-第一学期国际结算练习2

-第一学期国际结算练习2

《-第一学期国际结算练习2》由会员分享,可在线阅读,更多相关《-第一学期国际结算练习2(7页珍藏版)》请在装配图网上搜索。

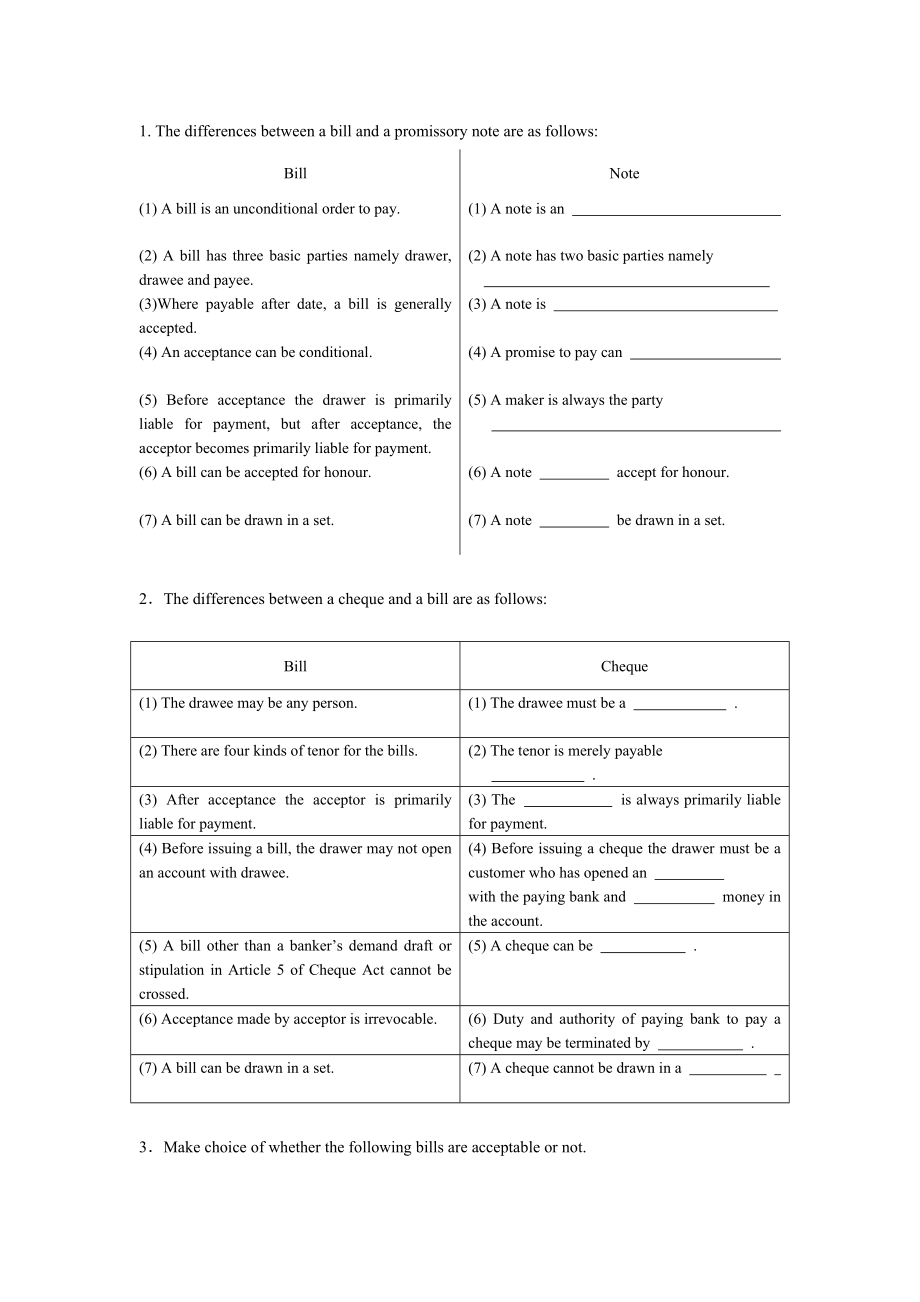

1、1. The differences between a bill and a promissory note are as follows:BillNote(1) A bill is an unconditional order to pay.(1) A note is an (2) A bill has three basic parties namely drawer, drawee and payee.(2) A note has two basic parties namely (3)Where payable after date, a bill is generally acce

