财务专业英语复习题

财务专业英语复习题

《财务专业英语复习题》由会员分享,可在线阅读,更多相关《财务专业英语复习题(6页珍藏版)》请在装配图网上搜索。

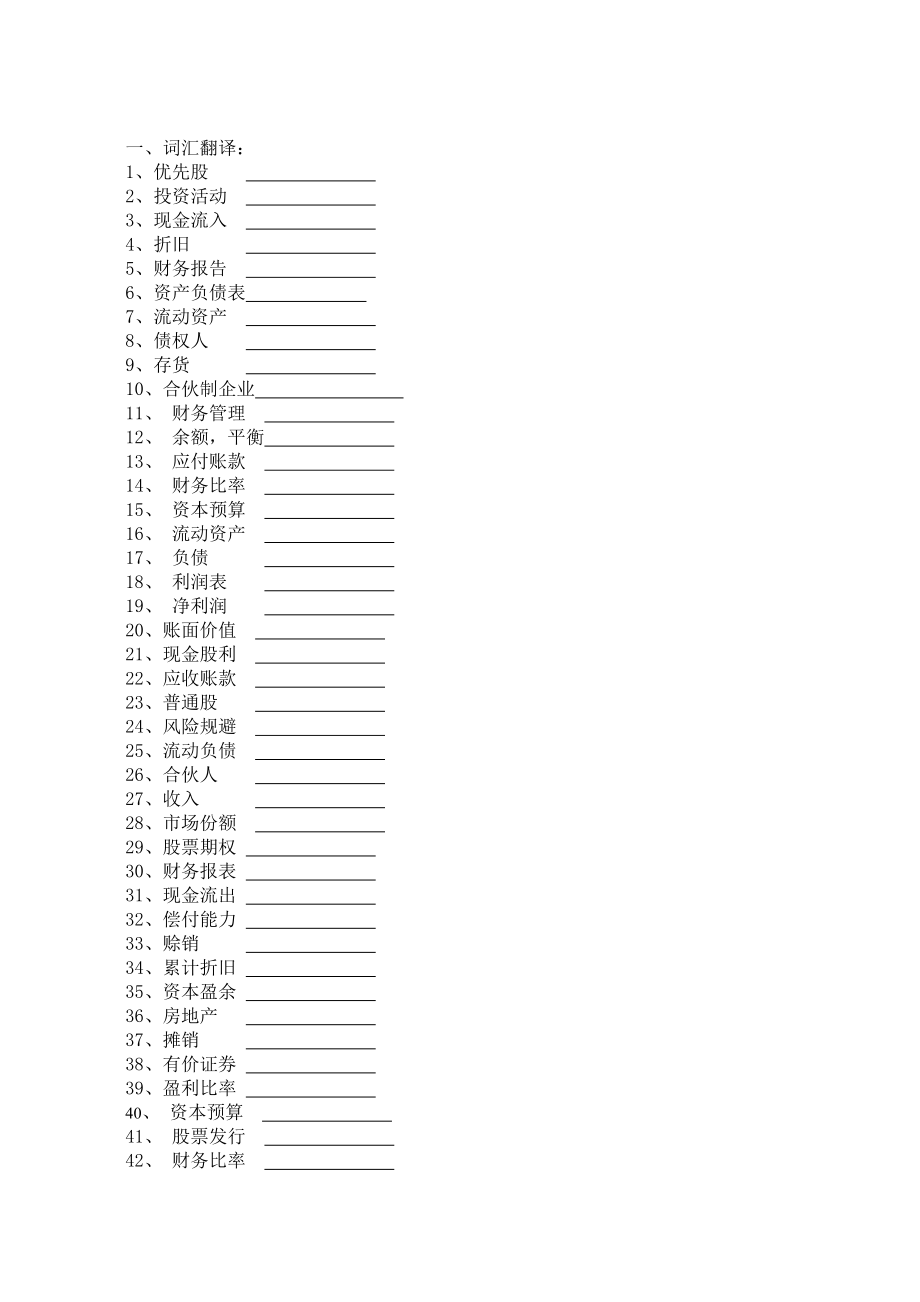

1、一、词汇翻译:1、优先股 2、投资活动 3、现金流入 4、折旧 5、财务报告 6、资产负债表 7、流动资产 8、债权人 9、存货 10、合伙制企业 11、 财务管理 12、 余额,平衡 13、 应付账款 14、 财务比率 15、 资本预算 16、 流动资产 17、 负债 18、 利润表 19、 净利润 20、账面价值 21、现金股利 22、应收账款 23、普通股 24、风险规避 25、流动负债 26、合伙人 27、收入 28、市场份额 29、股票期权 30、财务报表 31、现金流出 32、偿付能力 33、赊销 34、累计折旧 35、资本盈余 36、房地产 37、摊销 38、有价证券 39、盈利

