财务会计英文版课后习题答案Ch9

财务会计英文版课后习题答案Ch9

《财务会计英文版课后习题答案Ch9》由会员分享,可在线阅读,更多相关《财务会计英文版课后习题答案Ch9(42页珍藏版)》请在装配图网上搜索。

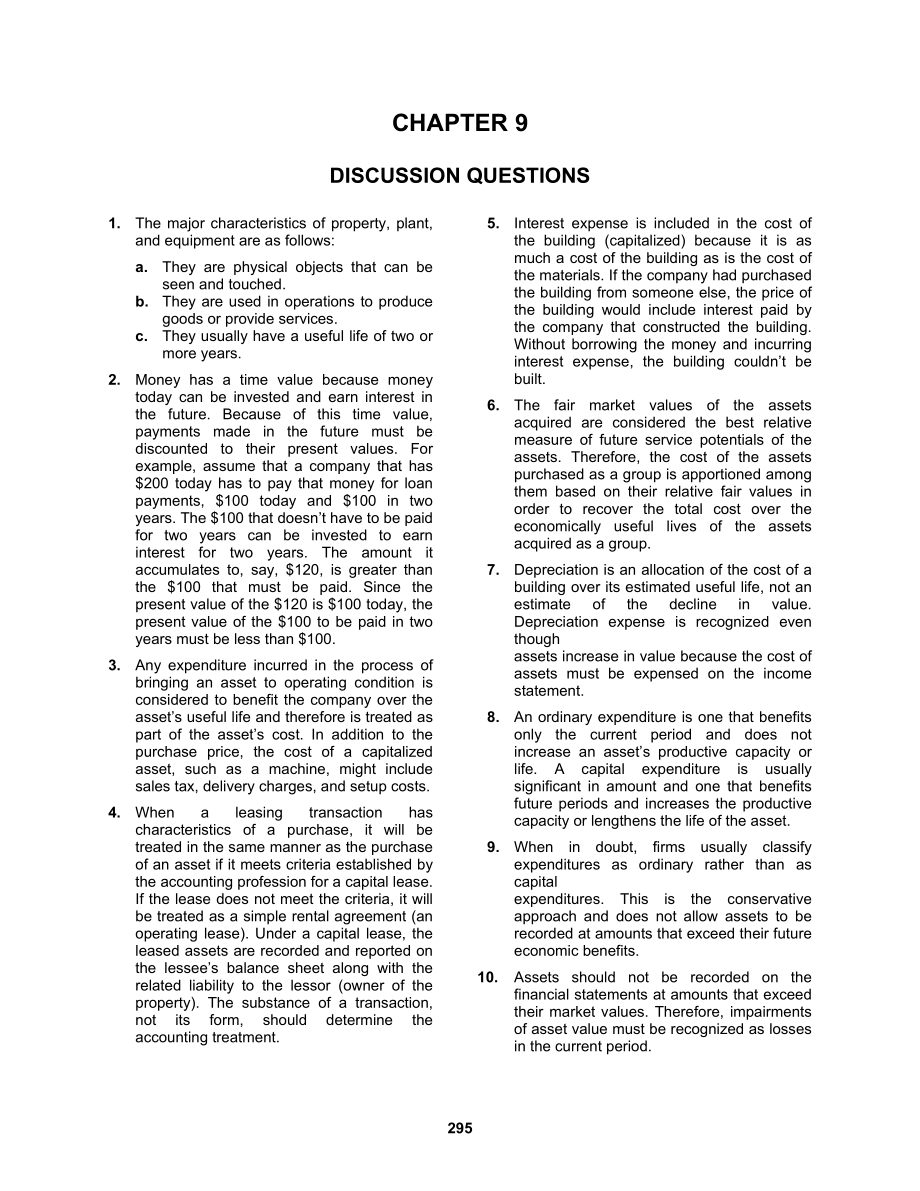

1、Chapter 9335CHAPTER 9DISCUSSION QUESTIONS1.The major characteristics of property, plant, and equipment are as follows:a.They are physical objects that can be seen and touched.b.They are used in operations to produce goods or provide services.c.They usually have a useful life of two or more years.2.M

2、oney has a time value because money today can be invested and earn interest in the future. Because of this time value, payments made in the future must be discounted to their present values. For example, assume that a company that has $200 today has to pay that money for loan payments, $100 today an

