宁通信第三季度报告全文英文版

宁通信第三季度报告全文英文版

《宁通信第三季度报告全文英文版》由会员分享,可在线阅读,更多相关《宁通信第三季度报告全文英文版(17页珍藏版)》请在装配图网上搜索。

1、I.-Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)I Important noticeThe Board of Directors,the Supervisory Committee,the directors,supervisors and seniormanagement of the Company hereby c

2、onfirm that there are no factitious record,misleading statementsor material omissions in this report,and collectively and individually accepts full responsibility for thetruthfulness,accuracy and completeness of the whole contents.All directors have attended the meeting for deliberation and approval

3、 for the quarterly report.The financial report of the third quarter was not audited by a public accounting firm.Chairman of the BOD Mr.Sun Liang,General Manager Ms.Wang Hong,and Chief Accountant Mr.ShiLian hereby confirm that the financial report in this report is truthful and complete.This report i

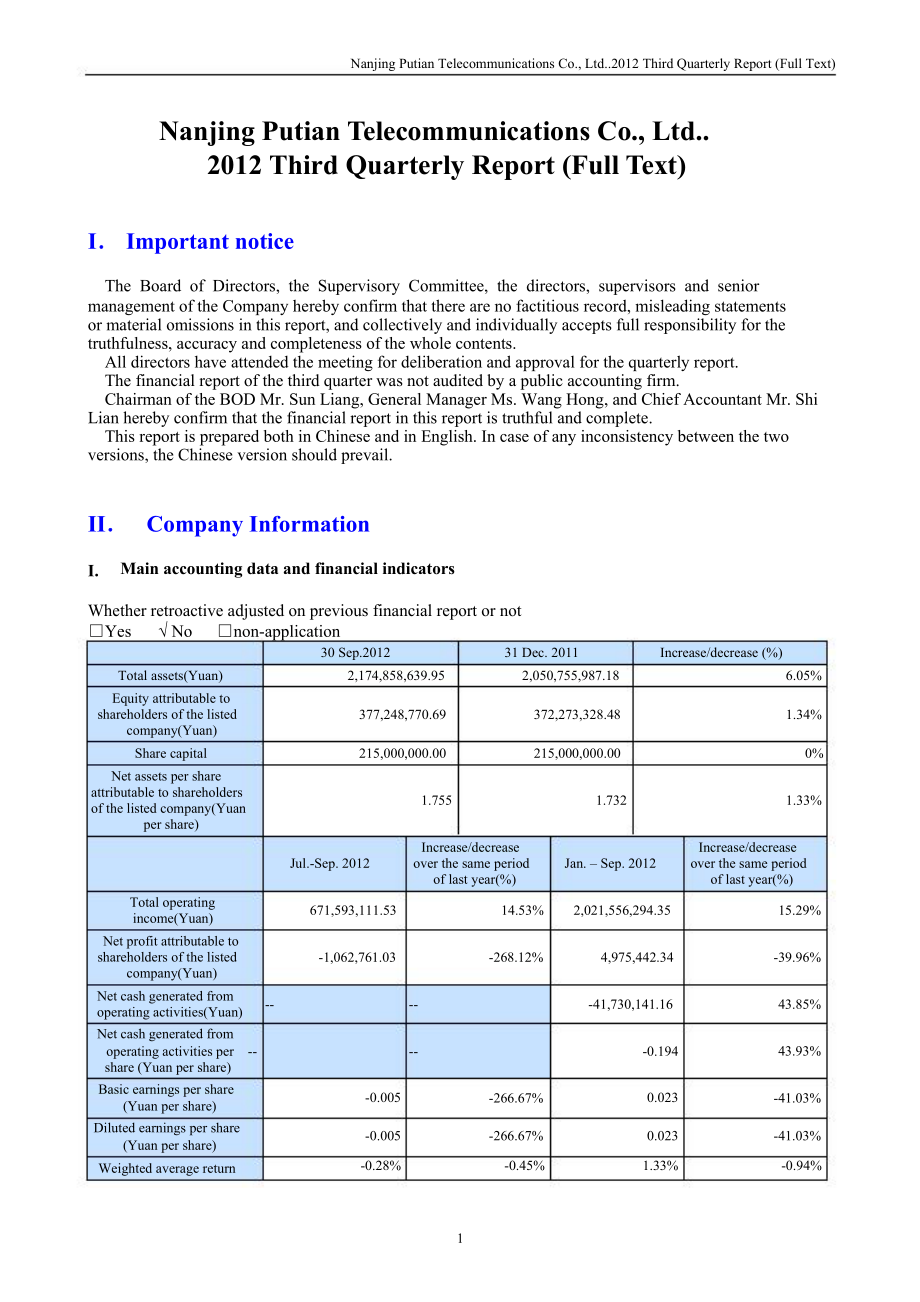

4、s prepared both in Chinese and in English.In case of any inconsistency between the twoversions,the Chinese version should prevail.II Company InformationMain accounting data and financial indicatorsWhether retroactive adjusted on previous financial report or notYes Nonon-application30 Sep.201231 Dec.

5、2011Increase/decrease(%)Total assets(Yuan)2,174,858,639.952,050,755,987.186.05%Equity attributable toshareholders of the listed377,248,770.69372,273,328.481.34%company(Yuan)Share capital215,000,000.00215,000,000.000%Net assets per shareattributable to shareholdersof the listed company(Yuan1.7551.732

6、1.33%per share)Increase/decreaseIncrease/decreaseJul.-Sep.2012over the same periodof last year(%)Jan.Sep.2012over the same periodof last year(%)Total operatingincome(Yuan)671,593,111.5314.53%2,021,556,294.3515.29%Net profit attributable toshareholders of the listed-1,062,761.03-268.12%4,975,442.34-3

7、9.96%company(Yuan)Net cash generated fromoperating activities(Yuan)Net cash generated fromoperating activities per -share(Yuan per share)-41,730,141.16-0.19443.85%43.93%Basic earnings per share(Yuan per share)Diluted earnings per share(Yuan per share)Weighted average return-0.005-0.005-0.28%-266.67%

