.21HANG SENG INDEX 23598.9MSCI Asia ex Japan 560.026BRAZIL BOVESPA 61966.26RTS-2 INDEX 1671.82COMMODITY PRICESCOMMODITIESClose1D%ChgYTD%ChgAsia Strategy The Investigator Ajay KapurWe follow the advice of our FX strategists, led by Bilal H

5、afeez, closely afterbeing relentlessly bullish on the Yen since 2008, they became neutral in late2011 and bearish last spring. We agree with their compelling rationale for afurther Yen weakening versus the USD to 95 in the coming quarters theycorrectly point out that Yen moves in either direction ar

6、e multi-year affairs.Details on page 9West TexasBrentCRBCopperGold (Spot)Alum. (LME)Baltic Dry94.58114.19300.60367.051681.402076.00817.00-1.70.1-0.3-0.4-0.30.0-1.03.02.01.90.50.40.116.9FOREIGN EXCHANGE PRICESGlobal Strategy Consensus Earnings Trends Lars SlomkaGlobal earnings for 2013E have been dow

7、ngraded marginally by 0.3% over thelast month (mid December to mid January), lower than the downgrade of0.6% observed in the previous month. The downgrade momentum continuedto stabilise for the second consecutive month as the Q4 reporting season kicksoff. At the global sector level, Healthcare (-2.5

8、%) was the key driver ofdowngrades for global 2013e earnings over the past month followed byMaterials (-1.2%). By contrast, Consumer Discretionary has witnessedupgrades of 0.6% over the last one month. Region-wise, Japan is the onlyregion with decent upgrades of 1.7% for 2013e earnings, followed by

9、marginalupgrades for Emerging Europe (0.3%) and Emerging Asia (0.1%). Details onpage 10FOREX (vs US$) CloseHK$ 7.75EUR 1.33JPY 89.34GBP 1.58Source: BloombergDERIVATIVESSPX 3M Mat ATM-Strike Imp VolSPX 3M Mat 90%-110% IV SkewSPX 3m Mat Realized Vol1D%Chg0.0-0.2-0.8-0.1CurrentValue12.218.4412.20YTD%Ch

10、g0.00.8-2.9-2.6%-ileRank0.0015.2038.00Source: BloombergCredit Strategy Early Morning Reid Jim ReidCREDITChinas PMI and Apples (Buy, $514.17) results are the two competing storiesovernight with the latter weighing on sentiment in the Asian session. IndeedCreditClose1D%ChgYTD%Chgbesides Japan (+1.2%),

11、 major bourses in Hong Kong, China and South Koreaare down -0.1%, -0.3% and -0.9% respectively. Before we take a closer look atApples disappointing results, the HSBC manufacturing PMI in China came inslightly above consensus (51.9 v 51.7) this morning. Details on page 11FX Strategy FX Daily John Hor

12、nerCDX.NA.IGITRX.EuropeCDX.NA.HYITRAX.XOVERSOVX.WESource: Deutsche Bank86.53619105.3193102.7276425.062799.069310.00 -8.29470.01 -10.29140.00 2.06140.00 -11.82240.00 -11.0447Dovish BoC further pressures CAD. As outlined in our recent FX Blueprint, ourcentral expectation has been that CAD would underp

13、erform AUD and NZD inthe early months of 2013, with fiscal drag likely to still weigh on the USeconomy even after the “fiscal cliff” deal, in contrast to an improving outlookin Asia boosting AUD and NZD. Details on page 12Contd on next page_Deutsche Bank Securities Inc.Deutsche Bank does and seeks t

14、o do business with companies covered in its research reports. Thus, investors shouldbe aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors shouldconsider this report as only a single factor in making their investment decision. DISCLOSURES A

15、ND ANALYSTCERTIFICATIONS ARE LOCATED IN APPENDIX 1. MICA(P) 072/04/2012.KatkarBloomfield24 January 2013DB Today - Global/MacroMACRO HIGHLIGHTSCommodities Global Commodities Daily Christina McGloneIn agriculture, sugar bounced off of recent lows. The strength could be a reflection of a drop in the pr

16、ojected sugarallocation of the upcoming 2013/14 Brazilian sugarcane harvest, an increase in arrears by millers in India, as well aslower production in Thailand combined with the latters willingness to hold sugar off the market at a time of year whenthe country is typically a seasonal seller. Details

