英语学习辅导讲义

英语学习辅导讲义

《英语学习辅导讲义》由会员分享,可在线阅读,更多相关《英语学习辅导讲义(12页珍藏版)》请在装配图网上搜索。

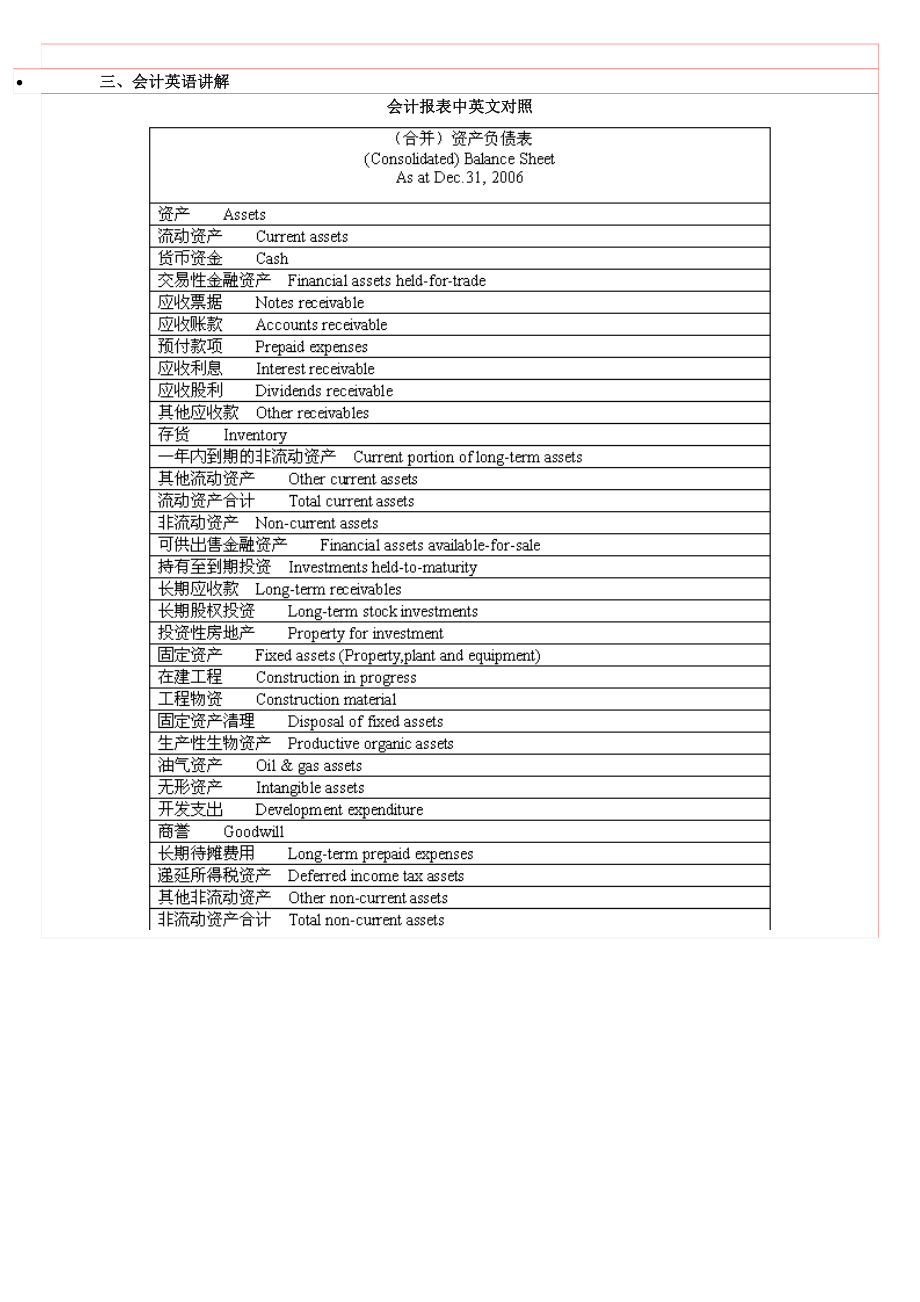

1、 三、会计英语讲解会计报表中英文对照Accounting1. Financial reporting(财务报告) includes not only financial statements but also other means of communicating information that relates, directly or indirectly, to the information provided by a business enterprises accounting system-that is, information about an enterprises re

2、sources, obligations, earnings, etc.2. Objectives of financial reporting: 财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions.(2) Provide information that enables assessing future cash flows.(3) Provide information that enables users to lear

3、n about economic resources, claims against those resources, and changes in them.3. Basic accounting assumptions 基本会计假设(1) Economic entity assumption 会计主体假设This assumption simply says that the business and the owner of the business are two separate legal and economic entities. Each entity should acco