8、-266.67%-0.45%0.0230.0231.33%-41.03%-41.03%-0.94%1Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)on net assets(%)Weighted average returnon net assets afterdeducting non-recurrent-0.54%-0.62%0.99%-1.02%profits or losses(%)Item and amount with non-recurring gains/losse

9、s deductedApplicable Non-applicableItemsGains and losses from disposal of non-currentassetsTax refund or exemption out of authorization,with absence of official approval document oraccidentallyGovernmental subsidy calculated into currentgains and losses(while closely related with thenormal business

10、of the Company,excluding thefixed-amount or fixed-proportion governmentalsubsidy according to the unified nationalstandard)Fund occupation expenses received fromnon-financial enterprises that reckon intocurrent gains/lossesIncome occurred when investment cost paid byenterprise for obtaining subsidia

11、ries,associates and joint ventures are lower thanits share in fair value of net realizable assets ofinvested unitsGains and losses from exchange ofnon-monetary assetsGains and losses from entrusted investment ormanagement assetsVarious asset impairment reserve provided forforce majeure,such as natur

12、al disasterGains/losses from debt reorganizationAmount(Jan.Sep.2012)(Yuan)422,846.23305,000.00696,793.071,030.00NoteReorganization expenses,such as expenditurefor allocation of employees and integration feeGains and losses from excess of transactionwhich are conducted on a non-fair-valued basisover

13、its fair valueCurrent net gains and losses of subsidiariesoccurred from combination under the samecontrol commencing from period-begin tocombination dateGains and losses from contingent events whichhas no relation with normal business of theCompanyGains and losses from change of fair values ofheld-f

14、or-transaction financial assets andfinancial liabilities except for the effectivehedge business related to normal business of2II.Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)the Company,and investment income fromdisposal of transactional financial assets andliabili

15、ties and financial assets available for saleReversal of impairment reserve for accountreceivable with separate impairment testinggains/losses from external entrustment loansGains and losses arising from change of fairvalue of investment properties whose follow-upmeasurement are at fair valueAffect u

