亨格瑞管理会计英文第15版练习答案05.doc

亨格瑞管理会计英文第15版练习答案05.doc

《亨格瑞管理会计英文第15版练习答案05.doc》由会员分享,可在线阅读,更多相关《亨格瑞管理会计英文第15版练习答案05.doc(45页珍藏版)》请在装配图网上搜索。

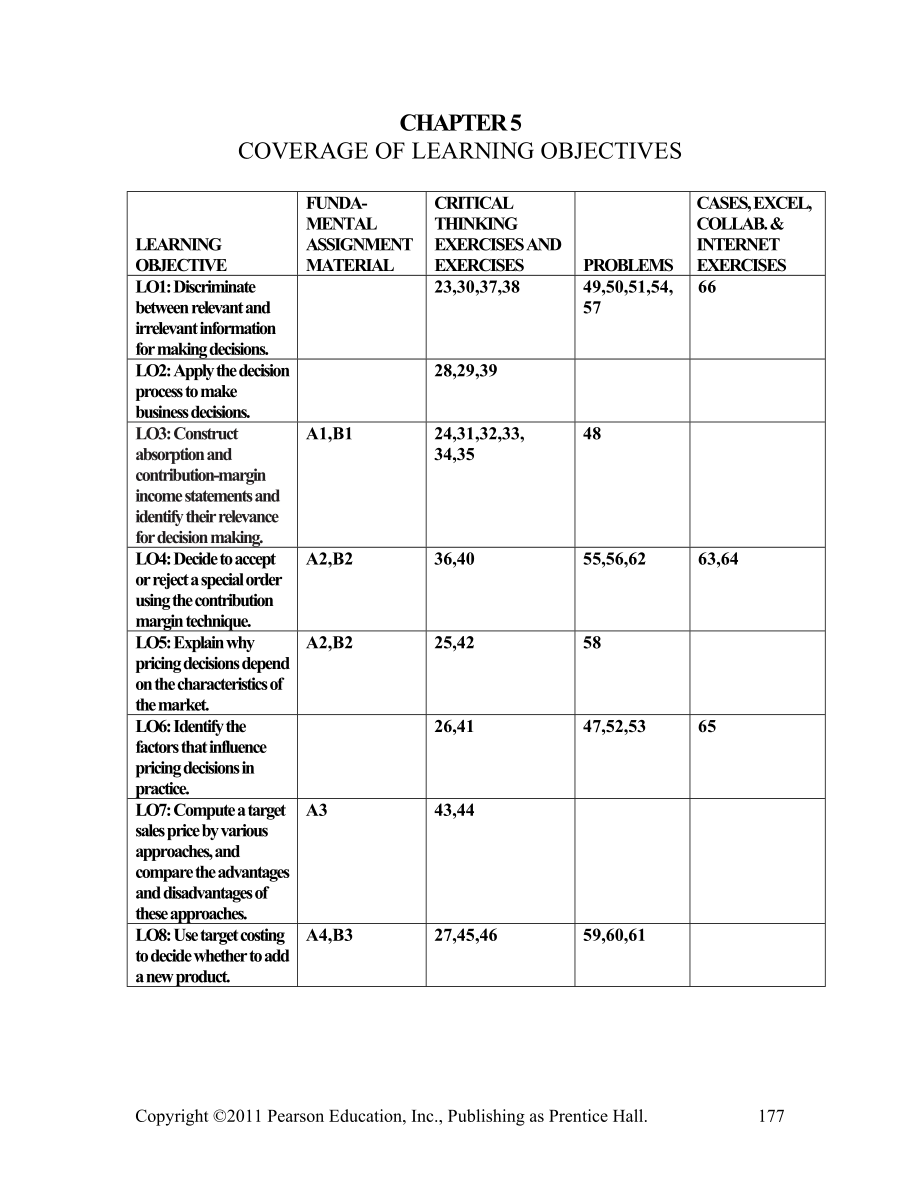

1、CHAPTER 5COVERAGE OF LEARNING OBJECTIVESLEARNING OBJECTIVEFUNDA-MENTAL ASSIGNMENTMATERIALCRITICAL THINKING EXERCISES AND EXERCISESPROBLEMSCASES, EXCEL, COLLAB. & INTERNET EXERCISESLO1: Discriminate between relevant and irrelevant information for making decisions.23,30,37,3849,50,51,54,5766LO2: Apply