17、 on page 13Japan Economics Japan FI Morning Memo Makoto YamashitaFutures declined for the first time in three days on the 23rd. Futures had recently tested a rebound but opened lowerahead of the upcoming 20-year JGB auction. Futures fluctuated as investors refrained from trading cash JGBs, despitea

18、fall in Japanese stocks. The swap curve flattened. Details on page 14US Economics - US Daily Economics Note Joseph LaVorgnaOne of the most significant indirect effects from the housing recovery is the “wealth effect” on consumers due to therecovery in home prices. The wealth effect is multi-faceted:

19、 It is partly due to the psychological lift resulting from higherhome values, i.e. the perception of a stronger household balance sheet position actually supports spending. Moredirectly, price appreciation enables households to refinance debt, thereby reducing interest expenses, as well as tapinto h

20、ome equity via lines of credit or cash-out refinancing. Details on page 15KEY COMPANY RESEARCHASIAIndia Oil & Gas - HarshadThai Market Strategy - DerekFuel subsidy cut improves outlook for upstream, lower impact on downstream. Thegovernments bold move to deregulate bulk diesel sales and allow oil ma

21、rketing companies(OMCs - IOC, BPCL, HPCL) to raise the diesel price by up to INR0.5/lit will erase diesel lossesover the next three years. The fuel subsidy will halve over FY13-16e to INR636bn. Ourpreference for upstream (ONGC, Oil India) over OMCs as beneficiaries of fuel reforms ispremised on a up

22、stream and government compensating OMCs for fuel losses in full, b bulkdiesel sales deregulation reducing fuel losses by INR125bn p.a. (9% of fuel subsidy) and cmonthly diesel price rise reducing fuel losses by INR200bn p.a. (14% of fuel subsidy). Wereiterate Buy on OIL and ONGC and Sell on HPCL and

23、 BPCL. Details on page 16SET target 1,650 for end-2013, new high in 2014. The SET is near our previous year-end2013 target of 1,450, and we raise our target to 1,650 (13.8x PE FY14E) for 15% upside. Anew all-time high of 1,800a further 9% upsidelooks possible during 2014. Our top picksare CPALL, INT

24、UCH, CPN, KBANK, BAY, KTB, HEMRAJ, CPF, TOP and BANPU. Details onpage 17EUROPEEuropean Insurers - OliverSteelCapital Goods - MAN/VW -Jochen GehrkePage2Top-down and bottom-up reasons to stay positive. The surge in insurers share prices overthe last year inevitably invites profit-taking. However, in o

25、ur view, the sectors capitalposition is now overtly more robust and resilient than 12 months ago, capable of furtherorganic improvement in 2013e, with less macro tail-risk. In addition we see emergingevidence of EPS upgrades. On a 12% prospective cost of equity, a still attractive 5% 2013eyield and

26、with long bond rates beginning to rise (a key positive for the sector), we thinkinsurers can rise further over the year ahead. Details on page 18VW goes for a domination agreement of MAN. As announced on January 9th VW hasdecided to enter into negotiations with MAN regarding a domination agreement.

27、As VWsufficiently controls 75% of the votes at this stage, we see the procedure as a meretechnicality. In our view the MAN AGM on June 6th will most likely be used as the event tovote on this step, hence all terms must be available at least 6 weeks prior to this. Details onpage 19Deutsche Bank Secur

28、ities Inc.24 January 2013DB Today - Global/MacroNORTH AMERICAApple Inc - Chris WhitmoreMcDonalds - Jason WestAt a critical junction; cutting ests and PT to $575. AAPL reported revs of $54.5B and EPS of$13.81 which beat EPS expectations (vs. Street at $54.5B/$13.33; DB at $53.4B/$12.55).Upside was le

29、d by iPhone (48M vs. DB at 45M) and iPad (22.9M vs. DB at 22.0M) whichoffset light Mac results (4.1M vs. DB at 5.4M). Despite the EPS beat, AAPL revised itsguidance format and the combination of margin pressure and decelerating iPhone growthimplicit in guidance raises growth concerns. We reset estim

30、ates and cut our price target to$575. Trading at $460 in the aftermarket (7x PE ex cash) we view AAPL as undervalued;maintain Buy. Details on page 20Solid print likely good enough to meet elevated expectations. 4Q EPS came in at $1.38 vs.DBe $1.31 and consensus $1.33. Reasonably clean beat. Tax rate

