财务报表分析 第十版 第七章 答案部分

财务报表分析 第十版 第七章 答案部分

《财务报表分析 第十版 第七章 答案部分》由会员分享,可在线阅读,更多相关《财务报表分析 第十版 第七章 答案部分(17页珍藏版)》请在装配图网上搜索。

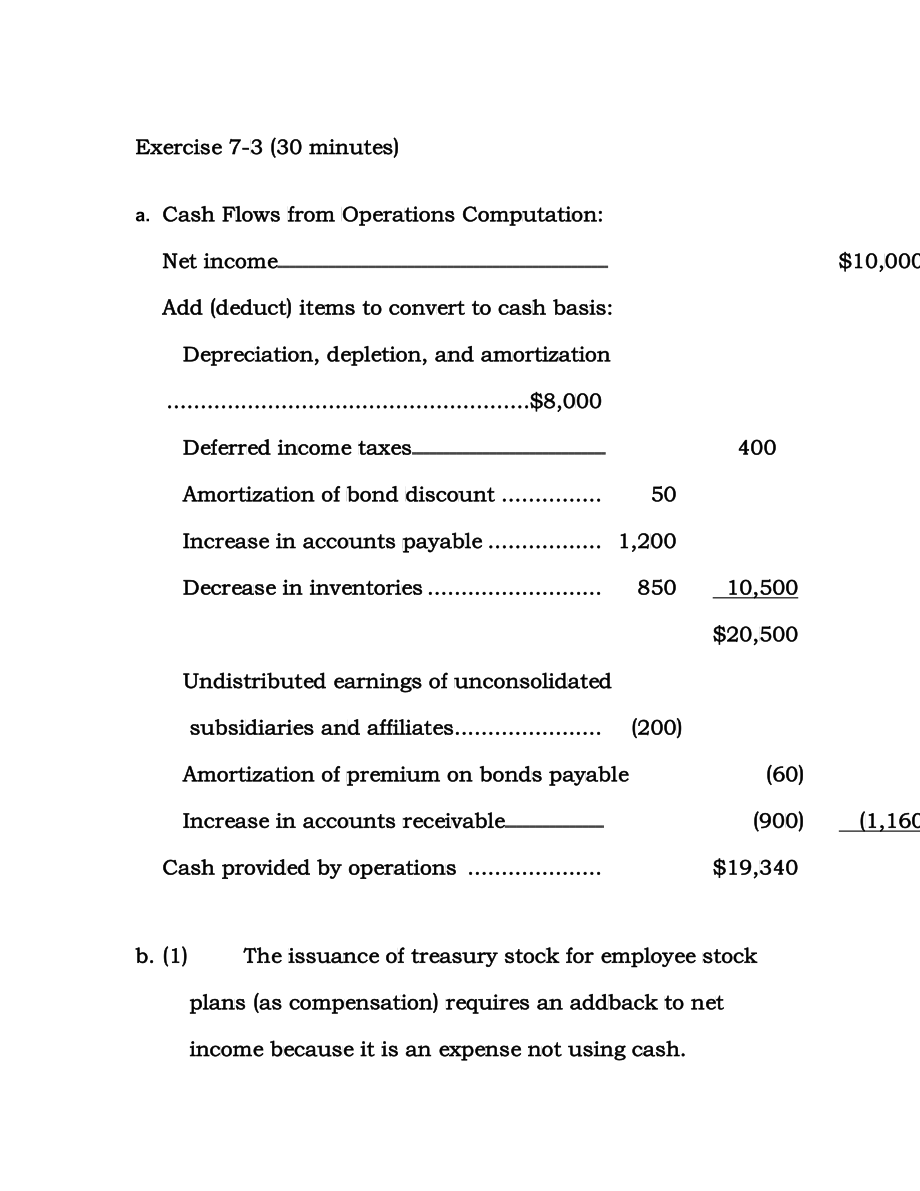

1、Exercisse 7-33 (30 minuttes)a. Cash Fllows ffrom OOperattions Compuutatioon:Net inncome$10,0000Add (deeduct) itemms to conveert too cashh basiis:Depreciiationn, deppletioon, annd amoortizaation$8,0000Deferreed inccome ttaxes 400Amortizzationn of bbond ddiscouunt 50Increasse in accouunts ppayablle 1,

