PURCHASEAGREEMENT买卖合同

PURCHASEAGREEMENT买卖合同

《PURCHASEAGREEMENT买卖合同》由会员分享,可在线阅读,更多相关《PURCHASEAGREEMENT买卖合同(71页珍藏版)》请在装配图网上搜索。

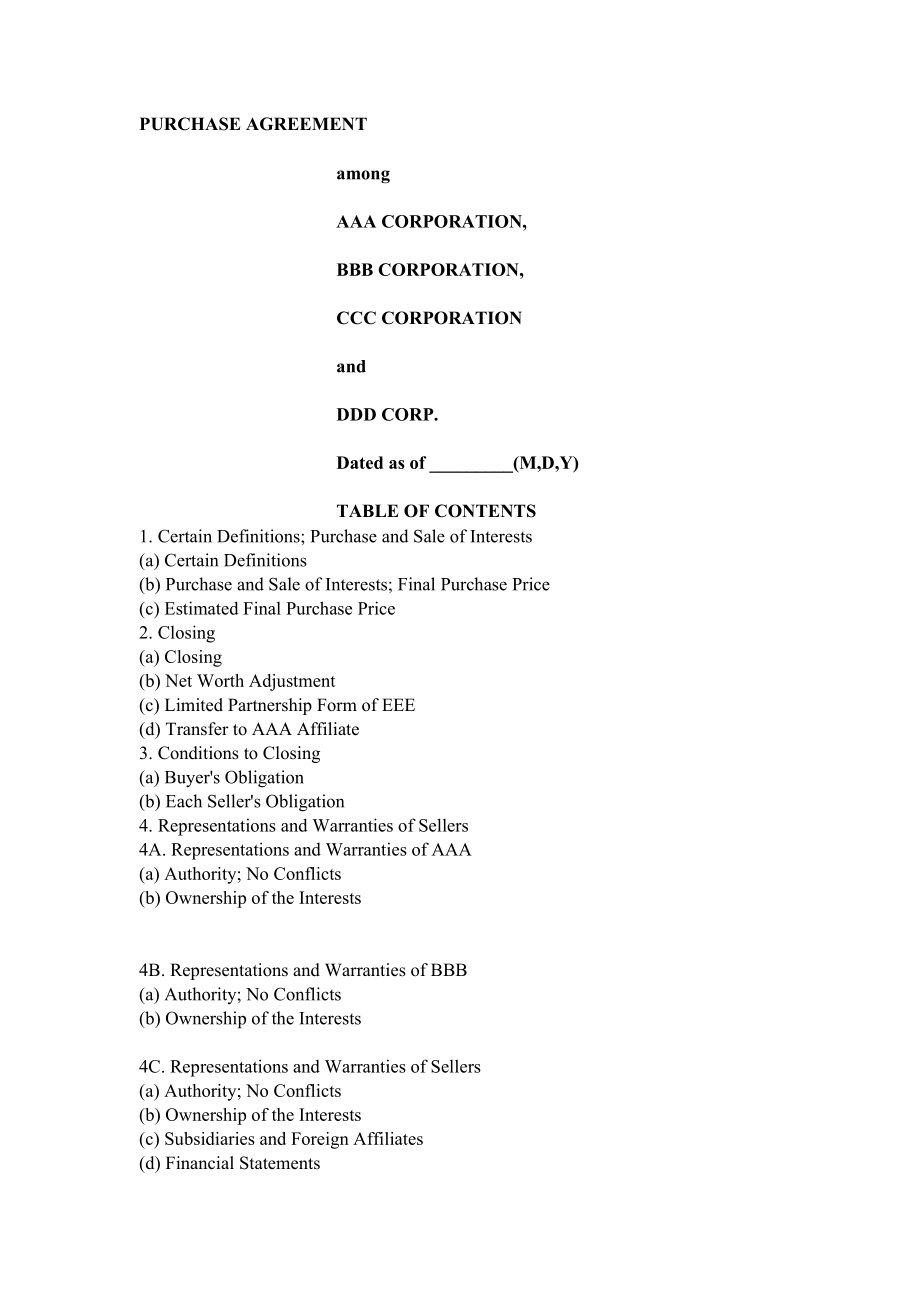

1、PURCHASE AGREEMENTamongAAA CORPORATION,BBB CORPORATION,CCC CORPORATIONandDDD CORP.Dated as of _(M,D,Y)TABLE OF CONTENTS1. Certain Definitions; Purchase and Sale of Interests (a) Certain Definitions(b) Purchase and Sale of Interests; Final Purchase Price (c) Estimated Final Purchase Price2. Closing (

2、a) Closing (b) Net Worth Adjustment (c) Limited Partnership Form of EEE (d) Transfer to AAA Affiliate3. Conditions to Closing (a) Buyers Obligation (b) Each Sellers Obligation4. Representations and Warranties of Sellers4A. Representations and Warranties of AAA (a) Authority; No Conflicts (b) Ownersh

3、ip of the Interests 4B. Representations and Warranties of BBB (a) Authority; No Conflicts (b) Ownership of the Interests 4C. Representations and Warranties of Sellers (a) Authority; No Conflicts (b) Ownership of the Interests (c) Subsidiaries and Foreign Affiliates (d) Financial Statements (e) Title

4、 to Tangible Assets Other than Real Property Interests. . (f) Title to Real Property (g) Intellectual Property (h) Material Contracts (i) Litigation; Decrees (j) Compliance with Applicable Laws (k) Employee Benefit Plans (l) Taxes (m) Insurance (n) Environmental Compliance (o) Undisclosed Liabilitie

5、s (p) Absence of Certain Changes or Events (q) Government Contracts (r) Labor Relations (s) Licenses, Permits and Authorizations (t) Assets (u) Loss Contracts; Backlog (v) Customers, Distributors and Suppliers (w) Dividends by Foreign Affiliates5. Covenants of Sellers (a) Access (b) Ordinary Conduct

