攻读硕士学位精读书

攻读硕士学位精读书

《攻读硕士学位精读书》由会员分享,可在线阅读,更多相关《攻读硕士学位精读书(7页珍藏版)》请在装配图网上搜索。

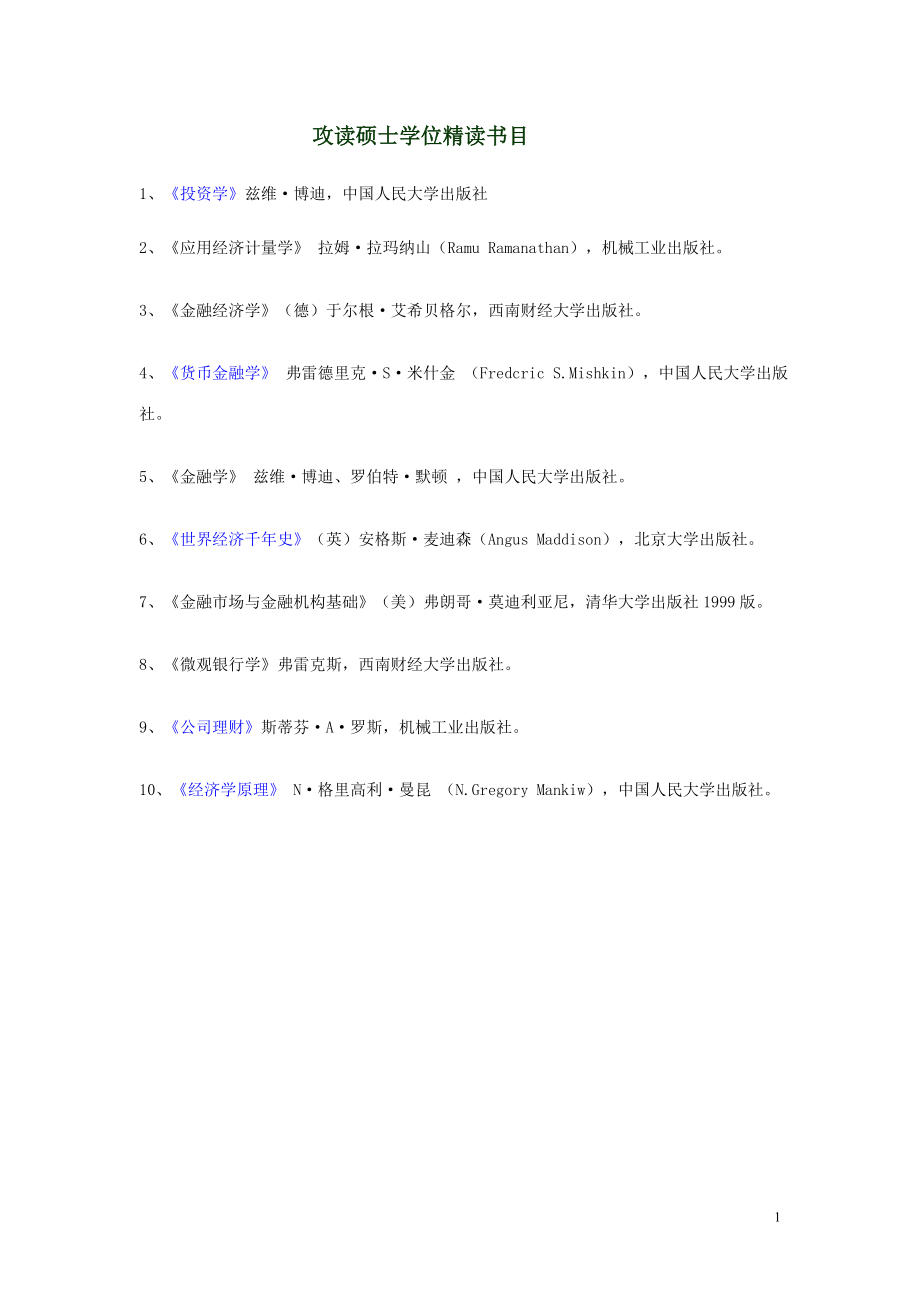

1、攻读硕士学位精读书目1、投资学兹维博迪,中国人民大学出版社2、应用经济计量学 拉姆拉玛纳山(Ramu Ramanathan),机械工业出版社。 3、金融经济学(德)于尔根艾希贝格尔,西南财经大学出版社。4、货币金融学 弗雷德里克S米什金 (Fredcric S.Mishkin),中国人民大学出版社。5、金融学 兹维博迪、罗伯特默顿 ,中国人民大学出版社。6、世界经济千年史(英)安格斯麦迪森(Angus Maddison),北京大学出版社。7、金融市场与金融机构基础(美)弗朗哥莫迪利亚尼,清华大学出版社1999版。8、微观银行学弗雷克斯,西南财经大学出版社。9、公司理财斯蒂芬A罗斯,机械工业出版

2、社。10、经济学原理 N格里高利曼昆 (N.Gregory Mankiw),中国人民大学出版社。推荐阅读原创论文目录一、货币经济学 1、剑桥方程式马歇尔、庇古Pigou,A.C. , “The value of money” Quarterly Journal of Economics 32,Nov.38-56,19172、模仿传染模型Lux. TLux.T, “Herd behavior, bubbles and crashes”, The Economic Journal, Vol. 105, pp 881-896, 19953、托宾q效应托宾Tobin, “A general equil

3、ibrium approach to monetary theory”, Journal of Money, Credit and Banking, pp15-29, Feb. 19694、消费的财富效应莫迪利亚尼Franco Modigliani, “Monetary Policy and Consumption”, in Consumer Spending and Money Policy: The Linkages (Federal Reserve Bank of Boston. 1971), pp9-845、流动性偏好凯恩斯Kenyes,J.M.,1936,“The general t

4、heory of employment, interest rate and money” in the collected writings of John Maynard Keeynes,Vol.6 London :Macmillan,19716、真实经济周期模型基德兰德、普雷斯科特Kydland,F.E.and Prescott,E.C. “Time to build and aggregate fluctuations”, Econometrica 50(6),November:1345-70, 19827、泰勒规则泰勒Taylor J., “Discretion versus pol

