尽职调查ination-request-list---ooc(doc13页精编版

尽职调查ination-request-list---ooc(doc13页精编版

《尽职调查ination-request-list---ooc(doc13页精编版》由会员分享,可在线阅读,更多相关《尽职调查ination-request-list---ooc(doc13页精编版(13页珍藏版)》请在装配图网上搜索。

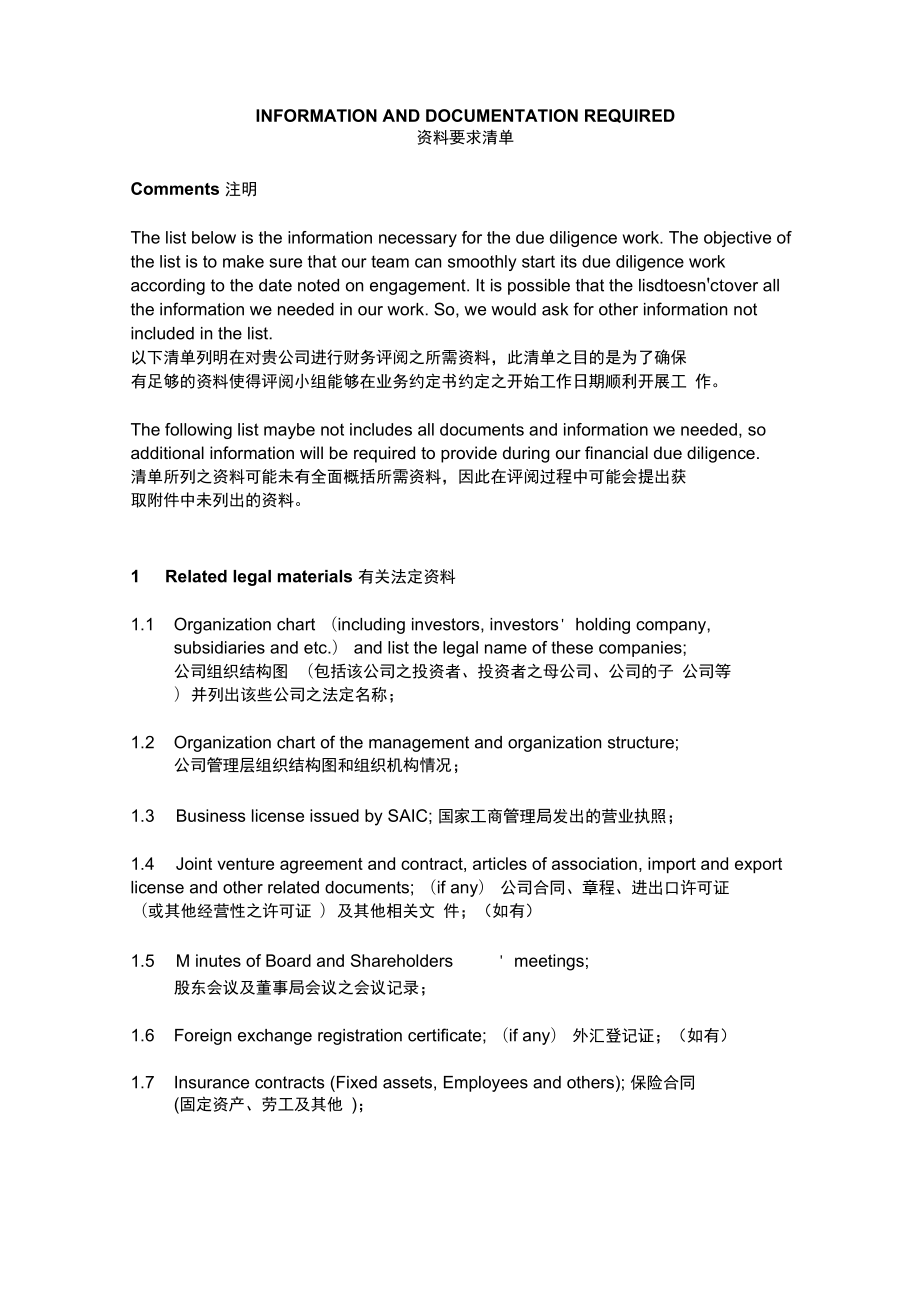

1、INFORMATION AND DOCUMENTATION REQUIRED资料要求清单Comments 注明The list below is the information necessary for the due diligence work. The objective of the list is to make sure that our team can smoothly start its due diligence work according to the date noted on engagement. It is possible that the lisdtoes

