经济学原理对应练习(共43页)

经济学原理对应练习(共43页)

《经济学原理对应练习(共43页)》由会员分享,可在线阅读,更多相关《经济学原理对应练习(共43页)(43页珍藏版)》请在装配图网上搜索。

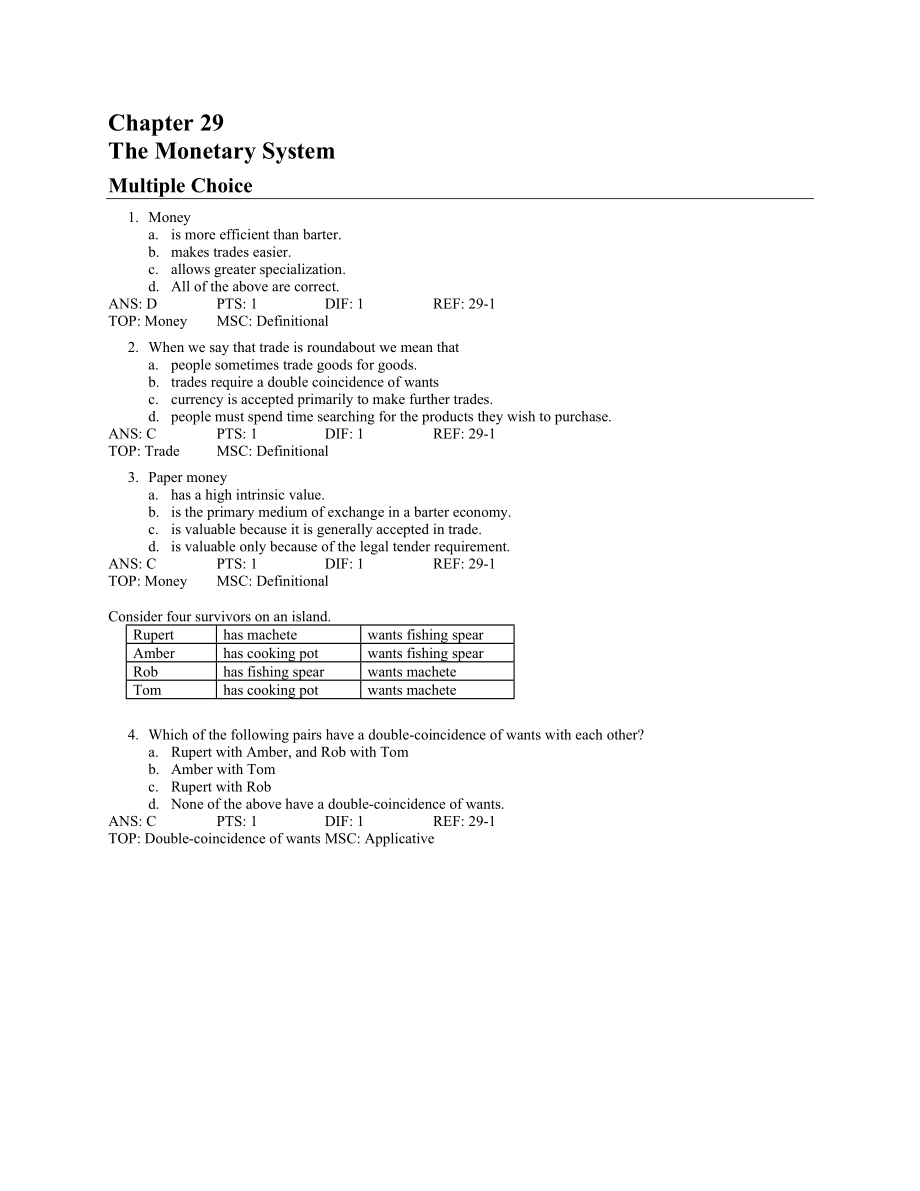

1、Chapter 29The Monetary SystemMultiple Choice1.Moneya.is more efficient than barter.b.makes trades easier.c.allows greater specialization.d.All of the above are correct.ANS: DPTS: 1DIF: 1REF: 29-1TOP: MoneyMSC: Definitional2.When we say that trade is roundabout we mean thata.people sometimes trade go

2、ods for goods.b.trades require a double coincidence of wantsc.currency is accepted primarily to make further trades.d.people must spend time searching for the products they wish to purchase.ANS: CPTS: 1DIF: 1REF: 29-1TOP: TradeMSC: Definitional3.Paper moneya.has a high intrinsic value.b.is the prima