5、icy rules in practice”, Carnegie-Rochester Conference Series on Public Policy, Vol.39, 19938、动态非一致性博弈模型Kydland,F,E and Prescott,E.C.Kydland,F,E and Prescott,E.C. ,“Rules rather than discretion: the inconsistency of optimal plans”, Journal of Political Economy, Vol.85, PP473, June 19779、MCIFreedman,

6、CFreedman, C ,“The use of indicators and the monetary conditions index in Canada” in Balino, T.J.T and Cottarelli,C eds. “Frameworks of monetary stability-policy issues and country experiments”, IMF, PP470, 199410、跨期生活费用指数Alchian和KleinAlchian, Klein “On a correct measure inflation”, Journal of Money

7、, Credit and Banking, Feb. 197311、动态均衡物价指数ShibuyaShibuya ,“Dynamic equilibrium price index: asset price and inflation”, Monetary and Economic Studies, Institute for Monetary and Economic Studies, Bank of Japan, 10(1), 199212、有弹性的通货膨胀目标Ben Bernanke and Mark GertlerBen Bernanke and Mark Gertler,“Monet

8、ary policy and asset price volatility”, in “New Challenge for Monetary Policy”, Jackson Hole, August 26-28,199913、金融体系内在脆弱性假说米什金Minsky,H.“the financial instability hypothesis: a restatement ”帕7714、生命周期假说 (Life cycle hypothesis)莫迪利亚尼、布伦伯格Modigliani,F and brumberg, F ,1954, “ Utility analysis and the