2、比率 40、 资本预算 41、 股票发行 42、 财务比率 43、 存货 44、 财务困境 45、账面价值 46、优先股 47、盈利能力 48、应计费用 49、合资企业 50、流动性比率 51、资产负债表 52、权益乘数 53、债权人 54、杠杆比率 55、收益 二、单项选择题 1、Which of the following users are not external users of financial management information?( )A. managers B. creditors C. investors D. employees2 、Which of the f

3、ollowing belongs to current liabilities?( )A. mortgages payable B. prepaid expensesC. notes payable D. bonds payable 3、Cash inflows related to investing activities are ( )A. cash received from the sale of assetsB. collection of notes receivableC. sale of another entitys equity securities by the repo

4、rting entityD. both A and C 4、Cash equivalents include ( )A. time deposits B. inventoriesC. accounts receivable D. prepaid expenses5、Which of the following service involves providing an independent report on the appropriateness of financial statements?( )A. audit B. tax C. consulting D. budgeting6、A

5、ccountants employed by large corporations may work in the areas of the following except ( )A. product costing and pricing B. budgeting C. internal auditing D. product producing7、Which of the following is a liability account?( )A. prepaid insurance B. additional paid-in capitalC. salaries payable D.

6、accumulated depreciation 8、Financial statement does not include ( )A. balance sheet B. income statement C. cash flow statement D. working sheet9、Net income or net loss are reported on the ( )A. balance sheet B. statement of owners equity C. income statement D. both b and c10、Which of the following u

7、sers are not external users of financial management information?( )A. managers B. creditors C. investors D. employees11、Cash inflows related to investing activities are ( )A. cash received from the sale of assetsB. collection of notes receivableC. sale of another entitys equity securities by the rep

8、orting entityD. both A and C 12、Cash equivalents include ( )A. time deposits B. inventoriesC. accounts receivable D. prepaid expenses三、英译汉 1、 Public corporations in the US and many other countries are required to prepare and disclose the following financial statements to the public on a periodic bas

9、is: balance sheet; income statement; statement of cash flows; statement of retained earnings. (上市公司在美国和许多其他国家都要准备和披露以下财务报表上的公众一个周期性的基础,资产负债表,损益表,现金流量表的声明,声明的留存收益)Taken together, these statements give an accounting picture of the firms operations and financial position. The quantitative and verbal ma

10、terials are equally important. The financial statements report what has actually happened to assets, earnings, and dividends over the past few years, whereas the verbal statements attempt to explain why things turned out the way they did.(综合起来,这些报表会计画公司的运营和财务状况,定量和语言是同等重要的,财务报表报告实际发生的资产,收益,股息过去几年来,而

11、口头陈述试图解释为什么事情结果他们所做的事) The information contained in an annual report is used by investors to help form expectations about future earnings and dividends. Firms typically prepare these statements quarterly, but many analysts and users of financial statements concentrate on a firms fiscal year-end stat

12、ements. Firms provide the annual statements in both the annual report to the SEC and the shareholder annual report.(所包含的信息的年度报告是用投资者对未来收入帮助形成预期和红利。这些陈述事务所通常准备季度,但许多分析师和财务报表的使用者集中对公司的财政年度报表。公司也提供年度报表都给了美国证券交易委员会的年度报告和股东的年度报告)2、 Valuation is the process that link risk and return to estimate the worth

13、of an asset or a firm. The term value can have different meanings when applied to a financial asset or a firm. Broadly defined, a financial asset is a monetary claim on an issuer, typically a paper asset such as a bond, preferred stock, or common stock. These different types of value include: going-

14、concern value, Liquidation value, book value, market value an intrinsic value. Going-concern value is the value of a firm as an operating business. This type of value depends on the firms ability to generate future cash flows rather than on its balance sheet assets. Going-concern value is particular