3、ry medium of exchange in a barter economy.c.is valuable because it is generally accepted in trade.d.is valuable only because of the legal tender requirement.ANS: CPTS: 1DIF: 1REF: 29-1TOP: MoneyMSC: DefinitionalConsider four survivors on an island.Ruperthas machetewants fishing spearAmberhas cooking

4、 potwants fishing spearRobhas fishing spearwants macheteTomhas cooking potwants machete4.Which of the following pairs have a double-coincidence of wants with each other?a.Rupert with Amber, and Rob with Tomb.Amber with Tomc.Rupert with Robd.None of the above have a double-coincidence of wants.ANS: C

5、PTS: 1DIF: 1REF: 29-1TOP: Double-coincidence of wantsMSC: ApplicativeConsider the following traders who meet.Bobhas an applewants an orangeTedhas an orangewants a peachMaryhas a pearwants an appleAlicehas a peachwants an orange5.Which if any pairs have a double coincidence of wants?a.Bob with Aliceb

6、.Ted with Alicec.Bob with Mary, Ted with Bob, and Ted with Alice d.None of the pairs above have a coincidence of wants with each otherANS: BPTS: 1DIF: 1REF: 29-1TOP: Double-coincidence of wantsMSC: Applicative6.The existence of money leads to a.greater specialization in production, but not a higher

7、standard of living.b.a higher standard of living, but not greater specialization.c.greater specialization and a higher standard of living.d.neither greater specialization or a higher standard of living.ANS: CPTS: 1DIF: 1REF: 29-1TOP: MoneyMSC: Definitional7.Changes in the quantity of money affecta.i

8、nterest ratesb.pricesc.productiond.All of the above are correctANS: DPTS: 1DIF: 1REF: 29-1TOP: Monetary policyMSC: Definitional8.Which of the following is a store of value?a.currencyb.U.S. government bondsc.fine artd.All of the above are correct.ANS: DPTS: 1DIF: 1REF: 29-1TOP: Store of valueMSC: Int

9、erpretive9.Which of the following best illustrates the unit of account function of money?a.You list prices for candy sold on your Web site, , in dollars.b.You pay for your WNBA tickets with dollars.c.You keep $10 in your backpack for emergencies.d.None of the above is correct.ANS: APTS: 1DIF: 1REF:

10、29-1TOP: Unit of accountMSC: Interpretive10.The “yardstick” people use to post prices and record debts is calleda.a medium of exchange.b.a unit of account.c.a store of value.d.liquidity.ANS: BPTS: 1DIF: 1REF: 29-1TOP: Unit of accountMSC: Definitional11.Mia puts money into a piggy bank so she can spe

11、nd it later. What function of money does this illustrate?a.store of valueb.medium of exchangec.unit of accountd.None of the above is correct.ANS: APTS: 1DIF: 1REF: 29-1TOP: Store of valueMSC: Interpretive12.Which of the following best illustrates the medium of exchange function of money?a.You keep s

12、ome money hidden in your shoe.b.You keep track of the value of your assets in terms of currency.c.You pay for your double latte using currency.d.None of the above is correct.ANS: CPTS: 1DIF: 1REF: 29-1TOP: Medium of exchangeMSC: Interpretive13.You get money for babysitting the neighbors children. Th

13、is best illustrates which function of money?a.medium of exchangeb.unit of accountc.store of valued.liquidityANS: APTS: 1DIF: 1REF: 29-1TOP: Medium of exchangeMSC: Definitional14.Which of the following is a function of money?a.a unit of accountb.a store of valuec.medium of exchanged.All of the above

14、is correct.ANS: DPTS: 1DIF: 1REF: 29-1TOP: MoneyMSC: Definitional15.An item that people can use to transfer purchasing power from the present to the future is calleda.a medium of exchange.b.a unit of account.c.a store of value.d.None of the above is correct.ANS: CPTS: 1DIF: 1REF: 29-1TOP: Store of v

15、alueMSC: Definitional16.Treasury Bonds area.liquid, but not a store of value.b.a store of value, but not liquid.c.both liquid and a store of value.d.neither liquid nor a store of valueANS: CPTS: 1DIF: 1REF: 29-1TOP: Liquidity | Store of valueMSC: Interpretive17.Which of the following functions of mo

16、ney is also a common function of most other financial assets?a.a unit of accountb.a store of valuec.medium of exchanged.None of the above is correct.ANS: BPTS: 1DIF: 1REF: 29-1TOP: Store of valueMSC: Definitional18.Economists use the word money to refer toa.income generated by the production of good

17、s and services.b.those assets regularly used to buy goods and services.c.the value of a persons assets.d.the value of stocks and bonds.ANS: BPTS: 1DIF: 1REF: 29-1TOP: MoneyMSC: Definitional19.Liquidity refers toa.the ease with which an asset is converted to the medium of exchange.b.a measurement of