9、consumption function :an interpretation of cross-section data.in post-keynesian economics”, ed.K.K. Kurihara, New Brunswick: Rutgers university pressModigliani,F and brumberg, F 1954. “Utility analysis and aggregate consumption functions :an attempt at integration” in the collected papers of franco

10、modigliani ,vol.2,the life cycle hypothesis of saving,ed.A.Abel, Cambridge, Mass: MIT Press,1980:79-12715、流动性偏好 (Liquidity preference)凯恩斯Keynes,J.M. , 1937 ,“Alternative theories of the rate of interest”, Economic Journal 47, June : 241-52, in the general theory and after ;part 2 defence and develop

11、ment, collected writing of J.M. Keynes Vol.XIV, ed.D.E. Moggride, London: MacmllanKeynes,J.M. 1936, “The general theory of employment, interest and money”,.In collected writing of J.M. Keynes Vol.XII, ed. D.E. Moggride, London: Macmllan16、通货膨胀缺口 (Inflation Gap)凯恩斯Keynes, J.M 1940,”How to pay for the

12、 war”, Lodon” Macmillan. Reprinted in essays in persuadsion: The collected Writing of Jonh Mayynard Keynes Vol.IX, London Macmillan,197217、IS-LM模型希克斯,汉森J.R.Hicks,1937,凯恩斯先生与古典经济学:一个尝试性解释,计量经济学年会18、银行的衍生存款理论(derivative deposit theory of banking)詹姆斯.彭宁顿“Observations on the private banking establishmen

13、ts of the metropolis: first memorandum to huskisson”, In Economic writings of James pennington, ed. R.S. sayers, London The London School of Economics and political Science, 196319、金融加速因子伯南克,哥特勒等Ben Bernanke, Mark Gertler and Simon Gilchrist, “The financial accelerator in a quantitative business cyc

14、le framework”, NBER Working Paper 645520、费雪效应费雪Fisher, I. 1930 “The theory of Interest” New York: Macmillan Company21、乘数理论汉森Hansen,A.H.1941 “business cycles and national income” New York: Norton22、“稳定黄金”法则23最优货币量学说米尔顿.弗里德曼Friedman,M.,1969, “The optimal quantity of money” in The optimum quantity of m

15、oney and other essays, Chicago: Aldine24、恒久性收入弗里德曼Friedman,M. 1957, “A theory of consumption function”, Princeton university Press25、鲍莫尔-托宾的存货理论鲍莫尔、托宾Baumol, W.J. 1952 “The transactions demand for cash: an inventory theoretic approach” , Quarterly Journal of Economics 66,Nov. 545-56Tobin, J. 1956 “T

16、he interest elasticity of transactions demand for cash”, Review of economics and statistics 29, May :124-3126、理性预期模型汉森、萨金特Hansen, L. and Sargent ,T. 1981 “Linear rational expectations models for dynamically interrelated variables. In Rational Expectations and Econometric practice, ed. R.Lucas, Jr. a

17、nd T. Sargent, Minneapolis: University of Minnesota Press27、通货膨胀税28、金融结构雷蒙德.W.戈德史密斯发达国家的金融结构与经济增长关于金融形态的比较试验,195529、金融抑制、金融深化罗纳德I麦金农和爱德华S肖经济发展中的货币和资本与经济发展中的金融深化The American Economic Review,1970s30、利率的期限结构模型萨金特Sargent, T. 1979, “A note on maximum likelihood estimation of the rational expectations mod

18、el of the term structure”, Journal of Monetary Economics 5:133-4331、永久收入假设克里斯蒂诺、艾肯鲍姆、马歇尔Christensen,L., Eichenbaum ,M. and Marshall, D. 1911. “The permanent income hypothesis revisited”, Econometrica 59;397-42432、货币中性 (Neutrality of money)哈耶克Hayek,F.A. von. 1931 “Prices and production”, London: Geor

