Ch-4选择题

Ch-4选择题

《Ch-4选择题》由会员分享,可在线阅读,更多相关《Ch-4选择题(15页珍藏版)》请在装配图网上搜索。

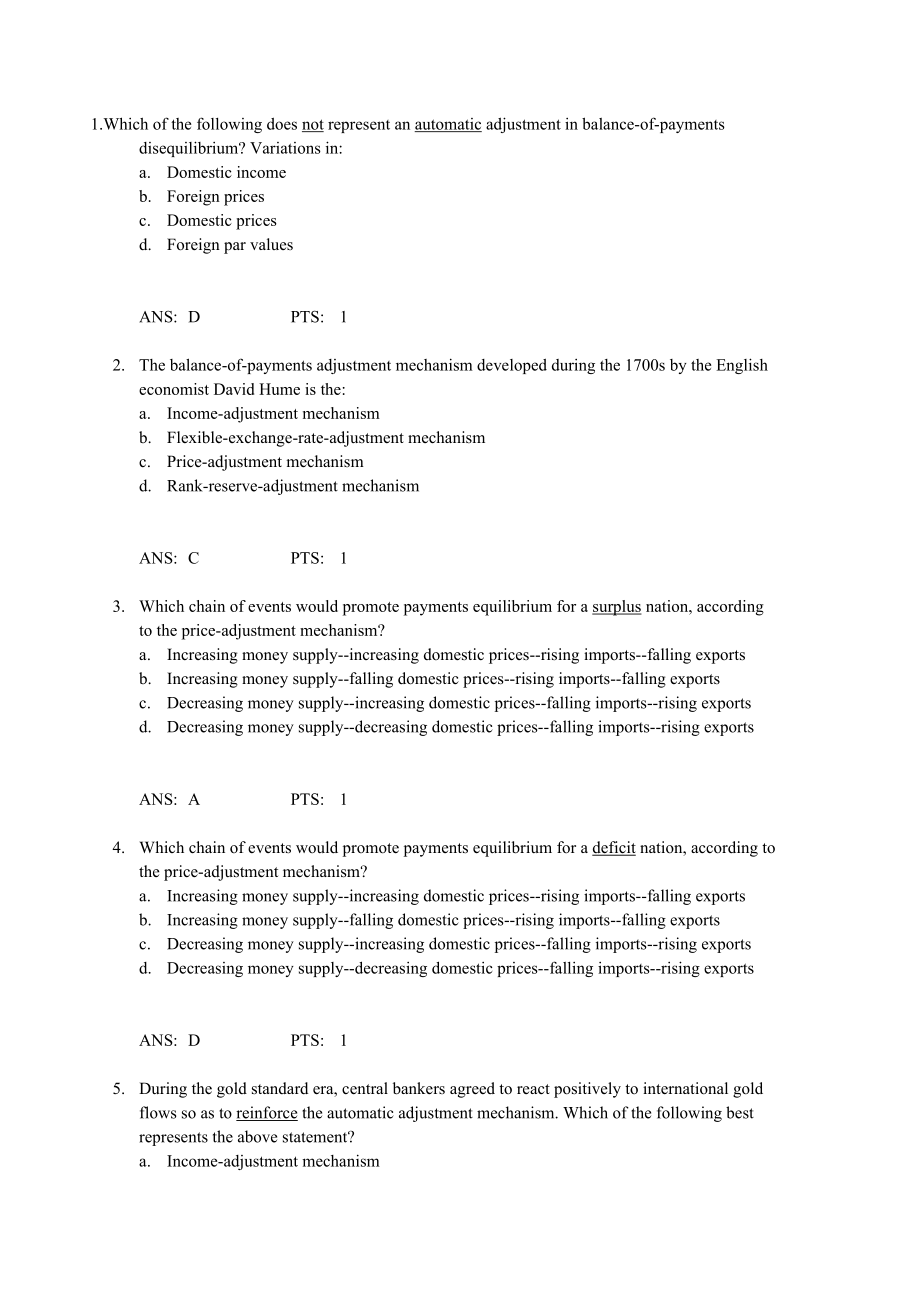

1、1.Which of the following does not represent an automatic adjustment in balance-of-payments disequilibrium? Variations in:a.Domestic incomeb.Foreign pricesc.Domestic pricesd.Foreign par valuesANS:DPTS:12.The balance-of-payments adjustment mechanism developed during the 1700s by the English economist