31、 hurt by 2c, though offsetby +2c from Other Income. SG&A was 2c better than model; interest expense 1c better; non-operating expense hurt by 1c. Details on page 21Deutsche Bank Securities Inc.Page324 January 2013DB Today - Global/MacroTODAYS HEADLINESMarkets: The Canadian dollar underperformed on FX

32、 markets in the wake of a dovish BoC statement. The S&P 500 againpushed to new highs while Treasuries were little changed.US: FHFA House Price Index (Nov): Up 0.6%mom, a touch weaker than expected.UK: BOE minutes showed an 8-1 vote on keeping the size of asset purchase plan unchanged.UK: Jobless cla

33、ims down 12.1K to 1.56mn in Dec, lowest since June 2011.FRA: INSEE survey down 3pts to 86 in January, below mkt.CHN: HSBC PMI rises to 51.9 in January from 51.5 and above expectations of 51.7.THE DAY AHEAD.US: Initial Jobless Claims, Treasury Announcement 2 Yr./5 Yr./7 Yr, TIPS Auction 10 YrEMU: Man

34、uf. PMI (Jan A), Services PMI (Jan A)DEU: Manuf. PMI (Jan A), Services PMI (Jan A)FRA: Manuf. PMI (Jan P), Services PMI (Jan P)ESP: Unemployment Rate (Q4)SWE: PPI (Dec), Unemployment Rate (Dec)BEL: Business Confidence (Jan)Source: Excerpts from DB Daily published on 24 January 2013Page4Deutsche Bank

35、 Securities Inc.24 January 2013DB Today - Global/MacroFORECASTG7 Quarterly GDP growth% qoq saar/annual: % yoyUSJapanEurolandGermanyFranceItalyUKCanadaG7Q1 122.05.7-0.12.0-0.1-3.1-1.21.71.8Q2 121.3-0.1-0.71.1-0.2-2.9-1.51.70.4Q3 12F2.7-3.5-0.20.90.9-0.83.90.61.1Q4 12F1.3-1.2-1.7-1.2-1.2-2.3-0.62.10.1

36、20122.22.0-0.50.80.1-2.1-0.12.01.4Q1 13F1.51.2-0.50.0-0.7-1.20.62.20.9Q2 13F2.02.40.30.8-0.1-0.31.12.91.6Q3 13F2.82.60.91.60.30.61.43.22.2Q4 13F3.02.71.20.80.60.91.72.82.32013F1.90.6-0.30.3-0.3-0.90.92.31.22014F2.90.61.11.51.00.51.83.12.1Sources: National authorities, Deutsche BankCommoditiesUSDWTI

37、(bbl)Brent (bbl)US Natural Gas (mmBtu)GoldSilverQ1 1390.00108.003.80172533Q2 1395.00112.003.60182536Q3 13100.00115.003.70187538Q4 13100.00115.003.90195040201396.25112.503.751856372014103.25113.254.251900382015100.00110.004.50180036AluminiumUSc/lbUSD/t95.32100102.1225097.5215090.7200096.4212599.82200

38、99.82200Copper0USc/lbUSD/t372.18200385.78500363.08000353.97800368.68125340.37500328.97250Source: Deutsche Bank, Figures are period averagesCENTRAL BANK POLICYCurrentDec-12Mar-13Sept-13USEurolandJapanUKChinaIndia0 - 0.250.750.100.503.008.000 - 0.250.750.100.503.008.000 - 0.250.500.100.503.007.750 - 0

39、.250.500.100.503.007.00Deutsche Bank Securities Inc.Page5-24 January 2013DB Today - Global/MacroFORECAST - ContinuedFOREIGN EXCHANGE RATESCountriesSpot Rate3M6M12MUSEuroJapanUKSwitzerlandChinaDB US$ Index(Fwd. Rates)US$/Euro(Fwd. Rates)Yen/US$(Fwd. Rates)US$/(Fwd. Rates)Sfr/US$(Fwd. Rates)CNY/USD(Fw

40、d. Rates)66-1.3079.8-1.600.936.3466-1.351.3082781.611.620.900.936.356.3567-1.311.3084781.571.620.920.936.296.37701.241.3088781.521.620.990.936.166.41GOVERNMENT RATESCurrentQ4 2012Q1 2013Q3 2013US 10Y yield1.92.002.50EUR 10Y yield1.91.752.002.50Source: Deutsche BankINDEX FORECASTSCurrent2013DJ Stoxx