3、d $100 in two years. The $100 that doesnt have to be paid for two years can be invested to earn interest for two years. The amount it accumulates to, say, $120, is greater than the $100 that must be paid. Since the present value of the $120 is $100 today, the present value of the $100 to be paid in

4、two years must be less than $100.3.Any expenditure incurred in the process of bringing an asset to operating condition is considered to benefit the company over the assets useful life and therefore is treated as part of the assets cost. In addition to the purchase price, the cost of a capitalized as

5、set, such as a machine, might include sales tax, delivery charges, and setup costs.4.When a leasing transaction has characteristics of a purchase, it will be treated in the same manner as the purchase of an asset if it meets criteria established by the accounting profession for a capital lease. If t

6、he lease does not meet the criteria, it will be treated as a simple rental agreement (an operating lease). Under a capital lease, the leased assets are recorded and reported on the lessees balance sheet along with the related liability to the lessor (owner of the property). The substance of a transa

7、ction, not its form, should determine the accounting treatment.5.Interest expense is included in the cost of the building (capitalized) because it is as much a cost of the building as is the cost of the materials. If the company had purchased the building from someone else, the price of the building

8、 would include interest paid by the company that constructed the building. Without borrowing the money and incurring interest expense, the building couldnt be built.6.The fair market values of the assets acquired are considered the best relative measure of future service potentials of the assets. Th

9、erefore, the cost of the assets purchased as a group is apportioned among them based on their relative fair values in order to recover the total cost over the economically useful lives of the assets acquired as a group.7.Depreciation is an allocation of the cost of a building over its estimated usef

10、ul life, not an estimate of the decline in value. Depreciation expense is recognized even though assets increase in value because the cost of assets must be expensed on the income statement.8.An ordinary expenditure is one that benefits only the current period and does not increase an assets product

11、ive capacity or life. A capital expenditure is usually significant in amount and one that benefits future periods and increases the productive capacity or lengthens the life of the asset.9.When in doubt, firms usually classify expenditures as ordinary rather than as capital expenditures. This is the

12、 conservative approach and does not allow assets to be recorded at amounts that exceed their future economic benefits.10.Assets should not be recorded on the financial statements at amounts that exceed their market values. Therefore, impairments of asset value must be recognized as losses in the cur

13、rent period.11.U.S. accountants do not write up asset amounts when their values increase for several reasons including the following:a.In the United States, property, plant, and equipment assets are carried at cost, less accumulated depreciation.b.Not recognizing increases in value is the conservati

14、ve approach, which is usually preferred in the United States.c.The amount of an increase in value cannot be known with certainty until the asset is finally sold.12.It is common to have a gain or a loss on the disposal of a long-term operating asset because at the time an asset is purchased, the usef

15、ul life and salvage value can only be estimated. If either the actual life or the salvage value of an asset differs from the estimates made when the asset was purchased, there will be a gain or a loss. In the rare case where these estimates are exactly correct, there is no gain or loss if the asset

16、is held for its entire useful life.13.When recording the disposal of a long-term operating asset, it is necessary to debit the accumulated depreciation of the old asset because accumulated depreciation, as well as the original cost of the asset, must be removed from the books. If accumulated depreci

17、ation were not debitedhence, removedbalances that were associated with disposed-of assets would still be shown on the books. Eventually, the accumulated depreciation balance would exceed the costs of long-term operating assets.14.Intangible assets are considered assets because they provide future be

18、nefits to a firm. Tangible existence is not a criterion in deciding whether or not something is an asset.15.The fact that unsold businesses are not allowed to record goodwill can result in similar businesses having different kinds of financial statements. The accounts of a buyer of a firm might show

19、 higher assets than those of an unsold business because goodwill was part of the purchase. This difference in accounting could certainly affect many of the key financial ratios as well as the reported profitability of the companies.16.Fixed asset turnover is computed as sales divided by average prop

20、erty, plant, and equipment (fixed assets) and is interpreted as the number of dollars in sales generated by each dollar of fixed assets.17.*It is impossible to conclude that any one depreciation method will result in a higher net income without specifically identifying an assets age. During the earl