2、nctover all the information we needed in our work. So, we would ask for other information not included in the list. 以下清单列明在对贵公司进行财务评阅之所需资料,此清单之目的是为了确保 有足够的资料使得评阅小组能够在业务约定书约定之开始工作日期顺利开展工 作。The following list maybe not includes all documents and information we needed, so additional information will be

3、 required to provide during our financial due diligence. 清单所列之资料可能未有全面概括所需资料,因此在评阅过程中可能会提出获 取附件中未列出的资料。1 Related legal materials 有关法定资料1.1 Organization chart (including investors, investors holding company, subsidiaries and etc.) and list the legal name of these companies; 公司组织结构图 (包括该公司之投资者、投资者之母公司

4、、公司的子 公司等 )并列出该些公司之法定名称;1.2 Organization chart of the management and organization structure; 公司管理层组织结构图和组织机构情况;1.3 Business license issued by SAIC; 国家工商管理局发出的营业执照;1.4 Joint venture agreement and contract, articles of association, import and export license and other related documents; (if any) 公司合同、章

5、程、进出口许可证 (或其他经营性之许可证 )及其他相关文 件;(如有)1.5 M inutes of Board and Shareholders meetings;股东会议及董事局会议之会议记录;1.6 Foreign exchange registration certificate; (if any) 外汇登记证;(如有)1.7 Insurance contracts (Fixed assets, Employees and others); 保险合同 (固定资产、劳工及其他 );2 HR related information 人事相关资料2.1 Staff compensation

6、and benefits and compensation available to employees; 贵公司的员工薪酬及福利制度;2.2 Headcount of each functional department and workshop; 各车间及职能部门 2006 年度平均人数;2.3 Social securities commitment (whether in written or oral ), if any; 请提供社会保险的相关承诺(书面或口头形式),如有;3 General operation 业务之概况3.1 General description and bus

7、iness plan of the Company; 概述贵公司之一般业务性质及商业计划3.2 Details of its main equipment including the date of acquisition, date of putting into use and any possible improvement project; 贵公司经营场所之主要设施,设备之详情、购买及投入使用之年份及改良 计划;3.3 The flowchart of the Companys business; 贵公司营运流程图;3.4 The detailed information of the

8、 development of the Company; 贵公司的发展之详细资料;3.5 Appraisals and due diligence reports prepared by other external parties, if any; 贵公司由其他外部机构出具之评估报告或尽职调查报告,如有请提供;4 Important contract 重要合约Please provide the copies of important contract. For examples: 请提供所有重要合约的副本。例如:4.1 Main suppliers contracts; 与主要供应商之合约

9、;4.24.34.44.54.64.74.84.955.15.25.35.45.55.6Main sales contracts; 主要的销售合同;Loan agreement; 借款合同;Seniors managements contracts; 高级管理人员雇佣合同;Construction contracts; 工程合约;Assurance agreements; 担保合约;Loan contracts which are valid for the period under review; 审阅期间尚未清偿之贷款合约;Assets pledge agreements; 资产抵押合约;

10、Other important contracts; 其他有重大影响之合同;General financial materials 一般财务资料Accounting policy (for most major items on the financial statement); 贵公司的主要会计政策 ( 财务报表的各主要项目 ) ;Detailed summary of your accounting and management reporting systems; 贵公司会计及报表系统的详细说明;Audit report and management letter from statut

11、ory auditors; 法定审计师提供的审计报告和管理建议书;Provide balance sheets as at YTD February and March 2006 提供截至 2006年最近日期 (2 月底及 3月底)的资产负债表;Provide account ledger for the above mentioned period;提供截至 2006年最近日期 (2 月底及 3月底)的科目余额表;Provide the trial balance as of YTD February and March 2006 提供截至 2006年最近日期 (2 月底及 3月底)之试算平

12、衡表;5.766.16.26.36.46.56.66.76.86.9Provide the details of risk man agemer。提供公司有关风险管理的详情。Land, buildings and equipment 土地、房屋及设备List of the land use right owned by the Company, please describe the location, area of the land, the ownership of the land and the ownership of any buildings, factories and ot

