2022年2022年会计英语课后习题参考答案doc资料

2022年2022年会计英语课后习题参考答案doc资料

《2022年2022年会计英语课后习题参考答案doc资料》由会员分享,可在线阅读,更多相关《2022年2022年会计英语课后习题参考答案doc资料(22页珍藏版)》请在装配图网上搜索。

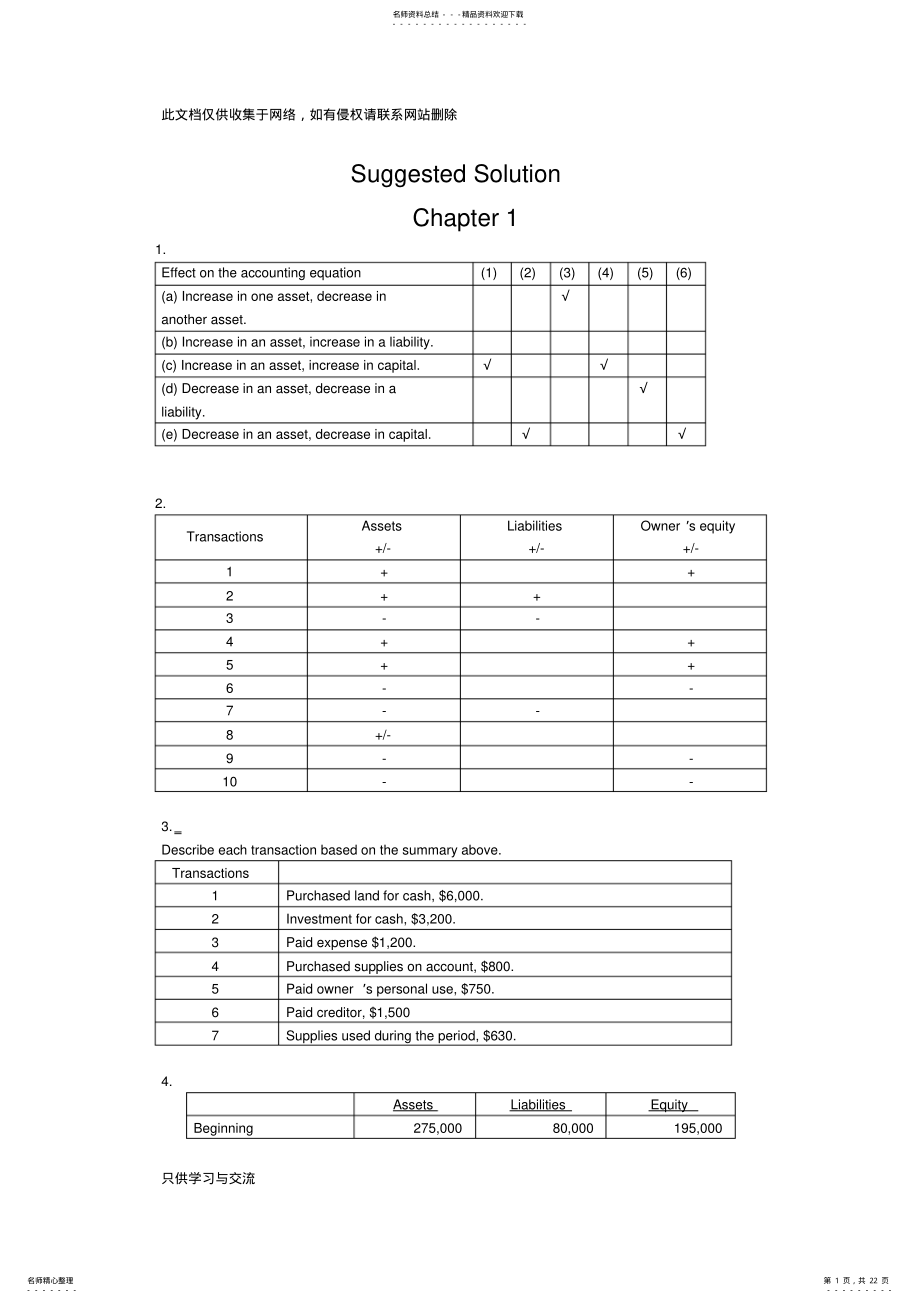

1、此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Suggested Solution Chapter 1 1.Effect on the accounting equation(1)(2)(3)(4)(5)(6)(a)Increase in one asset,decrease in another asset.(b)Increase in an asset,increase in a liability.(c)Increase in an asset,increase in capital.(d)Decrease in an asset,decrease in a liabilit