41、600FTSE 100DaxMSCI HKS&P 500Source: Deutsche BankPage628761547702130001486315657580001575Deutsche Bank Securities Inc.24 January 2013DB Today - Global/MacroTODAYS CONFERENCE CALLDateThursday, January 24th, 2013Time11:00am (ET)DescriptionRegulatory Update on Behavioral Health CareFacilities SectorHos

42、ted by: Darren LehrichDail-inUS: 800 309 8606Intl: +1 706 679 0645Conf ID: 92784475UPCOMING CONFERENCES/TRIPSDateJanuary 25, 2013January 28 2013January 29 - 31 2013February 6-7, 2013March 4 - 6, 2013March 4 - 6, 2013March 5, 2013March 5 - 6, 2013March 11 12, 2013March 13 - 15, 2013ConferencesDbAcces

43、s CEEMEA Conference LondonNorth American Equity Trading Conference Tarrytown, NYDbAccess Retail - 15th Annual Store Tour Liverpool and Chester2013 Market Outlook MadriddbAccess India Conference MumbaiDbAccess 21st Annual Media and Telecom Conference FloridaNew Zealand Corporate Day SydneyDbAccess Co

44、nsumer, Retail, Gaming and Lodging Conference BostondbAccess Australia Corporate Day in London LondonDeutsche Bank Hedge Fund Capital Group Bridging the Gap Conference Washington DCSource: Deutsche BankFor more details log on to Deutsche Bank Securities Inc.Page724 January 2013DB Today - Global/Macr

45、oGlobal EconomicCompetitiveness in EurolandPerspectivesIn this note we discuss the external competitiveness of the GIIPS countries plus France and Germany (as thebenchmark country). Standard indicators of competitiveness are only weakly anchored in economic theory and tendto give conflicting signals

46、. We therefore used an alternative indicator, the ratio of unit labour costs to the GDPdeflator, and cross-checked the results with another measure, export shares.Based on this approach we could identify improvements in competitiveness in the GIPS countries, but not in Italy andFrance. This suggests

47、 that the reduction in Italys current account deficit has been cyclical. The persistence of theFrench deficit is consistent with the lack of competitiveness and more robust domestic demand growth.Larger gains in competitiveness in the GIPS countries compared to France and Italy have also been associ

48、ated withlarger fiscal adjustment. This suggests that at least part of the negative output effects from fiscal adjustment arebeing countered by an improvement of exports.Our results also point to the need for further economic reform in France and Italy to raise competitiveness. De-regulation of the

49、labour market with a view to containing growth of unit wage costs would have to be supplementedwith de-regulation of product markets to increase competition and promote innovation. Without an improvement incompetitiveness, an increase of domestic demand (as it may arise in the case of Italy from an

50、improved creditimpulse) could be accompanied by a rise in net imports, inhibiting a recovery of GDP growth.Peter Hooper(+1) 212 250-Page8Deutsche Bank Securities Inc.24 January 2013DB Today - Global/MacroThe InvestigatorYen sentiment super-bearish; Buy domestics, sellexporters near termFX strategist

51、s fundamentally bearish on Yen-USD, 95 target by end-2013We follow the advice of our FX strategists, led by Bilal Hafeez, closely after being relentlessly bullish on the Yensince 2008, they became neutral in late 2011 and bearish last spring. We agree with their compelling rationale for afurther Yen

52、 weakening versus the USD to 95 in the coming quarters they correctly point out that Yen moves ineither direction are multi-year affairs.Our Yen Risk-Love model shows egregious bearish sentiment on the Yen; expect a contrarian reversalThe Daily Sentiment Index on the Yen was plumbing depths of pessi

53、mism, and has begun curling up in the past fewdays. The Market Vane bulls on the Yen have fallen to less than 20%, while a similar pessimism over the Yen is seenin the Consensus Inc. data. “Commercial” or “fundamental” investors are going long the Yen, while wrong-way smalltraders have recorded shor

54、t positions. 70% of the time from these levels of Yen pessimism, the currency will actuallyappreciate in the next six months.Short-term Trade I: Buy low operating leverage, low Yen/USD-sensitive sectors in JapanOur short-term view is to buy the low operating leverage, low Yen/USDsensitive sectors li