19、ge Routledge33、货币交易方程式费雪Fisher,I.1911, “The purchasing power of money” ,2nd revised edn.1926; reprinted New York:Kelley,196334、可贷资金理论35、流动性升水理论36、货币的替代效应37、哈恩难题二、金融市场学 1、随机游走模型Kendall, Osborn, Arnold Moore2、有效率市场假说(Efficient market hypothesis)Eugene FamaEugene Fama, “Efficient Capital Market: a Revi

20、ew of Theory and Empirical Work”, Journal of Finance, May 19703、规模效应(或小公司效应)Rolf BanzBanz,R.1981, “The relationship between return and market value of common stock”, Journal of Financial Economics 9:3-18小公司效应在一月份的前两个星期最为明显,见Donald Keim, “Size Related Anomalies and Stock Return Seasonality: Future Em

21、pirical Evidence”, Journal of Financial Economics, June 1983; Marshall Blume, Robert Stambaugh, “Biases in Computed Returns: an Application to Size Effect”, Journal of Financial Economics, August 1983.4、流动性效应Amihud & Mendelson5、账面价值/市场价值比率效应Eugene Fama, Kenneth FrenchEugene Fama, Kenneth French, “Th

22、e Cross Section of Expected Stock Returns”, Journal of Finance, June 1992.6、逆转效应(过度反应)DeBondt, ThalerDeBondt, Thaler, “Does the Stock Market Overact?” Journal of Finance, (40)19857、动力效应N. Jegadeesh, S. Titman,N. Jegadeesh, S. Titman, “Return to Buying Winners and Selling Losers: Implications for Sto

23、ck Market Efficiency”, Journal of Finance, (48)19938、股权溢价之谜米拉,普雷斯科特Mehra, R. and Prescott,E.1985. “The equity premium: a puzzle.” Journal of Monetary Economics 15(2)9、Grossman-Stiglitz悖论Grossman, Sanford, J. and Stiglitz, J. EGrossman, Sanford, J. and Stiglitz, J. E., 1980, “On the Impossibility of

24、Informationally Efficient Markets”, American Economic Review 70, 393-40810、现代组合理论 Harry Markowitz, Harry Markowitz, “Portfolio Selection”, Journal of Finance, March 195211、资本资产定价模型(CAPM)威廉?夏普 Sharpe,W.F. 1964, “Capital asset prices:a theory of market equilibrum under conditions risk”, Journal of Fin

25、ance 19,September1.放松了关于所有资产都可以市场化的假设,推导出存在非市场化资产情况下的资产定价公式。David Mayers, “Nonmarketable Assets and Capital Market Equilibrium under Uncertainty”, In Studier in the Theory of Capital Markets, ed. Michael Jensen, New York: Praeger.2.多因素的资本资产定价模型Robert Merton, “An Intertemporal Capital Asset Pricing M

26、odel”, Econometrica, 1973.3.以消费为导向的资本资产定价模型Breeden D., “An Intertemporal Asset Pricing Model with Stochastic Consumption and Investment Opportunities”, Journal of Financial Economics, (7)1979.12、APTStephen A. RossRoss,S.A., “The arbitrage theory of capital asset pricing”,Journal of Economic Theory13

27、(3),Dec.341-6013、共同基金定理(mutual fund theorem)James TobinJames Tobin, “Liquidity Preference as Behavior toward Risk”, The Review of Economic Studies, February 195814、MM定理(又称不相关定理)Modigliani, Franco and Merton H. MillerModigliani and Miller ,“The cost of capital, corporation finance, and the theory of

28、investment” ,American Economic Review, 48:26197,195815、税差主义F. Modigliani, M. H. MillerF. Modigliani, M. H. Miller, “Dividend Policy, Growth and the Valuation of Shares”, Journal of Business, October 1961.F. Modigliani, M. H. Miller, “Corporate Income Taxes and the Cost of Capital: A Correction,” Ame