2、David Hume is the:a.Income-adjustment mechanismb.Flexible-exchange-rate-adjustment mechanismc.Price-adjustment mechanismd.Rank-reserve-adjustment mechanismANS:CPTS:13.Which chain of events would promote payments equilibrium for a surplus nation, according to the price-adjustment mechanism?a.Increasi

3、ng money supply-increasing domestic prices-rising imports-falling exportsb.Increasing money supply-falling domestic prices-rising imports-falling exportsc.Decreasing money supply-increasing domestic prices-falling imports-rising exportsd.Decreasing money supply-decreasing domestic prices-falling imp

4、orts-rising exportsANS:APTS:14.Which chain of events would promote payments equilibrium for a deficit nation, according to the price-adjustment mechanism?a.Increasing money supply-increasing domestic prices-rising imports-falling exportsb.Increasing money supply-falling domestic prices-rising import

5、s-falling exportsc.Decreasing money supply-increasing domestic prices-falling imports-rising exportsd.Decreasing money supply-decreasing domestic prices-falling imports-rising exportsANS:DPTS:15.During the gold standard era, central bankers agreed to react positively to international gold flows so a

6、s to reinforce the automatic adjustment mechanism. Which of the following best represents the above statement?a.Income-adjustment mechanismb.Price-adjustment mechanismc.Rules of the gamed.Discretionary fiscal policyANS:CPTS:16.During the gold standard era, the rules of the game suggested that:a.Surp

7、lus countries should increase their money suppliesb.Deficit countries should increase their money suppliesc.Surplus and deficit countries should increase their money suppliesd.Surplus and deficit countries should decrease their money suppliesANS:APTS:17.Which of the following balance-of-payments adj

8、ustment mechanisms is most closely related to the quantity theory of money?a.Income-adjustment mechanismb.Price-adjustment mechanismc.Interest-rate-adjustment mechanismd.Output-adjustment mechanismANS:BPTS:18.Under the gold standard, a surplus nation facing a gold inflow and an increase in its money

9、 supply would also experience a:a.Rise in its interest rate and a short-term financial inflowb.Rise in its interest rate and a short-term financial outflowc.Fall in its interest rate and a short-term financial inflowd.Fall in its interest rate and a short-term financial outflowANS:DPTS:19.Under the

10、gold standard, a deficit nation facing a gold outflow and a decrease in its money supply would also experience a:a.Rise in its interest rate and a short-term financial inflowb.Rise in its interest rate and a short-term financial outflowc.Fall in its interest rate and a short-term financial inflowd.F

11、all in its interest rate and a short-term financial outflowANS:APTS:110.Assume that Canada initially faces payments equilibrium in its merchandise trade account as well as in its capital and financial account. Now suppose that Canadian interest rates increase to levels higher than those abroad. For

12、Canada, this tends to promote:a.Net financial inflowsb.Net financial outflowsc.Net merchandise exportsd.Net merchandise importsANS:APTS:111.Assume that Canada initially faces payments equilibrium in its merchandise trade account as well as in its capital and financial account. Now suppose that Canad

13、ian interest rates fall to levels below those abroad. For Canada, this tends to promote:a.Net financial inflowsb.Net financial outflowsc.Net merchandise exportsd.Net merchandise importsANS:BPTS:112.Suppose the United States levies an interest equalization tax, which taxes Americans on dividend and i

14、nterest income from foreign securities. Such a tax would be intended to:a.Encourage financial movements from the United States to overseasb.Discourage financial movements from the United States to overseasc.Discourage financial movements from overseas to the United Statesd.None of the aboveANS:BPTS:

15、113.Assume that interest rates on comparable securities are identical in the United States and foreign countries. Now suppose that investors anticipate that in the future the U.S. dollar will appreciate against foreign currencies. Investment funds would thus be expected to:a.Flow from the United Sta