2、pted.(3) A note is (4) An acceptance can be conditional.(4) A promise to pay can (5) Before acceptance the drawer is primarily liable for payment, but after acceptance, the acceptor becomes primarily liable for payment.(5) A maker is always the party (6) A bill can be accepted for honour.(6) A note

3、accept for honour.(7) A bill can be drawn in a set.(7) A note be drawn in a set.2The differences between a cheque and a bill are as follows:BillCheque(1) The drawee may be any person.(1) The drawee must be a .(2) There are four kinds of tenor for the bills.(2) The tenor is merely payable .(3) After

4、acceptance the acceptor is primarily liable for payment.(3) The is always primarily liable for payment.(4) Before issuing a bill, the drawer may not open an account with drawee.(4) Before issuing a cheque the drawer must be a customer who has opened an with the paying bank and money in the account.(

5、5) A bill other than a bankers demand draft or stipulation in Article 5 of Cheque Act cannot be crossed.(5) A cheque can be .(6) Acceptance made by acceptor is irrevocable.(6) Duty and authority of paying bank to pay a cheque may be terminated by .(7) A bill can be drawn in a set.(7) A cheque cannot

6、 be drawn in a 3Make choice of whether the following bills are acceptable or not.(1) A bill shows: Pay to ABC Co. providing the goods in compliance with contract the sum of one thousand US dollars. ( ) A. It is acceptable B. It is unacceptable(2) A bill shows: Pay to ABC Co. out of proceeds of sale

7、of woolen blankets the sum of one thousand US dollars. ( ) A. It is acceptable B. It is unacceptable(3) A bill shows: Pay from our No. 2 account to ABC Co. the sum of one thousand US dollars. ()A. It is acceptable B. It is unacceptable(4) A bill shows: Pay to ABC Co. or order the sum of one thousand

8、 US dollars and debit our No. 2 account. ( ) A. It is acceptable B. It is unacceptable(5) A bill shows: Pay to Mary the sum of fifty pounds and gave her a suit of clothes. ( ) A. It is acceptableB. It is unacceptable4. (1) The maturity of one month after 31 Jan. is ( ). (2) The maturity of two month

9、s after 28 Feb. is ( ). (3) The maturity of 180 days after 4 April is ( ).5. (1)The party who draws and deliver the bill is called ( ). (2)The party on whom a bill is drawn but has not accepted it is called ( ) . (3)The drawee agrees to pay on the due date and signs the bill expressing his agreement

10、, he is called ( ). (4)The party in whose favour the drawer directs payment to be made is called ( ). (5)The party who endorses the bill and delivers it is called ( ). (6)The party to whom an endorser endorses the bill is called ( ). (7)The person who transfers his possession of a bill to another is

11、 called ( ). (8)The person to whom the bill is transferred is called ( ). (9)Payment of a bill may be guaranteed by a third person who is called ( ). (10)A ( ) means the payee or endorsee of a bill who is in possession of it, or the bearer thereof. (11)A ( ) is any holder whether he gave value or no

12、t, providing some previous holder gave value, but now he is a holder. (12)A ( ) is a holder who has taken a bill with complete and regular items on the face under the following conditions: (a). That he became the holder of the bill before it was overdue, and without notice that it had been previousl

13、y dishonoured, if such was the fact. (b). That he took the bill in good faith and for value, and that at that time the bill was negotiated to him he had no notice of any defect in the title of the person who negotiated it.6. The holder may exercise his right of recourse only when he has completed th

14、e following procedures: (1) ( ) the bill to drawee for acceptance and / or payment, and it is dishonoured by non-acceptance / non-payment. (2) Give ( ) to his prior party in one business day following the day of dishonour. (3) Make a ( ) for non-acceptance or non-payment one business day following t

15、he day of dishonour.7. (1) The drawee banks of D/D are located in a clearing centre of draft currency, it is called draft ( ). (2) A D/D for USD1,000.00 drawn on American International Bank, Los Angeles ( is / isnt) a draft on centre in USD. (3) A D/D for USD2,000.00 drawn on Chase Manhattan Bank N.

