财务计价小练习

财务计价小练习

《财务计价小练习》由会员分享,可在线阅读,更多相关《财务计价小练习(6页珍藏版)》请在装配图网上搜索。

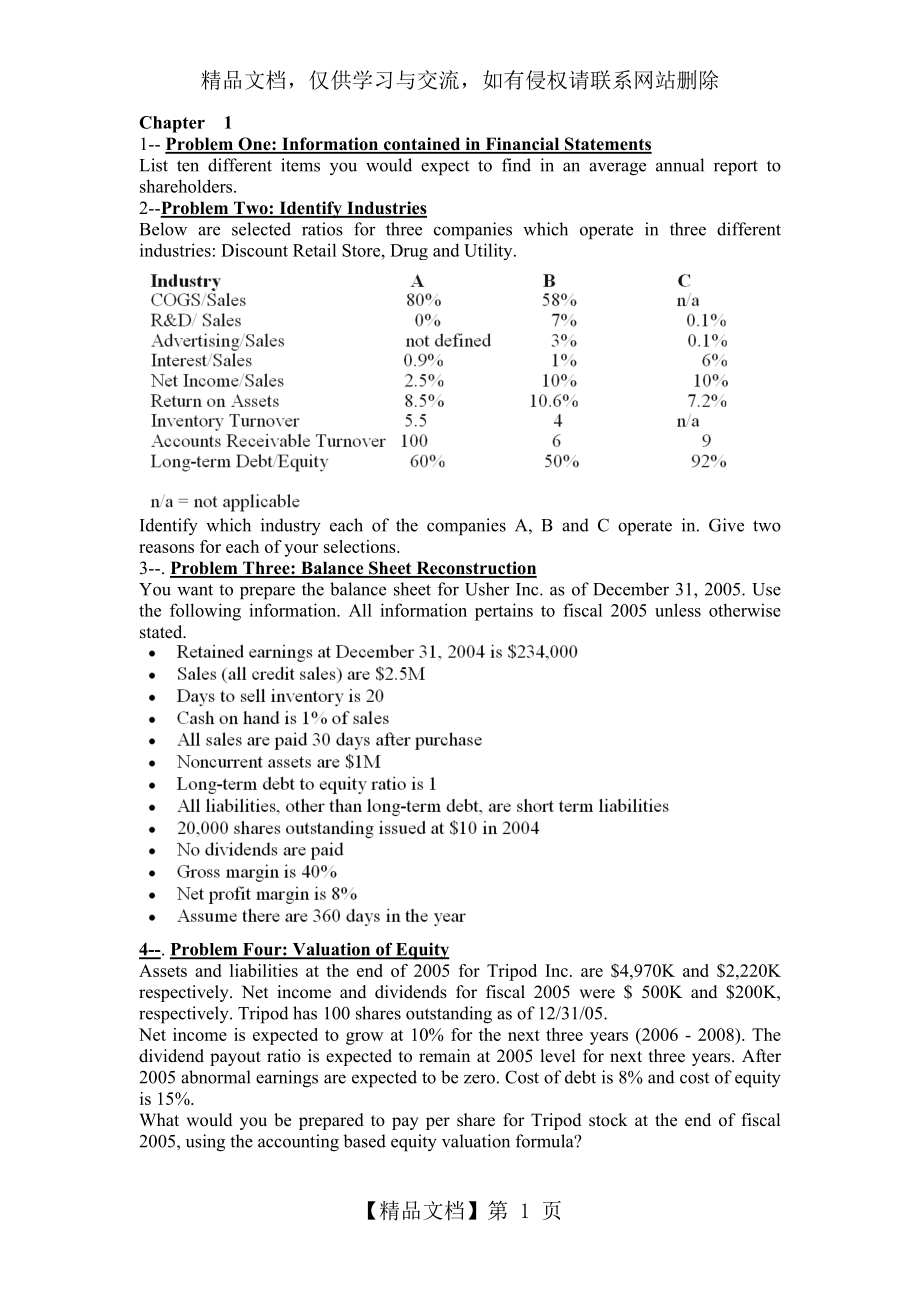

1、精品文档,仅供学习与交流,如有侵权请联系网站删除Chapter 11-Problem One: Information contained in Financial Statements List ten different items you would expect to find in an average annual report to shareholders.2-Problem Two: Identify Industries Below are selected ratios for three companies which operate in three differen