2、 the decision process to make business decisions.28,29,39LO3: Construct absorption and contribution-margin income statements and identify their relevancefor decision making. A1,B124,31,32,33, 34,3548LO4: Decide to accept or reject a special order using the contribution margin technique.A2,B236,4055,

3、56,6263,64LO5: Explain why pricing decisions depend on the characteristics of the market.A2,B225,4258LO6: Identify the factors that influence pricing decisions in practice.26,4147,52,5365LO7: Compute a target sales price by various approaches, and compare the advantages and disadvantages of these ap

4、proaches.A343,44LO8: Use target costing to decide whether to add a new product.A4,B327,45,4659,60,61CHAPTER 5Relevant Information for Decision Making with a Focus on Pricing Decisions5-A1(40-50 min.)1.INDEPENDENCE COMPANYContribution Income StatementFor the Year Ended December 31, 2009 (in thousands

5、 of dollars)Sales$2,200Less variable expensesDirect material$400Direct labor330Variable manufacturing overhead (Schedule 1) 150Total variable manufacturing cost of goods sold$880Variable selling expenses80Variable administrative expenses 25Total variable expenses 985Contribution margin$ 1,215Less fi

6、xed expenses:Fixed manufacturing overhead (Schedule 2)$345 Selling expenses220Administrative expenses 119Total fixed expenses 684Operating income$ 531INDEPENDENCE COMPANYAbsorption Income StatementFor the Year Ended December 31, 2009(in thousands of dollars)Sales$2,200Less manufacturing cost of good

7、s sold:Direct material$400Direct labor330Manufacturing overhead (Schedules 1 and 2) 495Total manufacturing cost of goods sold 1,225Gross margin$ 975Less:Selling expenses$300Administrative expenses 144 444Operating income$ 531INDEPENDENCE COMPANYSchedules of Manufacturing OverheadFor the Year Ended D

8、ecember 31, 2009(in thousands of dollars)Schedule 1: Variable CostsSupplies$ 20Utilities, variable portion40Indirect labor, variable portion 90$150Schedule 2: Fixed CostsUtilities, fixed portion$ 15Indirect labor, fixed portion50Depreciation200Property taxes20Supervisory salaries 60 345Total manufac

9、turing overhead$4952.Change in revenue$200,000Change in total contribution margin:Contribution margin ratio in part 1 is $1,215 $2,200 = .552Ratio times decrease in revenue is .552 $200,000$ 110,400Operating income before change 531,000New operating income$420,600This analysis is readily done by usi

10、ng data from the contribution income statement. In contrast, the data in the absorption income statement must be analyzed and split into variable and fixed categories before the effect on operating income can be estimated.5-A2(25-30 min.)1.A contribution format, which is similar to Exhibit 5-6, clar

11、ifies the analysis.WithoutWithSpecialEffect ofSpecialOrder Special OrderOrderUnits2,000,000150,0002,150,000 Total Per UnitSales$11,000,000$660,000$4.40 1$11,660,000Less variable expenses: Manufacturing$ 3,500,000$322,500$2.15 2$ 3,822,500 Selling & administrative 800,000 35,250 .2353 835,250 Total v

12、ariable expenses$ 4,300,000$357,750$2.385$ 4,647,250Contribution margin$ 6,700,000$302,250$2.015$ 7,002,250Less fixed expenses: Manufacturing$ 3,000,00000.00$ 3,000,000 Selling & administrative 2,200,000 00.00 2,200,000 Total fixed expenses$ 5,200,000 0 0.00$ 5,200,000Operating income$ 1,500,000$302

13、,250$2.015$ 1,802,2501$660,000 150,000 = $4.402Regular unit cost = $3,500,000 2,000,000 =$1.75Logo .40Variable manufacturing costs$2.153Regular unit cost = $800,000 2,000,000 =$ .40Less sales commissions not paid (3% of $5.50) (.165)Regular unit cost, excluding sales commission$ .2352.Operating inco

14、me from selling 7.5% more units would increase by $302,250 $1,500,000 = 20.15%. Note also that the average selling price on regular business was $5.50. The full cost, including selling and administrative expenses, was $4.75. The $4.75, plus the 40 per logo, less savings in commissions of .165 came t

15、o $4.985. The president apparently wanted $4.985 + .08($4.985) = $4.985 + .3988 = $5.3838 per pen.Most students will probably criticize the president for being too stubborn. The cost to the company was the forgoing of $302,250 of income in order to protect the companys image and general market posit