2、y.(e)Decrease in an asset,decrease in capital.2.Transactions Assets+/-Liabilities+/-Owner s equity+/-1+2+3-4+5+6-7-8+/-9-10-3.Describe each transaction based on the summary above.Transactions 1 Purchased land for cash,$6,000.2 Investment for cash,$3,200.3 Paid expense$1,200.4 Purchased supplies on a

3、ccount,$800.5 Paid owner s personal use,$750.6 Paid creditor,$1,500 7 Supplies used during the period,$630.4.Assets Liabilities Equity Beginning 275,000 80,000 195,000 名师资料总结-精品资料欢迎下载-名师精心整理-第 1 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Add.investment 48,000 Add.Net income 27,000 Less withdrawals-35,00

4、0 Ending 320,000 85,000 235,000 5.(a)March 31,20XX April 30,20XX Assets Cash 4,500 5,400 Accounts receivable 2,560 4,100 Supplies 840 450 Total assets 7,900 9,950 Liabilities Accounts payable 430 690 Equity Tina Pierce,Capital7,470 9,260(b)net income=9,260-7,470=1,790(c)net income=1,790+2,500=4,290

5、名师资料总结-精品资料欢迎下载-名师精心整理-第 2 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Chapter 2 1.a.To increase Notes Payable-CR b.To decrease Accounts Receivable-CR c.To increase Owner,Capital-CR d.To decrease Unearned Fees-DR e.To decrease Prepaid Insurance-CR f.To decrease Cash-CR g.To increase Utilities Expense-DR

6、h.To increase Fees Earned-CR i.To increase Store Equipment-DR j.To increase Owner,Withdrawal-DR 2.a.Cash 1,800 Accounts payable.1,800 b.Revenue.4,500 Accounts receivable .4,500 c.Owner s withdrawals.1,500 Salaries Expense.1,500 d.Accounts Receivable.750 Revenue .750 3.Prepare adjusting journal entri

7、es at December 31,the end of the year.Advertising expense 600 Prepaid advertising 600 Insurance expense(2160/12*2)360 Prepaid insurance 360 名师资料总结-精品资料欢迎下载-名师精心整理-第 3 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Unearned revenue 2,100 Service revenue 2,100 Consultant expense 900 Prepaid consultant 900 Une

8、arned revenue 3,000 Service revenue 3,000 4.1.$388,400 2.$22,520 3.$366,600 4.$21,800 loss for the year ended June 30,2002:$60,000 2.DR Jon Nissen,Capital 60,000 CR income summary 60,000 3.post-closing balance in Jon Nissen,Capital at June 30,2002:$54,000 名师资料总结-精品资料欢迎下载-名师精心整理-第 4 页,共 22 页 -此文档仅供收集

9、于网络,如有侵权请联系网站删除只供学习与交流Chapter 3 1.Dundee Realty bank reconciliation October 31,2009 Reconciled balance$6,220 Reconciled balance$6,220 2.April 7 Dr:Notes receivableA company 5400 Cr:Accounts receivableA company 5400 12 Dr:Cash 5394.5 Interest expense 5.5 Cr:Notes receivable 5400 June 6 Dr:Accounts re

10、ceivableA company 5533 Cr:Cash 5533 18 Dr:Cash 5560.7 Cr:Accounts receivableA company 5533 Interest revenue 27.7 3.(a)As a whole:the ending inventory=685(b)applied separately to each product:the ending inventory=625 4.The cost of goods available for sale=ending inventory+the cost of goods=80,000+200

