Intermediateaccountinganswerchapter4

Intermediateaccountinganswerchapter4

《Intermediateaccountinganswerchapter4》由会员分享,可在线阅读,更多相关《Intermediateaccountinganswerchapter4(73页珍藏版)》请在装配图网上搜索。

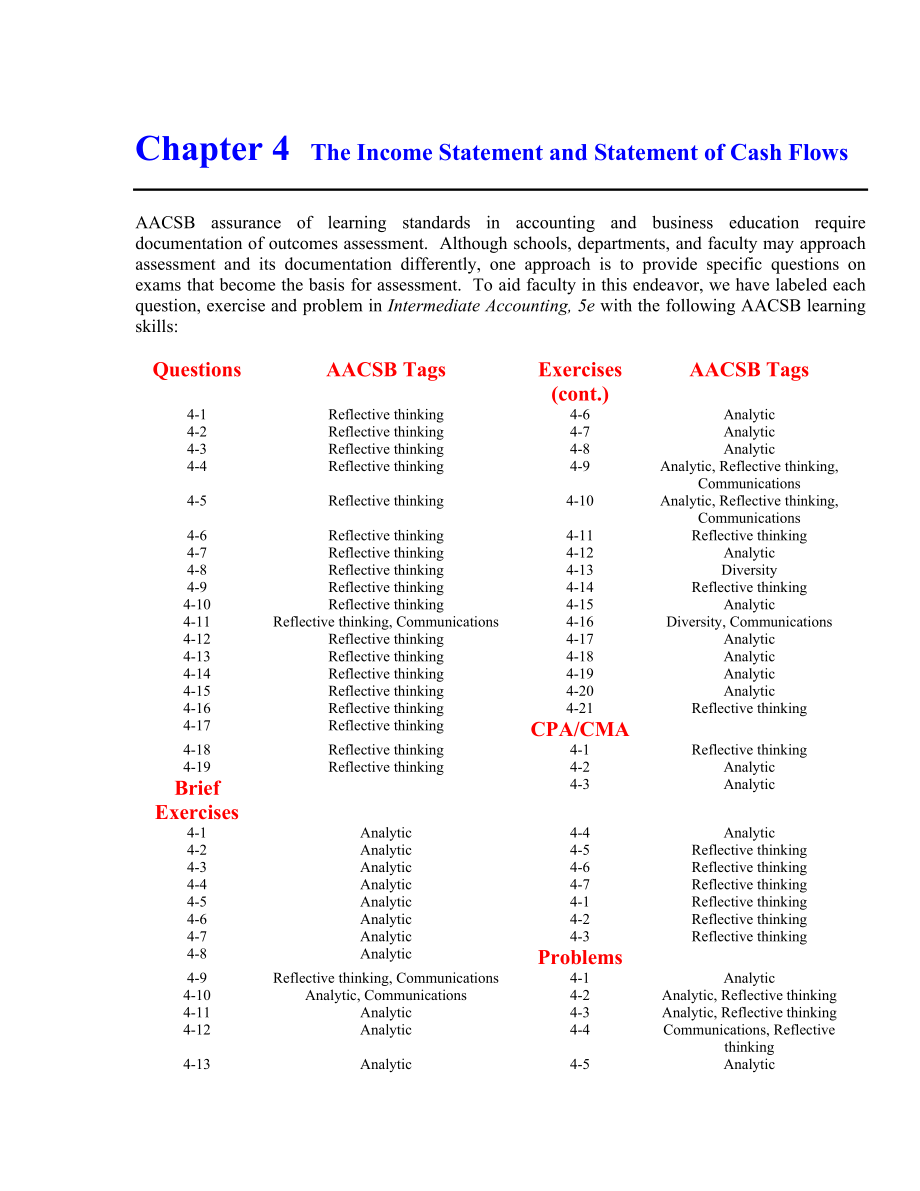

1、 CHAPTER 4 THE INCOME STATEMENT AND STATEMENT OF CASH FLOWSAACSB assurance of learning standards in accounting and business education require documentation of outcomes assessment. Although schools, departments, and faculty may approach assessment and its documentation differently, one approach is to