4、unt and report its own financial activities.(2) Going concern assumption 持续经营假设This assumption states that the enterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be

5、amortized over time.This assumption enables an accountant to use accrual accounting which records accrual and deferral entries as of each balance sheet date.(3) Time period assumption 会计分期假设This assumption assumes that the economic life of a business can be divided into artificial time periods.The m

6、ost typical time segment = Calendar YearNext most typical time segment = Fiscal Year(4) Monetary unit assumption 货币计量假设This assumption states that only transaction data that can be expressed in terms of money be included in the accounting records, and the unit of measure remains relatively constant

7、over time in terms of purchasing power.In essence, this assumption disregards the effects of inflation or deflation in the economy in which the entity operates.This assumption provides support for the Historical Cost principle.4. Accrual-basis accounting 权责发生制会计5. Qualitative characteristics 会计信息质量特

8、征(1) Reliability 可靠性For accounting information to be reliable, it must be dependable and trustworthy.Accounting information is reliable to the extend that it is:Verifiable: means that information has been objectively determined, arrived at, or created. More than one person could consider the facts o

9、f a situation and reach a similar conclusion.Representationally faithful: that something is what it is represented to be. For example, if a machine is listed as a fixed asset on the balance sheet, then the company can prove that the machine exists, is owned by the company, is in working condition, a

10、nd is currently being used to support the revenue generating activities of the company.Neutral: means that information is presented in accordance with generally accepted accounting principles and practices, and without bias.(2) Relevance 相关性Relevant information is capable of making a difference in t

11、he decisions of users by helping them to evaluate the potential effects of past, present, or future transactions or other events on future cash flows (predictive value) or to confirm or correct their previous evaluations (confirmatory value).(3) Understandability 可理解性Understandability is the quality

12、 of information that enables users who have a reasonable knowledge of business and economic activities and financial reporting, and who study the information with reasonable diligence, to comprehend its meaning.(4) Comparability 可比性Comparability: suggests that accounting information that has been me

13、asured and reported in a similar manner by different enterprises should be capable of being compared because each of the enterprises is applying the same generally accepted accounting principles and practices.Consistency: suggests that an entity has used the same accounting principle or practice fro

14、m one period to another, therefore, if the dollar amount reported for a category is different from one period to the next, then chances are that the difference is due to a change like an increase or decrease in sales volume rather than being due to a change in the method of calculating the dollar am

15、ount.(5) Substance over form 实质重于形式Substance over form emphasizes the economic substance of an event even though its legal form may provide a different result.It requires that business enterprise should perform accounting recognition, measurement and reporting in accordance with the economic substan

16、ce rather than the legal form of an event or transaction.(6) Materiality 重要性Information is material if its omission or misstatement could influence the resource allocation decisions that users make on the basis of an entitys financial report. Materiality depends on the nature and amount of the item

17、judged in the particular circumstances of its omission or misstatement. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise.(7) Conservatism 谨慎性Conservatism dictates that when in doubt, choose the method that will be least likely to ove

18、rstate assets and income, and understate liabilities and expenses.(8) Timeliness 及时性Timeliness means having information available to decision makers before it loses its capacity to influence decisions. If information becomes available only after the time that a decision must be made, it has no capac

19、ity to influence that decision and thus lacks relevance.6. Basic accounting elements 基本会计要素(1) Asset 资产An asset is a resource that is owned or controlled by an enterprise as a result of past transactions or events and is expected to generate economic benefits to the enterprise.(2) Liability 负债A liab

20、ility is a present obligation arising from past transactions or events which are expected to give rise to an outflow of economic benefits from the enterprise.A present obligation is a duty committed by the enterprise under current circumstances. Obligations that will result from the occurrence of fu

21、ture transactions or events are not present obligations and shall not be recognized as liabilities.(3) owners equity 所有者权益Owners equity is the residual interest in the assets of an enterprise after deducting all its liabilities.Owners equity of a company is also known as shareholders equity.(4) Reve

22、nue 收入Revenue is the gross inflow of economic benefits derived from the course of ordinary activities that result in increases in equity, other than those relating to contributions from owners.(5) Expense 费用Expenses are the gross outflow of economic benefits resulted from the course of ordinary acti

23、vities that result in decreases in owners equity, other than those relating to appropriations of profits to owners.(6) Profit 利润Profit is the operating result of an enterprise over a specific accounting period. Profit includes the net amount of revenue after deducting expenses, gains and losses dire

24、ctly recognized in profit of the current period, etc.7. Five measurement attributes 会计计量属性(1) Historical cost 历史成本Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition. Liabilities are recorded