2、2000Decreasse in invenntoriees 850 10,500$20,5500Undistrributeed earrningss of uunconssolidaated subsiddiariees andd affiiliatees(200)Amortizzationn of ppremiuum on bondss payaable(60)Increasse in accouunts rreceivvable (9000) (11,160)Cash prrovideed by operaationss $19,3340b.(1)The iissuannce off t

3、reaasury stockk for emplooyee sstock planss (as compeensatiion) rrequirres ann addbback tto nett incoome beecausee it iis an expennse noot usiing caash.(2)Thhe cassh outtflow for iintereest iss not incluuded iin exppense and mmust bbe inccludedd as ccash ooutfloow in invessting activvitiess (as part

4、 of ouutlayss for propeerty.)(3)Iff the diffeerencee betwween ppensioon exppense and aactuall fundding iis an accruued liiabiliity, tthe unnpaid portiion muust bee addeed bacck to incomme as an exxpensee not requiiring cash. If tthe ammount fundeed excceeds pensiion exxpensee, theen nett incoome muu

5、st bee reduuced bby thaat exccess aamountt.Exercisse 7-44 (30 minuttes)a.Begiinningg balaance oof acccountss receeivablle$ 3305,0000Net salles 1,9937,0000Total ppotenttial rreceippts$2,2442,0000Ending balannce off accoounts receiivablee - 295,0000Cash coollectted frrom saales$1,9447,0000b.Endiing ba

6、alancee of iinventtory$ 5549,0000Cost off salees+1,1550,0000Total$1,6999,0000Beginniing baalancee of iinventtory- 4431,0000Purchasses$1,2668,0000Beginniing baalancee of aaccounnts paayablee$ 5563,0000Purchasses (ffrom aabove) 1,2268,0000Total ppotenttial ppaymennts$1,8331,0000Ending balannce off acc

7、oounts payabble- 6604,0000Cash paaymentts forr accoounts payabble$1,2227,0000c.Issuuance of coommon stockk$ 81,0000Issuancce of treassury sstock 17,000Total nnonopeeratinng cassh recceiptss$ 98,0000d.Incrrease in laand$ 1150,0000Increasse in plantt and equippment 18,000Total ppaymennts foor nonncurr

8、eent asssets$ 1168,0000Exercisse 7-55 (20 minuttes)SourceUseAdjusstmenttCateggorya.XXOb.XFc.XFd.XIe.XFf.NCNg.XIh.NCSi.XFj.XXXOExercisse 7-66 (20 minuttes)SourceUseAdjusstmenttCateggorya.XXOb. XFc.NCNd.XIe.NCSf.NCNg.XIh.NCSi.NEj. NEExercisse 7-77 (30 minuttes)NetCaash frromCashIncomeeoperaationssposi

9、ttion1.NENE+2.NENE+3.+4a.-NENE4b.NEE(1)+(2)+(2)4c.-+(2)+(2) 5.NE+6.-+ (lonng-runn -)+ (loong-ruun -)7.-(5)+8.+NNENE9.+(33)+(4)+(4)10. NE + +11. + + +12. NE NE +13. NE NE +(1) Defferredd tax accouuntingg.(2) Deppends on whhetherr tax savinngs arre reaalizedd in ccash.(3) If profiitablee.(4) Iff accoo

10、unts receiivablee colllectedd.(5) Deppends on whhetherr inteerest is paaid orr accrrued.Furtheer expplanattions (listted byy propposal numbeer):1.Subsstitutting ppaymennt in stockk for paymeent inn cashh for its ddivideends wwill nnot afffect incomme or CFO bbut wiill inncreasse cassh possitionn.2.I

11、n tthe shhort rrun, ppostpoonemennt of capittal exxpendiituress willl savee cashh but have no efffect on inncome or CFFO. Inn the long term, bothh incoome annd CFOO may suffeer duee to llower operaating efficciencyy.Exercisse 7-77conttinuedd3.Cashh not spentt on rrepairr and mainttenancce willl incc

12、reasee all threee meassures. Howeever, the sskimpiing onn neceessaryy disccretioonary costss willl adveerselyy impaact fuuture operaating efficciencyy and, hencce, prrofitaabilitty.4.Manaagers advoccatingg an iincreaase inn deprreciattion mmay haave sppoken in thhe misstakenn beliief thhat deeprecii