13、her equipment on the land;有关所拥有之土地使用权,请列出该地之位置、面积、拥有该土地使用权 之公司名称及该土地工厂或其他设施之业权;The nature of the lands the Company is using and the method the Company got this using right;拥有土地之性质 (如土地使用权 )及取得该拥有权之方法;The nature of the lands the Company is using and the method the Company got this using right;土地使用证、土

14、地批文或免地价之批文之副本;Land use contracts;土地使用合同;Land transfer contracts;土地转让合同;Land lease contracts;土地租赁合同;Property ownership certificates;房屋之房产证;Assets appraisal report; 贵公司的资产评估报告;Assets appraisal report;所有租赁协议之副本;7 Balance sheet items资产负债表Please provide the information for the year ended YTD Feb and Mar

15、2006. 请提供与公司截止 2006年最新日期 (2 月底及 3月底)之资产负债表有关之以下 资料内容。Fixed assets固定资产7.1 Detailed list of fixed assets as at YTD Feb and Mar 2060; 截止 2006年最新日期 (2 月底及 3月底)的固定资产明细表;7.2 Detailed list of fixed assets movement in different accounting period listed above, disposal details since the establishement, and p

16、lans of sale, lease, sublease or other dispositions of existing properties; 列出固定资产於每个会计年度内的增购变卖及报废明细表(自成立之日 起),以及目前准备购买、租赁或处置其他现有固定资产的计划;7.3 Whether there is any pledge of fixed assets to other parties and any supporting documents;说明固定资产有否用作抵押并提供有关文件;7.4 The existence of any major idle fixed assets;

17、 固定资产闲置情况;7.5 Describe any important accounting policy (depreciation, appraisal, capitalization and other);说明会计政策 (折旧、评估、资本化及其他会计政策 );7.6 Describe any capitalized expenses and the accounting policy; 说明资本化费用的会计政策,以及相关资本化费用的情况;7.7 Describe any fixed assets re-valuation, indicate increase to the fixed

18、assets book and the basis for such increase; 说明固定资产有无评估增值的情况以及增值的依据;7.8 Describe any lease agreementsand terms of assetsleased to or by the Target Company;说明固定资产有无租入或租出的情况,及相应的条款;Construction in progress (if applicable)在建工程 (如适用 )7.9 Detailed list of Construction in progress; 在建工程明细表;7.10 Important

19、construction contracts and decoration contracts; 重要的工程合同以及装修合同;7.11 The budget of construction projects and related working capital arrangement and forecast;各项工程预算以及资金安排和预测;7.12 The details of capitalized expenses; 资本化费用的详情;Accounts receivable应收帐款7.13 List of accounts receivable (including related c

20、ompanies balances); 列出应收帐款清单 (包括关联公司往来 );7.14 An ageing analysis of accounts receivable as at YTD Feb and Mar 2006 (030days, 3190days, 91180days, 181365days, above 1 year); 应收帐款帐龄分析 (030天, 3190天, 91180天, 181天365天, 1 年以 上), 截止 2006年最新日期 (2月底及 3月底);7.15 Basis of bad and doubtful debts provision; 坏帐准备计

21、提原则;7.16 List of sold or pledged trade debts; 请提供已出售或抵押之应收款项的清单;Cash and equivalents现金及现金等价物7.17 Reconciliation of latest cash balances with bank accoun;ts 最近一期的银行对帐单及银行余额调节表;Other assets其他资产7.18 List of other assets and their nature (if applicable, its ageing analysis); 列出其他资产的明细并注明业务性质 (如可能,作帐龄分析

22、);Intangible assets, other deferred assets and goodwill 无形资产,其他递延资产及商誉7.19 Breakdown of the above items; 列出无形资产、其他递延资产和商誉的清单以及相关的摊销政策;7.20 Basis of amortization; 指出摊销基础;Equity 所有者权益7.21 Breakdown of equity and the movement during the review period; 所有者权益明细及复核期间的增减变动情况;Short-term loan短期借款7.22 Breakdo

23、wn of outstanding short-term loans as at latest balance sheet date, and relevant loan agreement, guarantee agreement, and pledge agreement; 截至最近资产负债表日未偿还短期借款明细,及相关借款合同、担保合 同、抵押合同等;Accounts payable应付帐款7.23 Suppliers balances at the latest balance sheet date with the aging analysis; 按供货商名列出应付帐款清单,并请提供