21、y years of an assets life, the straight-line method usually results in the highest net income; during the later years of an assets life, one of the accelerated methodssum-of-the-years-digits or declining-balanceusually results in the highest net income.18.*Declining-balance depreciation differs in t

22、he following two ways from other depreciation methods: (1) the initial computation of the declining-balance rate ignores the assets salvage value, and (2) a constant depreciation rate is multiplied by a decreasing book value.19.*MACRS is an accelerated depreciation method allowed by the IRS. It is b

23、ased on the double-declining-balance method. The purpose of MACRS is to allow taxpayers to rapidly report depreciation expense, thus reducing their income taxes and encouraging them to invest in new depreciable assets.20.*When an estimate of an assets useful life is changed, the depreciation expense

24、 for previous years should not be recalculated. Accounting practice specifies that a change in estimate should be accounted for by changing the estimate in each of the subsequent years, but not on a retroactive basis.21.*It is often necessary to recalculate the depletion rate for natural resources b

25、ecause the amount of the resource owned is usually an estimate, albeit based on scientific analysis and prior experience. For example, how do you determine how much oil is in a well? As new information becomes available, estimates of these types of reserves need to be changed.*Relates to expanded ma

26、terial.PRACTICE EXERCISESPE 91 (LO1)Long-Term Operating AssetsThe correct answer is E. Office supplies are a current asset.PE 92 (LO2)Decision of Long-Term Asset AcquisitionNo, the company should not purchase the machine. Even though the undiscounted sum of the future flows is $65,000 ($13,000 per y

27、ear 5 years = $65,000), the discounted present value of the future cash receipts is $46,862 according to the time value of money. Since the company would have to pay more money today than the drilling machine provides in profits in todays dollars, it should not invest its money in the machine.PE 93

28、(LO3)Asset Purchased with CashStamping Machine36,450Cash36,450Purchased a stamping machine for $36,450 ($35,000 retail price $700 purchase discount + $2,150 sales tax).PE 94 (LO3)Asset Purchased Partially with CashStamping Machine36,450Cash21,450Notes Payable15,000Purchased a stamping machine for $3

29、6,450 ($35,000 retail price $700 purchase discount + $2,150 sales tax). Paid $21,450 cash and issueda note for $15,000 to bank.PE 95 (LO3)Operating LeaseRent Expense4,500Cash4,500To record yearly rent of equipment.PE 96 (LO3)Capital Lease AcquisitionLeased Equipment27,651Lease Liability27,651To reco

30、rd equipment acquired under capital lease.PE 97 (LO3)Capital Lease PaymentsLease Liability1,735Interest Expense 2,765Cash4,500To record annual lease payment under capital lease.PE 98 (LO3)Classifying LeasesThe correct answer is C. If the lease term is equal to 75% (not 50%) or more of the estimated

31、economic life of the asset, the lease must be accounted for as a capital lease.PE 99 (LO3)Assets Acquired by Self-ConstructionDirect materials$1,450,000Direct labor860,000Overhead allocation ($2,450,000 0.30)735,000Capitalized interest140,000Total office building cost$3,185,000PE 910 (LO3)Acquisitio

32、n of Several Assets at OnceFirst, we need to allocate the correct percentages of the purchase price to the two assetsland and buildingas follows:Fair MarketPercentage of Apportionment ofAssetValueTotal ValueLump-Sum CostLand$240,00025%0.25 $890,000 =$222,500Building720,000750.75 $890,000 =667,500Tot

33、al$960,000100%$890,000Now we can make the following entry to record the purchase:Land222,500Building667,500Cash890,000PE 911 (LO4)Straight-Line Method of DepreciationDepreciation expense= = = $120,000Depreciation Expense120,000Accumulated Depreciation120,000To record depreciation expense on a straig

34、ht-line basis.PE 912 (LO4)Units-of-Production Method of DepreciationDepreciation rate= = = $0.60 per unitCurrent-year depreciation= Depreciation rate Units produced= $0.60 180,000 = $108,000Depreciation Expense108,000Accumulated Depreciation108,000To record depreciation expense on units-of-productio

35、n basis.PE 913 (LO4)Partial-Year Depreciation CalculationsFull-YearDepreciationDepreciationDepreciation*First Year (3 months)Second Year (12 months)$4,000$1,000 ($4,000 3/12)$4,000*Full-year depreciation= = = $4,000PE 914 (LO4)Units-of-Production Method with Natural ResourcesDepletion rate = = = $7.