2、t industries: Discount Retail Store, Drug and Utility.Identify which industry each of the companies A, B and C operate in. Give two reasons for each of your selections.3-.Problem Three: Balance Sheet Reconstruction You want to prepare the balance sheet for Usher Inc. as of December 31, 2005. Use the

3、 following information. All information pertains to fiscal 2005 unless otherwise stated.4-.Problem Four: Valuation of Equity Assets and liabilities at the end of 2005 for Tripod Inc. are $4,970K and $2,220K respectively. Net income and dividends for fiscal 2005 were $ 500K and $200K, respectively. T

4、ripod has 100 shares outstanding as of 12/31/05.Net income is expected to grow at 10% for the next three years (2006 - 2008). The dividend payout ratio is expected to remain at 2005 level for next three years. After 2005 abnormal earnings are expected to be zero. Cost of debt is 8% and cost of equit

5、y is 15%.What would you be prepared to pay per share for Tripod stock at the end of fiscal 2005, using the accounting based equity valuation formula?.5-Problem Five: Equity Valuation In the table below is selected information for Sprigue Company.All figures are in thousands and represent expectation

6、s of the future.a. Calculate the expected free cash flow to equity for the years 2005 to 2009.b. Explain the expected changes in debt levels over the five yearsChapter 2Problem Two: Earnings Management Earnings management can be defined as the purposeful intervention by management in the earnings pr

7、ocess, usually to satisfy selfish objectives (Schipper, 1989).Earnings management techniques can be separated into those that are cosmetic (without cash flow consequences) and those that are real (with cash flow consequences).The management of a company wishes to increase earnings this period.List t

8、hree cosmetic and three real techniques that can be used to achieve this objective and explain why they will achieve the objective.Problem Six: Fair Value Accounting ABC Co. starts its business raising $110,000 in cash; $60,000 from issuing equity and $50,000 from issuing 6% bonds at par. ABC used t

9、he whole amount of cash to buy a building, which it rents out for $10,000 per year. Given below is the opening balance sheet of ABC Co. for the first year of operations.At the end of Year 1, the building is valued at $150,000. Also, the market value of bonds has fallen to $49,000. Assume the useful

10、life of the building is 30 years and its salvage value is $50,000 at the end of that period. The rental income is received on the last day of the year. Interest on bonds is also paid on this day.Prepare the year-end balance sheet and income statement of ABC Co. based on Fair value. Compare the histo

11、rical and fair values at year-end.Chapter 31-Problem One: Leases Compare the effects of operating leases as compared to capitalized leases, in the first year of a lease, on the following items listed. Explain your answer.1. EBIT 2. Net Income 3. Return on Assets (levered) 4. Cash flow from Operation

12、s 5. Current Ratio2-.Problem Two: Liabilities not recorded on balance sheet You are considering purchasing a company - assets, liabilities, warts and all. You are aware that sometimes liabilities do not always show up on the balance sheet. Give five examples of liabilities that may not be explicitly

13、 recognized on the balance sheet, being sure to explain why they are liabilities.3-.Problem Five: The effect of leases on financial ratios Some financial information about Retail Inc. and Store Inc. is given below:You are asked to analyze these companies and specifically analyze the impact of the le

14、ases on different financial ratios.a. Compute the present value of the lease obligations for Retail Inc. using an annual interest rate of 8%. You should assume all payments are made at the end of the year, and all payments after year X6 are equal to the payment in year X6.b. Compute the present valu

15、e of the lease obligations for Stores Inc. using an annual interest rate of 8%. You should assume all payments are made at the end of the year, and all payments after year X6 are equal to the payment in year X6.Error! Hyperlink reference not valid.c. Compute the total liabilities to asset ratio and

16、the long-term debt to assets ratio for Retail Inc. for the end of year X1.d. Compute the total liabilities to asset ratio and the long-term debt to assets ratio for Stores Inc for the end of year X1.e. Repeat c and d and compute the total liabilities to asset ratio and the long-term debt to assets r