15、ly important when one firm wants to acquire another. Book value is the accounting value of a firm or an asset. Book value is a historical value rather than a current value. Firms usually report book value on a per share basis. Book value per share of common stock is the share holders equity -total a

16、ssets less liabilities and preferred stock as listed on the balance sheet-divided by the number of shares outstanding. Book value per share may bear little relationship to liquidation value per share or market value per share.(评估环节的过程中风险跟收益的价值估计资产或公司,这个词可以有不痛的价值意义,当应用金融资产或公司,广义的定义,一个金融资产是一种货币要求发行人通常

17、是一个纸资产,诸如债券,优先股,普通股,这些不同类型的价值包括:Going-concern价值,清算价值,账面价值,市场价值的一种内在价值,Going-concern是以一个公司的价值为经济业务,这种类型的价值取决于公司的能力,而不是产生未来现金流在其资产负债表的资产。Going-concern值时尤其重要公司想收购另一个。账面价值会计价值是一个公司或一个资产,账面价值是一个历史的价值,而不是目前的价值,公司账面价值通常报告按每股分配,每股账面价值的普通股票的股东权益-total资产减去负债和优先股票上市公司资产负债表divided流通股数量,每股账面价值可以承受清算,每股没什么关系价值或市场

18、价值。)3、 The risk of an asset can be considered in two ways (1) on a stand-alone basis, where the assets cash flows are analyzed by themselves, or (2) in a portfolio context, where the assets cash flows are combined with those of other assets, and then the consolidated cash flows are analyzed. There i

19、s an important difference between stand-alone and portfolio risk, and an asset that has a great deal of risk if held by itself may be much less risky if it is held as part of a larger portfolio. (一项资产的风险可以被视为两种方法(1)一个单独的基础,那里的资产的现金流量分析自己,或(2)在上下文中,在一个投资组合资产的现金流结合其他的资产,然后合并现金流量表进行分析。我有一个重要的区别和投资组合的风险

20、,独立为一种资产,拥有大量的风险本身可能持有的风险要少得多,如果它是一个更大的一部分举行的投资组合)In a portfolio context, an assets risk can be divided into two components: (1) diversifiable risk, which can be diversified away and thus is of little concern to diversified investors, and (2) market risk, which reflects the risk of a general stock m

21、arket decline and cannot be eliminated by diversification, and does concern investors. Only market risk is relevant-diversifiable risk is irrelevant to rational investors because it can be eliminated.( 在投资组合风险资产的语境下,可分为两部分组成:(1)可分散风险,可开,因此是多元化的小投资者关注多元化,以及(2)市场风险,这反映了一种普遍的股票市场风险下降,不能通过分散投资消除投资者,并关注。

22、只有市场风险相关-diversifiable无关理性投资者的风险,因为它会被淘汰)An asset with a high degree of relevant (market) risk must provide a relatively high expected rate of return to attract investors. Investors in general are averse to risk, so the will not buy risky assets unless those assets have high expected returns. (资产以高度

23、相关(市场)风险须提供一个相对较高的预期收益率来吸引投资者。投资者通常都厌恶风险,所以不能购买风险资产,除非这些资产具有较高的预期收益。)4、The statement of cash flows is an integral part of the financial statement, and should be presented alongside the balance sheet, income statement, and statement of owners equity. (该声明现金流量表是不可分割的一部分,财务报表,都不应被表述与资产负债表、损益表、所有者权益的声明。

24、)This is of particular concern if the management term is taking steps to “dress up” the results shown in the statement of cash flows at the expense of a companys long-term financial health, which might be more readily evident through a careful perusal of a complete package of financial statements, r

25、ather than just the statement of cash flows. (这是特别关注的如果管理术语是采取措施,“把自己打扮起来结果显示现金流报表以牺牲公司的长期财政健康,这可能是更容易地通过这本书明显小心一套完整的财务报表,而不仅仅是声明现金流量表) For example, management might not be making a sufficient investment in the replacement of existing fixed assets, thereby making the amount of cash outflows look sma

26、ller, even though this will result in more equipment failures and higher maintenance costs that will eventually appear on the income statement.( 例如,管理也许并不是做一个足够多的投资在更换,从而使现有固定资产的现金流出看起来小巧,即使这将会导致更多的设备维护成本,失败和高将会出现在利润表。)5. The statement of cash flows is an integral part of the financial statement, an