16、 A., New York ( is / isnt) a draft on centre in USD. (4) A D/D for USD860.00 drawn on Bank of China, London ( is / isnt) a draft on centre in USD. (5) A D/D for GBP1,000.00 drawn on Bank of China, London ( is / isnt) a draft on centre in GBP. (6) A D/D for GBP1,800.00 drawn on Midland Bank Ltd., Liv

17、erpool ( is / isnt) a draft on centre in GBP.8. Please write “cover instruction” for each remittance in the following blanks. a. The paying bank has maintained an USD account with the remitting bank. Suppose an outward remittance in USD is made, how do you write “cover instruction” for this remittan

18、ce? b. The remitting bank has maintained a GBP account with the paying bank. Suppose an outward remittance in GBP is made, how do you write “cover instruction” for this remittance? c. Both remitting bank and paying bank have maintained USD accounts with XYZ Bank, New York. Suppose an outward remitta

19、nce in USD is made, how do you write “cover instruction” for this remittance? d. Remitting bank and paying bank have not maintained account with each other, nor have kept both the accounts with a third bank. Suppose an outward remittance is made, how do you write cover instruction for such remittanc

20、e?9. URC522 says that goods should not be consigned to or to the order of a bank without prior agreement on the part of that bank. Put x in the check boxes of the following sentences to express the consignee of B/L corresponding with above stipulation or usual practice. (1) ( ) B/L consigned to orde

21、r and blank endorsed (2) ( ) B/L consigned to order of collecting bank (3) ( ) B/L consigned to order of shipper and blank endorsed (4) ( ) B/L consigned to order of Bank of China, London (5) ( ) B/L consigned to order of buyer.10. How many parties are there in a collection?(1) (or seller)(2) (3) ba

22、nk/ bank(or buyer)11. (1) The remitting bank has maintained an account with the collecting bank, how do you write collecting proceeds instructions in the collection instruction?(2) The collecting bank has maintained an account with the remitting bank, how do you write collecting proceeds instruction

23、s in the collection instruction?(3) The remitting bank has maintained an account with the X Bank, how do you write collecting proceeds instructions in the collecting instructions?12. What are the duties of remitting bank and collecting bank?13. How many methods of financing in the collection transac

24、tions?14. Under an irrevocable credit, who must undertake primary liability for payment? (1) ( ) the applicant (2) ( ) the issuing bank (3) ( ) the nominated bank15. An irrevocable confirmed credit gives the beneficiary: (1) ( ) a single assurance of payment (2) ( ) a double assurance of payment (3)

25、 ( ) a triple assurance of payment16. A letter of credit is ( ). A. a formal guarantee of payment B. a conditional undertaking to make payment C. an unconditional undertaking to make payment D. a two bank guarantee of payment17. “Independent and abstraction principle” may be explained as follows: (1

26、) Issuing Bank must independently undertake its primary responsibility to ( ) beneficiarys complying presentation without interference coming from the other party. (2) A credit is an independent instrument, it is a separate transaction from the ( ). (3) A credit is the ( ) business.18. Under negotia

27、tion credit, the negotiating bank make payment to the beneficiary (1) ( ) with recourse. (2) ( ) without recourse.19. Under negotiation credit, the confirming bank make payment to the negotiating bank (1) ( ) with recourse. (2) ( ) without recourse.20. Under negotiation credit, the issuing bank make

28、 payment to the confirming bank (1) ( ) with recourse. (2) ( ) without recourse.21. Negotiation means that the Negotiating Bank gives value for draft (s) and / or documents to the Beneficiary. Once the value has been given, the Negotiating Bank would become: (1) ( ) the creditor of the draft (s) (2)

29、 ( ) the holder of the draft (s) (3) ( ) the holder in due course of the draft (s)22. A German bank has added its confirmation to a documentary credit issued by a Turkish bank. Which of the following risks is NOT borne by the confirming bank? (1) ( ) Fraud by the beneficiary. (2) ( ) Insolvency of t

30、he issuing bank. (3) ( ) Refusal of the issuing bank to pay against complying documents. (4) ( ) Government restrictions on funds transfer from the issuing bank.23. What is called international factoring?International factoring is that factor will provide a series of financial services such as:(1) e

31、xport trade .(2) maintenance of ledger.(3) collection of .(4) protection for credit.for an exporter under his sales on credit in internantional trade.24. (1) How many parties are there in an international factoring transaction? (2) The exporter who invoices for the supply of goods or the rendering o

32、f services and whose account are factored by the export factor. (3) The importer, or buyer, or debtor who is liable for payment of the account arising from the supply of goods or the rendering of services. (4) The export factor who factors the sellers account under an arrangement to that effect.(5)

33、The import factor who agrees to collect the account invoiced by the seller and assigned to the and who is bound to pay such accounts assigned to him for which he has assumed the credit risk.25. Where does account receivable arise from?Account receivable arises from sales on credit. The sellers sell goods on credit ( including transactions of O/A or D/A at xx days after B/L date) and obtain account from the buyers who are liable for payment of those account at the end of each specific period.

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。