6、 (c) Confidentiality (d) Preservation of Business (e) Covenant Not to Compete (f) Cooperation (g) AAA Resource Transfer (h) Intercompany Obligations (i) Financing Obligations (j) Notification of Certain Matters (k) AAA Arabia6. Representations and Warranties of Buyer (a) Authority; No Conflicts (b)

7、Actions and Proceedings, etc. (c) Availability of Funds (d) Acquisition of Interests for Investment (e) Fulfillment of Condition7. Covenants of Buyer (a) Confidentiality (b) Performance of Obligations by Buyer After Closing Date . (c) No Additional Representations; Disclaimer Regarding Estimates and

8、Projections (d) Intentionally omitted (e) Certain Guaranties (f) Retained Assets and Liabilities (g) _(YEAR) Audited Financial Statements8. Mutual Covenants (a) Consents (b) Publicity (c) Best Efforts (d) HSR Act Compliance (e) Cooperation with Financings (f) Environmental Indemnification (g) Writte

9、n Materials and Records (h) Transferred Employees and Employee Benefits . (i) Mutual Release (j) Insurance (k) Transition Services Agreement (l) Technology and Environmental Services Agreement (m) Lease (n) Intellectual Property Agreements (o) Intellectual Property Recordations (p) Cash Balance as o

10、f the Closing (q) FNSS Royalty Dispute.9. Further Assurances10. Tax Matters11. Indemnification (a) Indemnification by Sellers (b) Exclusive Remedy (c) Indemnification by Buyer (d) Losses Net of Insurance and Tax Benefits (e) Termination of Indemnification (f) Procedures Relating to Indemnification12

11、. Assignment13. No Third-Party Beneficiaries14. Termination15. Survival of Representations16. Expenses17. Amendment and Waiver18. Notices19. Interpretation20. No Strict Construction21. Counterparts22. Entire Agreement23. Brokerage24. Schedules25. Representation by Counsel; Interpretation26. Severabi

