财务报表词汇-中英对照

财务报表词汇-中英对照

《财务报表词汇-中英对照》由会员分享,可在线阅读,更多相关《财务报表词汇-中英对照(15页珍藏版)》请在装配图网上搜索。

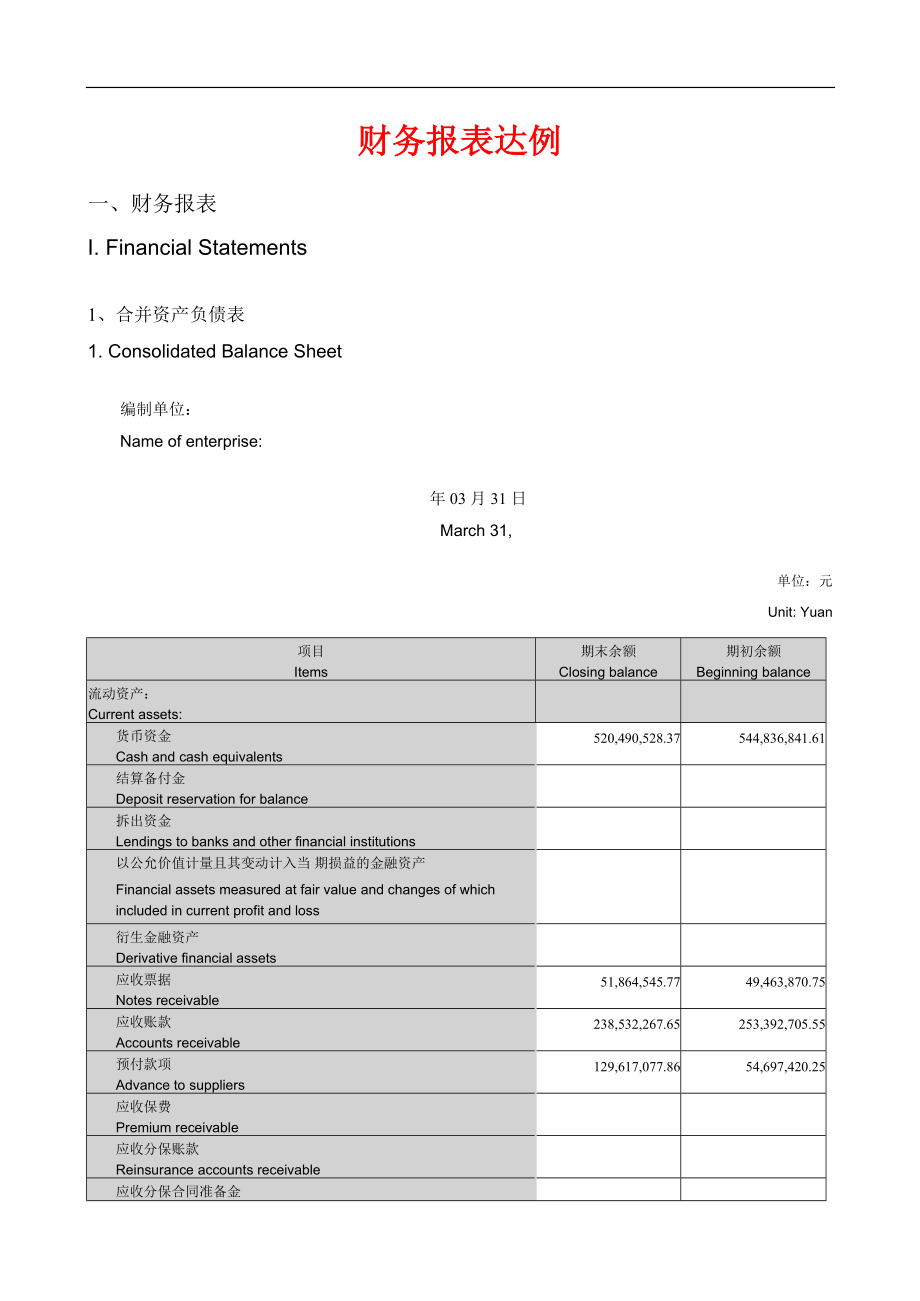

1、财务报表达例一、财务报表I. Financial Statements1、合并资产负债表1. Consolidated Balance Sheet编制单位: Name of enterprise: 年 03 月 31 日March 31, 单位:元Unit: Yuan项目Items期末余额Closing balance期初余额Beginning balance流动资产:Current assets:货币资金Cash and cash equivalents520,490,528.37544,836,841.61结算备付金Deposit reservation for balance拆出资金Le