18、the intrinsic value of commodity money.c.the suitability of an asset to serve as a store of value.d.how many time a dollar circulates in a given year.ANS: APTS: 1DIF: 1REF: 29-1TOP: LiquidityMSC: Definitional20.Which list ranks assets from most to least liquid?a.currency, fine art, stocksb.currency,

19、 stocks, fine artc.fine art, currency, stocksd.fine art, stocks, currencyANS: BPTS: 1DIF: 1REF: 29-1TOP: LiquidityMSC: Definitional21.Current U.S. currency isa.fiat money with intrinsic value.b.fiat money with no intrinsic modity money with intrinsic modity money with no intrinsic value.ANS: BPTS: 1

20、DIF: 1REF: 29-1TOP: Commodity money | Fiat moneyMSC: Definitional22.Fiat moneya.has no intrinsic value.b.is backed by gold.c.has intrinsic value equal to its value in exchange.d.is any close substitute for currency such as checkable deposits.ANS: APTS: 1DIF: 1REF: 29-1TOP: Fiat moneyMSC: Definitiona

21、l23.Commodity money isa.backed by gold.b.the principal type of money in use today.c.money with intrinsic value.d.receipts created in international trade that are used as a medium of exchange.ANS: CPTS: 1DIF: 1REF: 29-1TOP: Commodity moneyMSC: Definitional24.Fiat moneya.is worthless.b.has no intrinsi

22、c value.c.may be used as a medium of exchange, but is not legal tender.d.performs all the functions of money except providing a unit of account.ANS: BPTS: 1DIF: 1REF: 29-1TOP: Fiat moneyMSC: Definitional25.Which type of currency has intrinsic value?modity moneyb.fiat moneyc.both commodity money and

23、fiat moneyd.neither commodity money nor fiat moneyANS: APTS: 1DIF: 1REF: 29-1TOP: Commodity moneyMSC: Definitional26.If an economy used gold as money, its money would modity money, but not fiat money.b.fiat money, but not commodity money.c.both fiat and commodity money.d.neither fiat nor commodity m

24、oney.ANS: APTS: 1DIF: 1REF: 29-1TOP: Fiat money | Commodity moneyMSC: Definitional27.The legal tender requirement means thata.people are more likely to accept the dollar as a medium of exchange.b.the government must hold enough gold to redeem all currency.c.people may not make trades with anything e

25、lse.d.All of the above are correct.ANS: APTS: 1DIF: 1REF: 29-1TOP: Legal tender requirementMSC: Definitional28.M1 equals currency + demand deposits +a.nothing else.b.other checkable deposits.c.travelers checks + other checkable deposits.d.travelers checks + other checkable deposits + savings deposit

26、s.ANS: CPTS: 1DIF: 1REF: 29-1TOP: M1MSC: Definitional29.M1 includesa.currency.b.demand deposits.c.travelers checks.d.All of the above are correct.ANS: DPTS: 1DIF: 1REF: 29-1TOP: M1MSC: Definitional30.Which of the following is not included in M1?a.currencyb.demand depositsc.savings depositsd.traveler

27、s checksANS: CPTS: 1DIF: 1REF: 29-1TOP: M1MSC: Definitional31.Which of the following is not included in M1?a.currencyb.demand depositsc.travelers checksd.credit cardsANS: DPTS: 1DIF: 1REF: 29-1TOP: M1MSC: Definitional32.Which of the following is included in M2 but not in M1?a.currencyb.demand deposi

28、tsc.savings depositsd.All of the above are included in both M1 and M2ANS: CPTS: 1DIF: 1REF: 29-1TOP: M2 | M1MSC: Definitional33.Which of the following is included in M2 but not in M1?a.demand depositsb.corporate bondsc.large time depositsd.money market mutual fundsANS: DPTS: 1DIF: 2REF: 29-1TOP: M2

29、| M1MSC: Definitional34.Which of the following isnt included in either M1 or M2?a.U.S. Treasury billsb.small time depositsc.demand depositsd.money market mutual fundsANS: APTS: 1DIF: 2REF: 29-1TOP: M2 | M1MSC: Definitional35.Which of the following is included in the M2 definition of the money supply

30、?a.credit cardsb.money market mutual fundsc.corporate bondsd.large time depositsANS: BPTS: 1DIF: 1REF: 29-1TOP: M2MSC: Definitional36.Money market mutual funds are included ina.M1 but not M2.b.M1 and M2.c.M2 but not M1.d.neither M1 or M2.ANS: CPTS: 1DIF: 1REF: 29-1TOP: M1 | M2MSC: Definitional37.Dem