16、ion. Whether $302,250 was a wise investment in the future is a judgment that managers are paid for rendering.5-A3(15-20 min.)The purpose of this problem is to underscore the idea that any of a number of general formulas might be used that, properly employed, would achieve the same target selling pri

17、ces. Desired sales = $7,500,000 + $1,500,000 = $9,000,000.The target markup percentage would be:1.100% of direct materials and direct labor costs of $4,500,000. Computation is: ($9,000,000 - $4,500,000) $4,500,000 = 100%2.50% of the full cost of jobs of $6,000,000. Computation is: ($9,000,000 - $6,0

18、00,000) $6,000,000 = 50%3.$9,000,000 ($3,500,000 + $1,000,000 + $700,000) $5,200,000 = 73.08%4.($9,000,000 - $7,500,000) $7,500,000 = 20%5.$9,000,000 ($3,500,000 + $1,000,000 + $700,000 + $500,000) $5,700,000 = $3,300,000 $5,700,000 = 57.9%If the contractor is unable to maintain these profit percent

19、ages consistently, the desired operating income of $1,500,000 cannot be obtained.5-A4(15-20 minutes)1. Revenue ($360 70,000)$25,200,000Total cost over product life 16,000,000Estimated contribution to profit$ 9,200,000Desired (target) contribution to profit40% $25,200,000 10,080,000Deficiency in prof

20、it$ 880,000The product should not be released to production.2.Previous total estimated cost$16,000,000Cost savings from suppliers.20 .70 $8,000,000 1,120,000Revised total estimated cost$14,880,000Revised total contribution to profit:$25,200,000 - $14,880,000$10,320,000Desired (target) contribution t

21、o profit 10,080,000Excess contribution to profit$ 240,000The product should be released to production.3.Previous revised total estimated cost fromrequirement 2.$14,880,000Process improvement savings:.25 .30 $8,000,000$600,000Less cost of new technology 220,000 380,000Revised total estimated cost14,5

22、00,000Revised total contribution to profit:$25,200,000 - $14,500,000$10,700,000Desired (target) contribution to profit 10,080,000Excess contribution to profit$ 620,000The product should be released to production.5-B1(40-50 min.)1.KINGLAND MANUFACTURINGContribution Income StatementFor the Year Ended

23、December 31, 2009(In thousands of dollars)Sales$13,000Less variable expenses:Direct material$4,000Direct labor2,000Variable indirect manufacturing costs (Schedule 1) 960Total variable manufacturing cost of goods sold$6,960Variable selling expenses:Sales commissions$500Shipping expenses 300800Variabl

24、e clerical salaries 400Total variable expenses 8,160Contribution margin$ 4,840Less fixed expenses:Manufacturing (Schedule 2)$ 702Selling (advertising)400Administrative-executive salaries 100Total fixed expenses 1,202Operating income$ 3,638KINGLAND MANUFACTURINGAbsorption Income StatementFor the Year

25、 Ended December 31, 2009(In thousands of dollars)Sales$13,000Less manufacturing cost of goods sold:Direct material$4,000Direct labor2,000Indirect manufacturing costs (Schedules 1 and 2) 1,662 7,662Gross profit 5,338Selling expenses:Sales commissions$500Advertising400Shipping expenses 300$1,200Admini

26、strative expenses:Executive salaries$100Clerical salaries 400 500 1,700Operating income$ 3,638KINGLAND MANUFACTURINGSchedules 1 and 2Indirect Manufacturing CostsFor the Year Ended December 31, 2009(In thousands of dollars)Schedule 1: Variable CostsCutting bits$ 60Abrasives for machining100Indirect l

27、abor 800$ 960Schedule 2: Fixed CostsFactory supervisors salaries$100Factory methods research40Long-term rent, factory100Fire insurance on equipment2Property taxes on equipment30Depreciation on equipment400Factory superintendents salary 30 702Total indirect manufacturing costs$1,6622.Operating income

28、 would decrease from $3,638,000 to $3,268,000:Decrease in revenue$1,000,000Decrease in total contribution margin*:Ratio times revenue is .37 $1,000,000$ 370,000Decrease in fixed expenses0Operating income before increase 3,638,000New operating income$3,268,000*Contribution margin ratio in contributio