2、ndings to banks and other financial institutions以公允价值计量且其变动计入当 期损益的金融资产Financial assets measured at fair value and changes of which included in current profit and loss衍生金融资产Derivative financial assets应收票据Notes receivable51,864,545.7749,463,870.75应收账款Accounts receivable238,532,267.65253,392,705.55预付款

3、项Advance to suppliers129,617,077.8654,697,420.25应收保费Premium receivable应收分保账款Reinsurance accounts receivable应收分保合同准备金Receivable reserve for reinsurance contract应收利息Interest receivable应收股利Dividend receivable其她应收款Other receivables46,680,620.6227,018,836.80买入返售金融资产Redemptory monetary capital for sale存货I

4、nventory254,943,973.00149,509,500.29划分为持有待售的资产Classified as assets held for sale一年内到期的非流动资产Non-current assets matured within one year其她流动资产Other current assets3,300,577.805,562,663.42流动资产合计Total current assets1,245,429,591.071,084,481,838.67非流动资产:Non-current assets:发放贷款及垫款Make loans and advances可供发售

5、金融资产Available-for-sale financial assets128,324,600.00177,274,600.00持有至到期投资Held-to-maturity investment长期应收款Long-term receivables长期股权投资Long-term equity investment226,486,890.66217,239,415.19投资性房地产Investment real estate2,432,789.002,508,131.78固定资产Fixed assets114,318,486.42117,356,047.96在建工程Construction

6、 in progress5,983,161.565,983,161.56工程物资Engineer material固定资产清理Disposal of fixed assets生产性生物资产Productive biological assets油气资产Oil and gas assets无形资产Intangible assets32,619,234.5634,194,135.34开发支出Development expenditure商誉Goodwill541,598,069.40541,598,069.40长期待摊费用Long-term deferred expenses4,063,882.5

7、13,638,457.13递延所得税资产Deferred income tax assets7,029,045.889,202,491.06其她非流动资产Other non-current assets非流动资产合计Total non-current assets1,062,856,159.991,108,994,509.42资产总计Total assets2,308,285,751.062,193,476,348.09流动负债:Current liabilities:短期借款Short-term borrowing215,500,000.00175,500,000.00向中央银行借款Borr

8、owing from central bank吸取存款及同业寄存Deposit from customers and interbank拆入资金Borrowings from banks and other financial institutions以公允价值计量且其变动计入当 期损益的金融负债Financial liabilities measured at fair value and changes of which included in current profit and loss衍生金融负债Derivative financial liabilities应付票据Notes pa

9、yable166,266.00204,932.34应付账款Accounts payable270,339,054.18258,500,394.22预收款项Advance from customers189,897,382.55164,827,779.31卖出回购金融资产款Financial assets sold for repurchase应付手续费及佣金Handling charges and commissions payable应付职工薪酬Payroll payable18,176,004.1619,224,841.26应交税费Taxes payable38,602,820.7256,

10、040,107.67应付利息Interest payable356,666.67502,953.17应付股利Dividend payable565,762.77565,762.77其她应付款Other accounts payable96,896,122.5782,857,138.62应付分保账款Dividend payable for reinsurance保险合同准备金Insurance contract reserve代理买卖证券款Receiving from vicariously traded securities代理承销证券款Receivings from vicariously

11、sold securities划分为持有待售的负债Classified as liabilities held for sale一年内到期的非流动负债Non-current liabilities matured within one year其她流动负债Other current liabilities流动负债合计Total current liabilities830,500,079.62758,223,909.36非流动负债:Non-current liabilities:长期借款Long-term loans应付债券Bonds payable其中:优先股Incl.: Preferred

12、 stock永续债Perpetual capital securities长期应付款Long-term payables长期应付职工薪酬Long-term payroll payable专项应付款Special accounts payable估计负债Estimated liabilities递延收益Deferred income1,050,000.00递延所得税负债Deferred income tax liabilities6,378,937.326,269,437.32其她非流动负债Other non-current liabilities非流动负债合计Total non-current

