CHINAIPPS:DIVINGINTODATAPOINTSAMIDINDUSTRYUPCYCLE1026

CHINAIPPS:DIVINGINTODATAPOINTSAMIDINDUSTRYUPCYCLE1026

《CHINAIPPS:DIVINGINTODATAPOINTSAMIDINDUSTRYUPCYCLE1026》由会员分享,可在线阅读,更多相关《CHINAIPPS:DIVINGINTODATAPOINTSAMIDINDUSTRYUPCYCLE1026(20页珍藏版)》请在装配图网上搜索。

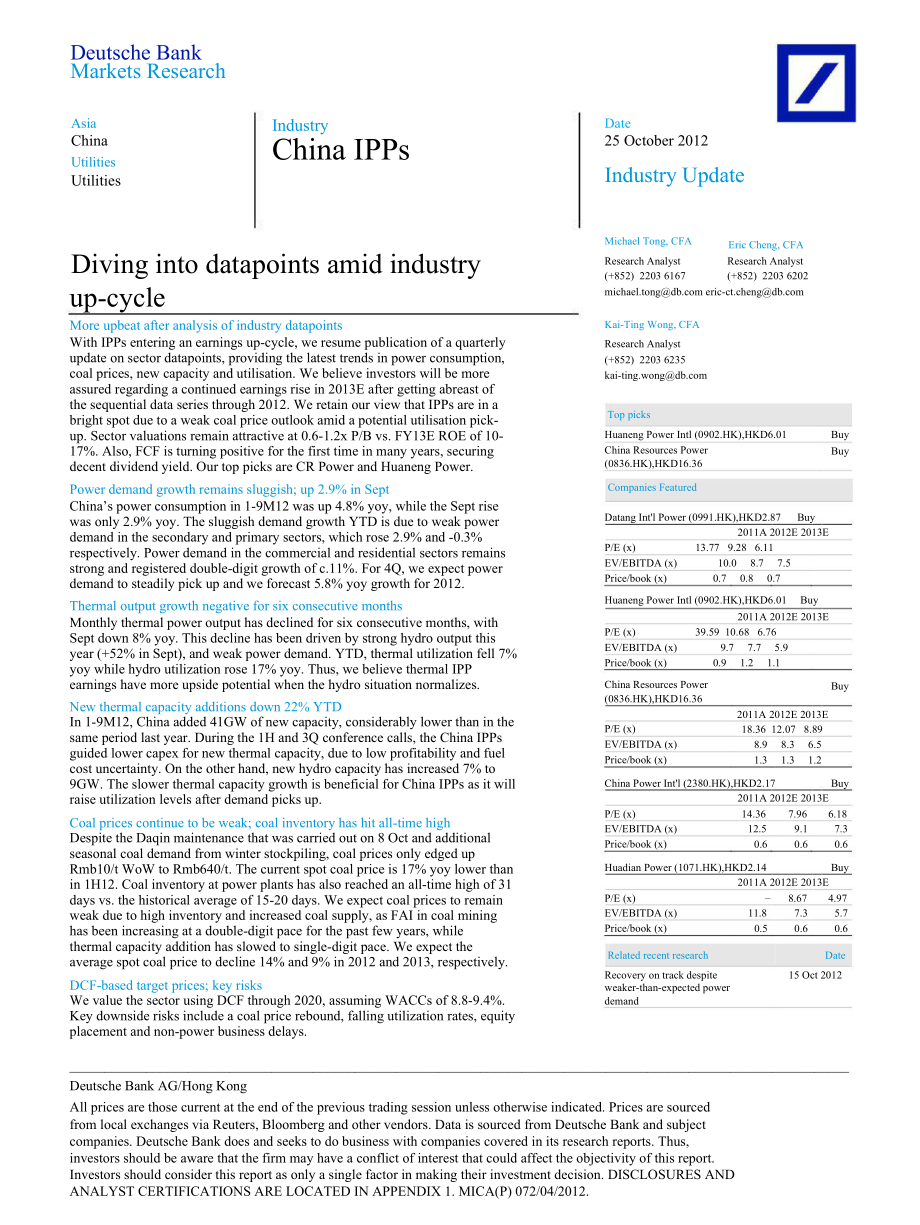

1、Top picksBuyBuyBuyBuyBuyDatedemandDeutsche BankMarkets ResearchAsiaChinaUtilitiesUtilitiesIndustryChina IPPsDate25 October 2012Industry UpdateMichael Tong, CFAEric Cheng, CFADiving into datapoints amid industryResearch Analyst(+852) 2203 6167Research Analyst(+852) 2203 6202up-cycleMore upbeat after