16、pon current gains/losses arising fromthe one-off adjustment in subject torequirement of laws and rules in relation totaxation and accountingIncome from entrusted custody operationOther non-operating income and expenditureexcept the abovementionedOther item that satisfied the definition ofnon-recurri

17、ng gains and lossesInfluenced amount of minority shareholdersequityImpact on income tax669,497.94-498,813.90-342,130.43Total1,254,222.91-Explanation on“Other item that satisfied the definition of non-recurring gains and losses”and definednon-recurring gains and losses as recurring gain/loss accordin

18、g to natures and characteristic ofself-operation statusItemAmount involved(RMB)NoteN/ATotal number of shareholders and top ten shareholders at the end of the reporting periodTotal number of shareholdersat the end of the reportingperiodTop ten shareholders of tradable shares13,735ShareholderHolding o

19、f tradable shares atShare type and amountthe end of the reportingperiodTypeAmountShanghai Wanguo SecuritiesHKGUOTAIJUNANSECURITIES(HONGKONG)4,459,0152,403,412B-shareB-share4,459,0152,403,412LIMITEDCHAN KEUNGWang FeifeiShu JianpingZhang XiufangGu FengCai Xilong1,289,600588,008500,500456,988442,400427

20、,855B-shareB-shareB-shareB-shareB-shareB-share1,289,600588,008500,500456,988442,400427,8553ofaintoNanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)Yan ZengqingLong Jianqiu399,806340,000B-shareB-share399,806340,000Explanation of shareholders -III Significant issuesI.Sub

21、stantial changes in main items on the financial statements and main financial indicators,and explanation on the reason of the changesapplicable inapplicableItem30 Sep.201231 Dec.2011Change(Yuan)Change(%)ReasonchangesubstantialBanking acceptance notes atNotes receivable8,526,015.8312,863,723.59-4,337

22、,707.76-33.72%year-beginning were settled inthe reporting period.Constructionprogress15,052,795.1710,062,821.544,989,973.6349.59%Construction of plant andstorage house in the reportingperiod.TheCompanyopenedNotes payable79,625,044.36262,091.2979,362,953.0730280.65%commercial acceptance notesin the r

23、eporting period.Bysendinggoodstocustomers in the period,Advances fromcustomers57,563,771.3787,763,330.36-30,199,558.99-34.41%prepayment by customers inprevious period wasrecognized as revenue fromsales of goodsAt the end of the reportingTaxes payable-60,116.0715,773,935.97-15,834,052.04-100.38%perio

24、d,the balance of input taxto be deducted was larger thanoutput taxSome subsidiaries of theDividends payable2,181,334.401,344,198.22837,136.1862.28%Companydividendhaventtheirpaidminorshareholders.Jan.-Sep.2012Jan.-Sep.2011Change(Yuan)Change(%)Operating tax andextras8,173,205.744,993,841.413,179,364.3

25、363.67%Taxes were increased as salesrevenues grew.Due to an increase ofpercentage of equity in thesubsidiary Nanjing MennekesElectric Appliances Co.,Ltd,Investmentincome2,924,840.075,061,610.08-2,136,770.01-42.22%there was a change ofaccounting method from equitymethod into cost method,andtheinvestm

26、entincomerecognized from the subsidiarywas therefore decreased.Gains from fixed assetsNon-operating2,627,717.191,638,261.54989,455.6560.40%disposal and tax refund werehigher than that of the sameincomeperiod of last year.There is an increase ofNon-operatingexpenses532,549.95126,022.06406,527.89322.5

27、8%compensation payout in thereporting period.Netattributableprofitto4,975,442.348,286,298.04-3,310,855.70-39.96%Growth margin of costs andexpenditures outpaced that of4Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)owners of theparent companysales revenue.Net Cash fl

28、owfrom operatingactivitiesNet Cash flow-41,730,141.16-74,317,507.5132,587,366.3543.85%With an increase of sales,payment from customers werelarger than the same period oflast year.Interestexpensesandfromfinancing-3,630,880.10-2,183,853.91-1,447,026.19-66.26%dividendsdistributedbyactivitiessubsidiarie

