高级会计学英文版资料:Chap004 CONSOLIDATED FINANCIAL STATEMENTS and Outside Ownership

高级会计学英文版资料:Chap004 CONSOLIDATED FINANCIAL STATEMENTS and Outside Ownership

《高级会计学英文版资料:Chap004 CONSOLIDATED FINANCIAL STATEMENTS and Outside Ownership》由会员分享,可在线阅读,更多相关《高级会计学英文版资料:Chap004 CONSOLIDATED FINANCIAL STATEMENTS and Outside Ownership(44页珍藏版)》请在装配图网上搜索。

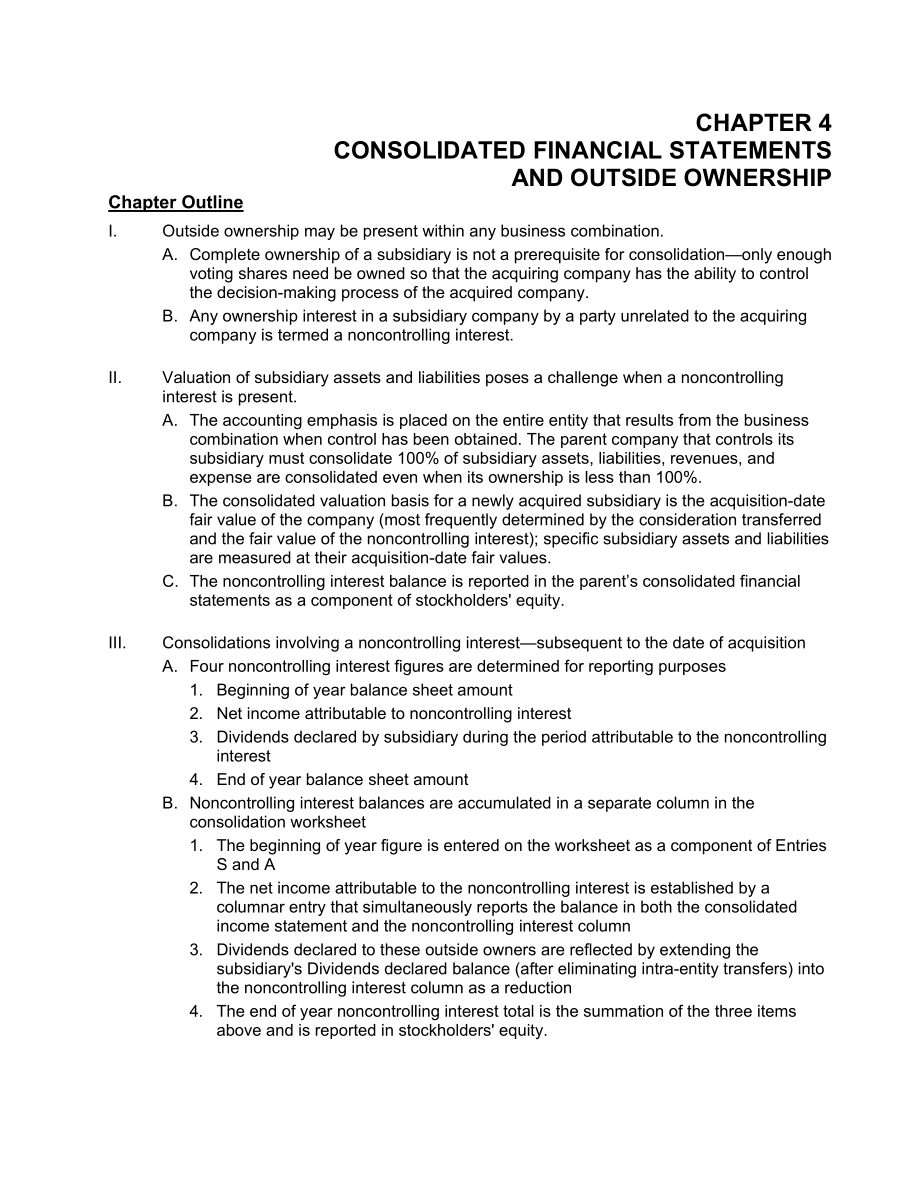

1、CHAPTER 4CONSOLIDATED FINANCIAL STATEMENTS AND OUTSIDE OWNERSHIPChapter OutlineI.Outside ownership may be present within any business combination.A.Complete ownership of a subsidiary is not a prerequisite for consolidationonly enough voting shares need be owned so that the acquiring company has the

