Test bank International Finance MCQ (word)Chap 2

Test bank International Finance MCQ (word)Chap 2

《Test bank International Finance MCQ (word)Chap 2》由会员分享,可在线阅读,更多相关《Test bank International Finance MCQ (word)Chap 2(11页珍藏版)》请在装配图网上搜索。

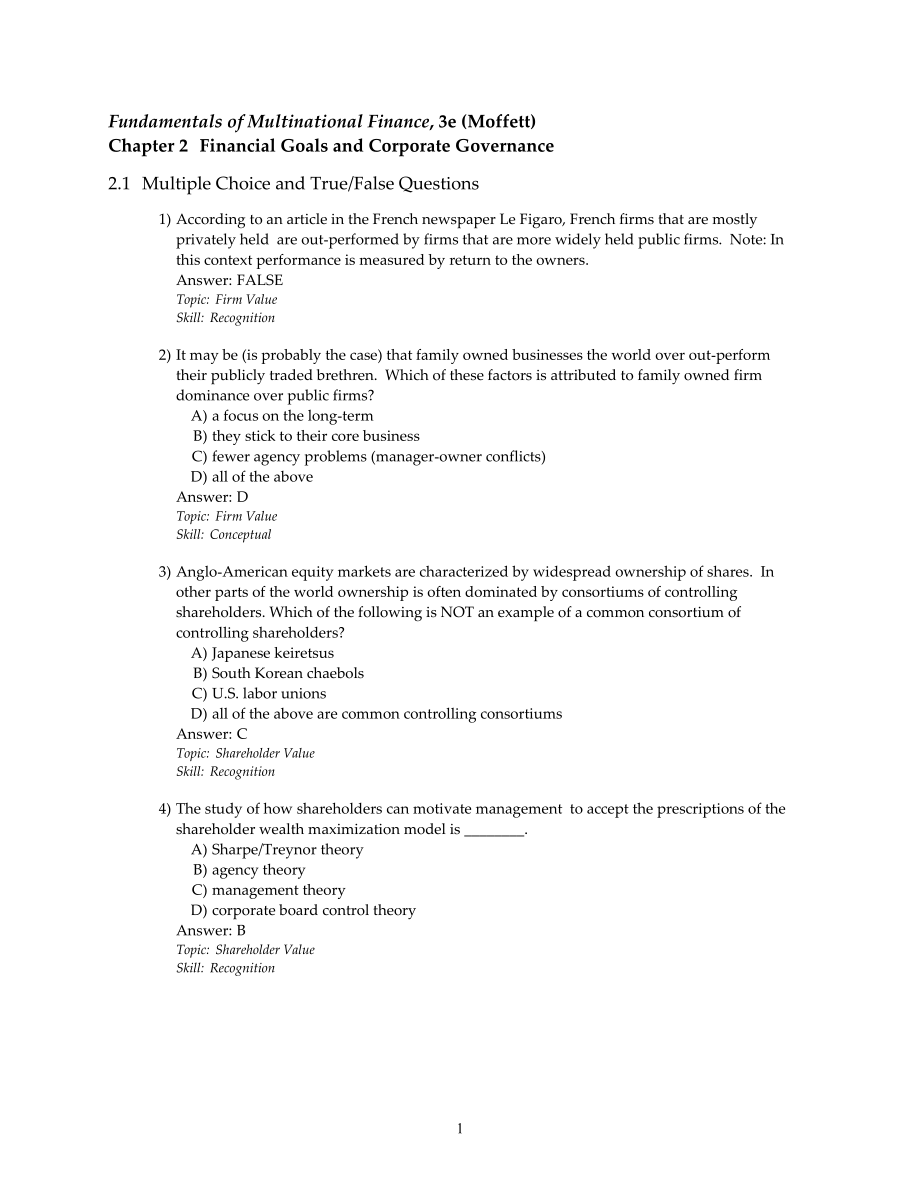

1、Fundamentals of Multinational Finance, 3e (Moffett) 11Chapter 2 Financial Goals and Corporate Governance2.1 Multiple Choice and True/False Questions1) According to an article in the French newspaper Le Figaro, French firms that are mostly privately held are out-performed by firms that are more widel

