2023年财务管理英文笔试题

2023年财务管理英文笔试题

《2023年财务管理英文笔试题》由会员分享,可在线阅读,更多相关《2023年财务管理英文笔试题(11页珍藏版)》请在装配图网上搜索。

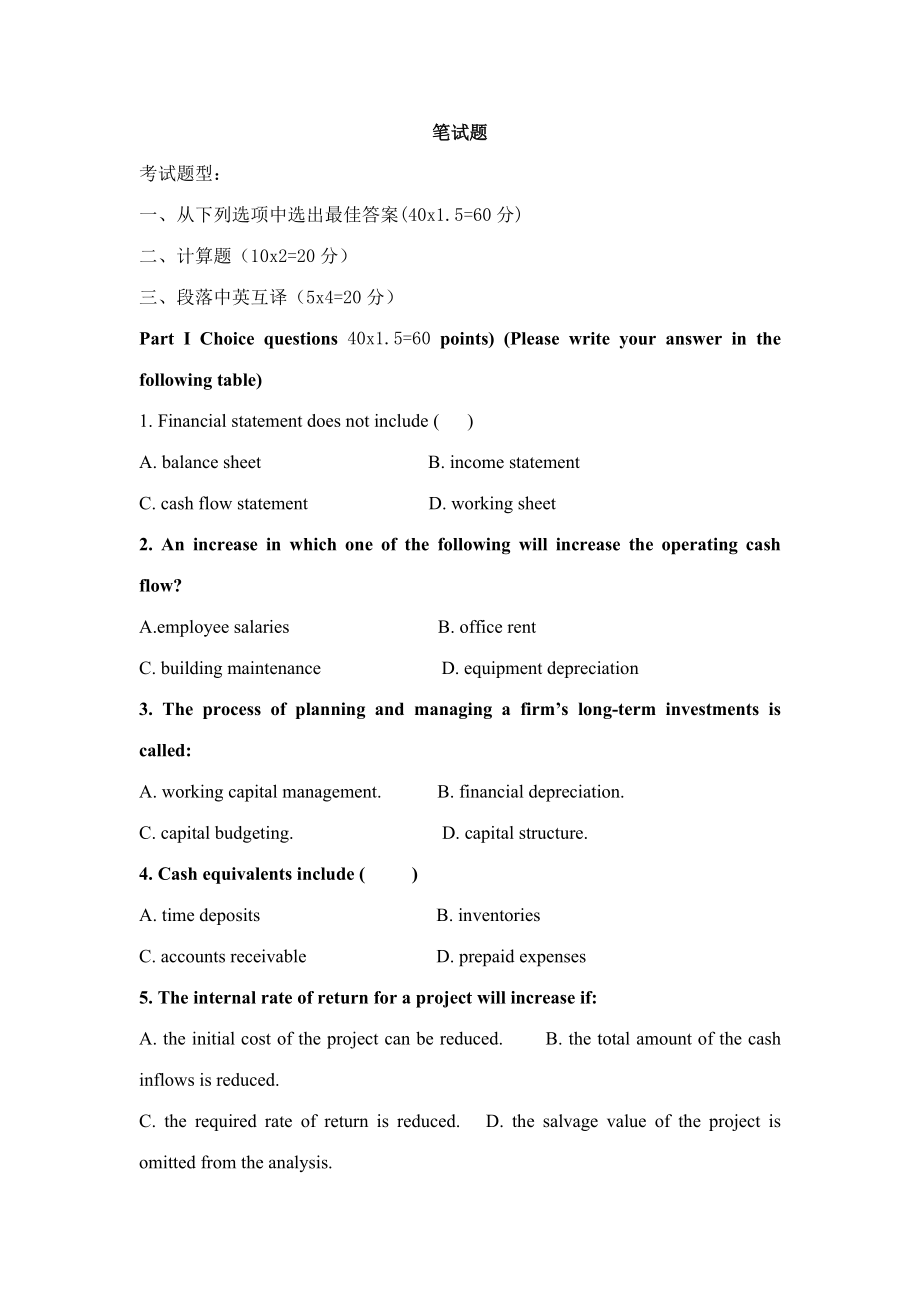

1、笔试题考试题型:一、从下列选项中选出最佳答案(40x1.5=60分)二、计算题(10x2=20分)三、段落中英互译(5x4=20分)Part I Choice questions 40x1.5=60 points) (Please write your answer in the following table) 1. Financial statement does not include ( )A. balance sheet B. income statement C. cash flow statement D. working sheet2. An increase in which

2、 one of the following will increase the operating cash flow?A.employee salaries B. office rentC. building maintenance D. equipment depreciation3. The process of planning and managing a firms long-term investments is called: A. working capital management. B. financial depreciation.C. capital budgetin

3、g. D. capital structure.4. Cash equivalents include ( )A. time deposits B. inventoriesC. accounts receivable D. prepaid expenses5. The internal rate of return for a project will increase if: A. the initial cost of the project can be reduced. B. the total amount of the cash inflows is reduced.C. the

4、required rate of return is reduced. D. the salvage value of the project is omitted from the analysis.6. Which of the following belongs to current liabilities?( )A. mortgages payable B. prepaid expensesC. notes payable D. bonds payable 7. You spent $500 last week fixing the transmission in your car.