11、,000*500%=80,000+1,000,000=1,080,000 5.(1)24,000+60,000-90,000*0.8=12000(2)(60,000+24,000)/(85,000+31,000)*(85,000+31,000-90,000)=18828 名师资料总结-精品资料欢迎下载-名师精心整理-第 5 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Chapter 4 1.(a)second-year depreciation=(114,000 5,700)/5=21,660;(b)second-year depreciation=8,600

12、*(114,000 5,700)/36,100=25,800;(c)first-year depreciation=114,000*40%=45,600 second-year depreciation=(114,000 45,600)*40%=27,360;(d)second-year depreciation=(114,000 5,700)*4/15=28,880.2.(a)weighted-average accumulated expenditures(2008)=75,000*12/12+84,000*9/12+180,000*8/12+300,000*7/12+100,000*6/

13、12=483,000(b)interest capitalized during 2008=60,000*12%+(483,000 60,000)*10%=49,500 3.(1)depreciation expense=30,000(2)book value=600,000 30,000*2=540,000(3)depreciation expense=(600,000 30,000*8)/16=22,500(4)book value=600,000 30,000*8 22,500=337,500 4.Situation 1:Jan 1st,2008 Investment in M 260,

14、000 Cash 260,000 June 30 Cash 6000 Dividend revenue 6000 Situation 2:January 1,2008 Investment in S 81,000 Cash 81,000 June 15 Cash 10,800 Investment in S 10,800 December 31 Investment in S 25,500 Investment Revenue 25,500 5.a.December 31,2008 Investment in K 1,200,000 Cash 1,200,000 June 30,2009 Di

15、vidend Receivable 42,500 Dividend Revenue 42,500 December 31,2009 Cash 42,500 Dividend Receivable 42,500 名师资料总结-精品资料欢迎下载-名师精心整理-第 6 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流b.December 31,2008 Investment in K 1,200,000 Cash 1,200,000 December 31,2009 Cash 42,500 Investment in K 42,500 Investment in K 1

16、46,000 Investment revenue 146,000 c.In a,the investment amount is 1,200,000 net income reposed is 42,500 In b,the investment amount is 1,303,500 Net income reposed is 146,000 名师资料总结-精品资料欢迎下载-名师精心整理-第 7 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Chapter 5 1.a.June 1:Dr:Inventory 198,000 Cr:Accounts Payab

17、le 198,000 June 11:Dr:Accounts Payable 198,000 Cr:Notes Payable 198,000 June 12:Dr:Cash 300,000 Cr:Notes Payable 300,000 b.Dr:Interest Expenses(for notes on June 11)12,100 Cr:Interest Payable 12,100 Dr:Interest Expenses(for notes on June 12)8,175 Cr:Interest Payable 8,175 c.Balance sheet presentatio

18、n:Notes Payable 498,000 Accrued Interest on Notes Payable 20,275 d.For Green:Dr:Notes Payable 198,000 Interest Payable 12,100 Interest Expense 7,700 Cr:Cash 217,800 For Western:Dr:Notes Payable 300,000 Interest Payable 8,175 Interest Expense 18,825 Cr:Cash 327,000 2.(1)208 Deferred income tax is a l

19、iability 2,400 Income tax payable 21,600 20 9 Deferred income tax is an asset 600 Income tax payable 26,100(2)208:Dr:Tax expense 24,000 Cr:Income tax payable 21,600 Deferred income tax 2,400 20 9:Dr:Tax expense 25,500 Deferred income tax 600 Cr:Income tax payable 26,100(3)208:Income statement:tax ex

20、pense 24,000 Balance sheet:income tax payable 21,600 20 9:Income statement:tax expense 25,500 Balance sheet:income tax payable 26,100 3.a.1,560,000(20000000*12%*(1-35%)b.7.8%(20000000*12%*(1-35%)/20000000)名师资料总结-精品资料欢迎下载-名师精心整理-第 8 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流4.maturity valuenumber of int