2、ability to control the decisionmaking process of the acquired company.B.Any ownership interest in a subsidiary company by a party unrelated to the acquiring company is termed a noncontrolling interest.II.Valuation of subsidiary assets and liabilities poses a challenge when a noncontrolling interest

3、is present. A. The accounting emphasis is placed on the entire entity that results from the business combination when control has been obtained. The parent company that controls its subsidiary must consolidate 100% of subsidiary assets, liabilities, revenues, and expense are consolidated even when i

4、ts ownership is less than 100%.B. The consolidated valuation basis for a newly acquired subsidiary is the acquisition-date fair value of the company (most frequently determined by the consideration transferred and the fair value of the noncontrolling interest); specific subsidiary assets and liabili

5、ties are measured at their acquisition-date fair values.C. The noncontrolling interest balance is reported in the parents consolidated financial statements as a component of stockholders equity.III.Consolidations involving a noncontrolling interestsubsequent to the date of acquisitionA.Four noncontr

6、olling interest figures are determined for reporting purposes1.Beginning of year balance sheet amount2.Net income attributable to noncontrolling interest3.Dividends declared by subsidiary during the period attributable to the noncontrolling interest4.End of year balance sheet amountB.Noncontrolling

7、interest balances are accumulated in a separate column in the consolidation worksheet1.The beginning of year figure is entered on the worksheet as a component of Entries S and A2.The net income attributable to the noncontrolling interest is established by a columnar entry that simultaneously reports

8、 the balance in both the consolidated income statement and the noncontrolling interest column3.Dividends declared to these outside owners are reflected by extending the subsidiarys Dividends declared balance (after eliminating intra-entity transfers) into the noncontrolling interest column as a redu

9、ction4.The end of year noncontrolling interest total is the summation of the three items above and is reported in stockholders equity. IV.Step acquisitionsA.An acquiring company may make several different purchases of a subsidiarys stock in order to gain controlB.Upon attaining control, all of the p

10、arents previous investments in the subsidiary are adjusted to fair value and a gain or loss recognized as appropriateC. Upon attaining control, the valuation basis for the subsidiary is established at its total fair value (the sum of the fair values of the controlling and noncontrolling interests)D.

11、 Post-control subsidiary stock acquisitions by the parent are considered transactions with current owners of the consolidated entity. Thus such post-control stock acquisitions neither result in gains or losses nor provide a basis for subsidiary asset remeasurement to fair value. The difference betwe

12、en the sale proceeds and the carrying value of the shares sold (equity method) is recorded as an adjustment to the parents additional paid in capital. V.Sales of subsidiary stockA.The proper book value must be established within the parents Investment account so that the sales transaction can be cor

13、rectly recordedB.The investment balance is adjusted as if the equity method had been applied during the entire period of ownershipC.If only a portion of the shares are being sold, the book value of the investment account is reduced using either a FIFO or a weightedaverage cost flow assumptionD. If t

14、he parent maintains control, any difference between the proceeds of the sale and the equity-adjusted book value of the share sold is recognized as an adjustment to additional paid-in capital.E. If the parent loses control with the sale of the subsidiary shares, the difference between the proceeds of

15、 the sale and the equity-adjusted book value of the share sold is recognized as a gain or loss.F.Any interest retained by the parent company should be accounted for by either consolidation, the equity method, or the fair value method depending on the influence remaining after the sale.Answer to Disc

16、ussion Question: Do you think the FASB made the correct decision in requiring consolidated financial statements to recognize all subsidiarys assets and liabilities at fair value regardless of the percentage ownership acquired by the parent?As the quotes from the five accounting professionals illustr

17、ate, the decision to require the revaluation of 100% of a newly controlled subsidiarys assets and liabilitiesregardless of percentage ownershipwas not without some controversy. Students can use the quotes to discuss cost-benefit issues, relevance of capturing the underlying economics, use of hypothe