2、 provide specific questions on exams that become the basis for assessment. To aid faculty in this endeavor, we have labeled each question, exercise and problem in Intermediate Accounting, 5e with the following AACSB learning skills:QuestionsAACSB TagsExercises (cont.)AACSB Tags4-1Reflective thinking

3、4-6Analytic4-2Reflective thinking4-7Analytic4-3Reflective thinking4-8Analytic4-4Reflective thinking4-9Analytic, Reflective thinking, Communications4-5Reflective thinking4-10Analytic, Reflective thinking, Communications4-6Reflective thinking4-11Reflective thinking4-7Reflective thinking4-12Analytic4-8

4、Reflective thinking4-13Diversity4-9Reflective thinking4-14Reflective thinking4-10Reflective thinking4-15Analytic4-11Reflective thinking, Communications4-16Diversity, Communications4-12Reflective thinking4-17Analytic4-13Reflective thinking4-18Analytic4-14Reflective thinking4-19Analytic4-15Reflective

5、thinking4-20Analytic4-16Reflective thinking4-21Reflective thinking4-17Reflective thinkingCPA/CMA4-18Reflective thinking4-1Reflective thinking4-19Reflective thinking4-2AnalyticBrief Exercises4-3Analytic4-1Analytic4-4Analytic4-2Analytic4-5Reflective thinking4-3Analytic4-6Reflective thinking4-4Analytic

6、4-7Reflective thinking4-5Analytic4-1Reflective thinking4-6Analytic4-2Reflective thinking4-7Analytic4-3Reflective thinking4-8AnalyticProblems4-9Reflective thinking, Communications4-1Analytic4-10Analytic, Communications4-2Analytic, Reflective thinking4-11Analytic4-3Analytic, Reflective thinking4-12Ana

7、lytic4-4Communications, Reflective thinking4-13Analytic4-5Analytic4-14Analytic4-6AnalyticExercisesProblems (cont.)4-1Analytic4-7Analytic4-2Analytic4-8Analytic4-3Analytic4-9Analytic4-4Analytic4-10Analytic4-5Analytic4-11AnalyticQUESTIONS FOR REVIEW OF KEY TOPICSQuestion 4-1The income statement is a ch

8、ange statement that reports transactions revenues, expenses, gains and losses that cause owners equity to change during a specified reporting period.Question 4-2Income from continuing operations includes the revenue, expense, gain, and loss transactions that will probably continue in future periods.

9、 It is important to segregate the income effects of these items because they are the most important transactions in terms of predicting future cash flows.Question 4-3 Operating income includes revenues and expenses that are directly related to the principal revenue generating activities of the compa

10、ny. Nonoperating income includes items that are not directly related to these activities.Question 4-4 The single-step format first lists all revenues and gains included in income from continuing operations to arrive at total revenues and gains. All expenses and losses are then grouped and subtotaled

11、, subtracted from revenues and gains to arrive at income from continuing operations. The multiple-step format reports a series (multiple) of intermediate totals such as gross profit, operating income, and income before taxes. Very often income statements adopt variations of these formats, falling so

12、mewhere in between the two extremes.Question 4-5 The term earnings quality refers to the ability of reported earnings (income) to predict a companys future earnings. After all, an income statement simply reports on events that already have occurred. The relevance of any historical-based financial st

13、atement hinges on its predictive value.Question 4-6 Restructuring costs include costs associated with shutdown or relocation of facilities or downsizing of operations. They are reported as an operating expense in the income statement.Question 4-7 The process of intraperiod tax allocation matches tax

14、 expense or tax benefit with each major component of income, specifically continuing operations and any item reported below continuing operations. The process is necessary to achieve the desired result of separating the total income effects of continuing operations from the two separately reported i

15、tems - discontinued operations and extraordinary items, and also to show the after-tax effect of each of those two components.Answers to Questions (continued)Question 4-8 A component of an entity comprises operations and cash flows that can be clearly distinguished, operationally and for financial r