13、 liabilities6,378,937.327,319,437.32负债合计Total liabilities836,879,016.94765,543,346.68所有者权益:Owners equity:股本Capital stock499,983,108.00500,481,802.00其她权益工具Other equity instruments其中:优先股Incl.: Preferred stock永续债Perpetual capital securities资本公积Capital reserve644,603,890.25644,603,890.25减:库存股Less: Treas

14、ury share63,391,195.8263,889,889.82其她综合收益Other comprehensive income1,062,696.581,248,514.49专项储藏Special reserve盈余公积Surplus reserve17,969,331.0717,969,331.07一般风险准备General risk preparation未分派利润Retained earnings292,465,187.40254,438,787.61归属于母公司所有者权益合计Total owners equity attributable to parent company1,

15、392,693,017.481,354,852,435.60少数股东权益Minority stockholders interest78,713,716.6473,080,565.81所有者权益合计Total owners equity1,471,406,734.121,427,933,001.41负债和所有者权益总计Total liabilities and owners equity2,308,285,751.062,193,476,348.092、合并利润表2. Consolidated Income Statement单位:元Unit: Yuan项目Items本期发生额Current

16、period上期发生额Prior period一、营业总收入I. Total operating income214,629,708.2587,116,299.88其中:营业收入Incl.: Operating income214,629,708.2587,116,299.88利息收入Interest income已赚保费Earned premium手续费及佣金收入Fee and commission income二、营业总成本II. Total operating cost173,080,892.6784,672,431.39其中:营业成本Incl.: Operating cost63,05

17、5,002.5934,682,675.22利息支出Interest expense号填列)号填列)手续费及佣金支出Fee and commission expense退保金Surrender value赔付支出净额Net payment for insurance claims提取保险合同准备金净额Net amount of insurance contract reserve保单红利支出Policyholder dividend expense分保费用Reinsurance expense营业税金及附加Business tax and surcharges1,757,439.58771,90

18、2.54销售费用Selling expenses42,838,576.9819,936,292.78管理费用Administration expenses64,692,353.0327,699,236.79财务费用Financial expenses1,445,570.161,178,719.37资产减值损失Assets impairment loss-708,049.67403,604.69加:公允价值变动收益(损失以“”号填列)Plus: income from fair value variation (- for loss)投资收益(损失以“”号填列)Income from inves

19、tment (- for loss)1,343,163.30-938,243.23其中:对联营公司和合营公司 的投资收益Incl.: Income from investment to joint venture and cooperative enterprise1,343,163.30-938,243.23汇兑收益(损失以“-”Exchange gain (- for loss)三、营业利润(亏损以“”号填列)III. Operating profit (- for loss)42,891,978.881,505,625.26加:营业外收入Plus: Non-operating reven

20、ue11,041,287.306,455,071.37其中:非流动资产处置利得Incl.: Gains from disposal of non-current assets减:营业外支出Less: Non-operating expenses22,963.46391.12其中:非流动资产处置损失Incl.: Loss on disposal of non-current assets四、利润总额(亏损总额以“”IV. Total profit (- for loss)53,910,302.727,960,305.51减:所得税费用Less: Income tax expense12,197,

21、565.337,251,890.52五、净利润(净亏损以“”号填列)V. Net profit (- for loss)41,712,737.39708,414.99归属于母公司所有者的净利润Net profit attributed to parent company owners38,026,399.791,724,034.89少数股东损益Minority interest income3,686,337.60-1,015,619.90六、其她综合收益的税后净额VI. Net amount of other comprehensive income after tax1,062,696.5

22、8129,787.96归属母公司所有者的其她综合收益 的税后净额Net amount of other comprehensive income after tax attributed to parent company owners1,062,696.58129,787.96(一)后来不能重分类进损益的其 她综合收益(I) Other comprehensive income that cant be reclassified into profit and loss1.重新计量设定受益筹划净 负债或净资产的变动1. Remeasure the variation of net indeb

23、tedness or net asset of defined benefit plan2.权益法下在被投资单位不能重分类进损益的其她综合收益中享 有的份额2. Share in other comprehensive income that cant be reclassified into profit and loss in the invested enterprise under equity method(二)后来将重分类进损益的其她 综合收益(II) Other comprehensive income that will be reclassified into profit

24、and loss1,062,696.58129,787.961.权益法下在被投资单位以 后将重分类进损益的其她综合收益中 享有的份额2. Share in other comprehensive income that will be reclassified into profit and loss in the invested enterprise under equity method2.可供发售金融资产公允价值变动损益2. Changes in fair value through profit and loss of available-for-sale financial ass