36、00 per barrelFirst-year depletion= Depletion rate Barrels extracted and sold = $7.00 70,000 = $490,000Depletion Expense490,000Accumulated Depletion, Oil Field490,000To record depletion for the year: 70,000 barrels at $7.00 per barrel.PE 915 (LO5)Repairing and Improving Property, Plant, and Equipment

37、Original cost$150,000Accumulated depreciation (prior to overhaul)110,000Remaining book value$40,000Capital expenditure (overhaul)24,000New book value$64,000Less salvage value8,000New depreciable amount$56,000Remaining life7 yearsNew annual depreciation ($56,000/7)$8,000PE 916 (LO6)Determining Asset

38、ImpairmentOriginal cost$720,000Accumulated depreciation504,000Book value$216,000Sum of future cash flows ($30,000 6 years)$180,000Because the sum of future cash flows is less than the book value of the building, the asset is deemed to be impaired.PE 917 (LO6)Recording Decreases in the Value of Prope

39、rty, Plant, and EquipmentThe amount of the impairment loss is equal to the $66,000 ($216,000 $150,000) difference between the book value of the building and its fair value. The impairment loss would be recorded as follows:Accumulated Depreciation, Building504,000Loss on Impairment of Building66,000B

40、uilding ($720,000 $150,000)570,000Recognized $66,000 impairment loss on building.PE 918 (LO7)Discarding Property, Plant, and EquipmentAccumulated Depreciation, Truck48,000Loss on Disposal of Truck12,500Truck60,000Cash500Scrapped $60,000 truck and recognized loss of $12,500 (including $500 disposal c

41、osts).PE 919 (LO7)Selling Property, Plant, and EquipmentCash7,000Accumulated Depreciation, Truck24,000Truck30,000Gain on Sale of Truck1,000Sold $30,000 truck at a gain of $1,000.PE 920 (LO8)PatentsAmortization Expense, Patent30,000Patent30,000To amortize one-seventh of the cost of the patent.PE 921

42、(LO8)GoodwillInventory25,000Property, Plant, and Equipment140,000Other Assets64,000Goodwill30,000Liabilities59,000Cash200,000Purchased Daughter Company for $200,000.PE 922 (LO9)Fixed Asset TurnoverFixed asset turnover= = = 3.17 timesPE 923 (LO10)Declining-Balance Method of Depreciation*DDB rate = 1/

43、10 2 = 20%Depreciation expense year 1 = $1,500,000 0.20 = $300,000Depreciation expense year 2 = ($1,500,000 $300,000) 0.20 = $240,000PE 924 (LO10)Sum-of-the-Years-Digits Method of Depreciation*Sum of the years = 10(10 + 1)/2 = 55Depreciation expense year 1 = ($1,500,000 $100,000) 10/55 = $254,545Dep

44、reciation expense year 2 = ($1,500,000 $100,000) 9/55 = $229,091PE 925 (LO11)Changes in Depreciation Estimates*Book value after two years = $1,000,000 (2 $120,000) = $760,000Depreciation expense year 3 = ($760,000 $40,000)/10 years = $72,000*Relates to expanded material.EXERCISESE 926 (LO3)Acquisiti

45、on DecisionSome other factors that must be considered are:1.Is there an option to purchase the airplane at the end of the 10-year period and, if so, for how much?2.Who is responsible for maintenance of the airplane if the lease option is chosen, and what kind of warranty arrangements are available u

46、nder the two options?3.What is the expected life of the airplane, and how much will it be used over the next 10 years?4.What will be the airplanes market value after 10 years?5.Does the company have the cash to make the down payment if the purchase option is chosen?Certainly, there are other factors

47、 to consider as well.E 927 (LO3)Accounting for the Acquisition of a Long-Term Asset1.Machine28,213Cash28,213Purchased machine ($25,000 cost + $750 in-stallation + $900 testing + $1,563 sales tax).2.Machine28,213Note Payable25,000Cash3,213Purchased machine, paying $3,213 with cash and issuing a note