24、相应的账龄分析;7.24 Purchase turnover with major suppliers for YTD Feb and Mar 2006; 2006年最近日期 (2月底及 3 月底)主要供货商的采购周转期;Accruals and other payable 预提费用和其他应付款7.25 Details of amount and nature; 列出明细及业务性质;7.26 Basis of calculation of accrual and movement of the accruals account; 列出预提费用变动表及计算依据;Payroll and welfa

25、re payable 应付工资其福利费7.27 Detailed list of welfare payables and related accrual basis; 应付福利费的明细及计提基准;Other liabilities其他负债7.28 Breakdown of the payables due to the related parties as at YTD Feb and Mar 2006 2006年最近日期 (2 月底及 3 月底)的应付关联方款项的明细;7.29 Details of amount and nature of other liabilities; 列出其他负

26、债的明细及业务性质;Contingent liabilities或有负债7.30 Detailed list of the guarantee given to other companies; 详列所有对其他单位所作之担保;7.31 Information of all the litigation the Company involved but not settled; 有关所有与公司有关而又尚未解决之法律诉讼之资料;7.32 List of unsettled conditional bill of exchanges; 详列所有有条件之承兑汇票;7.33 List of unsett

27、led conditional liabilities; 详列其他或有负债;Lease commitment and capital commitment租约及资本承担7.34 Detailed list of all the capital commitments which contracted but not paid and copies of all the related documents; 详列并提供已达成合约的资本性支出及提供有关文件之副本;7.35 Detailed list of any approved but not contracted capital expend

28、iture; 已经审批但未达成合约的资本性支出;7.36 Detailed lease commitment and related contracts. 详列租约承担并提供有关合约。8 Income statement items损益表Please provide the information for the period ended February 28, 2006 and March 31, 2006.提供公司截止 2006年最新日期 (2 月和 3 月)之下列资料。8.1 Detailed an alysis for the sales of products by categor

29、y, if available; 按产品大类编制收入明细分析,并请提供相应的销售量(如有的话);8.2 Details of sales and purchase to and from holdi ng compa ny, affiliate compa nies and other related parties (in clud ing descripti on, n ature and volume/am ount of the tran sacti on);与母公司、附属公司、联营公司或其他有关联人士销售收入及采购之金额 及明细(包括名称、交易性质及金额);8.3 Details o

30、f other transactions with holding company, affiliate companies and other related parties (in cludi ng descripti on, n ature and volume/am ount of the tran sacti on);与母公司,附属公司,联营公司或其他有关联人士之其他交易(财务及非财务)之资料,包括交易性质与金额;8.4 Detailed an alysis of cost of sales (on the basis of products by category);成本的明细分析

31、(按产品大类分析);8.5 Detailed analysis of general and administration expenses, selling expenses, finan cial expe nses, non-operati ng in come/expe nses and other in come;管理费用,销售费用,财务费用,营业外收支,其他业务利润的明细分 析;8.6 List of pote ntial non-recurri ng reve nu es. 请详列有可能不会持续产生的收入明细。9 Financial modeling财务模型9.1 Any inf

32、ormation in relation to the financial models, including financial models prepared by man ageme nt, major assumpti ons, etc.有关财务模型的资料,包括管理层准备的财务模型、主要假设等。税务尽职调查所需资料清单Please provide the following information for YTD Feb and Mar 2006. 请提供贵公司 2006 年最新一期 (2 月及 3 月) 下列有关税务资料。Detailed breakdown of the tax a

33、ccounts 税务帐目的明细帐Tax payable account应交税金明细帐Tax payment history (e.g. tax expense /cost account) 已交税金明细 帐Tax Registration Certificates ( issued by both the state tax bureau and local tax bureau) 税务登记证 ( 由国家税务局及地方税务局所发 )Annual Tax Review Report issued by the tax authorities-in-charge (if any) 主管税务机关年度税

34、务审查报告 ( 如有 )* 请确定应纳税金明细帐的期末余额与已缴税金明细帐的总额与本年度财务报表上的应付 税额(资产负债表 )以及已付税额 ( 利润表 ) 相符Documentation required for review on specific taxes 评审各项税项所需资料(1)Foreign Enterprise Income Tax ( FEIT ) 外商投资企业所得税Copies of filed annual FEIT tax returns and copies of FEIT payment certificates for all taxes paid.年度外商投资企业

35、所得税汇算清缴申报表及完税证In case where the taxable income / loss is different from the accounting profit / loss, please provide a statement of tax adjustments for the year with the review period, stating the amount, the reason and the basis of calculation for each of the tax adjustment items.如果任何年度应纳税所得 (或税务亏损