2、analysis of industry datapointsWith IPPs entering an earnings up-cycle, we resume publication of a quarterlyupdate on sector datapoints, providing the latest trends in power consumption,coal prices, new capacity and utilisation. We believe investors will be moreassured regarding a continued earnings

3、 rise in 2013E after getting abreast ofthe sequential data series through 2012. We retain our view that IPPs are in abright spot due to a weak coal price outlook amid a potential utilisation pick-up. Sector valuations remain attractive at 0.6-1.2x P/B vs. FY13E ROE of 10-17%. Also, FCF is turning po

4、sitive for the first time in many years, securingdecent dividend yield. Our top picks are CR Power and Huaneng Power.Power demand growth remains sluggish; up 2.9% in SeptChinas power consumption in 1-9M12 was up 4.8% yoy, while the Sept risewas only 2.9% yoy. The sluggish demand growth YTD is due to

5、 weak powerdemand in the secondary and primary sectors, which rose 2.9% and -0.3%respectively. Power demand in the commercial and residential sectors remainsstrong and registered double-digit growth of c.11%. For 4Q, we expect powerdemand to steadily pick up and we forecast 5.8% yoy growth for 2012.

6、Thermal output growth negative for six consecutive monthsMonthly thermal power output has declined for six consecutive months, withSept down 8% yoy. This decline has been driven by strong hydro output thisyear (+52% in Sept), and weak power demand. YTD, thermal utilization fell 7%yoy while hydro uti

7、lization rose 17% yoy. Thus, we believe thermal IPPearnings have more upside potential when the hydro situation eric-Kai-Ting Wong, CFAResearch Analyst(+852) 2203 6235kai-Huaneng Power Intl (0902.HK),HKD6.01China Resources Power(0836.HK),HKD16.36Companies FeaturedDatang Intl Power (0991.HK),HKD2.87

8、Buy2011A 2012E 2013EP/E (x) 13.77 9.28 6.11EV/EBITDA (x) 10.0 8.7 7.5Price/book (x) 0.7 0.8 0.7Huaneng Power Intl (0902.HK),HKD6.01 Buy2011A 2012E 2013EP/E (x) 39.59 10.68 6.76EV/EBITDA (x) 9.7 7.7 5.9Price/book (x) 0.9 1.2 1.1China Resources PowerNew thermal capacity additions down 22% YTDIn 1-9M12

9、, China added 41GW of new capacity, considerably lower than in thesame period last year. During the 1H and 3Q conference calls, the China IPPsguided lower capex for new thermal capacity, due to low profitability and fuelcost uncertainty. On the other hand, new hydro capacity has increased 7% to(0836

10、.HK),HKD16.36P/E (x)EV/EBITDA (x)Price/book (x)2011A 2012E 2013E18.36 12.07 8.898.9 8.3 6.51.3 1.3 1.29GW. The slower thermal capacity growth is beneficial for China IPPs as it willraise utilization levels after demand picks up.China Power Intl (2380.HK),HKD2.172011A 2012E 2013ECoal prices continue

11、to be weak; coal inventory has hit all-time highDespite the Daqin maintenance that was carried out on 8 Oct and additionalseasonal coal demand from winter stockpiling, coal prices only edged upP/E (x)EV/EBITDA (x)Price/book (x)14.3612.50.67.969.10.66.187.30.6Rmb10/t WoW to Rmb640/t. The current spot

12、 coal price is 17% yoy lower thanin 1H12. Coal inventory at power plants has also reached an all-time high of 31Huadian Power (1071.HK),HKD2.142011A 2012E 2013Edays vs. the historical average of 15-20 days. We expect coal prices to remainweak due to high inventory and increased coal supply, as FAI i

13、n coal mininghas been increasing at a double-digit pace for the past few years, whileP/E (x)EV/EBITDA (x)Price/book (x)11.80.58.677.30.64.975.70.6thermal capacity addition has slowed to single-digit pace. We expect theaverage spot coal price to decline 14% and 9% in 2012 and 2013, respectively.Relat