16、eporting purposes.The net-of-tax income effects of a discontinued operation must be disclosed separately in the income statement, below income from continuing operations. The income effects include income (loss) from operations and gain (loss) on disposal. The gain or loss on disposal must be disclo

17、sed either on the face of the statement or in a disclosure note. If the component is held for sale but not sold by the end of the reporting period, the income effects will include income (loss) from operations and an impairment loss if the fair value less costs to sell is less than the book value of

18、 the components assets. The income (loss) from operations of the component is reported separately in discontinued operations on prior income statements presented for comparative purposes.Question 4-9 Extraordinary items are material gains and losses that are both unusual in nature and infrequent in

19、occurrence, taking into account the environment in which the entity operates. Question 4-10 Extraordinary gains and losses are presented, net of tax, in the income statement below discontinued operations, if any.Answers to Questions (continued)Question 4-11 GAAP permit alternative treatments for sim

20、ilar transactions. Common examples are the choice among FIFO, LIFO, and average cost for the measurement of inventory and the choice among alternative revenue recognition methods. A change in accounting principle occurs when a company changes from one generally accepted treatment to another.In gener

21、al, we report voluntary changes in accounting principles retrospectively. This means revising all previous periods financial statements as if the new method were used in those periods. In other words, for each year in the comparative statements reported, we revise the balance of each account affecte

22、d. Specifically, we make those statements appear as if the newly adopted accounting method had been applied all along. Also, if retained earnings is one of the accounts whose balance requires adjustment (and it usually is), we revise the beginning balance of retained earnings for the earliest period

23、 reported in the comparative statements of shareholders equity (or statements of retained earnings if theyre presented instead). Then we create a journal entry to adjust all account balances affected as of the date of the change. In the first set of financial statements after the change, a disclosur

24、e note would describe the change and justify the new method as preferable. It also would describe the effects of the change on all items affected, including the fact that the retained earnings balance was revised in the statement of shareholders equity. An exception is a change in depreciation, amor

25、tization, or depletion method. These changes are accounted for as a change in estimate, rather than as a change in accounting principle. Changes in estimates are accounted for prospectively. The remaining book value is depreciated, amortized, or depleted, using the new method, over the remaining use

26、ful life.Question 4-12 A change in accounting estimate is accounted for in the year of the change and in subsequent periods; prior years financial statements are not restated. A disclosure note should justify that the change is preferable and should describe the effect of a change on any financial s

27、tatement line items and per share amounts affected for all periods reported.Question 4-13 Prior period adjustments are accounted for by restating prior years financial statements when those statements are presented again for comparison purposes. The beginning of period retained earnings is increased

28、 or decreased on the statement of shareholders equity (or the statement of retained earnings) in the year the error is discovered.Answers to Questions (concluded)Question 4-14 Earnings per share (EPS) is the amount of income achieved during a period for each share of common stock outstanding. If the

29、re are different components of income reported below continuing operations, their effects on earnings per share must be disclosed. If a period contains discontinued operations and extraordinary items, EPS data must be reported separately for income from continuing operations and net income. Per shar

30、e amounts for discontinued operations and extraordinary items would be disclosed on the face of the income statement.Question 4-15Comprehensive income is the total change in equity for a reporting period other than from transactions with owners. Reporting comprehensive income can be accomplished wit

31、h a separate statement or by including the information in either the income statement or the statement of changes in shareholders equity.Question 4-16 The purpose of the statement of cash flows is to provide information about the cash receipts and cash disbursements of an enterprise during a period.