31、and deposits are a type ofa.checking account.b.time deposit.c.money market mutual fund.d.savings deposit.ANS: APTS: 1DIF: 1REF: 29-1TOP: Demand depositsMSC: Definitional38.Demand deposits are included ina.M1 but not M2.b.M2 but not M1.c.M1 and M2.d.neither M1 nor M2.ANS: CPTS: 1DIF: 1REF: 29-1TOP: M

32、1 | M2MSC: Definitional39.Credit card limits are included ina.M1 but not M2.b.M2 but not M1.c.M1 and M2.d.neither M1 nor M2.ANS: DPTS: 1DIF: 1REF: 29-1TOP: M1 | M2MSC: Definitional40.Savings deposits are included ina.M1 but not M2.b.M2 but not M1.c.M1 and M2.d.neither M1 nor M2.ANS: BPTS: 1DIF: 1REF

33、: 29-1TOP: M1 | M2MSC: Definitional41.Which of the following is included in both M1 and M2?a.savings depositsb.demand depositsc.small time depositsd.money market mutual fundsANS: BPTS: 1DIF: 1REF: 29-1TOP: M1 | M2MSC: Definitional42.Credit cardsa.defer payments.b.are a store of value.c.have led to w

34、ider use of currency.d.are part of the money supply.ANS: APTS: 1DIF: 1REF: 29-1TOP: Credit cardsMSC: Definitional43.Credit cardsa.are included in M1 but not M2.b.are included in M1 and M2.c.are included in M2 but not M1d.are not included in any measure of the money supply.ANS: DPTS: 1DIF: 1REF: 29-1

35、TOP: Credit cardsMSC: Definitional44.Debit cardsa.defer payments.b.are equivalent to credit cards.c.are included in M2.d.are used as a method of payment.ANS: DPTS: 1DIF: 1REF: 29-1TOP: Debit cardsMSC: Definitional45.Which of the following defer payments?a.credit cards and debit cardsb.neither credit

36、 cards or debit cardsc.credit cards but not debit cardsd.debit cards but not credit cardsANS: CPTS: 1DIF: 1REF: 29-1TOP: Credit cards | Debit cardsMSC: DefinitionalUse the (hypothetical) information in the following table to answer the following Questions.Table 29-1Type of MoneyAmountLarge time depo

37、sits$80 billionSmall time deposits$75 billionDemand deposits$75 billionOther checkable deposits$40 billionSavings deposits$10 billionTravelers checks$1 billionMoney market mutual funds$15 billionCurrency$100 billionSDRs$10 billionMiscellaneous categories of M2$25 billion46.Refer to Table 29-1. What

38、is the M1 money supply?a.$215 billionb.$216 billionc.$226 billiond.$301 billionANS: BPTS: 1DIF: 2REF: 29-1TOP: M1MSC: Applicative47.Refer to Table 29-1. What is the M2 money supply?a.$125 billionb.$341 billionc.$421 billiond.$431 billionANS: BPTS: 1DIF: 2REF: 29-1TOP: M2MSC: Applicative48.Given the

39、following information, what would be the values of M1 and M2?Small time deposits$650 billionDemand Deposits and other Checkable Deposits$300 billionSavings-type deposits$750 billionMoney market mutual funds$600 billionTravelers checks$25 billionLarge time deposits$600 billionCurrency$100 billionMisc

40、ellaneous Categories in M2$25 billiona.M1 = $400 billion, M2 = $2,475 billion.b.M1 = $125 billion, M2 = $3,025 billion.c.M1 = $425 billion, M2 = $2, 450 billion.d.M1 = $425 billion, M2 = $1,875 billion.ANS: CPTS: 1DIF: 2REF: 29-1TOP: M1MSC: Definitional49.The amount of currency per person in the Uni

41、ted States is abouta.$200.b.$800.c.$1,600.d.$3,100.ANS: DPTS: 1DIF: 1REF: 29-1TOP: Currency holdingsMSC: Definitional50.In the US there is about $3,100 ofa.currency per person.b.demand deposits per person.c.M1 per person.d.M2 per person.ANS: APTS: 1DIF: 1REF: 29-1TOP: Currency holdingsMSC: Definitio

42、nal51.Which of the following might explain why the United States has so much currency per person?a.U.S. citizens are holding a lot of foreign currency.b.Currency may be a preferable store of wealth for criminals.c.People use credit and debit cards more frequently.d.All of the above help explain the