2、y held public firms. Note: In this context performance is measured by return to the owners. Answer: FALSE Topic: Firm Value Skill: Recognition2) It may be (is probably the case) that family owned businesses the world over out-perform their publicly traded brethren. Which of these factors is attribut

3、ed to family owned firm dominance over public firms? A) a focus on the long-term B) they stick to their core business C) fewer agency problems (manager-owner conflicts) D) all of the above Answer: D Topic: Firm Value Skill: Conceptual3) Anglo-American equity markets are characterized by widespread o

4、wnership of shares. In other parts of the world ownership is often dominated by consortiums of controlling shareholders. Which of the following is NOT an example of a common consortium of controlling shareholders? A) Japanese keiretsus B) South Korean chaebols C) U.S. labor unions D) all of the abov

5、e are common controlling consortiums Answer: C Topic: Shareholder Value Skill: Recognition4) The study of how shareholders can motivate management to accept the prescriptions of the shareholder wealth maximization model is _. A) Sharpe/Treynor theory B) agency theory C) management theory D) corporat

6、e board control theory Answer: B Topic: Shareholder Value Skill: Recognition 5) During the 1990s, rapidly increasing stock prices exposed a flaw in the shareholder wealth maximization model, the seeking of short-term value maximization. Such behavior by management is characterized by all but which o

7、f the following? A) a focus on quarterly earnings B) overly generous use of stock options to motivate management C) improper reporting of earnings by management D) All of the above may be characteristics of short-term value maximization. Answer: D Topic: Shareholder Value Skill: Recognition6) Warren

8、 Buffett and his investment firm Berkshire Hathaway is an outstanding example of impatient capital investing. Answer: FALSE Topic: Shareholder Value Skill: Recognition7) The stakeholder capitalism model is characterized by the desire of controlling shareholders to maximize long-term return to equity

9、 just as in the shareholder wealth maximization model of corporate governance. However, stakeholder capitalism controlling shareholders are more constrained by which of the following groups than in the shareholder wealth maximization model? A) banks B) governments C) other powerful stakeholders D) a

10、ll of the above Answer: D Topic: Shareholder Value Skill: Recognition8) Under the stakeholder capitalism model of corporate governance it is assumed that the long-term or loyal stockholders should influence corporate strategy more than the transient portfolio investor. Answer: TRUE Topic: Shareholde

11、r Value Skill: Recognition9) Under the shareholder wealth maximization model of corporate governance it is assumed that the long-term or loyal stockholders should influence corporate strategy more than the transient portfolio investor. Answer: FALSE Topic: Shareholder Value Skill: Recognition10) In

12、recent years there has been an increasing focus on the wealth maximization model of corporate governance and a move away from the stakeholder capitalism model among MNEs. Answer: TRUE Topic: Shareholder Value Skill: Recognition 11) Which of the following is a common operational financial objective f

13、or MNEs? A) maximization of consolidated after-tax income B) maximization of interest expense C) minimization of revenues from other countries D) minimization of total assets held in foreign locations Answer: A Topic: Operational Goals Skill: Conceptual12) Which of the following is a common operatio

14、nal financial objective for MNEs? A) maximization of interest expense B) minimization of the firms effective global tax burden C) minimization of revenues from other countries D) minimization of total assets held in foreign locations Answer: B Topic: Operational Goals Skill: Conceptual13) Which of t

15、he following is a common operational financial objective for MNEs? A) maximization of interest expense B) minimization of revenues from other countries C) correct positioning of the firms income, cash flow, and available funds as to country and currency D) minimization of total assets held in foreig

16、n locations Answer: C Topic: Operational Goals Skill: Conceptual14) Anglo-American is defined to mean A) North, Central, and South America. B) the United States, Canada, and Western Europe. C) the United States, United Kingdom, Canada, Australia and New Zealand. D) the United States, France, Britain