12、lity27. Governing Law28. Exhibits and Schedules29. Dispute Resolution (a) Negotiation (b) ArbitrationLIST OF EXHIBITS LIST OF SCHEDULESINDEX OF DEFINED TERMSAccounting FirmActivityAdjusted Net Worth AmountAdjustment AmountAdjustment PrinciplesAffiliateAgreementAncillary AgreementsApplicable Accounti

13、ng PrinciplesBacklog BPI AwardBusinessBuyerBuyer Indemnified PartiesBuyer Released PartiesCASCauseClosingClosing Balance SheetClosing DateClosing StatementCOBRACodeContinuing GuarantyContinuing LC ObligationsDefense Segment PlanDiligence Confidentiality AgreementFFFEnvironmental ClaimsEnvironmental

14、LossesEnvironmental RequirementsERISAEstimated Final Purchase PriceFacilityFile PlanFinal Purchase PriceFinancial StatementsFinancing ObligationsAAAAAA ArabiaAAA Arabia InterestsAAA Employee Benefit PlansAAA InsurersAAA Intellectual Property AgreementAAA Master TrustsAAA Salaried PlanAAA Thrift Plan

15、Foreign Affiliate Closing Balance SheetForeign Affiliate Tax BasketForeign AffiliatesFRSGovernment Contract BBB BBB Intellectual Property AgreementBBB PartyHazardous MaterialHSR ActCCCInactive ContractsIncome Tax ReturnsIncome Taxesindemnified partyInformationInitial Purchase PriceIntellectual Prope

16、rtyInterestsIRSJune 30 Balance SheetknowledgeLatest FinancialsLeaseLeased PropertyLeased SitesLiensLosses Material Adverse EffectMaterial ContractsMIPNon-Allowable CostsNotice of DisagreementOther TaxesOwned PropertiesOwned PropertyPension PlanPermitted LiensPersonnelPost-Closing Environmental Losse

17、sPost-Closing Partial PeriodPre-Closing Partial PeriodPrincipal Management Pro Rata BasisPropertiesPropertyPublic FilingsPurchase RecordsRemediation CostsRemediation ReportRepresentativesRequired ConsentEmployeesRetained LiabilitiesSan Jose PlanSchedulesScope of ActivitySeller GuarantySeller Indemni

18、fied PartiesSeller InformationSeller Released PartiesSellersSettlement and Advance AgreementSubsidiariesSubstitute Letters of CreditTarget Adjusted Net Worth AmountTaxTax LawsTax ReturnsTaxesTaxing AuthorityTechnology and Environmental Services AgreementThird Party ClaimTimely Non-Allowable Costs40

19、Transfer NoticeTransferred EmployeesTransition Services AgreementEEE EEE Employee Benefit PlansEEE EmployeesEEE Thrift Plan EEEs SharePURCHASE AGREEMENTThis PURCHASE AGREEMENT (this AGREEMENT), dated as of _(M,D,Y), is entered into by and among AAA Corporation, a _(STATE) corporation (AAA), BBB Corp

20、oration, a _(STATE) corporation, CCC Corporation, a _(STATE) business corporation (CCC and, together with BBB Corporation, BBB), and DDD Corp., a _(STATE) corporation (BUYER). AAA and BBB are collectively referred to herein as SELLERS.WITNESSETH:WHEREAS, AAA is the sole owner and holder of 100% of t

21、he outstanding general partnership interests of EEE, L.P., a _(STATE) limited partnership (EEE), and CCC is the sole owner and holder of 100% of the outstanding limited partnership interests of EEE; andWHEREAS, Buyer desires to purchase from Sellers, and Sellers desire to sell to Buyer, 100% of the

22、outstanding general partnership and limited partnership interests of EEE (the INTERESTS) (the sale and purchase of the Interests being referred to herein as the PURCHASE).NOW, THEREFORE, the parties hereto hereby agree as follows:1. CERTAIN DEFINITIONS; PURCHASE AND SALE OF INTERESTS.(a) CERTAIN DEF