21、erest periodsstated rate per interest-periodeffective interest rate per interest-periodpayment amount per periodpresent value of bonds at date of issue1$10 40 3.75%3%$0.375$11.73 2 20 10 10%12%2 17.74 3 25 10 0%12%0 8.05 5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned

22、Rent Revenue 7,200 Current Liabilities 82,896 名师资料总结-精品资料欢迎下载-名师精心整理-第 9 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Chapter 6 1.Mar.1 Cash 1,200,000 Common Stock 1,000,000 Paid-in Capital in Excess of Par Value 200,000 Mar.15 Organization Expense 50,000 Common Stock 50,000 Mar.23 Patent 120,000 Common S

23、tock 100,000 Paid-in Capital in Excess of Par Value 20,000 The value of the patent is not easily determinable,so use the issue price of$12 per share on March 1 which is the issuing price of common stock.2.July.1 Treasury Stock 180,000 Cash 180,000 The cost of treasury purchased is 180,000/30,000=60

24、per share.Nov.1 Cash 70,000 Treasury Stock 60,000 Paid-in Capital from Treasury Stock 10,000 Sell the treasury at the cost of$60 per share,and selling price is$70 per share.The treasury stock is sold above the cost.Dec.20 Cash 75,000 Paid-in Capital from Treasury Stock 15,000 Treasury Stock 90,000 T

25、he cost of treasury is$60 per share while the selling price is$50 which is lower than the cost.3.a.July 1 Retained Earnings 24,000 Dividends PayablePreferred Stock 24,000 b.Sept.1 Dividends PayablePreferred Stock 24,000 Cash 24,000 c.Dec.1 Retained Earnings 80,000 Dividends PayableCommon Stock 80,00

26、0 d.Dec.31 名师资料总结-精品资料欢迎下载-名师精心整理-第 10 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Income Summary 350,000 Retained Earnings 350,000 4.a.Preferred stock gives its owner certain advantages over common stockholders.These benefits include the right to receive dividends before the common stockholders and the

27、right to receive assets before the common stockholders if the corporation liquidates.Corporation pay a fixed amount of dividends on preferred stock.The 7%cumulative term indicates that the investors earn 7%fixed dividends.b.7%*120%*20,000=504,000 c.If corporation issued debt,it has obligation to rep

28、ay principal d.The date of declaration decrease the stockholders equity;the date of record and the date of payment have no effect on stockholders.5.a.Jan.15 Retained Earnings 35,000 Accumulated Depreciation 35,000 To correct error in prior year s depreciation.b.Mar.20 Loss from Earthquake 70,000 Bui

29、lding 70,000 c.Mar.31 Retained Earnings 12,500 Dividends Payable 12,500 d.Apirl.15 Dividends Payable 12,500 Cash 12,500 e.June 30 Retained Earnings 37,500 Common Stock 25,000 Additional Paid-in Capital 12,500 To record issuance of 10%stock dividend:10%*25,000=2,500 shares;2500*$15=$37,500 f.Dec.31 D

30、epreciation Expense 14,000 Accumulated Depreciation 14,000 Original depreciation:$40,000/40=$10,000 per year.Book value on Jan.1,2009 is$350,000(=$400,000-5*$10,000).Deprecation for 2009 is$14,000(=$350,000/25).g.The company does not need to make entry in the accounting records.But the amount of Com

31、mon Stock($10 par value)decreases 275,000,while the amount of Common Stock($5 par value)increases 275,000.名师资料总结-精品资料欢迎下载-名师精心整理-第 11 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Chapter 7 1.Requirement 1 If revenue is recognized at the date of delivery,the following journal entries would be used to recor

32、d the transactions for the two years:Year 1 Inventory.480,000 Cash/Accounts payable.480,000 To record purchase of inventory Inventory.124,000 Cash/Accounts payable.124,000 To record refurbishment of inventory Accounts receivable.310,000 Sales revenue.310,000 To record sale of goods on account Cost o