29、rican economic Review, 53(June 1963) pp.433-443认识到税收对资本结构以及企业价值的税盾(tax shield)效应,对MM定理进行了修正。 Farrar, Donald E. and Selwyn, Lee L. “Taxes, Corporate Financial Policy and Return to Investment,” National Tax Journal, 20, No.4(Dec. 1967), pp.444-454Miller, Merton.H, “Debt and Taxes,” Journal of Finance

30、32,1977, pp.261-275从投资者之间在边际税率上的差异这个角度出发,在一般市场均衡的条件下,科学阐述了资本结构理论。16、破产成本主义Baxter, Nevins D.Baxter, Nevins D. “Leverage, Risk of Ruin and the Lost of Capital”, Journal of Finance, 22, no.4(September, 1967)pp.395-404一旦债务超过可接受的水平,企业的平均资本成本就会随着债务水平的增加而增高,从而增加破产的可能性,过度的债务融资还会增加企业全部盈利的风险性,进而减少企业总价值。参考Stig

31、litz, Joseph E., “A Re-Examination of the Modigliani- Miller Theorem,” The American Review,59(Dec. 1969) pp.784-793Stiglitz, Joseph E., “On the Irrelevance of corporate Financial Policy,” The American Review,64(Dec. 1974) pp.851-85617权衡理论Robichek, Alexander A., and Myers, Stewart,Robichek, Alexander

32、 A., and Myers, Stewart, “Problems in the Theory of Optimal Capital Structure”, Journal of Financial and Quantitative Analysis, 1,no.1(1966)Myers, Stewart, “The Capital Structure Puzzle,” Journal of Finance, 39, no.3(July 1984), pp.575-592Masulis, Ronald W. “Discuss: How Big is the Tax Advantage to

33、Debt?” The Journal of Finance,39,no.3(July 1984), pp.853-855将负债的成本从破产成本进一步扩展到代理成本、财务困境成本以及非负债税收收益的损失等方面,扩大了成本和收益的内容,形成后权衡理论。18、代理成本理论M. Jensen, W. Meckling,M. Jensen, W. Meckling, “The Theory of the Firm: Managerial Behavior, Agency Costs, and Capital Structure”, Journal of Financial Economics, May

34、1976.19、财务契约论Smith, Clifford W. and Warner, Jerold B.Smith, Clifford W. and Warner, Jerold B. “On Financial Contracting: An Analysis of Bond Covenants,” Journal of Financial Economics (1979)117-16120、信号理论Spence, A. M. and S. A. RossSpence, A. M. “Job Marketing Signaling,” Quarterly Journal of Econom

35、ics 87, 1973,pp.355-374S. A. Ross, “The Determination of Financial Structure: the Incentive Signaling Approach”, Bell Journal of Economics, (8)1977将信号理论运用到资本结构理论中。21、新融资优序论Myers, Stewart C. and Majluf, Nicholas S.Myers, Stewart C. and Majluf, Nicholas S. “Corporate Financing and Investment Decisions

36、 When Firms Have Information That Investors Do Not Have”, Journal of Financial Economics, 13(1984) pp.187-22122、公司控制权市场Henry ManneHenry Manne, “Mergers and the Market for Corporate Control”, Journal of Political Economics(1965) pp110-12023、金融契约论Grossman, Sanford and Hart, OliverGrossman, Sanford and

37、 Hart, Oliver, “Takeover Bids, the Free Rider Problem, and the Theory of Corporation”, Bell Journal of Economics, 11, no.1(1980) pp42-6324、公司治理结构学说Williamson, Oliver EWilliamson, Oliver E., “Corporate Finance and Corporate Governance”, Journal of Finance, 43 no.3(June 1988) pp.567-59125、自由现金流理论Jense

38、n, Michael C.Jensen, Michael C. “Agency Costs of Free Cash Flow, Corporate Finance and Takeover”, American Economic Review, May 1986, vol.76, no.2 pp323-329Jensen, Michael C “The Free Cash Flow Theory of Takeover: A Ainancial Perspective on Mergers and Acquisitions and the Economy”, “The Merger Boom