48、for the remainder.E 928 (LO3, LO4)Computing Asset Cost and Depreciation Expense1.Purchase price$45,000Sales tax2,000Delivery costs1,000Assembly costs1,400Painting600Total cost$50,0002.First full years depreciation, straight-line method: $50,000/15 years = $3,333.E 929 (LO3, LO4)Acquisition and Depre

49、ciation of Assets1.2009July1Drilling Equipment230,000Cash230,000Purchased drilling equipment.2.Straight-line= 1/2 year= $18,800 1/2 year = $9,400E 930 (LO3)Accounting for Leased Assets1.a.2009Jan.1Leased Equipment9,413Lease Liability9,413To record copy machine acquired under 5-year, noncancelable le

50、ase (capital lease).b.2009Jan.31Lease Liability122Interest Expense78Cash200To record monthly lease payment under capital lease.2.Jan. 1, 2009No entry required since this is an operating (rental) lease.2009Jan.31Rent Expense200Cash200To record monthly rental for copy machine.E 931 (LO3)Interest Capit

51、alizationThe building should be recorded in the accounting records at $654,800, determined as follows:Wages paid to construction workers$185,000Building materials purchased456,000Interest expense on construction loan13,800Total$654,800Mortgage interest isnt included because it was incurred after the

52、 building was completed.E 932 (LO3)Accounting for the Acquisition of AssetsBasket PurchaseFairPercentMarketofAssetValueTotalCostLand$120,00025$112,500Building280,00058 1/3262,500*Equipment80,00016 2/375,000*Totals$480,000100$450,000Land (0.25 $450,000)112,500Building (0.5833 $450,000)262,500*Equipme

53、nt (0.1667 $450,000)75,000*Cash (or Notes Payable)450,000Purchased land, building, and equipment.*Differences are due to rounding.E 933 (LO4)Depreciation Calculations1.a.Straight-line method2008: = $5,000 1/2 year = $2,5002009: $5,000b.Units-of-production method2008: 9,000 miles = $2,0452009: 24,000

54、 miles = $5,4552.There is no definitive answer to the question of which depreciation method more closely reflects the used-up service potential of the car. If there is no obsolescence factor, then the asset probably would wear out based on use, for which the units-of-production method would appear t

55、o be more appropriate. If obsolescence is an important factor in determining the cars useful life, the cars service potential would probably decline on an accelerated basis because obsolescence affects a cars fair market value more when it is newer than when it is older. The decline in service poten

56、tial would also be affected by the extent to which the maintenance policy assumed in selecting the five-year life is actually followed during the five-year period.E 934 (LO4)Depreciation Calculations1.Straight-line methodInvoice cost$31,500Installation400Total cost$31,900Less salvage value1,900Depre

57、ciable amount$30,000 = $2,000 per year2.Units-of-production method 51,000 cans = $1,800E 935 (LO3, LO5)Acquisition and Improvement of Assets1.Machine47,100Cash47,100Purchased machine ($45,000 cost + $1,200 installa-tion + $1,800 sales tax $900 discount).2.Repairs and Maintenance Expense200Cash200To

58、record repairs and maintenance expense on themachine.3.Machine400Cash400Purchased a governor for the machine.E 936 (LO6)Asset Impairment1.123Original cost of asset$1,400$1,400$1,400Accumulated depreciation400400400Book value of the asset$1,000$1,000$1,000Sum of future cash flows1,5001,5009001a.Impai

59、red?NoNoYesThe impairment test involves a comparison of the book value of the asset with the sum of the future cash flows expected to be generated by the asset. If the future cash flows are less than the book value, then the asset is impaired.1b.Amount to be reported?$1,000$1,000$800If the asset is

60、not impaired, then it continues to be reported at its book value, as in Scenarios 1 and 2. If the asset is impaired, as in Scenario 3, then it is reported at its fair value.2.Loss on Impairment of Asset 3200Accumulated Depreciation400Asset 3 ($1,400 $800)600To record loss on impairment of Asset 3.E

61、937 (LO6)Asset ImpairmentThe impaired value of the land and building must be recognized. The journal entry on January 1, 2009, would be:Loss on Impairment of Land and Building430,000Accumulated Depreciation, Building150,000Land ($150,000 $50,000)100,000Building ($550,000 $70,000)480,000To record loss on impairment of land and building.E 938 (LO7)Accounting for the Disposal of

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。