25、 at the amount of proceeds or assets received in exchange for the present obligation, or the amount payable under contract for assuming the present obligation, or at the amount of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.(2) Current repla

26、cement cost 现时重置成本Assets are carried at the amount of cash or cash equivalents that would have to be paid if a same or similar asset was acquired currently. Liabilities are carried at the amount of cash or cash equivalents that would be currently required to settle the obligation.(3) Net realizable

27、value 可实现净值Assets are carried at the amount of cash or cash equivalents that could be obtained by selling the asset in the ordinary course of business, less the estimated costs of completion, the estimated selling costs and related tax payments.(4) Present value 现值Assets are carried at the present d

28、iscounted value of the future net cash inflows that the item is expected to generate from its continuing use and ultimate disposal. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities within the expected s

29、ettlement period.(5) Fair value 公允价值Assets and liabilities are carried at the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arms length transaction.8. Financial statements 财务报表(1) Balance sheet 资产负债表A balance sheet is an accounting

30、 statement that reflects the financial position of an enterprise at a specific date.(2) Income statement 损益表An income statement is an accounting statement that reflects the operating results of an enterprise for a certain accounting period.(3) Statement of cash flows 现金流量表A cash flow statement is an

31、 accounting statement that reflects the inflows and outflows of cash and cash equivalents of an enterprise for a certain accounting period.(4) Statement of changes in ownersequity 所有者权益变动表A statement of changes in owners equity reports the changes in owners equity for a specific period of time.(5) N

32、otes to financial statements 财务报表附注Notes to the accounting statements are further explanations of items presented in the accounting statements, and explanations of items not presented in the accounting statements, etc.9. Accounting entry 会计分录Debit: CashCredit: Common Stock10. Basic accounting equati

33、on 基本会计等式Assets = Liabilities + owners equity11. List of present and potential users of financial information 财务信息的使用者investors, creditors, employees, suppliers, customers, and governmental agencies. 四、审计英语讲解Auditing1. Assurance engagements and external auditMateriality, true and fair presentation,

34、reasonable assuranceMateriality is the magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or mi

35、sstatement. An auditor must consider materiality both in (1) planning the audit and designing audit procedures and (2) evaluating audit results.Appointment, removal and resignation of auditorsTypes of opinion: standard unqualified opinion, Unqualified with additional explanatory language, qualified

36、opinion, adverse opinion, disclaimer of opinionProfessional ethics: independence, objectivity, integrity, professional competence, due care, confidentiality, professional behaviorEngagement letter2. Planning and risk assessmentGeneral principlesPlan and perform audits with an attitude of professiona

37、l skepticismAudit risks = inherent risk control risk detection risk(1) Inherent risk refers to the likelihood of material misstatement of an assertion, assuming no related internal control. This risk differs by account and assertion.(2) Control risk is the likelihood that a material misstatement wil

38、l not be prevented or detected on a timely basis by internal control. This risk is assessed using the results of tests of control.(3) Detection risk is the likelihood that an auditors procedures lead to an improper conclusion that no material misstatement exists in an assertion when in fact such a m

39、isstatement does exist. The auditors substantive tests are primarily relied upon to restrict detection risk.Risk-based approachUnderstanding the entity and knowledge of the businessThe CPA should obtain a level of knowledge of the clients business that will enable effective planning and performance

40、of the audit in accordance with generally accepted auditing standards. This knowledge helps the auditor in(1) Identifying areas that may need special consideration(2) Assessing conditions under which accounting data are produced, processed, reviewed and accumulated(3) Evaluating accounting estimates

41、 for reasonableness (e.g., valuation of inventories, depreciation, allowance for doubtful accounts, percentage of completion of long-term contracts)(4) Evaluating the reasonableness of management representations(5) Making judgments about the appropriateness of the accounting principles applied and t

42、he adequacy of disclosuresAssessing the risks of material misstatement and fraudMateriality (level), tolerable errorAnalytical proceduresAnalytical procedures are normally used at three stages of the audit: (1) planning, (2) substantive testing, and (3) overall review at the conclusion of an audit.