27、d should be presented alongside the balance sheet, income statement, and statement of owners equity. (该声明现金流量表是不可分割的一部分,财务报表,都不应被表述与资产负债表、损益表、所有者权益的声明)This is of particular concern if the management term is taking steps to “dress up” the results shown in the statement of cash flows at the expense of

28、 a companys long-term financial health, which might be more readily evident through a careful perusal of a complete package of financial statements, rather than just the statement of cash flows. (这是特别关注的如果管理术语是采取措施,“把自己打扮起来结果显示现金流报表以牺牲公司的长期财政健康,这可能是更容易地通过这本书明显小心一套完整的财务报表,而不仅仅是声明现金流量表。)For example, m

29、anagement might not be making a sufficient investment in the replacement of existing fixed assets, thereby making the amount of cash outflows look smaller, even though this will result in more equipment failures and higher maintenance costs that will eventually appear on the income statement. (例如,管理

30、也许并不是做一个足够多的投资在更换,从而使现有固定资产的现金流出看起来小巧,即使这将会导致更多的设备维护成本,失败和高将会出现在利润表。)6、 In multiple-step income statement, there are series of steps in which costs and expenses are deducted from revenue. First, the cost of goods sold is subtracted from net sales to produce an amount for gross profit on sales. (在损益表

31、,改编有一系列步骤,成本和费用收入中扣除。第一,产品销售成本减去净销售额产生毛利润销售金额。)Second, operating expenses are deducted to obtain a subtotal term income from operations. Finally, other revenues and gains are added to income from operations, then other expenses and losses including income tax expense are deducted from the above to d

32、etermine the net income.( 第二,营业费用获得一个小结中扣除期限收益业务。最后,其他的收入和收益增加的收入来自运营,那么其他费用和损失费用包括所得税扣除上述确定净收入)The multiple-step income statement is noted for its numerous sections and significant subtotals including net sales, gross profit on sales and income from operations. The multiple-step income statement is

33、 widely used. In China, the official format of income statement is a multiple-step one. (损益表的改编而闻名,包括众多重要部分放入净销售额,销售和利润收入从操作。改编的损益表中应用非常广泛。在中国,官方的格式是一个改编损益表。7、The accounts receivable turnover ratio measures how many times a firms accounts receivable are generated and collected during the year. In ge

34、neral, higher receivables turnover ratios imply that a firm is managing its accounts receivable efficiently. But a high accounts receivable turnover ratio may indicate that a firms credit sales policy is too restrictive; manager should consider whether a more lenient policy could lead to enhanced sa

35、les. (应收账款周转率多少次措施公司的应收帐款产生和中收集的一年。一般来说,更高的应收账款周转比率意味著公司应收账款管理效率。但也有很高的应收账款周转率可以显示一个公司的信用销售的政策是太受限制,经理应该考虑是否更宽松的政策可能会导致提高销售。)Managers should analyze the tradeoff between any increased sales from a more lenient credit policy and the associated costs of longer collection periods and more uncollected r

36、eceivables to determine whether changing the firms credit sales policy could increase shareholders wealth. (管理者应该分析权衡增加的销售从一个更为宽松的信贷政策和相关费用较长的周期和更多的遗缺应收账款收集来决定是否改变公司的信用销售的政策可能会增加股东财富。)8、The statement of cash flows is an integral part of the financial statement, and should be presented alongside the

37、balance sheet, income statement, and statement of owners equity. (语句现金流量表是不可分割的一部分,财务报表,都不应被表述与资产负债表、损益表、所有者权益的声明。)This is of particular concern if the management term is taking steps to “dress up” the results shown in the statement of cash flows at the expense of a companys long-term financial heal

38、th, which might be more readily evident through a careful perusal of a complete package of financial statements, rather than just the statement of cash flows. (这是特别关注的如果管理术语是采取措施,“把自己打扮起来结果显示现金流报表以牺牲公司的长期财政健康,这可能是更容易地通过这本书明显小心一套完整的财务报表,而不仅仅是声明现金流量表。)For example, management might not be making a suff

39、icient investment in the replacement of existing fixed assets, thereby making the amount of cash outflows look smaller, even though this will result in more equipment failures and higher maintenance costs that will eventually appear on the income statement.( 例如,管理也许并不是做一个足够多的投资在更换,从而使现有固定资产的现金流出看起来小巧,即使这将会导致更多的设备维护成本,失败和高将会出现在利润表。)

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。