16、tes to foreign countriesb.Flow from foreign countries to the United Statesc.Remain totally in foreign countriesd.Not be affected by the expected dollar appreciationANS:BPTS:114.Suppose Japan increases its imports from Sweden, leading to a rise in Swedens exports and income level. With a higher incom

17、e level, Sweden imports more goods from Japan. Thus a change in imports in Japan results in a feedback effect on its exports. This process is best referred to as the:a.Monetary approach to balance-of-payments adjustmentb.Discretionary income adjustment processc.Foreign repercussion effectd.Price-spe

18、cie flow mechanismANS:CPTS:1Exhibit 13.1Assume the marginal propensity to consume for U.S. households equals 0.9, and the marginal propensity to import for the United States equals 0.1. Suppose there occurs an increase in investment of $10 billion at each level of income.15.Refer to Exhibit 13.1. Th

19、e value of the multiplier for the United States equals:a.2b.3c.4d.5ANS:DPTS:116.Refer to Exhibit 13.1. The change in the level of U.S. income resulting from the additional investment spending equalsa.$20 billionb.$30 billionc.$40 billiond.$50 billionANS:DPTS:117.Refer to Exhibit 13.1. The change in

20、the level of U.S. imports resulting from the rise in U.S. income equals:a.$5 billionb.$10 billionc.$15 billiond.$20 billionANS:APTS:118.The monetary approach to balance-of-payments adjustments suggests that all payments deficits are the result of:a.Too high interest rates in the home countryb.Too lo

21、w interest rates in the home countryc.Excess money supply over money demand in the home countryd.Excess money demand over money supply in the home countryANS:CPTS:119.The monetary approach to balance-of-payments adjustments suggests that all payments surpluses are the result of:a.Too high interest r

22、ates in the home countryb.Too low interest rates in the home countryc.Excess money supply over money demand in the home countryd.Excess money demand over money supply in the home countryANS:DPTS:120.Starting from a position where the nations money demand equals the money supply, and its balance of p

23、ayments is in equilibrium, economic theory suggests that the nations balance of payments would move into a deficit position if there occurred in the nation a:a.Decrease in the money supplyb.Increase in the money demandc.Decrease in the money demandd.None of the aboveANS:CPTS:121.Which approach to ba

24、lance-of-payments adjustment suggests that balance-of-payments surpluses are the result of excess money demand in the home country?a.Absorption approachb.Elasticities approachc.Monetary approachd.Purchasing-power-parity approachANS:CPTS:122.According to the rules of the game of the gold standard era

25、, a countrys central bank agreed to react to international gold flows so as to:a.Officially devalue a currency during eras of payments surplusesb.Officially revalue a currency during eras of payments deficitsc.Offset the automatic-adjustment mechanism (e.g., prices)d.Reinforce the automatic-adjustme

26、nt mechanismANS:DPTS:123.According to the quantity theory of money, a change in the domestic money supply will bring about:a.Inverse and proportionate changes in the price levelb.Inverse and less-than-proportionate changes in the price levelc.Direct and proportionate changes in the price leveld.Dire

27、ct and less-than-proportionate changes in the price levelANS:CPTS:124.The formulation of the so-called income adjustment mechanism is associated with:a.Adam Smithb.David Ricardoc.David Humed.John Maynard KeynesANS:DPTS:125.The value of the foreign trade multiplier equals the reciprocal of the sum of

28、 the marginal propensities to:a.Save plus importb.Import plus investc.Consume plus exportd.Save plus importANS:APTS:126.Starting from a position where the nations money demand equals the money supply and its balance of payments is in equilibrium, economic theory suggests that the nations balance of

29、payments would move into a deficit position if there occurred in the nation:a.An increase in the money supplyb.A decrease in the money supplyc.An increase in money demandd.None of the aboveANS:APTS:127.Starting from a position where the nations money demand equals the money supply and its balance of

30、 payments is in equilibrium, economic theory suggests that the nations balance of payments would move into a surplus position if there occurred in the nation:a.A decrease in the money supplyb.An increase in the money supplyc.A decrease in the money demandd.None of the aboveANS:APTS:128.Starting from

31、 a position where the nations money demand equals the money supply and its balance of payments is in equilibrium, economic theory suggests that the nations balance of payments would move into a surplus position if there occurred in the nation:a.An increase in the money demandb.A decrease in the mone