43、abundance of currency.ANS: BPTS: 1DIF: 1REF: 29-1TOP: Currency holdingsMSC: Definitional52.In the United States, per persona.average currency holdings are about $800. One explanation for this relatively small average is that money people use credit and debit cards to make transactions.b.average curr

44、ency holdings are about $800. One explanation for this relatively small average is that U.S. citizens hold a lot of foreign currency.c.average holdings of currency are about $3,100. One explanation for this relatively large amount is that criminals may prefer currency as a medium of exchange.d.avera

45、ge holdings are about $3,100. One explanation for this relatively large average is that U.S. citizens hold a lot of foreign currency.ANS: CPTS: 1DIF: 1REF: 29-1TOP: Currency holdingsMSC: Definitional53.One puzzle about the U.S. money stock is thata.banks hold so much currency relative to the public.

46、b.the public holds so much currency relative to banks.c.there is so little currency per person.d.there is so much currency per person.ANS: DPTS: 1DIF: 1REF: 29-1TOP: Currency holdingsMSC: Definitional54.The agency responsible for regulating the money supply in the United States isa.the Comptroller o

47、f the Currency.b.the U.S. Treasury.c.the Federal Reserve.d.the U.S. Bank.ANS: CPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional55.The Federal Reserve does all except which of the following?a.control the supply of moneyb.control the value of moneyc.make loans to individualsd.regulate the ba

48、nking systemANS: CPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional56.Members of the Board of Governorsa.are appointed by the U.S. president, while presidents of the Federal Reserve regional banks are appointed by the banks boards of directors.b.are appointed by the banks boards of director

49、s while the presidents of the Federal Reserve regional banks are appointed by the U.S. president.c.and the presidents of the Federal Reserve regional banks are appointed by the U.S. president.d.and the presidents of the Federal Reserve regional banks are appointed by the banks boards of directors.AN

50、S: APTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional57.Each Federal Reserve District Bank president is appointed bya.the US president with the approval of the Senate.b.the Board of Governors.c.the voting members of the FOMC.d.each banks board of directors.ANS: DPTS: 1DIF: 2REF: 29-2TOP: Fe

51、deral ReserveMSC: Definitional58.Which of the following executes open-market operations?a.Board of Governorsb.New York Federal Reserve Bankc.The FOMCd.None of the above is correct.ANS: BPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional59.What part of the Fed meets to discuss changes in the

52、economy and determine monetary policy?a.the Board of Governorsb.the FOMCc.the regional Federal Reserve Bank presidentsd.the Central Bank Policy Commission.ANS: BPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional60.The New York Federal Reserve Banka.president always gets to vote at the FOMC m

53、eetings.b.conducts open market transactions.c.is located in the traditional financial center of the United States.d.All of the above are correct.ANS: DPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional61.The Board of Governorsa.is currently chaired by Paul Volcker.b.are appointed by the pres

54、ident and confirmed by the Senate.c.has twelve members.d.All of the above are correct.ANS: BPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional62.Which of the following is correct?a.The Federal Reserve has 14 regional banks. The Board of Governors has 12 members who serve 7-year terms.b.The F

55、ederal Reserve has 14 regional banks. The Board of Governors has 7 members who serve 14-year terms.c.The Federal Reserve has 12 regional banks. The Board of Governors has 12 members who serve 7-year terms.d.The Federal Reserve has 12 regional banks. The Board of Governors has 7 members who serve 14-

56、year terms.ANS: DPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional63.Which of the following statements about the Federal Reserve is not correct?a.The members of the Board of Governors are also presidents of the Federal Reserves regional banks.b.The Federal Open Market Committee makes moneta

57、ry policy.c.All members of the Board of Governors sit on the Federal Open Market Committee.d.The Federal Reserve serves as a bank regulator.ANS: APTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional64.Which of the following has a four-year term?a.the members of the Board of Governorsb.the Chai

58、r of the Board of Governorsc.the members of the FOMCd.All of the above are correct.ANS: BPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional65.The 12 regional Federal Reserve Banksa.are not allowed to make loans to banks in their districts.b.regulate banks in their districts.c.have more votin

59、g members on the FOMC than does the Board of Governors.d.are each headed by a member of the Board of Governors.ANS: BPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional66.Which of the following does the Federal Reserve not do?a.conduct monetary policyb.act as a lender of last resortc.convert

60、Federal Reserve Notes into goldd.serve as a bank regulatorANS: CPTS: 1DIF: 1REF: 29-2TOP: Federal ReserveMSC: Definitional67.The Federal Open Market Committee is made up of a.5 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors.b.5 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors.c.12 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors.d.12 Federal Reserve Regional Bank Presi

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。