29、s increased.II.Progress of significant issues as well as analysis of their effect and solution plan1.Being issued a non-standard auditors opinionapplicable inapplicable2.Fund provided by the Company to its controlling shareholder or related parties of thecontrolling shareholder,and guaranty provided

30、 by the Company in violation of prescriptiveproceduresapplicable inapplicable3.Signing and implementation of significant contracts that are related to routine operationsapplicable inapplicable4.Other issuesapplicable inapplicableOn 12 July 2012,resolution about transferring 17.79%equity interests re

31、spectively in Shanghai Yulong Biology Science&Technology Co.,Ltd.and Qufu Yulong Biology Science&Technology Co.,Ltd.was approved at the 1st extraordinarygeneral meeting for 2012.The price of such equity transfer was based by reference to the valuation price of shareholdersequity concerning such tran

32、sferred equity interests held by the Company.The price for sale was not less than RMB40,657,400,including RMB25,039,700 and RMB15,617,700 for Shanghai Yulong and Qufu Yulong respectively.TheCompany traded the 17.79%equity interests respectively in Shanghai Yulong and Qufu Yulong by listing on Shangh

33、aiUnited Property Exchange on 19 July 2012,with price of RMB25,039,800 and RMB15,617,800.There is no intenttransferee till now and the listing is going on.III.Commitment made by the Company or shareholders owning over 5 percent of capital sharesduring the reporting periodapplicable inapplicableIV.Fo

34、recast of operating results of the year 2012Caution and explanation on a forecasted accumulated net loss for the period from the year-beginning to the end of thenext reporting period or a material change in net profit compared with the same period of last yearapplicable inapplicableV.Other significa

35、nt issues necessary to be stated1.Securities investmentapplicable inapplicable5I.Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)2.Derivative investmentapplicable inapplicable3.Holding of derivative investment products at the end of the reporting periodapplicable inap

36、plicable4.Registration form of receiving research,communication and interview in the report periodContent discussedDatePlaceWayTypeObjectand documentsprovidedInquiring about theoperating26 July 2012In the CompanyOn telephoneIndividualIndividual investor conditions of theCompanyssubsidiaries.Inquirin

37、g about the19 September2012In the CompanyOn telephoneIndividualprogress of theIndividual investor share trade ofYuLongcompanies.5.Issuing of corporate bondWhether issued corporate bond Yes NoIV AppendixFinancial StatementWhether consolidated statement or not:Yes No Non-applicableUnless otherwise,cur

38、rency for this statement refers to RMB(Yuan)6Nanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)1The Consolidated Balance SheetPrepared by:Nanjing Putian Telecommunications Co.,Ltd.ItemsCurrent assetsMonetary fundsSettlement provisionsCapital lentHeld for trading financi

39、al assetsNotes receivableAccounts receivableAdvances to suppliersInsurance receivableReinsurance receivablesContract reserve of reinsurance receivableInterest receivableDividend receivableOther receivablesPurchase restituted finance assetInventoriesLong-term debt investment due within a yearOther cu

40、rrent assetsTotal current assetsNon-current assetsGranted loans and advancesAvailable-for-sale financial assetsHeld-to-maturity investmentsLong-term accounts receivableLong-term equity investmentsInvestment propertyFixed assetsConstruction in progressConstruction materialsFixed assets held for dispo

41、salProductive biological assetsPetrol assetsIntangible assetsDevelopment costsGoodwillLong-term prepaymentsDeferred tax assetsOther non-current assetsTotal non-current assetsTotal assets30 September 201230 September 2012308,893,139.948,526,015.83874,222,311.6526,638,502.0653,270,115.11555,302,914.62

42、1,826,852,999.21208,793,139.854,659,356.0199,809,709.2815,052,795.1719,690,640.43348,005,640.742,174,858,639.95Unit:RMB Yuan31 December 2011312,420,215.5912,863,723.59736,141,568.3137,630,280.4455,323,271.93552,349,491.531,706,728,551.39206,616,139.784,814,179.95102,151,733.1610,062,821.5420,382,561