14、ed recent researchDCF-based target prices; key risksRecovery on track despiteweaker-than-expected power15 Oct 2012We value the sector using DCF through 2020, assuming WACCs of 8.8-9.4%.Key downside risks include a coal price rebound, falling utilization rates, equityplacement and non-power business

15、delays._Deutsche Bank AG/Hong KongAll prices are those current at the end of the previous trading session unless otherwise indicated. Prices are sourcedfrom local exchanges via Reuters, Bloomberg and other vendors. Data is sourced from Deutsche Bank and subjectcompanies. Deutsche Bank does and seeks

16、 to do business with companies covered in its research reports. Thus,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES

17、 ANDANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MICA(P) 072/04/2012.Jan/11Feb/11Mar/11Apr/11May/11Jun/11Jul/11Aug/11Sep/11Oct/11Nov/11Dec/11Jan/12Feb/12Mar/12Apr/12May/12Jun/12Jul/12Aug/12Sep/12Jan-11Feb-11Mar-11Apr-11May-11Jun-11Jul-11Aug-11Sep-11Oct-11Nov-11Dec-11Jan-12Feb-12Mar-12Apr-12May-

18、12Jun-12Jul-12Aug-12Sep-121-2M10Mar-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-101-2M11Mar-11Apr-11May-11Jun-11Jul-11Aug-11Sep-11Oct-11Nov-11Dec-111-2M12Mar-12Apr-12May-12Jun-12Jul-12Aug-12Sep-1225 October 2012UtilitiesChina IPPsMonthly power sector updatePower consumption remains weak; u

19、p 2.9% yoy in SeptAccording to the CEC, Chinas power consumption increased 2.9% yoy in Sept2012. Since April, Chinas power consumption growth has remained at lessthan 6% yoy, vs. its double-digit growth in 2011. In 1-9M12, power demandwas up 4.8% yoy.Decoding by source of consumption, primary indust

20、ry demand growth wasweakest, at -0.3% in 1-9M12, followed by secondary industry at a mere 2.9%yoy. Commercial and residential demand remains strong and was up 11.3%and 11.6% yoy, respectively.We project 5.8% yoy growth for 2012, and 8.6% yoy growth for 2013.Figure 1: Monthly power consumption totalF

21、igure 2: Monthly power consumption industrial500Total (bn kWh)YoY growth30%400Industry (bn kWh)yoy30%450400350300250200Source: Deutsche Bank, Wind25%20%15%10%5%0%350300250200150100500Source: Deutsche Bank, Wind25%20%15%10%5%0%-5%Figure 3: Monthly yoy power consumption growth rate by industryYTD, res

22、idential and35%IndustryResidentialCommercialcommercial power usages30%have been more resilientthan industrial usage.25%20%15%10%5%0%Source: Deutsche Bank, WindPage 2Deutsche Bank AG/Hong KongDec-03Mar-04Jun-04Sep-04Dec-04Mar-05Jun-05Sep-05Dec-05Mar-06Jun-06Sep-06Dec-06Mar-07Jun-07Sep-07Dec-07Mar-08J

23、un-08Sep-08Dec-08Mar-09Jun-09Sep-09Dec-09Mar-10Jun-10Sep-10Dec-10Mar-11Jun-11Sep-11Dec-11Mar-12Jun-12Sep-12InnerMongoliaHubeiLiaoningZhejiangHainanHunanHenanFujianShanghaiGuangxiHeilongjiangGuangdongShandongChongqingGuizhouXinjiangTianjinShanxiGansuShaanxiNingxiaSichuanAnhuiTibetQinghaiYunnanJiangxi

24、JiangsuBeijingHebeiJilin2.513%25 October 2012UtilitiesChina IPPsFigure 4: Power consumption growth vs. GDP growth (quarterly)The elasticity ratio has2.01.51.00.5Elasticity of Electricity production growthGDP growthElectricity Production Growth30%25%20%15%10%5%declined significantly thisyear to 0.7x

25、in 1-3Q12. Weexpect elasticity to return to1.0 x in 2013E as industrialsector activity picks up.0%0.0-0.5Source: Deutsche Bank, WindFigure 5: Power generation growth by province (1-9M12)30%25%20%-5%-10%25%23%15%10%5%1% 1% 1% 2%2% 2% 3% 3%5% 5% 5% 5%6% 7% 7% 8% 8%10%11%0%-5%-10%-7%-6% -4%-4%-3% -3% -