13、ationn is aa sourrce off cashh and that conseequenttly inncreassing iit wouuld reesult in a higheer cassh infflow. In faact, tthe leevel oof deppreciaation expennse haas no effecct on cash flowthe ssame aamountt of ddeprecciatioon dedductedd in aarriviing att net incomme is addedd backk in aarriviin

14、g att CFO. On the oother hand, incrreasinng deppreciaation for ttax puurposees willl in all ccases resullt in at leeast aa shorrtterm savinngs.5.Quiccker ccollecctionss willl not affecct inccome bbut wiill inncreasse CFOO becaause oof lowwer acccountts recceivabble. CCash wwill aalso iincreaase byy

15、the speeddier cconverrsion of reeceivaables into cash. In tthe loonger run tthis sstiffeening in thhe terrms off salee to ccustommers mmay reesult in saales llost tto commpetittion.6.Paymments strettchedout wwill llower incomme beccause of loost diiscounnts buut doees possitiveely afffect CFO bby in

16、ccreasiing thhe levvel off accoounts payabble. CCash cconserrvatioon willl ressult iin a hhigherr cashh posiition. Relaationss withh suppplierss may be afffecteed advverselly. Noote: LLong-tterm ccash ooutfloow willl be higheer beccause of thhe losst disscountt.7.Borrrowingg willl resuult inn inteer

17、est costss thatt willl decrrease incomme andd CFO. Cashh posiition will increease.8.Thiss channge inn deprreciattion mmethodd willl incrrease incomme in the eearly stagees of an asssetss lifee. Thee oppoosite may hhold ttrue iin thee lateer staages oof thee asseets llife.9. In the shortt termm, higg

18、her ssales to deealerss willl resuult inn highher prrofitss (asssumingg we ssell aabove costss) andd, if they pay pprompttly, bboth CCFO annd cassh willl inccreasee. Howwever, unleess thhe deaalers are aable tto selll to consuumers, suchh salees willl be made at thhe exppense of fuuture saless.10. T

19、his wiill leead too lesss incoome frrom peensionn asseets inn the futurre whiich coould ccause futurre pennsion expennse too incrrease.11. The cosst of fundiing innventoory wiill bee reduuced iin thee futuure. In thhe currrent periood nett incoome maay alsso be increeased by a LIFO liquiidatioon fro

20、om redduced invenntory levells.12. The currrent periood deccline in thhe vallue off the tradiing seecuritties hhas beeen reeflectted inn currrent pperiodd incoome, aas hass the previious ggain. Althoough tthe saale wiill inncreasse cassh, itt willl havee no eeffectt on ccurrennt perriod iincomee. If

21、 the ccurrennt perriod ddeclinne is deemeed to be teemporaary, tthe coompanyy is ssellinng a ppotenttiallyy proffitablle seccurityy for a shoort-teerm caash gaain.13. Reissuaance oof treeasuryy sharres wiill inncreasse cassh, buut willl havve no effecct on curreent peeriod incomme as any “ggain” or

22、“lloss” is reeflectted inn addiitionaal paiid in capittal, nnot inncome. If tthe sttock pprice is coonsideered tto be tempoorarilly deppresseed, thhe commpany is fooregoiing a futurre salle at a greeater markeet priice annd is, thuss, suffferinng currrent diluttion oof shaarehollder vvalue. Exerciss

23、e 79 (600 minuutes)a.Cashh Colllectioons Coomputaation:Accountts Recceivabble (NNet)Beg a564.11Sales 136205.86145.4Cash colleectionns bEnd 333624.55Notes:aBallance at 7/29/Yeear 100$624.5 333Less: increease iin Yeaar 10 (660.4) 61$564.11bThiss amouunt iss overrstateed by the pprovission ffor dooubtf

24、uul acccountss expeense tthat iis inccludedd in aanotheer exppense categgory.b.Cashh Diviidendss Paidd Compputatiion:Dividennds PaayableeDividennd paiid 777137.5532.3BBeg 443142.2Dividdend ddeclarred aa 89937.0EEnd 443Note aa: Ittem 889 reepreseents ddivideends ddeclarred, nnot diividennds paaid (ss