43、.36344,027,435.792,050,755,987.18Legal Representative:Sun LiangPerson in Charge of Accounting Work:Wang Hong7Person in Charge of Accounting Department:Shi LianNanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)1The Consolidated Balance Sheet(continued)Prepared by:Nanjing

44、 Putian Telecommunications Co.,Ltd.ItemsCurrent liabilitiesShort-term loansLoan from central bankAbsorbing deposit and interbank depositCapital borrowedTradable financial liabilitiesNotes payableAccounts payableAdvances from customersSelling financial asset of repurchaseCommission charge and commiss

45、ion payableAccrued payrollTaxes payableInterest payableDividend payableOther payablesReinsurance payablesInsurance contract reserveSecurity trading of agencySecurity sales of agencyLong-term liabilities due within a yearOther current liabilitiesTotal current liabilitiesNon-current liabilitiesLong-te

46、rm borrowingsBonds payableLong-term payablesSpecial payablesEstimated liabilitiesDeferred tax liabilitiesOther long-term liabilitiesTotal non-current liabilitiesTotal liabilitiesOwners equityShare capitalCapital reserveLess:Treasury stockReasonable reserveSurplus reserveProvision of general riskUndi

47、stributed profitBalance difference of foreign currency translationTotal shareholders equity attributable to parentCompanyMinority interestsTotal shareholders equityTotal liabilities and shareholders equity30 September 201230 September 2012565,300,000.0079,625,044.36949,081,825.2657,563,771.3716,179,

48、212.12-60,116.072,181,334.4042,807,640.121,712,678,711.5680,118.0080,118.001,712,758,829.56215,000,000.00185,374,533.85589,559.77-19,947,576.59-3,767,746.34377,248,770.6984,851,039.70462,099,810.392,174,858,639.95Unit:RMB Yuan31 December 2011511,500,000.00262,091.29906,751,164.9087,763,330.3614,914,

49、260.5915,773,935.971,344,198.2253,443,334.251,591,752,315.5880,118.0080,118.001,591,832,433.58215,000,000.00185,374,533.85589,559.77-24,923,018.93-3,767,746.21372,273,328.4886,650,225.12458,923,553.602,050,755,987.18Legal Representative:Sun LiangPerson in Charge of Accounting Work:Wang Hong8Person i

50、n Charge of Accounting Department:Shi LianNanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)2.The Consolidated Balance Sheet for Parent CompanyPrepared by Nanjing Putian Telecommunications Co.,Ltd.30 September 2012Unit:RMB YuanItemsCurrent assetsMonetary fundsTradable f

51、inancial assetsNotes receivableAccounts receivableAdvances to suppliersInterest receivableDividend receivableOther receivablesInventoriesLong-term debt investment duewithin a yearOther current assetsTotal current assetsNon-current assetsAvailable-for-salefinancialassetsHeld-to-maturity investmentsLo

52、ng-term accounts receivableLong-term equity investmentsInvestment propertyFixed assetsConstruction in progressConstruction materialsFixed assets held for disposalProductive biological assetsPetrol assetsIntangible assetsDevelopment costsGoodwillLong-term prepaymentsDeferred tax assetsOther non-curre

53、nt assetsTotal non-current assetsTotal assets30 September 2012223,313,536.846,079,959.42552,603,482.7421,721,197.1272,385,104.62285,534,827.271,161,638,108.01374,614,745.4732,256,113.432,487,606.124,716,895.51414,075,360.531,575,713,468.5431 December 2011195,625,750.233,938,705.00489,450,457.0327,74

54、8,693.0187,821,794.78283,735,577.581,088,320,977.63371,987,745.4032,993,773.68743,162.495,344,581.09411,069,262.661,499,390,240.29Legal Representative:Sun LiangPerson in Charge of Accounting Work:Wang Hong Person in Charge of Accounting Department:Shi Lian9Nanjing Putian Telecommunications Co.,Ltd.2