17、atio for both companies for the end of year X1 assuming the companies capitalize the leases.Chapter4Problem Two: Adjusting from LIFO to FIFO Below are selected numbers extracted from Harnischfegers Year X2 financial statements (numbers are in thousands).Inventories valued using the LIFO method repre

18、sented approximately 56% and 80% of consolidated inventories at October 31, X2 and X1, respectively.a. Calculate for Year X2:i) the gross margin percentageii) the current ratioiii) inventory turnoveriv) Estimate the following numbers if Harnischfeger used FIFO for all inventories:v) the gross margin

19、vi) the current ratiovii) nventory turnoverb. Compare your answers in part a) and b) and comment.Problem Five: Fixed Assets Below is selected information taken from the balance sheet of LongLi Corporation as of 12/31/06.From the operating section of the statement of cash flows, you determine that th

20、e depreciation expense for the year was $2,000 and loss on sales of assets was $5,000. The investing section reveals that the company purchased equipment for $14,000 and sold equipment for $2,000.In the footnotes to the financial statements, the company states:At the beginning of 2006, we determined

21、 that the useful life of our assets was higher than originally believed. Accordingly we have increased the useful life from 10 years to 15 years in 2006.a. What was the gross book value of the equipment that was sold?b. What was the net book value of the equipment that was sold?c. With respect to th

22、e change in the useful lives of the assets:i. What is the effect on 2005s financial statements?ii. What is the effect on 2006s financial statements?3 . Problem Six: Plant, Property and Equipment You are analyzing two companies that operate in the same industry. They are both growing capital-intensiv

23、e manufacturing companies, Guerr Corp. and Filk Corp. A diligent reading of their annual reports reveals the following:You know that these accounting differences will affect the comparability of the two companys financial results.Consider each of the above items (depreciation method, average depreci

24、able lives and leases) separately and determine all other things being equal, whether the following ratios will be higher, lower or the same for Guerr when compared to Filk. Explain your answers.i. Observed P/E ratioii. Price to Free Cash flowiii. Price to Book ValueProblem chpter 595.Problem One: E

25、quity method versus cost method Wilde Corporation owns 30% of the outstanding stock of Bernie Inc. Bernie recorded net income of $10M and paid dividends of $3M in 2006. For each of the following ratios, state the effect (higher, lower or no effect) that the use of the equity method would have on Wil

26、des financial ratios compared to the use of the cost method in 2006. Explain your answers.i. Gross marginii. Total Asset turnoveriii. Cash flow from operations to current liabilitiesiv. Debt to Equity98.Problem Four: Pooling vs. Purchase Accounting You are analyzing the financial statements of ABC C

27、orp. at the end of fiscal 2006. You notice that during the year, they made a major acquisition. Nowhere in the annual report does it state whether ABC used purchase or pooling-of-interests accounting for this acquisition. It made no other acquisitions during the year, and there were no disposals of any lines of business.How would you determine whether purchase accounting or pooling-of-interests accounting had been used. Give three ways. Explain fully.【精品文档】第 6 页

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 《认识角》ppt教学讲解课件

- 《从数据谈节水》数据的收集、整理与描述优秀教学ppt课件

- 人员配置-公司组织架构与人员配置计划课件

- 《认识分式》ppt课件

- 《从百草园到三味书屋》第一课时ppt课件

- 公路工程概预算三课件

- 中考物理专题突破-综合能力题教学课件

- 《创新设计》高考英语二轮复习(江苏专用)ppt课件:第二部分-基础语法巧学巧练-专题八-非谓语动词

- 中考物理专题复习课件:滑轮及滑轮组

- CIM安全标识统一规划课件

- 中考物理专题复习教学课件-质量和密度

- 《处理民族关系的原则平等团结共同繁荣》ppt课件

- 中考物理专题复习之物理实验和探究题复习指导教学课件

- 《十二人人都会有挫折》初中心理健康教育闽教版《中学生心理健康》七级课件

- Cisco无线网络-安全-Brief课件