32、y demandc.An increase in the money supplyd.None of the aboveANS:APTS:129.Assume identical interest rates on comparable securities in the United States and foreign countries. Suppose investors anticipate that in the future the U.S. dollar will depreciate against foreign currencies. Investment funds w

33、ould tend to:a.Flow from the United States to foreign countriesb.Flow from foreign countries to the United Statesc.Remain totally in foreign countriesd.Remain totally in the United StatesANS:APTS:130.Suppose that rising U.S. income leads to higher sales and profits in the United States. This would l

34、ikely result in:a.Increasing portfolio investment into the United Statesb.Decreasing portfolio investment into the United Statesc.Increasing direct investment into the United Statesd.Decreasing direct investment into the United StatesANS:CPTS:1Figure 13.1. U.S. Capital and Financial Account31.Refer

35、to Figure 13.1. Upward movements along U.S. capital and financial account schedule CA0 would be caused by:a.U.S. interest rates rising relative to foreign interest ratesb.U.S. interest rates falling relative to foreign interest ratesc.Taxes placed on income earned by U.S. residents from their foreig

36、n investmentsd.Taxes placed on income earned by foreign residents from their U.S. investmentsANS:APTS:132.Refer to Figure 13.1. Downward movements along U.S. capital and financial account schedule CA0 would be caused by:a.U.S. interest rates rising relative to foreign interest ratesb.U.S. interest r

37、ates falling relative to foreign interest ratesc.Taxes placed on income earned by U.S. residents from their foreign investmentsd.Taxes placed on income earned by foreign residents from their U.S. investmentsANS:BPTS:133.Refer to Figure 13.1. The U.S. capital and financial account schedule would shif

38、t upward from CA0 to CA1 if:a.U.S. interest rates exceeded foreign interest ratesb.Foreign interest rates exceeded U.S. interest ratesc.Taxes were placed on income earned by U.S. residents from their foreign investmentsd.Taxes were placed on income earned by foreign residents from their U.S. investm

39、entsANS:CPTS:134.Refer to Figure 13.1. The U.S. capital and financial account schedule would shift upward from CA0 to CA1 if:a.U.S. residents receive subsidies to invest in foreign nationsb.U.S. interest rates rise relative to foreign interest ratesc.Taxes are reduced on income earned by U.S. reside

40、nts from their foreign investmentsd.Expected profits decline on U.S. investments in foreign manufacturingANS:DPTS:135.Refer to Figure 13.1. The U.S. capital and financial account schedule would shift upward from CA0 to CA1 for all of the following reasons except:a.U.S. political stability improves r

41、elative to foreign political stabilityb.U.S. interest rates fall relative to foreign interest ratesc.Taxes are placed on income earned by U.S. residents from foreign investmentsd.Restrictions are imposed on foreign loans granted by U.S. banksANS:BPTS:136.Refer to Figure 13.1. U.S. capital and financ

42、ial account schedule CA0 would shift upwards, or downwards, for all of the following reasons except:a.U.S. residents being taxed on income earned from foreign investmentsb.U.S. banks being restricted on loans that can be made abroadc.U.S. political stability changing relative to foreign political st

43、abilityd.U.S. interest rates changing relative to foreign interest ratesANS:DPTS:1Table 13.1. Canadas Saving, Investment, Import, and Export Functions (in billions of dollars) Under a System of Fixed Exchange RatesExport FunctionX = 3000Investment FunctionI = 1000Saving FunctionS = -1000 + 0.2YImpor

44、t FunctionM = 500 + 0.25Y37.Referring to Table 13.1, if Canadas income rises by $200 billion, saving would rise by:a.$10 billionb.$20 billionc.$30 billiond.$40 billionANS:DPTS:138.Referring to Table 13.1, if Canadas income rises by $200 billion, imports would rise by:a.$50 billionb.$75 billionc.$100

45、 billiond.$125 billionANS:APTS:139.Referring to Table 13.1, Canadas foreign trade multiplier equals:a.1.75b.2.05c.2.22d.2.64ANS:CPTS:140.Referring to Table 13.1, Canadas equilibrium level of income is:a.$8000 billionb.$9000 billionc.$10,000 billiond.$11,000 billionANS:CPTS:141.Refer to Table 13.1. I