26、2%0%-15%-10%Source: Deutsche Bank, WindPower generation growth is highest in the western provinces, such as Qinghaiand Xinjiang, due in part to Chinas western development strategy and tomanufacturing relocations.Power generation growth in the coastal regions has been relatively weak, withnegative gr

27、owth for Shanghai, Tianjin and Zhejiang due to weak exportdemand.Chinas power consumption mix continues to be dominated by secondaryindustry, accounting for 73% of total demand in 1-9M12 (Figure 5).Chinas power generation continues to be mainly dominated by coal-firedgeneration, accounting for 79% o

28、f 1-9M12 output.Deutsche Bank AG/Hong KongPage 3Jan-95Jul-95Jan-96Jul-96Jan-97Jul-97Jan-98Jul-98Jan-99Jul-99Jan-00Jul-00Jan-01Jul-01Jan-02Jul-02Jan-03Jul-03Jan-04Jul-04Jan-05Jul-05Jan-06Jul-06Jan-07Jul-07Jan-08Jul-08Jan-09Jul-09Jan-10Jul-10Jan-11Jul-11Jan-12Jul-12Jan-11Jan-12Jan-09Jan-10Jul-09Jul-10

29、Jul-11Sep-09Sep-10Sep-11Jul-12May-09May-10May-11May-12Sep-12Nov-09Nov-10Nov-11Mar-09Mar-10Mar-11Mar-12Jul-09Jul-10Jul-11Jan-09Jan-10Jan-11Sep-11Jan-12Sep-09Nov-09Sep-10Nov-10Nov-11Mar-12Mar-09Mar-10Mar-11Jul-12May-09May-10May-11May-12Sep-1225 October 2012UtilitiesChina IPPsFigure 6: Power consumptio

30、n mix (1-9M12)Figure 7: Power generation mix (1-9M12)Residential13%Primaryindustry2%Nuclear2%Others3%Hydro16%Commercial12%SecondarySource: Deutsche Bank, CEICPower generationFigure 8: Monthly power generationindustry73%Thermal79%Source: Deutsche Bank, Windbn kWh500450400350300250200150100500Source:

31、Deutsche Bank, China Electricity CouncilPower generationyoy (%)40%30%20%10%0%-10%-20%Figure 9: Thermal generation outputFigure 10: Hydro generation output500450400350300250200150100500Thermal (bn kWh)YoY (%)50403020100-10-201009080706050403020100Hydro (bn kWh)YoY (%)6050403020100-10-20-30Source: Deu

32、tsche Bank, China Electricity CouncilPage 4Source: Deutsche Bank, China Electricity CouncilDeutsche Bank AG/Hong KongJul-09Aug-09Sep-09Oct-09Nov-09Dec-09Jan-Feb10Mar-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10Jan-Feb11Mar-11Apr-11May-11Jun-11Jul-11Aug-11Sep-11Oct-11Nov-11Dec-11Jan-Feb12

33、Mar-12Apr-12May-12Jun-12Jul-12Aug-12Sep-121-2M091-3M121-9M081-4M091-6M091-8M091-3M101-5M101-7M101-9M101-2M111-4M111-6M111-8M111-5M121-7M121-11M081-10M091-12M091-11M101-10M111-12M111-9M122015105025 October 2012UtilitiesChina IPPsThermal power generation continues to be very weak, and has experiencedn

34、egative growth for six consecutive months. In Sept, thermal power outputwas down 8% yoy.The weak thermal generation in the past few months was largely due to thesignificant increase in hydro generation this year. As a result, some of thethermal plants in the rich hydro provinces, such as Hunan, Yunn

35、an, andChongqing, are making losses.New capacityFigure 11: Monthly new installed capacity (May 2009 to Sept 2012)41GW of new capacity wasTotal new capacityHydroCoaladded in 1-9M12, muchlower than 1-9M11s3049.6GW.25Thermal and hydro installedcapacity increased by25.8GW and 9.4GW,respectively.The ther