5、Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the brake situation, the $500 you spent fixing the transmission is a(n) _ cost.A. opportunity B. sunk C. incremental D. fixed8. Which of the following statements are cor

6、rect concerning diversifiable risks? I. Diversifiable risks can be essentially eliminated by investing in several securities.II. The market rewards investors for diversifiable risk by paying a risk premium.III.Diversifiable risks are generally associated with an individual firm or industry.IV. Beta

7、measures diversifiable risk.A. I and III only B. II and IV onlyC. I and IV only D. II and III only9. Which of the following is a liability account?( )A. prepaid insurance B. additional paid-in capitalC. salaries payable D. accumulated depreciation 10. Accountants employed by large corporations may w

8、ork in the areas of the following except ( )A. product costing and pricing B. budgeting C. internal auditing D. product producing11. A corporations first sale of equity made available to the public is called a(n):( )A. share repurchase program. B. private placement.C. initial public offering (IPO).

9、D.seasoned equity offering (SEO).12. Standard deviation measures _ risk.A. total B. nondiversifiable C. unsystematic D. systematic13. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future value B. present value C. int

10、rinsic value D. market value14. Ellesmere Corporation issues 1 million $1 par value bonds. The stated interest rate is 8% per year and the interest is paid twice a year. What is the real interest rate of the bond? ( )A. 6% B.4% C. 10% D. (1+8%/2)2-1 15. Your firm purchased a warehouse for $335,000 s

11、ix years ago. Four years ago, repairs were made to the building which cost $60,000. The annual taxes on the property are $20,000. The warehouse has a current book value of $268,000 and a market value of $295,000. The warehouse is totally paid for and solely owned by your firm. If the company decides

12、 to assign this warehouse to a new project, what value, if any, should be included in the initial cash flow of the project for this building? ( )A. $268,000 B. $295,000 C. $395,000 D. $515,00016.Which one of the following will decrease the operating cycle? A. paying accounts payable fasterB. discont

13、inuing the discount given for early payment of an accounts receivableC. decreasing the inventory turnover rateD. collecting accounts receivable faster17. Assume that dividends of a common stock will be maintained at D forever, and the required return of the stockholder is r, the par value of the sto

14、ck is m, the value of the stock is ( )A. m B. m+D C. m+D/r D. D/r18. Which of the following items has the most risk? ( )A. treasury bill B. corporate bond C. preferred stock D. common stock19. ( ) equals the gross profit divided by net sales of a firm.A. gross profit margin B. net profit margin C. r

15、eturn on investment D. return on equity20. ( ) is the ratios that measure a firms ability to meet short-term obligationsA. liquidity ratios B. leverage ratios C. coverage ratios D. activity ratios21.Sensitivity analysis helps you determine the:A. range of possible outcomes given possible ranges for

16、every variable.B. degree to which the net present value reacts to changes in a single variable.C. net present value given the best and the worst possible situations.D. degree to which a project is reliant upon the fixed costs.22. According GAAP revenue is recognized as income when: ( ) A. a contract

17、 is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services delivered.C. payment is received.D. income taxes are paid.E. all of the above.23. ( ) is the result of Net Profit Margin total asset turnover (total assets/shareholders equity)A. Return on equi

18、ty B. return on investment C. current ratio D. quick ratio24. Government tax law adjustment is ( ) to a firm.A. general economic risk B. inflation and deflation risk C. firm-specific risk 25.Which of the following statements concerning the income statement is not true? A. It measures performance ove

19、r a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It does not include depreciation.E. it treats interest as an expense.26.Which of the following is not a noncash deduction? A. Depreciation. B. Deferred taxes. C. Interest. D. Two of the above E

20、. All of the above.27.Sasha Corp had an ROA of 10%. Sashas profit margin was 6% on sales of $180. What are total assets? ( )A.$300 B.$108 C.$48. D$162. 28. Calculate net income based on the following information ( )Sales = $200.00Cost of goods sold = $100.00Depreciation = $18.00Interest paid = $25.0

21、0Tax rate = 34%A. $16.50 B. $37.62 C. $34.60 D. $4.60 29.Which of the following is not true? ( )A. Financial markets can be used to adjust consumption patterns over time.B. Corporate investment decisions have nothing to do with financial markets,C. Financial markets deal with cash flows over time.D.