33、f goods sold.220,000 Inventory.220,000 To record the cost of the goods sold as an expense Sales returns(I/S).15,500*Allowance for sales returns(B/S).15,500 To record provision for return of goods sold under 30-day return period*5%of$310,000 Warranty expense.31,000*Provision for warranties(B/S).31,00

34、0 To record provision,at time of sale,for warranty expenditures*10%of$310,000 Allowance for sales returns.12,400 Accounts receivable.12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties(B/S).18,600 Ca

35、sh/Accounts payable.18,600 To record expenditures in year 1 for warranty work Cash.297,600*名师资料总结-精品资料欢迎下载-名师精心整理-第 12 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Accounts receivable.297,600 To record collection of Accounts Receivable*$310,000$12,400 Year 2 Provision for warranties(B/S).8,400 Cash/Accoun

36、ts payable.8,400 To record expenditures in year 2 for warranty work Requirement 2 If revenue is recognized only when the warranty period has expired,the following journal entries would be used to record the transactions for the two years:Year 1 Inventory.480,000 Cash/Accounts payable.480,000 To reco

37、rd purchase of inventory Inventory.124,000 Cash/Accounts payable.124,000 To record refurbishment of inventory Accounts receivable.310,000 Inventory.220,000 Deferred gross margin.90,000 To record sale of goods on account Deferred gross margin.12,400 Accounts receivable.12,400 To record return of good

38、s within the 30-day return period.It is assumed the goods have no value and are disposed of.Deferred warranty costs(B/S).18,600 Cash/Accounts payable.18,600 To record expenditures for warranty work in year 1.The warranty costs incurred are deferred because the related revenue has not yet been recogn

39、ized Cash.297,600*Accounts receivable.297,600 To record collection of Accounts receivable*$310,000$12,400 Year 2 名师资料总结-精品资料欢迎下载-名师精心整理-第 13 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Deferred warranty costs.8,400 Cash/Accounts payable.8,400 To record warranty costs incurred in year 2 related to year 1

40、sales.The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin.*77,600 Cost of goods sold.220,000 Sales revenue.297,600*To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period*$

41、310,000$12,400*($90,000$12,400)Warranty expense.27,000*Deferred warranty costs.27,000 To record recognition of warranty expense at same time as related sales revenue recognition*$18,600+$8,400 Requirement 3 Allied Auto Parts Inc.might choose to recognize revenue only after the warranty period has ex

42、pired if they are not able to make a good estimate,at the time of sale,of the amount of warranty work that will be required under the terms of the one-year warranty.If Allied is not able,at the time of sale,to make a good estimate of the warranty work that will be required,then the measurability cri

43、terion of revenue recognition is not met at the time of sale.The measurability criterion means that the amount of revenue can be reliably measured.If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement,then it is not able to reasonably measure

44、 the profit that it will eventually earn on the sales.The performance criteria might also be invoked here.The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer.As long as there is warranty work to be performed after the sale that

45、is the responsibility of the seller,you might argue that performance is not substantially complete.However,if the seller was able to reliably estimate the amount of warranty work,then performance would be satisfied on the assumption that we could measure the risk that remains with the seller,and mak

46、e a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method(using costs incurred to date compared to estimated total costs to determine the percentage of completion)is to estimate the percentage of completion of the

47、project at the end of each year.This is done in the following table(in$000s):名师资料总结-精品资料欢迎下载-名师精心整理-第 14 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流End of 2005 End of 2006 End of 2007 Total costs incurred$5,400$12,950$18,800 Total estimated costs 18,000 18,500 18,800%completed 30%70%100%Once the percent

48、age of completion at the end of each year has been calculated as above,the next step is to allocate the appropriate amount of revenue to each year,based on the percentage completed to date,less what has previously been recorded in revenue.This is done in the following table(in$000s):2005 2006 2007 2

49、005$20,000 30%$6,000 2006$20,000 70%$14,000 2007$20,000 100%$20,000 Less:Revenue recognized in prior years(0)(6,000)(14,000)Revenue for year$6,000$8,000$6,000 Therefore,the profit to be recognized each year on the construction project would be:2005 2006 2007 Total Revenue recognized$6,000$8,000$6,00