36、mal capacityaddition was 22% lowerSource: Deutsche Bank, CEICFigure 12: Accumulative newly installed capacitythan the same period lastyear while hydro was 7%higher.Total new capacityHydroCoal120100806040200Source: Deutsche Bank, CEICCoal power plants accounted for 72% of Chinas total installed capac

37、ity in 1-9M12 (Figure 13).However, the mix is changing, with more investment being poured intorenewable energy, such as wind, solar and hydro.Deutsche Bank AG/Hong KongPage 5Apr-08Apr-09Apr-10Apr-11Apr-12Jan-11Jan-08Jan-09Jan-10Jan-12Jul-08Jul-09Jul-10Jul-11Oct-08Oct-09Oct-10Oct-11Jul-1225 October 2

38、012UtilitiesChina IPPsFigure 13: 1-9M12 installed capacity mixFigure 14: 1-9M newly installed capacity mixWind4%Others2%Wind,13%Others,2%Thermal72%Source: Deutsche Bank, CEICUtilization rateFigure 15: Average utilization aggregatedHydro22%Thermal,62%Source: Deutsche Bank, CEICHydro,23%National utili

39、zation rate:52% in 1-9M12 vs. 51%, 54%57%20082009201020112012and 55% during the same55%53%51%49%47%45%period in 2009, 2010, and2011, respectively.1-2M1-3M1-4M1-5M1-6M1-7M1-8M1-9M1-10M1-11M1-12MSource: Deutsche Bank, WindFigure 16: Utilization rate trend (single month)70%60%50%40%30%20%10%0%ThermalHy

40、droThere is a strong seasonalityin hydro power utilizationthroughout the year.The hydro utilization rate inSept 2012 was 56.7%, muchhigher than in previousyears.Source: Deutsche Bank, WindPage 6Deutsche Bank AG/Hong KongMaySepMarNovAugDecJunFebJanAprOctJulJan-09Mar-09May-09Jul-09Sep-09Nov-09Jan-10Ma

41、r-10May-10Jul-10Sep-10Nov-10Jan-11Mar-11May-11Jul-11Sep-11Nov-11Jan-12Mar-12May-12Jul-12Sep-125045403525 October 2012UtilitiesChina IPPsFigure 17: Wind utilization (Longyuan proxy)Monthly wind utilization has300hrs201020112012been lower than in previousyears on grid curtailmentand lower wind speed.2

42、5020015010050Source: Deutsche Bank, Company dataFigure 18: Aggregated utilization hours (1-9M12)Utilization hours in 1-9M12were down 164hrs or 5%yoy. Hydro was up 400hrs or4,0003,500Average utilization hrsyoy growth25%20%17%, and thermal was down279hrs or 7%.3,00015%2,5002,0001,5001,00050003,439-5%T

43、otal3,707-7%Thermal17%2,788Hydro10%5%0%-5%-10%Source: Deutsche Bank, WindFigure 19: Daily water-flow in Chinas Three GorgesWater-flow levels in ChinasThree Gorges Water outflow (LHS, 000cm/s)ThreeGorgesis302520151050Source: Deutsche Bank, WindDeutsche Bank AG/Hong KongThree Gorges Dam water level (R

44、HS, m)180175170165160155150145140substantially higher in 2012than in 2011 and marginallyhigher than the historicalaverage.Page 7Apr-10Aug-10Apr-11Aug-11Apr-12Aug-12Dec-09Dec-10Dec-11Feb-10Feb-11Feb-12Jun-12Jun-10Jun-11Oct-10Oct-11Oct-12Oct-10Jan-11Feb-11Mar-11Jun-11Oct-11Jan-12Feb-12Mar-12May-11May-

45、12Apr-11Aug-11Apr-12 Jun-12Nov-10Nov-11Aug-12Jul-11Sep-11Jul-12Dec-11Dec-10Sep-12May-12Mar-10May-10Mar-11May-11Nov-10Nov-11Mar-12Sep-10Jan-10Jan-11Sep-11Jan-12Sep-12Jul-10Jul-11Jul-1225 October 2012UtilitiesChina IPPsSpot coal price and sea freightFigure 20: Qinhuangdao spot coal priceQinhuangdao sp

46、ot coal priceRmb/t950900850800Datong Premium (6,000kCal)Shanxi Premium (5,500kCal)(5,500kcal Datong premium)has weakened substantiallysince end-May, fromRmb785/t to Rmb615/t inmid-July.750700650600Coal prices have sincestabilized at Rmb640-650/tbetween August andOctober.Source: Deutsche Bank, WindFi