39、”, Proceedings of a conference sponsord by Federal Reserve Bank of Boston, Oct.1987, pp.102-143.26、市场无效说Delong, Shleifer, Summers, Waldmann,Delong, Shleifer, Summers, Waldmann, “Noise Trader Risk in financial Markets”, Journal of Political Economy, (98)1990.27、行为资本资产定价模型Hersh Shefrin, Meir Statman,H

40、ersh Shefrin, Meir Statman, “Behavioral Capital Asset Pricing Theory”, Journal of Financial and Quantative Analysts, September 1994.28、期望理论(又称前景理论)D. Kahneman, A.TverskyD. Kahneman, A.Tversky, “Prospect Theory: An Analysts of Decision Making Under Risk”, Econometrica, March 1979.29、积极反馈投资策略SummersDe

41、 long, J.B. Shleifer, A. Summers and Roberts J.W, “Positive feedback investment strategies and destabilizing rational speculation”, The Journal of Finance, Vol. 4530、噪声交易 Noise tradeBlack ,FBlack ,F, 1986, “Noise”,Journal of Finance 41,July:529-4331、MBO32、无套利模型休伯曼Huberman,G.1982, “A simple approach

42、to arbitrage pricing”, Journal of Economic theory28:1839133、布莱克斯科尔斯期权定价模型布莱克、斯科尔斯Black,F. and Scholes,M.J.1973, “The pricing of options and corporate liabilities”, Journal of Political Economy81(3),May:637-5434、二项式期权定价模型考克斯(Cox)、罗斯(Ross)、罗宾斯坦(Robinstein)等人于1979年在金融经济学月刊上发表了论文期权定价:一种简易的方法35、贴现现金流模型(D

43、iscount cash flow model)布伦南Brennan,M. 1979, “The pricing of contingent claims in discrete time models”, Journal of Finance34 :53-6836、贝叶斯决策理论 Bayesian decision theory托马斯.贝叶斯Bayes,T.1763,”An essay towards solving a problem in the doctrine of chances”, Philosophical Transactions of the royal society:3

44、70-41837、折旧的经济理论霍特林Hotelling ,H.1925. “A general mathematical theory of depreciation”, Journal of the American statistical association 20, September: 340-5338、违约溢价模型默顿Merton,R.C. 1974, “on the pricing of corporate debt: the risk structure of interest rates”, Journal of Finance 29:449-7039、股票回报模型希勒Sh

45、iller,R. 1981, “Do stock prices move too much to be justified by subsequent changes in dividends?” American Economic Review 71:421-3640、委托代理模型哈特Hart,O. 1983 “Optimal lab information :an introduction”,Review of Economic Studies 50:3-3541、公司控制理论施莱弗、萨默斯Shleifer ,A. and Summers, L. 1988 , “Breach of tru

46、st in hostile takeovers”, In Corporate Takeovers: Causes and consequences ed. A. Auerbach, Chicago Press42、公司治理结构法马Fama,E. 1980, “Agency problems and the theory of the firm”, Journal of Political Economy 88:288-30743、委托代理 (Principle and Agency)罗斯Ross,S. 1973, “The economic theory of agency: the prin

47、ciples problem”, American review 63(20,May:134-944、非公开信息哈里斯Harris,I.E. “Liquidity, trading rules,and electronic trading systems”, Monograph Serious in Finance and Economics,New York University Salomon Ceter,New York45、风险厌恶普拉特Pratt,J.W.1964.,“Risk aversion in small and in large”, Econometric 32:122-3

48、646、理性泡沫模型Flood, GarberFlood,R.P. and Garber, P.M. “Market fundamentals Versus price-level bubbles: The first Tests”, Journal of Political Economy, August 198047、系统性风险威廉.夏普Sharp,W.1964, “Capital asset prices: a theory of market equilibrium under conditions of risks” Journal of Finance 19:425-4248、股利折现模型49、股利增长模型7

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。