46、f improved business optimism leads to increases in Canadas planned investment spending from $1000 billion to $1200 billion, Canadas equilibrium income rises by approximately:a.$444 billionb.$555 billionc.$666 billiond.$777 billionANS:APTS:142.Refer to Table 13.1. If weak economic conditions abroad r

47、esult in Canadas exports falling from $3000 billion to $2500 billion, Canadas equilibrium income falls by approximately:a.$888 billionb.$990 billionc.$1110 billiond.$1220 billionANS:CPTS:1Figure 13.2. Australian Economy Under a Fixed Exchange Rate System43.Refer to Figure 13.2. The slope of the (X-M

48、) schedule and (S-I) schedule indicates that Australias foreign trade multiplier is:a.0.5b.1.0c.1.5d.2.0ANS:DPTS:144.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0, suppose that improving economic conditions abroad lead to an autonomous increase in A

49、ustralian exports of $5 billion. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, surplus of $2.5 billionb.Rises to $60 billion, surplus of $5 billionc.Falls to $40 billion, deficit of $2.5 billiond.Falls to $40 billion, deficit of $5 billionANS:

50、APTS:145.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S- I)0 intersects (X-M)0, suppose that worsening economic conditions abroad lead to an autonomous decrease in Australian exports of $5 billion. Australian income thus _ which leads to Australias trade account moving to

51、 a _.a.Rises to $60 billion, surplus of $2.5 billionb.Rises to $60 billion, surplus of $5 billionc.Falls to $40 billion, deficit of $2.5 billiond.Falls to $40 billion, deficit of $5 billionANS:CPTS:146.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0,

52、suppose that improving profit expectations lead to an autonomous increase in Australian investment of $5 billion. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, deficit of $2.5 billionb.Rises to $60 billion, deficit of $5 billionc.Falls to $40

53、billion, surplus of $2.5 billiond.Falls to $40 billion, surplus of $5 billionANS:APTS:147.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0, suppose that worsening profit expectations lead to an autonomous decrease in Australian investment of $5 billion

54、. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, deficit of $2.5 billionb.Rises to $60 billion, deficit of $5 billionc.Falls to $40 billion, surplus of $2.5 billiond.Falls to $40 billion, surplus of $5 billionANS:CPTS:148.Refer to Figure 13.2.

55、Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0, suppose that increased thriftiness leads to an autonomous increase in Australian saving of $5 billion. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, deficit of $2.5 bi

56、llionb.Rises to $60 billion, deficit of $5 billionc.Falls to $40 billion, surplus of $2.5 billiond.Falls to $40 billion, surplus of $5 billionANS:CPTS:149.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0, suppose that dwindling thriftiness leads to an

57、autonomous decrease in Australian saving to $5 billion. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, deficit of $2.5 billionb.Rises to $60 billion, deficit of $5 billionc.Falls to $40 billion, surplus of $2.5 billiond.Falls to $40 billion, su

58、rplus of $5 billionANS:APTS:150.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X-M)0, suppose that changing preferences lead to an autonomous increase in Australian imports of $5 billion. Australian income thus _ which leads to Australias trade account mov

59、ing to a _.a.Rises to $60 billion, surplus of $2.5 billionb.Rises to $60 billion, surplus of $5 billionc.Falls to $40 billion, deficit of $2.5 billiond.Falls to $40 billion, deficit of $5 billionANS:CPTS:151.Refer to Figure 13.2. Starting at equilibrium income $50 billion, where (S-I)0 intersects (X

60、-M)0, suppose that changing preferences lead to an autonomous decrease in Australian imports of $5 billion. Australian income thus _ which leads to Australias trade account moving to a _.a.Rises to $60 billion, surplus of $2.5 billionb.Rises to $60 billion, surplus of $5 billionc.Falls to $40 billion, deficit of $2.5 billiond.Falls to $40 billion, deficit of $5 billionANS:APTS:152.In explaining balance-of-payments adjustments, the classical economistsa.Focused on interest rates exclusivelyb.Remained aware of the role of interest ratesc.Only focused

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。