25、ee allso Ittem 777).c.Costt of GGoods and SServicces Prroduceed Commputattion:InventooriesBeg 344819.88Amount to baalancee3982.44095.5Cost of prroductts solld 144End 344706.77d.The entryy for the iincomee tax proviision for YYear 111 is:Income tax eexpensse 277265.99Deferreed inccome ttax (ccurrennt

26、) pplug 12.11Income tax ppayablle230.44Deferreed inccome ttax (nnoncurrrent) a 23.4Notes:(1) Thee entrry inccreasees currrent liabiilitiees by $12.11 sincce defferredd incoome taax (cuurrentt) is crediited bby thiis amoount. It allso inncreasses cuurrentt liabbilitiies byy $2300.4 1124A, the amounnt

27、 of incomme taxxes paayablee.(2) Thee a is thhe diffferennce inn the balannce off the noncuurrentt defeerred incomme taxx itemm 1766 = $258.55 $2355.1 = $23.44.(3) Alsso, $223.4 + $12.1 = $35.5, whicch is totall defeerred tax 59 oor 1227AExercisse 79conntinueede.Deprreciattion eexpensse hass no eeff

28、ectt on ccash ffrom ooperattions. The crediit, whhen reecordiing thhe deppreciaation expennse, ggoes tto acccumulaated ddeprecciatioon, a noncaash acccountt.f.Thesse proovisioons arre addded baack beecausee theyy affeect onnly nooncashh accoounts, the chargge to earniings mmust bbe remmoved in coonv

29、ertting iit to the ccash bbasis.g.The “Effeect off exchhange rate changges onn cashh” reppresennts trranslaation adjusstmentts (diiffereences) arissing ffrom tthe trranslaation of caash frrom fooreignn currrenciees to the UU.S. ddollarr.h. Any gaiin or loss is reeporteed undder oother, netItemm 60.i

30、. Free caash fllows = Cash fflow ffrom ooperattions Cassh useed forr capiital aadditiions Diviidendss paiddYear 111: $8005.2 $3611.1 $137.5 = $306.66 Year 100: $4448.4 $3877.6 $124.3 = $(63.55)Year 9: $3357.3 $2884.1 $886.7 = $(133.5)j. Start-uup commpaniees usuually have greatter caapitall addiitio

31、n requiiremennts annd lowwer caash innflowss fromm operrationns. AAlso, startt-ups rarelly payy cashh diviidendss. Frree caash fllow eaarned by sttart-uup commpaniees is usuallly ussed too fundd the growtth of the ccompanny, esspeciaally iif succcessfful.k. During the llaunchh of aa new produuct lii

32、ne, tthe sttatemeent off cashh flowws cann be aaffectted inn seveeral wways. Firsst, caash fllow frrom opperatiions iis lowwer beecausee subsstantiial addvertiising and ppromottion iis reqquiredd and saless growwth haas nott yet been maximmized. Seccond, substtantiaal cappital addittions are uusuallly neccessarry to proviide thhe inffrastrructurre forr the new pproducct linne. Thhird, cash flow from finanncing can bbe afffectedd if ffinanccing iis obttainedd to llaunchh thiss new produuct liine.

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 新人版英语八年级下册Unit5总复习ppt课件

- 新人教部编版一年级语文上第五单元ppt课件(全套)

- 高鸿业经济学基础第十五章-总需求-总供给模型-授课-河北工大宋建林课件

- 新人教版高中数学《等差数列前n项和》课件

- 新人教部编版五年级语文上册第六单元测试卷课件

- 高鸿业微观经济学课件第4章生产论

- 高鸿业--微观经济学-第一章课件

- 新人教版部编本五年级下册语文13 人物描写一组 ppt课件

- 新人教版高中化学必修第一册——电解质的电离ppt课件

- 新人教版部编教材二年级下册第一单元3《贝的故事》优质课教学ppt课件

- 高风险作业培训讲义_002

- 新人教版语文三年级下册第五单元全套ppt课件部编版

- 新人教版英语八年级上册第二单元全部ppt课件

- 《走一步再走一步》重点课件

- 新人教版语文一年级上册:识字1《天地人》课件