18、tical transactions in financial reporting, potential for abuse, etc. The requirement to value all acquisition date subsidiary assets at 100% fair value thus provides a useful vehicle for the class to discuss the many issues surrounding standard setters decisions.Answer to Discussion Question: DOES G

19、AAP UNDERVALUE POST-CONTROL STOCK ACQUISITIONS?From the Berkshire Hathaway 2012 annual 10-K report:We have owned a controlling interest in Marmon Holdings, Inc. (“Marmon”) since 2008. In the fourth quarter of 2012, pursuant to the terms of the 2008 Marmon acquisition agreement, we acquired an additi

20、onal 10% of the outstanding shares of Marmon held by noncontrolling interests for aggregate consideration of approximately $1.4 billion. Approximately $800 million of the consideration was paid in the fourth quarter of 2012, and the remainder is payable in March 2013. In the fourth quarter of 2010,

21、we acquired 16.6% of Marmons outstanding common stock for approximately $1.5 billion. As a result of these acquisitions, our ownership interest in Marmon has increased to approximately 90%. These purchases were accounted for as acquisitions of noncontrolling interests. The differences between the co

22、nsideration paid or payable and the carrying amounts of the noncontrolling interests acquired were recorded as reductions in Berkshires shareholders equity of approximately $700 million in 2012 and $614 million in 2010. We are contractually required to acquire substantially all of the remaining nonc

23、ontrolling interests of Marmon no later than March 31, 2014, for an amount that will be based on Marmons future operating results.On the date control is established, the new subsidiarys valuation basis is established. Subsequent acquisitions of any remaining portions of the noncontrolling interests

24、do not establish a new valuation basis for the subsidiary. In the Berkshire case, the new valuation basis for Marmon was established in 2008 when its 64% control was acquired. Berkshire then increases Marmons consolidated carrying amount as Marmon earns income, not by subsequent purchases of Marmons

25、 noncontrolling shares.Berkshires payments for its post-control equity acquisitions (16% and 10%) were in excess of Marmons proportionate carrying amounts. Because these transactions were with owners (not outside parties), no gain or loss is recorded. Berkshire reduces its paid-in capital the for ex

26、cess of the purchase price over the carrying amount. The accounting is similar to retirement of stock for a payment in excess of the companys proportionate carrying amount.Mr.Buffett may be correct that the current market value of Marmon is $4.6 bilion more that its carrying amount. However, GAAP do

27、es not, in general, record unrealized increases in a firms market value as increases in reported asset amounts.Answers to Questions1.Noncontrolling interest refers to an equity interest that is held in a member of a business combination by an unrelated (outside) party.2.Acquisition method = $220,000

28、 (fair value)3.A control premium is the portion of an acquisition price (above currently traded market values) paid by a parent company to induce shareholders to sell a sufficient number of shares to obtain control. The extra payment typically becomes part of the goodwill acquired in the acquisition

29、 attributable to the parent company.4.Current accounting standards require the noncontrolling interest to appear in the stockholders equity section. The noncontrolling interests share of the subsidiarys net income is shown as an allocated component of consolidated net income. 5.The ending noncontrol

30、ling interest is determined on a consolidation worksheet by adding the four components found in the noncontrolling interest column: (1) the beginning balance of the subsidiarys book value, (2) the noncontrolling interest share of the adusted acquisition-date excess fair over book value allocation, (

31、3) its share of current year net income, (4) less dividends declared to these outside owners. 6.Allsports should remove the pre-acquisition revenues and expenses from the consolidated totals. These amounts were earned (incurred) prior to ownership by Allsports and therefore should are not earnings f

32、or the current parent company owners.7.Following the second acquisition, consolidation is appropriate. Once Tree gains control, the 10% previous ownership is included at fair value as part of the total consideration transferred by Tree in the acquisition.8.When a company sells a portion of an invest

33、ment, it must remove the carrying value of that portion from its investment account. The carrying value is based upon application of the equity method. Thus, if either the initial value method or the partial equity method has been used, Duke must first restate the account to the equity method before

34、 recording the sales transaction. The same method is applied to the operations of the current period occurring prior to the time of sale. 9.Unless control is surrendered, the acquisition method views the sale of subsidiarys stock as a transaction with its owners. Thus, no gain or loss is recognized.