36、 ) 有异于会计利润 (或会计亏损 ) ,请提供税 务调整明细表,并对有关税务调整项目的原因、依据、金额等逐一说明。Formal written confirmation on the applicable tax incentives issued by the relevant tax bureaux税务局发出有关税务减免优惠的正式批文Copies of zero-tax return filed, if no profit made for the year(s) or during the year when the entity is entitled to tax exemptio

37、n treatment 如该公司於某 (些)年度内没有利润或享有免税优惠,已呈交的“零税负 ”Statement of tax losses carried forward from previous 5 years 企业年度亏损弥补情况表(2) Tax withholding obligations (FEIT withheld on payments such as royalties, interest, rental, service income, etc.made to non-residents)预提所得税 ( 在支付给非居民特许权使用费、利息、租金、服务收入等费用时所预扣 的税

38、款 ) (如适用)Details of payments to non-residents (including types of payments and amount) or accrued payable 向非中国居民所付款项或应付款项的明细 ( 包括应付款类别及数额 ) (如有)Returns field and tax payment certificates for withheld taxes 预提所得税申报表计完税凭证(如有)(3) Value-added Tax (VAT)增值税Monthly VAT returns filed and tax payment certifi

39、cates 增值税月申报表及完税样本VAT detailed account for the year年度增值税明细帐Approvals issued by the tax authority and relevant information on VAT preferential treatment 税务机关颁发的增值税税收优惠批复及相关文件Amount of input VAT attributable to purchased goods used for employee welfare, personal consumption, non-taxable projects (e.g.

40、, commission processing for foreign principal) or tax-exempt projects (if any) 外购货物用于集体福利、个人消费、非应税项目 ( 如承接外商来料加工业务 ) 或 免税项目的进项税额 ( 如有 )Amount of output VAT for self-manufactured , subcontract processed or purchased goods used for gifts , capital contribution of distribution to shareholders, if any 将

41、自产、委托加工或购买的货物无偿赠送、作为投资或分配给股东的销项税额( 如有 )In respect of export sales, if any:如有出口销售:Export VAT rebate rate(s) for export product(s)出口货物的退税额Total amount of input VAT for the period, input VAT attributable togoodssold within China and input VAT attributable to export goods进项增值税总额、用于生产内销货品的进项税及用于生产出口货品的进项

42、税Amount of tax-exempt imported raw materials used for the production of export goods for the year / period 当期用于生产出口货品的免税进口原料Samples approved application of export VAT refund批准的出口退税申请(4) Individual Income Tax (“ IIT ”)个人收入所得税Number of expatriate employees and local staff 外籍雇员及国内员工人数Sample IIT returns

43、 filed and tax payment certificate个人所得税申报表和完税证样本(5) Other taxes (e.g. Real Estate Tax, Land Use Tax, Deed Tax, etc.)其他税项 ( 例如房地产税、土地使用税、契税等 )Historical cost of properties owned拥有房地产的历史成本Cost, expenses and sales price of properties sold 转让房地产的成本、费用及售价Tax returns filed and tax payment certificates 有关申

44、报表及完税证Written confirmation from the PRC tax authorities regarding tax exemption, if applicable 有中国税务局发出的免税证明 (如有 )(6) Documentation for related parties transactions与关联企业业务往来的文件Reporting or description of related parties tions transac与关联企业业务往来情况说明或申报Agreements with associated entities, including, but

45、 not limited to, management agreements, supply agreements, procurement agreements, etc.与关联企业订立的协议,包括但不限于管理服务合同、供应合同、采购合同等Any challenges raised by the PRC tax authorities on the related parties transactions such as transfer pricing issue, etc. 由中国税务机关就关联机构之间的交易提出的质询,如转让定价问题等Transfer pricing policy an

46、d methodology for payments between related parties/companies 关联企业之间转让定价的确定方法和政策(7) Other information其他资料In respect of various PRC taxes, indicate the years during the review period that have not been audited/agreed with the relevant PRC tax authorities 对于评审期间的每一年度的各种税务申报,未经有关中国税务机关确认所作的说 明Any disagreements/challengesraised or tax audit conducted by the tax authorities during the review period and any settlement/penalties incurred as a result对于过去年度税务局提出的任何质询 / 异议或税务审查,及因而导致的罚款所作 的说明Any other unsettled issues that warrant additional tax provisions 未落实的税项处理问题

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。