17、, and Germany. Answer: C Topic: Fundamentals of Finance Skill: Recognition15) In finance, an efficient market is one in which A) prices are assumed to be correct. B) prices adjust quickly and accurately to new information. C) prices are the best allocators of capital in the macro economy. D) all of

18、the above. Answer: D Topic: Fundamentals of Finance Skill: Recognition 16) In the Anglo-American model of corporate governance, the primary goal of management is to A) maximize the wealth of all stakeholders. B) maximize shareholder wealth. C) minimize costs. D) minimize risk. Answer: B Topic: Funda

19、mentals of Finance Skill: Recognition17) Systematic risk can be defined as A) the total risk to the firm. B) the risk of the individual security. C) the added risk that a firms shares bring to a diversified portfolio. D) the risk that can be systematically diversified away. Answer: C Topic: Fundamen

20、tals of Finance Skill: Recognition18) Which of the following is the signature clause of the Sarbanes -Oxley Act? A) CEOs and CFOs of publicly-traded firms must vouch for the veracity of the firms financial statements. B) Corporate board audit and compensation committee members must come from outside

21、 directors. C) Companies may not make loans to their officers and directors. D) Companies must test their internal financial controls against fraud. Answer: A Topic: Sarbanes-Oxley Skill: Conceptual19) Accountants and lawyers have found the costs to corporations to meet Sarbanes-Oxley regulatory req

22、uirements to be disappointingly small and less than anticipated when the legislation was enacted in 2002. Answer: FALSE Topic: Sarbanes-Oxley Skill: Conceptual20) Unsystematic risk can be defined as A) the total risk to the firm. B) the risk of the individual security. C) the added risk that a firms

23、 shares bring to a diversified portfolio. D) the risk that can be systematically diversified away. Answer: A Topic: Fundamentals of Finance Skill: Recognition 21) Maximize corporate wealth A) is the primary objective of the European/Japanese model of management. B) as a management objective treats s

24、hareholders on a par with other corporate stakeholders such as creditors, labor, and local community. C) has a broader definition than just financial wealth. D) all of the above. Answer: D Topic: Alternative Management Objectives Skill: Recognition22) Corporate wealth maximization, also known as the

25、 stakeholder capitalism model, holds that total risk (operational and financial) is more important than just systematic risk. Answer: TRUE Topic: Alternative Management Objectives Skill: Recognition23) The Corporate Wealth Maximization Model A) clearly places shareholders as the primary stakeholder.

26、 B) combines the interests and inputs of shareholders, creditors, management, employees, and society. C) has financial profit as its goal and is often termed impatient capital. D) is the Anglo-American model of corporate governance. Answer: B Topic: Alternative Management Objectives Skill: Recogniti

27、on24) The Shareholder Wealth Maximization Model A) combines the interests and inputs of shareholders, creditors, management, employees, and society. B) is being usurped by the Corporate Wealth Maximization Model as those types of MNEs dominate their global industry segments. C) clearly places shareh

28、olders as the primary stakeholder. D) is the dominant form of corporate management in the European-Japanese governance system. Answer: C Topic: Alternative Management Objectives Skill: Recognition25) In recent years the trend has been for markets to increase focus on the shareholder wealth form of w

29、ealth maximization. Answer: TRUE Topic: Alternative Management Objectives Skill: Recognition 26) Under the Shareholder Wealth Maximization Goal of Corporate Governance, poor firm performance is likely to be faced with all but which of the following? A) sale of shares by disgruntled current sharehold

30、ers B) shareholder activism to attempt a change in current management C) as a maximum threat, initiation of a corporate takeover D) prison time for executive management Answer: D Topic: Corporate Governance Skill: Conceptual27) Non-Anglo-American markets are dominated by the one-vote-one-share rule.