43、They are required during the planning and overall review stages.Analytical procedures used for 3 purposes:(1) Planning nature, timing, and extent of other auditing procedures(2) Substantive tests about particular assertions(3) Overall review in the final stage of auditPlanning an auditAudit document

44、ation: working papersThe work of othersRely on the work of expertsRely on the work of internal audit3. Internal controlInternal control is a process effected by an entitys board of directors, management, and other personneldesigned to provide reasonable assurance regarding the achievement of objecti

45、ves in the following categories: (1) reliability of financial reporting, (2) effectiveness and efficiency of operations, and (3) compliance with applicable laws and regulations.Five components of internal control(1) control environment(2) risk assessment(3) control activities(4) information and comm

46、unication(5) monitoringThe evaluation of internal control systemsTests of controlSubstantive procedures (time, nature, extent)Transaction cycles: revenue, purchases, inventory, etc.4. Audit evidenceObtain sufficient, appropriate audit evidenceAssertions contained in the financial statements: complet

47、eness, occurrence, existence, measurement, presentation and disclosure, rights and obligations, valuationThe audit of specific itemsReceivables: confirmationInventory: counting, cut-off, confirmation of inventory held by third partiesPayables: supplier statement reconciliation, confirmationBank and

48、cash: bank confirmationAuditing sampling5. ReviewSubsequent eventsGoing concernManagement representationsAudit finalization and the final review: unadjusted differences6. Reporting审计1.鉴证业务和外部审计重要性,真实、公允反映,合理保证注册会计师的聘用,解聘和辞职审计意见类型:标准无保留意见,带解释段的无保留意见,保留意见,否定意见,无法表示意见职业道德:独立、客观和公正,专业胜任能力,应有的关注,保密性,职业行为

49、审计业务约定书2.审计计划和风险评估一般原则计划和执行审计业务应保持应有的职业怀疑态度审计风险=固有风险控制风险检查风险风险导向型审计了解被审单位估计重大错报或舞弊的风险重要性水平,可容忍误差分析性复核程序制定审计计划审计记录:工作底稿利用其他人的工作利用专家工作利用内部审计人员的工作3.内部控制内部控制系统评价控制测试实质性程序(时间,性质,范围)交易循环:收入循环、采购循环、存货循环,等等。4.审计证据获取充分、适当的审计证据财务报表所包含的认定:完整性,发生,存在,计价,表达和披露,权利和义务, 估价具体项目的审计应收账款:函证存货:盘点,截止测试,对第三方持有存货进行函证应付账款:供应

50、商对帐,函证货币资金:银行函证审计抽样5.复核期后事项持续经营管理层声明终结审计和最后复核:未调整差异6.审计报告Examples for audit report(1) Standard unqualified reportIndependent Auditors ReportTo: Board of Directors and Stockholders ABC Company We have audited the accompanying balance sheet of ABC Co., Ltd. (“ the Company”) as of December 31, 2006, an

51、d the related statements of income and cash flows for the year then ended. These financial statements are the responsibility of the Companys management. Our responsibility is to express an audit opinion on these financial statements based on our audits. We conducted our audits in accordance with the

52、 Independent Auditing Standards for Certified Public Accountants. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the

53、amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion

54、. In our opinion, the financial statements give a true and fair view( or are presented fairly, in all material respects, ) the financial position of ABC as of December 31, 2006 , and the results of its operations and its cash flows for the year then ended in conformity with the requirements of both

55、the Accounting Standard for Business Enterprises and other relevant financial and accounting laws and regulations promulgated by the State.Zhang Hua, CPAFebruary 26, 2007(2) Unqualified with additional explanatory languageIndependent Auditors ReportTo: Board of Directors and Stockholders ABC Company

56、 We have audited the accompanying balance sheet of ABC Co., Ltd. (“ the Company”) as of December 31, 2006, and the related statements of income and cash flows for the year then ended. These financial statements are the responsibility of the Companys management. Our responsibility is to express an au

57、dit opinion on these financial statements based on our audits. We conducted our audits in accordance with the Independent Auditing Standards for Certified Public Accountants. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial stateme

58、nts are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the ov

59、erall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements give a true and fair view( or are presented fairly, in all material respects, ) the financial position of ABC as of December 31, 2006 , and the resu

60、lts of its operations and its cash flows for the year then ended in conformity with the requirements of both the Accounting Standard for Business Enterprises and other relevant financial and accounting laws and regulations promulgated by the State. In the course of our audit, we have reminded the ma

61、nagement that, due to the sharp price decline in the stock market since January 2003, an investment loss totaling RMB5 700 000 would be incurred if the short-term equity securities held by your Company were sold out on March 10.Zhang Hua, CPAFebruary 26, 2007(3) qualified opinionIndependent Auditors

62、 ReportTo: Board of Directors and Stockholders ABC Company We have audited the accompanying balance sheet of ABC Co., Ltd. (“ the Company”) as of December 31, 2006, and the related statements of income and cash flows for the year then ended. These financial statements are the responsibility of the C

63、ompanys management. Our responsibility is to express an audit opinion on these financial statements based on our audits. We conducted our audits in accordance with the Independent Auditing Standards for Certified Public Accountants. Those Standards require that we plan and perform the audit to obtai

64、n reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. The Company has excluded from

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。