55、ke food/beverages/tobacco,pharma, utilities, household products, consumer services and food/staples retailing collectively, they were up only15% since the Topix Index lows on 14 November 2012. We think profits should be taken in the high operatingleverage/high Yen-sensitive sectors like tech hardwar

56、e, consumer durables, transportation, capital goods, materialsand semis these were collectively up 27% from recent market lows. In addition, profit-taking in Japanese financials banks, real estate, diversified financials and insurance were up 32% from market lows. They are supersensitive tothe Yen-U

57、SD rate, rising during Yen weakness, and vice versa.Short-term Trade II: Buy Korean exporters, Sell domesticsKorean domestic sectors outperform Korean exporters when the Yen weakens, as seen recently they haveoutperformed by 18% since the Yen hit its peak strength on 27 September 2012. While the Yen

58、-USD rate is only onefactor affecting this trade, it is the salient one. We recommend simply reversing this trade buy the exporters and sellthe domestics.Ajay Kapur(+852) 2203 Deutsche Bank Securities Inc.Page924 January 2013DB Today - Global/MacroConsensus Earnings Stabilising revisions as Q4 repor

59、ting kicks offTrendsThis monthly note contains the most up-to-date consensus earnings developments for regions, countries and sectorsby region. It covers European sectors in more detail and contains data for European Stoxx 600 companies.Global earnings for 2013E have been downgraded marginally by 0.

60、3% over the last month (mid December to midJanuary), lower than the downgrade of 0.6% observed in the previous month. The downgrade momentum continuedto stabilise for the second consecutive month as the Q4 reporting season kicks off. At the global sector level,Healthcare (-2.5%) was the key driver o

61、f downgrades for global 2013e earnings over the past month followed byMaterials (-1.2%). By contrast, Consumer Discretionary has witnessed upgrades of 0.6% over the last one month.Region-wise, Japan is the only region with decent upgrades of 1.7% for 2013e earnings, followed by marginalupgrades for

62、Emerging Europe (0.3%) and Emerging Asia (0.1%).In Europe, Stoxx600 earnings for 2013E have been downgraded by 0.5% (3.4%) over the last one (three) month(s)indicating stabilising downward revision momentum. Also, the company revision ratio (no. of upgrades lessdowngrades relative to the total no. o

63、f up-/ and downgrades) declined from -0.30 observed last month to -0.23,although it remains in negative territory. According to our estimates, European Q4 beat ratio could be at least in linewith Q3 when 55% of the companies reported better-than-expected results. The improvements in PMI and firmergl

64、obal economy also points to a decent outcome. And if our estimate holds true, then the earnings revisionmomentum should further stabilise or improve and we have already started witnessing an initial trend in this direction(please refer to “Q4 Reporting Preview - A better season in prospect” publishe

65、d on 22 January 2013 for more details).Among European countries, all the major countries such as Germany, the UK, France, Switzerland, Italy and Spainhave witness revisions in the narrow band of -0.1% to -0.5%. By contrast, Finland (2.0%) and Greece (1.3%) havewitnessed strongest upgrades, while Por

66、tugal (-1.7%) and Belgium (-1.3%) saw strongest downgrades.Among European sectors, Basic Resources and Automobiles have witnessed strongest downgrades to their 2013eearnings with both falling by 1.1% over the last one month. By contrast, Technology (+0.4%) and Personal &Household Goods (+0.1%) were the only sectors with upgrades over the last month, although marginal.Lars Slomka(+49) 69 910-Page10Deutsche Bank Securities Inc.24 January 2013DB Today - Global/MacroMacro StrategyEarly Morning ReidC

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 2020【企业咨询】行业前景分析投资调研课件

- 2020、6《民法典》资深律师解读宣讲课件

- 2020《推广普通话主题班会》课件

- 1205史剑波《纪昌学射》教学ppt课件

- 1981-1990诺贝尔生理或医学奖课件

- 2020【CDMO】行业前景分析投资调研课件

- 2020-2021年A股投资策略报告课件

- 2020【自助售货机】行业前景分析投资调研课件

- 刘姥姥进大观园PPT部编版9上课件

- 2020-2021年创新说课大赛获奖作品:教师说课比赛:等差数列课件

- 婚姻家庭与继承法课件

- 2020-2021年85、95后宝妈人群洞察课件

- 青少年的同伴关系

- 2020-2021年创新说课大赛获奖作品:教师说课比赛:等差数列的前n项和课件

- 青少年用眼健康知识讲解