25、ets3.持有至到期投资重分类为 可供发售金融资产损益3. Held-to-maturity investment reclassified into available-for-sale financial assets4.钞票流量套期损益的有效部分4. Effective part of cash-flow hedge profit and loss5.外币财务报表折算差额5. Balance arising from the translation of foreign currency financial statements1,062,696.58129,787.966.其她6. O

26、thers归属于少数股东的其她综合收益的 税后净额Net amount of other comprehensive income after tax attributed to minority shareholders七、综合收益总额VII. Total comprehensive income42,775,433.97838,202.95归属于母公司所有者的综合收益总额Total comprehensive income attributed to parent company owners39,089,096.371,853,822.85归属于少数股东的综合收益总额Total comp

27、rehensive income attributed to minority shareholders3,686,337.60-1,015,619.90八、每股收益:VIII. Earnings per share:(一)基本每股收益(I) Basic earnings per share0.07610.0034(二)稀释每股收益(II) Diluted earnings per share0.07610.0034本期发生同一控制下公司合并的,被合并方在合并前实现的净利润为:0.00 元,上期被合并方实现的净利润为:0.00 元。In case of enterprise merger un

28、der the same control, the merged party had a net profit: 0.00 Yuan before being merged and 0.00 Yuan in prior period.3、合并钞票流量表3. Consolidated Cash Flow Statement单位:元Unit: Yuan项目Items本期发生额Current period上期发生额Prior period一、经营活动产生的钞票流量:I. Cash flows arising from operating activities:销售商品、提供劳务收到的钞票Cash r

29、eceipts from sale of goods and rendering of services280,994,340.19111,849,965.13客户存款和同业寄存款项净增长额Net increase in deposit from customers and interbank向中央银行借款净增长额Net increase in borrowing from central bank向其她金融机构拆入资金净增长额Net increase in borrowings from other financial institutions收到原保险合同保费获得的钞票Cash recei

30、pts from original insurance contract premium收到再保险业务钞票净额Net cash receipts from reinsurance business保户储金及投资款净增长额Net increase of insured deposit and investment处置以公允价值计量且其变动 计入当期损益的金融资产净增长额Net increase in disposal of financial assets measured at fair value and changes of which included in current profit

31、 and loss收取利息、手续费及佣金的钞票Cash receipts from interest, fee and commission拆入资金净增长额Net increase in borrowings from banks and other financial institutions回购业务资金净增长额Net increase in repurchase business funds收到的税费返还Cash receipts from tax refunds9,883,556.216,388,503.35收到其她与经营活动有关的钞票Other cash receipts relati

32、ng to operating activities85,784,307.698,633,806.22经营活动钞票流入小计Total cash inflows from operating activities376,662,204.09126,872,274.70购买商品、接受劳务支付的钞票Cash payments for goods acquired and services received239,736,598.4385,776,276.41客户贷款及垫款净增长额Net increase in customer loans and advances寄存中央银行和同业款项净增长额Net

33、 increase of deposits in central bank and other financial institutions支付原保险合同赔付款项的钞票Cash payments for original insurance contract claims支付利息、手续费及佣金的钞票Cash payments for interest, fee and commission支付保单红利的钞票Cash payment for policyholder dividend支付给职工以及为职工支付的钞票Cash payments to and on behalf of employee

34、s66,078,220.5632,050,797.34支付的各项税费Cash payments for taxes49,751,661.3627,356,605.71支付其她与经营活动有关的钞票Other cash payments relating to operating activities67,684,678.8242,218,856.22经营活动钞票流出小计Total cash outflows from operating activities423,251,159.17187,402,535.68经营活动产生的钞票流量净额Net cash flows from operating

35、 activities-46,588,955.08-60,530,260.98二、投资活动产生的钞票流量:II. Cash flows arising from investment activities:收回投资收到的钞票Cash receipts from investment withdrawal2,880,000.001,470,000.00获得投资收益收到的钞票Cash receipts from return on investments287,833.64处置固定资产、无形资产和其她 长期资产收回的钞票净额Net cash receipts from disposal of fi