29、n income statement is $4,840 $13,000 = .37 (rounded).The above analysis is readily calculated by using data from the contribution income statement. In contrast, the data in the absorption income statement must be analyzed and divided into variable and fixed categories before the effect on operating

30、income can be estimated.5-B2(30-40 min.)1.DANUBE COMPANYIncome StatementFor the Year Ended December 31, 20X0 Total Per UnitSales$40,000,000$20.00Less variable expenses: Manufacturing$18,000,000 Selling & administrative 9,000,000 27,000,000 13.50Contribution margin$13,000,000$ 6.50Less fixed expenses

31、: Manufacturing$ 4,000,000 Selling & administrative 6,000,000 10,000,000 5.00Operating income$ 3,000,000$ 1.502.Additional details are either in the statement of the problem or in the solution to requirement 1: TotalPer UnitFull manufacturing cost$22,000,000$11.00Variable cost: Manufacturing$18,000,

32、000$ 9.00 Selling and administrative 9,000,000 4.50Total variable cost$27,000,000$13.50Full cost = fully allocated cost* Full manufacturing cost$22,000,000$11.00 Selling and administrative expenses 15,000,000 7.50 Full cost$37,000,000$18.50Gross margin ($40,000,000 - $22,000,000)$18,000,000$ 9.00Con

33、trib. margin ($40,000,000 - $27,000,000)$13,000,000$ 6.50*Students should be alerted to the loose use of these words. Their meaning may not be exactly the same from company to company. Thus, fully allocated cost in some companies may be used to refer to manufacturing costs only.3.Ricardos analysis i

34、s incorrect. He was on the right track, but he did not distinguish sufficiently between variable and fixed costs. For example, when multiplying the additional quantity ordered by the $11 full manufacturing cost, he failed to recognize that $2.00 of the $11 full manufacturing cost was a unitized fixe

35、d cost allocation. The first fallacy is in regarding the total fixed cost as though it fluctuated like a variable cost. A unit fixed cost can be misleading if it is used as a basis for predicting how total costs will behave.A second false assumption is that no selling and administrative expenses wil

36、l be affected except commissions. Shipping expenses and advertising allowances will be affected also - unless arrangements with Costco on these items differ from the regular arrangements.The following summary, which is similar to Exhibit 5-6 in the textbook, is a correct analysis. The middle columns

37、 are all that are really necessary.WithoutWithSpecialEffect of SpecialOrderSpecial OrderOrderUnits2,000,000100,0002,100,000 Total Per UnitSales$40,000,000$1,600,000$16.00$41,600,000Less variable expenses:Manufacturing$18,000,000$ 900,000$ 9.00$18,900,000Selling and administrative 9,000,000 330,000 3

38、.30* 9,330,000Total variable expenses$27,000,000$1,230,000$12.30$28,230,000Contribution margin$13,000,000$ 370,000$ 3.70$13,370,000Less fixed expenses:Manufacturing$ 4,000,000 0 0.00$ 4,000,000Selling and administrative 6,000,000 20,000 0.20* 6,020,000Total fixed expenses$10,000,000 20,000 0.20$10,0

39、20,000Operating income$ 3,000,000$ 350,000$ 3.50$ 3,350,000*Regular variable selling and administrative expenses, $9,000,000 2,000,000 =$ 4.50Less: Average sales commission at 6% of $20 =(1.20)Regular variable sell. and admin. expenses, less commission$ 3.30*Fixed selling and administrative expenses

40、, special commission, $20,000 100,000 .20Some students may wish to enter the $20,000 as an extra variable cost, making the unit variable selling and administrative cost $3.50 and thus adding no fixed cost. The final result would be the same; in any event, the cost is relevant because it would not ex

41、ist without the special order.Some instructors may wish to point out that a 5% increase in volume would cause an 11.7% increase in operating income, which seems like a high investment by Danube to maintain a rigid pricing policy.4.Ricardo is incorrect. Operating income would have declined from $3,00

42、0,000 to $2,850,000, a decline of $150,000. Ricardos faulty analysis follows:Old fixed manufacturing cost per unit, $4,000,000 2,000,000 =$2.00New fixed manufacturing cost per unit, $4,000,000 2,500,000 = 1.60Savings$ .40Loss on variable manufacturing costs per unit, $8.70 - $9.00 (.30)Net savings p