35、 The difference between the sale proceeds and the carrying value of the shares sold (equity method) is accounted for as an adjustment to the parents additional paid in capital.10.The accounting method choice for the remaining shares depends upon the current relationship between the two firms. If Duk

36、e retains control, consolidation is still required. However, if the parent now can only significantly influence the decisionmaking process, the equity method is applied. A third possibility is Duke may have lost the power to exercise even significant influence. The fair value method then is appropri

37、ate.Answers to Problems1.C2.AAt the date control is obtained, the parent consolidates subsidiary assets at fair value ($549,000 in this case) regardless of the parents percentage ownership. 3.DIn consolidating the subsidiarys figures, all intra-entity balances must be eliminated in their entirety fo

38、r external reporting purposes. Even though the subsidiary is less than fully owned, the parent nonetheless controls it.4. CAn asset acquired in a business combination is initially valued at 100% acquisition-date fair value and subsequently amortized its useful life.Patent fair value at January 1, 20

39、14$45,000Amortization for 2 years (10 year remaining life)(9,000)Patent reported amount December 31, 2015$36,0005.C6.BCombined revenues $1,100,000 Combined expenses(700,000)Excess acquisition-date fair value amortization(15,000)Consolidated net income$385,000 Less: noncontrolling interest share ($85

40、,000 40%)(34,000)Consolidated net income to Chamberlain Corporation$351,000 7. CConsideration transferred by Pride$540,000Noncontrolling interest fair value60,000Star acquisition-date fair value$600,000Star book value420,000Excess fair over book value$180,000Amort. to equipment (8 year remaining lif

41、e)$ 80,000$10,000 to customer list (4 year remaining life)100,00025,000$35,000Combined revenues$783,000Combined expenses$545,000Excess fair value amortization35,000580,000Consolidated net income$203,0008. A Under the equity method, consolidated RE = parents RE.9.B10. AAmie, Inc. fair value at July 1

42、, 2015:30% previously owned fair value (30,000 shares $5) $150,00060% new shares acquired (60,000 shares $6) 360,00010% NCI fair value (10,000 shares $5) 50,000Acquisition-date fair value$560,000 Net assets fair value500,000 Goodwill$60,000 11. C12. BFair value of 30% noncontrolling interest on Apri

43、l 1$165,000 30% of net income for remainder of year ($240,000 30%)72,000 Noncontrolling interest December 31$237,000 13. CProceeds of $80,000 less $64,000 ( $192,000) book value = $16,000Control is maintained so excess proceeds go to APIC.14. BCombined revenues$1,300,000 Combined expenses(800,000)Tr

44、ademark amortization(6,000)Patented technology amortization(8,000)Consolidated net income $486,000 15. CSubsidiary net income ($100,000 $14,000 excess amortizations)$86,000 Noncontrolling interest percentage40%Net income attributable to noncontrolling interest$34,400 Fair value of noncontrolling int

45、erest at acquisition date$200,00040% change in previous year Solar book value ($530,000 $400,000) 40%52,00040% of excess fair value amortizationyear one(5,600)Net income attributable to noncontrolling interest (above)34,400Noncontrolling interest at end of year$280,80016. AWest trademark balance$260

46、,000 Solar trademark balance200,000 Acquisition-date fair value allocation60,000 Excess fair value amortization for two years(12,000)Consolidated trademarks$508,00017. A Acquisition-date fair value ($60,000 80%)$75,000Strands book value (50,000)Fair value in excess of book value $25,000Excess assign

47、ed to inventory (60%) $15,000Excess assigned to goodwill (40%) $10,000Park current assets$70,000 Strand current assets20,000 Excess inventory fair value 15,000 Consolidated current assets$105,000 18. DPark noncurrent assets$90,000 Strand noncurrent assets40,000 Excess fair value to goodwill 10,000 C

48、onsolidated noncurrent assets$140,000 19.BAdd the two book values and include 10% (the $6,000 current portion) of the loan taken out by Park to acquire Strand.20.BAdd the two book values and include 90% (the $54,000 noncurrent portion) of the loan taken out by Park to acquire Strand. 21. CPark stock