36、xed assets, intangible assets and other long-term assets22,770.9621,834.00处置子公司及其她营业单位收 到的钞票净额Net cash receipts from disposal of subsidiary or any other business unit300,000.00收到其她与投资活动有关的钞票Other cash receipts relating to investment activities14,936.99100,000.00投资活动钞票流入小计Total cash inflows from inve

37、stment activities3,205,541.591,891,834.00购建固定资产、无形资产和其她 长期资产支付的钞票Cash payments to acquire fixed assets, intangible assets and other long-term assets1,314,811.025,968,544.15投资支付的钞票Cash payments to acquire investments9,650,000.00335,613.25质押贷款净增长额Net increase of hypothecated loan获得子公司及其她营业单位支 付的钞票净额Ne

38、t cash payments to acquire subsidiary and other business units支付其她与投资活动有关的钞票Other cash payments relating to investment activities3,000,000.00投资活动钞票流出小计Total cash outflows from investment activities10,964,811.029,304,157.40投资活动产生的钞票流量净额Net cash flows from investment activities-7,759,269.43-7,412,323.

39、40三、筹资活动产生的钞票流量:III. Cash flows arising from financing activities:吸取投资收到的钞票Cash receipts from investments by others1,051,000.00其中:子公司吸取少数股东投资 收到的钞票Incl.: Cash receipts from subsidiary investments from minority shareholders获得借款收到的钞票Cash receipts from borrowings49,900,000.00发行债券收到的钞票Cash receipts from

40、 issuance of bonds收到其她与筹资活动有关的钞票Other cash receipts relating to financing activities筹资活动钞票流入小计Total cash inflows from financing activities50,951,000.00归还债务支付的钞票Cash repayments of amounts borrowed9,900,000.00分派股利、利润或偿付利息支付的钞票Cash paid for distribution of dividends or profits, or cash payments for int

41、erests10,885,711.761,545,222.22其中:子公司支付给少数股东的 股利、利润Incl.: Dividends and profits paid to minority stockholders from subsidiary支付其她与筹资活动有关的钞票Other cash payments relating to financing activities筹资活动钞票流出小计Total cash outflows from financing activities20,785,711.761,545,222.22筹资活动产生的钞票流量净额Net cash flows f

42、rom financing activities30,165,288.24-1,545,222.22四、汇率变动对钞票及钞票等价物的 影响IV. Effect of exchange rate changes on cash and cash equivalents-163,376.9794,872.63五、钞票及钞票等价物净增长额V. Net increase in cash and cash equivalents-24,346,313.24-69,392,933.97加:期初钞票及钞票等价物余额Plus: Beginning balance of cash and cash equiva

43、lents544,836,841.61346,175,518.98六、期末钞票及钞票等价物余额V. Closing balance of cash and cash equivalents520,490,528.37276,782,585.01会计科目中英文对照 (北京市审计局发布)顺序号编号会计科目名称合用范畴英文体现法 一、资产类 11001库存钞票Cash on Hand 21002银行存款Bank Deposit 31003寄存中央银行款项银行专用Deposit in the Central Bank 41011寄存同业银行专用Due from Placements with Bank

44、s and Other Financial Institutions 51015其她货币资金Other Monetary Capital 61021结算备付金证券专用Deposit Reservation for Balance 71031存出保证金金融共用Deposit for Recognizance 81051拆出资金金融共用Lendings to Banks and Other Financial Institutions 91101交易性金融资产Transactional Monetary Capital 101111买入返售金融资产金融共用Redemptory Monetary C

45、apital for Sale 111121应收票据Notes Receivable 121122应收账款Accounts Receivable 131123预付账款Accounts Prepayment 141131应收股利Dividend Receivable 151132应收利息Accrued Interest Receivable 161211应收保户储金保险专用Receivable Deposit from the Insured 171221应收代位追偿款保险专用Subrogation Receivables 181222应收分保账款保险专用Reinsurance Accounts

46、 Receivable 191223应收分保未到期责任准备金保险专用Receivable Deposit for Undue Duty of Reinsurance 201224应收分保保险责任准备金保险专用Receivable Deposit for Duty of Reinsurance 211231其她应收款Other Accounts Receivable 221241坏账准备Bad Debit Reserve 231251贴现资产银行专用Deposit of Capital Discounted 241301贷款银行和保险共用Loans 251302贷款损失准备银行和保险共用Loan