50、0$20,000 Construction costs incurred(expenses)(5,400)(7,550)(5,850)(18,800)Gross profit for the year$600$450$150$1,200 The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 2007 1.Costs of construction:Constructio

51、n in progress.5,400 7,550 5,850 Cash,payables,etc.5,400 7,550 5,850 2.Progress billings:Accounts receivable.3,100 4,900 12,000 Progress billings.3,100 4,900 12,000 3.Collections on billings:Cash.2,400 4,000 12,400 Accounts receivable.2,400 4,000 12,400 4.Recognition of profit:Construction in progres

52、s.600 450 150 Construction expense.5,400 7,550 5,850 Revenue from long-term contract.6,000 8,000 6,000 5.To close construction in progress:Progress billings.20,000 Construction in progress.20,000名师资料总结-精品资料欢迎下载-名师精心整理-第 15 页,共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流2005 2006 2007 Balance sheet Current a

53、ssets:Accounts receivable$700$1,600$1,200 Inventory:Construction in process 6,000 14,000 Less:Progress billings(3,100)(8,000)Costs in excess of billings 2,900 6,000 Income statement Revenue from long-term contracts$6,000$8,000$6,000 Construction expense(5,400)(7,550)(5,850)Gross profit$600$450$150 3

54、.a.The three criteria of revenue recognition are performance,measurability,and collectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service,performance may mean quite different points of revenue recognition.For example,

55、for the sale of products,IAS18 defines performance as the point when the seller of the goods has transferred the risks and rewards of ownership to the buyer.Normally,this means that performance is done at the time of sale.Although the seller may have performed much of the work prior to the sale(prod

56、uction,selling efforts,etc.),there is still significant risk to the seller that a buyer may not be found.Therefore,from a reliability point of view,revenue recognition is delayed until the point of sale.Also,there may be significant risks remaining with the seller of the product even after the sale.

57、Warranties given by the seller are a risk that remains with the seller.However,if this risk can be reliably estimated at the time of sale,revenue can be recognized at the point of sale.Performance is quite different under a long-term construction contract.Here,performance really is considered to be

58、a measure of the work done.Revenue is recognized over the production period as the work is performed.It is intended to reflect the amount of effort expended by the seller(contractor).Although legal title wont transfer to the buyer until the project is completed,revenue can be recognized because ther

59、e is a known and committed buyer.If the contractor is not able to estimate how much of the work has been done(perhaps because he or she cant reliably estimate how much work must still be done),then profit would not be recognized until the extent of performance is known.名师资料总结-精品资料欢迎下载-名师精心整理-第 16 页,

60、共 22 页 -此文档仅供收集于网络,如有侵权请联系网站删除只供学习与交流Measurability means that the seller or service provider must be able to reliably estimate the amount of the revenue from the sale or service.For the sale of products this is generally known at the time of sale(the sales price is set).However,if the seller provide

61、s a return period,it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected.In most cases for

62、the sales of products,the seller is able to recognize revenue at the time of sale even if the sale is on account.This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment.As long as the seller is able to make this estimate,it is appropriate

63、 to recognize the revenue but to offset it with a provision for possible non collection.If the seller is unable to make reliable estimates of future collection of amounts owing,the recognition of revenue would be delayed until the cash is actually received.This is what is done using the instalment s

64、ales method of revenue recognition.b.Because of the performance criterion of revenue recognition,it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work.This would be the best measure of performance.This would mean,for example,that sellers o

65、f products would recognize their revenue over the whole production,selling,and post sales servicing periods.As we saw above,this is not commonly done because,in many cases,there are still significant risks that are retained by the seller(risk of not being able to sell the product,for example).There

66、are also measurement risks(knowing the selling price)that exist prior to the sale.The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed.As mentioned in Part 1,we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project(assuming certain conditions are met)and the sales price is known because of the existence of the contract.4.If al

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。