49、holders equity$80,000 Noncontrolling interest at fair value (20% $75,000)15,000 Total stockholders equity$95,000 22.(15 minutes) (Compute consolidated net income and noncontrolling interest)2014 2015 a.Harrison net income$220,000 $260,000 Starr net income70,000 90,000 Acquisition-date excess fair va

50、lue amortization(8,000)(8,000)Consolidated net income$282,000 $342,000 b.Starr fair value$1,200,000 Fair value of consideration transferred1,125,000 Noncontrolling interest fair value$75,000 Noncontrolling interest fair value January 1, 2014 (above)$75,000 2014 income to NCI ($70,000 $8,000 10%)6,20

51、0 2014 dividends to NCI (3,000) Noncontrolling interest reported value December 31, 201478,200 2015 net income attributable to NCI ($90,000 $8,000 10%)8,200 2015 dividends to NCI (3,000) Noncontrolling interest reported value December 31, 2015$83,40023. (30 minutes) (Consolidated balances, allocatio

52、n of consolidated net income to controlling and noncontrolling interest, calculation of noncontrolling interest).a. Stayers technology processes: Acquisition-date fair value (20 year remaining life)$1,000,0002015 amortization (50,000)Technology processes 12/31/15$ 950,000b. Stayers building:Acquisit

53、ion-date fair value (10 year remaining life)$345,0002015 depreciation (34,500)Building 12/31/15$310,500 -or- $175,500 + $150,000 $15,000 = $310,500c. Controlling interest in consolidated net income:Net incomeJohnsonville$650,000 Net incomeStayer adjusted for excess fair value amortization (see part

54、d below) 285,000 Consolidated net income 935,000 Less: net income attributable to noncontrolling interest (see part d below) (57,000) Net income attributable to Johnsonville Co.$878,000-OR-Johnsonvilles separate net income$650,000Stayers reported net income350,000Excess fair value amortization: Tech

55、nology processes (50,000) Building ($345,000 $195,000) 10 years(15,000)Stayers adjusted net income285,000Johnsonvilles ownership percentage80% 228,000Net income attributable to Johnsonville Co.$878,000d. Net income attributable to noncontrolling interest:Stayers reported net income350,000Excess fair

56、 value amortization: Technology processes (50,000) Building ($345,000 $195,000) 10 years(15,000)Stayers adjusted net income285,000Noncontrolling interest percentage20%Net income attributable to noncontrolling interest$57,00023. (continued)e. Noncontrolling interest: Acquisition-date balance 1/1/15To

57、tal Stayer fair value ($3,000,000 80%)$3,750,000Noncontrolling interest percentage20%Noncontrolling interest acquisition-date fair value $750,000Net income attributable to noncontrolling interest57,000Noncontrolling interest share of Stayer dividends (20% $50,000) (10,000)Noncontrolling interest 12/

58、31/15$ 797,00024. (40 minutes) (Several valuation and income determination questions for a business combination involving a noncontrolling interest.)a. Business combinations are recorded generally at the fair value of the consideration transferred by the acquiring firm plus the acquisition-date fair

59、 value of the noncontrolling interest.Pattersons consideration transferred ($31.25 80,000 shares)$2,500,000Noncontrolling interest fair value ($30.00 20,000 shares) 600,000Sorianos total fair value January 1$3,100,000b. Each identifiable asset acquired and liability assumed in a business combination

60、 is initially reported at its acquisition-date fair value. c. In periods subsequent to acquisition, the subsidiarys assets and liabilities are reported at their book values adjusted for acquisition-date fair value allocations and for subsequent amortization and depreciation on those allocations. Exc

61、ept for certain financial items, the subsidiarys assets and liabilities are not continually adjusted for changing fair values.d. Sorianos total fair value January 1$3,100,000Sorianos net assets book value 1,290,000Excess acquisition-date fair value over book value$1,810,000Adjustments from book to fair valuesBuildings and equipment(250,000)Trademarks200,000Patented technology1,060,000Unpatented technology 600,000 1,610,000Goodwill$ 200,000e.Combined revenues$4,400,000 Combined expenses(2,350,000)Building and equipment excess depreciation50,000Trademark excess amortization(20,000)

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。