32、 Similar to the income statement, it is a change statement, summarizing the transactions that caused cash to change during a particular period of time.Question 4-17 The three categories of cash flows reported on the statement of cash flows are:1. Operating activities Inflows and outflows of cash rel

33、ated to the transactions entering into the determination of net income from operations.2. Investing activities Involve the acquisition and sale of (1) long-term assets used in the business and (2) nonoperating investment assets.3. Financing activities Involve cash inflows and outflows from transacti

34、ons with creditors and owners.Question 4-18 Noncash investing and financing activities are transactions that do not increase or decrease cash but are important investing and financing activities. An example would be the acquisition of property, plant and equipment (an investing activity) by issuing

35、either long-term debt or equity securities (a financing activity). These activities are reported either on the face of the statement of cash flows or in a disclosure note.Question 4-19 The direct method of reporting cash flows from operating activities presents the cash effect of each operating acti

36、vity directly on the statement of cash flows. The indirect method of reporting cash flows from operating activities is derived indirectly, by starting with reported net income and adding and subtracting items to convert that amount to a cash basis.BRIEF EXERCISESBrief Exercise 4-1PACIFIC SCIENTIFIC

37、CORPORATIONIncome StatementFor the Year Ended December 31, 2021($ in millions)Revenues and gains:Sales $2,106Gain on sale of investments 45 Total revenues and gains 2,151Expenses and losses:Cost of goods sold $1,240Selling126General and administrative105Interest35Income tax expense* 258 Total expens

38、es and losses 1,764Net income $ 387*$2,151 (1,240 + 126 + 105 + 35) = $645 x 40% = $258Brief Exercise 4-2(a) Sales revenue$2,106Less: Cost of goods sold(1,240)Gross profit866 Less: Selling expenses(126) General and administrative expenses (105)Operating income$ 635(b)Gain on sale of investments45Int

39、erest expense(35)Nonoperating income$10Brief Exercise 4-3PACIFIC SCIENTIFIC CORPORATIONIncome StatementFor the Year Ended December 31, 2021($ in millions)Sales revenue $2,106Cost of goods sold 1,240Gross profit 866Operating expenses:Selling$126General and administrative 105 Total operating expenses

40、231Operating income 635Other income (expense):Gain on sale of investments 45Interest expense (35) Total other income, net 10Income before income taxes 645Income tax expense* 258 Net income $ 387 *$645 x 40%Brief Exercise 4-4(a) Sales revenue$300,000Less: Cost of goods sold(160,000) General and admin

41、istrative expenses(40,000) Restructuring costs(50,000) Selling expenses (25,000)Operating income$ 25,000(b)Operating income$25,000 Add: Interest revenue4,000Deduct: Loss on sale of investments(22,000)Income before income taxes and Extraordinary item7,000Income tax expense (40%) (2,800)Income before

42、extraordinary item$ 4,200(c)Income before extraordinary item$ 4,200Extraordinary item:Loss from flood damage, net of $20,000 tax benefit(30,000)Net loss(25,800)Brief Exercise 4-5WHITE AND SONS, INC.Partial Income StatementFor the Year Ended December 31, 2021Income before income taxes and extraordina

43、ry item $ 850,000Income tax expense* 340,000Income before extraordinary item 510,000Extraordinary item: Loss from earthquake, net of $160,000 tax benefit(240,000)Net income $ 270,000Earnings per share:Income before extraordinary item$ 5.10 Loss from earthquake )Net income *$850,000 x 40%Note: Restru

44、cturing costs, interest revenue, and loss on sale of investments are included in income before income taxes and extraordinary item.Brief Exercise 4-6CALIFORNIA MICROTECH CORPORATIONPartial Income StatementFor the Year Ended December 31, 2021Income from continuing operations before income taxes $ 5,8

45、00,000Income tax expense* 1,740,000Income from continuing operations $ 4,060,000Discontinued operations:Loss from operations of discontinued component (including gain on disposal of $2,000,000)* (1,600,000) Income tax benefit 480,000 Loss on discontinued operations (1,120,000)Net income $ 2,940,000*

46、 $5,800,000 x 30%* Loss from operations of discontinued component:Gain on sale of assets$ 2,000,000 ($10 million less $8 million)Operating loss (3,600,000) Total before-tax loss$(1,600,000)Brief Exercise 4-7CALIFORNIA MICROTECH CORPORATIONPartial Income StatementFor the Year Ended December 31, 2021I