23、INITIONS. As used in this Agreement (including the Schedules and Exhibits hereto), the following definitions shall apply:(i) AFFILIATE shall mean any natural person, and any corporation, partnership or other entity, that directly, or indirectly through one or more intermediaries, controls or is cont

24、rolled by or is under common control with the party specified.(ii) ANCILLARY AGREEMENTS shall mean the Transition Services Agreement, the Technology and Environmental Services Agreement, the Lease, the AAA Intellectual Property Agreement and the BBB Intellectual Property Agreement.(iii) APPLICABLE A

25、CCOUNTING PRINCIPLES shall mean United States generally accepted accounting principles as consistently applied in the preparation of the Financial Statements, subject to any exceptions therefrom disclosed in the notes to the Financial Statements.(iv) BUSINESS shall mean the entire business and opera

26、tions of EEE and its Subsidiaries and Foreign Affiliates as conducted on the date hereof, including the business to be transferred to EEE pursuant to Section 5(g).(v) FINANCING OBLIGATIONS shall mean (i) indebtedness of EEE or its Subsidiaries for borrowed money, (ii) obligations of EEE or any of it

27、s Subsidiaries evidenced by bonds, notes, debentures, letters of credit or similar instruments, (iii) obligations of EEE or any of its Subsidiaries under conditional sale, title retention or similar agreements or arrangements creating an obligation of EEE or any of its Subsidiaries with respect to t

28、he deferred purchase price of property (other than customary trade credit), (iv) breakage and other costs relating to interest rate and currency obligation swaps, hedges or similar arrangements to which EEE or any of its Subsidiaries is a party and (v) all obligations of EEE or any of its Subsidiari

29、es to guarantee any of the foregoing types of obligations on behalf of others.(vi) INACTIVE CONTRACTS shall mean all contracts or other legally binding arrangements, whether oral or written, which have been entered into or assumed by EEE which provide for the delivery of products or the rendering of

30、 contract-defined deliverable services by a Seller or EEE and with respect to which the final product has been delivered and the final service has been rendered.(vii) INTELLECTUAL PROPERTY shall mean all (i) domestic and foreign registrations of trademarks, service marks, logos, corporate names, pro

31、tected models, designs, created works, trade names or other trade rights, (ii) pending applications for any such registrations, (iii) patents and registered copyrights and pending applications therefor, (iv) rights to other trademarks, service marks, copyrights, logos, corporate names, protected mod

32、els, designs, created works, trade names and other trade rights and all other trade secrets, designs, plans, specifications, technology, know-how, methods, designs, concepts and other proprietary rights, whether or not registered and (v) rights under any licenses to use any copyrights, marks, trade

33、names, trade rights, patents, registered models and designs, created works or other proprietary rights.(viii) The term KNOWLEDGE, when used in the phrase TO THE KNOWLEDGE OF SELLERS, shall mean, and shall be limited to, the actual knowledge after reasonable inquiry of the following individuals: _, _

34、, _, _, _, _, _, David A. _. _ (as to the operations of the Ground Systems Division of the Business), _ (as to the operations of the Armament Systems Division of the Business), _, _ and each current member of the Advisory Committee (as defined in that certain Partnership Agreement by and among Selle

35、rs and EEE dated _(M,D,Y).(ix) MATERIAL ADVERSE EFFECT shall mean a material adverse effect upon the Business or the assets, liabilities or financial condition of EEE, its Subsidiaries and Foreign Affiliates taken as a whole.(x) PRO RATA BASIS shall mean 60% with respect to AAA and 40% with respect

36、to BBB.(xi) RETAINED LIABILITIES shall mean any and all liabilities of Sellers, EEE or any of its Subsidiaries arising out of, relating to, or in respect of the matters described on SCHEDULE 7(f) hereto.(xii) SCHEDULES shall mean the disclosure schedules attached hereto and incorporated by reference