55、012 Third Quarterly Report(Full Text)2.The Consolidated Balance Sheet for Parent Company(continued)Prepared by Nanjing Putian Telecommunications Co.,Ltd.30 September 2012Unit:RMB YuanItemsCurrent liabilitiesShort-term loansTradable financial liabilitiesNotes payableAccounts payableAdvances from cust

56、omersAccrued payrollTaxes payableInterest payableDividend payableOther payablesLong-term liabilities due within ayearOther current liabilitiesTotal current liabilitiesNon-current liabilitiesLong-term borrowingsBonds payableLong-term payablesSpecial payablesEstimated liabilitiesDeferred tax liabiliti

57、esOther long-term liabilitiesTotal non-current liabilitiesTotal liabilitiesOwners equityShare capitalCapital reserveLess:Treasury stockSpecial reservesSurplus reserveProvision of general riskUndistributed profitCurrency translation differencesTotal shareholders equityTotal liabilities and shareholde

58、rsequity30 September 2012336,000,000.00187,333,000.00569,464,203.8613,312,505.416,269,128.073,799,837.45158,235,877.871,274,414,552.6680,118.0080,118.001,274,494,670.66215,000,000.00172,417,299.81589,559.76-86,788,061.69301,218,797.881,575,713,468.5431 December 2011335,000,000.0080,262,091.29529,289

59、,003.7427,009,137.515,715,497.6110,002,772.65207,378,257.201,194,656,760.0080,118.0080,118.001,194,736,878.00215,000,000.00172,417,299.81589,559.76-83,353,497.28304,653,362.291,499,390,240.29Legal Representative:Sun LiangPerson in Charge of Accounting Work:Wang Hong10Person in Charge of Accounting D

60、epartment:Shi LianItemsNanjing Putian Telecommunications Co.,Ltd.2012 Third Quarterly Report(Full Text)3.Consolidated Income Statement for the Reporting PeriodPrepared by Nanjing Putian Telecommunications Co.,Ltd.July to September 2011Unit:RMB YuanJuly to September 2012July to September 2011I.Total

61、operating incomeIncluding:Operating incomeInterest incomeInsurance gainedCommission charge and commission incomeII.Total operating costIncluding:Operating costInterest expenseCommission charge and commission expenseCash surrender valueNet amount of expense of compensationNet amount of withdrawal of

62、insurance contractreserveBonus expense of guarantee slipReinsurance expenseSales tax and surchargeSales expensesAdministration expensesFinancial expensesLosses of devaluation of assetAdd:Changing income of fair value(Loss is listed with“-”)Investment income(Loss is listed with“-”)Including:Investmen

63、t income on affiliated Companyand joint venture and joint ventureExchange income(Loss is listed with“-”)III.Operating profit (Loss is listed with“-”)Add:Non-operating incomeLess:Non-operating expenseIncluding:Disposal loss of non-current asset671,593,111.53671,593,111.53669,421,815.02574,636,201.683

64、,887,439.8344,552,742.4137,749,293.629,709,354.59-1,113,217.111,462,794.411,462,794.413,634,090.921,421,260.27149,288.683,789.98586,366,046.19586,366,046.19583,175,244.93498,796,176.071,474,279.4637,671,537.7034,942,962.5810,209,097.8681,191.262,207,626.432,207,626.435,398,427.69299,920.1268,649.725

65、5,176.00IV.Total Profit(Loss is listed with“-”)4,906,062.515,629,698.09Less:Income taxV.Net profit(Net loss is listed with“-”)Include:the net profit of the consolidated party beforeconsolidationNet profit attributable to owners equity of parentCompanyMinority shareholders gains and lossesVI.Earnings

66、 per sharei.Basic earnings per shareii.Diluted earnings per shareVII.Other comprehensive incomeVIII.Total comprehensive incomeTotal comprehensive income attributable to owners of theparent company the parent companyTotal comprehensive income attributable to minorityinterests1,974,397.872,931,664.64-1,062,761.033,994,425.67-0.005-0.00593,168.053,024,832.69-969,592.983,994,425.67-1,657,706.073,971,992.02632,151.513,339,840.510.0030.0033,971,992.02632,151.513,339,840.51Business combination under co

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。