43、er unit in manufacturing costs$ .10The analytical pitfalls of unit-cost analysis can be avoided by using the contribution approach and concentrating on the totals:WithoutEffect ofWithSpecialSpecialSpecialOrder OrderOrderSales$40,000,000$4,350,000a$44,350,000Variable manufacturing costs$18,000,000$4,

44、500,000b$22,500,000Other variable costs 9,000,000 0 9,000,000Total variable costs$27,000,000$4,500,000$31,500,000Contribution margin$13,000,000$ (150,000)c$12,850,000a 500,000 $8.70 selling price of special orderb 500,000 $9.00 variable manufacturing cost per unit of special orderc 500,000 $.30 nega

45、tive contribution margin per unit of special orderNo matter how fixed manufacturing costs are unitized, or spread over the units produced, their total of $4,000,000 remains unchanged by the special order.5-B3(10-15 min.)1.Cost-plus pricing is adding a specified markup to cost to cover those componen

46、ts of the value chain not included in the cost plus a desired profit. In this case the markup is 30% of production cost. Price charged for piston pin = 1.30 $50.00 = $65.00. If the estimated selling price is only $46 and this price cannot be influenced by Caterpillar, a manager would be unlikely to

47、favor releasing this product for production.2.Target costing assumes the market price cannot be influenced by companies except by changing the value of the product to consumers. The price charged would then be the $46 estimated by market research. The highest acceptable manufactured cost or target c

48、ost, T, is DollarsTarget Price$ 46.00Target Cost T Target Gross Margin$ .30T46 T = .30T1.30T = 46T = 46 1.30 = $35.383.The required cost reduction over the products life isExisting manufacturing cost$50.00Target manufacturing cost 35.38Required cost reduction$14.62Steps that Caterpillar managers can

49、 take to meet the required cost reduction include value engineering during the design phase, Kaizen costing during the production phase, and activity-based management throughout the products life.5-1Precision is a measure of the accuracy of certain data. It is a quantifiable term. Relevance is an in

50、dication of the pertinence of certain facts for the problem at hand. Ideally, data should be both precise and relevant, but relevance generally takes priority.5-2Decisions may have both quantitative and qualitative aspects corresponding to the nature of the facts being considered before deciding. Qu

51、antitative implications of alternative choices can be expressed in monetary or numerical terms, such as variable costs, initial investment, etc. Other relevant features may not be quantifiable, such as the quality of life in a choice between locating in San Francisco or New York. The advantage of qu

52、antitative information is that it is more objective and often easier to compare alternatives than with qualitative judgments.5-3The accountants role in decision-making is primarily that of a technical expert on relevant information analysis, especially relevant costs. The accountant is usually an in

53、formation provider, not the decision maker, although the accountant may be part of a management team charged with making decisions.5-4No. Only future costs that are different under different alternatives are relevant to a decision.5-5Past data are unchangeable regardless of present or future action

54、and thus would not differ under different alternatives.5-6Past costs may be bases for formulating predictions. However, past costs are not inputs to the decision model itself because past costs cannot be changed by the decision.5-7The contribution approach has several advantages over the absorption

55、approach, including a better analysis of cost-volume-profit relationships, clearer presentation of all variable costs, and more relevant arrangement of data for such decisions as make-or-buy or product expansion.5-8The terms that describe an income statement that emphasizes the differences between v

56、ariable or fixed costs are contribution approach, variable costing, or direct costing.5-9The commonalty of approach is the focus on the differences between future costs and revenues of different available alternatives.5-10No, fixed costs are not always irrelevant. Often they are not relevant. Howeve

57、r, they can be relevant if they are affected by the decision being considered.5-11 Customers are one of the factors influencing pricing decisions because they can buy or do without the product, they can make the product themselves, or they can usually purchase a similar product from another supplier

58、.5-12 Target cost per unit is the average total unit cost over the products life cycle that will yield the desired profit margin.5-13 Value engineering is a cost-reduction technique, used primarily during the design function in the value chain, that uses information about all value chain functions t

59、o satisfy customer needs while reducing costs.5-14 Kaizen costing is the Japanese term for continuous improvement during manufacturing. 5-15In target costing, managers start with a market price. Then they try to design a product with costs low enough to be profitable at that price. Thus, prices essentially determine costs.5-16 Customer demands and requirements are important in the product development process. Many companies seek customer input on the design of product features. They seek to reduce non-value-added costs without affecti

- 温馨提示:

1: 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

2: 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

3.本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

5. 装配图网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。