47、gure 21: Bohai Rim coal indexThe Bohai-Rim coal priceRmb/t900850800750700650600Source: Deutsche Bank, WindBohai Rimindex, which tracks thermalcoal prices at six ports, alsoregistered similar declines inspot coal prices.Figure 22: Qinhuangdao Newcastle spot coal price comparisonDespite the rapid decl

48、ine inUS$/ton14013012011010090Datong Premium (5,500kCal) (US$/t)Newcastle (FOB,US$/t) (5,500kCal)Qinhuangdaos coal pricesince May, the internationalcoal price has weakenedsignificantly since late Septand the price gap with thedomestic spot coal price hasexpanded again.80Source: Deutsche Bank, WindPa

49、ge 8Deutsche Bank AG/Hong KongMay-10May-11May-12Sep-09Nov-09Sep-10Nov-10Sep-11Nov-11Jul-12Jul-09Jul-10Jul-11Mar-10Mar-11Mar-12Sep-12Jan-10Jan-11Jan-12Rmb/t25 October 2012UtilitiesChina IPPsFigure 23: China IPPs coal priceThe spot coal price on 22Datong Premium (6,000kcal) Shanxi Premium (5,500kcal)S

50、hanxi Blend (5,000kcal)Oct 2012 was 22% lowerCurrent Price (22700640560than in 2Q12.Oct, 2012)Average 3Q12Average 2Q12Average 1Q12Average 2011Average 2010Average 2009708825834873796660634772779820751622540670677715652540If coal prices stay at thecurrent level through to2013, the average spot coalpri

51、ce decline in 2012 and2013 will be 14% and 9%respectively.% changeCurrent vs. 20113Q12 vs. 20112Q12 vs. 20111Q12 vs. 20122011 vs. 20102010 vs. 2009-20%-19%-6%-4%10%21%-22%-23%-6%-5%9%21%-22%-24%-6%-5%10%21%Source: Deutsche Bank, Industry dataFigure 24: Mine-mouth vs. port coal priceMine-mouth coal p

52、rices haveShanxi, Taiyuan (5,500kCal)Shandong, Tengzhou (5,500kCal)Inner Mongolia, Dongsheng (5,200kCal)Shaanxi, Yulin (6,000kCal)been declining rapidly sinceJune 2012.1000TheShandongTengzhou9005,500kCalcoalpricehas800experiencedthemost700600500400substantial decline since itspeak in May.Compared to

53、 the Bohai Rim300indexwhichtrackscoal200prices at the six ports, thecoal price decline at the coalmines has a 1-2 month lag.Source: Deutsche Bank, WindStock implication: thus, forIPPs with a big exposure tomine-mouth coal mines (CPI2380.HK, Huadian 1071.HK),the fuel cost decline impactwill be felt m

54、ainly in Aug-Sep 2012, vs. June-July forIPP in coastal areas.Deutsche Bank AG/Hong KongPage 9Feb-10May-10Aug-08Nov-08Feb-09May-09Aug-09Feb-11May-11Feb-12May-12Nov-09Aug-10Nov-10Aug-11Nov-11Aug-12May-11May-08May-09May-10May-12Sep-09Sep-08Sep-10Sep-11Jun-09Jun-10Jun-11Aug-09Aug-10Aug-11Dec-09Dec-10Dec

55、-11Feb-10Feb-11Feb-12Jun-12Oct-09Apr-10Oct-10Apr-11Oct-11Apr-12Sep-12Jan-09Jan-12Jan-08Jan-10Jan-1125 October 2012UtilitiesChina IPPsFigure 25: Qinhuangdao coal inventorymn tons109876543Source: Deutsche Bank, WindFigure 26: Coal inventory days at power plants(days)35302520151050Source: Deutsche Bank

56、, WindCoal inventories at the Qinhuangdao port dropped from over 9m tons in Juneto 5.3m tons in Oct, as many coal traders expect further coal price declinesahead due to weak power demand. However, at 5.3m tons, coal inventory isstill considered sufficient. A shortage occurs when coal inventory is be

57、low 5mtons.Power plants coal inventory also remains high and trending upwards to over30 days, which is significantly higher than the historical average of 15-20 days.Overall, we see ample coal inventory at power plants and believe that most ofthe winter stocking has been done. Thus, going forward, w