37、 herein.(xiii) SUBSIDIARIES shall mean, with respect to any person, any corporation or other entity of which 50% or more of the voting power of the equity securities or equity interests is owned, directly or indirectly, by such person, and shall include (without limitation) in the case of EEE, EEE I

38、nternational, Inc., a _ corporation, UD EEE International Sales Corporation, a Barbados corporation and EEE Components, Limited, a Bermuda corporation, but shall specifically exclude the Foreign Affiliates. Notwithstanding anything herein or on Schedule 4C(c)-1, G&F Company, a California general par

39、tnership, shall not be deemed a Subsidiary for purposes of this Agreement.All other capitalized terms used herein (or in the Schedules or Exhibits hereto) and not defined above are defined elsewhere in this Agreement. See Index of Defined Terms above for references to the page numbers on which such

40、terms are defined.(b) PURCHASE AND SALE OF INTERESTS; FINAL PURCHASE PRICE. On the terms and subject to the conditions of this Agreement, at the Closing Sellers shall sell, transfer and deliver to Buyer, and Buyer shall purchase from Sellers, the Interests, free and clear of all Liens, and the coven

41、ants contained in Section 5(e) for an aggregate cash purchase price of $,_ in respect of the general partnership interests held by AAA and the covenants made by AAA in Section 5(e) and $,_ in respect of the limited partnership interests held by CCC and the covenants made by CCC in Section 5(e) (coll

42、ectively, the INITIAL PURCHASE PRICE). The final purchase price for the Interests and the covenants contained in Section 5(e) (the FINAL PURCHASE PRICE) shall be equal to:(i) the Initial Purchase Price; PLUS(ii) the amount, if any, by which the Adjusted Net Worth Amount reflected on the Closing Stat

43、ement in its final and binding form exceeds $,_ (the TARGET ADJUSTED NET WORTH AMOUNT); MINUS(iii) the amount, if any, by which the Target Adjusted Net Worth Amount exceeds the Adjusted Net Worth Amount reflected on the Closing Statement in its final and binding form.(c) ESTIMATED FINAL PURCHASE PRI

44、CE. At the Closing, pursuant to the provisions of Section 2(a)(i) below, Buyer shall pay Sellers an amount (the ESTIMATED FINAL PURCHASE PRICE) equal to the Final Purchase Price as estimated in good faith by AAA based on information provided by EEE management and set forth in a statement delivered t

45、o Buyer not less than two business days prior to the Closing Date. Such notice shall set forth AAAs and EEEs good faith estimate of the Adjusted Net Worth Amount. For purposes of this Agreement, the difference, positive or negative, between the Estimated Final Purchase Price and the Initial Purchase

46、 Price is referred to herein as the ADJUSTMENT AMOUNT.2. CLOSING.(a) CLOSING. The closing (the CLOSING) of the transactions contemplated hereby shall be held at the offices of Kirkland & Ellis, 200 East Randolph Drive, Chicago, Illinois at 10:00 a.m., local time, on _(M,D,Y) or, if the conditions to

47、 Closing set forth in Sections 3(a)(iii) and 3(b)(iii) shall not have been satisfied or waived by such date, on the third business day following satisfaction of such conditions. Notwithstanding the scheduled Closing Date of _(M,D,Y), as set forth above, the parties agree to use their commercially re

48、asonable efforts to cause the Closing to occur earlier on _(M,D,Y), or other mutually agreeable date as soon after _(M,D,Y) as practicable. The date on which the Closing shall occur is hereinafter referred to as the CLOSING DATE, and the Closing shall be deemed effective as of 12:01 a.m. on the Clos

49、ing Date. On the business day immediately preceding the Closing Date, Buyer and Sellers shall conduct a pre-Closing at the same location as the Closing, commencing at 10:00 a.m., local time, at which each party shall present for review by the other party copies in execution form of all documents req