31、 Answer: FALSE Topic: Corporate Governance Skill: Conceptual28) Which of the following is a reason why managers act to maximize shareholder wealth in Anglo-American markets? A) the use of stock options to align the goals of shareholders and managers B) the market for corporate control that allows fo

32、r outside takeover of the firm C) performance based compensation for executive management D) all of the above Answer: D Topic: Corporate Governance Skill: Conceptual29) Which of the following was NOT identified by the authors as a knowledge asset? A) customer care B) foreign macroeconomic issues C)

33、brand value D) management skill Answer: B Topic: Firm Value Skill: Recognition30) Which of the following is generally NOT considered to be a viable operational goal for a firm? A) maintaining a strong local currency B) maximization of after-tax income C) minimization of the firms effective global ta

34、x burden D) correct positioning of the firms income, cash flows and available funds as to country and currency Answer: A Topic: Operational Goals Skill: Conceptual31) The primary operational goal for the firm is to A) maximize after-tax profits in each country where the firm is operating. B) minimiz

35、e the total financial risk to the firm. C) maximize the consolidated after-tax profits of the firm. D) maximize the total risk to the firm. Answer: C Topic: Operational Goals Skill: Conceptual 32) Which of the following is an operational process that can destroy firm value? A) interest rate fluctuat

36、ions B) competitive pressures C) natural disasters D) accounting irregularities Answer: D Topic: Operational Goals Skill: Conceptual33) Privatization is a term used to describe A) firms that are purchased by the government. B) government operations that are purchased by corporations and other invest

37、ors. C) firms that do not use publicly available debt. D) non-public meetings held by members of interlocking directorates. Answer: B Topic: Operational Goals Skill: Conceptual34) The goal of all international corporations is to maximize shareholder wealth. Answer: FALSE Topic: Operational Goals Ski

38、ll: Conceptual35) According to a recent Forrester survey, which of the following categories is the single most important cause of losses of stock value? A) operational mistakes B) business hazard C) strategic mistakes D) financial mistakes Answer: C Topic: Risk Skill: Conceptual36) Systematic risk c

39、an be eliminated through portfolio diversification. Answer: FALSE Topic: Risk Skill: Conceptual37) According to the authors, dual classes of voting stock are the norm in non-Anglo-American markets. Answer: TRUE Topic: Corporate Governance Skill: Recognition38) Which of the following is not a form of

40、 direct foreign investment? A) joint ventures B) acquisitions of existing operations in a foreign country C) franchising D) international trade Answer: D Topic: The Globalization Process Fundamentals Skill: Recognition 39) Typically, Licensing is considered to be a greater foreign investment than a

41、Greenfield investment. Answer: FALSE Topic: The Globalization Process Fundamentals Skill: Recognition40) The deliberation of the of the process demonstrated in the European-Japanese system of corporate governance has sometimes been termed _. A) socialism B) impatient capital C) patient capital D) co

42、mmunism Answer: C Topic: Corporate Governance Skill: Recognition41) With shareholder wealth maximization as the managers goal, capital may be termed _. A) impatient B) patient C) borrowed D) bought Answer: A Topic: Corporate Governance Skill: Recognition42) Which of the following is NOT an important

43、 concept when distinguishing between international and domestic financial management? A) corporate governance B) culture, history, and institutions C) political risk D) All of the above are important distinguishing concepts. Answer: D Topic: Financial Management Skill: Recognition43) The Board of Di

44、rectors A) consists exclusively of the officers of the corporation. B) is the legal body which is accountable for the governance of the corporation. C) are not subject to the external forces of the marketplace. D) is appointed by the Securities and Exchange Commission (SEC). Answer: B Topic: Board o

45、f Directors Skill: Recognition 44) The relationship among stakeholders used to determine and control the strategic direction and performance of an organization is termed _. A) corporate governance B) Anglo-American activism C) capital structure D) working capital management Answer: A Topic: Corporat

46、e Governance Skill: Recognition45) When discussing the structure of corporate governance, the authors distinguish between internal and external factors. _ is an example of an internal factor, and _ is an example of an external factor. A) Equity markets; executive management B) Debt markets; board of

47、 directors C) Executive management; auditors D) Auditors; regulators Answer: C Topic: Corporate Governance Skill: Recognition46) According to recent research, family-owned firms in some highly-developed economies typically outperform publicly-owned firms. Answer: TRUE Topic: Family Ownership Skill:

48、Recognition47) If share price falls from $15 to $12 per share, and pays a dividend of $1 per share, what was the rate of return to shareholders? A) 13.33% B) -13.33% C) 16.67% D) -16.67% Answer: B Topic: Shareholder Returns Skill: Analytical48) MultiProducts, Inc. has two classes of common stock. Cl

49、ass A has 1 million shares with 10 votes per share. Class B has 2 million shares with 1 vote per share. If the dividends per share are equal for both class A and B stock, then Class A shareholders have _ of the votes and _ of the dividends. A) 33.33%; 33.33% B) 33.33%; 83.33% C) 83.33%; 83.33% D) 83

50、.33%; 33.33% Answer: D Topic: Shareholder Returns Skill: Analytical 2.2 Essay Questions1) Compare and contrast the Shareholder Wealth Maximization model and the Stakeholder Capitalism model for purposes of managerial goals. Answer: SWM is at the heart of the Anglo-American form of corporate manageme

51、nt in that the primary objective is to maximize shareholders wealth. SWM assumes that markets are efficient in that security prices react quickly and correctly to the arrival of new information. Further, unsystematic risk can be eliminated through diversification and that systematic risk must be eva

52、luated by market participants. Sometimes, however, capital can be impatient and cause management to focus on short-term benchmarks causing a shift away from wealth maximization.The SCM recognizes that there are several powerful interests at work influencing management. In addition to stockholders, t

53、here are also banks, governments, and workers that place constraints on management behavior. SCM does not specifically assume efficient markets but it does consider total risk to be important in valuing a firm.2) Describe the management objectives of a firm governed by the shareholder wealth maximiz

54、ation model and one governed by the stakeholder wealth maximization model. Give an example of how these two models may lead to different decision-making by executive management. Answer: Shareholder wealth maximization attempts to do just that, typically through the maximization of share price. Stake

55、holder wealth maximization is much more difficult because of the necessity to satisfy many stakeholders all having approximately equal claim on the objectives of management. These stakeholders may include shareholders, creditors, customers, employees, and community. Differing decisions may occur in

56、a situation that involves significant social costs. For example, in the U.S. the decision to shift production from a local factory to a foreign one may be in large based on the change in NPV as the result of the move with only minor consideration of the impact that a change in location would have on

57、 the community at large or the local employees. A manager of a stakeholder driven firm may place equal or greater emphasis on the local employees and community and choose to maintain the current facility rather than move even if the foreign operation provided a much greater NPV. Ultimately, the latt

58、er may cause an inefficient allocation of scarce resources and lead to an overall lower standard of living. 3) The Sarbanes-Oxley Act (SOX) was passes in 2002 by the U.S. Congress to address corporate governance reform. SOX has not been without controversy to put it mildly. Identify and discuss several positive and negative impacts of SOX on corporations here and abroad. Answer: The Signature clause requires CEOs and CFOs to sign-off on financial statements. This in turn has led companies to do the same at multiple levels of management

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 《认识角》ppt教学讲解课件

- 《从数据谈节水》数据的收集、整理与描述优秀教学ppt课件

- 人员配置-公司组织架构与人员配置计划课件

- 《认识分式》ppt课件

- 《从百草园到三味书屋》第一课时ppt课件

- 公路工程概预算三课件

- 中考物理专题突破-综合能力题教学课件

- 《创新设计》高考英语二轮复习(江苏专用)ppt课件:第二部分-基础语法巧学巧练-专题八-非谓语动词

- 中考物理专题复习课件:滑轮及滑轮组

- CIM安全标识统一规划课件

- 中考物理专题复习教学课件-质量和密度

- 《处理民族关系的原则平等团结共同繁荣》ppt课件

- 中考物理专题复习之物理实验和探究题复习指导教学课件

- 《十二人人都会有挫折》初中心理健康教育闽教版《中学生心理健康》七级课件

- Cisco无线网络-安全-Brief课件