58、e expectQinhuangdao coal inventory to edge up in the upcoming months.Figure 27: Investment in the coal sectorAggregate coal investment YoY growthAggregate thermal capacity YoY growth80%60%40%20%0%-20%-40%-60%-80%Source: Deutsche Bank, WINDDespite recent news flow on production cuts, monthly raw coal

59、 production inrecent months has remained high at more than 300m tonsWhile FAI in the coal mining sector has also maintained double-digit growth inthe last three years, thermal power capacity growth has slowed significantlysince Jan 2011. This suggests potentially lower coal demand vs. supply in thef

60、uture.Page 10Deutsche Bank AG/Hong KongOct-11Jul-11Jan-11Jun-11Dec-11Jan-12Mar-11Mar-12Feb-11Feb-12Aug-11Sep-11 Nov-11Jun-12Apr-11Apr-12Jul-12Aug-12May-11May-12Sep-12Dec-11Jan-11Jun-11Oct-11Jan-12Jun-12Jul-11Feb-11Mar-11Feb-12Mar-12Aug-11Sep-11Nov-11Apr-12Apr-11Jul-12Aug-12May-11Oct-09Dec-09Feb-10Ap

61、r-10Jun-10Aug-10Oct-10Dec-10Feb-11Apr-11Jun-11Aug-11Oct-11Dec-11Feb-12Apr-12Jun-12Aug-12May-12Sep-12Dec-09Jun-10Dec-10Jun-11Dec-11Aug-10Feb-11Feb-10Aug-11Feb-12 Jun-12Apr-11Oct-09Apr-10Oct-10Oct-11Apr-12Aug-1225 October 2012UtilitiesChina IPPsFigure 28: Coal seaborne freight index (China)Domestic se

62、a freight rates2,4002,2002,000QHD-ShanghaiQHD-GuangzhouCCBFIfor bulk goods (CCBFI)stayed flat over the pastmonth, but are c.30% off thepeak in Mar 2011.1,8001,6001,4001,2001,000800Qinhuangdao-Guangzhouand Shanghai cost of coalfreight has continued todecline by 5% over the lastmonth, and compared wit

63、hthe peak in Mar 2011, bothprices are 40% lower.Source: Deutsche Bank, WindFigure 29: BDIBDI2,4002,0001,6001,200800400Source: Deutsche Bank, WindOutput growth of key electricity consuming sectorsThe BDI is still trading below800 in Sept.Figure 30: Crude steel production outputSteel Output (1,000) to

64、nsFigure 31: Aluminum production outputAluminium output (1,000) tons700600500400300200100yoy growth (%)50%40%30%20%10%0%2018161412108642yoy growth (%)706050403020100-100-200Source: Deutsche Bank, WindDeutsche Bank AG/Hong Kong-10%Source: Deutsche Bank, WindPage 11Oct-09Dec-09Feb-10Apr-10Jun-10Aug-10

65、Oct-10Dec-10Feb-11Apr-11Jun-11Aug-11Oct-11Dec-11Feb-12Apr-12Jun-12Aug-12Oct-09Dec-09Feb-10Apr-10Jun-10Aug-10Oct-10Dec-10Feb-11Apr-11Jun-11Aug-11Oct-11Dec-11Feb-12Apr-12Jun-12Aug-12Jun-10Jun-11Feb-10Feb-11Dec-09Aug-10 Dec-10Aug-11 Dec-11Feb-12Jun-12Feb-10Jun-10Feb-11Jun-11Feb-12Dec-09Dec-10Dec-11Aug-

66、11Aug-10Jun-12Aug-12Oct-10Oct-09Apr-10Apr-11Oct-11Apr-12Aug-12Apr-10Apr-11Apr-12Oct-11Oct-09Oct-1025 October 2012UtilitiesChina IPPsFigure 32: Ferroalloy production outputFerroalloy output (1,000) tonsFigure 33: Cement production outputCement output (1,000) tons312927252321191715yoy growth (%)120100806040200-20-402300210019001700150013001100900700500yoy growth (%)6050403020100-10-20Source: Deutsche Bank, WindFigure 34: Ten non-ferrous metals production outputsNon-ferrous Metals output (1,000) t

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。