50、uired to be delivered by such party at the Closing.(i) At the Closing, subject to and on the terms and conditions set forth in this Agreement, Buyer shall deliver to Sellers (A) the Estimated Final Purchase Price as follows: (1) by wire transfer to a bank account designated in writing by AAA, immedi

51、ately available funds in an amount equal to $,_ plus 60% of the Adjustment Amount (whether positive or negative), and (2) by wire transfer to a bank account designated in writing by BBB, immediately available funds in an amount equal to $,_ plus 40% of the Adjustment Amount (whether positive or nega

52、tive), (b) an instrument of assumption reasonably satisfactory to each Seller and Buyer assuming, subject to the other terms and conditions of this Agreement, all of the obligations and liabilities of whatever kind of such Seller in its capacity as a partner or predecessor of EEE to be assumed pursu

53、ant to the terms of this Agreement, (C) such other documents as are specifically required by this Agreement, (D) certified copies of resolutions duly adopted by Buyers board of directors authorizing the execution, delivery and performance of this Agreement and the Ancillary Agreements to which Buyer

54、 is a party, (E) a certificate of the Secretary or an Assistant Secretary of Buyer as to the incumbency of the officer(s) of Buyer (who shall not be such Secretary or Assistant Secretary) executing this Agreement or any Ancillary Agreement, (F) a legal opinion of Buyers special counsel, addressed to

55、 each Seller and dated the Closing Date, substantially in the form attached hereto as EXHIBIT 2(a)(i) and (G) appropriate releases by EEE of each Seller as a partner or predecessor of EEE, in form and substance reasonably satisfactory to such Seller and Buyer, and consistent with the provisions of S

56、ection 8(i) below.(ii) At the Closing, subject to and on the terms and conditions set forth in this Agreement, Sellers shall deliver or cause to be delivered to Buyer (A) such appropriately executed instruments of sale, assignment, transfer and conveyance in form and substance reasonably satisfactor

57、y to Buyer and Seller and its counsel evidencing and effecting the sale and transfer to Buyer of the Interests (it being understood that such instruments shall not require Sellers or their Affiliates to make any additional representations, warranties or covenants, expressed or implied, not contained

58、 in this Agreement), (b) such other documents as are specifically required by this Agreement, (C) certified copies of resolutions duly adopted by the board of directors of each Seller authorizing the execution, delivery and performance of this Agreement and the Ancillary Agreements, to the extent ea

59、ch is a party hereto or thereto, (D) a certificate of the Secretary or an Assistant Secretary of each Seller, and of EEE, as to the incumbency of the officer(s) of each (who shall not be such Secretary or Assistant Secretary) executing this Agreement or any Ancillary Agreement and (E) legal opinions

60、 of each Sellers special counsel, addressed to Buyer and dated the Closing Date, substantially in the form attached hereto as EXHIBIT 2(a)(ii).(b) NET WORTH ADJUSTMENT.(i) Within 60 days after the Closing Date, EEE shall, with the assistance of AAA consistent with past practice, prepare and deliver

61、to Buyer a balance sheet of EEE as of the Closing Date (the CLOSING BALANCE SHEET). The Closing Balance Sheet shall be prepared in a manner consistent with the June 30 Balance Sheet and in accordance with the Applicable Accounting Principles (without regard to any purchase accounting adjustments ari

62、sing out of the consummation of the transactions contemplated hereby). The Closing Balance Sheet shall be audited by FFF L.L.P. (FFF). FFF shall also provide audited financial statements through the Closing Date to Sellers so that each may comply with its respective reporting obligations. In connect

63、ion with the foregoing, EEE shall provide the Closing Date financial reporting system (FRS) package to AAA five days prior to the commencement of the FFF audit, and EEE shall provide Buyer and Sellers a complete list of all adjustments to accruals in excess of $,_ made subsequent to _(M,D,Y). FFF may begin field work for procedural tests prior to delivery of the Closing Date FRS package.Within 60 days after the Closing Date, EEE shall, wit

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。