47、ncome from continuing operations before income taxes $ 5,800,000Income tax expense* 1,740,000Income from continuing operations $ 4,060,000Discontinued operations:Loss from operations of discontinued component* (3,600,000) Income tax benefit 1,080,000 Loss on discontinued operations (2,520,000)Net in

48、come $ 1,540,000* $5,800,000 x 30%* Includes only the operating loss. There is no impairment loss.Brief Exercise 4-8CALIFORNIA MICROTECH CORPORATIONPartial Income StatementFor the Year Ended December 31, 2021Income from continuing operations before income taxes $ 5,800,000Income tax expense* 1,740,0

49、00Income from continuing operations $ 4,060,000Discontinued operations:Loss from operations of discontinued component (including impairment loss of $1,000,000)* (4,600,000) Income tax benefit 1,380,000 Loss on discontinued operations (3,220,000)Net income $ 840,000* $5,800,000 x 30%* Loss from opera

50、tions of discontinued component:Impairment loss ($8 million book value less $7 million net fair value)$(1,000,000)Operating loss (3,600,000) Total before-tax loss$(4,600,000)Brief Exercise 4-9The change in inventory method is a change in accounting principle. The depreciation method change is consid

51、ered to be a change in accounting estimate that is achieved by a change in accounting principle and is accounted for prospectively, exactly as we would account for any other change in estimate. The inventory method change, however, is accounted for by retrospectively recasting prior years financial

52、statements presented with the current year for comparative purposes, applying the new inventory method (FIFO in this case) in those years.Brief Exercise 4-10This is a change in accounting estimate.When an estimate is revised as new information comes to light, accounting for the change in estimate is

53、 quite straightforward. We do not restate prior years financial statements to reflect the new estimate. Instead, we merely incorporate the new estimate in any related accounting determinations from there on. If the after-tax income effect of the change in estimate is material, the effect on net inco

54、me and earnings per share must be disclosed in a note, along with the justification for the change. Depreciation for 2021 is $25,000:$300,000Cost$ 50,000 Old annual depreciation ($300,000 6 years) x 2 years 100,000 Depreciation to date (2007-2021)200,000Book value 8 yrs. Estimated remaining life (10

55、 years - 2 years)$ 25,000New annual depreciation Brief Exercise 4-11OREILLY BEVERAGE COMPANYStatement of Comprehensive Income For the Year Ended December 31, 2021Net income $650,000Other comprehensive income (loss): Unrealized gains on investment securities, net of tax $ 24,000 Deferred loss on deri

56、vatives, net of tax (36,000)Total other comprehensive loss (12,000)Comprehensive income $638,000Brief Exercise 4-12Cash Flows from Operating Activities:Collections from customers $ 660,000Interest on note receivable 12,000Interest on note payable (18,000)Payment of operating expenses (440,000) Net c

57、ash flows from operating activities$214,000Only these four cash flow transactions relate to operating activities. The others are investing and financing activities.Brief Exercise 4-13Cash Flows from Investing Activities:Sale of land$ 40,000Purchase of equipment (120,000) Net cash flows from investin

58、g activities$(80,000)Cash Flows from Financing Activities:Proceeds from note payable collection$100,000Issuance of common stock 200,000Payment of dividends (30,000) Net cash flows from financing activities 270,000Brief Exercise 4-14Cash Flows from Operating Activities:Net income $45,000Adjustments f

59、or noncash effects: Depreciation expense 80,000Changes in operating assets and liabilities: Increase in prepaid rent(60,000) Increase in salaries payable15,000 Increase in income taxes payable 12,000 Net cash inflows from operating activities $92,000EXERCISESExercise 4-1Requirement 1GREEN STAR CORPO

60、RATIONIncome StatementFor the Year Ended December 31, 2021Revenues and gains:Sales $1,300,000Interest 30,000Gain on sale of equipment 50,000 Total revenues and gains 1,380,000Expenses and losses:Cost of goods sold $720,000Salaries160,000Depreciation50,000Interest40,000Rent25,000Income tax 130,000 Total expenses and losses

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。