47、s Impairment Reserve 261311代理兑付证券银行和证券共用Vicariously Cashed Securities 271321代理业务资产Capital in Vicarious Business 281401材料采购Procurement of Materials 291402在途物资Materials in Transit 301403原材料Raw Materials 311404材料成本差别Balance of Materials 321406库存商品Commodity Stocks 331407发出商品Goods in Transit 341410商品进销差价

48、Difference between Purchase and Sales of Commodities 351411委托加工物资Materials for Consigned Processing 361412包装物及低值易耗品Wrappage and Easily Wornout Inexpensive Articles 371421消耗性生物资产农业专用Consumptive Biological Assets 381431周转材料建造承包商专用Revolving Materials 391441贵金属银行专用Expensive Metals 401442抵债资产金融共用Capital

49、for Debt Payment 411451损余物资保险专用Salvage Value Of Insured Properties 421461存货跌价准备Reserve For Stock Depreciation 431501待摊费用Unamortized Expenditures 441511独立账户资产保险专用Capital in Independent Accounts 451521持有至到期投资Held-To-Maturity Investment 461522持有至到期投资减值准备Reserve for Held-To-Maturity Investment Impairmen

50、t 471523可供发售金融资产Financial Assets Available for Sale 481524长期股权投资Long-term Equity Investment 491525长期股权投资减值准备Reserve for Long-term Equity Investment Impairment 501526投资性房地产Investment Real Estate 511531长期应收款Long-term Accounts Receivable 521541未实现融资收益Unrealized Financing Profits 531551存出资本保证金保险专用Deposi

51、t for Capital Recognizance 541601固定资产Fixed Assets 551602合计折旧Accumulative Depreciation 561603固定资产减值准备Reserve for Fixed Assets Impairment 571604在建工程Construction in Process 581605工程物资Engineer Material 591606固定资产清理Disposal of Fixed Assets 601611融资租赁资产租赁专用Financial Leasing Assets 611612未担保余值租赁专用Unguarant

52、eed Residual Value 621621生产性生物资产农业专用Productive Biological Assets 631622生产性生物资产合计折旧农业专用Accumulative Depreciation of Productive Biological Assets 641623公益性生物资产农业专用Biological Assets for Commonweal 651631油气资产石油天然气开采专用Oil and Gas Assets 661632合计折耗石油天然气开采专用Accumulated Depletion 671701无形资产Intangible Assets

53、 681702合计摊销Accumulated Amortization 691703无形资产减值准备Reserve for Intangible Assets Impairment 701711商誉Business Reputation 711801长期待摊费用Long-term Deferred Expenses 721811递延所得税资产Deferred Income Tax Assets 731901待解决财产损溢Unsettled Assets Profit and Loss 二、负债类 74短期借款Short-term Borrowings 75存入保证金金融共用Deposit Re

54、ceived for Recognizance 76拆入资金金融共用Borrowings from Banks and Other Financial Institutions 77向中央银行借款银行专用Borrowings from the Central Bank 78同业寄存银行专用Due to Placements with Banks and Other Financial Institutions 79吸取存款银行专用Savings Absorption 80贴现负债银行专用Liabilities of Capital Discounted 812101交易性金融负债Transac

55、tional Moneytary Liabilities 822111卖出回购金融资产款金融共用Financial Assets Sold for Repurchase 832201应付票据Notes Payable 842202应付账款Accounts Payable 852205预收账款Accounts Received in Advance 862211应付职工薪酬Payroll Payable 872221应交税费Tax Payable 882231应付股利Dividend Payable 892232应付利息Accrued Interest Payable 902241其她应付款Ot

56、her Accounts Payable 912251应付保户红利保险专用Dividend Payable for The Insured 922261应付分保账款保险专用Dividend Payable for Reinsurance 932311代理买卖证券款证券专用Receivings from Vicariously Traded Securities 942312代理承销证券款证券和银行共用Receivings from Vicariously Sold Securities 952313代理兑付证券款证券和银行共用Receivings from Vicariously Cashed

57、 Securities 962314代理业务负债Liabilities from Vicarious Business 972401预提费用Withholding Expenses 982411估计负债Estimated Liabilities 992501递延收益Deferred Profits 1002601长期借款Long-term Borrowings 1012602长期债券Long-term Bonds 1022701未到期责任准备金保险专用Deposit for Undue Duty of Reinsurance 1032702保险责任准备金保险专用Deposit for Duty of Reinsurance

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。