22、 Investment decisions rely on the economic principles of financial markets.E. None of the above.30. ( ) is concerned with the acquisition, financing, and management of assets with some overall goal in mind.A. Financial management B. Profit maximization C. Agency theory D. Social responsibility31. A

23、major disadvantage of the corporate form of organization is the ( ).A. double taxation of dividends B. inability of the firm to raise large sums of additional capitalC. limited liability of shareholders D. limited life of the corporate form.32. Interest paid (earned) on both the original principal b

24、orrowed (lent) and previous interest earned is often referred to as ( ).A. present value B. simple interest C. future value D. compound interest33. If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion? ( )A. The sto

25、ck has a low level of risk. B. The stock offers a high dividend payout ratio.C. The market is undervaluing the stock. D. The market is overvaluing the stock.34. A 250 face value share of preferred stock, pays a 20 annual dividend and investors require a 7% return on this investment. If the security

26、is currently selling for 276, what is the difference (overvaluation) between its intrinsic and market value (rounded to the nearest whole dollar)? A. approximately 26 B. approximately 10 C. approximately 6 D. approximately 135. Felton Farm Supplies, Inc., has an 8 percent return on total assets of 4

27、80,000 and a net profit margin of 6percent. What are its sales? ( )A. 3,750,000 B.640,000 C. 480,000 D. 1,500,00036. A company can improve (lower) its debt-to-total asset ratio by doing which of the following? A. Borrow more. B. Shift short-term to long-term debt. C. Shift long-term to short-term de

28、bt. D. issue common stock.37. The DuPont Approach breaks down the earning power on shareholders book value (ROE) as follows: ROE = ( ).A. Net profit margin Total asset turnover Equity multiplierB. Total asset turnover Gross profit margin Debt ratioC. Total asset turnover Net profit marginD. Total as

29、set turnover Gross profit margin Equity multiplier38. Which of the following items concerns financing decision? ( )A. sales forecasting B. bond issuing C. receivables collection D. investment project selection39. Which of the following items is the function of a treasurer? ( )A. cost accounting B. i

30、nternal control C. capital budgeting D. general ledger40. For financial instruments, ( ) is judged in relation to the ability to sell a significant volume of securities in a short period of time without significant price concession.A. maturity B. marketability C. default D. inflationPart II: Calcula

31、tion Questions (10x2 points)(注意:要写出计算公式和计算过程,否则不得分;需要用文字描述的问题回答内容要具体,语句对的、完整。)1、The most recent financial statements for company CCC are shown here ($):Income StatementBalance SheetSales10,400Current assets11,000Current liabilities10,000Costs6,820Long-term debt12,000Taxable Income3,580Fixed assets27

32、,000Equity16,000Taxes1,253Total38,000Total38,000Net income2,3271) Compute the following ratios: Current ratio:Total debt ratioTotal asset turnoverProfit marginEquity multiplierROAROE2) Using Du Pont Identity to compute the ROE 2. A Microgats Industries bond has a 10% coupon rate and a $1,000 face va

33、lue. Coupons are paid semiannually, and the bond has 20 years to maturity. If investor required a 12% yield, whats the bonds value? (P/A, 6%, 40)=15.0463 (P/F, 6%, 40) = 0.0972(P/A, 12%, 20)=7.4694 (P/F, 12%, 20) = 0.1037Part III Translation (将下面的topic 由英文翻译成中文或者由中文翻译成英文,5x4=20 points)Topic 1 Introd

34、uction to Financial Management Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Other names for financial management include managerial finance, corporate finance, and busi

35、ness finance. Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations(翻译成中文)Topic 2A corporation is a legal entity separate from its owners. This means that the corporation can own assets, e

36、nter into contracts, sue and be sued. Being a separate legal entity also implies that corporate income is taxable, thus giving rise to double taxation, i.e., corporate tax on profits plus personal tax on after-corporate-tax profits distributed to shareholders (the exception being a full imputation s

37、ystem). There is a separation of ownership (shareholders) and control (managers). Shareholders who hold shares in a corporation own the corporation. Shares represent a claim to corporate profits, which are distributed in the form of dividends, share repurchases, or acquisition payout, (e.g., managem

38、ent buyouts and tender offers). Shareholders have limiter liability. 翻译成中文)Topic 3公司资产负债表报告的价值大部分都是账面价值,账面价值基于历史成本或原始价值。资产的历史成本是公司购买资产时支付的价格。负债的历史成本是公司负有偿还责任时的金额。(翻译成英文)Topic 4市盈率反映普通股股东乐意为每一美元净利润支付的价格,为预测一个公司的成长和获利机会提供了重要的信息。未来具有较强获利机会的高增长公司希望较高的市盈率,但是它有几个潜在的缺陷。例如,一个公司的收入是负的,那么市盈率就毫无意义。此外,管理者可以通过会计惯例允许的酌情解决权利来歪曲报告。(翻译成英文)

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 中移动绩效管理系统1课件

- 第五节维生素D缺乏性佝偻病ppt课件

- 登革热主题班会ppt课件

- 新生儿持续肺动脉高压诊治进展课件

- 新湘少版三年级英语上册Unit2goodmorning课件

- 新生儿呼吸窘迫综合症(Neonatal-Respiratory-Distress-Syndrome)课件

- 中移动滚动规划中关于流量经营的考虑课件

- 电气排故高级证ppt课件

- 新浙教版-九年级科学上-第一章复习课件

- 把握新高考的难得机遇做一位成功的高考考生ppt课件

- 新生儿缺氧缺血性脑病课件

- 中科院讲义-分布式操作系统-Peterson和Dekker算法证明教学课件

- 新生儿巨细胞病毒感染课件

- 大学生恋爱观及恋爱问题的应对策略ppt课件

- 新生儿惊厥ppt课件